Emeco Bundle

How Does Emeco Stack Up in the Mining Equipment Arena?

The mining industry's unsung hero is the equipment rental and maintenance sector, a vital cog in global operations. Emeco Holdings Limited has emerged as a key player, offering crucial earthmoving equipment and support to mining giants. Established in 1972, Emeco has evolved from its Australian roots to become a global force, adapting to the industry's ebbs and flows.

Understanding the Emeco SWOT Analysis is essential to grasp its strategic positioning. This analysis delves into Emeco's competitive landscape, dissecting its rivals and highlighting its core strengths. By examining the company's market position, we can assess its ability to thrive amidst fluctuating commodity prices and technological advancements, ultimately shaping its future strategy within the Emeco company analysis.

Where Does Emeco’ Stand in the Current Market?

Emeco Holdings Limited holds a strong market position in the mining equipment rental and maintenance sector. This is especially true in Australia, a key global mining hub. As a leading provider of heavy earthmoving equipment, including excavators and dump trucks, for mining applications, Emeco serves large-scale mining operations. The company's focus is on providing reliable and efficient solutions to its customers.

The company's primary geographic presence is in Australia, where it has built a robust network and strong client relationships. Emeco's commitment to optimizing its fleet utilization and maintenance capabilities is a key part of its strategy. This allows the company to offer dependable services to its customers, supporting their operational needs in the mining sector.

Emeco's financial health indicates stable performance within the industry. For the first half of the 2024 financial year, the company reported a statutory net profit after tax of A$45.7 million. The underlying EBITDA was A$154.0 million, showing its operational profitability. This financial performance underscores its ability to generate significant earnings from its core operations.

Emeco is a leading provider of heavy earthmoving equipment. While specific global market share figures can fluctuate, Emeco is recognized for its strong presence in the mining sector, particularly in Australia. The company's focus on equipment rental and maintenance positions it as a key player.

Emeco's primary geographic focus is Australia, where it has established a strong network and client base. This concentration allows for optimized fleet management and efficient service delivery. The company's strategic location enables it to effectively serve major mining operations.

Emeco's financial performance indicates stability and profitability. In the first half of the 2024 financial year, the company reported a statutory net profit after tax of A$45.7 million. This financial strength supports its operational capabilities and market position.

Emeco's competitive advantage lies in its modern and well-serviced fleet. By offering reliable equipment and maintenance, Emeco helps mining companies minimize capital expenditure. This approach makes Emeco a preferred supplier for maximizing operational uptime.

Emeco's market position is strengthened by its focus on the mining sector and its ability to provide essential services. The company's financial results reflect its operational efficiency and market relevance. Emeco's strategy is centered on maintaining a modern fleet and providing reliable services.

- Strong presence in the Australian mining market.

- Focus on equipment rental and maintenance.

- Proven financial performance, including a statutory net profit after tax of A$45.7 million in the first half of 2024.

- Strategic focus on fleet optimization and customer service.

- Target Market of Emeco includes large-scale mining operations.

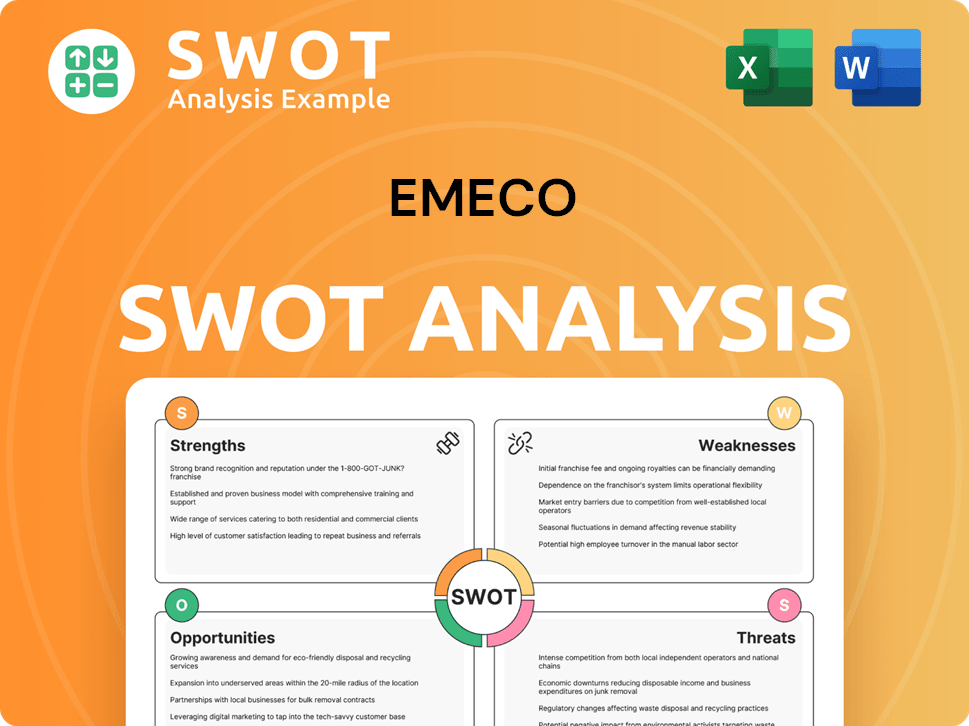

Emeco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Emeco?

The Emeco competitive landscape is shaped by a variety of players in the mining equipment rental and maintenance sector. Direct competition primarily comes from other large-scale equipment rental companies that possess extensive fleets of heavy earthmoving machinery. These competitors often offer comprehensive services, including equipment sales, rental, and maintenance, directly challenging Emeco's core offerings.

Indirect competition arises from mining companies that may opt to own and maintain their equipment fleets. Additionally, smaller, specialized rental companies focusing on specific equipment types or niche mining applications can also pose a localized challenge. The competitive environment is also influenced by equipment manufacturers that are increasingly offering their own rental and service packages, aiming to capture a larger share of the equipment lifecycle value.

Securing long-term contracts with major mining houses is a key battleground, where factors such as equipment availability, maintenance efficiency, and competitive pricing are crucial. Mergers and alliances among smaller rental players or strategic partnerships between manufacturers and service providers can reshape competitive dynamics, potentially leading to larger, more integrated competitors. The market position of Emeco is constantly evolving due to these factors.

Direct competitors include large-scale equipment rental companies with extensive fleets of heavy earthmoving machinery. These companies often offer integrated solutions, including equipment sales, rental, and maintenance services.

Indirect competition comes from mining companies that maintain their own equipment fleets. Smaller, specialized rental companies focusing on specific equipment types also pose a challenge.

Key factors include equipment availability, maintenance efficiency, and competitive pricing. Securing long-term contracts with major mining houses is a primary focus.

Mergers, alliances, and strategic partnerships can reshape the competitive landscape. Equipment manufacturers offering rental and service packages also influence the market.

Regional specialists with strong local networks are significant competitors. These companies often have established relationships with equipment manufacturers.

Larger, diversified industrial equipment rental giants also compete in this sector. They offer a wide range of services and equipment.

Key competitors such as Hastings Deering and WesTrac leverage their relationships with equipment manufacturers to provide integrated solutions. They compete with Emeco by offering comprehensive services, including equipment sales, rental, and maintenance. The Emeco company analysis reveals the importance of these competitors.

- Hastings Deering: A Caterpillar dealer, providing equipment sales, rental, and maintenance services.

- WesTrac: Another major Caterpillar dealer, offering similar comprehensive services.

- Mining Companies: Some mining companies choose to own and maintain their equipment fleets.

- Specialized Rental Companies: Focus on specific equipment types or niche mining applications.

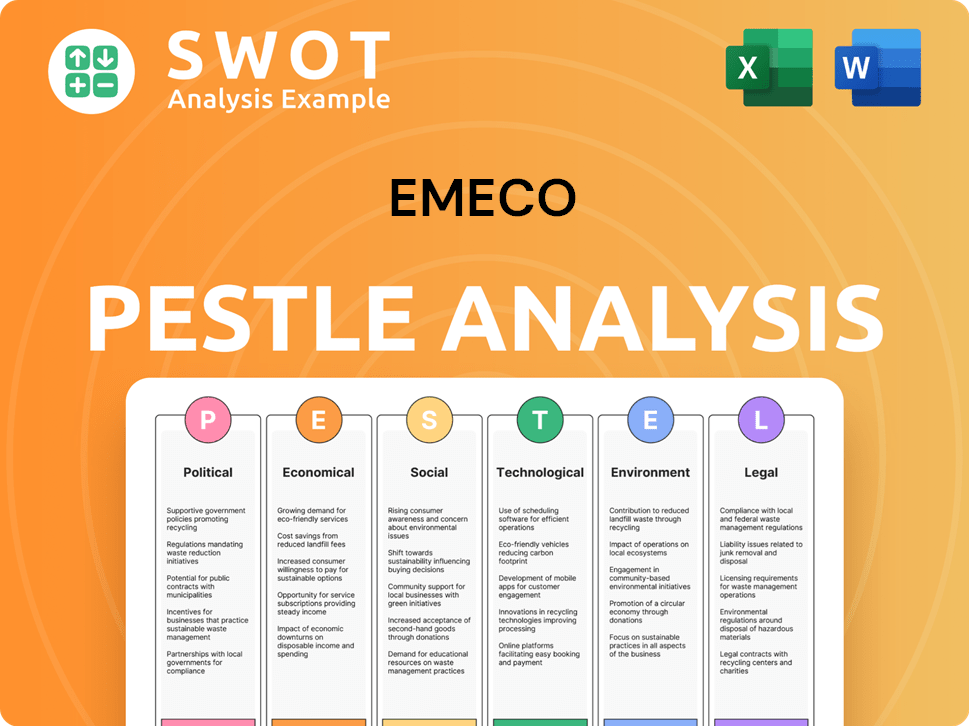

Emeco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Emeco a Competitive Edge Over Its Rivals?

Analyzing the Marketing Strategy of Emeco reveals a company that has carved a strong niche in the heavy earthmoving equipment sector. The Emeco competitive landscape is characterized by its focus on providing comprehensive solutions to the mining industry. This approach, combined with a modern fleet and specialized maintenance capabilities, sets Emeco apart from its competitors.

Emeco's market position is bolstered by its deep understanding of the mining sector's unique demands. This industry-specific expertise allows Emeco to offer tailored solutions, fostering strong customer relationships. The company's operational excellence, driven by efficient fleet management and a skilled workforce, contributes significantly to its competitive edge. This focus on reliability and efficiency is a key differentiator in a market where uptime is critical.

The Emeco company analysis highlights a business model built on providing equipment solutions and building long-term partnerships with major mining firms. The company's ability to offer a wide range of machinery and provide rapid response to breakdowns minimizes disruptions for mining operations. This commitment to service, combined with economies of scale, allows Emeco to maintain a strong competitive position.

Emeco maintains a modern and extensive fleet of heavy earthmoving equipment. This diverse range ensures the company can meet the varied demands of mining projects. The fleet's modern age and maintenance practices contribute to high equipment utilization rates.

Proprietary maintenance capabilities and a skilled workforce are crucial for Emeco. These capabilities ensure high equipment utilization and operational efficiency. Preventative maintenance and rapid response to breakdowns are key aspects of their service.

Emeco's deep understanding of the mining industry is a significant advantage. This expertise allows the company to offer tailored solutions. Established relationships with major mining companies contribute to strong customer loyalty.

Economies of scale in equipment procurement and maintenance benefit Emeco. These efficiencies can translate into competitive pricing for clients. This allows Emeco to maintain a strong market position.

Emeco's competitive advantages are multifaceted, including a modern fleet, specialized maintenance, and industry expertise. These strengths enable the company to offer tailored solutions and build strong customer relationships. The focus on operational efficiency and economies of scale further enhances its market position.

- Extensive and well-maintained fleet of heavy earthmoving equipment.

- Proprietary maintenance capabilities and skilled workforce.

- Deep understanding of the mining industry and its operational demands.

- Established relationships with major mining companies.

- Economies of scale in equipment procurement and maintenance.

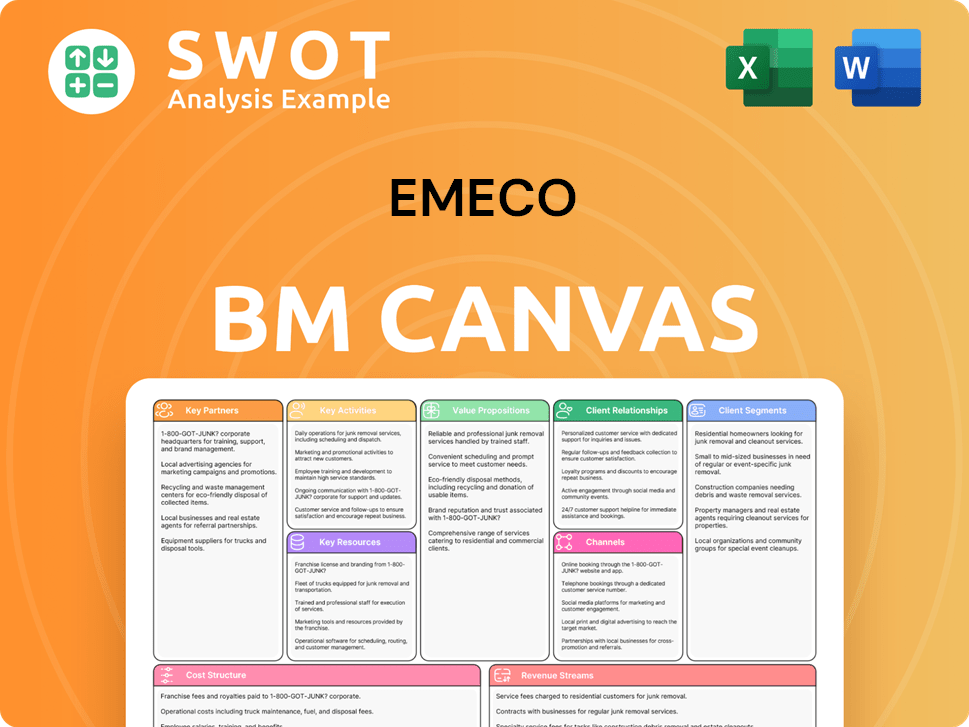

Emeco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Emeco’s Competitive Landscape?

The mining equipment rental and maintenance industry is shaped by technological advancements, the global drive for decarbonization, and fluctuating commodity prices. These factors significantly influence the Emeco market position and its competitive landscape. The company must navigate these trends to maintain its market share and achieve its strategic goals. Understanding these dynamics is crucial for assessing Emeco's future prospects.

Emeco faces challenges from the cyclical nature of the mining industry, intense competition, and potential supply chain disruptions. However, opportunities exist in emerging markets and through diversification. Adapting to technological and sustainability demands is vital for long-term success. The company's strategic focus on operational excellence and market expansion is key.

Technological advancements, such as autonomous equipment and predictive maintenance, are transforming the industry. The focus on Environmental, Social, and Governance (ESG) factors is increasing demand for fuel-efficient and lower-emission equipment. Fluctuating commodity prices impact the demand for mining equipment and services.

The cyclical nature of the mining industry leads to volatile demand. Intense competition from established and new players poses a significant challenge. Geopolitical instability and supply chain disruptions can affect equipment availability and costs. The need for continuous investment in technology is also a challenge.

Emerging markets with growing mining sectors present significant growth potential. Diversification into new service offerings and specialized equipment for critical minerals mining offers opportunities. The global energy transition is expected to drive demand for minerals, creating long-term prospects. Strategic partnerships can expand market reach and service offerings.

Emeco is focused on optimizing its fleet and enhancing its maintenance capabilities. The company is actively pursuing emissions reduction initiatives, aiming for a 20% reduction in Scope 1 and 2 emissions by 2030 from a 2022 baseline. Strategic partnerships are being explored to expand market reach and service offerings. Operational excellence and adapting to technological and sustainability demands are key.

Emeco's

- Embrace technological advancements like autonomous equipment.

- Focus on ESG initiatives to meet sustainability demands.

- Explore diversification into new service offerings and markets.

- Enhance operational efficiency and adapt to market changes.

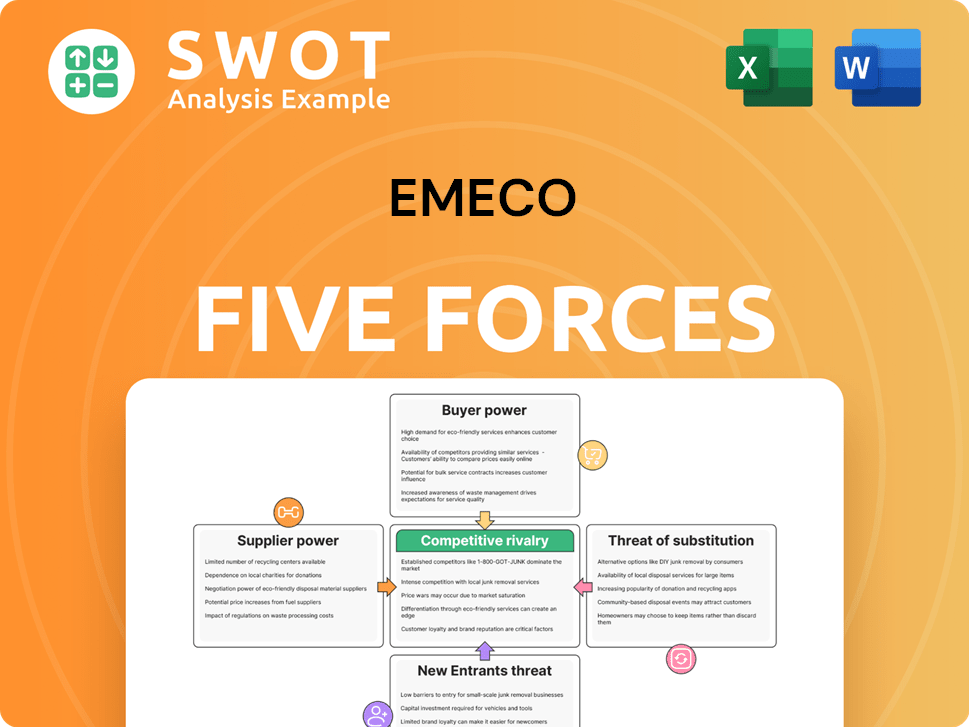

Emeco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Emeco Company?

- What is Growth Strategy and Future Prospects of Emeco Company?

- How Does Emeco Company Work?

- What is Sales and Marketing Strategy of Emeco Company?

- What is Brief History of Emeco Company?

- Who Owns Emeco Company?

- What is Customer Demographics and Target Market of Emeco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.