Exide Industries Bundle

Who Really Controls Exide Industries?

Unraveling the ownership of a company like Exide Industries is key to understanding its strategic moves and future prospects. With the electric vehicle revolution reshaping the automotive landscape, knowing who calls the shots at this leading Exide Industries SWOT Analysis is more critical than ever. From its roots to its current standing, the ownership structure of Exide Industries reveals a fascinating story of market influence and strategic direction.

This exploration of Exide ownership will delve into the company's evolution, tracing the influence of key investors and the dynamics of its public shareholding. Understanding who owns Exide is vital for investors and stakeholders seeking to navigate the complexities of the battery manufacturer's market position in India. We'll uncover the major stakeholders and examine how these ownership changes have shaped Exide Industries' journey, including its financial performance and market share.

Who Founded Exide Industries?

The story of Exide Industries begins with the Chloride Electrical Storage Company, which established its presence in India. The company's roots trace back to 1947, but specific details about the individual founders and their initial equity split are not readily available in public records from that time.

Initially, the Indian operations were closely linked to or a subsidiary of its UK parent company. This setup is typical of multinational expansions, where the parent company holds substantial control and equity. Early ownership would have been primarily held by the Chloride Group, reflecting a common strategy for overseas ventures.

During its early years, the ownership structure was influenced by British corporate practices. Shares were likely held by the parent company, with the potential for some local stakeholders or partners. Agreements regarding dividend repatriation and operational control would have been dictated by the relationship with the Chloride Group. Any initial disputes or buyouts would have occurred within the framework of this parent-subsidiary relationship, shaping the initial distribution of control. This approach reflected the parent company's vision for its Indian operations as a strategic extension of its global business.

Understanding the early ownership of Exide Industries is crucial for grasping its evolution as a leading battery manufacturer. The initial structure was heavily influenced by its parent company, the Chloride Group, which held a significant portion of the shares. Over time, as the company grew and adapted to the Indian market, the ownership structure evolved.

- The Chloride Group, based in the UK, initially controlled a substantial portion of the company.

- Local stakeholders or partners may have held a limited number of shares.

- The parent-subsidiary relationship dictated key operational and financial decisions.

- The early focus was on establishing a strong presence in the Indian market.

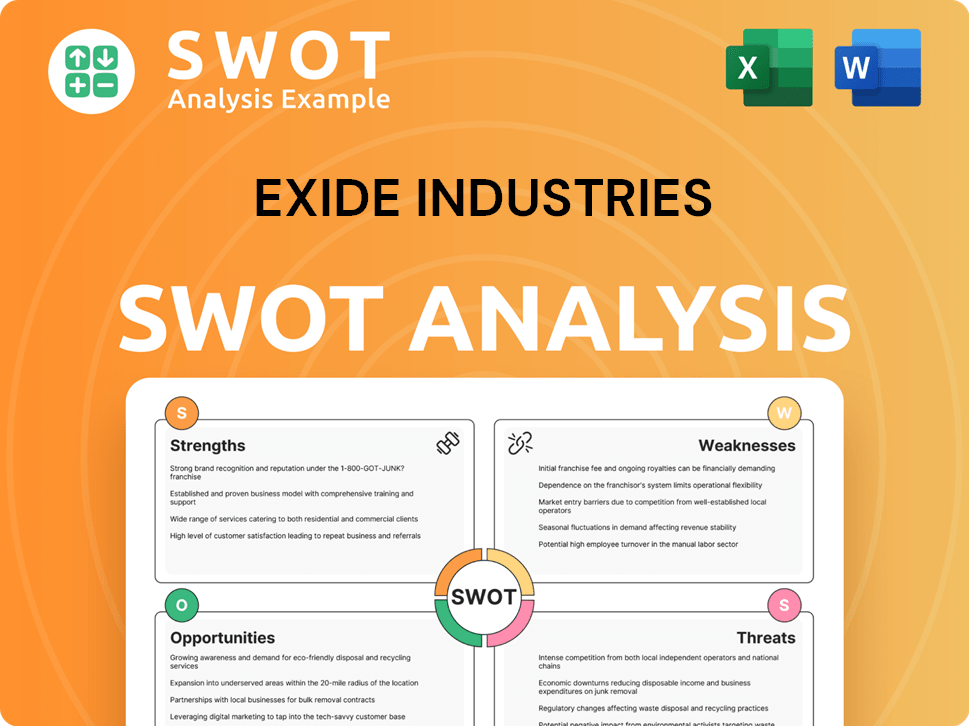

Exide Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Exide Industries’s Ownership Changed Over Time?

The ownership structure of Exide Industries has evolved significantly, particularly after it transitioned into an Indian-controlled entity and became a publicly listed company. The listing on Indian stock exchanges was a pivotal moment, opening up ownership to both institutional and individual investors. This shift marked a transition from a more concentrated ownership model to a diversified one, reflecting the company's growth and integration within the Indian economy. Understanding the growth strategy of Exide Industries is crucial in grasping how its ownership structure supports its market position.

As of the financial year ending March 2024, Exide Industries' ownership is characterized by a diversified shareholder base. Public shareholders hold a substantial portion of the company's equity. This distribution reflects a mature corporate structure, common among large, established Indian public companies. The evolution of Exide's ownership has been instrumental in shaping its strategic direction, especially its focus on technological innovation and market expansion.

| Stakeholder Category | Approximate Percentage of Shares (as of March 2024) | Notes |

|---|---|---|

| Public Shareholders | Significant percentage | Includes retail and institutional investors. |

| Institutional Investors | Significant percentage | Includes mutual funds and insurance companies. |

| Promoters | Minority stake | Reflects a widely dispersed ownership structure. |

Major stakeholders in Exide Industries include a mix of institutional investors, mutual funds, foreign portfolio investors, and retail individual shareholders. Public shareholders collectively hold a significant percentage of the company's equity. Institutional investors, such as mutual funds and insurance companies, maintain notable stakes, signaling confidence in the company's long-term prospects, particularly given its strong position in the growing EV battery segment. Promoters hold a minority stake. The absence of a dominant single promoter group means that institutional investors and the collective body of public shareholders exert considerable influence. This diversified ownership structure has influenced the company's strategy toward sustained growth, technological advancements, and expansion into emerging markets, such as electric vehicle batteries, as evidenced by its recent strategic investments and collaborations. The company's market share in the battery manufacturer industry is a key factor influenced by its ownership dynamics.

Exide Industries is a publicly listed company with a diversified ownership structure.

- Public shareholders hold a significant portion of the equity.

- Institutional investors, including mutual funds and insurance companies, are major stakeholders.

- Promoters hold a minority stake.

- The ownership structure supports the company's strategic focus on growth and technological advancement.

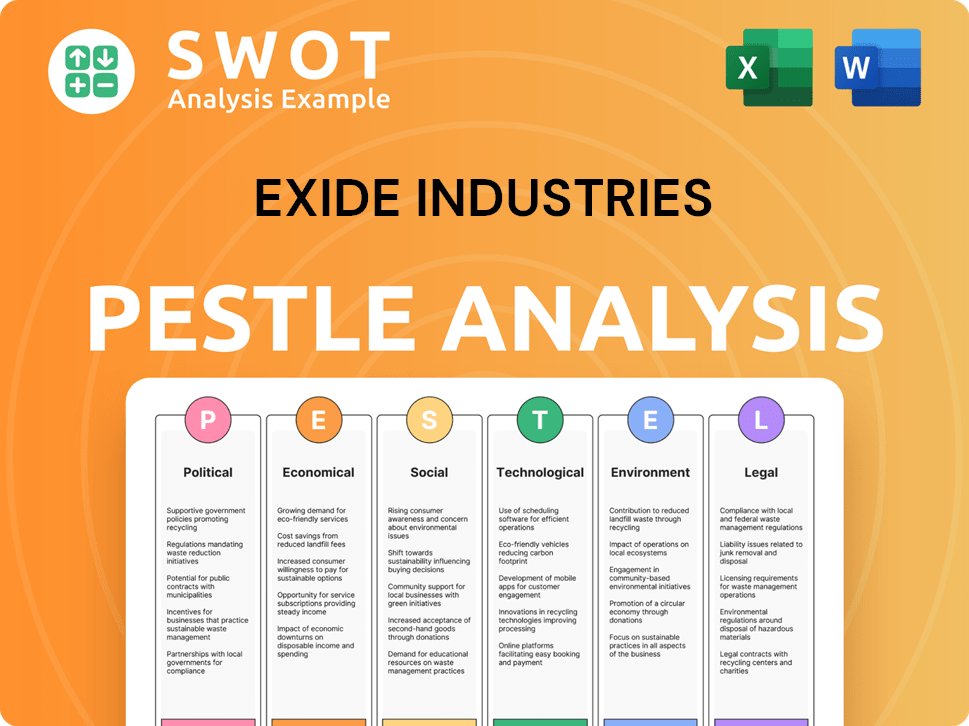

Exide Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Exide Industries’s Board?

As of early 2025, the Board of Directors of Exide Industries comprises a mix of executive, non-executive, and independent directors. The composition reflects a balance intended to ensure good corporate governance. Independent directors play a crucial role in providing objective oversight. The company, a prominent battery manufacturer, ensures that its board structure aligns with best practices in corporate governance, which is crucial for maintaining investor confidence and ensuring long-term sustainability.

While specific board members representing major shareholders are not always explicitly stated, the board's structure typically includes individuals with expertise in finance, operations, and strategic planning. This diverse skill set is essential for guiding the company's strategic direction, especially given its significant investments in areas like lithium-ion cell manufacturing. The management team is accountable to a broad spectrum of investors, ensuring that decisions consider shareholder value.

| Board Member | Designation | Details |

|---|---|---|

| Mr. Gautam Chatterjee | Chairman | Oversees the strategic direction and governance of the company. |

| Mr. Subir Chakraborty | Managing Director & CEO | Responsible for the day-to-day operations and overall performance. |

| Mr. Rajat Moona | Independent Director | Provides independent oversight and ensures compliance with governance standards. |

The voting structure of Exide Industries typically follows the one-share-one-vote principle, common for publicly listed companies in India. This means voting power is directly proportional to the number of shares held. The diversified ownership structure, with a significant public float and institutional investor holdings, generally mitigates the risk of single-entity dominance. As of December 31, 2024, the company's market capitalization was approximately ₹40,000 crore, reflecting its strong position in the Exide battery market.

The voting power in Exide Industries is directly proportional to the number of shares held, ensuring a fair representation of all shareholders. This structure promotes transparency and accountability within the company.

- One-share-one-vote principle is followed.

- No special voting rights or golden shares are reported.

- Institutional investors and public shareholders have significant influence.

- The board is accountable to a diverse shareholder base.

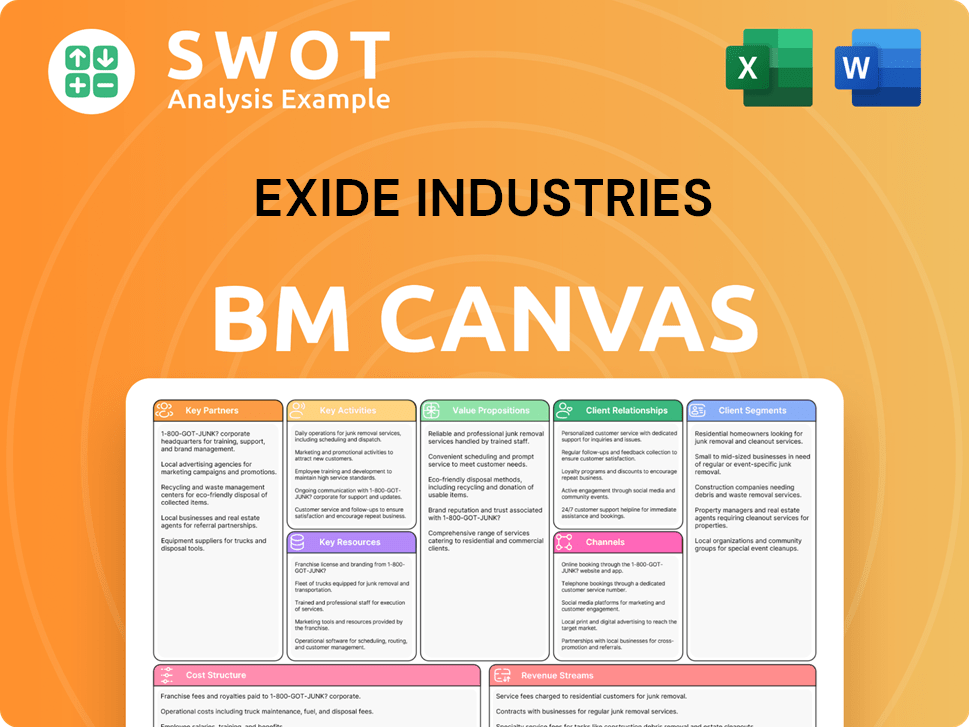

Exide Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Exide Industries’s Ownership Landscape?

Over the past few years, especially from 2022 to 2025, Exide Industries has seen significant shifts in its ownership structure. This is largely due to its strategic move into lithium-ion battery manufacturing. A major development has been the company's substantial investment in its subsidiary, Exide Energy Solutions Limited, for a multi-gigawatt lithium-ion cell manufacturing facility. This has drawn more investor interest, potentially leading to future capital raises or partnerships, which could change the ownership mix. While there haven't been widespread reports of large share buybacks or secondary offerings, the company's growth initiatives often attract institutional investors.

Industry trends, like the global shift towards electric vehicles and renewable energy storage, have greatly impacted ownership patterns in battery manufacturers. There's a noticeable increase in institutional and foreign portfolio investor interest in companies positioned to benefit from these trends. This often leads to some dilution for founders or long-term promoters as companies seek capital, but in this case, the promoter holding has remained relatively stable as a minority stake. Future changes in Exide ownership could involve strategic investors or collaborations for its new energy ventures, or further dilution as the company expands its lithium-ion operations. Public statements from the company highlight its growth plans and technological advancements, signaling its commitment to expanding its market presence in the new energy sector, which naturally attracts various investor types.

Institutional investors are increasingly interested in battery manufacturers like Exide India, driven by the growth in electric vehicles and renewable energy. This trend may lead to changes in ownership structure as the company seeks capital for expansion. The company's focus on lithium-ion battery manufacturing is a key factor influencing investor interest and ownership patterns.

The investment in Exide Energy Solutions Limited is a major strategic move. It is setting up a lithium-ion cell manufacturing facility, which is expected to attract more investors. This could potentially lead to future capital raises or strategic partnerships. These changes are likely to influence Exide ownership in the coming years.

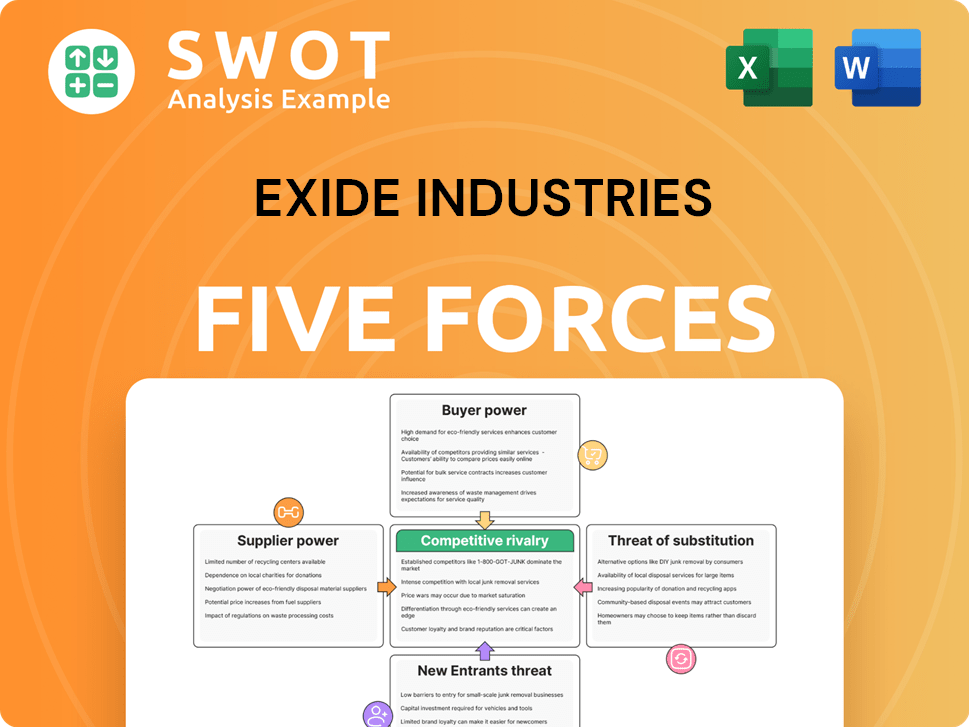

Exide Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exide Industries Company?

- What is Competitive Landscape of Exide Industries Company?

- What is Growth Strategy and Future Prospects of Exide Industries Company?

- How Does Exide Industries Company Work?

- What is Sales and Marketing Strategy of Exide Industries Company?

- What is Brief History of Exide Industries Company?

- What is Customer Demographics and Target Market of Exide Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.