Evolution Mining Bundle

How Does Evolution Mining Stack Up in the Gold Mining Arena?

Since its inception in 2011, Evolution Mining has rapidly ascended as a major player in the global gold market. Through strategic acquisitions and organic growth, this Australian gold producer has built a robust portfolio of assets. But how does Evolution Mining truly fare against its rivals?

Evolution Mining's recent approval for the Cowal Gold Mine extension, backed by a significant investment, underscores its long-term vision and confidence in the gold market. To understand its standing, a thorough Evolution Mining SWOT Analysis is essential, evaluating its strengths and weaknesses against the backdrop of the gold mining industry. This analysis will delve into Evolution Mining's market position, comparing it with key competitors and assessing its financial performance and growth strategy.

Where Does Evolution Mining’ Stand in the Current Market?

Evolution Mining has established itself as a prominent player in the global gold mining industry. The company's diverse portfolio includes high-quality gold and copper assets, contributing to its strong market position. As of June 2025, the company's market capitalization reached approximately A$18.98 billion, reflecting its significant value in the market.

The company's operational strategy focuses on efficiency and cost management. In FY2024, Evolution Mining produced 717,000 ounces of gold at an all-in sustaining cost (AISC) of A$1,477/oz. This positions the company as a relatively low-cost producer. Evolution Mining also produced 67,862 tonnes of copper in FY2024, diversifying its revenue streams.

For FY25, Evolution Mining has guided for gold production of 710,000-780,000 ounces and 70,000-80,000 tonnes of copper at an AISC of $1,475-$1,575 per ounce. This demonstrates the company's commitment to maintaining consistent production levels and cost-effectiveness. This Growth Strategy of Evolution Mining is a key driver of the company's success.

Evolution Mining operates six mines, including five wholly-owned mines and an 80% share in Northparkes. These mines are located in key gold and copper producing regions, ensuring a global market presence. The Cowal Gold Mine is a significant asset, with operations extended until 2042, expected to add approximately 2 million ounces of gold production.

The company reported a record statutory net profit of $365 million for the six months ended December 31, 2024, a 277% year-on-year increase. The underlying net profit for the same period was $385 million, up 144%. Record mine cash flow of $600 million was reported in the March 2025 quarter, with net mine cash flow up 15% to $303 million.

Evolution Mining maintains a robust balance sheet with a reduced gearing of 23% as of December 2024, targeting 20% by the end of FY25. The company's disciplined capital allocation strategy focuses on organic growth and maximizing returns. This approach differentiates it from competitors that pursue aggressive acquisition strategies.

Evolution Mining's strong financial performance and strategic focus on cost-efficiency and organic growth have solidified its market position. The company's commitment to disciplined capital allocation and a focus on high-quality assets supports its growth trajectory. The company is well-positioned to capitalize on opportunities in the gold mining industry.

Evolution Mining's competitive advantages include its low-cost production, diversified asset base, and strong financial performance. The company's strategic focus on organic growth, disciplined capital allocation, and efficient operations contributes to its success. These factors make Evolution Mining a notable player in the gold mining industry.

- Low-cost gold producer.

- Geographically diverse asset base.

- Strong financial performance and balance sheet.

- Focus on organic growth and disciplined capital allocation.

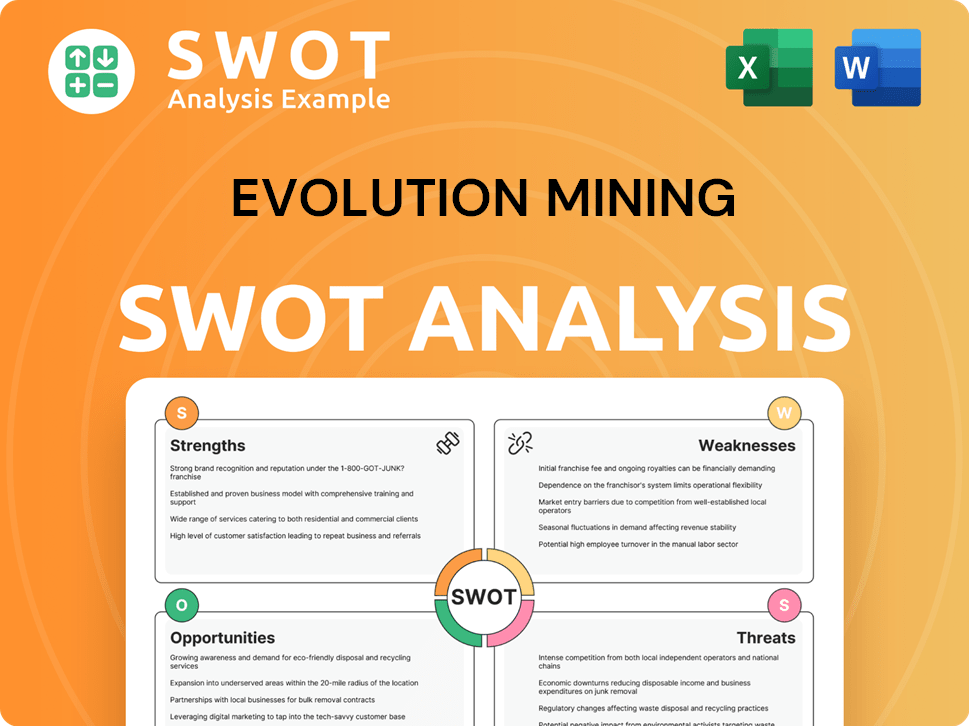

Evolution Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Evolution Mining?

The competitive landscape for Evolution Mining is primarily defined by its position within the global gold and copper mining sectors. A comprehensive Evolution Mining competitive landscape analysis reveals a dynamic environment shaped by production volumes, cost efficiency, and strategic acquisitions. The company's market position is influenced by its ability to navigate these competitive pressures effectively.

The gold mining industry is highly competitive, with companies constantly vying for market share and investor confidence. This competition extends beyond production metrics to include factors like exploration success, technological innovation, and environmental, social, and governance (ESG) performance. Understanding the Evolution Mining company overview is crucial for investors and stakeholders.

Evolution Mining analysis involves assessing its performance against key competitors. The company's operations are subject to the fluctuations of the global market, making it essential to monitor its financial health and strategic decisions closely. For more context, you can refer to a Brief History of Evolution Mining.

In Australia, Evolution Mining faces strong competition from established players. These competitors often have significant resources and operational experience, influencing the overall mining company comparison.

Globally, Evolution Mining competes with major international mining companies. These companies bring extensive resources and global reach to the competitive arena, affecting Evolution Mining's market position.

Mergers and acquisitions are a key aspect of the competitive landscape. These activities can reshape the industry by consolidating assets and changing market dynamics. Recent acquisitions, like the Northparkes mine stake in December 2023, are examples of how companies are expanding their portfolios.

Cost efficiency is a critical factor in the mining industry. The ability to maintain a low all-in sustaining cost (AISC) is a key competitive advantage. Evolution Mining's AISC of $1,666 per ounce in March 2025 is a key indicator of its operational efficiency.

Emerging technologies, such as AI and automation, are impacting the competitive landscape. These innovations can introduce new efficiencies and challenge traditional operational norms. The adoption of advanced mining technologies is a key area of focus for many companies.

Indirect competition arises from companies focusing on different commodities or stages of the mining value chain. This can include competition for resources, exploration ground, or operational efficiencies. The focus on sustainable mining practices also plays a role.

A detailed Evolution Mining analysis involves comparing the company against key competitors. This comparison includes production capacity, financial performance, and strategic initiatives. Understanding Evolution Mining's key competitors is crucial for assessing its position within the industry.

- Newcrest Mining Limited: A major player in the Australian gold mining sector, known for its large-scale operations and diversified asset portfolio.

- Northern Star Resources Limited: Another significant Australian gold producer, often engaging in strategic acquisitions to expand its reserves and production.

- Newmont Australia Pty Ltd: Part of a global mining giant, bringing extensive resources and technological capabilities to the competitive landscape.

- AngloGold Ashanti Australia Limited: A notable competitor with a strong presence in the Australian market.

- Perseus Mining Limited: Operates in the gold mining sector, competing on production volume and cost efficiency.

- Regis Resources Limited: Another key player in the Australian gold mining industry.

- St Ives Holding Company Pty Limited: Involved in gold mining operations, contributing to the competitive dynamics.

- OceanaGold Corporation: A global gold producer with operations that compete with Evolution Mining.

- Resolute Mining Limited: Operates in the gold mining sector, facing similar competitive pressures.

- Kinross Gold Corp.: A global competitor with significant gold production capacity.

- Endeavour Mining: Another global player in the gold mining industry.

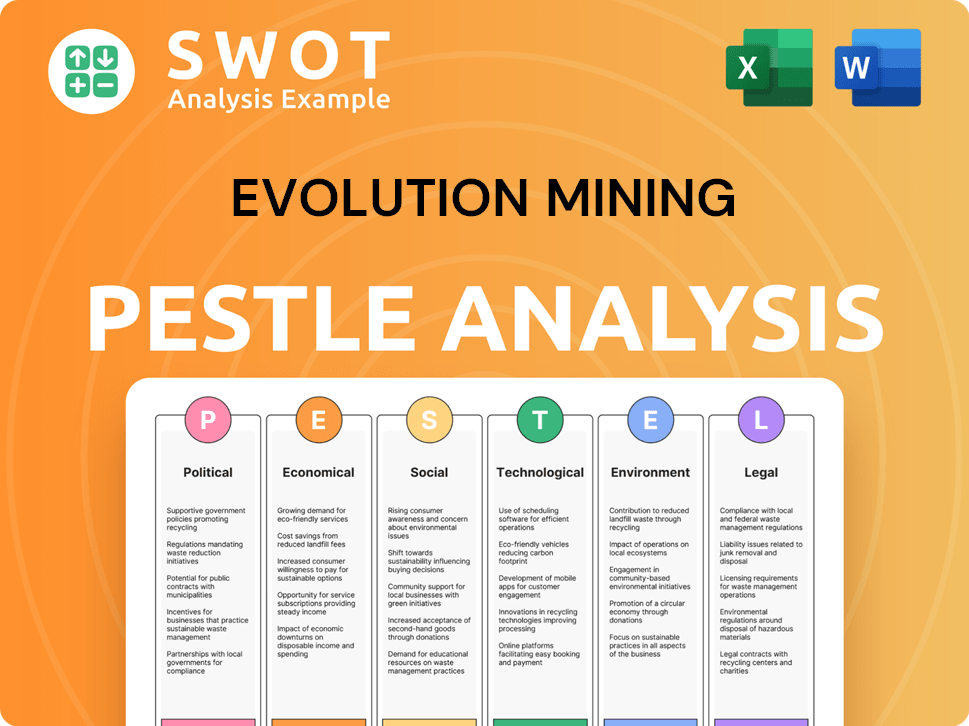

Evolution Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Evolution Mining a Competitive Edge Over Its Rivals?

Understanding the Marketing Strategy of Evolution Mining requires a deep dive into its competitive advantages. The company's success is rooted in its ability to maintain a low-cost asset base, operational excellence, and disciplined capital allocation. These factors enable strong financial performance and strategic growth, setting it apart in the gold mining industry.

A key aspect of Evolution Mining's strategy is its focus on organic growth and mine life extensions. This approach, combined with a portfolio of long-life assets in Tier 1 jurisdictions, provides a solid foundation for sustained value creation. The company's commitment to operational improvements and capital discipline further solidifies its competitive edge.

Evolution Mining's competitive landscape is shaped by its ability to consistently generate strong cash flow and strategic investments. The company’s financial strength and operational efficiency enable it to adapt to industry shifts, maintaining a leading position among Australian gold producers and globally.

Evolution Mining consistently ranks among the lowest-cost gold producers. As of March 2025, the All-in Sustaining Cost (AISC) was $1,666 per ounce. This cost efficiency provides healthy margins even in fluctuating commodity price environments, a key factor in Evolution Mining's competitive advantages.

Operational excellence is a key differentiator for Evolution Mining. The Mungari mill expansion was completed nine months ahead of schedule and 9% under budget. Predictive maintenance at Ernest Henry has reduced maintenance-related production losses by approximately 15%, showcasing strong project management and execution capabilities.

Evolution Mining prioritizes the banking of significant cash generated in high metal price environments. This financial flexibility allows strategic investments in mine life extensions, such as the Cowal Gold Mine. This strategy is considered lower-risk compared to greenfield development or large-scale acquisitions.

The company's portfolio includes long-life, high-margin assets in Tier 1 jurisdictions. This provides a robust foundation for consistent production and strong financial performance. Evolution Mining's ability to generate strong cash flow, with a record mine cash flow of $600 million in the March 2025 quarter, underscores its financial strength.

Evolution Mining's competitive advantages are multifaceted, ensuring its strong market position. These advantages include a low-cost structure, operational efficiency, and disciplined capital allocation.

- Low-Cost Asset Base: AISC of $1,666 per ounce as of March 2025.

- Operational Excellence: Mungari mill expansion completed ahead of schedule.

- Disciplined Capital Management: Prioritizing cash generation and strategic investments.

- Strategic Asset Portfolio: Long-life, high-margin assets in Tier 1 jurisdictions.

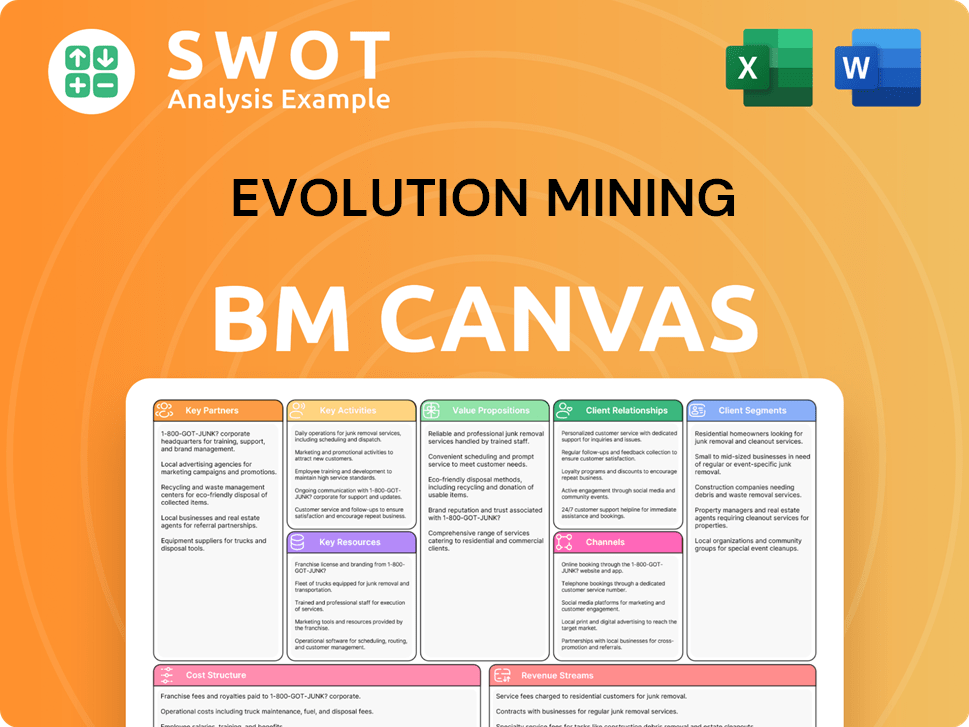

Evolution Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Evolution Mining’s Competitive Landscape?

The Owners & Shareholders of Evolution Mining are navigating a dynamic gold and copper mining industry. Their competitive landscape is shaped by technological advancements, evolving regulations, and global economic shifts. Understanding the current industry trends, future challenges, and opportunities is crucial for assessing Evolution Mining's market position and potential for growth.

Evolution Mining's analysis reveals a company strategically positioned to capitalize on rising commodity prices, particularly copper, essential for electric vehicles and renewable energy grids. The company is also focused on long-term production through mine life extensions, such as the Cowal Gold Mine, which is expected to operate until 2042. However, the industry faces challenges like rising costs and regulatory changes, demanding proactive strategies for compliance and competitive advantage.

The gold mining industry is experiencing significant technological advancements, including automation, AI, and data analytics. Sustainability is a major focus, with companies investing in renewable energy and reducing environmental impact. There's also an increasing demand for critical minerals, especially copper, driven by the global energy transition.

Rising operational costs, geopolitical tensions, and supply chain disruptions pose significant challenges. Stricter environmental and sustainability standards require proactive compliance. Attracting and retaining skilled talent is also a continuous challenge for Evolution Mining and the broader mining sector. Investor scrutiny on capital deployment is also increasing.

Evolution Mining can capitalize on the increasing demand for copper and gold. Strategic investments in mine life extensions and exploration successes, such as at Ernest Henry, support future growth. The company's focus on capital discipline and operational efficiency helps mitigate challenges and maintain a competitive edge.

Evolution Mining is focusing on capital discipline and operational efficiency to maintain its low-cost position. The company is embracing technological advancements and investing in exploration and mine life extensions. This approach aims to meet the growing demand for gold and copper while navigating industry complexities.

Evolution Mining's approach includes financial flexibility through capital discipline and banking cash generated in high metal price environments. Operational efficiency is enhanced by initiatives like the early completion of the Mungari mill expansion. These strategies support the company's ability to maintain a strong production profile and a low-cost position.

- Focus on capital discipline to ensure financial flexibility.

- Embrace technological advancements to improve efficiency.

- Invest in exploration and mine life extensions for long-term growth.

- Maintain a low-cost position to withstand market fluctuations.

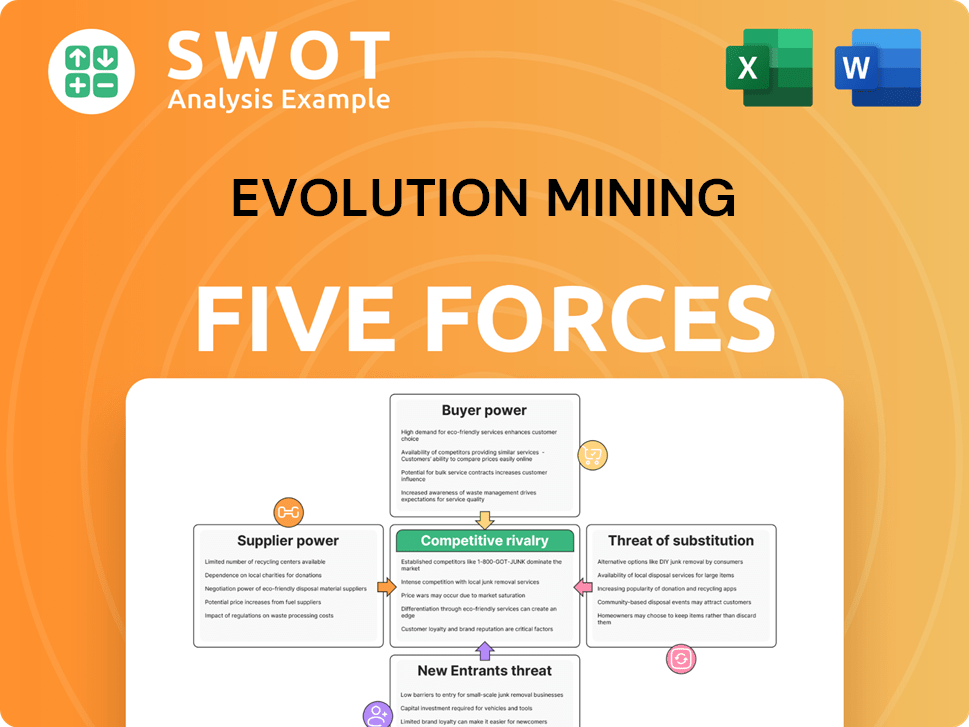

Evolution Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Evolution Mining Company?

- What is Growth Strategy and Future Prospects of Evolution Mining Company?

- How Does Evolution Mining Company Work?

- What is Sales and Marketing Strategy of Evolution Mining Company?

- What is Brief History of Evolution Mining Company?

- Who Owns Evolution Mining Company?

- What is Customer Demographics and Target Market of Evolution Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.