Emeco Bundle

Unveiling the Inner Workings of Emeco Company: How Does It Thrive?

Emeco Holdings Limited stands as a cornerstone in the mining sector, providing essential equipment rental and maintenance services globally. Its influence is undeniable, supporting efficient and productive mining operations worldwide. Discover how Emeco's robust performance, reflected in its strong financial results, underscores its critical role in the industry.

Understanding the Emeco SWOT Analysis, its operational framework, and revenue generation is vital for investors and industry watchers alike. This exploration will dissect the Emeco business model, examining its core value proposition and strategic moves that have solidified its competitive edge. Whether you're interested in the Emeco operations or its impact on the market, this analysis provides a comprehensive view.

What Are the Key Operations Driving Emeco’s Success?

The core operations of the Emeco company focus on providing heavy earthmoving equipment to the mining industry. This involves a comprehensive fleet of machinery, including excavators, dump trucks, and loaders, which supports various stages of the mining process. The Emeco business model centers on offering these machines alongside maintenance and support services, making it a key partner for mining companies.

Emeco's primary customer segments are mining companies of different sizes, from large multinational corporations to smaller independent operators. These companies operate across various commodities, such as coal, iron ore, and gold. The company's operational effectiveness is further enhanced by its strong relationships with mining companies, often resulting in long-term contracts and repeat business.

The company's value proposition goes beyond just renting out machinery. Emeco offers an integrated approach that includes equipment rental, maintenance, and support. This helps clients optimize fleet utilization and reduce operational costs. This integrated service model translates directly into customer benefits, such as increased productivity and reduced capital expenditure.

Emeco's operational process begins with the strategic acquisition and maintenance of its equipment fleet. The company employs a rigorous asset management strategy, focusing on acquiring late-model, high-quality equipment and maintaining it to exacting standards. This includes in-house maintenance capabilities and strategically located workshops to ensure reliability and maximize uptime for its clients.

The supply chain involves sourcing equipment from leading original equipment manufacturers (OEMs) and procuring spare parts and components to support its maintenance operations. This is crucial for maintaining the availability and performance of the equipment. The company's success also depends on strong partnerships.

Emeco's integrated service model leads to increased productivity, reduced capital expenditure, and enhanced operational flexibility for its clients. By focusing on equipment uptime and performance, Emeco helps mining companies improve their efficiency and reduce costs. This approach makes Emeco a valuable partner in the mining sector.

Emeco's strong relationships with mining companies often result in long-term contracts and repeat business. This demonstrates the value of the services provided. The company's focus on customer satisfaction and reliable equipment contributes to its success in the industry.

Emeco differentiates itself through its integrated approach, combining equipment rental with comprehensive maintenance and support. This model allows Emeco to act as a strategic partner, helping clients reduce costs and improve operational efficiency. This focus on customer support and equipment performance gives Emeco a competitive edge in the market.

- Integrated service model, including equipment rental, maintenance, and support.

- Strong relationships with mining companies, leading to long-term contracts.

- Focus on equipment uptime and performance, ensuring customer productivity.

- Strategic partnerships with OEMs and suppliers for equipment and parts.

For more details on Emeco's history and evolution, you can read the Brief History of Emeco. This integrated service model, coupled with a focus on equipment uptime and performance, translates directly into customer benefits such as increased productivity and reduced capital expenditure for clients.

Emeco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Emeco Make Money?

The Emeco company primarily generates revenue through two main streams: equipment rentals and maintenance services. This dual approach ensures a stable income flow, crucial for the Emeco business model. The focus on long-term contracts and comprehensive services allows for consistent financial performance.

Emeco operations are centered on providing earthmoving equipment to mining companies. Rental fees are determined by factors such as equipment type, rental duration, and operational hours. In addition to rentals, Emeco offers maintenance and support services, which are integral to its revenue model, ensuring equipment longevity and optimal performance.

By offering both equipment and maintenance, the company aims to capture a larger share of its clients' operational expenditure. The strategic management of its fleet helps adapt to market demands and commodity cycles, optimizing pricing and utilization rates. While specific details on innovative monetization strategies are not widely publicized, the bundling of equipment rental with maintenance services is a key element of its value proposition and revenue generation.

Emeco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Emeco’s Business Model?

The journey of the Emeco company has been marked by strategic acquisitions and a consistent focus on operational efficiency, which have been pivotal to its growth and competitive standing. A significant milestone was the acquisition of Orionstone and Andy's Earthmovers in 2017, which substantially expanded Emeco's fleet and market presence, particularly in the Australian mining sector. This strategic move allowed Emeco to achieve greater economies of scale and diversify its client base.

The Emeco business model has also demonstrated resilience in navigating market challenges, such as downturns in commodity prices, by focusing on cost control, optimizing fleet utilization, and maintaining strong customer relationships. The company's ability to adapt to changing market conditions and maintain a strong financial position has been crucial. Emeco's strategic moves have consistently aimed at strengthening its market position and ensuring long-term sustainability.

Emeco's competitive advantages are multifaceted. Its extensive, well-maintained fleet of modern earthmoving equipment is a significant asset, allowing it to meet diverse client needs across various mining operations. Furthermore, its integrated service model, which combines equipment rental with comprehensive maintenance and support, differentiates it from competitors who may offer only equipment or maintenance services separately. This bundled offering provides a more holistic solution for mining companies, enhancing operational efficiency and reducing downtime.

The acquisition of Orionstone and Andy's Earthmovers in 2017 significantly expanded Emeco's fleet and market presence. These acquisitions allowed Emeco to achieve greater economies of scale. Further strategic moves have consistently aimed at strengthening its market position.

Emeco focuses on cost control and optimizing fleet utilization. The company maintains strong customer relationships. These strategies help navigate market challenges.

Emeco's extensive fleet meets diverse client needs. The integrated service model combines equipment rental with maintenance. Strong client relationships lead to long-term contracts.

Emeco builds customer loyalty through reliability and quality equipment. Responsive service is a key factor. Data analytics optimizes fleet performance.

Emeco adapts to industry trends, such as the increasing demand for more efficient equipment. The company invests in its fleet and operational capabilities. This helps maintain its competitive edge in a dynamic market. For more details, you can read about Owners & Shareholders of Emeco.

- Investment in new technologies and equipment.

- Focus on sustainable practices and reducing environmental impact.

- Expansion into new markets and diversification of services.

- Continuous improvement of operational efficiency through data analytics.

Emeco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Emeco Positioning Itself for Continued Success?

The Emeco company holds a strong position in the mining equipment rental and maintenance sector, especially in Australia, where it's a leading provider. Its market share is supported by a large fleet, comprehensive services, and established relationships with major mining companies. Customer loyalty is generally high because of the critical nature of the equipment and services it provides, where reliability and uptime are paramount for mining operations. The company's global reach, while focused, allows it to serve diverse mining regions.

However, the

Emeco is a leading provider of mining equipment rental and maintenance services, particularly in Australia. Its extensive fleet and comprehensive service offerings support its strong market position. The company benefits from established relationships with major mining companies.

Emeco is exposed to commodity price cycles, which can reduce mining activity and demand for its services. Regulatory changes, new competition, technological advancements, and evolving consumer preferences also pose challenges. The company faces risks related to operational efficiency and fleet management.

Emeco aims to sustain and expand revenue through fleet investments and operational efficiency. Strategic initiatives include enhancing maintenance capabilities and exploring sustainable equipment options. The company's success depends on adapting to technological advancements and managing commodity price volatility.

Emeco is likely focusing on enhancing its maintenance capabilities and using data analytics for predictive maintenance. It may also explore more sustainable equipment options. Leadership emphasizes operational excellence, customer satisfaction, and prudent capital allocation.

Emeco's financial performance is closely tied to the mining sector's health. The company's ability to generate revenue is influenced by commodity prices and global mining activities. The company's future outlook hinges on its ability to adapt to technological advancements, manage commodity price volatility, and maintain its strong service proposition.

- Continued investment in fleet and operational efficiency.

- Exploring opportunities in new mining regions or niche markets.

- Focus on enhancing maintenance capabilities and leveraging data analytics.

- Potential exploration of more sustainable equipment options.

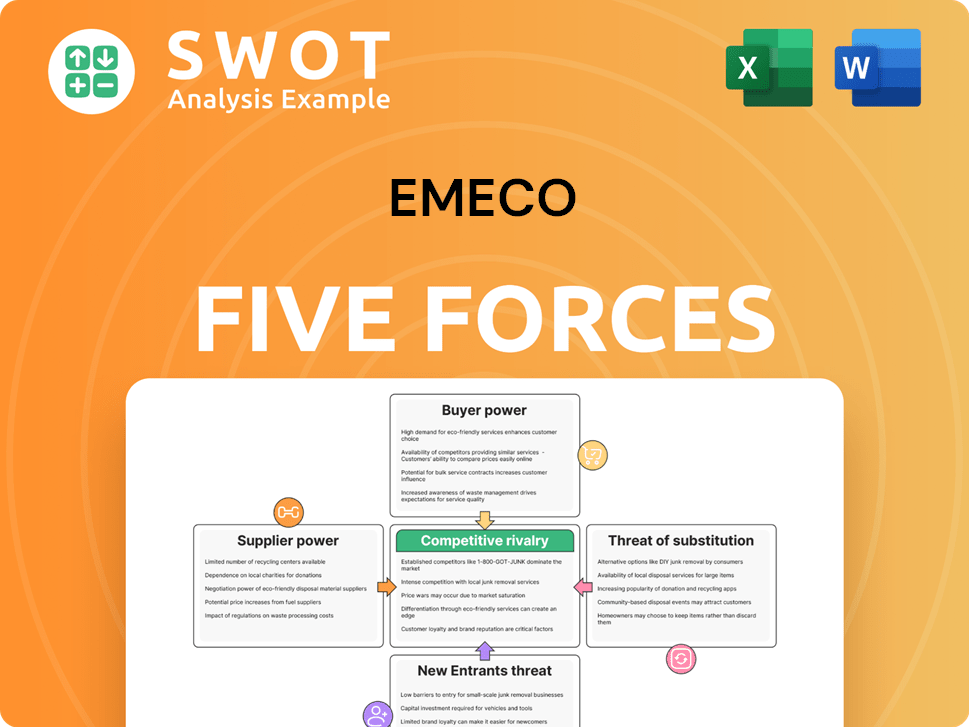

Emeco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Emeco Company?

- What is Competitive Landscape of Emeco Company?

- What is Growth Strategy and Future Prospects of Emeco Company?

- What is Sales and Marketing Strategy of Emeco Company?

- What is Brief History of Emeco Company?

- Who Owns Emeco Company?

- What is Customer Demographics and Target Market of Emeco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.