Evolution Mining Bundle

How Did Evolution Mining Rise to Gold Mining Prominence?

Embark on a journey through the Evolution Mining SWOT Analysis and discover the fascinating story of Evolution Mining, a leading force in the Australian mining landscape. From its humble beginnings to its current status as a major gold producer, the Evolution Mining company has consistently demonstrated strategic prowess. This overview explores the key milestones that shaped the Evolution Mining history.

This exploration of the brief history of Evolution Mining will cover the company's evolution within the mining industry, highlighting its strategic acquisitions, mine locations, and commitment to sustainable practices. Learn about Evolution Mining's gold production and financial performance, providing a comprehensive company overview. Understanding the Evolution Mining company's journey offers valuable insights for investors and industry observers alike, showcasing its adaptability and resilience in the dynamic gold mining sector.

What is the Evolution Mining Founding Story?

The story of Evolution Mining begins in 2011, born from the strategic merger of Catalpa Resources and Conquest Mining. This union was a pivotal moment, creating a new force in the Australian mining industry. The goal was to establish a diversified gold producer with a strong operational foundation.

The founders of Evolution Mining saw an opportunity to combine the strengths of the two companies. This move was designed to enhance gold production capabilities and operational efficiency. The initial business model focused on exploring, developing, and operating gold mines.

The merger itself provided the initial funding for Evolution Mining, utilizing the combined capital and assets of Catalpa Resources and Conquest Mining. This foundational phase involved integrating operations and establishing a clear corporate vision. Understanding the Marketing Strategy of Evolution Mining provides further insight into their growth.

Evolution Mining's journey is marked by strategic acquisitions and operational expansions, solidifying its position in the gold mining sector.

- 2011: Merger of Catalpa Resources and Conquest Mining, forming Evolution Mining.

- 2015: Acquisition of the Cowal Gold Mine, a significant asset in New South Wales.

- 2019: Acquisition of the Red Lake Gold Mine in Canada, expanding international presence.

- 2020: Strategic focus on high-quality, long-life assets and disciplined capital allocation.

In recent years, Evolution Mining has focused on optimizing its portfolio and enhancing shareholder value. The company's commitment to sustainability and responsible mining practices is increasingly important. Evolution Mining continues to explore new opportunities for growth and innovation within the gold mining industry.

As of the latest reports, Evolution Mining's production profile includes several key assets. The company's financial performance reflects its strategic decisions and operational efficiency. For the fiscal year 2024, Evolution Mining reported strong production figures, demonstrating its ability to consistently deliver value.

Evolution Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Evolution Mining?

The early years of Evolution Mining were marked by strategic moves aimed at rapid expansion and operational optimization. This Evolution Mining history is characterized by a series of acquisitions that significantly increased its asset base. These acquisitions, coupled with exploration and development, propelled the company's growth within the Australian mining sector.

In 2011, Evolution Mining made a crucial move by acquiring an interest in the Ernest Henry copper-gold mine in Queensland, Australia. This acquisition provided a strong cash flow stream. The company further solidified its position in the Gold mining market with the acquisition of the Edna May gold mine in 2013.

The acquisition of the Cowal gold mine from Barrick Gold in 2015 was a major step, significantly boosting its gold production. These acquisitions were complemented by ongoing exploration and development efforts at existing sites. This strategy focused on acquiring and optimizing high-quality, long-life assets, establishing Evolution Mining company as a key player.

The company focused on improving operational efficiencies across its portfolio. This involved integrating new assets and optimizing existing operations to increase production volumes. The Mining industry saw Evolution Mining consistently seeking to enhance its operational performance.

During this period, Evolution Mining demonstrated strong financial performance, driven by increased gold production and strategic cost management. The company's financial results reflected the success of its acquisition strategy and operational improvements. The focus on high-quality assets contributed to consistent revenue and profitability.

Evolution Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Evolution Mining history?

The Evolution Mining history is marked by significant milestones, including strategic acquisitions and operational achievements that have solidified its position in the Australian mining sector. The company's journey reflects a commitment to growth and operational excellence within the dynamic landscape of the mining industry.

| Year | Milestone |

|---|---|

| 2011 | Formation of Evolution Mining through the merger of Catalpa Resources and Conquest Mining. |

| 2015 | Acquisition of the Cowal gold mine, significantly increasing gold production capacity. |

| 2019 | Acquisition of the Red Lake gold mine in Canada, expanding its international footprint. |

| 2020 | Achieved record gold production, highlighting operational efficiency and strategic acquisitions. |

| 2023 | Continued focus on portfolio optimization and exploration, aiming to enhance long-term value. |

Evolution Mining has integrated advanced technologies, like automation and data analytics, to boost efficiency and safety across its operations. These innovations have led to improved gold recovery rates and optimized resource management at various mine locations.

Implementation of automated systems in underground and surface mining operations to enhance productivity and reduce operational costs. This includes autonomous haulage systems and remote-controlled equipment.

Use of data analytics and predictive maintenance to optimize equipment performance and reduce downtime. This also helps in better resource allocation and improved decision-making.

Adoption of advanced processing methods, such as enhanced flotation and leaching techniques, to improve gold recovery rates. This boosts overall efficiency and reduces environmental impact.

Application of sophisticated geological modeling and exploration techniques to identify and assess new ore bodies. This helps in extending mine life and discovering new reserves.

Use of remote monitoring systems to track and manage mining operations in real-time. This improves safety and enables quicker responses to potential issues.

Implementation of energy-efficient technologies and practices to reduce the carbon footprint of mining operations. This includes the use of renewable energy sources where feasible.

The Evolution Mining company has faced challenges such as fluctuating gold prices and increasing operational costs, which have impacted its financial performance. The mining industry's inherent volatility and the need for sustainable practices have required strategic adaptations and continuous improvement efforts.

Fluctuations in gold prices, which directly affect revenue and profitability. This necessitates hedging strategies and flexible operational planning to mitigate risks.

Rising operational costs, including labor, energy, and materials, which can squeeze profit margins. Cost-cutting measures and efficiency improvements are essential to combat these pressures.

Stringent environmental regulations and the need for sustainable practices, which increase operational complexity and costs. Compliance and environmental stewardship are crucial for long-term viability.

Geopolitical instability and regulatory changes in regions where the company operates, which can disrupt operations and impact investment decisions. Diversification and risk management are key.

Competition from other gold mining companies, which can affect market share and pricing. Strategic acquisitions and operational excellence are vital for maintaining a competitive edge.

Depletion of existing ore reserves, requiring continuous exploration and investment in new projects. This ensures the long-term sustainability of mining operations.

Evolution Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Evolution Mining?

The Evolution Mining company has a history marked by strategic acquisitions and a focus on gold production. Formed in 2011, it quickly expanded its portfolio through key acquisitions, including the Ernest Henry copper-gold mine and the Edna May gold mine. The company's growth continued with the acquisition of the Cowal gold mine in 2015 and the Red Lake gold complex in Canada in 2020, marking its first international venture. Evolution Mining has consistently demonstrated a commitment to sustainable practices, highlighted by its net-zero emissions target by 2050, and strong financial results, driven by robust gold production and favorable gold prices.

| Year | Key Event |

|---|---|

| 2011 | Evolution Mining formed through the merger of Catalpa Resources and Conquest Mining. |

| 2011 | Acquired an interest in the Ernest Henry copper-gold mine. |

| 2013 | Acquired the Edna May gold mine. |

| 2015 | Acquired the Cowal gold mine from Barrick Gold. |

| 2016 | Acquired the Mungana gold and copper project. |

| 2020 | Acquired the Red Lake gold complex in Canada, marking its first international venture. |

| 2021 | Announced a commitment to net-zero emissions by 2050. |

| 2022 | Continued to focus on optimizing its existing assets and exploring new opportunities. |

| 2023 | Reported strong financial results, driven by robust gold production and favorable gold prices. |

| 2024 | Continued to invest in exploration and development across its portfolio, aiming for sustained growth. |

Evolution Mining aims to increase its gold production to 1 million ounces per annum. This increase is expected through a combination of optimizing existing operations and extending mine lives through exploration. The company's focus on key assets like Cowal, Ernest Henry, and Red Lake will be crucial in achieving this production target. The company is working on exploration projects to extend mine life and increase production.

Strategic initiatives include optimizing operational efficiencies and reducing its environmental footprint. The company is committed to achieving net-zero emissions by 2050, demonstrating its dedication to sustainable mining practices. Evolution Mining also continues to evaluate potential growth opportunities, both organic and through disciplined acquisitions. The company is focused on sustainable and cost-effective mining practices.

Evolution Mining maintains a strong balance sheet to support its growth strategy. The company's financial performance is closely tied to global gold price trends. The company's ability to continue implementing sustainable and cost-effective mining practices will be crucial for its future success. The company aims to balance capital allocation for exploration, development, and potential acquisitions.

The future trajectory of Evolution Mining is closely tied to global gold price trends. The company's focus on maximizing value from its current portfolio, particularly its key assets, is a key strategy. The company is focused on sustainable and cost-effective mining practices. The company is working on exploration projects to extend mine life and increase production.

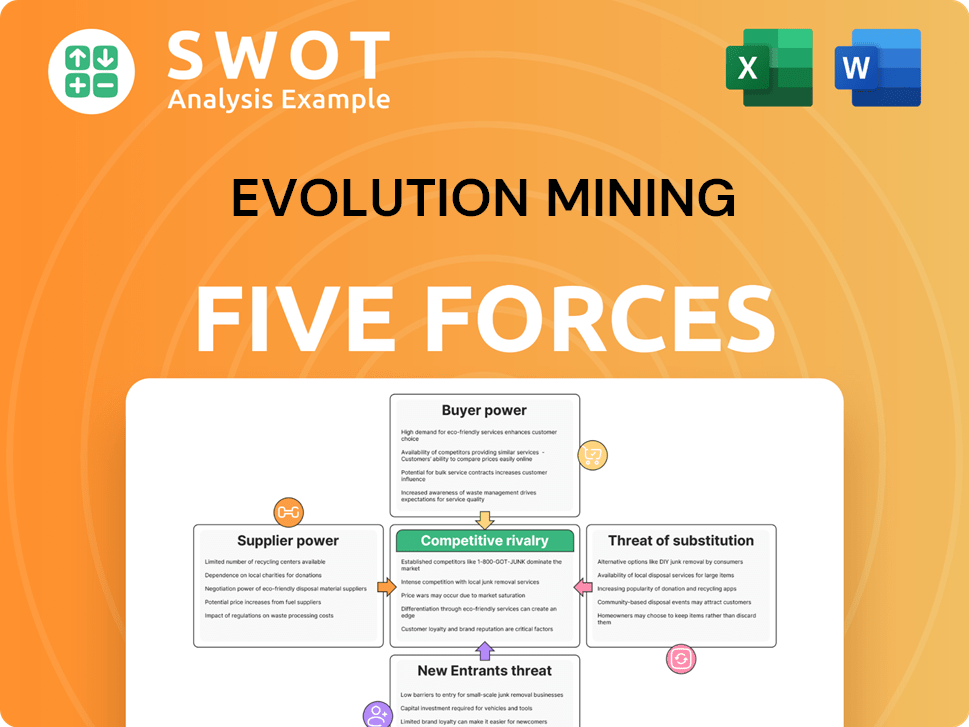

Evolution Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Evolution Mining Company?

- What is Growth Strategy and Future Prospects of Evolution Mining Company?

- How Does Evolution Mining Company Work?

- What is Sales and Marketing Strategy of Evolution Mining Company?

- What is Brief History of Evolution Mining Company?

- Who Owns Evolution Mining Company?

- What is Customer Demographics and Target Market of Evolution Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.