Downer Bundle

How Does Downer Company Thrive in the Infrastructure Realm?

Downer Company, a major player in Australia and New Zealand, is at the forefront of designing, building, and maintaining critical infrastructure and facilities. With over 26,000 employees as of March 2024, Downer Group significantly impacts sectors like transport and resources. Its involvement in large-scale Downer SWOT Analysis projects, such as the Queensland Train Manufacturing Program, showcases its capabilities.

This deep dive into Downer Company will explore its operational model, revenue streams, and strategic shifts. We'll examine how Downer services create value, its competitive positioning, and its future outlook in a constantly evolving market. Understanding Downer's business is crucial for investors and anyone interested in the infrastructure sector, including Downer projects and its impact on local communities.

What Are the Key Operations Driving Downer’s Success?

The core of the Downer Company's operations revolves around delivering integrated services. This includes the design, construction, and maintenance of assets, infrastructure, and facilities. Their primary focus is on serving government entities, public and private organizations, and communities across Australia and New Zealand.

Downer Group segments its offerings into Transport, Utilities, and Facilities. Each segment provides specialized services, ensuring a comprehensive approach to infrastructure and asset management. This allows them to handle diverse projects, from road maintenance to complex facility management.

Downer's value proposition lies in its ability to provide end-to-end solutions. This integrated approach, combined with long-term client relationships, allows the company to secure recurring work. The company's commitment to innovation, such as its work on battery-electric trains, further enhances its competitive edge.

The Transport segment offers a wide array of services. These include road services, transport infrastructure, rail, light rail, and buses. They provide end-to-end transport solutions and asset management. This covers road network management and the manufacture and maintenance of passenger rolling stock.

The Utilities segment focuses on essential services. These services include power, gas, water, and telecommunications. The segment covers planning, designing, constructing, operating, maintaining, managing, and decommissioning network assets.

The Facilities segment delivers integrated services. These services cater to customers in government, education, healthcare, and more. Capabilities include technical and engineering services, asset maintenance and management, catering, cleaning, and security solutions.

Downer's operational processes are supported by a robust supply chain and strategic partnerships. The company leverages its integrated value chain and long-term relationships with government clients. This helps to maintain a competitive edge in the market.

Downer services are supported by a strong focus on innovation and efficiency. This includes initiatives like developing new technologies for the freight rail industry. The company's commitment to a 'back-to-basics' approach and enhanced risk management also contribute to its success.

- The Queensland Train Manufacturing Program, where Downer is constructing 65 passenger trains, is a significant project.

- Downer's focus on long-term government contracts ensures a consistent stream of work.

- The company's integrated value chain and strategic fixed asset investments are key to its competitive advantage.

- Downer's commitment to sustainability is evident in its ventures into battery-electric trains.

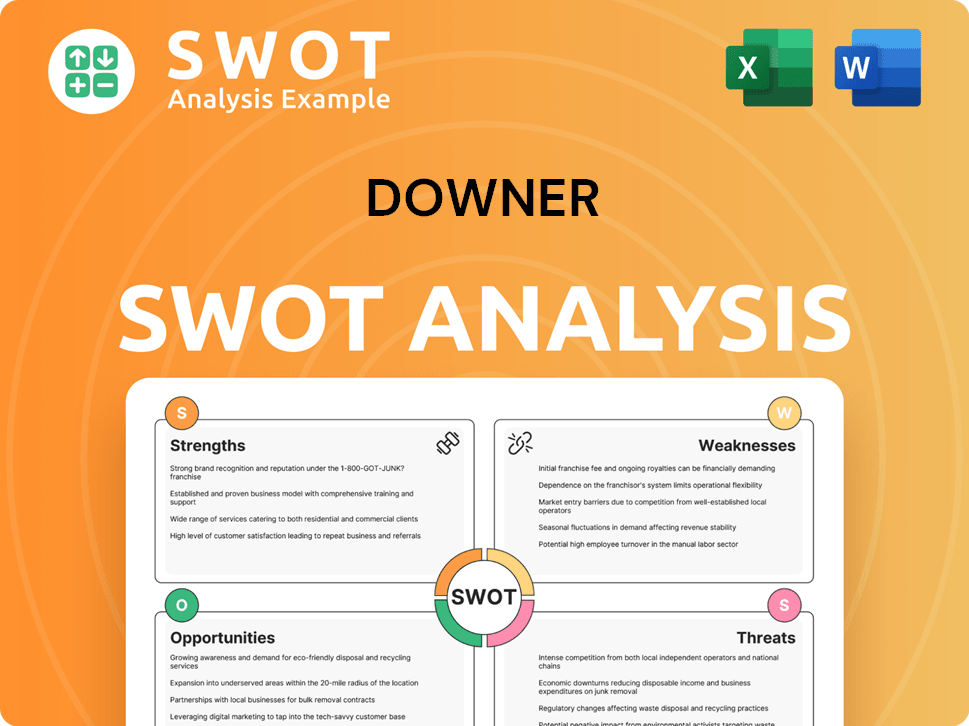

Downer SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Downer Make Money?

The Downer Company generates revenue through a diverse range of service offerings. These services span across the Transport, Utilities, and Facilities segments, ensuring a broad market presence. The company's financial performance is underpinned by a strategic focus on long-term contracts and capital-light business models.

For the fiscal year ending June 30, 2024, the Downer Group reported a pro forma revenue of AU$11.7 billion, marking a 5.5% increase from the previous year. The trailing 12-month revenue, as of December 31, 2024, reached $7.02 billion, demonstrating consistent financial growth. This growth is further supported by strategic contract wins and operational efficiencies across its various business segments.

The company's monetization strategies are heavily reliant on long-term service contracts, particularly with government and public sector clients. These contracts, which make up around 90% of its work-in-hand portfolio, provide a stable revenue stream. The emphasis on urban services and a capital-light model contributes to improved returns and operational efficiency. To know more about the company's marketing strategies, you can read the Marketing Strategy of Downer.

The Transport segment is a significant revenue driver for Downer services, accounting for approximately half of the group's EBIT. The Utilities sector experienced a remarkable turnaround, and the Facilities segment continued to perform well. Recent contract wins further solidify the company's revenue streams.

- Transport: Revenue increased by 7.8% to AU$6.0 billion in FY24, driven by projects such as the Queensland Traffic Management Program.

- Utilities: EBITA soared by over 100% to AU$54.5 million in FY24, boosted by new contracts like the AU$600 million Unitywater contract.

- Facilities: Despite a slight dip in revenue, EBITA increased by 3.3% in FY24, supported by strong performance in government health and education projects.

- Recent Contracts: New contracts, such as the NZ$600 million electricity field services contract with Powerco announced in March 2025, and a new NZ$550 million telco field services agreement with Chorus NZ in February 2025, demonstrate continuous revenue generation.

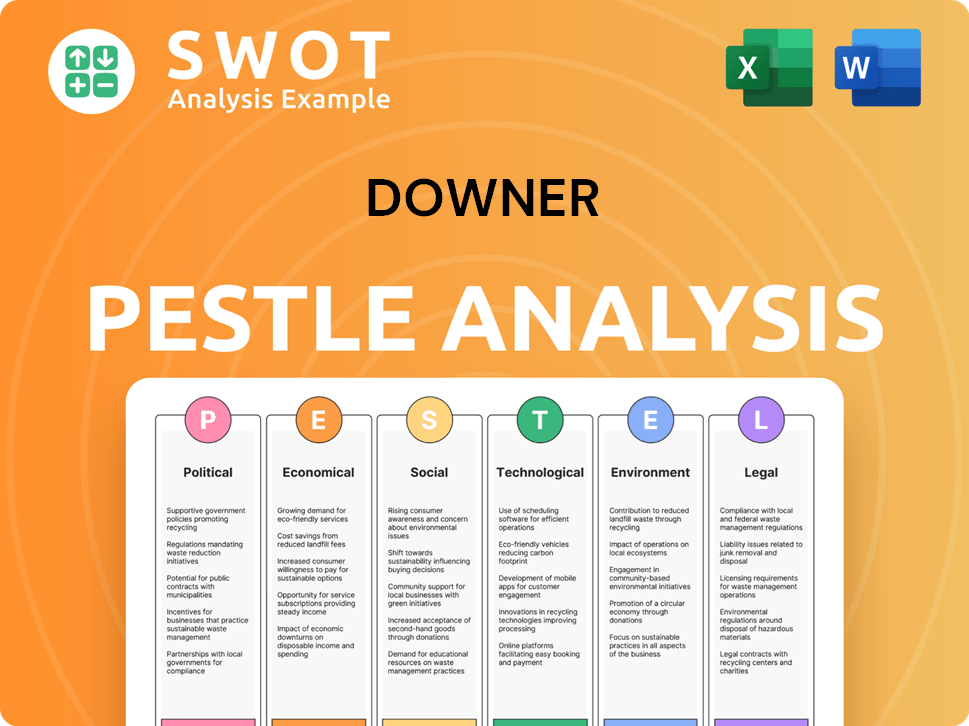

Downer PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Downer’s Business Model?

The Growth Strategy of Downer has been significantly reshaped in recent years, marked by key strategic moves. These include divesting non-core businesses to focus on core urban services. This strategic shift has positioned the company for sustained growth and a more capital-light business model, impacting how the Downer Group operates.

A significant milestone was the divestment of non-core businesses, including mining and high-risk construction. This involved the sale of its Open Cut Mining East business and the completion of its Laundries Business divestment in April 2025. The company also merged its utilities and industrial energy sectors to optimize operations. These changes reflect Downer's efforts to streamline its Downer business and improve efficiency.

Operational and market challenges have included accounting irregularities and profit warnings. In response, Downer has implemented a refreshed board, enhanced governance, and strengthened risk management. The focus on 'back-to-basics' contracting disciplines and improved project controls is part of its strategy to de-risk project exposures and improve profitability. This approach is crucial for the company's financial performance analysis.

Divestment of non-core businesses, including mining and high-risk construction. Sale of Open Cut Mining East and completion of Laundries Business divestment. Merger of utilities and industrial energy sectors to optimize operations, which is a key part of Downer services.

Implementation of a refreshed board, enhanced governance, and strengthened risk management. Focus on 'back-to-basics' contracting disciplines and improved project controls. Leveraging AI to enhance safety at work, showing Downer's commitment to innovation.

Scale, market leadership, and technical capabilities in integrated infrastructure services across Australia and New Zealand. Long-standing relationships with local and state governments. Commitment to innovation, such as developing world-first Electrical Equipment Enclosures for freight rail.

Addressing accounting irregularities and profit warnings through enhanced governance and risk management. De-risking project exposures and improving profitability through improved project controls. The company's ability to deliver earnings and EBITA margin improvement in varied market conditions.

Downer's competitive advantages stem from its scale, market leadership, and technical capabilities in integrated infrastructure services. The company's commitment to innovation, such as developing world-first Electrical Equipment Enclosures for freight rail and exploring battery-electric trains, further differentiates it. The company is also leveraging AI to enhance safety at work.

- Scale and market leadership in Australia and New Zealand.

- Long-standing relationships with government clients.

- Commitment to innovation and technology adoption.

- Resilience of a diversified portfolio.

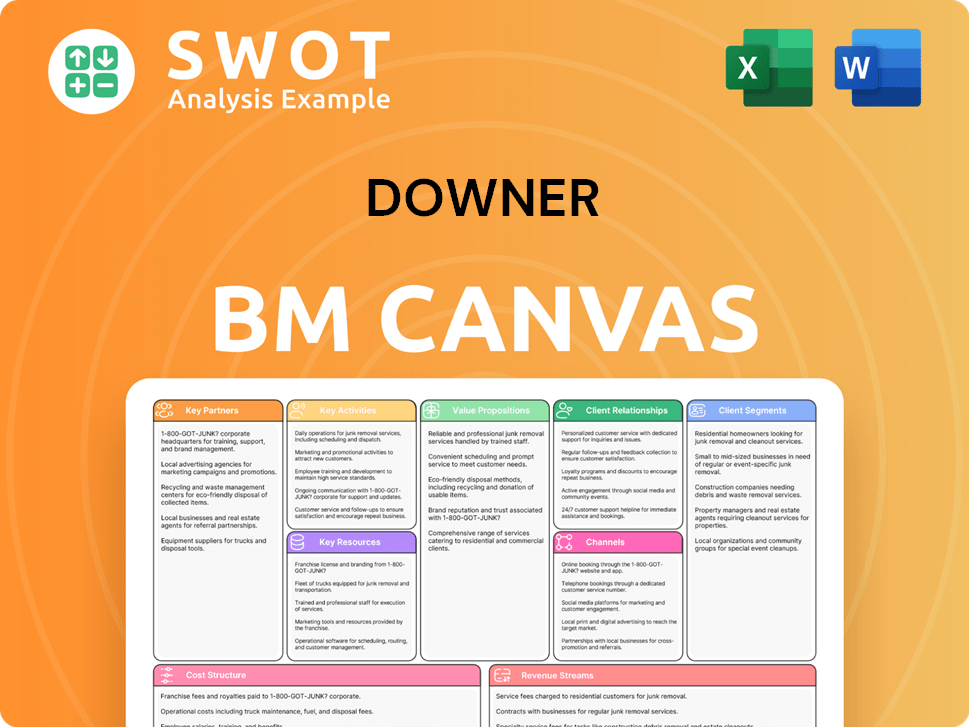

Downer Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Downer Positioning Itself for Continued Success?

The Downer Company holds a strong position in the infrastructure services sector across Australia and New Zealand. Its diverse portfolio, encompassing transport, utilities, and facilities, along with its significant work-in-hand, provides a solid foundation for its operations. As an ASX 200 company, Downer Group has a substantial presence in the market, bolstered by its focus on government-related projects.

However, Downer services face risks, including cost pressures and reputational challenges from past accounting issues. The company also deals with the cyclical nature of infrastructure projects and government spending plans. Despite these challenges, Downer projects are strategically positioned for growth.

Downer is a leading provider of integrated infrastructure services in Australia and New Zealand. It has a diversified portfolio across transport, utilities, and facilities. Approximately 90% of its work is government-related, providing a stable revenue base.

Key risks include cost pressures impacting margins and reputational risks. The company faces cyclical demand in infrastructure projects. There is also exposure to government expenditure plans.

The company is transitioning from turnaround to sustainable growth. It aims to improve its EBITA margin to over 4.5% by FY25. The company is committed to net-zero targets, with a 50% reduction in Scope 1 and 2 emissions by 2032.

As of August 2024, Downer's work-in-hand portfolio was valued at AU$38.5 billion. The company aims to achieve the remaining AU$45 million of its AU$175 million annualised cost-out target by the end of FY25. Analysts project a doubling of earnings over the next few years.

Downer is focused on sustainable growth, with strategic initiatives in place to improve financial performance and reduce environmental impact. The company is targeting improvements in EBITA margins while pursuing cost-out targets.

- Enhancing the quality of revenue.

- Targeting an ongoing improvement in EBITA margin towards a management target of more than 4.5% by FY25.

- Achieving the remaining AU$45 million of its AU$175 million annualised cost-out target by the end of FY25.

- Reducing Scope 1 and 2 greenhouse gas emissions by 50% by 2032 and achieving net zero by 2050.

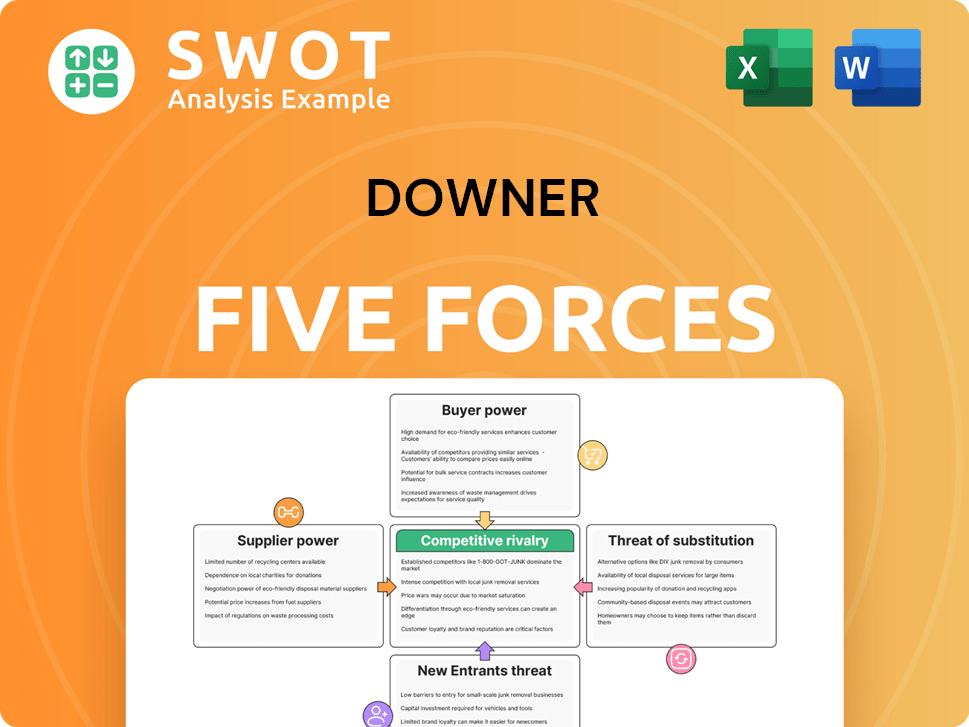

Downer Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Downer Company?

- What is Competitive Landscape of Downer Company?

- What is Growth Strategy and Future Prospects of Downer Company?

- What is Sales and Marketing Strategy of Downer Company?

- What is Brief History of Downer Company?

- Who Owns Downer Company?

- What is Customer Demographics and Target Market of Downer Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.