FirstEnergy Bundle

How Well Do You Know FirstEnergy?

Delve into the fascinating FirstEnergy SWOT Analysis and explore the complex journey of FirstEnergy, an energy company that has significantly shaped the utility landscape. Established in 1997 through a pivotal merger, FirstEnergy rapidly ascended to become a major player in the U.S. energy market. From its Ohio roots, the company's story is one of strategic growth and adaptation within a dynamic industry.

This FirstEnergy company background reveals how FirstEnergy, a prominent utility company, evolved from a regional entity to a major power provider, serving millions across multiple states. Understanding the brief history of FirstEnergy's formation provides crucial context for its current strategic direction and its impact on Ohio and beyond. Exploring FirstEnergy's early years and major milestones offers valuable insights into its adaptability and resilience within the ever-changing energy sector.

What is the FirstEnergy Founding Story?

The story of FirstEnergy's founding is rooted in the strategic consolidation of existing utility giants. It wasn't a startup launch but a merger designed to reshape the energy landscape. Understanding the brief history of FirstEnergy's formation is key to grasping its evolution.

FirstEnergy Corp. officially came into existence on November 7, 1997. This was a result of the merger between Ohio Edison Company and Centerior Energy Corporation. This union created a significant player in the energy market.

The merger aimed to create a large investor-owned electric system. This strategic move was about consolidating resources and expanding market reach. The goal was to streamline operations and enhance efficiency in the competitive energy sector.

FirstEnergy's formation was a merger of established utility companies, not a traditional startup.

- FirstEnergy history begins with the merger of Ohio Edison Company and Centerior Energy Corporation.

- Ohio Edison, founded in 1930, served northeastern Ohio.

- Centerior Energy, formed in 1986, was the parent company of The Cleveland Electric Illuminating Company (established 1892) and Toledo Edison Company (founded 1901).

- The merger created a large electric system serving 2.2 million customers.

- The initial business model focused on electricity generation, transmission, and distribution.

- The merger was driven by restructuring and cost-cutting measures.

The merger of Ohio Edison and Centerior Energy was a pivotal moment. The combined entity aimed to serve a broad customer base. The merger was a response to the changing dynamics of the energy market.

The merger's primary objective was to cut costs and streamline operations. This involved restructuring and workforce reductions. The consolidation was designed to create a more competitive and efficient utility company.

The newly formed entity inherited the assets and valuations of the merging companies. The initial capital came from the combined resources of Ohio Edison and Centerior Energy. Key leaders from both companies played critical roles in the formation of FirstEnergy.

The Owners & Shareholders of FirstEnergy have played a crucial role in the company's evolution. The merger was a strategic move to adapt to the changing energy landscape.

In 2024, FirstEnergy's total operating revenue was approximately $12.9 billion. The company continues to adapt and evolve in the energy sector.

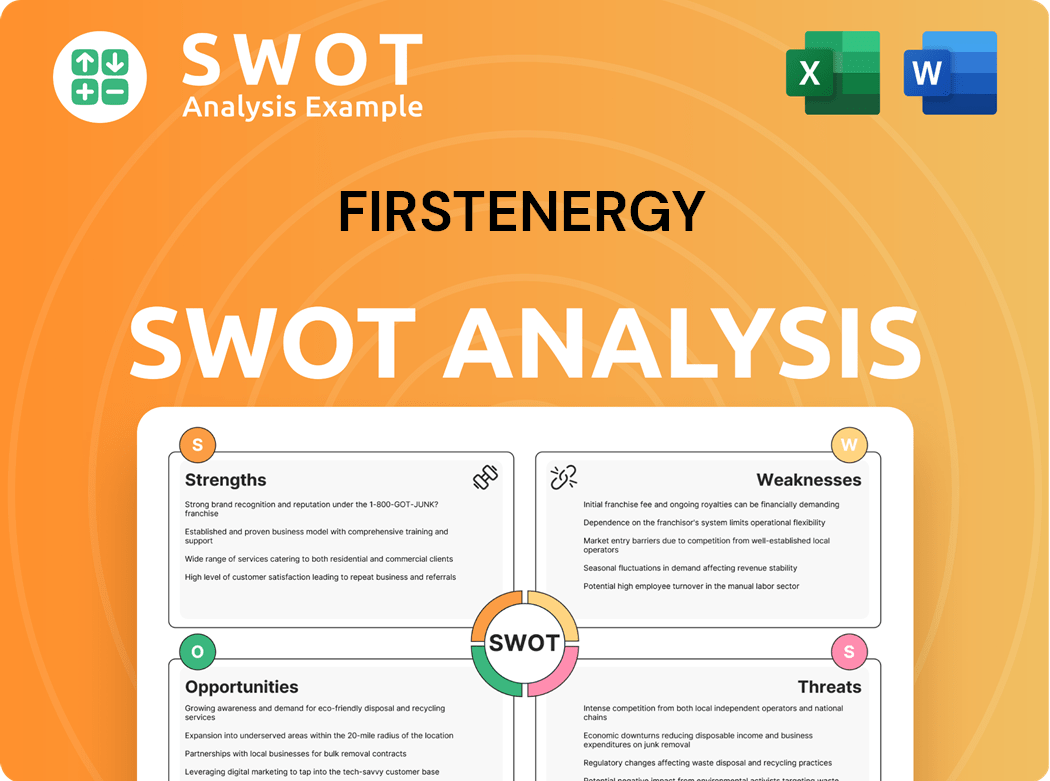

FirstEnergy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of FirstEnergy?

The early years of FirstEnergy were marked by significant growth and expansion. Following its formation, the company quickly pursued strategic mergers and acquisitions to broaden its reach and customer base. These moves were crucial in establishing FirstEnergy as a major player in the energy sector.

In 2001,

In 2011,

Throughout its early growth,

Brian X. Tierney became President and CEO of FirstEnergy Corp. on June 1, 2023. In 2024,

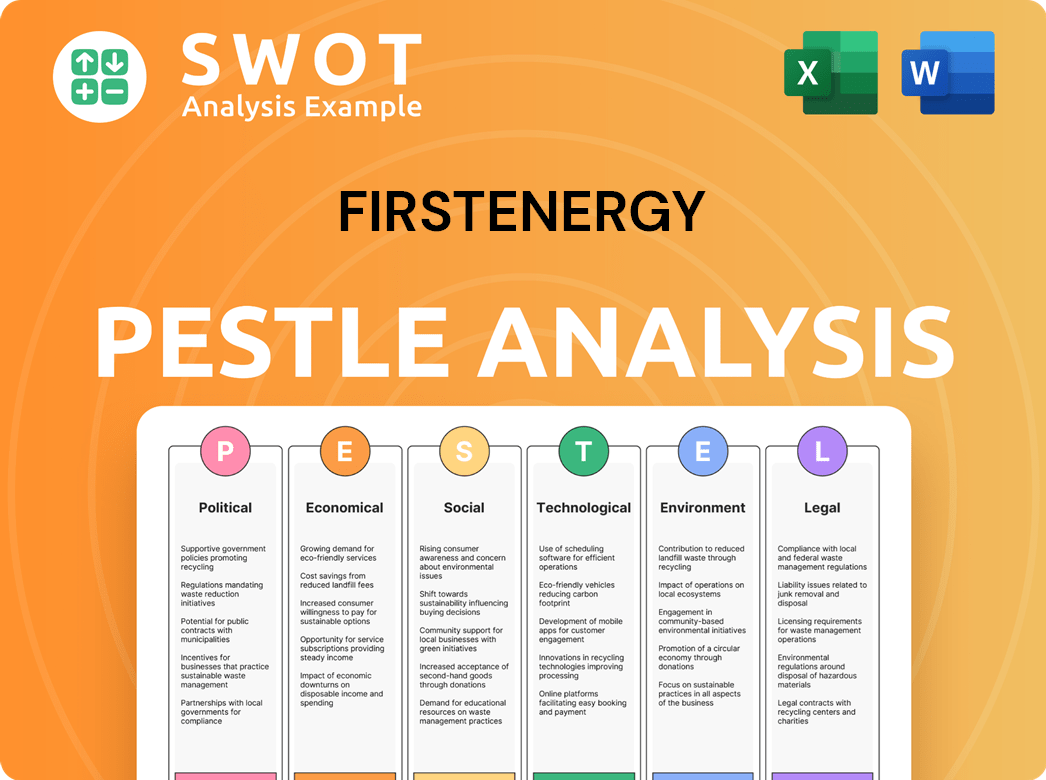

FirstEnergy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in FirstEnergy history?

The FirstEnergy company has a history marked by strategic shifts and significant developments. A key move was the 2016 announcement to become a fully regulated transmission and distribution utility, which involved divesting competitive generation assets. This transformation was completed on February 27, 2020, reshaping the FirstEnergy company's focus.

| Year | Milestone |

|---|---|

| 2016 | FirstEnergy announced its plan to transition away from commodity-exposed generation. |

| 2018 | FirstEnergy Solutions, a subsidiary, filed for bankruptcy. |

| 2020 | The final step in the separation of competitive generation assets was completed. |

| 2021 | A bribery scandal led to a deferred prosecution agreement and a $230 million fine. |

| 2024 | The 'Energize365' capital investment program saw a $4.5 billion investment. |

| 2025 | A court determined that FirstEnergy should be treated as a party to alleged crimes, leading to the dismissal of theft charges against former executives. |

FirstEnergy has consistently focused on innovation, particularly through its grid modernization efforts. The 'Energize365' capital investment program saw a 20% increase in investment in 2024, reaching $4.5 billion. The company is also investing in renewable energy, including solar projects in West Virginia, with plans to own at least 50 megawatts of solar generation there by 2025.

The 'Energize365' program aims to make the grid smarter, more secure, and reliable. This initiative supports customer affordability and enhances the overall energy infrastructure.

FirstEnergy is actively investing in renewable energy projects, such as solar. New solar sites are coming online, with a goal to own at least 50 megawatts of solar generation in West Virginia by 2025.

In 2024, the FirstEnergy company invested over $1 billion in upgrading its transmission and distribution infrastructure. These upgrades are crucial for enhancing reliability and efficiency.

FirstEnergy has faced considerable challenges, including the bankruptcy of its subsidiary, FirstEnergy Solutions, in 2018. This was largely due to difficulties in the competitive power generation market. Additionally, the company has been involved in a bribery scandal, which led to significant financial penalties and internal crises. For more details, you can read about the Growth Strategy of FirstEnergy.

The bankruptcy filing in 2018 was a significant setback, driven by challenges in the competitive power generation market. This event led to a restructuring of the company and impacted its financial performance.

The bribery scandal resulted in a deferred prosecution agreement and a $230 million fine in July 2021. This led to internal crises and a renewed focus on corporate governance.

These challenges have led to internal crises, leadership changes, and a renewed focus on corporate governance and compliance. The company is working to address these issues and restore stakeholder trust.

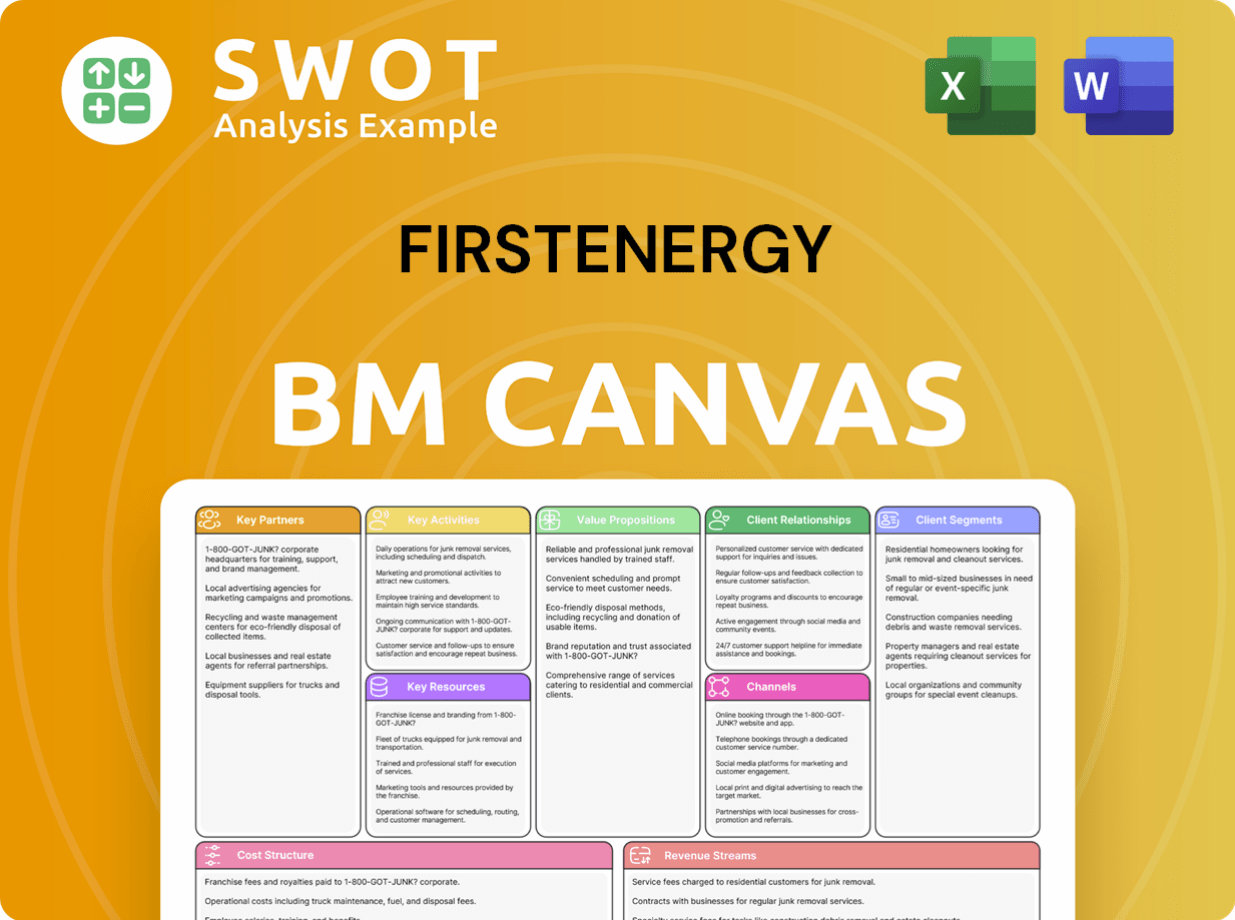

FirstEnergy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for FirstEnergy?

The FirstEnergy company has a rich history marked by significant mergers, strategic shifts, and a focus on adapting to the evolving energy landscape. This energy company has transformed from its early beginnings to become a major utility company in the United States.

| Year | Key Event |

|---|---|

| 1997 | FirstEnergy Corp. was formed through the merger of Ohio Edison Company and Centerior Energy Corporation. |

| 2001 | FirstEnergy merged with GPU, Inc., expanding its service territory into Pennsylvania and New Jersey. |

| 2011 | The company completed a merger with Allegheny Energy, increasing its footprint in West Virginia and Maryland. |

| 2016 | FirstEnergy announced its plan to transition to a fully regulated transmission and distribution utility. |

| 2018 | FirstEnergy Solutions, a subsidiary, filed for bankruptcy. |

| 2020 | The separation from competitive generation assets was completed, and former CEO Charles E. Jones was terminated. |

| 2021 | FirstEnergy reached a deferred prosecution agreement and was fined $230 million due to a bribery scandal. |

| 2023 | Brian X. Tierney assumed the role of President and CEO on June 1. |

| 2024 | FirstEnergy invested $4.5 billion in its Energize365 program and reported full-year revenue of $13.5 billion; the first solar project was completed in January. |

| 2025 | The company plans to invest $5 billion in its Energize365 program; Q1 GAAP earnings are $0.62 per share on revenue of $3.8 billion; and it plans to submit an Integrated Resource Plan (IRP) to the West Virginia Public Service Commission (WVPSC). |

FirstEnergy is heavily invested in grid modernization. The company plans to spend $28 billion through 2029. This investment is part of the Energize365 program and is designed to enhance reliability and security. Smart meter installation is planned for approximately 86% of customers by 2028.

The company is committed to a low-carbon future. Ongoing investments in renewable energy, particularly solar generation in West Virginia, are a key focus. FirstEnergy is exploring battery storage technologies. The company anticipates a 6-8% core earnings compound annual growth rate through 2029.

FirstEnergy aims to improve customer experience through smart grid technologies. Energy efficiency programs are also being implemented. The company is dedicated to providing superior service to its 6 million customers. The company is focused on safety and operational excellence.

FirstEnergy is focused on long-term strategic initiatives, including grid modernization and sustainable growth. The company's five-year investment target has been expanded to $28 billion through 2029, with $5 billion allocated for 2025. This investment is designed to drive predictable rate base growth.

FirstEnergy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of FirstEnergy Company?

- What is Growth Strategy and Future Prospects of FirstEnergy Company?

- How Does FirstEnergy Company Work?

- What is Sales and Marketing Strategy of FirstEnergy Company?

- What is Brief History of FirstEnergy Company?

- Who Owns FirstEnergy Company?

- What is Customer Demographics and Target Market of FirstEnergy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.