Downer Bundle

Can Downer Company Navigate the Future of Infrastructure?

Downer Company, a key player in Australia and New Zealand's infrastructure and services sector, is at a critical juncture. Its recent strategic overhaul, including significant divestments, underscores the importance of a robust Downer SWOT Analysis for understanding its Growth strategy. This transformation sets the stage for a deep dive into its Future prospects.

This analysis explores Downer's evolution from its 1933 origins to its current status as an ASX 200 company. We'll examine its current market position, financial performance, and strategic initiatives. The focus will be on how Downer Company plans to leverage its strengths and adapt to the evolving market outlook to ensure long-term growth and success in a competitive environment.

How Is Downer Expanding Its Reach?

The Mission, Vision & Core Values of Downer are driving its expansion initiatives, particularly within its urban services portfolio. This strategic shift follows the divestment of its mining and high-risk construction businesses, allowing the company to concentrate on areas with strong growth potential. The company is well-positioned to capitalize on government services, infrastructure expansion, and the energy transition, which are key drivers for future prospects.

As of August 2024, the company’s work-in-hand stood at a robust $38.5 billion, indicating a healthy pipeline of future projects. This strong foundation supports the company’s growth strategy and provides a solid base for continued expansion. The focus on urban services aligns with market trends and the increasing demand for sustainable infrastructure solutions.

The company's expansion initiatives are tailored to meet the evolving needs of its customers and the broader market. By concentrating on high-margin opportunities and enhancing its risk management framework, the company aims to secure sustainable long-term growth. This approach is critical for achieving its financial targets and maintaining its competitive edge.

The transport segment experienced a 7.8% increase in revenue, reaching AU$6.0 billion in FY24. This growth was partially fueled by the Queensland Traffic Management Program (QTMP), demonstrating the company's ability to secure and execute large-scale infrastructure projects. This segment's performance highlights the company's strong position in the transport sector.

The utilities sector showed a remarkable turnaround, with EBITA soaring by over 100% to AU$54.5 million. This significant improvement was driven by new contracts, such as a AU$600 million Unitywater contract. The utilities sector's success underscores the company's ability to diversify its portfolio and capitalize on emerging opportunities.

The company is actively supporting customers in achieving zero-carbon outputs through re-engineering capabilities. An early-stage project in November 2024 exemplifies this commitment, aligning with the broader energy transition. This initiative positions the company as a leader in sustainable infrastructure solutions.

The company continues to prioritize securing opportunities that aim for higher margins and align with its enhanced risk management framework. This strategic focus is crucial for sustaining long-term profitability and ensuring the company's financial health. The emphasis on margin improvement is a key element of the overall business strategy.

The company's expansion initiatives are centered on urban services, supported by a strong work-in-hand of $38.5 billion. The transport segment saw a 7.8% revenue increase, and the utilities sector experienced significant EBITA growth.

- Focus on government services and infrastructure expansion.

- Support for customers in achieving zero-carbon outputs.

- Emphasis on securing higher-margin opportunities.

- Alignment with an enhanced risk management framework.

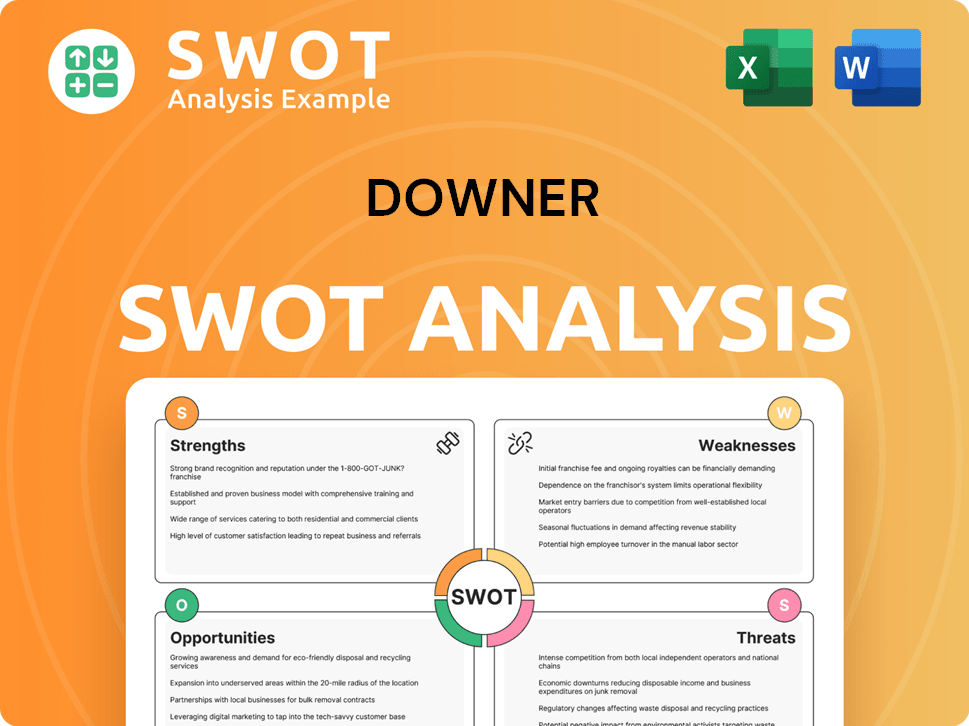

Downer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Downer Invest in Innovation?

The Downer Company is actively employing innovation and technology as key drivers for sustained growth. Their focus is on digital transformation and enhancing operational efficiency. This approach is crucial for navigating the future prospects of the company within the infrastructure and related sectors.

A core element of their strategy involves leveraging cutting-edge technologies. This includes the use of AI-driven analytics to improve asset management and predictive capabilities. The company is also focused on sustainability, setting targets for reducing Scope 1 and 2 emissions, aligning with a 1.5°C pathway, and aiming for net-zero emissions by 2050.

The company's Chief Information Officer (CIO), Nicola Dorling, recognized as a top CIO in 2024, emphasizes aligning technology with strategic goals. This is a business-led digital transformation strategy, simplifying processes, standardizing data, and refining operational models.

The company's digital transformation strategy focuses on simplifying complexities and redesigning processes to enhance efficiency. This includes standardizing data and refining operating models.

AI-driven analytics are being used to support infrastructure management. This includes improving asset maintenance and predictive capabilities, which is crucial for the future of infrastructure.

The RTS Digital platform provides digital consulting, software, and services. It leverages over 15 years of technology innovation and takes a product-based approach.

The xDNA initiative accelerates digital transformation for critical industries. It creates data-driven solutions and integrated work experiences, enhancing the company's business strategy.

The company is exploring low-code or no-code technologies for rapid solution development. This approach is highlighted by the digital engineering lead at Downer Group.

Sustainability is a key focus, with targets set for Scope 1 and 2 emissions reductions. These targets align with a 1.5°C pathway and a net-zero target by 2050, demonstrating a commitment to environmental responsibility.

The company's approach to innovation and technology is multi-faceted, focusing on both internal efficiencies and external service offerings. These initiatives are designed to support Downer's long-term growth potential.

- AI and Data Analytics: Implementing AI-driven analytics to improve asset management and predictive maintenance.

- RTS Digital Platform: Utilizing the RTS Digital platform for digital consulting, software, and services, leveraging over 15 years of technology innovation.

- xDNA: Accelerating digital transformation through the xDNA initiative, creating data-driven solutions for various industries.

- Low-Code/No-Code Development: Exploring low-code and no-code technologies for rapid solution development.

- Sustainability Initiatives: Setting and pursuing ambitious targets for reducing emissions, aligning with global climate goals.

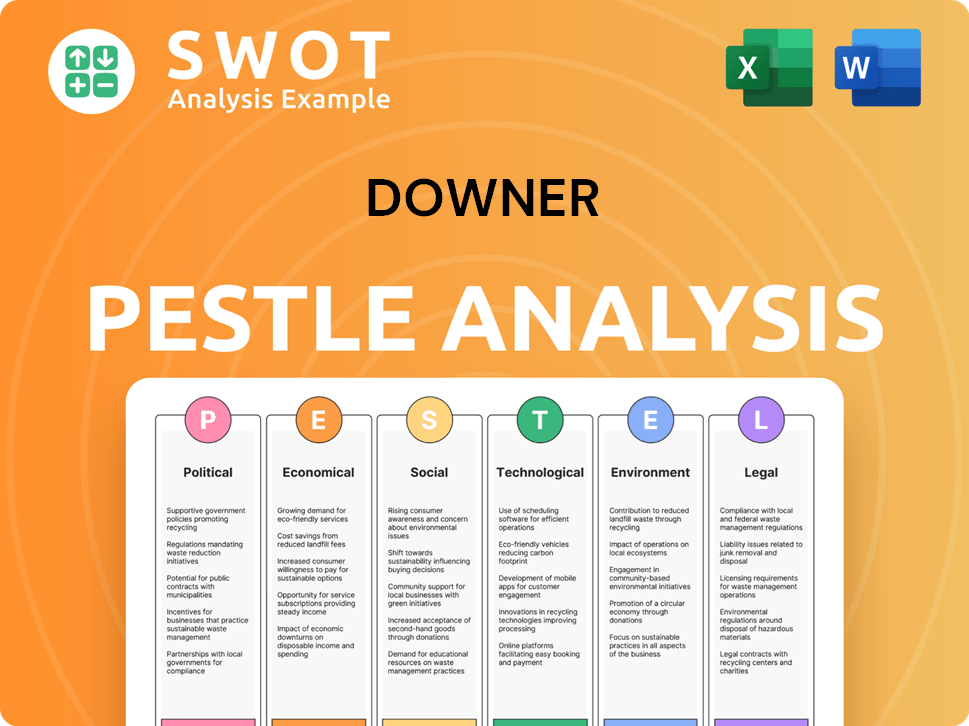

Downer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Downer’s Growth Forecast?

The financial outlook for the Downer Company reflects a positive trajectory, building on strong performance in fiscal year 2024. The company's focus on a robust growth strategy is evident in its financial results and future projections. This positive trend is supported by strategic initiatives and a commitment to operational efficiency.

In fiscal year 2024, Downer reported significant improvements across key financial metrics. The company's ability to enhance its profitability and manage its financial obligations demonstrates a solid foundation for future growth. This financial health positions the company well to capitalize on market opportunities and achieve its strategic objectives.

The company's performance in the first half of fiscal year 2025 further reinforces its positive outlook. With continued improvements in profitability and cost management, Downer is on track to meet its financial targets and sustain its growth momentum. These results highlight the effectiveness of the company's business strategy and its ability to adapt to market dynamics.

Downer's pro forma EBITA increased by 34% to AU$384.1 million in FY24. Revenue reached AU$11.7 billion, showcasing strong operational performance. The EBITA margin improved to 3.3% for FY24, with 4.0% in the second half.

Net operating cash flow increased by 72% to AUD 546 million. Net debt excluding leases declined by 36% to AUD 456 million. Gearing stood at 20%, with a net debt/EBITDA of 0.8.

Statutory NPAT increased by 4.7% to $75.5 million. Pro forma EBITA increased by 37.1% to $204.4 million. The pro forma EBITA margin grew to 3.7% in the first half of FY25.

Cumulative annualised gross cost out reached $180 million. The company is on track to achieve $200 million in cost savings by June 30, 2025. This demonstrates effective cost management and operational efficiency.

The company is targeting ongoing improvement in EBITA margin towards a management target of more than 4.5%, with a minimum average of 4.5% across FY25 and FY26. Downer is in compliance with all financial covenants and has no refinancing requirements in the next year. As of December 31, 2024, Downer's trailing 12-month revenue was $7.02 billion. The Brief History of Downer provides additional context on the company's evolution and strategic direction.

Analysts' consensus target price for Downer EDI shares is AU$5.65, with forecasts ranging from AU$5.45 to AU$6.09. This reflects positive sentiment regarding the company's future prospects and potential for growth. The company's strategic initiatives and operational improvements are expected to drive shareholder value.

- The company's strong financial performance and strategic initiatives are expected to drive shareholder value.

- The company's focus on cost management and operational efficiency contributes to its positive market outlook.

- The company's compliance with financial covenants and lack of refinancing needs provide financial stability.

- The analysts' target price reflects the positive outlook for the company's future growth and performance.

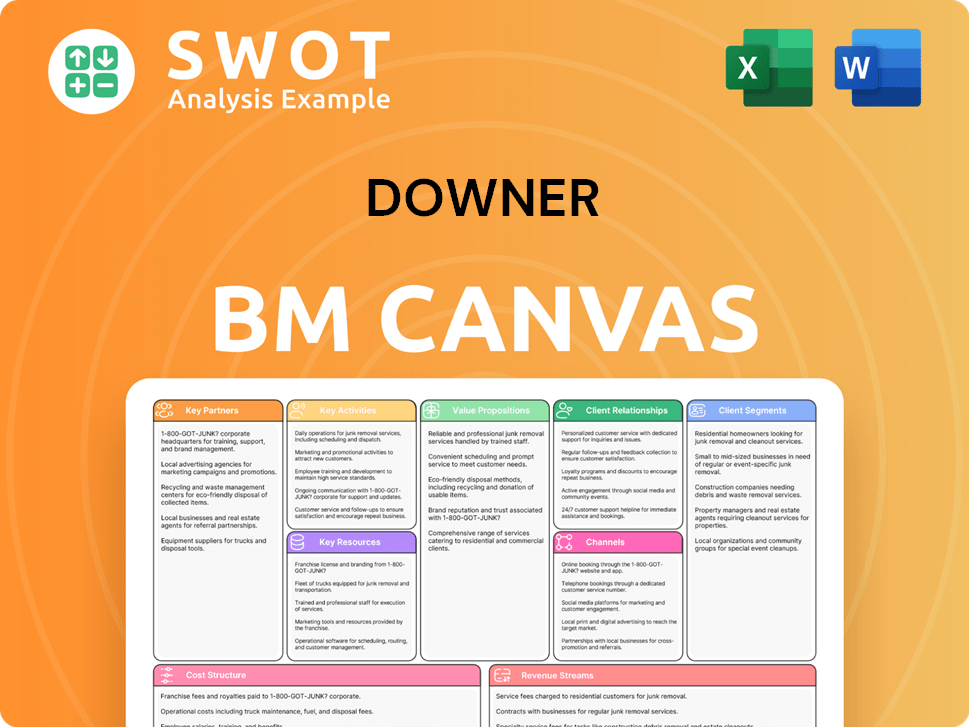

Downer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Downer’s Growth?

The Owners & Shareholders of Downer face several risks that could impact its ambitious growth strategy. Market competition, regulatory changes, and supply chain vulnerabilities are significant challenges. Internal factors like project management and governance also present potential obstacles to future success.

Market competition is intense in the maintenance services sector, with a mix of local and international providers vying for contracts. Regulatory shifts in the infrastructure and services sectors can also create uncertainty. These factors can affect the company's ability to secure profitable projects and maintain its market position.

Supply chain security is a growing concern, especially with the increasing threat of cyberattacks targeting third-party relationships. Furthermore, the company's road maintenance and paving, along with utilities maintenance and construction works, representing approximately 31% of total revenue, are exposed to physical climate risks.

The market for maintenance services is highly fragmented, leading to intense competition. This can impact profit margins and market share. The company must continually seek ways to differentiate itself to stay competitive.

Changes in regulations within the infrastructure and services sectors can introduce uncertainty. These changes may require the company to adapt its operations and strategies to remain compliant. Compliance costs can also increase.

Cyber threats and other disruptions to the supply chain can impact project delivery and profitability. The company is working to mitigate these risks, but the interconnectedness of supply chains remains a significant concern. The company's enterprise-wide source-to-contract technology platform is designed to mitigate fraud and corruption risks in its procurement control environment.

Revenue from road maintenance and paving, as well as utilities maintenance and construction works, is exposed to physical climate risks. Severe weather events can disrupt operations and increase costs. Strategic planning is essential to address these challenges.

Effective tender assessment, risk evaluation, and project management are critical for success. The company has introduced a new project management framework to address these risks. The effectiveness of these measures is crucial for future growth.

Issues related to service quality, safety, business ethics, and corporate governance can pose risks. The company actively manages these risks through diversification, risk management frameworks, and scenario planning. Strengthening investment approval disciplines and governance relating to capital allocation processes is also important.

The company employs various strategies to mitigate risks, including diversification across different sectors and geographies. Risk management frameworks are in place to identify, assess, and manage potential threats. Scenario planning helps prepare for various adverse events.

Strengthening investment approval disciplines and governance related to capital allocation processes is a key focus. This helps ensure that investments are aligned with the company's strategic goals and that risks are appropriately managed. The company's digital transformation strategy is also crucial.

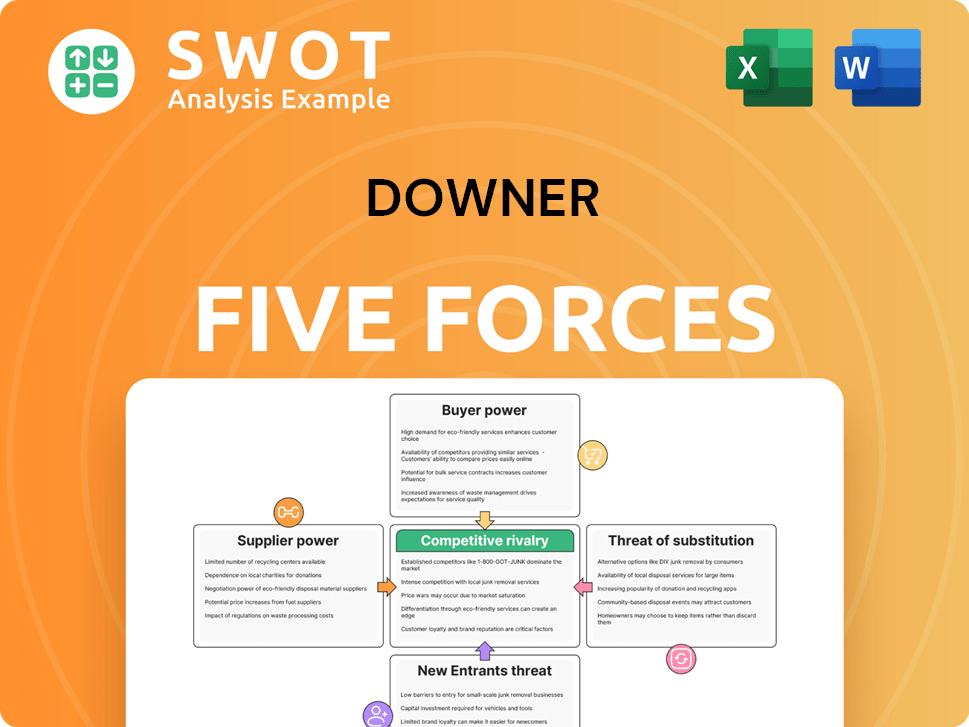

Downer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Downer Company?

- What is Competitive Landscape of Downer Company?

- How Does Downer Company Work?

- What is Sales and Marketing Strategy of Downer Company?

- What is Brief History of Downer Company?

- Who Owns Downer Company?

- What is Customer Demographics and Target Market of Downer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.