Evolution Mining Bundle

How Does Evolution Mining Thrive in the Gold Market?

Evolution Mining, an Australian mining company, stands as a significant force in the global gold market, holding a market capitalization of AUD 7.02 billion as of June 2024. This prominent gold producer operates across Australia and Canada, making it a crucial entity for investors. Understanding its operations is vital for anyone looking to understand the precious metals industry.

This deep dive into Evolution Mining will unpack its core Evolution Mining SWOT Analysis, operational processes, and monetization strategies. By exploring its value proposition and market positioning, we'll uncover how this leading gold producer navigates the complexities of gold mining and generates sustainable returns. From mining operations to financial performance, we'll explore what makes this mining company a key player in the sector, including its Australian mining assets and management of mineral resources.

What Are the Key Operations Driving Evolution Mining’s Success?

Evolution Mining is a key player in the gold mining industry, focused on the exploration, development, and operation of gold mines. Their primary goal is to maximize gold production while maintaining operational efficiency. This involves a multifaceted approach, from identifying viable gold deposits to delivering high-quality gold and gold concentrate to global markets.

The company's value proposition centers on providing a reliable supply of gold to a diverse customer base, including refiners, financial institutions, and industrial users. Their operational processes are designed to ensure consistent and responsible gold production. Evolution Mining's commitment to sustainable mining practices and disciplined capital allocation further enhances its value creation.

The core offerings of Evolution Mining are high-quality gold and gold concentrate. These products serve a global market, reaching various customer segments such as refiners, financial institutions, and industrial users. The company's operational processes are designed to maximize gold production and optimize efficiency.

Evolution Mining's mining operations begin with extensive geological exploration to identify promising gold deposits. This is followed by mine development, which involves significant capital expenditure on infrastructure and equipment. These activities are crucial for the company's long-term growth and sustainability.

Once operational, the gold mining process includes drilling, blasting, hauling, and ore processing. This involves crushing, grinding, and metallurgical techniques like flotation and carbon-in-leach (CIL) to extract gold. Efficient processing is key to maximizing gold recovery.

Evolution Mining maintains a robust supply chain, partnering with equipment suppliers, logistics providers, and specialized service companies. Their distribution networks are global, ensuring efficient delivery of gold to the market. This global reach is crucial for serving international customers.

The company is committed to sustainable mining practices, including environmental stewardship and community engagement. This approach differentiates them from competitors and supports long-term value creation. Sustainability is integral to their operational strategy.

What sets Evolution Mining apart is its disciplined approach to capital allocation, focusing on assets with long mine lives and significant production potential. This ensures sustained value creation for shareholders. For more information on the company's ownership structure, you can read about the Owners & Shareholders of Evolution Mining.

- Focus on high-quality gold and gold concentrate.

- Disciplined capital allocation for long-term value.

- Commitment to sustainable mining practices.

- Efficient global distribution networks.

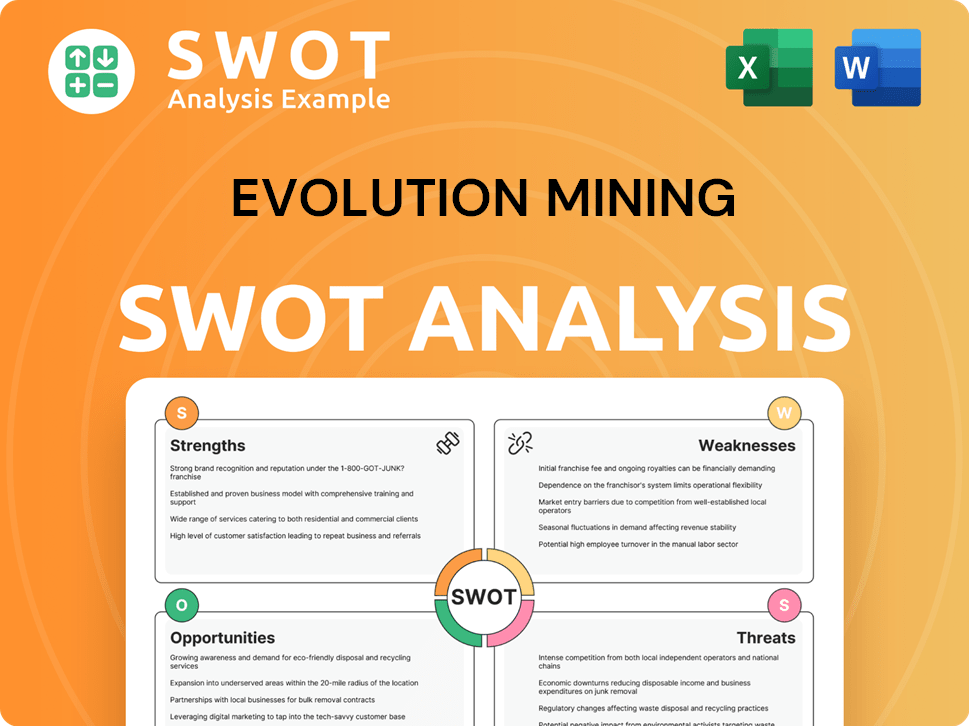

Evolution Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Evolution Mining Make Money?

Evolution Mining's primary revenue stream is the sale of gold and gold concentrate, a core aspect of its mining operations. The company's monetization strategy centers on directly selling refined gold bullion and concentrate to global market buyers. The price of gold significantly influences Evolution Mining's financial performance, affected by global events and economic policies.

In the first half of the 2024 financial year, Evolution Mining reported a revenue of AUD 1,288.6 million. This figure underscores the company's reliance on gold sales and its ability to generate substantial income from its mineral resources. The company's focus on operational efficiency is a key part of its monetization strategy.

Evolution Mining strategically manages its production costs to boost profitability. This approach directly impacts its net revenue. For the first half of the 2024 financial year, the All-In Sustaining Cost (AISC) was reported at AUD 1,373 per ounce, reflecting the cost-effectiveness of its mining operations. The company's revenue is largely derived from its Australian and Canadian operations.

Evolution Mining's approach to generating revenue and maximizing profits involves several key strategies. These strategies are crucial for understanding the company's financial health and its position within the gold mining industry.

- Direct Gold Sales: The primary method of generating revenue is through the direct sale of refined gold bullion and gold concentrate to various buyers in the global market.

- Cost Management: A strong emphasis on optimizing operational efficiency and reducing All-In Sustaining Costs (AISC) per ounce of gold produced is a critical strategy.

- Geographical Focus: The company concentrates its operations in Australia and Canada, which significantly contributes to its revenue mix.

- Portfolio Management: Evolution Mining continuously evaluates its portfolio, sometimes divesting non-core assets or acquiring new ones to enhance its revenue-generating capacity.

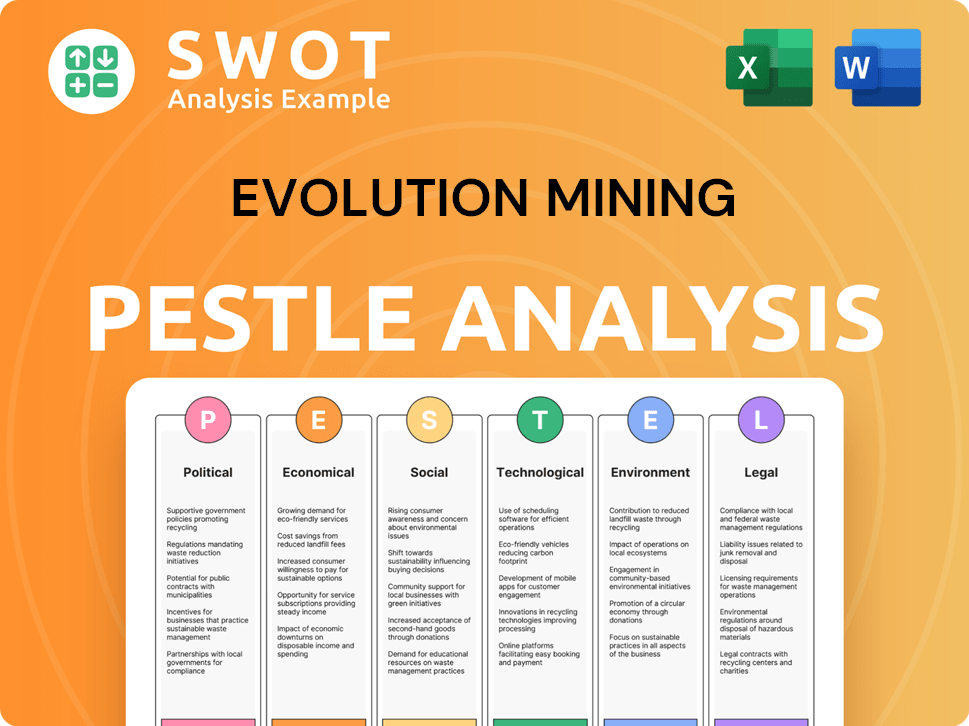

Evolution Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Evolution Mining’s Business Model?

Evolution Mining has established itself as a significant player in the gold mining industry, marked by strategic acquisitions and operational efficiencies. The company's approach to portfolio management, including the acquisition of high-quality assets and divestment of non-core mines, has been a key driver of its growth. Its focus on cost control and operational excellence has allowed it to navigate challenges such as fluctuating gold prices and rising input costs.

The company's competitive edge is underpinned by its portfolio of long-life, low-cost assets and a strong balance sheet. Evolution Mining's commitment to innovation and sustainability further solidifies its position in a dynamic industry. Understanding the evolution of Evolution Mining's strategy and operations is crucial for investors and stakeholders looking to assess its long-term value and performance.

The company's financial performance reflects its strategic initiatives and operational capabilities. For example, in the first half of fiscal year 2024, Evolution Mining reported a net profit after tax of $244 million. This financial success is a testament to its disciplined approach to capital allocation and operational efficiency.

Evolution Mining has achieved several significant milestones, including the acquisition of strategic assets and the successful integration of new operations. The acquisition of the Northparkes copper-gold mine in December 2023, for instance, is a notable example of its strategic expansion. These milestones have been instrumental in shaping its production profile and diversifying its revenue streams.

A disciplined approach to portfolio management is a hallmark of Evolution Mining's strategy. This includes the acquisition of high-quality assets and the divestment of non-core mines. The company consistently focuses on cost control and operational efficiency to address challenges such as fluctuating gold prices and rising input costs.

Evolution Mining's competitive advantages include its portfolio of long-life, low-cost assets, providing a stable production base. Its strong balance sheet and disciplined capital allocation framework also contribute to its competitive edge. The company leverages its technical expertise in exploration and mining to optimize resource recovery and extend mine lives.

Evolution Mining invests in technology and innovation to improve mining techniques and reduce environmental impact. This commitment ensures its business model remains sustainable and competitive. The company's focus on sustainability practices is crucial for long-term success. You can learn more about the Target Market of Evolution Mining.

Evolution Mining’s operational and financial performance showcases its resilience and strategic acumen. The company's focus on cost control and operational efficiency has been crucial in navigating market fluctuations. The company’s ability to maintain a strong balance sheet and disciplined capital allocation is also a key factor.

- The Northparkes acquisition, completed in December 2023, is expected to enhance production and diversify revenue.

- In the first half of fiscal year 2024, the company reported a net profit after tax of $244 million.

- The company's commitment to innovation and sustainability ensures long-term competitiveness.

- Evolution Mining continues to focus on its portfolio of long-life, low-cost assets.

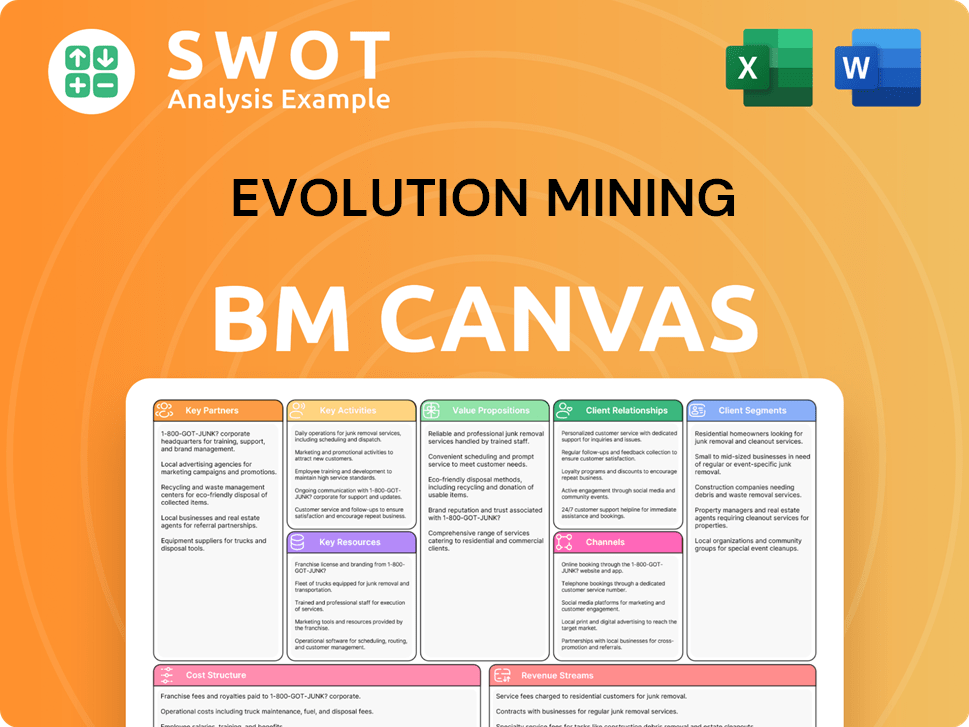

Evolution Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Evolution Mining Positioning Itself for Continued Success?

Evolution Mining holds a prominent position in the global gold mining sector, particularly excelling as a leading gold producer in Australia. Its substantial market share and high-quality assets foster strong relationships with refiners and financial institutions. The company's operational footprint is mainly in Australia and Canada, providing geographical diversification within politically stable mining regions.

Several factors could affect Evolution Mining's operations and revenue. These include fluctuations in gold prices due to global economic conditions, inflation, and geopolitical events. Changes in regulations, especially concerning environmental and social governance (ESG) standards, also pose potential risks. Furthermore, new market entrants or technological advancements could reshape the competitive landscape.

Evolution Mining is a significant player in the Australian mining landscape. Its focus on gold mining has established it as a key producer. The company's assets and operational efficiency contribute to its strong industry standing.

Key risks include gold price volatility, influenced by global economic factors. Regulatory changes, particularly in ESG standards, pose challenges. Competition and technological disruptions could also impact the Marketing Strategy of Evolution Mining and its market position.

Evolution Mining aims to optimize existing assets and explore growth opportunities. The company focuses on sustainable mining practices and strategic acquisitions. Maximizing cash flow and delivering shareholder returns are central to its strategy.

The company plans to continue production from its core assets. Integrating the Northparkes mine is a key initiative. Further strategic acquisitions are under consideration to expand its portfolio and production capacity.

Evolution Mining focuses on generating robust cash flow and enhancing shareholder value through its mining operations. The company's strategic goals emphasize sustainable mining practices and the exploration of new growth prospects within the Australian mining sector and beyond. Recent reports indicate a strong commitment to environmental stewardship and community engagement, reflecting its dedication to responsible mining.

- Focus on maximizing cash flow from existing assets.

- Continued exploration for new mineral resources to expand reserves.

- Strategic acquisitions to bolster production capacity.

- Emphasis on sustainability to meet ESG standards.

Evolution Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Evolution Mining Company?

- What is Competitive Landscape of Evolution Mining Company?

- What is Growth Strategy and Future Prospects of Evolution Mining Company?

- What is Sales and Marketing Strategy of Evolution Mining Company?

- What is Brief History of Evolution Mining Company?

- Who Owns Evolution Mining Company?

- What is Customer Demographics and Target Market of Evolution Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.