DOMO Bundle

Can DOMO Conquer the Business Intelligence Realm?

Founded in 2010, Domo, Inc. set out to democratize data, and its cloud-based platform has since become a key player in the business intelligence market. With over 2,600 customers, Domo has established a strong foothold, offering comprehensive data visualization and analytics tools. This deep dive will explore the DOMO SWOT Analysis, its growth strategy, and its future prospects in the ever-evolving data landscape.

This detailed DOMO company analysis will dissect its DOMO growth strategy, examining its expansion plans and technological advancements. We'll also assess its DOMO future prospects, including financial performance, and potential challenges, providing a comprehensive view for investors and business strategists alike. Understanding the DOMO business model and its impact on DOMO market share is crucial for grasping its long-term viability and investment potential.

How Is DOMO Expanding Its Reach?

The expansion initiatives of the company are primarily centered around strengthening its partner ecosystem, transitioning to a consumption-based pricing model, and continuously improving its platform. These strategies are designed to drive growth and enhance the company's market position. The company's approach focuses on building a robust foundation for sustainable growth in the data analytics and business intelligence (BI) space.

The company is actively expanding its partner network, which includes agreements with software resellers and systems integrators. This ecosystem-led growth strategy aims to broaden its reach among both enterprise and corporate customers. The company is also leveraging 'Domo Everywhere' to partner with customers, enabling them to embed data and insights into their own applications, thereby unlocking value for their clients in B2B2B or B2B2C setups. This strategy is aimed at increasing its market share.

A core component of the company's growth strategy involves a shift to a consumption-based pricing model. This model is expected to improve customer adoption and retention by aligning pricing with the value delivered. By the end of fiscal year 2025, the company aims to have 90% of its Annual Recurring Revenue (ARR) on this consumption model. This transition is expected to boost sales and marketing productivity and drive revenue growth. For more information, consider reading about Owners & Shareholders of DOMO.

The company is significantly investing in its partner network to drive growth. This includes collaborations with software resellers and systems integrators. Partner-sourced contribution to billings increased by over 20% from Q2 to Q3 in fiscal year 2025, demonstrating the effectiveness of this strategy. This also helps to expand its customer base.

The company is transitioning to a consumption-based pricing model to enhance customer adoption and retention. This strategic shift is expected to align pricing with the value delivered to customers. The goal is to have 90% of ARR on this model by the end of fiscal year 2025, which is expected to improve sales and marketing productivity.

The company is leveraging 'Domo Everywhere' to enable customers to embed data and insights into their applications. This strategy allows partners to provide data and insights to their clients in B2B2B or B2B2C setups. This approach is designed to unlock additional value for customers and expand the company's reach.

The company is focusing on expanding its sales force and improving sales efficiency. Continued investment in product development and sales and marketing is expected to support growth opportunities. These efforts are crucial for driving revenue growth and achieving the company's financial goals.

The company's growth is primarily driven by its partner ecosystem, the shift to a consumption-based pricing model, and ongoing platform enhancements. These initiatives are crucial for the company's future prospects in the data analytics market. The company's focus on these areas is expected to enhance its competitive advantages in the BI space.

- Partner Network Expansion: Agreements with software resellers and systems integrators.

- Consumption-Based Pricing: Transitioning to align pricing with value.

- 'Domo Everywhere': Embedding data and insights into customer applications.

- Sales and Marketing: Expanding the sales force and improving efficiency.

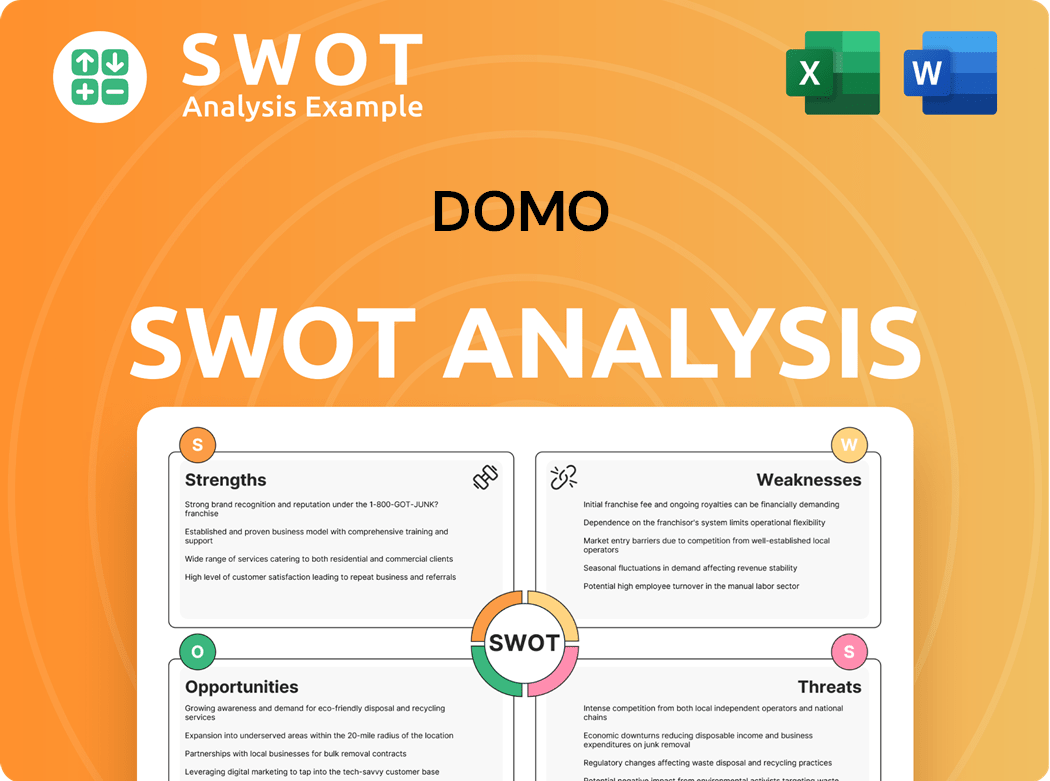

DOMO SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DOMO Invest in Innovation?

The core of the company's strategy centers on leveraging technology and innovation to drive sustained growth. This involves a significant focus on artificial intelligence (AI) and the development of advanced data products. The company's approach is designed to enhance platform functionality continually, focusing on machine learning and predictive analytics.

The company's commitment to innovation is evident in its investment in research and development. This includes expanding the Domo Appstore and developer toolkits to support custom data applications. The company's strategic initiatives are geared towards maintaining a competitive edge in the data analytics market.

The company has been recognized for its AI innovations, including the Domo.AI platform. This platform has received awards, such as the 2025 DEVIES Award in the Data Analytics & Visualization category. The company was also named a Trend-Setting Product in Data and Information Management for 2025 by Database Trends and Applications magazine.

The introduction of AI-driven workflow automation tools is a key innovation. These tools streamline business processes and improve efficiency. This focus helps the company to remain competitive in the data analytics space.

Improved cloud data integrations are another area of focus. These integrations enhance the platform's ability to connect with various data sources. This improves the platform's overall usability and effectiveness.

The 'Domo Agent Catalyst' is a powerful agentic framework. It enables users to create autonomous AI agents. These agents analyze and complete business processes while maintaining security and governance.

Nucleus Research found that customers reported a return of $6.93 for every dollar invested in its AI and Data Products platform. This highlights the financial benefits of the company's technology. This underscores the value of the company's offerings.

Customers experienced a 35% improvement in user productivity. This increase in productivity is a direct result of the platform's efficiency. This boost in productivity is a significant advantage.

Customers achieved 20% technology cost savings. These savings demonstrate the platform's cost-effectiveness. This cost reduction is a key benefit for users.

The company's platform is built to meet enterprise security, compliance, and privacy requirements. This ensures data protection and regulatory compliance. The company holds certifications like SOC 1, SOC 2, HITRUST, HIPAA, and ISO 27001.

- The company focuses on AI and data product development.

- The company has introduced AI-driven workflow automation tools.

- The platform offers improved cloud data integrations.

- The company's platform is built to meet enterprise security, compliance, and privacy requirements.

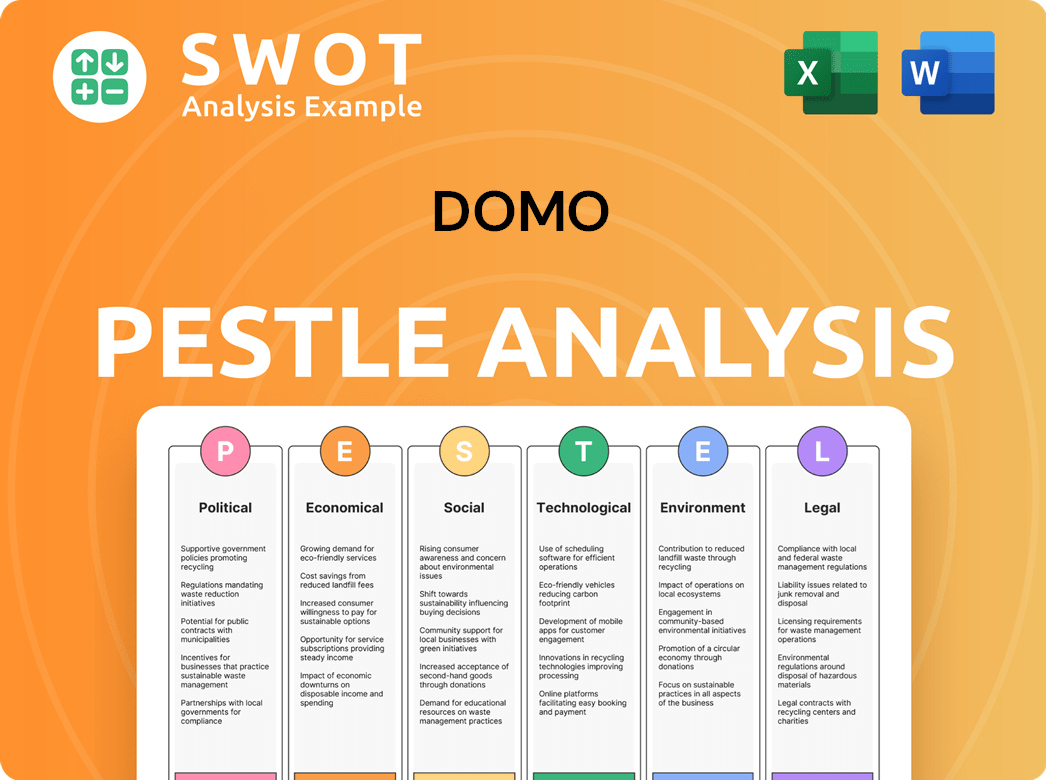

DOMO PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is DOMO’s Growth Forecast?

The financial outlook for the company reflects a strategic focus on achieving profitable, sustainable growth. Despite a history of net losses, the company is implementing strategies aimed at improving its financial performance and market position. Understanding the financial trajectory is crucial for assessing the company's future prospects and its ability to compete in the data analytics market.

For the fiscal year that ended January 31, 2025, the company reported total revenue of $317.0 million, representing a 1% year-over-year decline. However, subscription revenue, a key indicator of recurring revenue, was $286.0 million for the same period. This suggests a stable base of recurring revenue, which is essential for long-term financial health. The company's gross profit for fiscal year 2025 was $236.1 million, with a gross margin of 74%.

The company reported a net loss of $(81.9) million for fiscal year 2025, with an accumulated deficit of $1,487.5 million as of January 31, 2025. While the net loss is a concern, the company's focus on achieving profitability and managing its expenses is a key factor to consider. The company's ability to manage its costs and increase revenue will be critical for achieving profitability. For more details, you can review the Target Market of DOMO.

Total revenue for fiscal year 2025 was $317.0 million, a 1% decrease year-over-year. Subscription revenue was $286.0 million, indicating a stable base of recurring income. The company's financial performance is influenced by its ability to attract and retain customers in a competitive market.

The gross profit for fiscal year 2025 was $236.1 million, with a gross margin of 74%. The company reported a net loss of $(81.9) million for the same period. Managing costs and improving margins are crucial for achieving profitability and sustainable growth.

For fiscal year 2026, the company projects revenue to be between $312.0 million and $320.0 million. Non-GAAP net loss per share is expected to be between $0.18 and $0.26. These projections reflect the company's expectations for the coming year.

The company anticipates billings for fiscal year 2026 to be between $310 million and $320 million, targeting a 5% growth and a 5% operating margin by year-end. The company expects to be cash flow positive in both Q1 and for the full fiscal year 2026.

The company's Subscription Remaining Performance Obligations (RPO) was $408.2 million as of April 30, 2025, a 24% increase year-over-year. This increase indicates a deepening commitment from customers and a positive outlook for future revenue.

The company projects revenue to be in the range of $312.0 million to $320.0 million for fiscal year 2026. This guidance reflects the company's expectations for revenue growth and its strategic initiatives.

Non-GAAP net loss per share for fiscal year 2026 is expected to be between $0.18 and $0.26. The company's focus on managing costs and improving operational efficiency is critical to reducing losses.

The company anticipates billings for fiscal year 2026 to be between $310 million and $320 million. This projection indicates the company's expectations for future revenue generation and growth.

The company expects to be cash flow positive in both Q1 and for the full fiscal year 2026. This positive cash flow outlook is a significant milestone in the company's path to financial stability.

The company is targeting a 5% growth and a 5% operating margin by year-end. These strategic goals underscore the company's commitment to improving its financial performance and achieving sustainable growth.

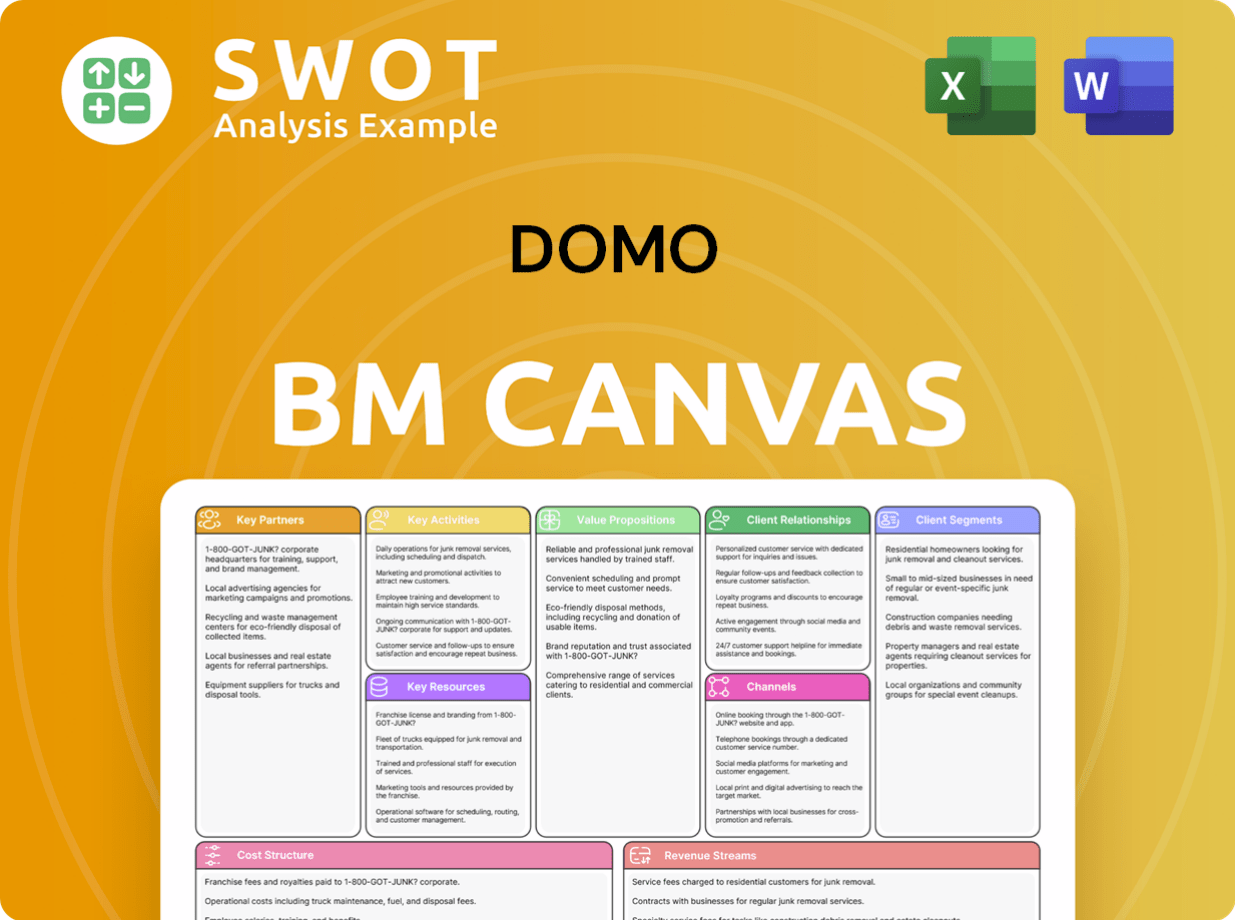

DOMO Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow DOMO’s Growth?

The company faces several potential risks and obstacles that could influence its growth trajectory. These challenges range from financial and operational issues to competitive and market-related pressures. Understanding these risks is crucial for assessing the overall outlook and making informed decisions about the company's future.

A primary financial risk stems from the company's history of losses and the uncertainty of achieving profitability. Additionally, the company's operating results may fluctuate due to various factors, including customer base expansion, contract terms, and broader economic conditions. These factors can significantly impact the company's financial performance and its ability to execute its growth strategies.

The transition to a consumption-based pricing model, while strategically beneficial, may lead to short-term revenue fluctuations. Furthermore, intense market competition and macroeconomic uncertainties could affect client budgets and spending, potentially impacting the company's ability to secure new business and retain existing customers. The company's ability to navigate these challenges will be critical for its long-term success.

The company has a history of losses, posing a significant financial risk. The ability to achieve future profitability is uncertain. Key expenditures, such as those in sales and marketing, may not yield immediate revenue growth.

Reliance on third-party data centers and technology systems introduces operational risks. Disruptions could impact service delivery and customer satisfaction. The company is exposed to currency exchange risks due to international sales.

Intense competition in the data analytics and AI services market is a challenge. Macroeconomic uncertainties could affect client budgets and spending. Recruiting and retaining qualified personnel, especially in sales and technical roles, is crucial.

The shift to a consumption-based pricing model could cause short-term revenue fluctuations. This change, while strategic, requires careful management to avoid negative impacts on financial performance. This is a key aspect of the DOMO growth strategy.

Economic conditions and geopolitical tensions can influence the company's operating results. These factors can affect customer spending and the overall market environment. The company must navigate these external influences effectively.

The lack of a hedging program for foreign currency exposures increases vulnerability to exchange rate volatility. This can impact the financial performance of international sales. Managing this risk is essential.

The company's DOMO business model and DOMO future prospects are closely tied to its ability to overcome these challenges. The company's management is focused on effectively managing growth, aligning sales and marketing strategies with its new pricing structure, and expanding its partner ecosystem to mitigate these challenges. The company's ability to maintain and grow its DOMO market share will depend on its success in these areas. For a deeper understanding of the competitive environment, consider reading about the Competitors Landscape of DOMO.

The company must manage financial risks, including the potential for continued losses. Operational risks involve reliance on third-party services and the impact of disruptions. Competitive pressures in the data analytics market require continuous innovation and strategic positioning. The company's ability to retain and attract talent is crucial for its DOMO company analysis.

The company is focusing on effectively managing growth and aligning sales and marketing strategies. Expanding the partner ecosystem is a key initiative to mitigate challenges. Addressing currency exchange risks and operational disruptions is crucial. The company's DOMO financial performance will be influenced by its success in these areas.

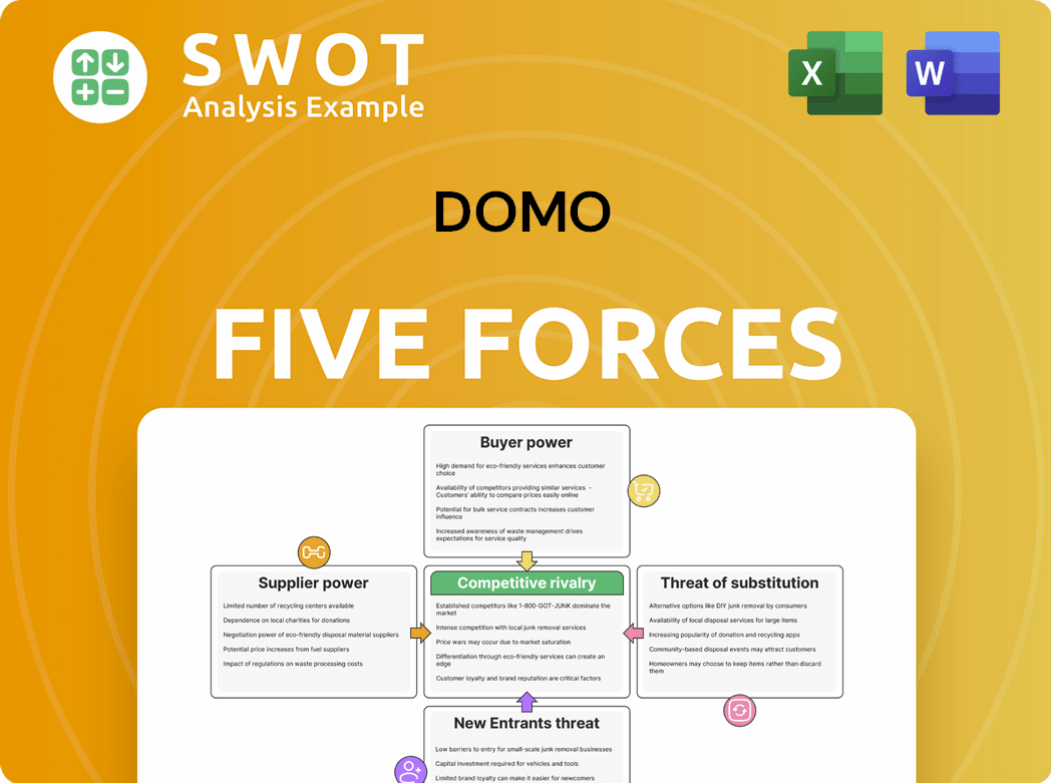

DOMO Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DOMO Company?

- What is Competitive Landscape of DOMO Company?

- How Does DOMO Company Work?

- What is Sales and Marketing Strategy of DOMO Company?

- What is Brief History of DOMO Company?

- Who Owns DOMO Company?

- What is Customer Demographics and Target Market of DOMO Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.