Exide Industries Bundle

How Does Exide Industries Power India?

Exide Industries, a leading battery manufacturer in India, is a powerhouse in the energy storage sector. Its influence stems from a diverse product portfolio and widespread market presence, particularly in automotive batteries and industrial applications. As of early 2024, Exide continues to be a dominant force, offering a comprehensive range of lead-acid batteries and advanced solutions. Understanding Exide's operational framework is key for anyone looking to understand the company.

Exide's enduring presence and consistent performance highlight its adaptable business model, critical for powering India's growth. This analysis will delve into the intricacies of its operations, value proposition, and financial strategies. For a deeper dive into Exide's strengths and weaknesses, consider exploring the Exide Industries SWOT Analysis. This comprehensive overview will provide a holistic view of how the Exide company continues to thrive and innovate in the dynamic market, offering insights into its battery technology and market position.

What Are the Key Operations Driving Exide Industries’s Success?

Exide Industries, a prominent battery manufacturer, generates value primarily through the creation and distribution of storage batteries. Their core business revolves around producing a diverse range of batteries, including automotive, industrial, and specialized types, catering to a broad customer base. The company's operations are structured to ensure the efficient production and delivery of these essential power solutions.

The company's value proposition centers on providing reliable power solutions, extended product life, and readily available support. This integrated approach, from production to distribution and service, allows the company to meet the diverse needs of its customers effectively. This strategy has helped the company maintain a strong market presence.

The operational framework of Exide Industries encompasses extensive manufacturing capabilities, stringent quality control measures, and ongoing research and development initiatives. Their supply chain is robust, ensuring the sourcing of raw materials, in-house manufacturing, and a vast distribution network. Strategic partnerships further enhance their market reach and technological advancements. The company's focus on after-sales service strengthens customer loyalty and reinforces its brand image.

Exide Industries excels in manufacturing, utilizing advanced processes to produce high-quality Exide batteries. Their expertise ensures that each battery meets stringent performance and safety standards. The manufacturing process is designed for efficiency and scalability, allowing the company to meet high-volume demands effectively.

A robust distribution network is crucial for the success of Exide company. The company has a vast network that includes dealerships, service centers, and direct sales channels. This widespread presence ensures that their products are readily available to customers across various regions, enhancing customer convenience and accessibility.

Exide's strong emphasis on after-sales service sets it apart. They offer comprehensive support, including warranty services, maintenance, and customer assistance. This commitment to customer satisfaction fosters loyalty and reinforces the brand's reputation for reliability and trust, which is essential in the competitive lead-acid batteries market.

Strategic partnerships play a vital role in Exide's operations. These collaborations facilitate technology transfer and market penetration, ensuring the company remains competitive. Partnerships enable Exide Industries to leverage external expertise and resources, driving innovation and expanding its market reach, which is a key aspect of their growth strategy.

Exide Industries offers several key benefits to its customers, solidifying its market position. These benefits include reliable power solutions, extended product life, and readily available support, which are crucial for customer satisfaction and loyalty.

- Reliable Power: Ensures consistent and dependable power supply for various applications.

- Extended Product Life: Batteries are designed for durability, offering a longer lifespan.

- Readily Available Support: Comprehensive after-sales service and support network.

- Wide Product Range: Offers a variety of battery types to meet diverse customer needs.

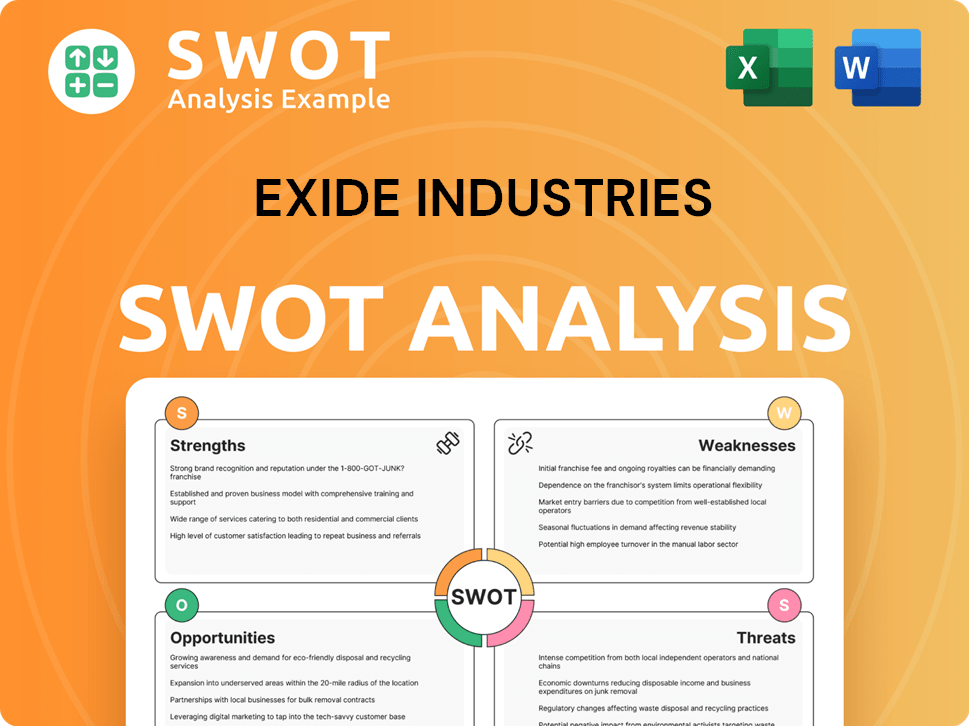

Exide Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Exide Industries Make Money?

The revenue streams and monetization strategies of Exide Industries are centered around the sale of batteries and related services. The company primarily generates revenue through the sale of various battery types, including automotive, industrial, and inverter batteries. Exide also earns from the sale of associated products like chargers and inverters, as well as through after-sales services such as maintenance and recycling.

Exide's approach involves a multi-faceted monetization strategy. The automotive battery segment leverages both OEM and replacement markets, ensuring broad market reach. In the industrial sector, direct sales to businesses, along with customized solutions and long-term contracts, are common. A wide network of dealers and distributors is utilized, especially for inverter and home UPS battery segments, to maximize market penetration. Exide is also exploring new avenues, such as advanced battery technologies like lithium-ion, to adapt to evolving market demands and expand its revenue base.

The automotive segment has historically been a significant contributor to Exide's revenue, followed closely by industrial applications. While specific financial breakdowns for 2024-2025 are still emerging, the company's focus on both the OEM and replacement markets for automotive batteries ensures a steady revenue stream. The industrial segment benefits from direct sales and long-term contracts, providing stability. Furthermore, the expansion into new technologies like lithium-ion batteries reflects Exide's commitment to adapting to market changes and exploring new revenue opportunities, particularly in the growing electric vehicle and renewable energy storage sectors.

Exide Industries, a leading battery manufacturer, employs several strategies to generate revenue and maintain a strong market presence:

- Automotive Batteries: Sales through both OEM and replacement markets, targeting a broad customer base.

- Industrial Batteries: Direct sales, customized solutions, and long-term contracts with businesses.

- Inverter and Home UPS Batteries: Utilization of a wide dealer and distributor network to enhance market reach.

- After-Sales Services: Battery maintenance, recycling programs, and other related services.

- Emerging Technologies: Investment in advanced battery technologies, such as lithium-ion, to capitalize on the growing demand for electric vehicles and renewable energy storage.

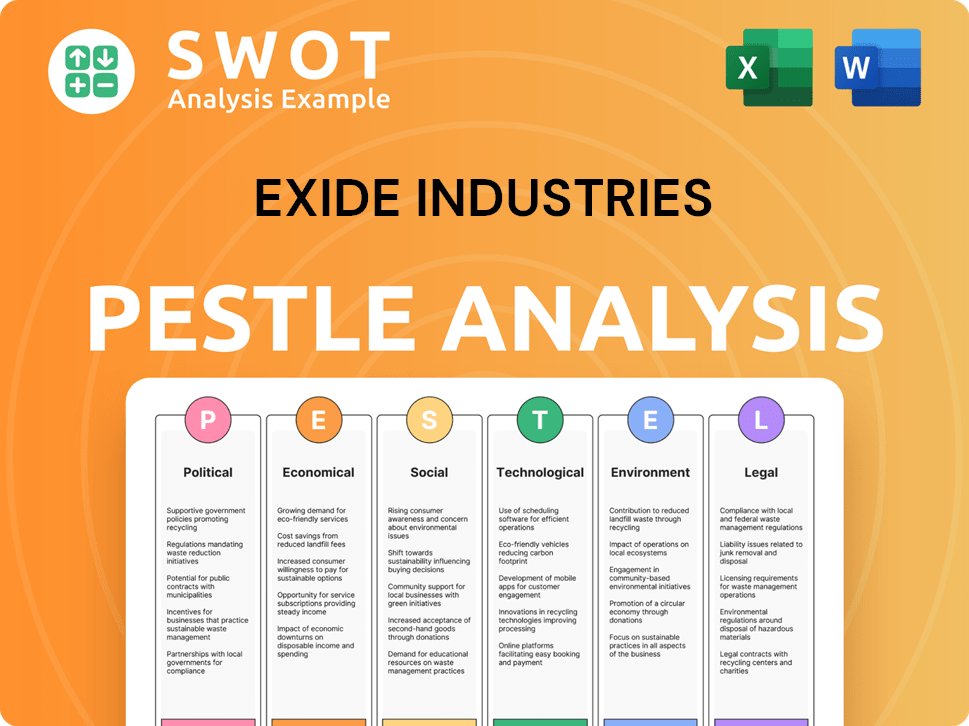

Exide Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Exide Industries’s Business Model?

Exide Industries has a long history marked by significant milestones that have shaped its operations and financial performance. A key strategic move in recent years has been its expansion into the lithium-ion battery market, which is crucial for its future, especially with the increasing adoption of electric vehicles (EVs) and renewable energy storage. The company's continuous investment in manufacturing capacity and technology upgrades has been essential to maintain its competitive edge.

Operational challenges have included managing raw material price volatility, particularly for lead, and navigating intense competition from both organized and unorganized sectors. Exide has responded by focusing on cost efficiencies, product innovation, and strengthening its distribution network. The company's strategic initiatives are geared towards adapting to the evolving market dynamics and sustaining its leadership in the battery industry.

The company's competitive advantages are multifaceted, including strong brand recognition and a legacy of trust built over decades in the Indian market. Exide benefits from economies of scale due to its large-scale manufacturing operations, which allows for competitive pricing. Furthermore, its extensive pan-India sales and service network is a formidable asset, ensuring widespread product availability and robust after-sales support. For more insights into the ownership and shareholder structure, you can read more on Owners & Shareholders of Exide Industries.

Exide's journey includes major expansions and technological advancements. A significant milestone was the establishment of its manufacturing facilities, which have been upgraded over time to meet evolving market demands. The company's strategic partnerships and acquisitions have also been pivotal in expanding its market reach and product portfolio. These milestones have solidified Exide's position as a leading battery manufacturer.

The company has strategically entered the lithium-ion battery market through a joint venture, Exide Energy Solutions Ltd., to capitalize on the EV and renewable energy storage sectors. Continuous investment in research and development (R&D) for advanced battery technologies is another key strategic move. Strengthening its distribution network and focusing on cost efficiencies are ongoing strategies.

Exide's strong brand recognition and extensive distribution network provide a competitive advantage. Economies of scale from large-scale manufacturing allow for competitive pricing. The company's focus on R&D and sustainable practices helps maintain its market leadership. These elements collectively contribute to Exide's ability to withstand competition and adapt to technological shifts.

In recent financial reports, Exide has shown resilience with consistent revenue streams and profitability. The company's investments in new technologies, such as lithium-ion batteries, are expected to drive future growth. Exide's financial strategies focus on managing operational costs and enhancing shareholder value. The company's performance is closely tied to its ability to adapt to market changes.

Exide's strong brand recognition and extensive distribution network are key competitive strengths. The company benefits from economies of scale due to its large-scale manufacturing operations, allowing for competitive pricing. Exide's focus on R&D and sustainable practices helps maintain its market leadership.

- Brand Recognition: Decades of trust in the Indian market.

- Distribution Network: Extensive pan-India sales and service network.

- Economies of Scale: Large-scale manufacturing leading to competitive pricing.

- R&D Focus: Investment in next-generation battery technologies.

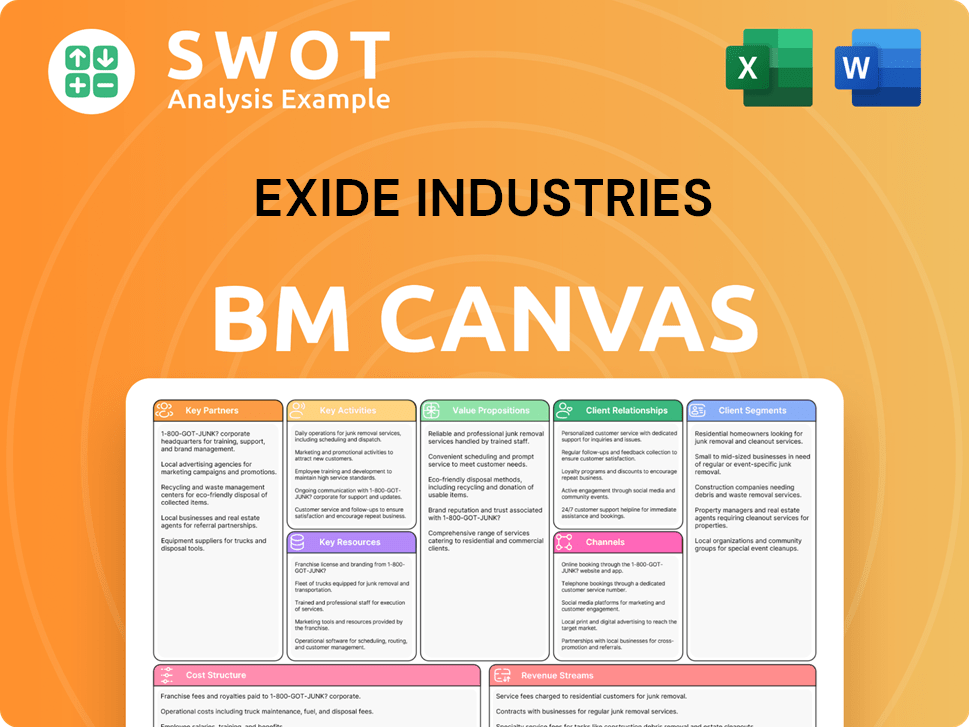

Exide Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Exide Industries Positioning Itself for Continued Success?

In the Indian battery market, Exide Industries holds a strong position, particularly in the automotive and industrial sectors. The company competes with players like Amara Raja Batteries. Its brand recognition and extensive customer base are key strengths, supporting a significant market share. Exide batteries also exports to various international markets.

However, Exide company faces several risks. These include fluctuating raw material prices, especially lead, which impact production costs. Changes in regulations regarding battery disposal and environmental standards also pose challenges. Moreover, the emergence of new battery technologies and competitors in the advanced battery space could affect its traditional lead-acid battery business.

Exide Industries is a leading battery manufacturer in India, with a strong presence in the automotive and industrial sectors. The company benefits from high brand loyalty. It faces competition from other key players in the market.

The company is exposed to the volatility of raw material prices, particularly lead, which affects its production costs. Regulatory changes related to battery disposal and environmental norms also pose challenges. Technological advancements in battery technologies could disrupt its business.

Exide Industries is focusing on diversifying its product portfolio and expanding into the new-age battery segment. This includes investments in lithium-ion cell manufacturing, aiming to cater to the EV market. The company's future depends on its successful transition to advanced battery technologies.

Key initiatives include investments in lithium-ion cell manufacturing for the EV market. The company is committed to innovation, sustainability, and expanding its technological capabilities. Exide batteries aims to maintain market leadership by adapting to the shift towards cleaner energy.

Exide Industries is strategically focusing on expanding its presence in the new-age battery segment. The company is adapting to the global shift towards cleaner energy solutions, with significant investments in lithium-ion cell manufacturing. This positions Exide to meet the growing demand for EV and grid-scale energy storage solutions.

- Investments in lithium-ion cell manufacturing to cater to the EV market.

- Commitment to innovation and sustainability.

- Expansion of technological capabilities to meet future demands.

- Focus on adapting to the evolving market trends.

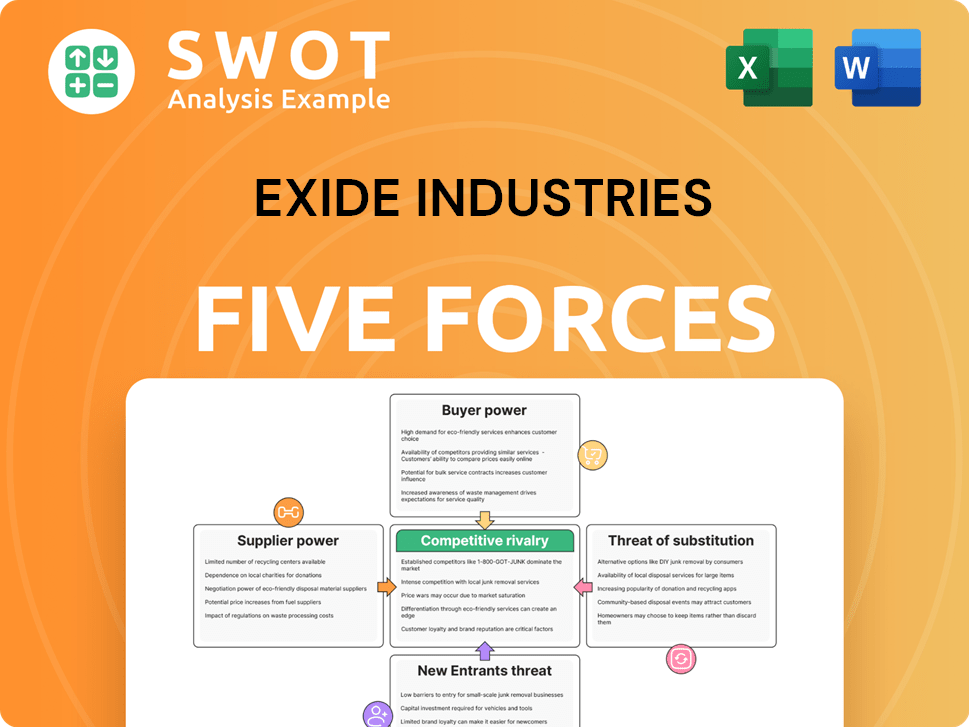

Exide Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Exide Industries Company?

- What is Competitive Landscape of Exide Industries Company?

- What is Growth Strategy and Future Prospects of Exide Industries Company?

- What is Sales and Marketing Strategy of Exide Industries Company?

- What is Brief History of Exide Industries Company?

- Who Owns Exide Industries Company?

- What is Customer Demographics and Target Market of Exide Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.