DOMO Bundle

Who Really Owns DOMO?

Ever wondered who pulls the strings at a leading cloud-based business intelligence platform like DOMO? Understanding the DOMO SWOT Analysis starts with knowing its ownership. From its IPO in 2018 to its current status, the DOMO company ownership structure has seen significant shifts, impacting its strategic direction and market performance. This exploration unveils the key players shaping the future of DOMO Inc.

The journey of DOMO from a privately held startup, backed by venture capital, to a publicly traded entity offers a fascinating study in corporate evolution. This piece will dissect the DOMO ownership landscape, from the influence of the DOMO founder Josh James to the role of institutional DOMO investors and public shareholders, shedding light on the dynamics of its board and leadership. We'll also examine the DOMO company ownership structure and its impact on the company's valuation and financial performance.

Who Founded DOMO?

The story of the company, now known as DOMO, began in 2010. It was founded by Josh James, an entrepreneur with a successful track record, having previously founded Omniture, which was acquired by Adobe in 2009 for $1.8 billion.

Initially, James established Shacho, Inc. in October 2010. This entity later acquired Corda Technologies in December 2010 and was subsequently rebranded as DOMO. This marked the official start of what would become a significant player in the data analytics field.

From its inception, DOMO attracted substantial investment from prominent venture capital firms, shaping its ownership structure and fueling its growth. The early backing from these firms helped DOMO establish its presence in the market.

DOMO's early investors included Benchmark, Andreessen Horowitz, and TPG Growth, among others.

In 2011, DOMO secured $20 million in Series A funding from Institutional Venture Partners.

By 2013, the company announced a Series B investment of $60 million, with participation from GGV Capital, Greylock, and Bezos Expeditions.

In February 2014, DOMO raised $125 million in Series C funding, with investors like TPG Growth and T. Rowe Price.

In April 2015, DOMO raised $200 million in Series D financing, led by BlackRock, at a $2 billion valuation.

DOMO closed a Series D investment round of $131 million in March 2016.

The DOMO ownership structure has evolved significantly since its founding. While the exact equity splits of early investors are not always public, it's known that DOMO founder Josh James holds a significant stake. Early funding agreements likely included standard venture capital terms. For those interested in a broader view of the competitive landscape, you can explore the Competitors Landscape of DOMO. Understanding who owns DOMO and the history of DOMO Inc is key to understanding its current position in the market. The company's journey from its initial funding rounds to its current status reflects a sustained effort to secure capital and drive growth. As of the latest available data, DOMO continues to operate, with its ownership structure shaped by multiple rounds of investment from various firms and individuals. The DOMO investors have played a crucial role in the company's development.

DOMO's early ownership was heavily influenced by venture capital investments, with Josh James as a key figure.

- Josh James, the DOMO founder, has maintained a significant ownership stake.

- Early investors included Benchmark, Andreessen Horowitz, and BlackRock.

- The company's valuation reached $2 billion by April 2015, during its Series D funding round.

- Multiple funding rounds have shaped the DOMO company ownership structure.

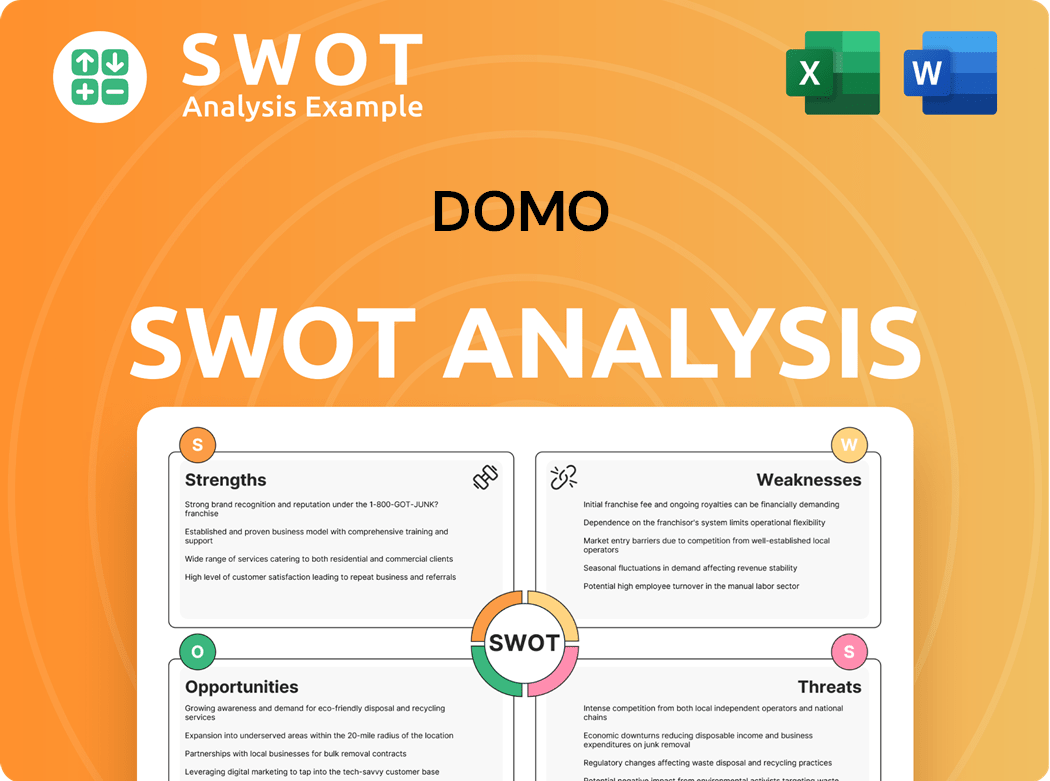

DOMO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has DOMO’s Ownership Changed Over Time?

The ownership structure of the data analytics company, DOMO, has evolved significantly since its inception. Initially backed by venture capital, the company transitioned to a publicly traded entity through an Initial Public Offering (IPO) in 2018, which raised over $193 million. Before going public, key venture capital firms like IVP, Benchmark, and BlackRock held substantial stakes, alongside the founder, Josh James.

As of May 2025, the ownership of DOMO Inc is primarily distributed among institutional investors, insiders, and retail investors. This shift reflects a move from early-stage venture capital to a more diversified shareholder base typical of a publicly traded company. These changes in ownership have influenced the company's strategic direction and governance, with institutional investors often prioritizing financial performance and transparency.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Funding Rounds | Pre-2018 | Venture capital firms held significant stakes. |

| IPO | 2018 | Transitioned to a publicly traded company, increased retail and institutional ownership. |

| Insider Transactions | June 2024 | Daniel David III acquired 400,000 shares, influencing insider ownership. |

Currently, institutional investors hold the largest portion of DOMO's shares, with a significant number of institutional owners filing with the SEC. Key institutional shareholders include Vanguard Group Inc. (holding 12.58% as of March 30, 2025), Ameriprise Financial Inc. (8.58% as of March 30, 2025), and BlackRock, Inc. (7.77% as of March 30, 2025). Josh James, the DOMO founder, remains a major individual shareholder, holding 4.04% of the company as of May 2025. For further insights, consider reading a Brief History of DOMO.

DOMO's ownership structure has evolved significantly since its founding, transitioning from venture capital to a publicly traded company.

- Institutional investors hold a significant portion of the shares.

- Josh James, the founder, remains a key individual shareholder.

- The IPO in 2018 marked a major shift in ownership.

- Insider transactions continue to influence the ownership dynamics.

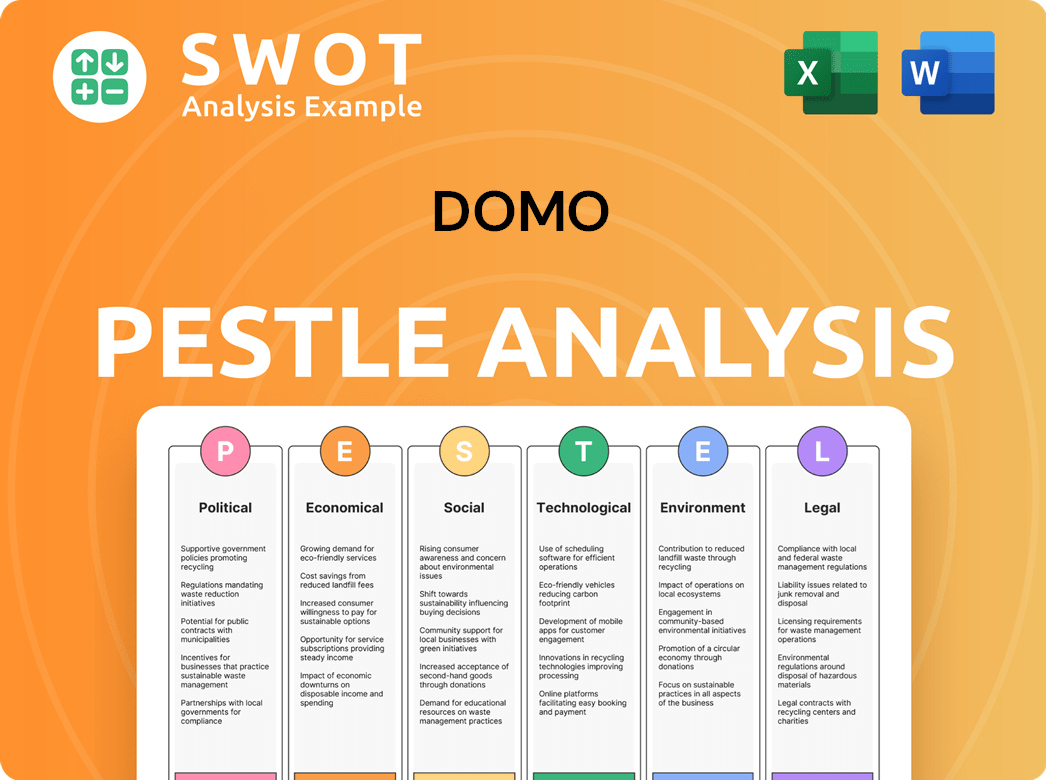

DOMO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on DOMO’s Board?

As of June 2024, the board of directors for the data analytics company, DOMO Inc, comprises seven elected members. These members serve one-year terms. The current board members include Joshua G. James, Carine S. Clark, Daniel Daniel, Jeff Kearl, John Pestana, Dan Strong, and Renée Soto. Joshua G. James, the DOMO founder and CEO, holds a prominent position on the board.

The composition of the board and the voting power dynamics are crucial aspects of understanding DOMO's ownership structure. The board's decisions significantly influence the company's strategic direction and operational activities. The presence of the founder and CEO on the board, coupled with the company's share structure, concentrates control within the leadership.

| Board Member | Position | Term |

|---|---|---|

| Joshua G. James | Founder & CEO | One Year |

| Carine S. Clark | Director | One Year |

| Daniel Daniel | Director | One Year |

| Jeff Kearl | Director | One Year |

| John Pestana | Director | One Year |

| Dan Strong | Director | One Year |

| Renée Soto | Director | One Year |

DOMO operates with a dual-class share structure, which is a key aspect of its ownership. This structure grants disproportionate voting power to certain shares, often controlled by the founder. Specifically, Class A common stock holders are entitled to forty votes per share, while Class B common stock holders receive one vote per share. This structure allows the DOMO founder, Josh James, to maintain substantial influence over the company's direction. For example, pre-IPO, James, despite holding around 4.5% of the company's shares, was projected to have 86% of the voting power. This means that outside shareholders have limited say in the company's strategic decisions. For more insights into the company's broader strategy, consider reading about the Target Market of DOMO.

Understanding DOMO's ownership structure is crucial for investors and stakeholders. The dual-class share structure concentrates voting power, primarily with the founder.

- Dual-class share structure.

- Founder controls significant voting power.

- Outside shareholders have limited influence.

- Legal challenges have arisen regarding executive compensation.

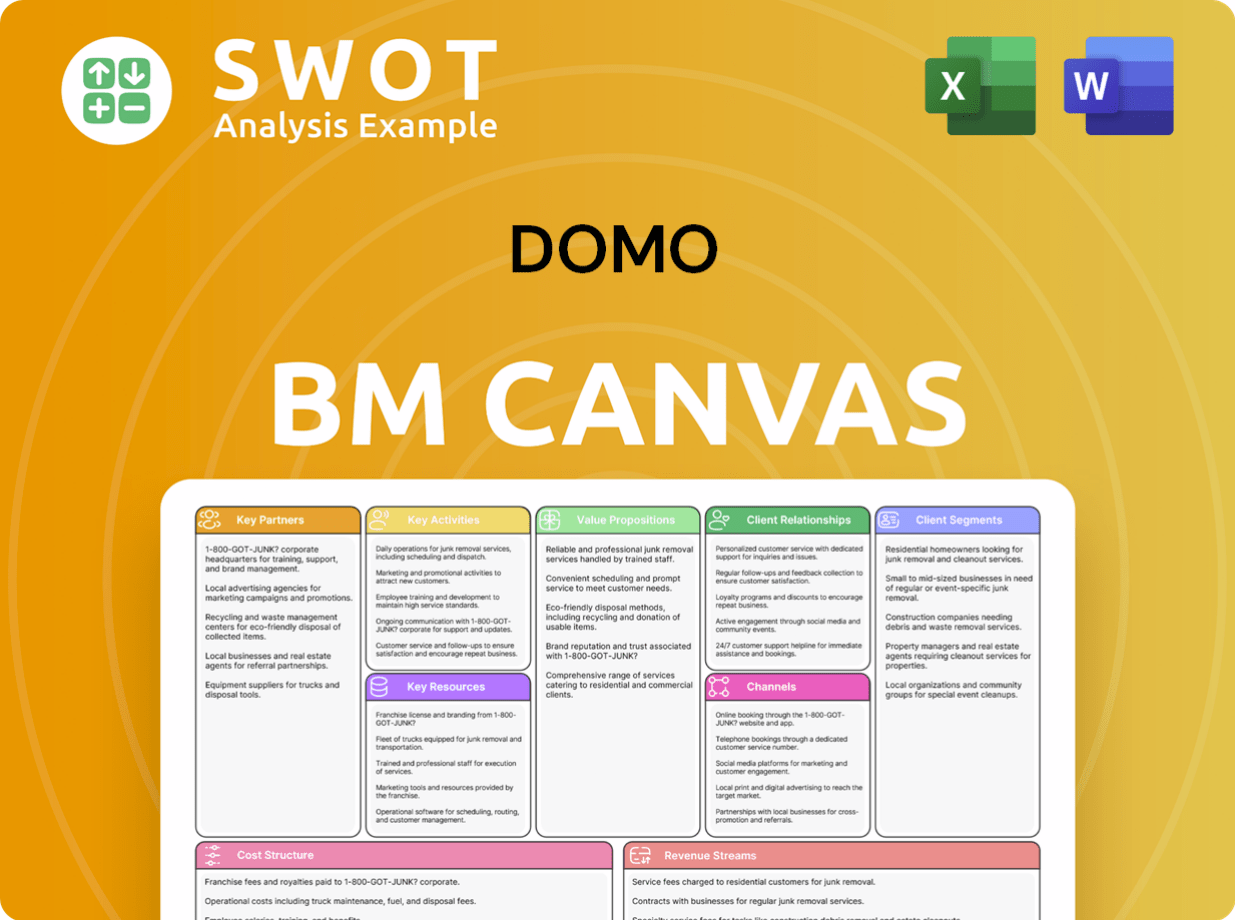

DOMO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped DOMO’s Ownership Landscape?

Over the past few years, the ownership landscape of DOMO has seen shifts alongside the company's financial performance. In fiscal year 2025, the company's revenue reached $317.0 million, marking a 1% decrease from the previous year. Simultaneously, the net loss for fiscal year 2025 was $43.1 million. These financial outcomes have coincided with changes in both insider and institutional ownership, reflecting evolving investor sentiment and strategic decisions.

The company's gross retention rate decreased from 89% in fiscal year 2023 to 85% in fiscal year 2025, and its annual recurring revenue (ARR) net retention rate decreased from 100% to 91% over the same period. Insider ownership saw fluctuations, with an increase in March 2025 followed by a slight decrease in May 2025. Institutional investors continue to hold a significant portion of shares, with some adding and others reducing their positions. These trends provide insights into the dynamics of DOMO's Growth Strategy and its position in the market.

| Metric | Fiscal Year 2023 | Fiscal Year 2025 |

|---|---|---|

| Total Revenue | $320.2 million | $317.0 million |

| Gross Retention Rate | 89% | 85% |

| ARR Net Retention Rate | 100% | 91% |

Institutional ownership remains a key aspect of DOMO's ownership structure, with 60.51% of shares held by institutional investors as of May 2025. In the first quarter of fiscal year 2025, there was notable activity among institutional investors. The market capitalization has also fluctuated, reflecting the company's performance and market conditions. These developments provide a snapshot of the current DOMO ownership and its evolution.

In March 2025, insider holdings increased from 8.41% to 8.98%. By May 2025, insider holdings slightly decreased to 9.70%. Recent trading includes Daniel David III purchasing shares in June 2024.

Institutional investors held 60.51% of shares as of May 2025. Notable additions to portfolios include AIGH Capital Management LLC and PORTOLAN CAPITAL MANAGEMENT, LLC. JPMorgan Chase & Co. and Clearline Capital LP removed shares.

The market capitalization declined from $376.80 million in January 2024 to $276.89 million in 2024. As of March 13, 2025, the market cap was $0.31 billion. This reflects overall market sentiment and the company's performance.

DOMO is transitioning to a consumption model and exploring sales options. The company focuses on product innovation, receiving awards in 2024. These strategies aim to drive future growth and market position.

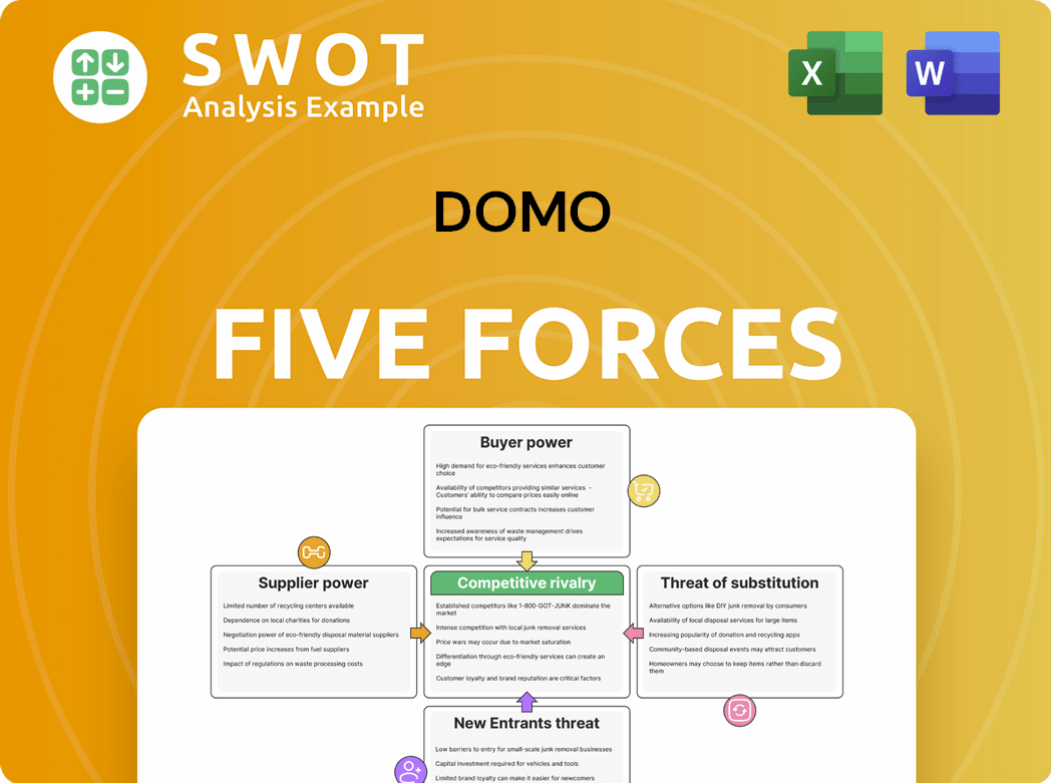

DOMO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DOMO Company?

- What is Competitive Landscape of DOMO Company?

- What is Growth Strategy and Future Prospects of DOMO Company?

- How Does DOMO Company Work?

- What is Sales and Marketing Strategy of DOMO Company?

- What is Brief History of DOMO Company?

- What is Customer Demographics and Target Market of DOMO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.