Downer Bundle

How Does Downer Company Stack Up Against Its Rivals?

Downer Company, a key player in Australia and New Zealand's infrastructure and services sector, has a rich history dating back to 1933. From its origins in civil engineering, Downer Group has evolved into a diversified leader, managing essential assets and infrastructure. Understanding the Downer SWOT Analysis is crucial to grasp its position.

This exploration into the competitive landscape of Downer Company will provide a detailed market analysis, identifying its industry rivals and dissecting Downer's competitive advantages. We will examine Downer's position in the Australian construction market, its financial performance compared to rivals, and the impact of its recent acquisitions. Furthermore, we'll investigate Downer's key strategic partnerships and its sustainability initiatives, offering insights into its future growth strategies in a competitive market.

Where Does Downer’ Stand in the Current Market?

The Downer Company holds a significant market position within the integrated services industry, particularly in Australia and New Zealand. Its operations span transport, infrastructure, and resources sectors. The company's substantial 'work in hand' figure of $35.7 billion as of the first half of the 2024 financial year underscores its robust market presence and consistent pipeline of projects.

Downer's primary offerings include road and rail infrastructure, facilities management, mining services, and utilities. It primarily serves clients in Australia and New Zealand, including government agencies, local councils, and private sector entities. Over time, the company has emphasized an integrated service model, providing end-to-end solutions from design and construction to maintenance and management, fostering long-term client relationships.

The company's financial health, as evidenced by its revenue from continuing operations of $5,739.6 million in the first half of FY2024, positions it as a major player compared to many industry averages. Downer reported a statutory net profit after tax of $70.8 million for the first half of the 2024 financial year, a notable improvement from a statutory net loss after tax of $385.7 million in the previous corresponding period. This financial performance reflects its strong market position and strategic initiatives.

Downer's market share varies across its diverse segments, with specific figures not always publicly detailed. However, its large 'work in hand' of $35.7 billion indicates a strong market presence. This substantial backlog of projects demonstrates its ability to secure and manage large-scale contracts, reinforcing its position in the competitive landscape.

Downer offers a wide array of services, including road and rail infrastructure, facilities management, mining services, and utilities. Its integrated service model allows it to provide end-to-end solutions. This comprehensive approach enables the company to capture larger projects and build lasting client relationships.

Downer’s primary geographic focus is Australia and New Zealand. Its clients include government agencies, local councils, and private sector entities. This broad client base and regional focus provide a stable foundation for its operations and growth. The company's presence in these key markets is a critical aspect of its competitive strategy.

In the first half of FY2024, Downer reported revenue from continuing operations of $5,739.6 million and a statutory net profit after tax of $70.8 million. This financial performance highlights its ability to generate revenue and achieve profitability. The improvement from the previous period's loss demonstrates the effectiveness of its strategic initiatives.

Downer has strategically shifted its positioning to emphasize an integrated service model, focusing on end-to-end solutions. This approach allows for larger, more complex projects and fosters long-term client relationships. This strategic shift enhances its competitive advantages.

- Focus on integrated services: Providing comprehensive solutions from design to maintenance.

- Long-term client relationships: Building lasting partnerships through service excellence.

- Financial stability: Demonstrating strong financial performance and profitability.

- Geographic focus: Concentrating on Australia and New Zealand.

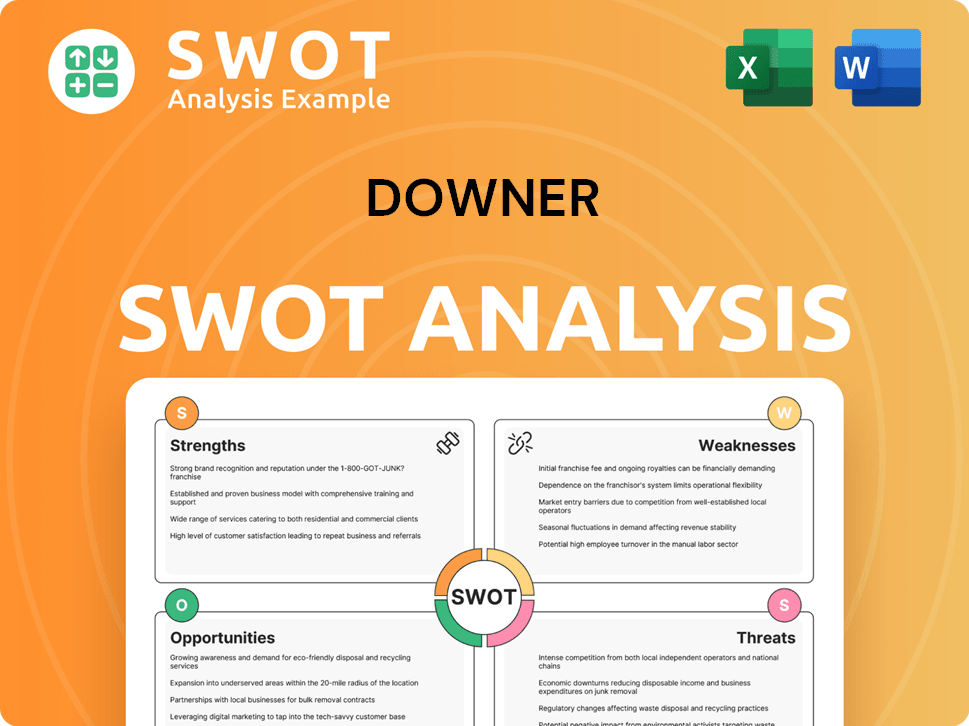

Downer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Downer?

The Downer Company operates within a dynamic and competitive market, facing a range of rivals across its diverse sectors. Understanding the competitive landscape is crucial for assessing its market position and future prospects. This analysis examines the key players challenging Downer Group in its core areas of operation.

Market analysis reveals that Downer's competitors vary depending on the specific segment. The company's strategic responses and operational efficiencies are constantly tested by both established and emerging competitors. The competitive environment also sees shifts due to mergers and alliances, requiring Downer to stay agile.

In the transport and infrastructure sectors, Downer competes with major players like Fulton Hogan. Acciona also presents a challenge, especially on large-scale infrastructure projects. UGL, a subsidiary of CIMIC Group, is another key competitor, particularly in maintenance and engineering services.

In the resources sector, Downer faces competition from mining services providers such as Perenti and Macmahon Holdings. These companies offer contract mining and maintenance services, challenging Downer through specialized expertise and competitive pricing.

Competitive dynamics often involve intense bidding processes for major projects. Factors such as project delivery capabilities, safety records, and cost-effectiveness are crucial. Emerging players and specialized firms also pose a challenge through niche services or innovative technologies.

Downer continuously optimizes its service delivery and operational efficiencies to maintain its market position. The company must remain agile in its strategic responses to industry changes, including mergers and alliances among competitors.

Understanding Downer Company market share analysis is essential for evaluating its performance. The company's position in the Australian construction market is influenced by its ability to compete effectively against these rivals. For more insights, consider reading Marketing Strategy of Downer.

Downer Group's future growth strategies in this competitive market will be critical. The company's ability to innovate, form strategic partnerships, and adapt to market changes will determine its long-term success.

The competitive landscape is further shaped by factors such as project delivery capabilities, safety records, and cost-effectiveness. Downer's strengths and weaknesses analysis, along with its strategic partnerships, play a crucial role in its ability to maintain a competitive edge. Downer's competitive landscape in the rail industry and its overall competitive analysis of Downer's service offerings are key areas to watch. The company's sustainability initiatives and its response to latest news on Downer Company's competitive positioning will also influence its market performance.

Downer's competitors include major players in transport and infrastructure, such as Fulton Hogan, Acciona, and UGL. In the resources sector, Downer's competitors are Perenti and Macmahon Holdings. The company's performance is influenced by its ability to compete effectively. The competitive environment is constantly shifting due to mergers, acquisitions, and the emergence of new players.

- Fulton Hogan: Key competitor in civil construction and roading.

- Acciona: Competes on large-scale infrastructure projects.

- UGL: Competes in maintenance and engineering services.

- Perenti: Provides contract mining and maintenance services.

- Macmahon Holdings: Offers contract mining and equipment services.

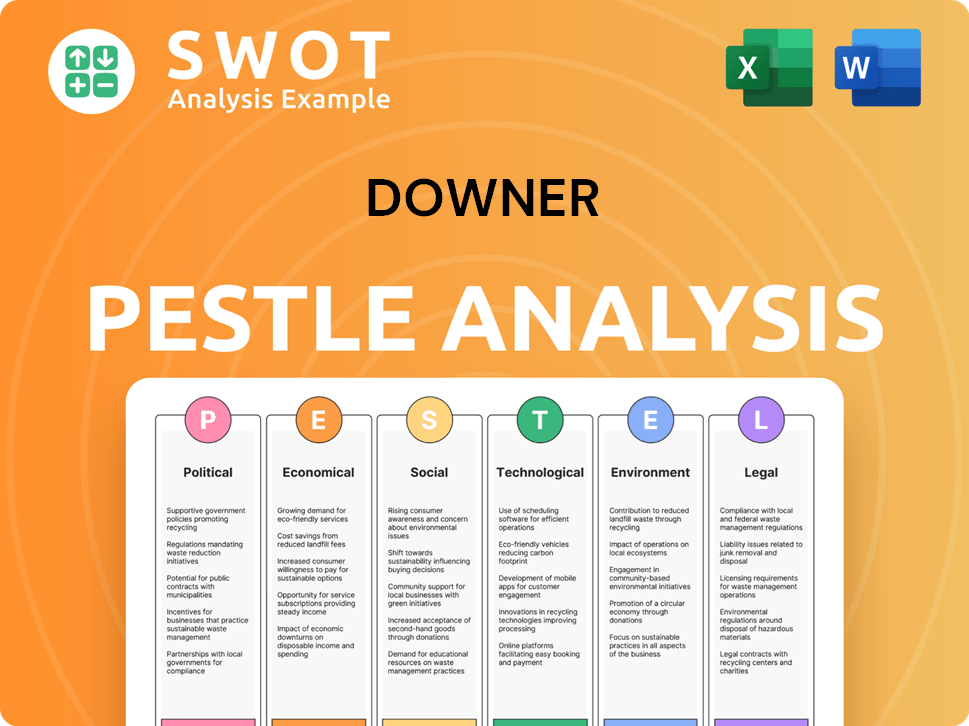

Downer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Downer a Competitive Edge Over Its Rivals?

Understanding the Owners & Shareholders of Downer is crucial to assessing its competitive advantages. The company, known for its integrated service model, holds a strong position in the market. This approach allows it to manage projects from start to finish, giving it a significant edge over competitors.

Downer's extensive operational scale and deep sector expertise are key differentiators. With a history of decades-long presence in Australia and New Zealand, the company has built strong client relationships. This local market knowledge and trust provide a solid foundation for its operations.

As of the first half of FY2024, Downer had a substantial 'work in hand' valued at $35.7 billion, reflecting its strong market position. The company's focus on technology and innovation, including digital asset management and sustainable practices, further enhances its service quality and efficiency.

Downer's integrated service model offers end-to-end solutions. This approach streamlines project delivery and reduces coordination complexities. It is particularly valuable for large-scale infrastructure projects.

Downer has a strong presence in Australia and New Zealand. Decades of experience have built trust and understanding of local markets. This provides a competitive advantage over newer entrants.

Downer's operational scale is a key advantage. It allows the company to handle large and complex projects efficiently. The company's substantial 'work in hand' supports its operational capabilities.

Investment in technology and innovation enhances service quality. Digital asset management and sustainable practices improve operational efficiency. These initiatives contribute to Downer's competitive edge.

Downer's competitive advantages are multifaceted, including its integrated service model, which offers end-to-end solutions. This approach streamlines project delivery. The company's extensive operational scale and deep expertise across various sectors are also significant strengths.

- Integrated Service Model: Provides comprehensive solutions, from design to maintenance.

- Extensive Operational Scale: Enables efficient handling of large and complex projects.

- Established Market Presence: Strong relationships and local knowledge in Australia and New Zealand.

- Technology and Innovation: Investment in digital asset management and sustainable practices.

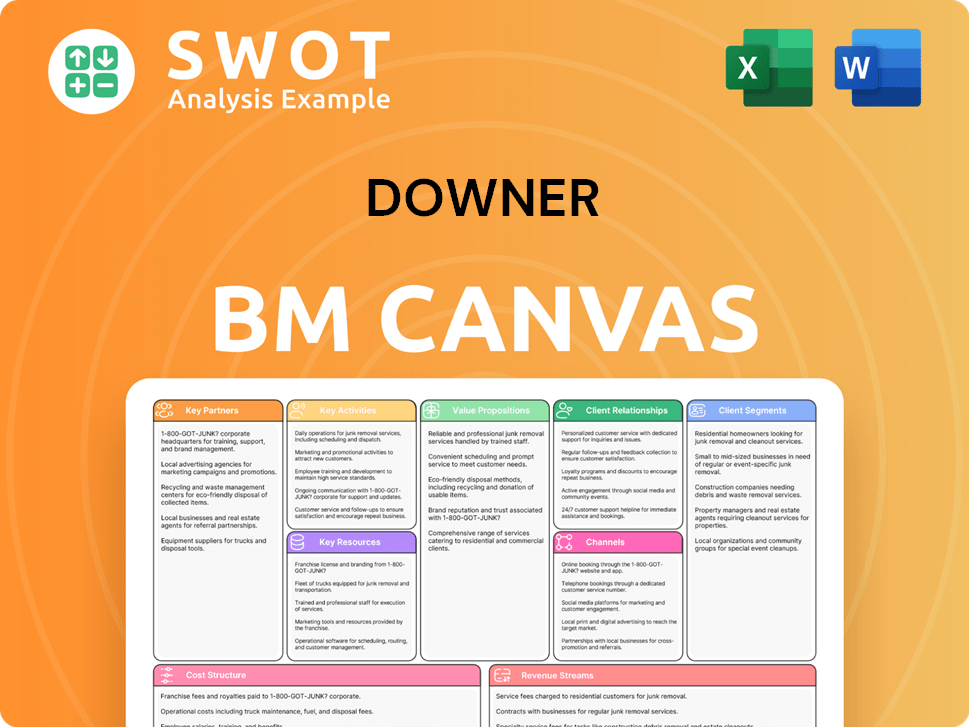

Downer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Downer’s Competitive Landscape?

Understanding the competitive landscape of the Downer Company requires an analysis of its industry trends, future challenges, and opportunities. The integrated services industry is dynamic, shaped by factors such as government infrastructure spending, sustainability demands, and technological advancements. This analysis is crucial for investors, financial professionals, and business strategists to make informed decisions.

Downer Group faces both risks and opportunities in this evolving market. Economic downturns, increased regulatory scrutiny, and the emergence of specialized competitors pose challenges. However, opportunities abound in renewable energy, smart cities, and digital services. Strategic investments, partnerships, and operational resilience are essential for navigating these dynamics. For a deeper understanding, consider the Growth Strategy of Downer.

The integrated services industry is experiencing significant shifts. Increased government investment in infrastructure, especially in Australia and New Zealand, is a key driver. There's a growing emphasis on sustainability and decarbonization, as well as rapid technological advancements, such as digital twins and AI-driven predictive maintenance. These trends shape the Downer Company's strategic approach.

Several challenges could affect Downer's performance. Economic downturns may reduce government spending on infrastructure. Increased regulatory scrutiny and the rise of specialized competitors also pose risks. Furthermore, the need to integrate sustainable practices and invest in new technologies requires significant capital and strategic planning.

Significant growth opportunities exist for Downer Group. Renewable energy infrastructure, smart city development, and expanding digital services offer potential. Focusing on sustainable solutions and technological advancements can provide a competitive edge. Strategic partnerships and operational resilience are crucial for capitalizing on these opportunities.

Downer's competitive position is evolving towards sustainable and technologically advanced solutions. The company's integrated model allows it to offer comprehensive value. Key strategies include continued investment in innovation, strategic partnerships, and a focus on operational resilience. This approach is vital for maintaining a strong market presence.

Downer's future hinges on its ability to adapt to industry changes. This involves strategic investments, partnerships, and a focus on operational excellence. The company's success depends on effectively managing risks and seizing emerging opportunities in the market.

- Investing in sustainable practices to meet ESG requirements.

- Adopting digital technologies for enhanced efficiency and service delivery.

- Forming strategic partnerships to expand service offerings and market reach.

- Focusing on operational resilience to withstand economic and regulatory pressures.

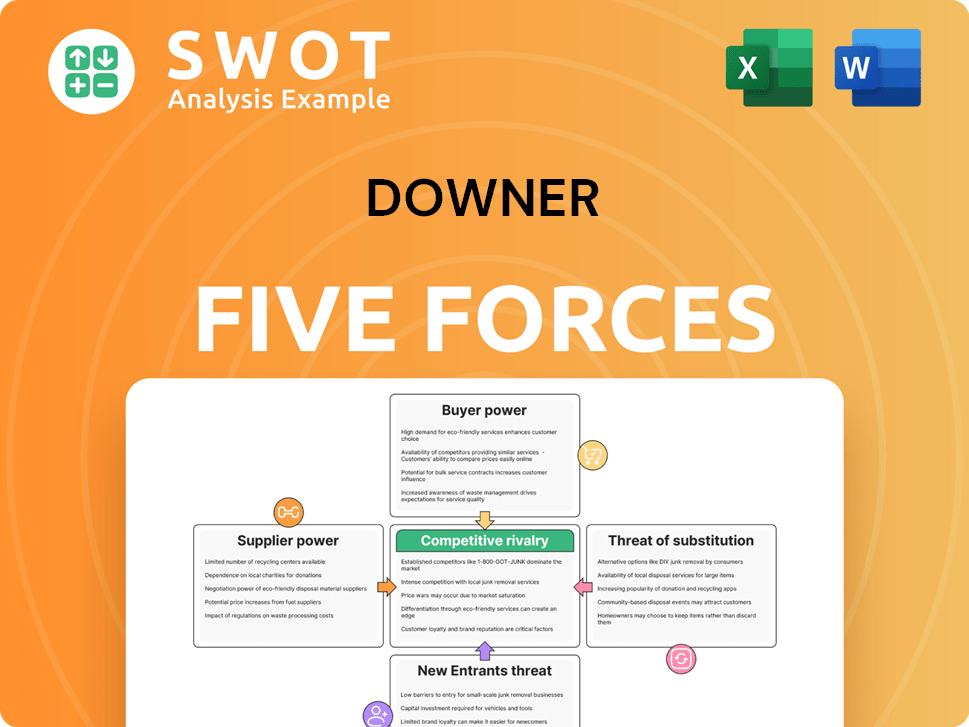

Downer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Downer Company?

- What is Growth Strategy and Future Prospects of Downer Company?

- How Does Downer Company Work?

- What is Sales and Marketing Strategy of Downer Company?

- What is Brief History of Downer Company?

- Who Owns Downer Company?

- What is Customer Demographics and Target Market of Downer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.