Emeco Bundle

Who Really Owns Emeco Company?

Unraveling the intricacies of Emeco SWOT Analysis and its Emeco ownership structure is paramount for any investor or stakeholder. Understanding who controls a company like Emeco, a key player in the earthmoving equipment rental sector, offers critical insights into its strategic direction and financial health. From its humble beginnings to its current status as a publicly traded entity, the evolution of Emeco's ownership tells a compelling story.

This exploration of Emeco company ownership will examine its Emeco history, from its founders to its current major shareholders. We'll uncover the influence of institutional investors, the role of the Emeco chair, and the composition of its Board of Directors. By analyzing recent ownership trends, we aim to provide a comprehensive understanding of who owns Emeco and how this impacts its future, considering it is a public company.

Who Founded Emeco?

The story of the Emeco company, also known as EarthMoving Equipment Company, begins with its founder, Ron Sayers, in 1972. Sayers started the business by importing used construction equipment from the UK to Australia, setting the stage for what would become a major player in the equipment industry.

As the demand for heavy machinery grew in Australia, Emeco shifted its focus to used mining equipment. This strategic move led to the establishment of the first branch in Perth, marking a significant expansion of the company's operations.

While the initial ownership structure and early investors aren't fully detailed in available information, the company's trajectory shows consistent growth. Emeco expanded its operations across Australia, demonstrating a strong commitment to meeting the needs of the mining and construction sectors.

Ron Sayers founded the Emeco company in 1972. He initially focused on importing used construction equipment from the UK to Australia.

Emeco's growth included establishing a branch in Perth. The company expanded its operations across Australia, including New South Wales by 1985 and nationwide by 1992.

In 1997, Emeco was acquired by Darr Equipment Company. This was a key moment in the company's history.

A management buyout occurred in 2005. Private equity firms Pacific Equity Partners and Archer Capital acquired Emeco from Darr Equipment Company.

The initial ownership of the Emeco company evolved significantly over time. The company's ownership structure saw a major shift in 2005.

- 1972: Ron Sayers founded the company.

- 1997: Acquired by Darr Equipment Company.

- 2005: Management buyout by Pacific Equity Partners and Archer Capital. This marked a pivotal change in the company's ownership before it became a public entity.

- The exact financial details regarding the initial equity split or early investors are not available in the provided information.

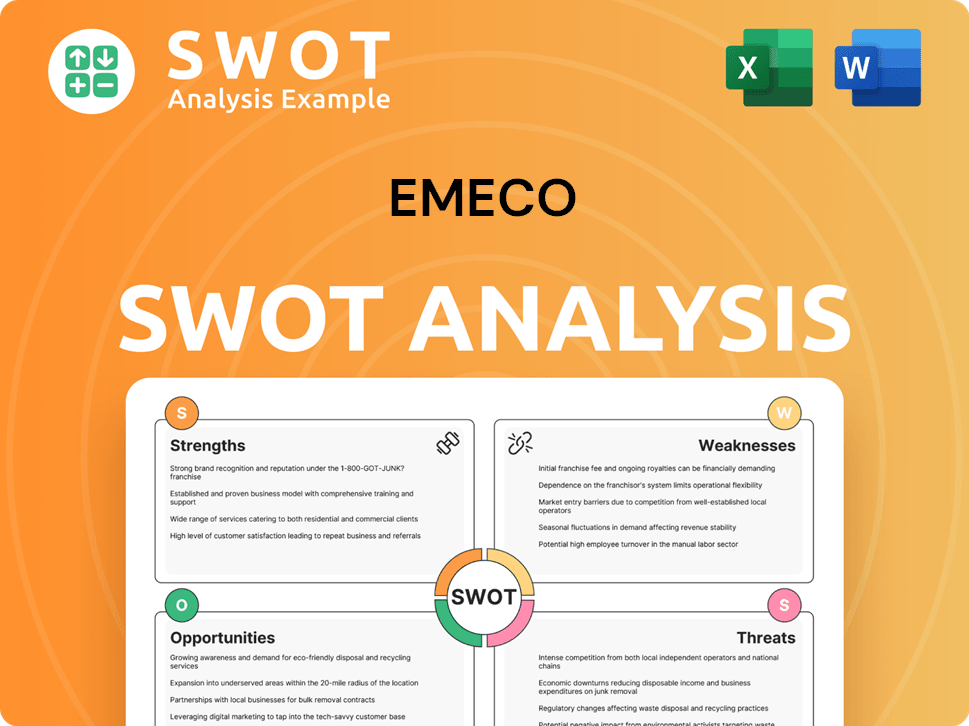

Emeco SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Emeco’s Ownership Changed Over Time?

The journey of the Emeco company from private to public ownership marks a significant chapter in its history. Initially a privately held entity, the company went public in 2006, listing on the Australian Securities Exchange (ASX) under the ticker EHL. This transition was a pivotal moment, reshaping the company's ownership structure and setting the stage for its future growth.

Before its public listing, a management buyout in 2005, backed by Pacific Equity Partners and Archer Capital, set the stage for the IPO. This strategic move highlights the evolution of

| Shareholder | Stake (as of) | Shares |

|---|---|---|

| Black Diamond Capital Management LLC | 40.65% (December 18, 2024) | 210,735,380 |

| Paradice Investment Management Pty Ltd | 10.15% (August 2, 2024) | 52.60 million |

| The Vanguard Group, Inc. | 3.47% (May 7, 2025) | N/A |

| Dimensional Fund Advisors LP | 2.25% (May 8, 2025) | N/A |

| DFA Australia Ltd. | 1.43% (April 30, 2025) | N/A |

| Washington H. Soul Pattinson and Company Limited | 2.653% | N/A |

The ownership of the

The

- Institutional investors hold a majority stake.

- Black Diamond Capital Management LLC is a major shareholder.

- The company went public in 2006.

- Individual investors also hold a portion of the shares.

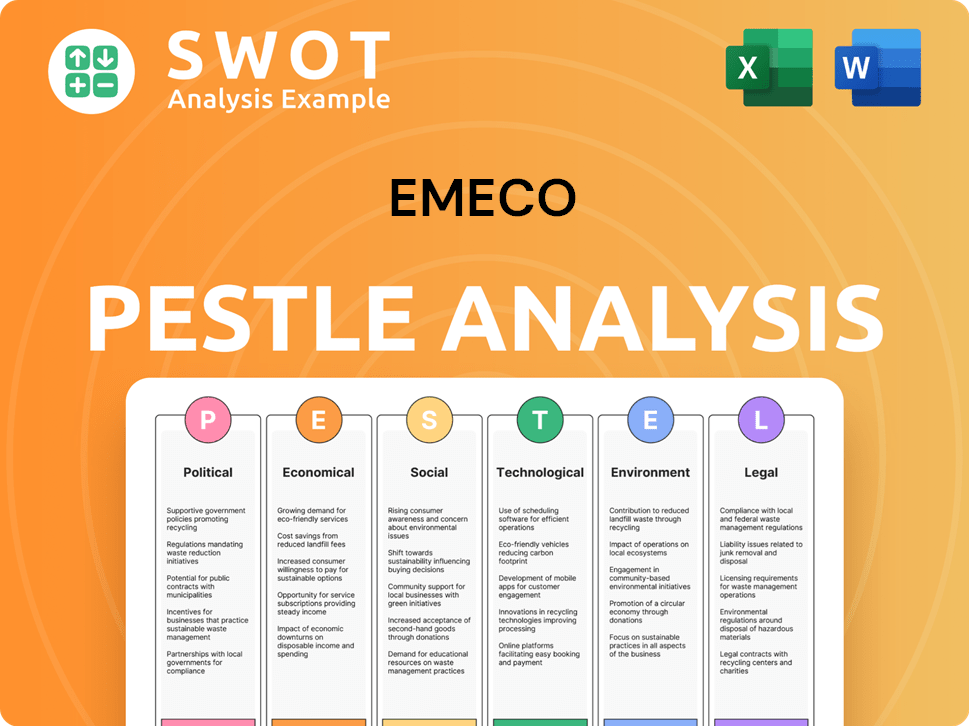

Emeco PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Emeco’s Board?

The current Board of Directors of the Emeco company plays a significant role in its governance. As of October 2024, the board includes Ian Testrow as Chief Executive Officer and Managing Director, a position he has held since August 20, 2015. Ian Macliver was appointed as Chairman and Independent Non-Executive Director, effective December 1, 2024. Other non-executive directors include Peter Frank (appointed April 1, 2017), Sarah Adam-Gedge (appointed October 1, 2023), and James Walker III (appointed June 6, 2023).

Recent changes to the board include the retirement of Peter Richards as Chair, effective May 31, 2024, with Peter Frank serving as interim chairperson before Macliver's appointment. Additionally, Peter Kane, an independent director, retired from the Board. These changes reflect Emeco's ongoing efforts to appoint independent directors. The company's corporate governance statement for the year ended June 30, 2024, indicates adherence to the ASX Corporate Governance Council's principles.

| Director | Role | Appointment Date |

|---|---|---|

| Ian Testrow | Chief Executive Officer and Managing Director | August 20, 2015 |

| Ian Macliver | Chairman and Independent Non-Executive Director | December 1, 2024 |

| Peter Frank | Non-Executive Director | April 1, 2017 |

| Sarah Adam-Gedge | Non-Executive Director | October 1, 2023 |

| James Walker III | Non-Executive Director | June 6, 2023 |

The voting structure for Emeco's ordinary shares follows a one-share-one-vote principle. Holders of ordinary shares are entitled to one vote per fully paid ordinary share at shareholders' meetings. There are no indications of dual-class shares or special voting rights. Understanding the Emeco ownership structure and the board's composition is crucial for anyone interested in the company. For more insights into the competitive landscape, consider reviewing the Competitors Landscape of Emeco.

The Board of Directors oversees Emeco's strategic direction and governance. Recent changes reflect a focus on independent directors and adherence to corporate governance best practices.

- Ian Macliver is the current Chairman.

- Ian Testrow serves as the CEO and Managing Director.

- Voting rights are straightforward: one share, one vote.

- The board is committed to following ASX Corporate Governance Council principles.

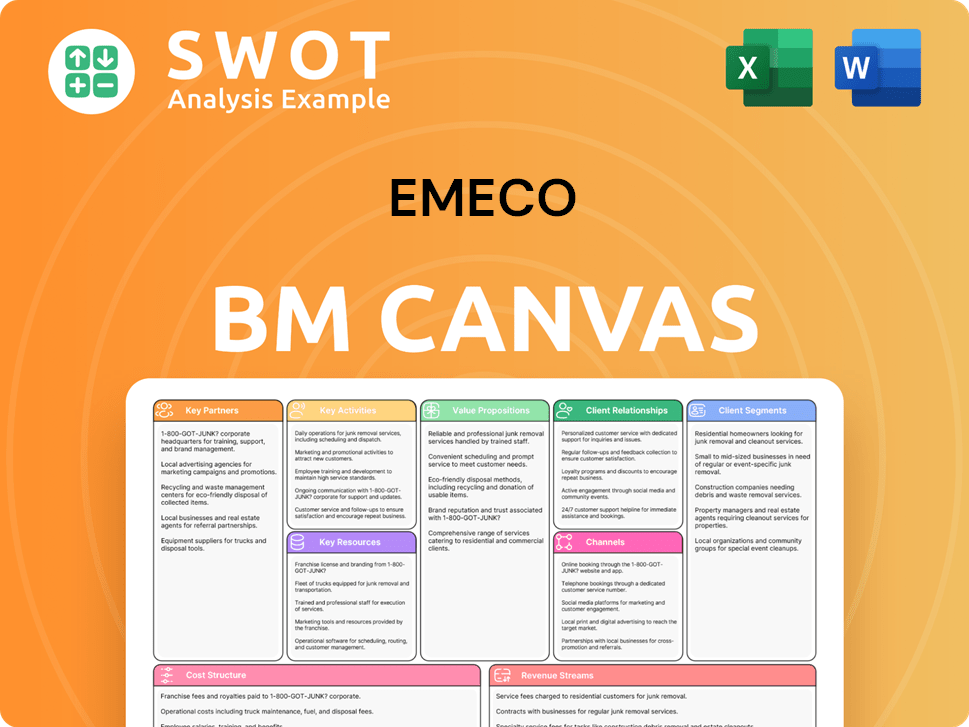

Emeco Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Emeco’s Ownership Landscape?

In the past few years, Emeco Holdings Limited has seen significant shifts. In the first half of fiscal year 2025 (1H25), ending December 31, 2024, the company reported a net profit after tax of $33.6 million. This financial performance reflects the current state of the Emeco company and its ability to navigate the market. The company's leverage ratio improved from 1.0x at June 30, 2024, to 0.84x at December 31, 2024, due to higher Operating EBITDA and a restricted capital expenditure program.

Regarding Emeco ownership, there have been notable changes in the Board of Directors. Mr. Ian Macliver was appointed Chairman and Independent Non-Executive Director effective December 1, 2024. This follows the retirement of Mr. Peter Richards as Chair in May 2024 and Mr. Peter Kane's decision not to seek re-election. These changes in leadership are crucial for understanding the strategic direction of the company. The company also suspended its capital management program, including share buy-backs and dividends, from February 2024, to reduce financing requirements.

| Metric | Value | Date |

|---|---|---|

| Net Profit After Tax | $33.6 million | 1H25 (ending December 31, 2024) |

| Leverage Ratio | 0.84x | December 31, 2024 |

| Share Buy-back (period ending) | 627,858 shares for AUD 0.41 million | December 31, 2023 |

Emeco has also been active in acquisitions, completing three acquisitions averaging $68.9 million, mainly in the construction equipment sector in Australia. The most recent acquisition was Borex on January 1, 2021. These acquisitions are part of the company's growth strategy. Industry trends show an increased institutional ownership in Emeco, with 37 institutional owners holding a total of 30,699,428 shares. If you're interested in the Emeco history and how it has evolved, consider reading about the Target Market of Emeco.

Mr. Ian Macliver appointed Chairman effective December 1, 2024, following the retirement of Mr. Peter Richards and Mr. Peter Kane's decision not to seek re-election.

Net profit after tax of $33.6 million reported for 1H25 (ending December 31, 2024). Leverage ratio improved to 0.84x by December 31, 2024.

Suspension of capital management program, including share buy-backs and dividends, from February 2024 to reduce financing requirements.

Increased institutional ownership with 37 owners holding a total of 30,699,428 shares, indicating strong investor confidence.

Emeco Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Emeco Company?

- What is Competitive Landscape of Emeco Company?

- What is Growth Strategy and Future Prospects of Emeco Company?

- How Does Emeco Company Work?

- What is Sales and Marketing Strategy of Emeco Company?

- What is Brief History of Emeco Company?

- What is Customer Demographics and Target Market of Emeco Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.