Downer Bundle

What's the Story Behind Downer Company's Success?

Discover the remarkable journey of Downer, an integrated services powerhouse that has shaped the infrastructure of Australia and New Zealand for nearly a century. From its origins in 1933, Downer has evolved into a leading provider of essential services, leaving an indelible mark on transport, infrastructure, and resources. Explore the Downer SWOT Analysis and uncover the strategic decisions that propelled this ASX 200-listed company to its current prominence.

This deep dive into the Downer Group history will explore the Downer EDI company timeline, revealing key milestones and strategic shifts that have defined its trajectory. Learn about the early days of Downer Group, its significant acquisitions, and its involvement in pivotal Australian infrastructure projects. Understand how Downer Company has not only survived but thrived, becoming a cornerstone of the Australian economy and a global player in engineering services and construction.

What is the Downer Founding Story?

The story of the Downer Company begins in New Zealand. It's a tale of engineering, construction, and infrastructure development, starting in the early 20th century.

The company's journey began with a vision to contribute to infrastructure projects, laying the groundwork for what would become a significant player in the industry. The early focus was on New Zealand, but the company's ambitions soon expanded.

Downer & Co. was officially established on July 5, 1933, in Wellington, New Zealand. The company's initial focus was on providing engineering and construction services.

- Arnold Downer, a civil engineer and World War I veteran, co-founded the company.

- Other founders included George McLean, Billy Mill, and Arch McLean.

- Their first major project involved tunneling and construction for the Waipori hydroelectric project in Dunedin.

- The company saw an opportunity in the growing need for infrastructure development in New Zealand.

The founding team, including Arnold Downer, recognized the potential in the growing infrastructure needs of New Zealand. This foresight set the stage for the company's early projects.

The company's establishment was influenced by the cultural and economic context of the time, with a strong emphasis on public works and national development. The company's early projects reflect this focus.

An interesting anecdote from the early years includes Arnold Downer being assigned as Project Manager for a major airfield construction program in Fiji in November 1941, managing over 3,000 people and subsequently building runways in the Pacific, Cook Islands, and Tonga. During the war years, Downer & Co. also pioneered open-cast coal mining and constructed power stations, tunnels, and earthwork projects.

During the war years, Downer & Co. also pioneered open-cast coal mining and constructed power stations, tunnels, and earthwork projects. To learn more about how the company operates, check out this article: Revenue Streams & Business Model of Downer.

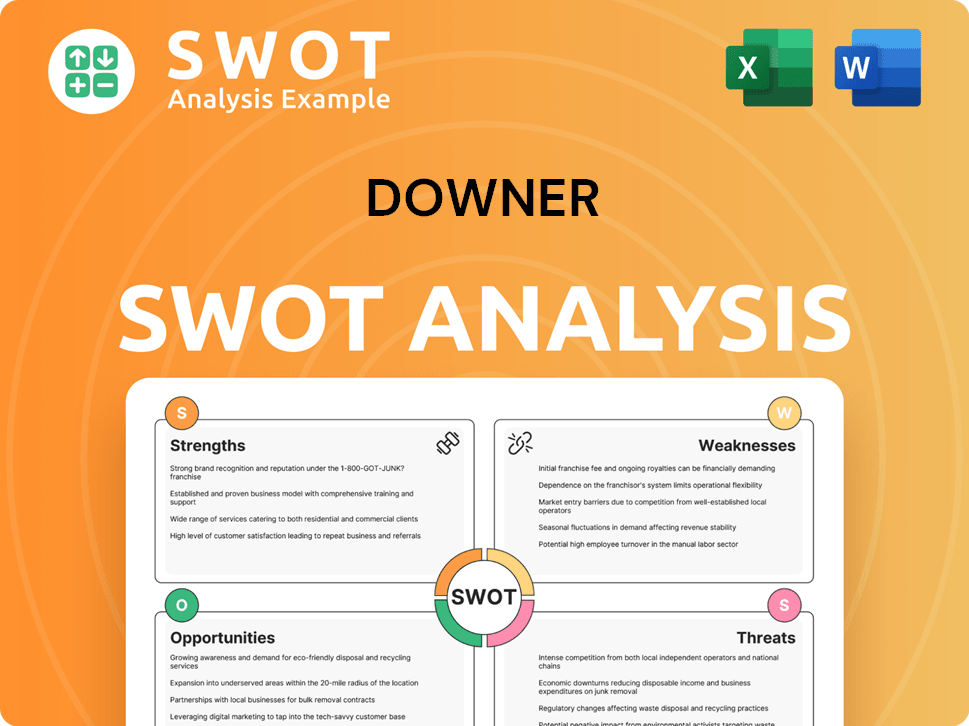

Downer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Downer?

The early growth of the Downer Company was characterized by strategic projects and mergers, significantly broadening its capabilities and market reach. These initiatives were pivotal in shaping the Downer Group history. The company's expansion strategy involved both organic growth and strategic acquisitions, which allowed it to diversify its services and strengthen its market position. This period laid the groundwork for Downer EDI's evolution into a leading integrated services provider.

In the 1950s, Downer initiated joint ventures with international partners. Notable projects included the construction of a rail tunnel through the Rimutaka Range with Morrison Knudsen and the Roxburgh hydroelectric scheme, involving companies from the UK and Switzerland. These collaborations demonstrated an early focus on large-scale projects and international partnerships, setting the stage for its future in the Australian infrastructure sector.

Mergers and acquisitions played a crucial role in Downer's expansion. The company merged with William Cable Holdings in 1954 and A&G Price in 1964, forming Cable Price Downer. Further acquisitions included Roche Brothers in 1997 and Technic Group in 1998, enhancing its capabilities as a construction company. The acquisition of Bitumix in 2000 further diversified its service offerings.

A significant milestone was the merger with Evans Deakin Industries (EDI) in March 2001, creating Downer EDI Limited. This merger was particularly important as EDI brought in Downer's rail business. Before the merger, this rail business had a turnover of $173 million, primarily from rolling stock. This strategic move significantly expanded Downer's footprint in the rail sector, which remains a core division today. For a deeper understanding of Downer's competitive landscape, consider reading about the Competitors Landscape of Downer.

Between 2003 and 2008, Downer made several acquisitions, including Stork, QCC, Snowden, Emoleum, and Excell Corporation, solidifying its position in various engineering and mining services. The acquisition of Tenix's construction assets in October 2014 and Hawkins in March 2017 further expanded its construction capabilities. The acquisition of Spotless Group Holdings in June 2017 allowed Downer to diversify into facilities management, reducing its reliance on cyclical mining and resources sectors.

For the full year ended June 30, 2024 (FY24), Downer reported a pro forma revenue of $11,743.4 million, a 5.5% increase from FY23. The pro forma EBITA increased by 34.1% to $384.1 million in FY24, with the EBITA margin growing by 0.7 percentage points to 3.3%. The company's work-in-hand also increased by 1.0% to $38.5 billion. These figures highlight the sustained growth and strategic expansion efforts of Downer, solidifying its position as a leading integrated services company.

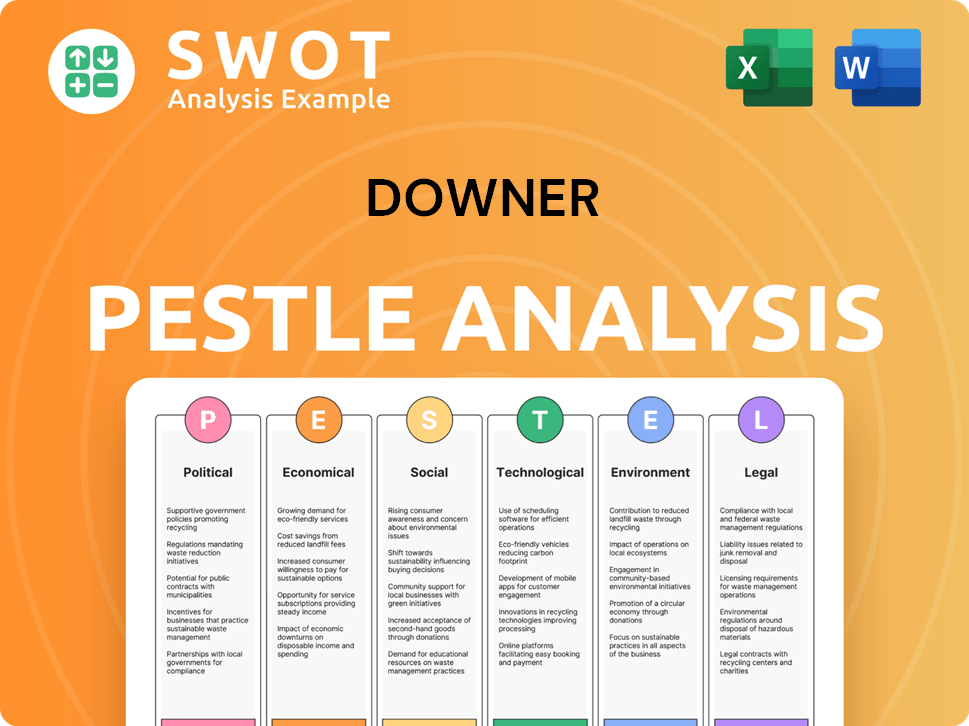

Downer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Downer history?

The Downer Group history showcases significant strategic shifts and operational adjustments within the integrated services sector. A notable pivot occurred around 2020, focusing on core Urban Services segments, which included the divestment of the Mining business in October 2021 and the establishment of Downer Defence. This repositioning, marked by the acquisition of Spotless in October 2020, aimed to diversify operations and reduce reliance on cyclical sectors.

| Year | Milestone |

|---|---|

| 2020 | Downer reshaped its business to focus on core Urban Services segments and acquired Spotless. |

| 2021 | Divestment of the Mining business was completed. |

| 2024 | Launched its new Innovate Reconciliation Action Plan (RAP). |

| 2025 | Downer's Rail & Transit System team designed and validated the world's first prototype Electrical Equipment Enclosures (EEEs). |

In terms of innovations, Downer has consistently utilized technology to enhance its service offerings, particularly in rail and transit systems. For example, in April 2025, the company designed and validated the world's first Electrical Equipment Enclosures (EEEs) for the freight rail industry.

In August 2023, Downer signed a global agreement with Danburykline to develop and supply the Soros application. This system supports cloud and product development capabilities through Downer's RTS Digital services.

In April 2025, Downer's Rail & Transit System team designed and validated the world's first prototype Electrical Equipment Enclosures (EEEs) to support the freight rail industry.

Despite its achievements, Downer Company has faced challenges, including financial losses and legal scrutiny. The company reported a statutory net loss after tax of $385.7 million in FY23, although it returned to a statutory net profit after tax of $82.1 million in FY24.

The company reported a statutory net loss after tax of $385.7 million in FY23. However, it returned to a statutory net profit after tax of $82.1 million in FY24.

The company has been subject to a class action lawsuit alleging misleading or deceptive conduct. As of February 2025, a claim was brought against KPMG, Downer's auditor, in connection with these allegations.

Downer has undertaken a significant business turnaround program, including refreshing its leadership team and implementing a cost reduction program. The company achieved $130 million in annualised gross cost-out in FY24.

Downer achieved $130 million in annualised gross cost-out in FY24, exceeding its initial target of $100 million. The company aims to achieve the remaining $45 million by the end of FY25.

Downer's management is focused on maintaining discipline in applying enhanced risk guardrails and improving the quality of new revenue onboarded. The return of the Utilities business to profitability is also a positive sign.

The company is focused on improving its financial performance and navigating the challenges it faces, including legal and operational issues. For more details, you can read about the Mission, Vision & Core Values of Downer.

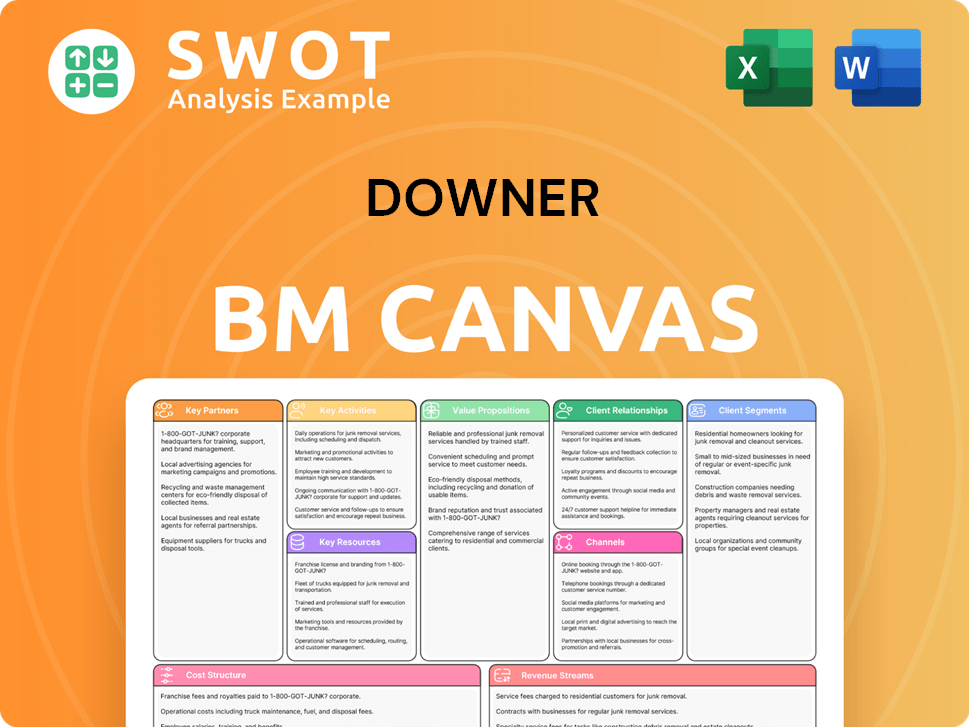

Downer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Downer?

The Downer Group history reflects a journey of strategic mergers, acquisitions, and adaptations within the construction and engineering services sectors. From its founding in New Zealand to its expansion across Australia and beyond, Downer has consistently evolved to meet market demands and capitalize on growth opportunities. The company's timeline showcases a commitment to infrastructure development and urban services, including significant projects in transport, utilities, and facilities management.

| Year | Key Event |

|---|---|

| 1933 | Downer & Co. was founded in Wellington, New Zealand. |

| 1941 | Arnold Downer managed a major airfield construction program in Fiji. |

| 1954 | Downer & Co. merged with William Cable Holdings. |

| 1964 | Merged with A&G Price to form Cable Price Downer. |

| 1997 | Acquired mining contractor Roche Brothers. |

| 1998 | Purchased Technic Group and was first listed on the Australian Securities Exchange. |

| 2001 | Downer merged with Evans Deakin Industries (EDI) to form Downer EDI. |

| 2014 | Acquired the construction assets of Tenix. |

| 2017 | Acquired Hawkins and took majority ownership of Spotless Group Holdings. |

| 2020 | Completed the compulsory acquisition of Spotless. |

| 2021 | Completed the divestment of all Mining businesses. |

| 2023 (August) | Signed a global agreement with Danburykline for the Soros rail maintenance system. |

| 2024 (August) | Released FY24 financial results, reporting a 34% increase in pro forma EBITA and a statutory NPAT of $82.1 million. |

| 2024 (November) | Held its Annual General Meeting, presenting its 2024 Annual Report. |

| 2025 (February) | Declared an interim dividend of 10.8 cents per share. |

| 2025 (March) | Awarded a new NZ$600 million electricity field services contract by Powerco and signed a new seven-year Field Services Agreement valued at over NZ$550 million with Chorus NZ. |

| 2025 (April) | Completed the divestment of its remaining 29.9% interest in the Laundries business for approximately $64 million. Downer's Rail & Transit System's team develops the world's first prototype Electrical Equipment Enclosures (EEEs). |

Downer reported a 34% increase in pro forma EBITA in FY24, with a statutory NPAT of $82.1 million. The company declared an interim dividend of 10.8 cents per share in February 2025, reflecting improved financial performance. The company is targeting an EBITA margin of more than 4.5%.

Downer focuses on business turnaround and strategic growth in its core Urban Services businesses: Transport, Utilities, and Facilities. Key initiatives include enhancing revenue quality, selective tendering, and investing in digital transformation and AI-driven analytics. The company aims to achieve the remaining $45 million of its annualised gross cost-out target by the end of FY25.

Downer is committed to reducing Scope 1 and 2 greenhouse gas emissions by 50% by 2032 and achieving net zero emissions by 2050. These targets reflect Downer's dedication to a cleaner and greener future. The company is focused on connecting its services to a sustainable future for Australia and New Zealand.

Analyst predictions suggest that with continued stabilization of earnings, reduction in leverage, and organic revenue growth, Downer's return on invested capital (ROIC) could climb to 12-14% by 2026. The company's focus remains on 'Enabling communities to thrive,' with a strategic emphasis on urban services and sustainable practices.

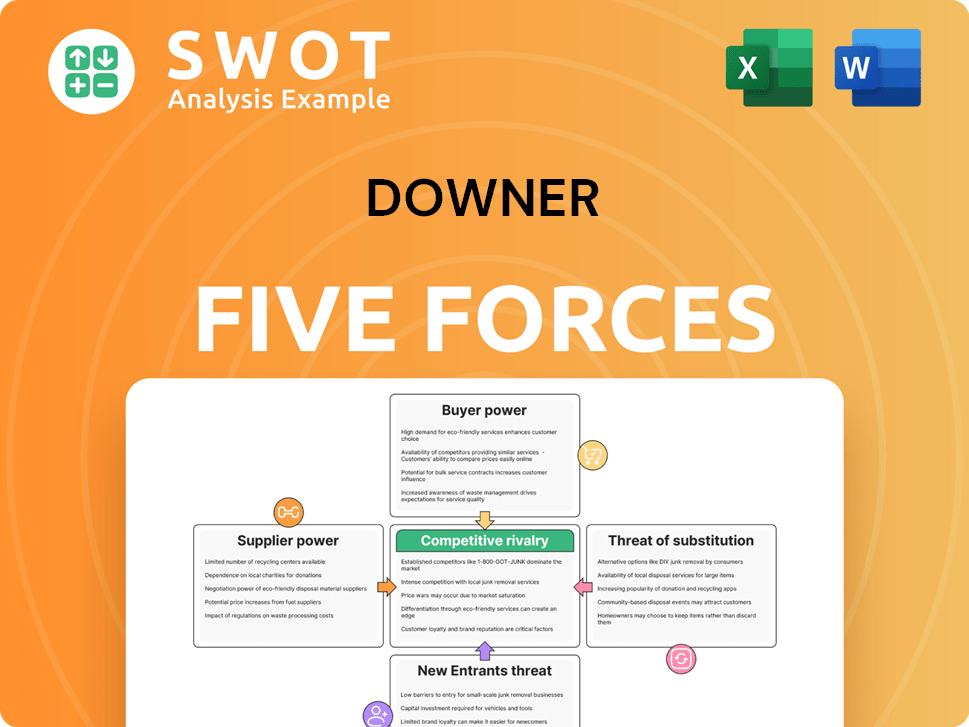

Downer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Downer Company?

- What is Growth Strategy and Future Prospects of Downer Company?

- How Does Downer Company Work?

- What is Sales and Marketing Strategy of Downer Company?

- What is Brief History of Downer Company?

- Who Owns Downer Company?

- What is Customer Demographics and Target Market of Downer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.