Evolution Mining Bundle

Who Does Evolution Mining Really Serve?

In today's evolving financial landscape, understanding a company's customer base is paramount, especially in the mining sector. For Evolution Mining, a leading Australian gold producer, identifying its customer demographics and target market is key to both strategic success and sustainable operations. This analysis delves into the multifaceted customer profile of Evolution Mining, exploring who they are and what drives their decisions.

Beyond traditional investors, the company's target audience now encompasses a broader spectrum, including communities, employees, and regulatory bodies. This shift requires a comprehensive understanding of Evolution Mining's customer profile, from institutional investors seeking reliable returns to local communities prioritizing responsible resource management. Analyzing Evolution Mining's customer demographics helps to identify the company's ideal customer, customer location, and customer interests, providing valuable insights for future market strategies. By understanding the demographic breakdown of Evolution Mining's customer base, we can better assess its market position and future growth potential.

Who Are Evolution Mining’s Main Customers?

Understanding the customer demographics and target market of Evolution Mining is crucial for grasping its operational and strategic focus. As a Business-to-Business (B2B) entity, Evolution Mining's primary 'customers' are not retail consumers but rather institutional investors and the financial markets. This structure dictates the company's approach to capital raising, stakeholder engagement, and overall business strategy.

The company's success hinges on attracting and retaining investment from a diverse group of financial entities. These entities provide the essential capital for exploration, development, and ongoing operations. Key players include large asset managers, pension funds, mutual funds, and high-net-worth individuals. Their investment decisions are influenced by various factors, including gold price forecasts, the company's profitability, and its operational efficiency.

Evolution Mining's target market also extends beyond traditional investors. It includes refining companies, suppliers, contractors, local communities, and regulatory bodies. These stakeholders are vital for ensuring the smooth operation of the mining process, from raw ore extraction to the final marketable product. The company's commitment to sustainable mining practices and community engagement further broadens its stakeholder focus.

The core customer base of Evolution Mining consists of institutional investors, shareholders, and the broader financial markets. These entities provide the financial resources necessary for the company's operations. They are typically financially literate and seek long-term returns. Their investment decisions are driven by gold price forecasts, company profitability, and operational efficiency.

Evolution Mining engages with refining companies to process raw gold ore into a marketable product. Suppliers and contractors are also essential for the mining operations. These relationships are critical for the company's value chain, ensuring efficient and effective operations. These B2B relationships are vital for the company's overall performance.

Local communities and regulatory bodies are significant stakeholders due to the company's commitment to sustainable mining practices. Their support is essential for obtaining and maintaining mining licenses and ensuring operational continuity. Initiatives like Indigenous employment and business development programs demonstrate this broadened stakeholder focus.

The increasing emphasis on ESG factors has led to a shift in the target market, with investors scrutinizing environmental impact, social responsibility, and governance structures. This has prompted Evolution Mining to enhance its reporting and performance in these areas. This expands its reach to include socially responsible investment (SRI) funds and ethical investors.

Investors in Evolution Mining consider several key factors when making decisions. These include the current gold price, the company's profitability, operational efficiency, and the lifespan of its reserves. In Q3 FY24, Evolution Mining reported gold production of 170,000 ounces at an All-in Sustaining Cost (AISC) of A$1,675 per ounce. This data directly impacts investor sentiment and confidence. Furthermore, ESG performance is becoming increasingly important.

- Gold Price Forecasts: Predictions about future gold prices significantly influence investment decisions.

- Company Profitability: Investors closely monitor the company's financial performance and profitability metrics.

- Operational Efficiency: Efficient operations and cost management are key to attracting and retaining investors.

- Reserve Life: The lifespan of the company's gold reserves is crucial for long-term investment viability.

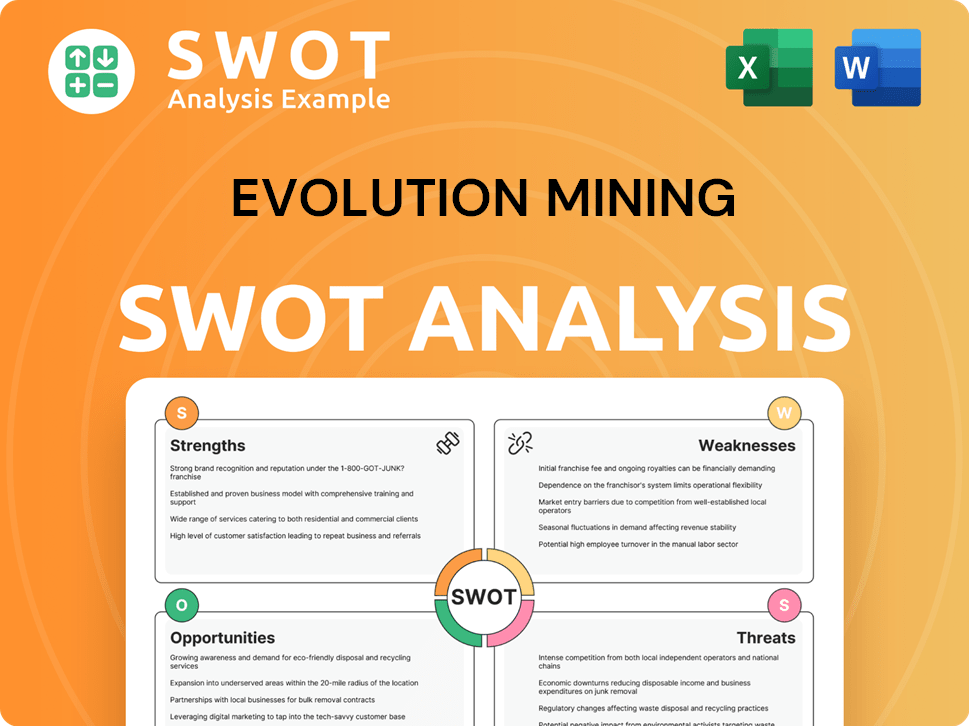

Evolution Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Evolution Mining’s Customers Want?

Understanding the customer base of a mining company like Evolution Mining, requires a deep dive into the needs and preferences of its primary stakeholders. The Owners & Shareholders of Evolution Mining, predominantly institutional investors and shareholders, drive the company's financial and strategic decisions. Their investment choices are heavily influenced by financial performance, risk management, and the growing importance of environmental, social, and governance (ESG) factors.

The core needs of these customers revolve around maximizing returns while minimizing risks. This translates into a focus on profitability, dividend payouts, and growth prospects. For instance, in H1 FY24, the company declared an interim dividend of 2.0 cents per share, which is a direct reflection of its commitment to shareholder returns. Key metrics such as gold production guidance, set at 660,000 – 720,000 ounces for FY24, and All-in Sustaining Costs (AISC), projected at A$1,670 – A$1,730 per ounce, are critical in their decision-making process.

These investors are also increasingly focused on ESG factors, recognizing that sustainable practices can mitigate long-term risks and enhance the company's reputation. Evolution Mining addresses this by highlighting its commitment to sustainable mining practices, including efforts to reduce carbon emissions and improve water management. The company has set a target to reduce Scope 1 and 2 emissions by 30% by 2030 from a 2020 baseline.

Investors prioritize financial metrics such as revenue, profit margins, and dividend yields. The company's ability to generate consistent profits and offer attractive returns is a primary driver of investment decisions. For example, the company's gold production guidance for FY24, set at 660,000 – 720,000 ounces, directly impacts revenue projections.

Risk management is crucial, with investors assessing the company's ability to navigate market volatility, geopolitical risks, and operational challenges. This includes evaluating the company's hedging strategies, debt levels, and diversification of assets. A lower AISC, as projected at A$1,670 – A$1,730 per ounce, indicates better operational efficiency and reduced financial risk.

There's a growing focus on ESG factors. Investors want to see a commitment to environmental sustainability, social responsibility, and good governance. This includes initiatives to reduce carbon emissions, improve community relations, and ensure ethical business practices. The company's target to reduce Scope 1 and 2 emissions by 30% by 2030 reflects this focus.

Investors are interested in the company's growth potential, including its exploration activities, project pipeline, and expansion strategies. This involves assessing the company's ability to discover new resources, increase production, and expand its market share. The company's strategic initiatives and future projects are key indicators of growth.

The target audience values transparent and detailed financial reporting. This includes regular updates on financial performance, operational progress, and strategic initiatives. Clear and consistent communication builds trust and enables informed investment decisions. The company's annual reports and investor presentations are crucial in this regard.

Market sentiment and analyst ratings significantly influence investment decisions. Investors monitor analyst reports, market trends, and industry forecasts to gauge the company's performance relative to its peers. Positive ratings and favorable market conditions can drive increased investment.

The primary needs and preferences of Evolution Mining's target market, which is the institutional investors and shareholders, are centered around financial performance, risk management, and sustainability. Their purchasing behavior, which translates to investment decisions, is heavily influenced by the company's profitability, dividend payouts, and growth prospects.

- Financial Performance: Investors seek strong financial results, including revenue growth, profitability, and dividend yields. They assess metrics like gold production, AISC, and profit margins.

- Risk Management: Investors prioritize companies with robust risk management strategies. This includes managing operational, financial, and geopolitical risks.

- ESG Factors: A growing emphasis on ESG considerations, including environmental sustainability, social responsibility, and corporate governance.

- Growth Prospects: Investors look for companies with strong growth potential, including exploration activities, project pipelines, and expansion strategies.

- Transparency and Reporting: The target audience values transparent and detailed financial reporting, including regular updates on financial performance and strategic initiatives.

- Market Sentiment: Market sentiment and analyst ratings significantly influence investment decisions.

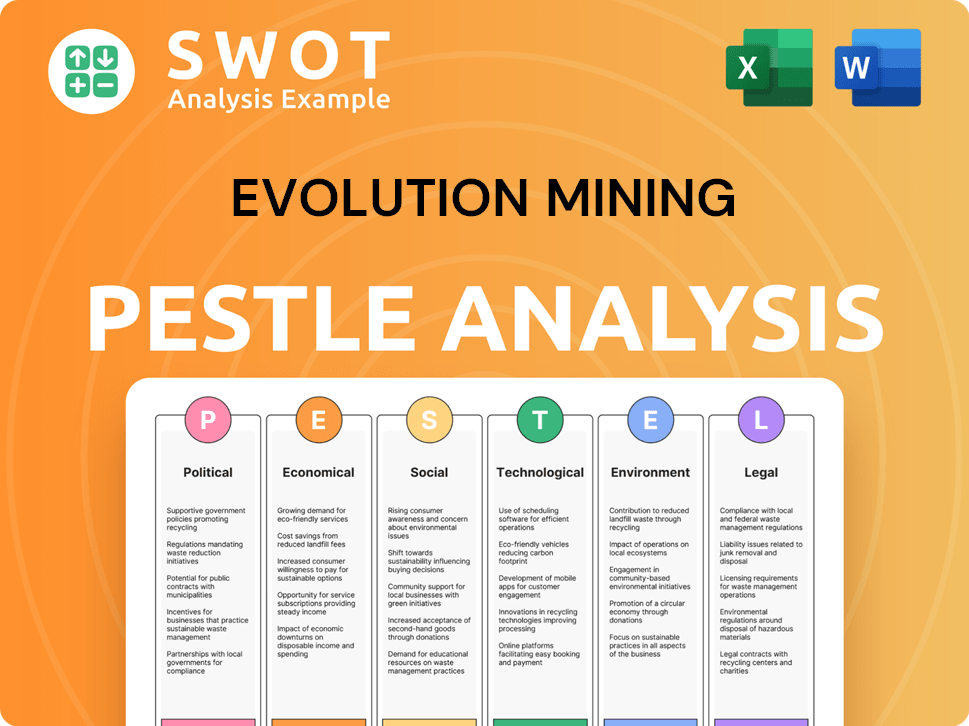

Evolution Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Evolution Mining operate?

The geographical market presence of Evolution Mining is primarily concentrated in Australia and Canada. These regions host the company's key gold mining operations, including Cowal in New South Wales, Ernest Henry in Queensland, and Red Lake in Ontario, Canada. This strategic focus is driven by the stable regulatory environments and established infrastructure in these areas, crucial for large-scale mining.

Evolution Mining's operational footprint is designed to capitalize on the resources available in these locations. The company's production for the nine months ending March 31, 2024, included 484,888 ounces of gold, mainly from its Australian and Canadian assets. This highlights the significance of these regions to its revenue generation and overall business strategy.

The company's approach to its geographical markets involves adapting to regional specifics. This adaptation includes community engagement and environmental management plans tailored to each region. For instance, the company's commitment to Indigenous partnerships at Ernest Henry showcases its localized approach in Australia.

Evolution Mining's focus is on its existing assets, rather than expanding into new markets. This strategy aims to strengthen its market share and brand recognition within its current operational strongholds. This is a key aspect of understanding the Evolution Mining target market.

The company navigates different regional stakeholders, including community engagement expectations and environmental regulations. In Canada, especially at Red Lake, there's a strong emphasis on Indigenous relations. Understanding these stakeholders is vital for the company's success.

Evolution Mining localizes its community engagement programs and environmental management plans. This approach ensures alignment with regional specificities and stakeholder expectations. The company's actions reflect its commitment to responsible mining practices.

Continued investment in exploration and development at sites like Cowal and Red Lake is a key part of the strategy. This investment aims to extend mine life and increase production. These actions are crucial for the future of the company.

The primary mining company customer is the global market for gold, but the company's focus is on regional stakeholders and regulatory bodies. The company's approach involves adapting to the specific needs of each region, which includes community engagement and environmental management plans. For more insights, consider reading about the Competitors Landscape of Evolution Mining.

- Stable regulatory environments in Australia and Canada.

- Emphasis on Indigenous relations in Canada.

- Continued investment in exploration and development.

- Focus on strengthening market share in existing strongholds.

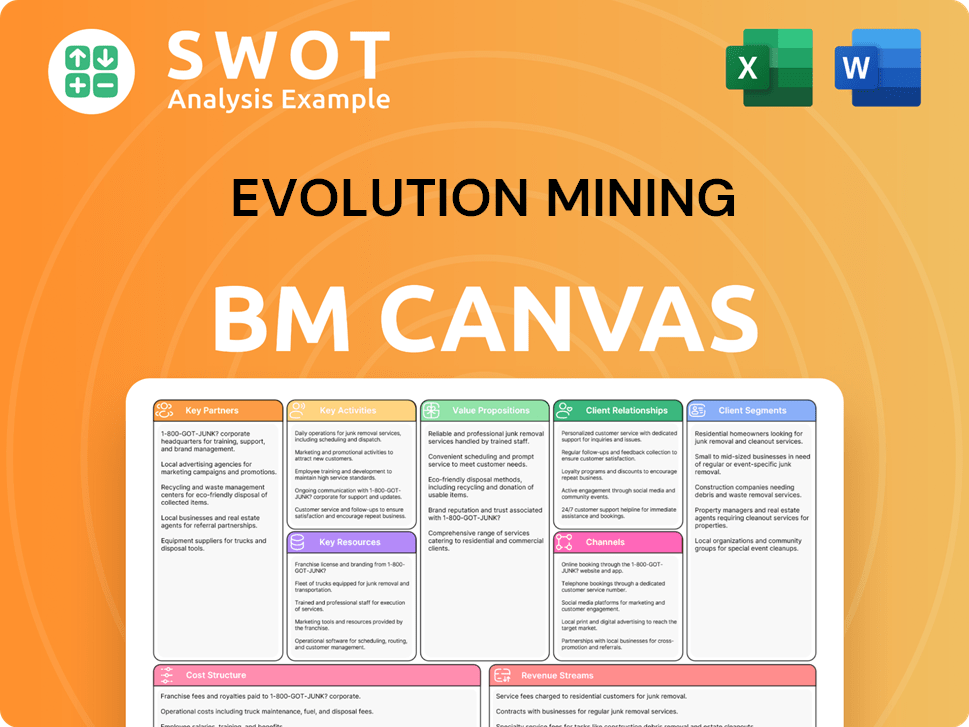

Evolution Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Evolution Mining Win & Keep Customers?

The customer acquisition and retention strategies of Evolution Mining are primarily focused on institutional investors and shareholders. These investors are the main source of capital for the company's operations. This approach differs significantly from companies that sell directly to consumers. Understanding the Evolution Mining target market is crucial for grasping its strategic direction.

Attracting new investors involves transparent financial reporting, consistent operational performance, and strategic growth initiatives. The company uses investor presentations, quarterly and annual reports, and participation in financial conferences to communicate its value proposition. These channels aim to attract new capital and reinforce the confidence of existing investors. This approach is designed to align with the needs and expectations of its core target audience mining.

Retention strategies focus on demonstrating consistent returns and responsible corporate governance. This includes a commitment to dividends, as evidenced by the interim dividend of 2.0 cents per share declared in H1 FY24. The company also emphasizes its strong financial position, with cash and bullion of A$535.1 million and available liquidity of A$1.1 billion as of March 31, 2024, which reassures investors about its financial stability. The company's focus on operational excellence, such as achieving its FY24 production and cost guidance, is crucial for retaining investor trust and loyalty.

Evolution Mining uses detailed financial reports, including quarterly and annual reports, to keep investors informed. These reports provide key performance indicators (KPIs) and insights into the company's financial health. This transparency helps build trust and attract investors looking for reliable investment opportunities. The company's commitment to clear communication aligns with its broader strategy to maintain investor confidence.

The company focuses on delivering consistent operational results, including meeting production targets and managing costs effectively. This consistency is crucial for retaining investor confidence. For instance, achieving its FY24 production and cost guidance is a key factor in maintaining investor trust. This reliability is a cornerstone of its customer acquisition strategy.

Evolution Mining actively pursues strategic growth initiatives, such as acquisitions and exploration projects, to increase shareholder value. These initiatives demonstrate the company's commitment to long-term growth and profitability. These efforts help to attract investors seeking opportunities for capital appreciation. The company's strategic moves are carefully communicated to the market to ensure investors understand its vision.

Evolution Mining's commitment to dividends, such as the interim dividend of 2.0 cents per share declared in H1 FY24, is a key element of its retention strategy. Regular dividend payments provide investors with a steady income stream, encouraging them to maintain their investments. This approach is designed to reward investors and build loyalty. This is a crucial aspect of its Evolution Mining customer profile example.

The company's strong balance sheet, with cash and bullion of A$535.1 million and available liquidity of A$1.1 billion as of March 31, 2024, reassures investors about its financial stability. A solid financial position helps to mitigate risks and provides a buffer against market volatility. This financial strength enhances the company's attractiveness to investors. This is a key factor in determining Evolution Mining's ideal customer.

Evolution Mining integrates Environmental, Social, and Governance (ESG) factors into its operations and reporting. By reporting on its ESG performance, including carbon emission reduction targets and community engagement, the company appeals to a growing segment of socially responsible investors. This approach helps to attract and retain investors who prioritize sustainability. This focus is an essential part of their Evolution Mining target market segmentation.

Evolution Mining employs a multifaceted approach to attract and retain investors. This includes transparent financial reporting, consistent operational performance, strategic growth initiatives, and a strong commitment to sustainability. These strategies are designed to build trust, demonstrate value, and foster long-term relationships with investors. For more insights, consider reading about the Growth Strategy of Evolution Mining.

- Transparent Financial Reporting: Provides detailed financial information to build trust.

- Consistent Operational Performance: Focuses on meeting production targets and managing costs.

- Strategic Growth Initiatives: Pursues acquisitions and exploration to increase shareholder value.

- Dividend Payments: Rewards investors with a steady income stream.

- Strong Financial Position: Maintains a solid balance sheet to reassure investors.

- ESG Integration: Incorporates environmental, social, and governance factors to attract socially responsible investors.

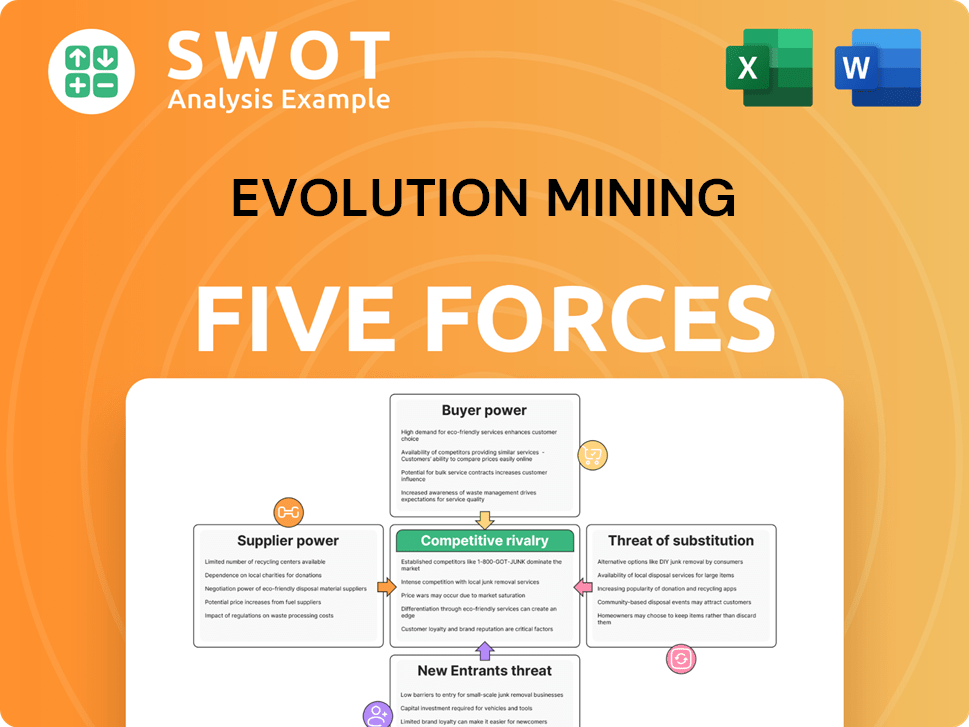

Evolution Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Evolution Mining Company?

- What is Competitive Landscape of Evolution Mining Company?

- What is Growth Strategy and Future Prospects of Evolution Mining Company?

- How Does Evolution Mining Company Work?

- What is Sales and Marketing Strategy of Evolution Mining Company?

- What is Brief History of Evolution Mining Company?

- Who Owns Evolution Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.