Emeco Bundle

How has the Emeco Company evolved since 1972?

Journey back in time to discover the fascinating Emeco SWOT Analysis and its remarkable transformation. From its humble beginnings, Emeco has become a vital provider of mining equipment solutions. Explore how this Australian-based company has grown into a leading force in the industry, offering rental, maintenance, and project support services.

Emeco's story is a testament to strategic adaptation and technological advancement. Initially focused on providing essential earthmoving equipment, Emeco's evolution reflects its commitment to innovation. The company's financial performance in 1H25 highlights its resilience and strategic focus on higher-margin activities. This brief history of Emeco showcases the company's journey to becoming a key player in the mining sector.

What is the Emeco Founding Story?

The Emeco Company's story began in 1972. The primary focus was to provide essential earthmoving equipment to the mining industry. The company's initial strategy revolved around renting out equipment and offering maintenance services to mining companies.

Emeco's early operations were based in Australia. The company quickly established a strong presence in key mining regions across the country. The establishment of Emeco was shaped by the increasing need for dependable and well-maintained heavy earthmoving equipment within the Australian mining sector.

While specific details about the exact founding date, the names of all founders, and their individual backgrounds are not readily available in the provided information, the company's vision was clear from the start: to support the mining industry with the necessary tools and services.

Emeco was founded in 1972 with a focus on the mining industry.

- The company initially provided earthmoving equipment.

- Emeco's business model centered on equipment rental and maintenance.

- Early operations were based in Australia.

- The company aimed to meet the growing needs of the Australian mining sector.

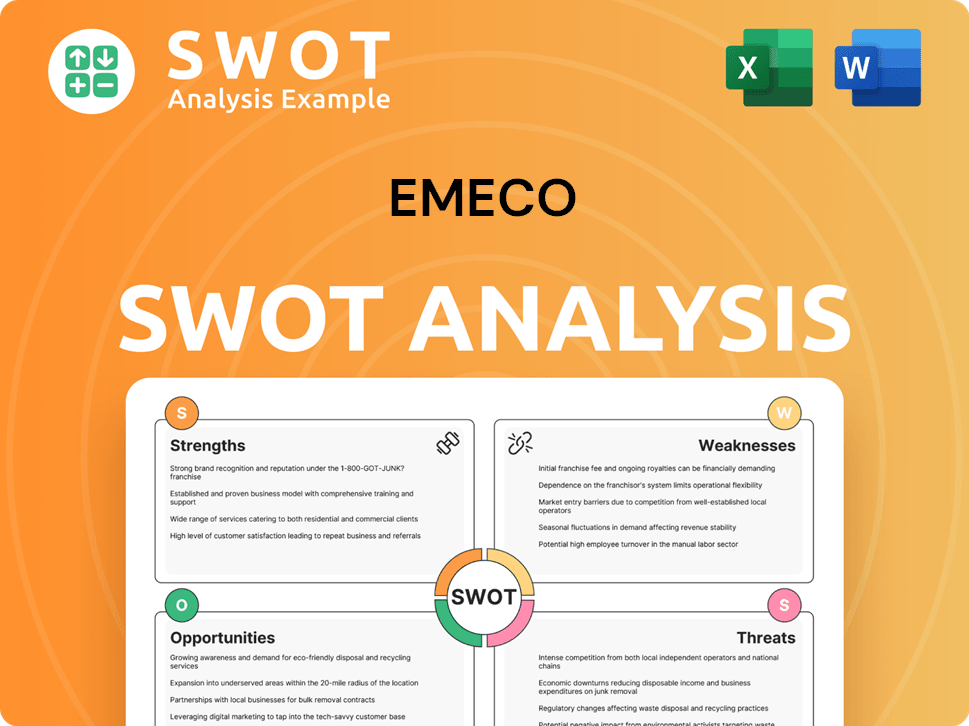

Emeco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Emeco?

The early growth of the Emeco Company involved expanding its rental operations and securing long-term contracts, particularly in Australia. Simultaneously, the company developed its Force workshops business, which broadened its customer service offerings. By fiscal year 2020, the workforce had grown to approximately 1,000 employees nationwide, reflecting significant expansion.

A key strategic move was the acquisition of the Pit N Portal business in FY20, which expanded the service offerings to include hard-rock underground equipment and mining services. This acquisition also diversified the commodity and customer base, focusing on long-term hard rock projects. This expansion is a crucial part of the Marketing Strategy of Emeco.

The company faced challenges, including the mining industry downturn in FY14, which impacted earnings from Australia and Indonesia. In response, Emeco restructured its Australian operations and exited the Indonesian market. Despite these challenges, the company focused on cost management and capital allocation.

By FY24, Emeco reported an Operating EBITDA growth of 12% to $280.5 million and Operating Net Profit after Tax growth of 17% to $69.4 million. The company's leverage ratio improved from 1.1x in FY23 to 1.0x in FY24. The strategy in FY24 involved refocusing on equipment rental and maintenance.

Emeco's strategic focus in FY24 was on its core competency of equipment rental and maintenance. This involved exiting contract mining to re-calibrate the business around its competitive strengths. This strategic shift helped improve financial performance and streamline operations.

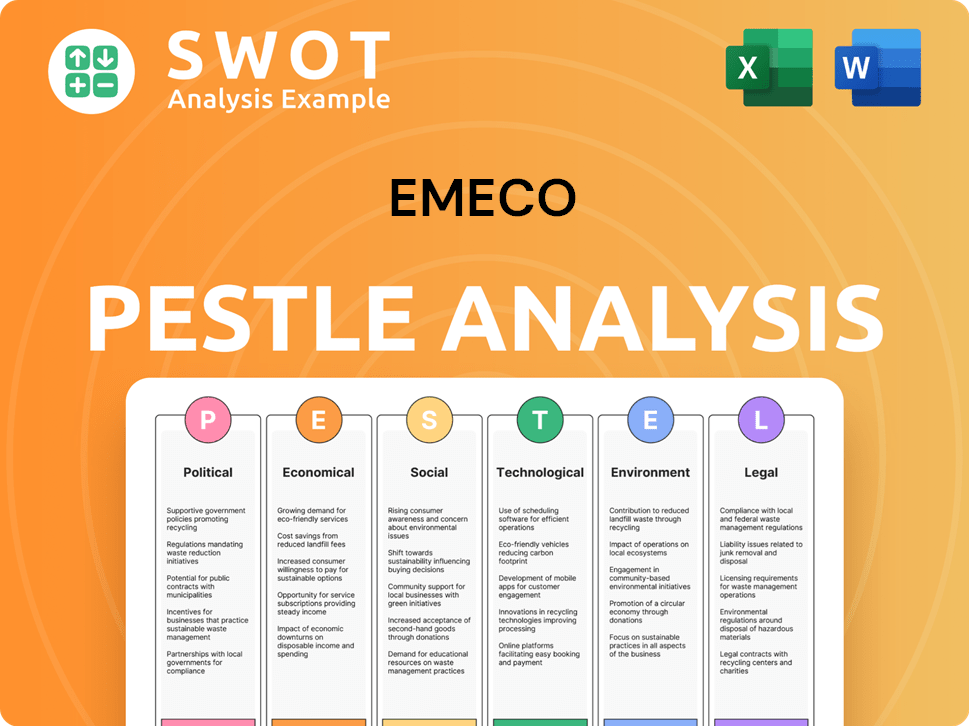

Emeco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Emeco history?

The Emeco Company has a rich history marked by significant achievements and strategic adaptations. The company has consistently evolved to meet market demands and overcome challenges, solidifying its position in the industry. Further insights into the Emeco history can be found in the article Revenue Streams & Business Model of Emeco.

Empower with Milestones Table| Year | Milestone |

|---|---|

| FY24 | Strategic investments were prioritized in IT, Business Systems and Intelligence, Digital Transformation, and Operational Technology, implementing a robust innovation framework. |

| FY24 | Successfully executed a major growth capital expenditure program, refurbishing equipment to enhance fleets for new projects. |

| 1H25 | Cost savings programs were activated across overheads, parts, and labor, with annualized overhead savings of approximately $15 million successfully implemented between October 2024 and February 2025. |

| 31 December 2024 | Leverage ratio improved from 1.0x at 30 June 2024 to 0.84x. |

A key innovation for the Emeco Company is its proprietary asset management and fleet optimization technology. This technology supports its network of maintenance and component rebuilding workshops and its substantial fleet of nearly 1,000 machines.

The company utilizes proprietary technology to manage and optimize its assets. This includes fleet optimization to ensure efficiency and reduce costs.

Emeco's fleet optimization strategies are crucial for maintaining a competitive edge. They ensure the effective deployment and maintenance of its machinery.

The Emeco Company has faced challenges such as market downturns and competitive threats, leading to strategic pivots. The company has also had to navigate internal weaknesses and external risks.

The company experienced a substantial downturn in the resources sector around 2013-2016. This impacted the company's financial performance.

Competition in the market has led to strategic adjustments. These adjustments include exiting certain markets and restructuring operations.

The company has addressed internal weaknesses such as high prices and supply chain inefficiencies. Disciplined cost management has been implemented.

Changing economic conditions pose a risk to the company. The company monitors these conditions and makes strategic adjustments as needed.

Stringent environmental regulations present another challenge. The company must comply with these regulations to maintain operations.

Disciplined cost management is a strategy to address challenges. This includes programs to reduce overhead, parts, and labor costs.

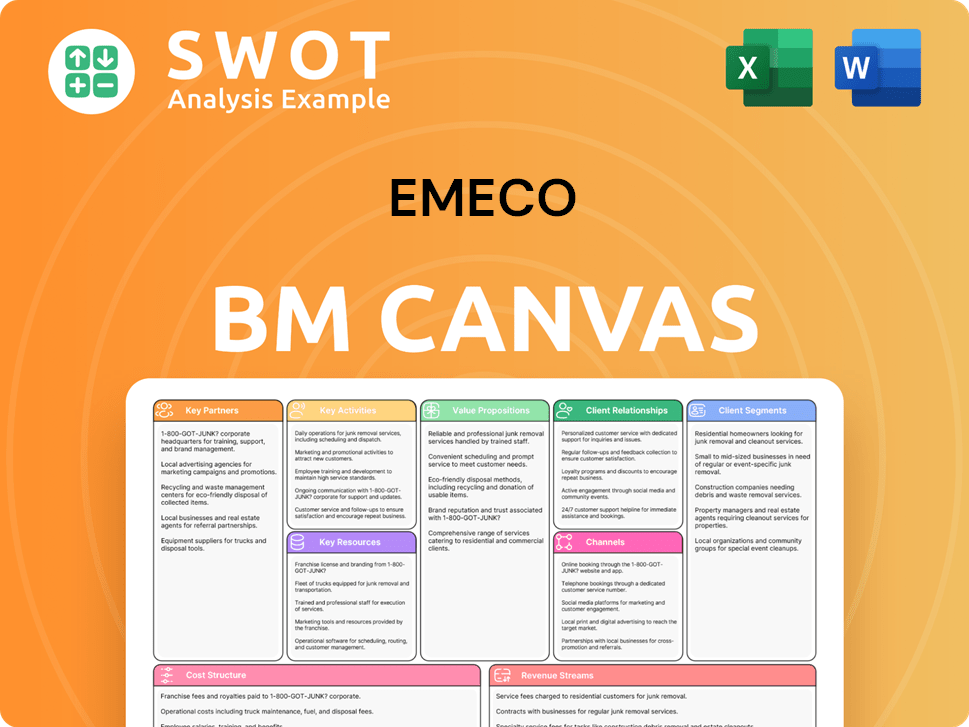

Emeco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Emeco?

The Emeco Company has a rich history, marked by strategic shifts and significant growth. Founded in 1972, the company has evolved from its early days to become a key player in the mining equipment rental and services sector. Key milestones include its incorporation in 2004, a strategic focus on mining customers in 2010, and the acquisition of Pit N Portal in 2020, expanding its services. Recent years have seen substantial revenue increases, with a reported revenue of $874.9 million in 2023, and strong financial performance in 2024 and early 2025, reflecting its robust market position.

| Year | Key Event |

|---|---|

| 1972 | Emeco Holdings Limited is founded. |

| 2004 | Emeco Holdings Ltd is incorporated on December 14. |

| 2010 | Emeco decides to focus on servicing mining customers and exits civil infrastructure markets. |

| 2014 | Emeco restructures Australian operations and exits the Indonesian market. |

| 2017 | Emeco reports an operating EBITDA of $83.5 million for FY2017. |

| 2020 | Emeco acquires Pit N Portal, expanding into hard-rock underground equipment and mining services. |

| 2023 | Emeco reports revenue of $874.9 million for the year ended June 30. |

| 2024 (August) | Emeco reports Operating EBITDA growth of 12% to $280.5 million and Operating Net Profit after Tax growth of 17% to $69.4 million for FY24. |

| 2024 (November) | Emeco reiterates its FY25 Operating EBITDA target of $300 million. |

| 2024 (December) | Emeco reports total debt at AU$358.74 million in FY24. |

| 2025 (February) | Emeco reports an operating net profit after tax of $38.3 million for the half year ended 31 December 2024. |

| 2025 (May) | Emeco's subsidiary, Force Equipment Pty Ltd, enters a five-year agreement with XCMG Mining Equipment Australia. |

Emeco is focused on organic earnings growth through its core rental and workshop businesses. They are also working on strengthening their balance sheet to improve long-term shareholder returns. Their aim is to achieve a Return on Capital (ROC) of around 20% in the next two years.

Emeco's strategic priorities for FY25 include a continued focus on disciplined capital expenditure and cost efficiencies. They aim to build market share through new projects and expand fully maintained projects. This approach is designed to drive returns and cash flow.

Emeco plans to expand the Force service offering, including enhancing in-field and workshop capabilities for battery-powered fleets. This expansion aligns with the industry’s trend towards electrification in mining. The company is also focused on developing electric capabilities.

The partnership with XCMG to develop electric capabilities and support long-term mining operations and fleet maintenance is a key part of Emeco's strategy. This collaboration highlights their commitment to sustainable growth. This is part of their commitment to support long-term mining operations.

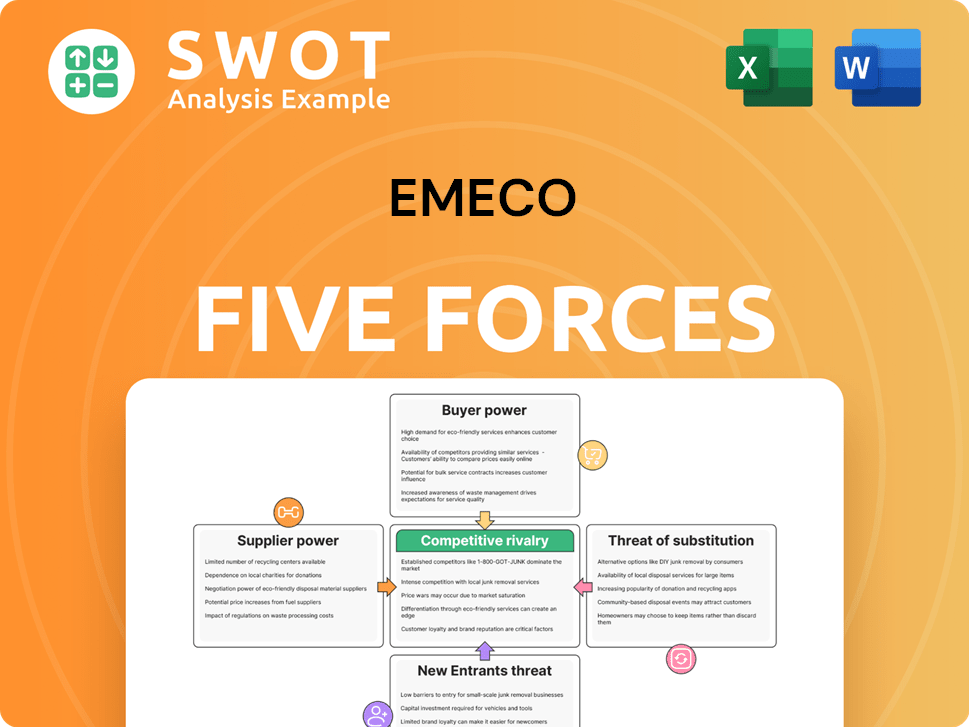

Emeco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Emeco Company?

- What is Growth Strategy and Future Prospects of Emeco Company?

- How Does Emeco Company Work?

- What is Sales and Marketing Strategy of Emeco Company?

- What is Brief History of Emeco Company?

- Who Owns Emeco Company?

- What is Customer Demographics and Target Market of Emeco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.