DOMO Bundle

How Did DOMO Company Revolutionize Business Intelligence?

Uncover the DOMO SWOT Analysis and explore the fascinating brief history of DOMO company, a pioneer in the data analytics field. Founded in 2010, this cloud-based business intelligence platform has reshaped how businesses harness the power of their data. From its inception, DOMO has been on a mission to empower executives with real-time insights, driving data-driven decision-making.

The DOMO history reveals a journey from a startup to a publicly traded company, marked by innovation and strategic growth. Led by DOMO founder Josh James, the company quickly established itself as a leader in the DOMO business intelligence sector. With a focus on user-friendly features and a centralized data approach, DOMO's platform has attracted a diverse clientele and continues to evolve to meet the dynamic needs of the market.

What is the DOMO Founding Story?

The founding story of the DOMO company began in 2010. It was driven by a vision to transform how businesses interact with their data. The DOMO founder, Josh James, identified a significant gap in the market.

James, formerly the CEO of Omniture, saw the need for a more efficient way for executives to access and analyze business data. This observation led to the creation of a platform designed to provide real-time data insights. The initial focus was on simplifying data access and facilitating self-service business intelligence for executives.

The company's roots trace back to October 2010 when James started Shacho, Inc. This entity later acquired Corda Technologies in December 2010. Following this acquisition, Shacho was rebranded as DOMO, marking a pivotal moment in its evolution. This transition set the stage for DOMO to become a leading player in the data analytics field.

Early investment played a crucial role in DOMO's growth. The company secured substantial funding from prominent investors, demonstrating strong confidence in its potential.

- Initial investors included Benchmark Capital, Andreessen Horowitz, and others.

- In 2011, Institutional Venture Partners (IVP) contributed $20 million in Series A-1 funding.

- By March 2013, DOMO had raised over $125 million in total funding.

- The rapid influx of capital highlighted investor belief in DOMO's disruptive potential.

The early funding rounds were instrumental in fueling DOMO's expansion and development. The initial investments, totaling $63 million by 2011, were followed by additional rounds. By 2013, the company had raised over $125 million, which enabled it to scale its operations and enhance its DOMO platform.

The DOMO business intelligence platform was designed to give executives a powerful tool for managing their business data. This approach aimed to provide real-time insights and simplify data analysis. The company's focus on user-friendliness and accessibility set it apart in the market.

For an in-depth look at how DOMO approaches its market, consider exploring the Marketing Strategy of DOMO. This resource provides valuable insights into the company's strategic initiatives.

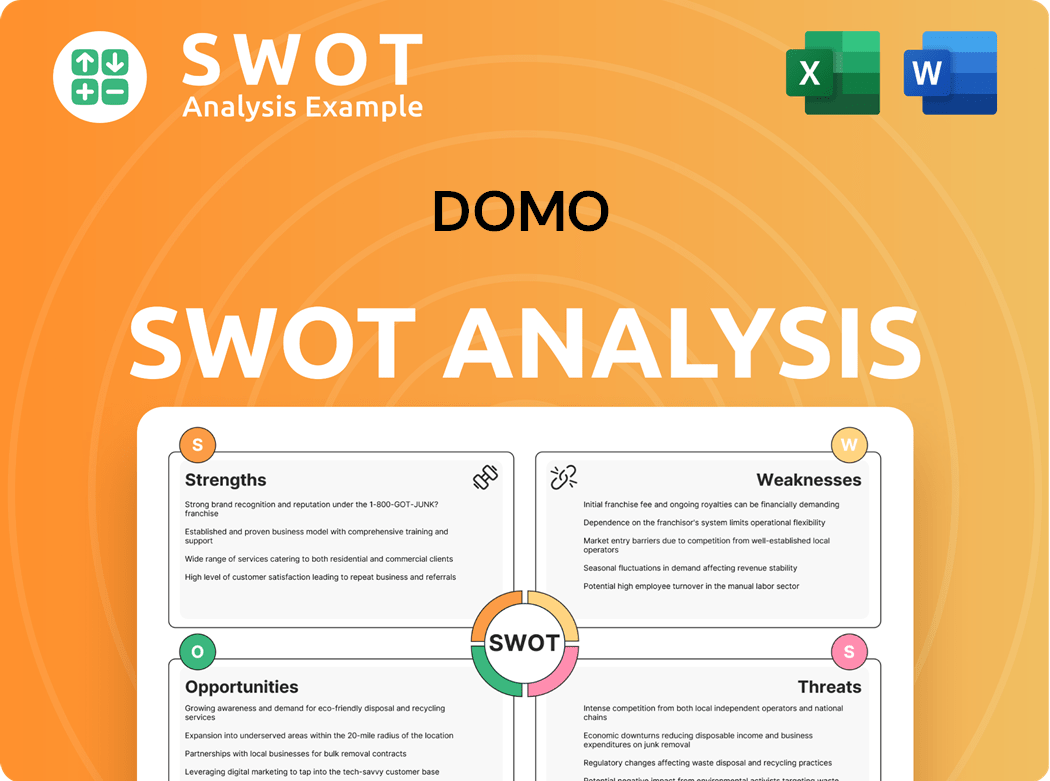

DOMO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of DOMO?

The early years of the DOMO company were marked by rapid expansion and strategic innovation. Following its 2010 founding, the company officially launched its executive management platform in 2011, quickly establishing itself in the business intelligence and analytics sector. This period saw the company's cloud-native platform gain a significant advantage as cloud adoption grew, setting the stage for future developments. Learn more about the Mission, Vision & Core Values of DOMO.

Key to DOMO's early growth was the formation of strategic partnerships and integrations. In 2014, these collaborations with leading tech companies and popular business applications enhanced the platform's capabilities and reach. These partnerships were crucial for expanding the functionality of the DOMO platform and integrating it into existing business workflows. This approach helped to broaden the appeal of DOMO data analytics solutions.

In April 2015, DOMO unveiled its cloud-based business management platform, emphasizing automation and self-service. This platform allowed users to connect, prepare, visualize, collaborate, and optimize data. The introduction of the Domo Appstore in 2016, a marketplace for third-party apps, further enabled customization and extended the platform's functionality. These features were designed to provide users with meaningful insights from their data.

Early customer acquisition focused on mid-sized to large enterprises across sectors like finance, retail, and healthcare. The company's mobile accessibility from the outset differentiated it, leading to widespread adoption among executives. DOMO went public with its IPO on June 29, 2018, raising significant capital. The IPO was a pivotal moment, solidifying its position as a publicly traded company.

Financially, while DOMO faced consistent net losses, revenues were on the rise, with subscription revenue improving. By 2021, the company continued to innovate its platform, attracting more customers and expanding its market presence. The company's focus on innovation and customer acquisition helped it navigate the competitive landscape of the DOMO business intelligence market.

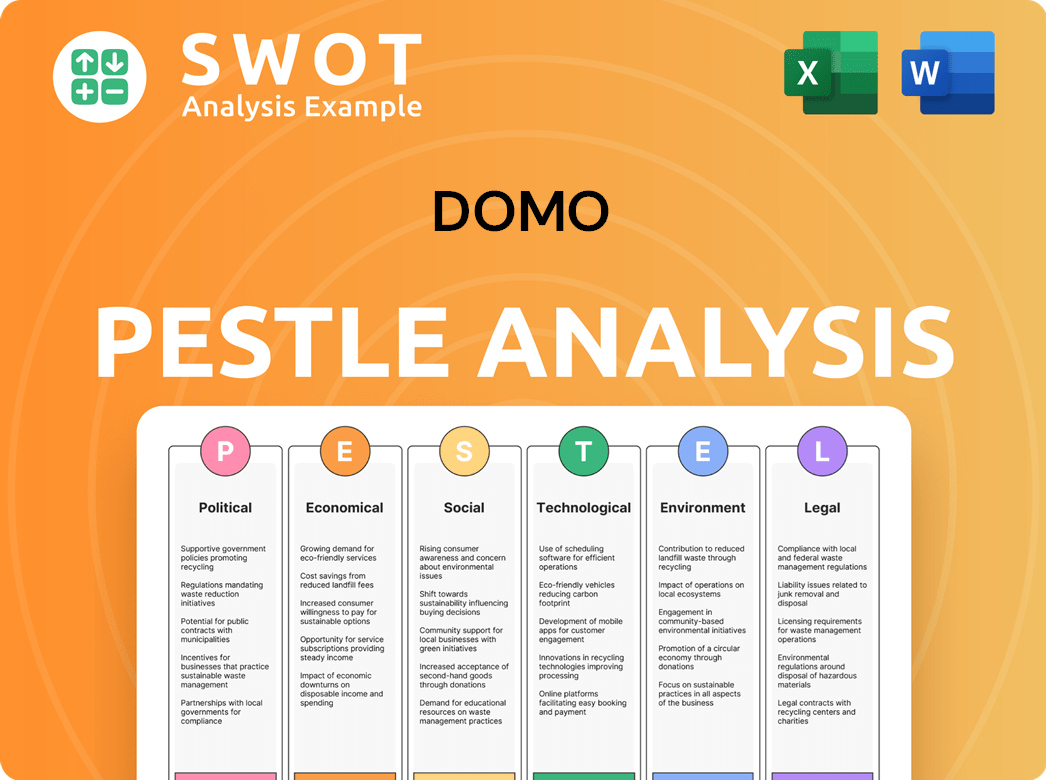

DOMO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in DOMO history?

The DOMO company has achieved several significant milestones since its inception, marking its growth and evolution in the DOMO business intelligence landscape. The company's journey reflects its strategic adaptations and innovations within the competitive data analytics market.

| Year | Milestone |

|---|---|

| Early Years | Early commitment to a cloud-native platform, which initially faced challenges due to nascent cloud adoption but later became a substantial advantage. |

| 2016 | Launched the Domo Appstore, a marketplace for third-party applications and integrations, allowing for greater customization and functionality extension for users. |

| June 2018 | Initial Public Offering (IPO), which raised substantial capital and cemented its market position. |

| 2024 | Named an Overall Leader in Dresner Advisory Services' Wisdom of Crowds Industry Excellence Awards for eight consecutive years and recognized as a 'Challenger' in the Gartner Magic Quadrant for Analytics and BI Platforms. |

DOMO has consistently introduced innovative features and functionalities to enhance its DOMO platform. These innovations have helped the company to stay competitive in the fast-evolving data analytics market, providing users with advanced tools for data analysis and visualization.

Early adoption of a cloud-native platform provided a scalable and flexible infrastructure. This approach allowed for easier data integration and accessibility, crucial for modern business needs.

The DOMO platform offers over 1,000 pre-built connectors for data integration. This feature enables real-time data from various sources, streamlining the data analysis process.

The Domo Appstore, launched in 2016, provides a marketplace for third-party applications. This feature allows for greater customization and functionality extension for users, enhancing the platform's versatility.

Recent product innovations showcased at Domopalooza 2024 included enhancements to Magic ETL for data transformation. New Cloud Amplifier capabilities for cross-cloud data integration were also highlighted.

Advancements in Domo.AI Chat for conversational data analysis were introduced. This feature allows for more intuitive and interactive data exploration.

Focus on agentic AI to enable automated actions driven by predictive and generative AI models. This focus aims to enhance automation and provide actionable insights.

Despite its successes, the DOMO company faces several challenges within the competitive DOMO data analytics market. These challenges include intense competition, high implementation costs, and financial pressures.

The business intelligence market is highly competitive, with established players like Tableau, Microsoft Power BI, and Qlik posing significant threats. These competitors offer alternative solutions, creating pressure on DOMO to innovate and maintain its market position.

DOMO's platform has been noted for high implementation and licensing costs compared to some competitors. This can be a barrier for scaling businesses, potentially affecting customer acquisition and retention.

The company has contended with a history of financial losses, reporting a net loss of $65.9 million for fiscal year 2023. High operational expenses contribute to these financial challenges.

Data security concerns, as a cloud-based platform, and the need for continuous innovation in a rapidly changing technological landscape present ongoing challenges. Addressing these concerns is critical for maintaining customer trust and ensuring long-term viability.

To address these challenges, DOMO has focused on strategic shifts, including transitioning to a consumption-based pricing model to improve customer adoption and retention. Expanding its partner ecosystem is another key strategy.

Expanding the partner ecosystem is a key strategy for driving growth and increasing market reach. This involves collaborations and integrations that enhance the platform's capabilities and appeal to a wider audience.

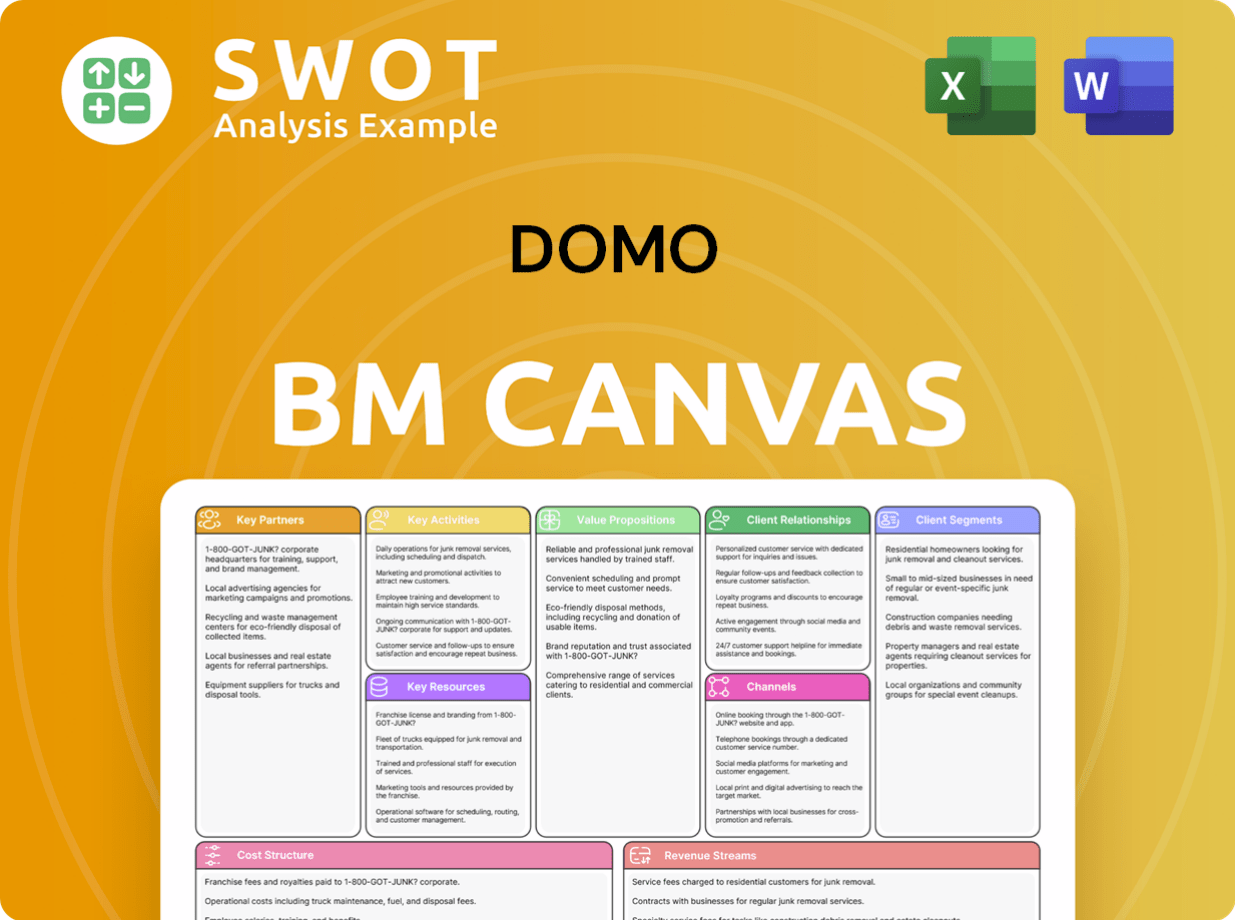

DOMO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for DOMO?

The DOMO company's journey, from its inception to its current standing, showcases a strategic evolution in the business intelligence sector. Founded by Josh James in 2010, the company quickly established itself as a key player in the data analytics field. The DOMO platform has seen continuous enhancements, strategic partnerships, and a successful IPO, marking significant milestones in its DOMO history.

| Year | Key Event |

|---|---|

| 2010 | Founded by Josh James, marking the beginning of the DOMO company. |

| 2011 | Officially launched its executive management platform as a service. |

| 2011-2017 | Secured multiple funding rounds, accumulating over $730 million in total funding. |

| 2012 | Experienced rapid growth in its customer base and expanded globally. |

| 2014 | Formed strategic partnerships and integrations. |

| 2015 | Unveiled its cloud-based business management platform. |

| 2016 | Introduced the Domo Appstore. |

| June 29, 2018 | Went public with its IPO on NASDAQ (DOMO). |

| 2020-2021 | Continued innovation and growth, receiving recognition and awards. |

| 2024 | Recognized as an Overall Leader in Dresner Advisory Services' Industry Excellence Awards for the eighth consecutive year, along with enhancements to Magic ETL and Cloud Amplifier. |

| 2025 | Fiscal Q1 2026 results show total revenue of $80.1 million, with subscription revenue at $71.4 million. Subscription RPO increased by 24% year-over-year, reaching $408.2 million as of April 30, 2025. |

The company is heavily investing in product development, especially in AI and machine learning capabilities. This focus aims to enhance the DOMO data analytics offerings and provide more advanced insights to users. The goal is to multiply business impact through leveraging AI.

A transition to a consumption-based pricing model is underway, aiming to align pricing with the value delivered to customers. This strategy is targeted to account for 90% of Annual Recurring Revenue (ARR) by the end of 2025. This shift should enhance customer adoption and retention.

The company is actively expanding its partner ecosystem, including recent collaborations with Koantek for AI and ML solutions. Strengthening relationships with platforms like Databricks and Snowflake to streamline data management is also a priority. This approach is designed to broaden the platform's capabilities.

The company anticipates continued losses in the near term but aims to improve gross margins to the mid-80s% in the long term. Leadership is focused on achieving 'five and five' growth and margin for Q4 2025 and 'ten and ten' for Q4 2026. The focus is also on sustaining positive cash flow through cost control measures.

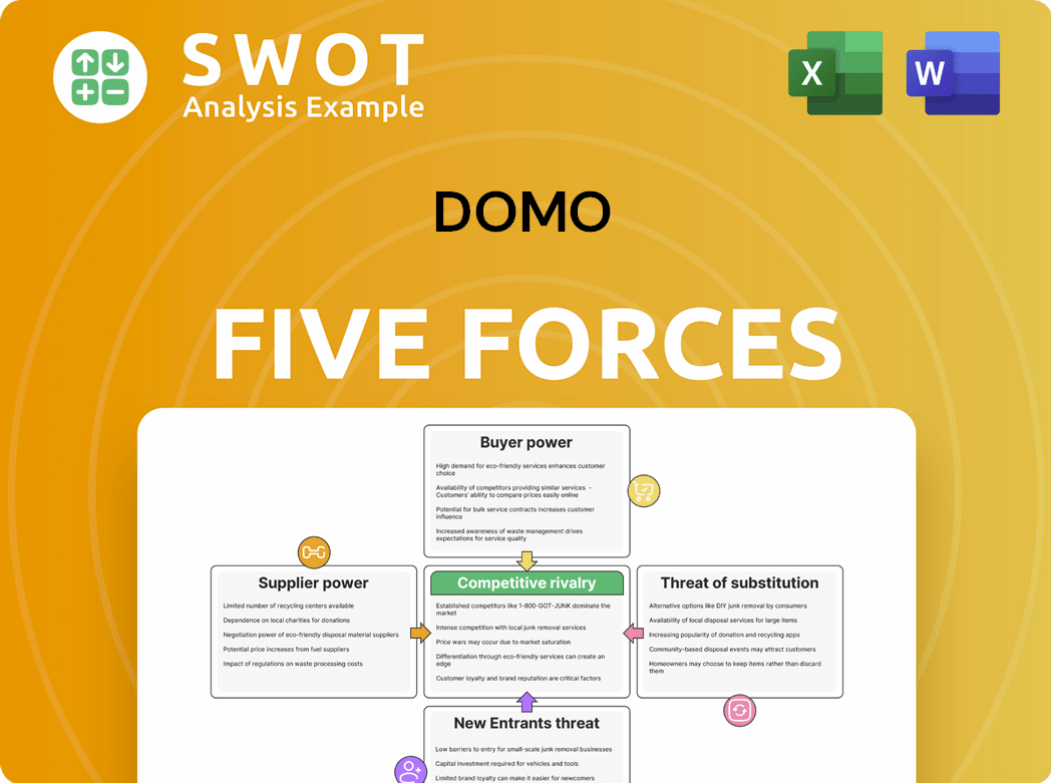

DOMO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of DOMO Company?

- What is Growth Strategy and Future Prospects of DOMO Company?

- How Does DOMO Company Work?

- What is Sales and Marketing Strategy of DOMO Company?

- What is Brief History of DOMO Company?

- Who Owns DOMO Company?

- What is Customer Demographics and Target Market of DOMO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.