FirstEnergy Bundle

Can FirstEnergy Thrive in Today's Energy Revolution?

The energy sector is in constant flux, with renewable energy and evolving regulations reshaping the playing field. FirstEnergy, a key player in the electric utility industry, faces a dynamic FirstEnergy SWOT Analysis. Understanding the company's competitive landscape is crucial for investors, analysts, and anyone interested in the future of energy.

This analysis delves into FirstEnergy's competitive environment, examining its major competitors and market share within the utility industry. We'll explore FirstEnergy's strategic initiatives, including its renewable energy projects, and assess its position in the energy market. Furthermore, we'll compare FirstEnergy's financial performance against its rivals, providing a comprehensive energy sector analysis and insights into its competitive advantages and disadvantages.

Where Does FirstEnergy’ Stand in the Current Market?

FirstEnergy holds a significant market position within the U.S. electric utility industry. It primarily operates through its regulated utilities, offering electricity generation, transmission, and distribution services. The company serves approximately 6 million customers across Ohio, Pennsylvania, West Virginia, Maryland, and New Jersey.

The company's core product lines revolve around the reliable delivery of electricity, a fundamental service in its operational territories. Its geographic presence is concentrated in the mid-Atlantic and Midwest, regions with substantial industrial and residential electricity demand. This strategic focus helps define the Growth Strategy of FirstEnergy.

FirstEnergy consistently ranks among the largest investor-owned utilities based on customer count and revenue. In 2023, FirstEnergy reported total operating revenues of $12.37 billion. The company's financial health, as indicated by its revenue and strategic investments in infrastructure, positions it as a stable entity within the industry.

FirstEnergy has a substantial market share in its service areas. Its customer base includes roughly 6 million customers, making it a major player in the utility industry. This large customer base contributes to its strong market position and revenue generation.

In 2023, FirstEnergy's total operating revenues were $12.37 billion. The company's financial performance reflects its stability and ability to invest in infrastructure. These financial results are crucial to understanding the FirstEnergy competitive landscape.

FirstEnergy is actively engaged in grid modernization efforts. It has a $3.7 billion investment plan for 2024-2025 to enhance reliability. These investments show a commitment to maintaining a strong market position and improving service quality.

The company's focus is on the mid-Atlantic and Midwest regions. These areas have high electricity demand, which supports FirstEnergy's market position. This geographic concentration affects FirstEnergy's market share.

FirstEnergy’s regulated utility model provides a stable revenue stream, differentiating it from competitive energy businesses. Its strong position in core service territories is due to the essential nature of its services and regulatory frameworks.

- Reliable Service: Focus on delivering dependable electricity to customers.

- Infrastructure Investments: Ongoing grid modernization with a $3.7 billion plan for 2024-2025.

- Regulatory Framework: Operates within a regulated environment that provides stability.

- Customer Base: Serves approximately 6 million customers.

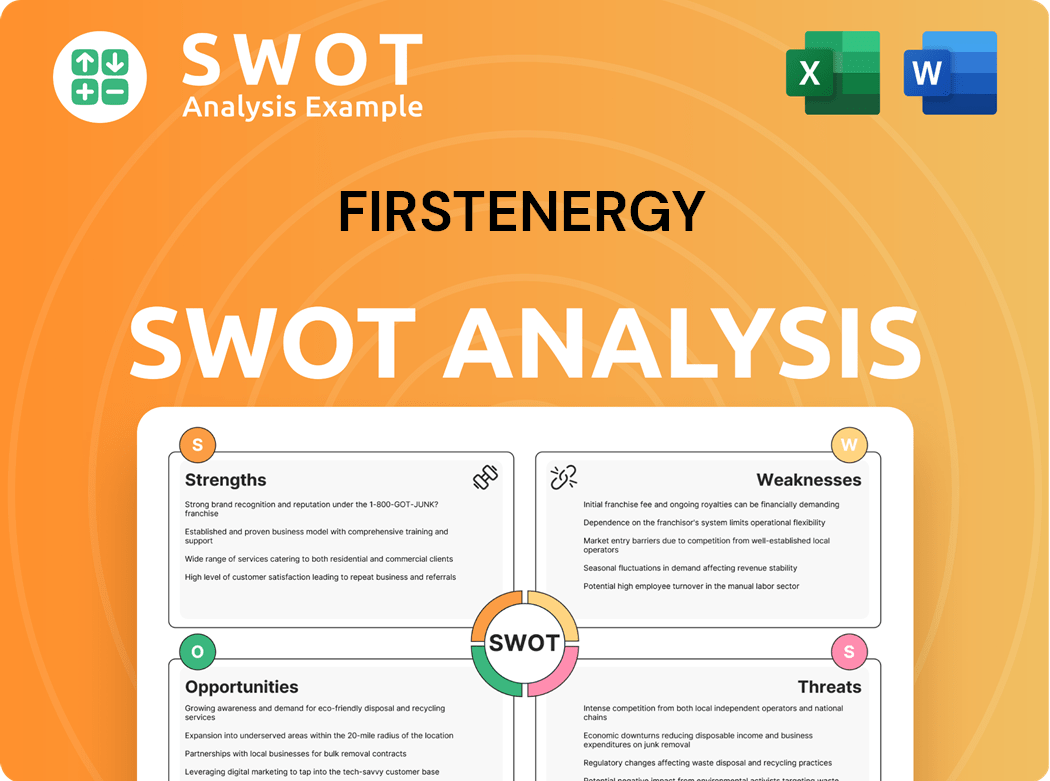

FirstEnergy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging FirstEnergy?

The competitive landscape for FirstEnergy is shaped by a mix of direct and indirect competitors, reflecting the dynamic nature of the energy sector. Understanding this landscape is crucial for assessing the company's strategic positioning and future prospects. The firm faces challenges from established utilities and emerging energy solutions.

FirstEnergy's market share and overall performance are heavily influenced by the competitive actions of these entities. Analyzing the strategies of competitors, along with the impact of regulatory changes and technological advancements, offers insights into the company's ability to maintain and grow its market position. This competitive analysis is essential for investors and stakeholders.

The competitive dynamics within the energy sector are constantly evolving. Factors such as technological innovation, regulatory changes, and shifts in consumer preferences are reshaping the industry. FirstEnergy, like other utilities, must adapt to these changes to remain competitive and meet the evolving needs of its customers. For more information, you can check Owners & Shareholders of FirstEnergy.

FirstEnergy's primary competitors are other major investor-owned utilities operating within its service territories. These companies often offer similar services, including electricity generation, transmission, and distribution. They compete on factors like reliability, pricing, and customer service.

PPL Corporation is a significant competitor, particularly in parts of Pennsylvania. PPL's operations include regulated utilities that compete directly with FirstEnergy for customers in the region. PPL's focus on regulated utilities makes it a direct rival.

Exelon, through its PECO subsidiary, also competes with FirstEnergy in certain areas. PECO provides electricity and natural gas services, creating direct competition for FirstEnergy, especially in customer acquisition and retention. The competition is based on service quality and pricing.

AEP Ohio, a subsidiary of American Electric Power, is a major competitor for FirstEnergy in Ohio. AEP Ohio's integrated utility model mirrors FirstEnergy's, leading to competition in the same markets. They compete on service quality and efficiency.

Indirect competition comes from various sources, including distributed generation, energy efficiency programs, and the broader energy market. These entities offer alternatives that can reduce demand for traditional grid-supplied electricity. The competitive landscape is influenced by technological advancements and consumer preferences.

The growth of distributed generation, such as rooftop solar, allows customers to generate their own power. This reduces reliance on the grid and impacts FirstEnergy's market share. The increasing adoption of renewable energy sources poses a challenge.

FirstEnergy's competitive standing is determined by several factors. These include service reliability, rate structures, customer service, and strategic initiatives. The company must continually improve in these areas to maintain its market position.

- Service Reliability: Maintaining a reliable grid is critical for customer satisfaction and retention.

- Rate Structures: Competitive pricing is essential for attracting and retaining customers.

- Customer Service: Providing excellent customer service enhances loyalty and brand reputation.

- Strategic Initiatives: Investments in smart grid technologies and renewable energy projects can improve competitiveness.

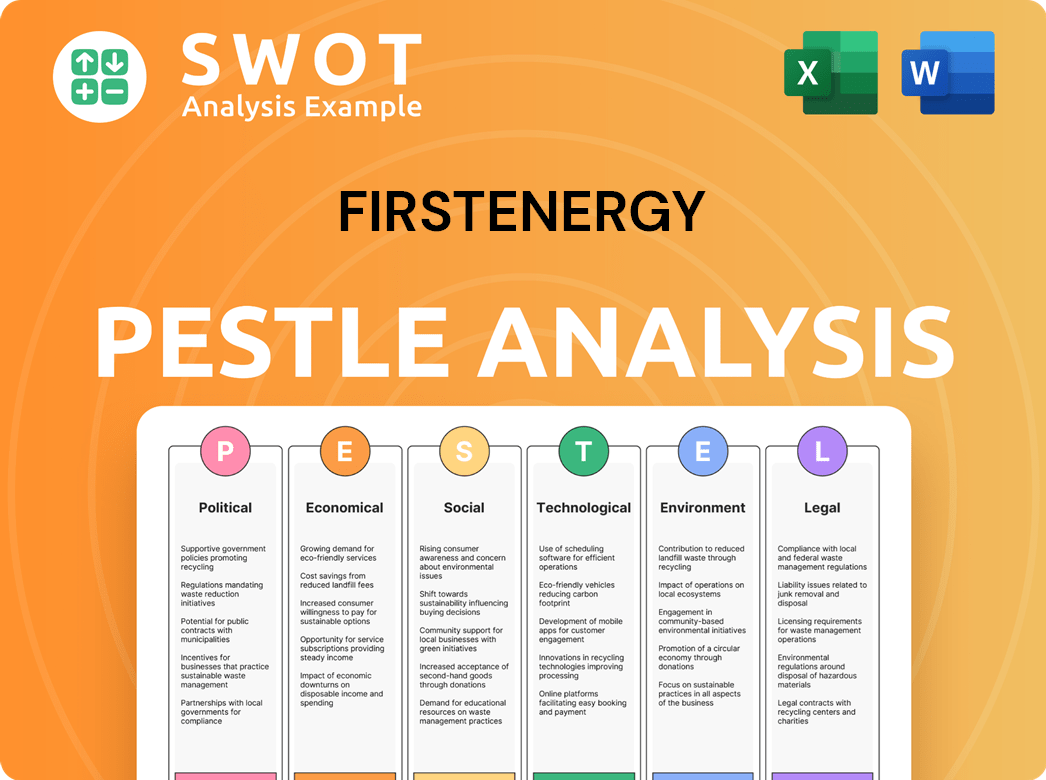

FirstEnergy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives FirstEnergy a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape of FirstEnergy reveals a company leveraging several key advantages in the electric utility sector. Its robust regulated asset base, which includes a vast transmission and distribution network, is a significant strength. This infrastructure provides a stable revenue stream and acts as a barrier to entry for new competitors. The company’s long-standing presence and established customer relationships also contribute to its competitive edge.

FirstEnergy's strategic investments and operational efficiencies are also noteworthy. The company's focus on grid modernization and smart grid technologies, such as the $3.7 billion investment plan for 2024-2025, enhances its service quality and operational efficiency. These investments aim to improve system resilience and reduce outages, which are critical for customer satisfaction and regulatory compliance. The company's commitment to innovation and its substantial asset base position it strongly within the utility industry.

The competitive dynamics within the utility sector are influenced by various factors, including regulatory changes and technological advancements. Understanding FirstEnergy's target market and how it adapts to these changes is crucial for assessing its long-term prospects. The company's ability to navigate these challenges will be key to maintaining its competitive position.

FirstEnergy's extensive transmission and distribution network across its five-state service territory forms a significant competitive advantage. This established infrastructure provides a stable revenue stream and high barriers to entry. The company's substantial asset base supports its market position.

FirstEnergy benefits from strong brand equity and long-standing customer relationships. Decades of providing essential services have built significant customer loyalty. This loyalty is a critical factor in maintaining market share and resisting competition.

Economies of scale in operations allow for cost efficiencies in maintenance, infrastructure development, and power procurement. An experienced workforce and established operational protocols contribute to reliable service delivery. This focus on efficiency enhances its competitive standing.

Ongoing investments in grid modernization and smart grid technologies, such as the $3.7 billion investment plan for 2024-2025, are designed to improve operational efficiency. These advancements include smart meters and automated grid devices, enhancing the energy delivery system. These investments are crucial for maintaining a competitive edge.

FirstEnergy's competitive advantages stem from its extensive infrastructure, strong customer relationships, operational efficiencies, and strategic investments in grid modernization. These factors contribute to its market position within the utility industry. The company’s ability to leverage these strengths is critical for its long-term success.

- Extensive Regulated Asset Base: Provides a stable revenue stream and high barriers to entry.

- Strong Customer Relationships: Built over decades of service, fostering customer loyalty.

- Operational Efficiencies: Economies of scale and experienced workforce contribute to cost savings.

- Grid Modernization: Investments in smart grid technologies enhance service quality and efficiency.

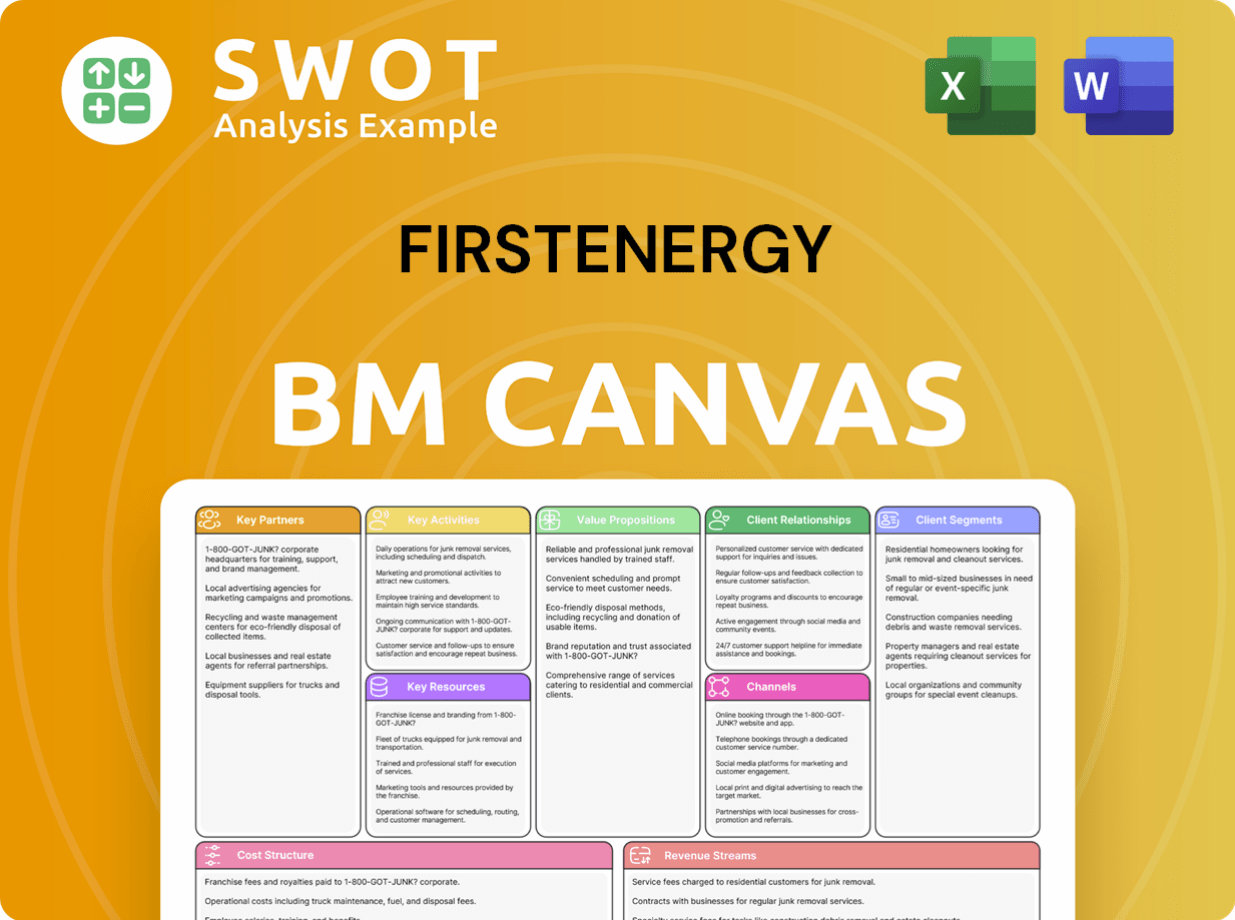

FirstEnergy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping FirstEnergy’s Competitive Landscape?

The electric utility industry is undergoing significant transformation, creating both challenges and opportunities for companies like FirstEnergy. Key trends include the push for decarbonization, the integration of renewable energy sources, and the modernization of existing infrastructure. Regulatory changes and evolving consumer preferences for energy efficiency and distributed generation are also reshaping the competitive landscape. Understanding the FirstEnergy competitive landscape requires a deep dive into these evolving dynamics.

FirstEnergy's position in the market is influenced by its ability to adapt to these changes. The company faces potential risks from distributed energy resources and regulatory shifts, but also has opportunities in electric vehicle charging, energy storage, and grid modernization. Its strategic investments and partnerships will be crucial for maintaining and improving its market position. For a broader understanding, check out the Marketing Strategy of FirstEnergy.

The energy sector is experiencing a shift towards decarbonization, driven by environmental concerns and government mandates. This necessitates significant investments in renewable energy sources and grid modernization. Regulatory changes, particularly those related to emissions standards, are also influencing operational costs and investment strategies. These trends greatly impact FirstEnergy's competitive landscape.

FirstEnergy faces challenges from the increasing adoption of distributed energy resources, which could reduce demand for grid-supplied electricity. Aging infrastructure and potential changes in regulatory frameworks also pose risks. Adapting to these challenges requires strategic investments and innovative solutions. These factors affect the competitive dynamics within the utility industry.

FirstEnergy can capitalize on the growing demand for electric vehicle charging infrastructure and energy storage solutions. Expanding grid modernization initiatives to integrate more renewable energy presents further opportunities. Strategic partnerships and investments in technology can drive growth and enhance its market position. These initiatives are important for FirstEnergy's strategies for growth and market share.

The company's focus on its 'Smart Grid' program, with over $600 million invested in 2023, demonstrates its commitment to leveraging technology for future resilience and efficiency. Investments in grid modernization and renewable energy integration are key. These initiatives are crucial for FirstEnergy's long-term competitiveness.

To succeed, FirstEnergy must strategically adapt to industry shifts, invest in new technologies, and provide reliable, sustainable energy solutions. Key areas of focus include grid modernization, renewable energy integration, and customer-focused services. These strategies are vital for improving FirstEnergy market share.

- Grid Modernization: Investing in smart grid technologies to improve reliability and efficiency.

- Renewable Energy: Expanding renewable energy projects to meet decarbonization goals.

- Customer Engagement: Offering new services and demand-side management programs to meet changing consumer preferences.

- Financial Performance: Focusing on FirstEnergy's financial performance compared to competitors.

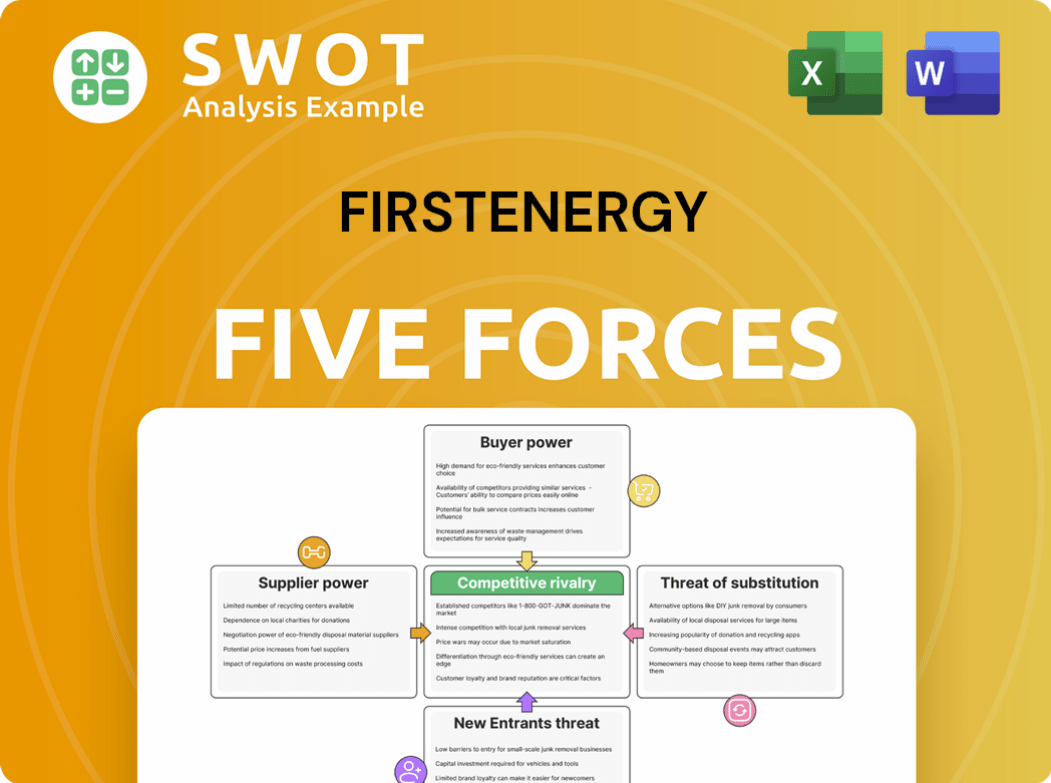

FirstEnergy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FirstEnergy Company?

- What is Growth Strategy and Future Prospects of FirstEnergy Company?

- How Does FirstEnergy Company Work?

- What is Sales and Marketing Strategy of FirstEnergy Company?

- What is Brief History of FirstEnergy Company?

- Who Owns FirstEnergy Company?

- What is Customer Demographics and Target Market of FirstEnergy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.