DOMO Bundle

How Does DOMO Thrive in the Data-Driven World?

Domo, Inc. (Nasdaq: DOMO) is a cloud-based DOMO SWOT Analysis powerhouse, turning raw data into actionable insights. Recognized as a leader in business intelligence, its platform empowers organizations to visualize and analyze data effectively. Domo’s innovative approach is reshaping how businesses leverage data for strategic advantage.

Domo's DOMO platform provides powerful BI tools and data visualization capabilities, allowing businesses to centralize data from various sources. This enables data-driven decision-making and fosters improved collaboration across operations. With a focus on AI-driven solutions and enhanced cloud data integrations, Domo continues to innovate within the competitive DOMO business intelligence market. Understanding How does DOMO software work is key to evaluating its strategic direction and potential, especially considering its recent financial performance and strategic shifts.

What Are the Key Operations Driving DOMO’s Success?

The core of the company's operations revolves around its cloud-native data experience platform. This platform is designed to go beyond traditional business intelligence and analytics, offering a comprehensive solution for businesses. It allows users to connect to various data sources, analyze information, and make data-driven decisions using user-friendly dashboards and applications. The DOMO platform centralizes data, enhances visibility, and facilitates better collaboration across organizations.

The value proposition of the DOMO platform lies in its ability to transform raw data into actionable insights. By providing a centralized hub for data, the platform enables businesses to make informed decisions quickly. The platform's ease of use and comprehensive features translate into significant customer benefits and market differentiation, making it a powerful tool for modern businesses. This approach helps executives stay ahead of market trends.

DOMO serves a wide range of customers, including large enterprises and mid-market businesses. It offers scalable solutions to meet diverse needs and targets specific industry verticals such as finance, healthcare, retail, and manufacturing. As of April 30, 2025, the company had over 2,500 customers. Enterprise customers accounted for 45% of the revenue for the three months ended April 30, 2025.

The platform's operational processes involve robust technology development, focusing on data ingestion, preparation, analysis, and visualization. It seamlessly integrates with various data sources and applications. This creates a centralized hub for all data-related needs, improving data accessibility and management.

DOMO continuously enhances its platform with new features, including AI-driven workflow automation tools and improved cloud data integrations. The company also leverages its partner ecosystem, working with cloud data warehouses to extend its capabilities. This commitment to innovation ensures the platform remains at the forefront of the business analytics industry.

The 'Domo Everywhere' solutions allow customers to embed data and insights into their own applications. This feature offers cost savings and monetization opportunities. This unique approach provides competitive differentiation without the need for internal data-sharing solution development.

DOMO focuses on delivering real-time data insights, enabling executives to make informed decisions quickly. This capability helps them stay ahead of market trends. The platform's comprehensive features, ease of use, and actionable insights contribute to significant customer benefits and market differentiation.

DOMO distinguishes itself through its comprehensive platform and ease of use. It provides actionable insights, which leads to significant customer benefits and market differentiation. Nucleus Research has highlighted the platform's over 1,000 pre-built connectors that unify data from various sources.

- Centralized Data Hub: Consolidates data from multiple sources.

- Real-Time Insights: Provides up-to-the-minute data analysis.

- User-Friendly Interface: Offers an intuitive and easy-to-navigate platform.

- Scalable Solutions: Meets the needs of both large enterprises and mid-market businesses.

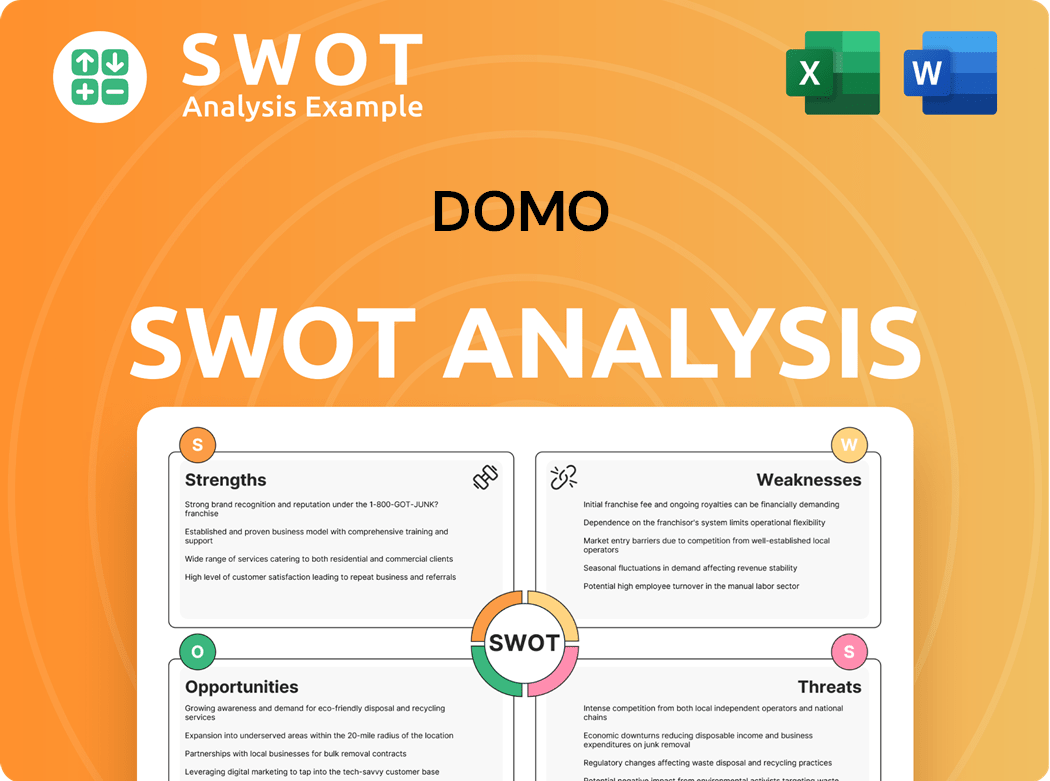

DOMO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DOMO Make Money?

The company primarily generates revenue through subscription services for its cloud-based platform, ensuring a consistent income stream. This is complemented by professional services, including implementation and training. The transition to a consumption-based pricing model is a key strategy for growth.

In the first quarter of fiscal year 2026, subscription revenue reached $71.4 million, making up about 89% of the total revenue of $80.1 million. This highlights the importance of subscriptions to the company's financial performance. The company's approach focuses on retaining customers and expanding their platform use over time.

The company’s revenue model and strategic initiatives are designed to foster sustainable growth and customer satisfaction. For more insights into the company's overall strategy, consider reading about the Growth Strategy of DOMO.

The company has been actively shifting to a consumption-based pricing model, which has significantly improved sales productivity. This model aligns pricing with the value provided, encouraging rapid adoption and allowing customers to explore the platform's capabilities. The 'land, expand, and retain' sales model is evident in the strong customer commitments.

- Over 68% of annual recurring revenue (ARR) utilized the platform on a consumption basis by the end of the most recent fiscal quarter.

- Over 90% of new contract dollar value was on consumption in Q1 fiscal year 2025.

- The company aimed to approach 90% consumption-based ARR by the end of fiscal year 2026.

- Subscription Remaining Performance Obligations (RPO) increased by 24% year-over-year to $408.2 million as of April 30, 2025.

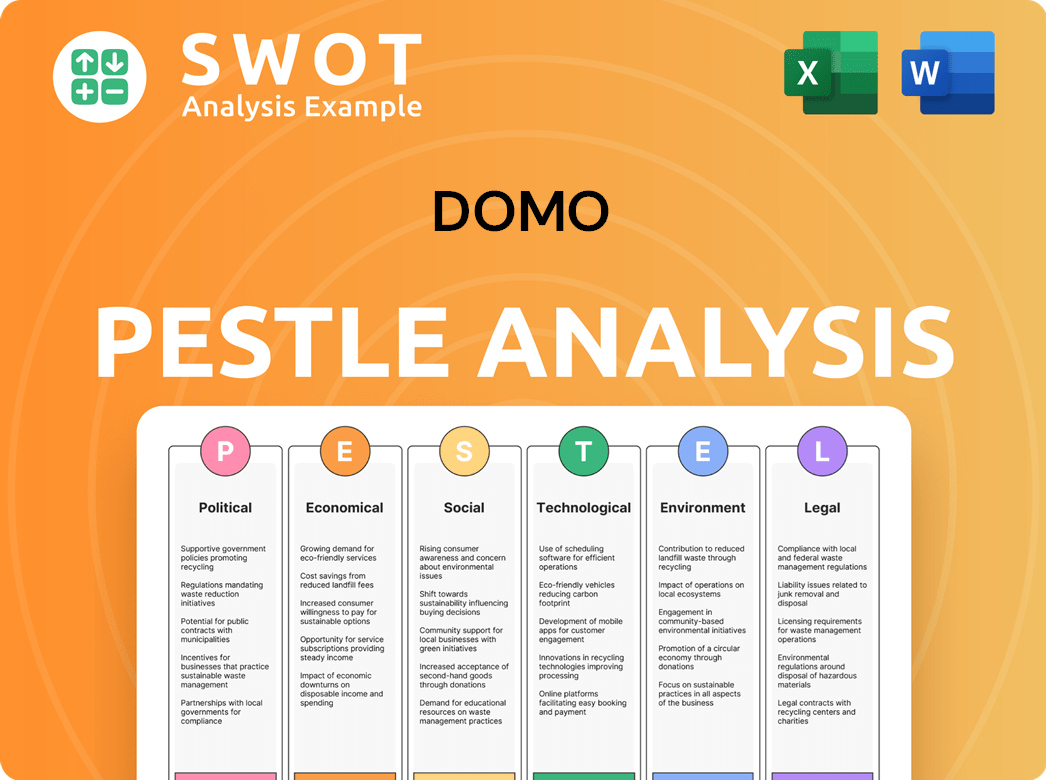

DOMO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped DOMO’s Business Model?

The journey of the company has been marked by significant milestones and strategic shifts. A pivotal move has been the accelerated transition to a consumption-based pricing model, which now represents over 65% of its Annual Recurring Revenue (ARR) as of the end of fiscal year 2025, with a target to reach 90% by the end of fiscal year 2026. This strategic pivot has not only improved sales productivity by over 60% but also better aligns pricing with value delivered and fosters deeper customer adoption.

The company has consistently invested in product innovation, particularly in AI. The company launched new AI-driven workflow automation tools and improved cloud data integrations in Q1 2025. The company's AI solution, Domo AI, has been recognized for delivering machine learning, natural language processing, predictive analytics, and generative AI capabilities. The company's platform is designed to capitalize on the 'AI moment' by providing enterprise-grade access to data products in a secure and governed manner.

Operationally, the company has focused on driving efficiency and achieving positive operating margins and free cash flow. Despite incurring net losses, including $81.9 million for the fiscal year ended January 31, 2025, the company has shown progress in narrowing these losses. The company's adjusted free cash flow was positive $1.3 million in Q1 fiscal year 2026, an increase of 159% year over year.

The company has achieved key milestones, including the transition to a consumption-based pricing model. This shift has significantly improved sales productivity. Furthermore, the company continues to invest in product innovation, especially in AI-driven tools and cloud integrations, enhancing its DOMO platform capabilities.

Strategic moves include a pivot to consumption-based pricing, which now constitutes a major portion of ARR. The company is also focusing on operational efficiency to achieve positive margins. These moves are designed to drive growth and improve financial performance. You can read more about the Marketing Strategy of DOMO.

The company's competitive advantages stem from its comprehensive cloud-native data experience platform. This platform offers real-time data insights and seamless integration with over 1,000 pre-built connectors. The 'Domo Everywhere' solution further differentiates it by allowing customers to embed data and insights into their own applications, creating competitive differentiation and monetization opportunities.

The company's adjusted free cash flow was positive $1.3 million in Q1 fiscal year 2026, an increase of 159% year over year. The consumption customer cohort has demonstrated strong gross retention of over 90% and net retention exceeding 100% in fiscal year 2025, highlighting the success of this model.

The company's consistent investment in product innovation, especially in AI, has led to significant recognition. The company was named a finalist in the Business Intelligence or Analytics category of the 2024 SaaS Awards. The company was also recognized as a Business Intelligence (BI) One to Watch in the Modern Marketing Data Stack 2025.

- Launch of new AI-driven workflow automation tools.

- Improved cloud data integrations.

- Recognition for delivering machine learning, natural language processing, predictive analytics, and generative AI capabilities.

- Ranked #1 in the 2024 Dresner Advisory Wisdom of Crowds® Analytical Platforms Report for the fourth consecutive year.

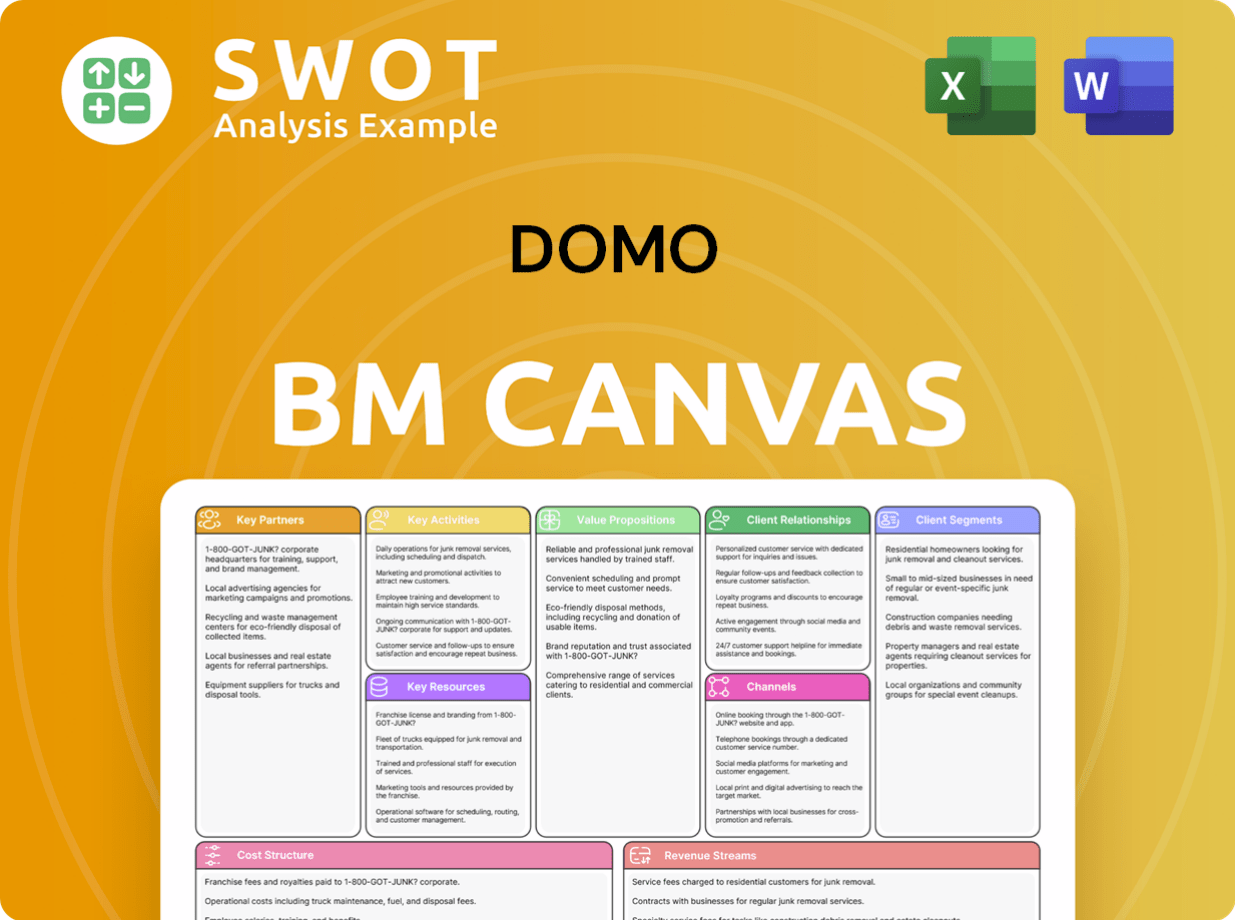

DOMO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is DOMO Positioning Itself for Continued Success?

Understanding the industry position, risks, and future outlook of a company like DOMO is crucial for investors and stakeholders. This analysis delves into the current market standing, potential challenges, and strategic direction of the company, providing a comprehensive view of its prospects. The business intelligence and analytics sector is dynamic, and DOMO's success hinges on its ability to navigate these complexities and capitalize on emerging opportunities.

DOMO's position in the market, challenges it faces, and future growth trajectory are all interconnected. The company's ability to maintain its competitive edge, manage financial performance, and adapt to technological advancements will shape its long-term success. This overview offers insights into these critical aspects, providing a well-rounded perspective on DOMO's current state and future potential.

DOMO holds a strong position in the business intelligence and analytics industry. It has been recognized as a leader in multiple reports. For the fifth consecutive year, DOMO was named a leader in Nucleus Research's 2025 Business Intelligence (BI) and Analytics Technology Value Matrix.

DOMO faces several risks, including significant net losses since its inception. The company reported a loss of $81.9 million for the fiscal year ended January 31, 2025. Competition from established players and emerging technologies, particularly in AI, poses a threat. Regulatory changes and evolving consumer preferences could also impact operations.

DOMO's future outlook is shaped by strategic initiatives focused on ecosystem-led growth, consumption-based contracts, and AI innovation. The company aims to have 90% of its Annual Recurring Revenue (ARR) under the consumption model by the end of fiscal year 2026. DOMO is enhancing its AI capabilities to capitalize on the demand for AI-enabled analytics.

DOMO expects revenue to be in the range of $310 million to $318 million for the full fiscal year 2026. As of April 30, 2025, DOMO's customer base includes over 2,500 customers. The company's strategic moves are designed to achieve efficient growth and capitalize on new market opportunities in the data and AI landscape.

DOMO's strategic focus includes ecosystem-led growth, consumption-based contracts, and AI innovation. The company is working towards migrating its customer base to a consumption model, which is expected to improve retention and drive product-led growth. The company's ability to integrate DOMO platform with various data connectors and provide robust reporting tools are critical.

- DOMO is recognized as a leader in the Business Intelligence and Analytics space.

- The company is enhancing its AI capabilities to meet increasing demand.

- The shift to a consumption model is a key strategy for future growth.

- Competition from established players and emerging technologies poses a significant challenge.

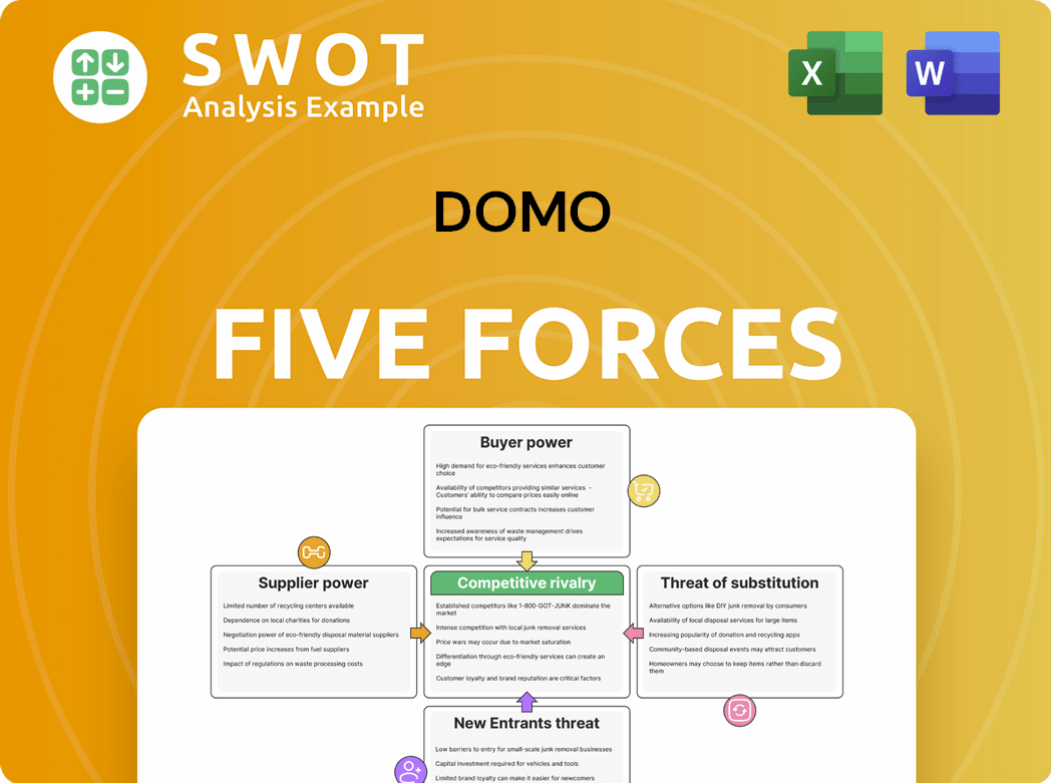

DOMO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DOMO Company?

- What is Competitive Landscape of DOMO Company?

- What is Growth Strategy and Future Prospects of DOMO Company?

- What is Sales and Marketing Strategy of DOMO Company?

- What is Brief History of DOMO Company?

- Who Owns DOMO Company?

- What is Customer Demographics and Target Market of DOMO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.