Exide Industries Bundle

How has Exide Industries powered India for over 7 decades?

Exide Industries, a titan in the battery manufacturing arena, boasts a fascinating history that mirrors India's industrial evolution. From its humble beginnings in 1947, the company has consistently adapted to meet the nation's ever-growing energy demands. This journey showcases Exide's resilience and its pivotal role in powering various sectors.

Exide Industries' story is one of continuous innovation and strategic foresight, evolving from a simple battery manufacturer to a comprehensive energy solutions provider. The company's dominance in the Exide Industries SWOT Analysis, particularly in the Indian battery market with its lead-acid batteries, is a testament to its commitment to quality and customer satisfaction. Understanding the brief history of Exide Industries India provides valuable insights into the dynamics of the Indian automotive industry and the broader energy landscape.

What is the Exide Industries Founding Story?

The story of Exide Industries Limited begins with the Chloride Electrical Storage Company (CESCO), which started in India in 1920. CESCO initially focused on assembling and manufacturing Exide batteries, which were previously imported. This marked the early presence of Exide in the Indian market, setting the stage for its future growth.

The official establishment of Associated Battery Makers Eastern Limited (ABMEL) on January 31, 1947, was a crucial step. This event led to the creation of its first manufacturing unit in Shamnagar, West Bengal. This marked a significant expansion of the company's operations in India. The company's establishment was influenced by the cultural and economic context of a newly independent India, which had a burgeoning need for industrial and automotive power solutions.

The company's early business model centered on producing batteries for both automotive and industrial purposes. ABMEL's primary brands for road vehicles included Exide and Dagenite. In a notable event, the company doubled its production of special defense batteries in 1963 following Chinese aggression, highlighting its contribution to national defense. During this time, the company also manufactured large stationary batteries for railway track electrification, further diversifying its product range.

Exide Industries' journey began with the assembly of batteries and evolved into a major player in the Indian battery market.

- 1920: Chloride Electrical Storage Company (CESCO) starts in India, assembling Exide batteries.

- January 31, 1947: Associated Battery Makers Eastern Limited (ABMEL) is established, opening its first manufacturing unit.

- 1963: Increased production of defense batteries due to Chinese aggression.

- Early focus on lead-acid batteries for automotive and industrial applications.

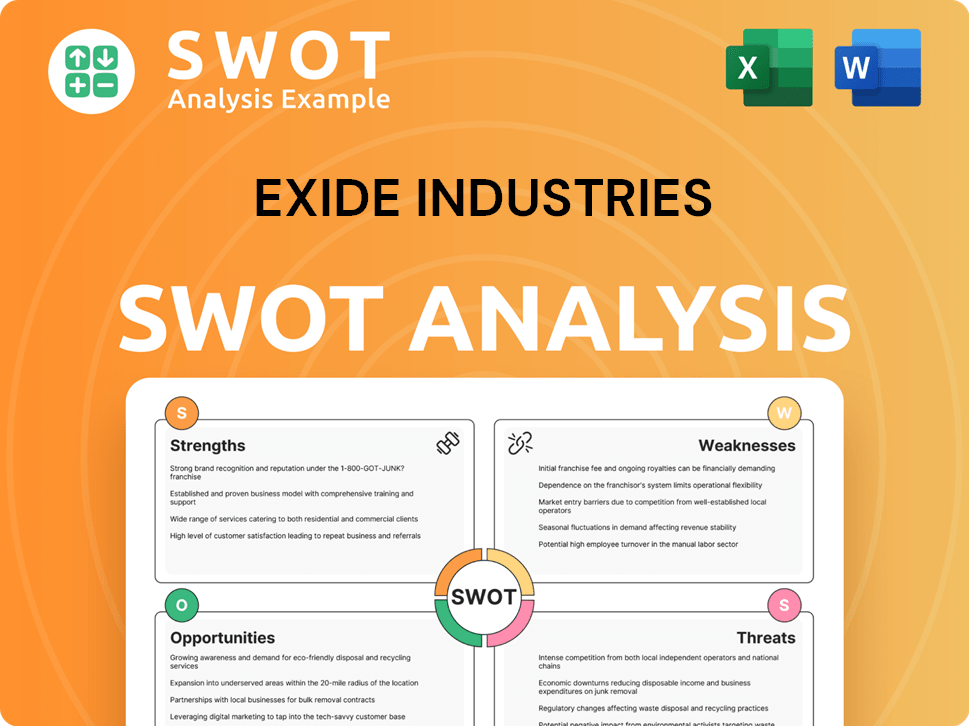

Exide Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Exide Industries?

The early years of Exide Industries, formerly known as Associated Battery Makers Eastern Limited (ABMEL), were marked by considerable expansion and growth. Following its establishment in 1947, the company began by introducing batteries for road vehicles under the Exide and Dagenite brands. A significant step in its early development was the opening of a second factory in 1969 in Chinchwad, Maharashtra, strategically located near Original Equipment Manufacturers (OEMs) to meet the rising demand for automobile batteries.

The initial product offerings of Exide Industries included batteries specifically designed for road vehicles. These batteries were marketed under the Exide and Dagenite brands, establishing an early presence in the Indian battery market.

In 1969, Exide Industries expanded its manufacturing capacity by establishing a second factory in Chinchwad, Maharashtra. This strategic location was chosen to be close to OEMs, facilitating efficient supply chains and catering to the growing demand for automobile batteries. This expansion was crucial for the company's growth.

Exide Industries has consistently focused on modernizing its manufacturing processes. This commitment to technological advancement has been a key driver in maintaining its competitive edge within the lead-acid batteries industry. This includes adopting the latest technologies.

The company's growth strategy involves strategic acquisitions and partnerships to broaden its product portfolio and extend its market reach. Exide has consistently focused on providing products with the latest technologies, increasing its distribution reach, and maintaining a strong market position. The company has been a key player in the Indian battery market.

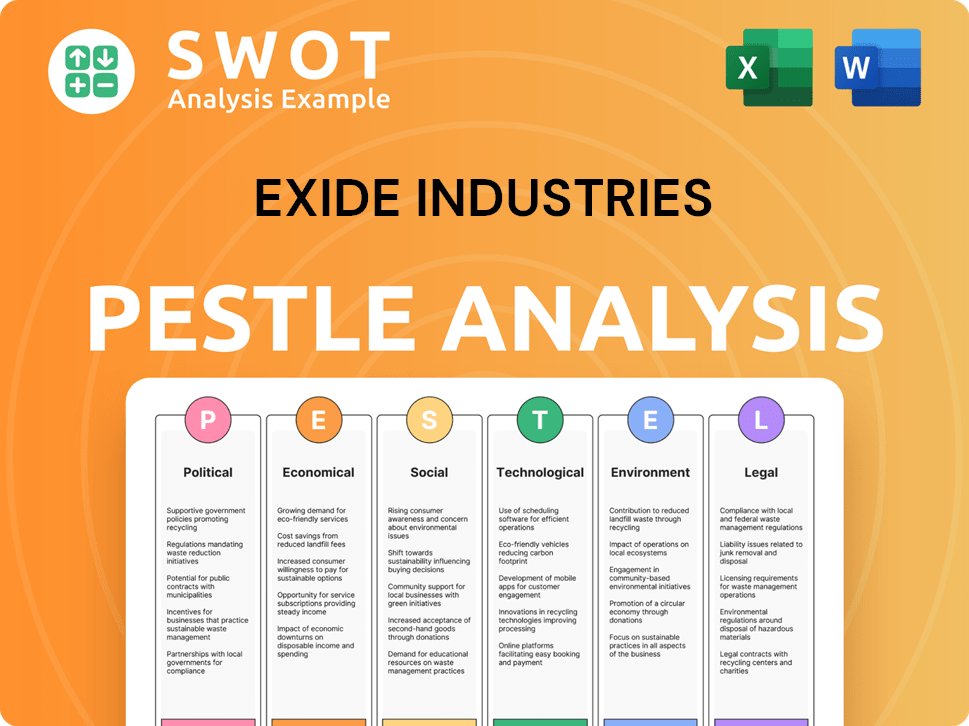

Exide Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Exide Industries history?

The journey of Exide Industries has been marked by significant milestones, demonstrating its growth and adaptation within the Indian battery market. The company has consistently evolved, responding to market demands and technological advancements to maintain its position as a leading battery manufacturer.

| Year | Milestone |

|---|---|

| 2024 | Launched a new range of advanced lithium-ion batteries specifically for electric vehicles and renewable energy storage solutions. |

| 2024 | Strengthened its AGM battery range with two new additions dedicated to Start-Stop and hybrid cars, expanding coverage for nearly one million additional vehicles in Europe. |

| 2024 | Recognized as 'India's Best Battery Manufacturer' at the ASSOCHAM Energy Meet & Excellence Awards. |

| 2024 | Received a Silver Award at the 10th Asia Integrated Reporting Awards (AIRA) for its commitment to sustainability and transparent ESG reporting. |

| 2025 (Projected) | Completion of the first phase of its lithium-ion cell manufacturing project in Bengaluru, with an initial capacity of 6 GWh. |

Exide Industries has been at the forefront of innovation, particularly in the development of advanced battery technologies. This includes the introduction of high-efficiency AGM batteries and the adoption of lithium-ion battery technology, driven by the growth of electric vehicles and renewable energy systems. The company's strategic investments and partnerships highlight its commitment to staying ahead in the evolving Exide battery market.

Exide Industries developed high-efficiency AGM batteries to meet the demands of the automotive industry. These batteries are designed for enhanced performance and durability, catering to a wide range of vehicles.

The company has invested significantly in lithium-ion cell manufacturing to capitalize on the growing EV market. This move is part of Exide Industries' strategy to adapt to the changing landscape of Exide history and battery technology.

Partnerships with companies like Hyundai Motor India and Kia Corporation support the localization of EV battery production. This initiative aims to strengthen Exide Industries' position in the EV market.

Exide Industries is expanding its focus on renewable energy storage solutions. This includes developing batteries for solar and wind energy systems, aligning with the global shift towards sustainable energy.

The company has expanded its AGM battery range with new additions for Start-Stop and hybrid cars. This expansion increases coverage for nearly one million additional vehicles in Europe.

Exide Industries continuously explores and adopts advanced battery technologies to maintain its competitive edge. This includes research and development in areas such as battery management systems and improved energy density.

Exide Industries faces challenges such as market volatility and fluctuating raw material prices, particularly for materials like antimony. A slowdown in automotive OEM volumes has also raised concerns about near-term revenue growth. The transition to electric vehicles presents a strategic challenge, requiring rapid adaptation to new battery technologies. For a deeper understanding of Exide Industries' marketing strategies, consider reading Marketing Strategy of Exide Industries.

Fluctuations in market conditions can impact the company's financial performance. This includes changes in consumer demand and economic uncertainties.

The cost of raw materials, such as antimony, can significantly affect profit margins. Price increases can lead to higher production costs.

A decrease in automotive OEM volumes can lead to lower demand for lead-acid batteries. This impacts revenue growth in the short term.

The shift towards EVs requires Exide Industries to adapt its product offerings and manufacturing capabilities. This includes investing in lithium-ion technology.

The Indian battery market is competitive, with various battery manufacturers vying for market share. Staying ahead requires continuous innovation and strategic partnerships.

Changes in environmental regulations and safety standards can impact the company's operations. Compliance with these regulations is crucial for long-term sustainability.

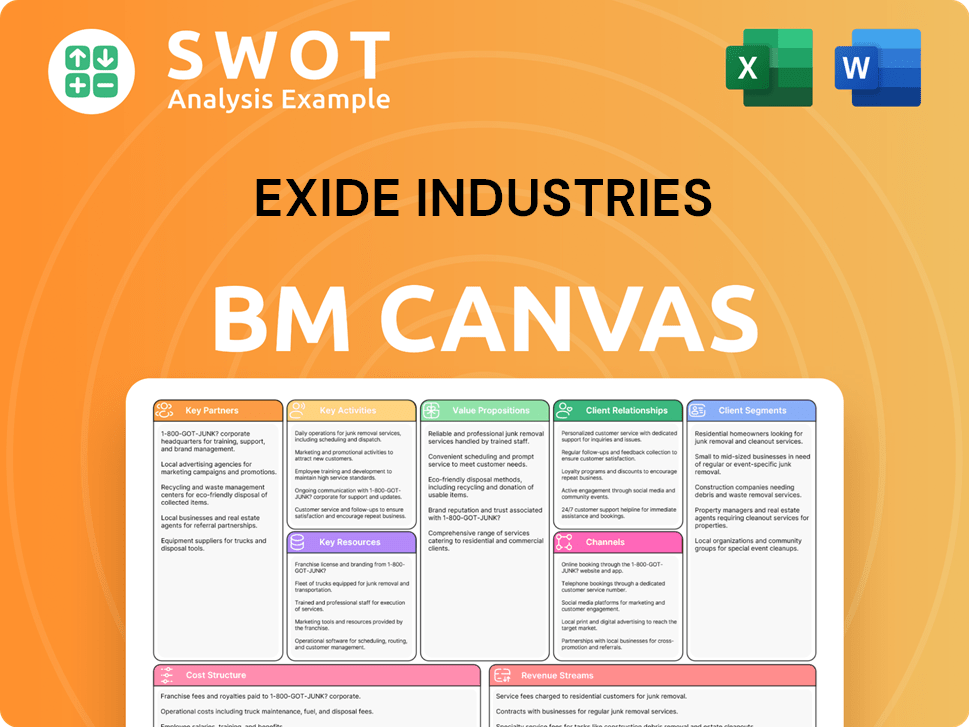

Exide Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Exide Industries?

The history of Exide Industries is marked by significant milestones in the Indian battery market. From its early days in the 1920s to its current focus on electric vehicles and renewable energy, the company has continually adapted and expanded its operations. Key moments include the establishment of manufacturing units, the introduction of new technologies, and strategic partnerships to meet evolving market demands. Exide's journey reflects its commitment to innovation and its response to the changing landscape of the battery industry.

| Year | Key Event |

|---|---|

| 1920 | Chloride Electrical Storage Company (CESCO) established in India for battery assembly and manufacturing. |

| 1947 | Associated Battery Makers Eastern Limited (ABMEL) founded in Shamnagar, West Bengal, launching its first manufacturing unit. |

| 1963 | Doubled production of special defense batteries and manufactured large stationary batteries for railway track electrification. |

| 1969 | Established a second factory in Chinchwad, Maharashtra, to meet growing demand for automotive batteries. |

| 1976 | Exide R&D Centre established in Kolkata. |

| 2018 | Ventured into a joint venture with Leclanché SA for EV battery assembly operations in India. |

| 2021 | Announced technical collaboration with China's SVOLT Energy Technology Co Ltd for a lithium-ion cell manufacturing plant. |

| 2022 | Exide Energy Solutions Ltd (EESL) established as a wholly-owned subsidiary for lithium-ion cell business. |

| April 2024 | Launched a new range of advanced lithium-ion batteries for EVs and renewable energy storage and partnered with Hyundai Motor India and Kia Corporation for EV battery localization in India. |

| May 2024 | Announced investment of approximately INR 1,000 crore in EESL for FY25 as part of a larger INR 5,000 crore plan for the lithium-ion cell manufacturing project. |

| November 2024 | Strengthened AGM battery range with two new additions for Start-Stop and hybrid cars. |

| Q4 FY2024-25 | Reported sales grew by 8.1% on a sequential basis. |

| March 31, 2025 | Reported total income of INR 4,378.95 crores for the quarter. Consolidated net profit for Q4 FY25 was INR 186.87 crore. |

| FY2024-25 | Total income was INR 17,350.65 crores. Net profit for the full year was INR 1,076.93 crore, up 3% from the previous year. |

| FY2026 (expected) | Commercialization of the 6 GWh lithium-ion cell manufacturing facility. |

Exide is strongly focused on the growing demand for electric vehicles and energy storage solutions. The company aims to generate 30% of its revenue from renewable energy solutions by 2025. This strategic shift is a response to the increasing adoption of EVs and the need for sustainable energy storage.

Exide is establishing a large greenfield lithium-ion cell manufacturing facility in Bangalore. The initial capacity will be 6 GWh by 2025, with plans to expand to 12 GWh. This facility will manufacture cylindrical and radial prismatic cells to cater to various applications, enhancing its presence in the Indian battery market.

The company plans to introduce new products for commercial vehicles, e-rickshaws, and inverter systems, and aims to roll out comprehensive rooftop solar solutions. This expansion strategy aims to diversify its product portfolio and capture a larger share of the lead-acid batteries and overall battery manufacturers market.

Exide aims to reduce its carbon footprint by 25% by 2025 and achieve carbon neutrality by 2030. Analyst predictions suggest a rise in share price to approximately ₹509.75 per share by 2025, with a positive long-term outlook for 2030, potentially reaching between ₹800 and ₹900. The company's total income for FY2024-25 was INR 17,350.65 crores.

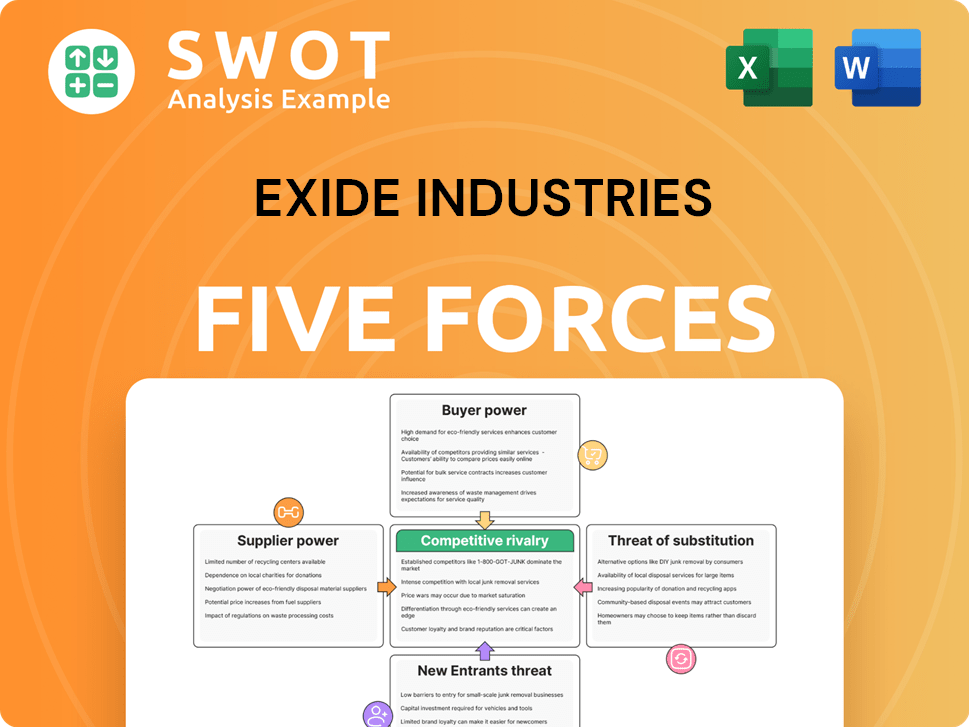

Exide Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Exide Industries Company?

- What is Growth Strategy and Future Prospects of Exide Industries Company?

- How Does Exide Industries Company Work?

- What is Sales and Marketing Strategy of Exide Industries Company?

- What is Brief History of Exide Industries Company?

- Who Owns Exide Industries Company?

- What is Customer Demographics and Target Market of Exide Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.