FirstEnergy Bundle

How Does FirstEnergy Power Your World?

FirstEnergy, a major FirstEnergy SWOT Analysis, is a vital FirstEnergy Company operating in the Midwest and Mid-Atlantic. As a key utility company, it delivers electricity to millions of homes and businesses. Understanding FirstEnergy operations is crucial for anyone interested in the energy sector.

This exploration of FirstEnergy will help you understand its role as an energy provider. We'll examine how this electric company generates and distributes power, impacting both consumers and investors. Whether you're curious about FirstEnergy's service area map or the FirstEnergy stock price, this analysis provides valuable insights.

What Are the Key Operations Driving FirstEnergy’s Success?

FirstEnergy Company operates as an integrated utility company, delivering electricity to residential, commercial, and industrial customers. Its core business involves the generation, transmission, and distribution of electricity across a five-state service territory. The company's value proposition centers on providing reliable and efficient power while investing in infrastructure and customer service.

The FirstEnergy operations are complex, encompassing various processes to ensure a consistent electricity supply. This includes power generation from diverse sources, managing a vast transmission network, and operating local distribution systems. Continuous investment in grid modernization is crucial to enhance reliability and integrate new energy technologies.

The company's commitment to operational excellence and infrastructure investment translates into tangible benefits for customers, such as consistent power delivery and improved service quality. This integrated approach and broad geographic footprint help define FirstEnergy's market position.

FirstEnergy provides electricity supply, infrastructure maintenance, and customer support services. The company focuses on delivering reliable power to its customers. They also offer various programs to enhance energy efficiency and customer satisfaction.

The operational processes include power generation, transmission, and distribution. FirstEnergy manages a vast network of transmission lines and local distribution systems. Investments in grid modernization and technology development are ongoing to improve reliability.

FirstEnergy's value proposition includes reliable electricity supply and improved service quality. The company aims to adapt to future energy demands through infrastructure investments. The company's focus on customer satisfaction and energy efficiency programs enhance its market position.

The company's broad geographic footprint and integrated utility model provide a strong foundation. FirstEnergy combines generation, transmission, and distribution for operational efficiency. This integrated approach sets it apart from competitors in the utility company landscape.

FirstEnergy focuses on several key areas to ensure efficient operations and customer satisfaction. These include grid modernization, renewable energy initiatives, and customer service enhancements. These initiatives support the company's mission to provide reliable and sustainable energy solutions.

- Grid Modernization: Ongoing projects to enhance grid reliability and resilience.

- Renewable Energy: Investments in renewable energy sources to diversify the energy mix.

- Customer Service: Improvements in customer service and outage response times.

- Financial Performance: Strong financial performance, with a focus on shareholder value.

For more detailed insights into FirstEnergy's strategic direction, consider exploring the Growth Strategy of FirstEnergy. Recent data indicates that FirstEnergy has been actively investing in grid modernization, with significant capital expenditures allocated to improve infrastructure. In 2024, the company reported a strong focus on renewable energy projects, aiming to increase the proportion of clean energy in its portfolio. The company's commitment to customer service is reflected in its efforts to reduce outage durations and enhance communication during service disruptions. FirstEnergy continues to adapt to the evolving energy landscape, focusing on operational efficiency and customer satisfaction.

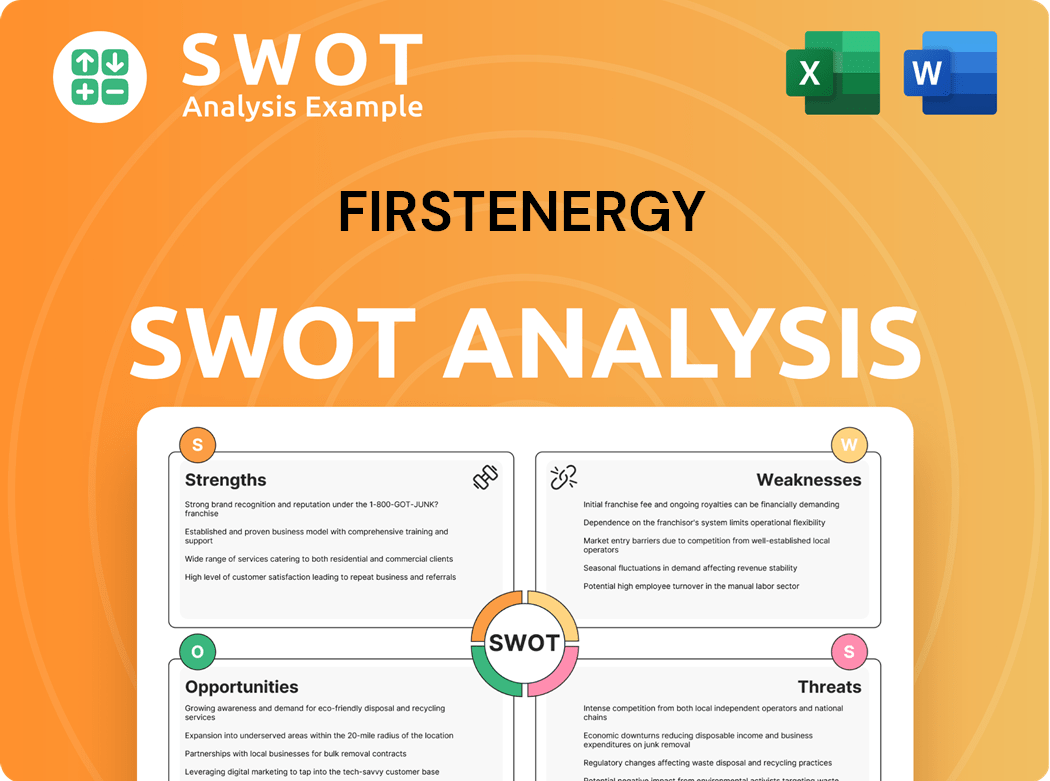

FirstEnergy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FirstEnergy Make Money?

The FirstEnergy Company primarily generates revenue through its regulated electric utility operations. This involves the sale and delivery of electricity to its customers. These operations are subject to state and federal regulations, which allow the company to recover costs and earn a reasonable return on its investments.

For the fiscal year 2024, FirstEnergy reported total operating revenues of $12.37 billion. This revenue is largely driven by electricity sales volume, customer growth, and approved rate adjustments. The company's business model is centered on providing essential services within a regulated framework, which offers a degree of financial stability.

FirstEnergy's monetization strategy is based on a traditional utility model, where customers are billed based on their electricity consumption. Beyond direct electricity sales, the company also generates revenue from transmission services, utilizing its extensive network to transmit power for other entities. The regulated earnings contribute to a predictable income stream.

FirstEnergy's revenue streams are primarily derived from its regulated electric utility operations. The company's financial health is closely tied to its ability to manage costs and maintain a reliable supply of electricity. Key aspects of its revenue model include:

- Electricity Sales: Revenue from selling electricity to residential, commercial, and industrial customers.

- Transmission Services: Revenue from transmitting power for other utilities and entities.

- Rate Adjustments: Revenue adjustments approved by regulatory bodies to reflect changes in costs and investments.

- Customer Growth: Increased revenue from acquiring new customers within its service territories.

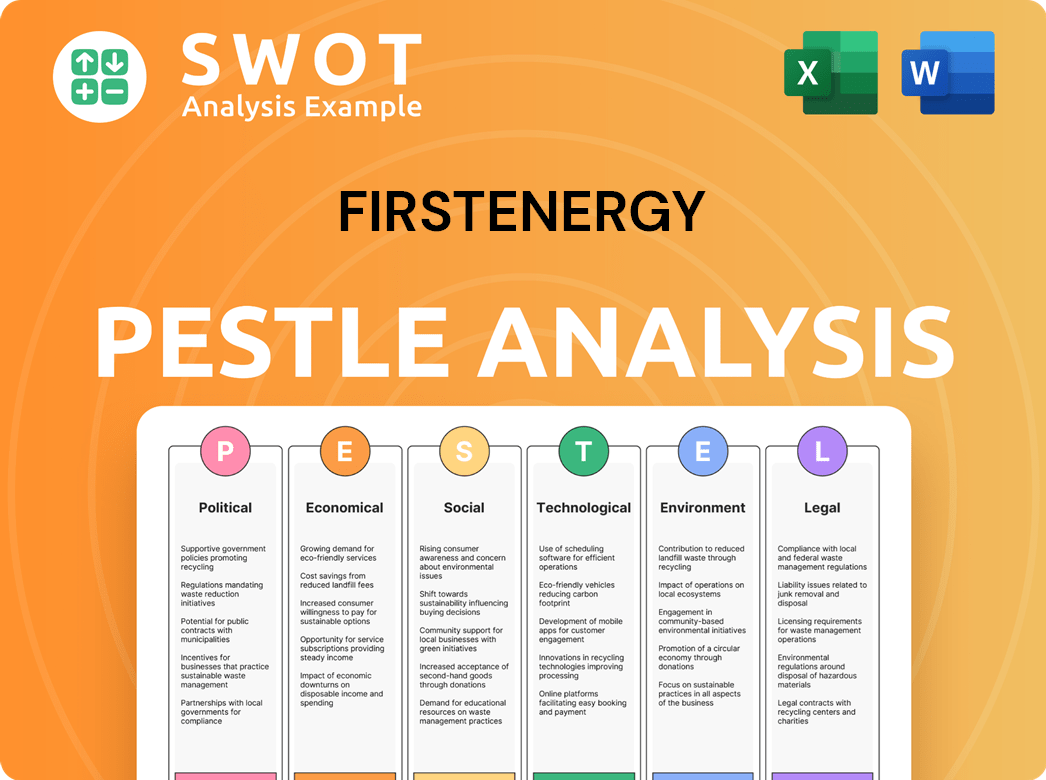

FirstEnergy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped FirstEnergy’s Business Model?

FirstEnergy Company has a rich history marked by significant milestones and strategic shifts. The company has consistently focused on strengthening its regulated utility businesses. This strategic direction aims to enhance financial stability and predictability, involving substantial investments in grid modernization and infrastructure upgrades.

A key aspect of FirstEnergy operations involves adapting to the evolving energy landscape. This includes addressing the increasing demand for renewable energy and integrating smart grid technologies. The company's commitment to its long-term financial targets and capital investment plans, as reaffirmed in 2024, underscores its strategic focus on core regulated operations.

Operational challenges faced by the Utility company include navigating evolving regulatory landscapes and managing the impact of severe weather events on its infrastructure. Despite these challenges, FirstEnergy has leveraged its established brand strength, extensive infrastructure network, and economies of scale to maintain a competitive edge in the energy market.

FirstEnergy has achieved several key milestones throughout its history, including significant infrastructure investments. These investments have been crucial for improving reliability and resilience. The company has also focused on strategic acquisitions and divestitures to streamline its operations and enhance its market position.

FirstEnergy has made strategic moves to strengthen its regulated utility businesses. This includes divesting from non-core assets to enhance financial stability. The company continues to invest in grid modernization projects to improve operational efficiency and customer service.

FirstEnergy's competitive advantages stem from its established brand strength and extensive infrastructure. As a regulated electric company, it benefits from market stability and a captive customer base. The company's focus on grid modernization and renewable energy initiatives positions it well for future growth.

FirstEnergy faces operational challenges, including regulatory changes and severe weather impacts. The company is actively managing these challenges through infrastructure investments and strategic planning. Adapting to these challenges is crucial for maintaining its competitive position.

In 2024, FirstEnergy reaffirmed its commitment to its long-term financial targets. The company continues to invest in grid modernization, with approximately $2.3 billion in capital expenditures allocated for this purpose in 2023. FirstEnergy serves approximately 6 million customers across its service territories.

- Capital expenditures for grid modernization in 2023 were around $2.3 billion.

- FirstEnergy serves about 6 million customers.

- The company is focused on improving reliability and resilience through infrastructure upgrades.

- FirstEnergy is actively exploring renewable energy opportunities.

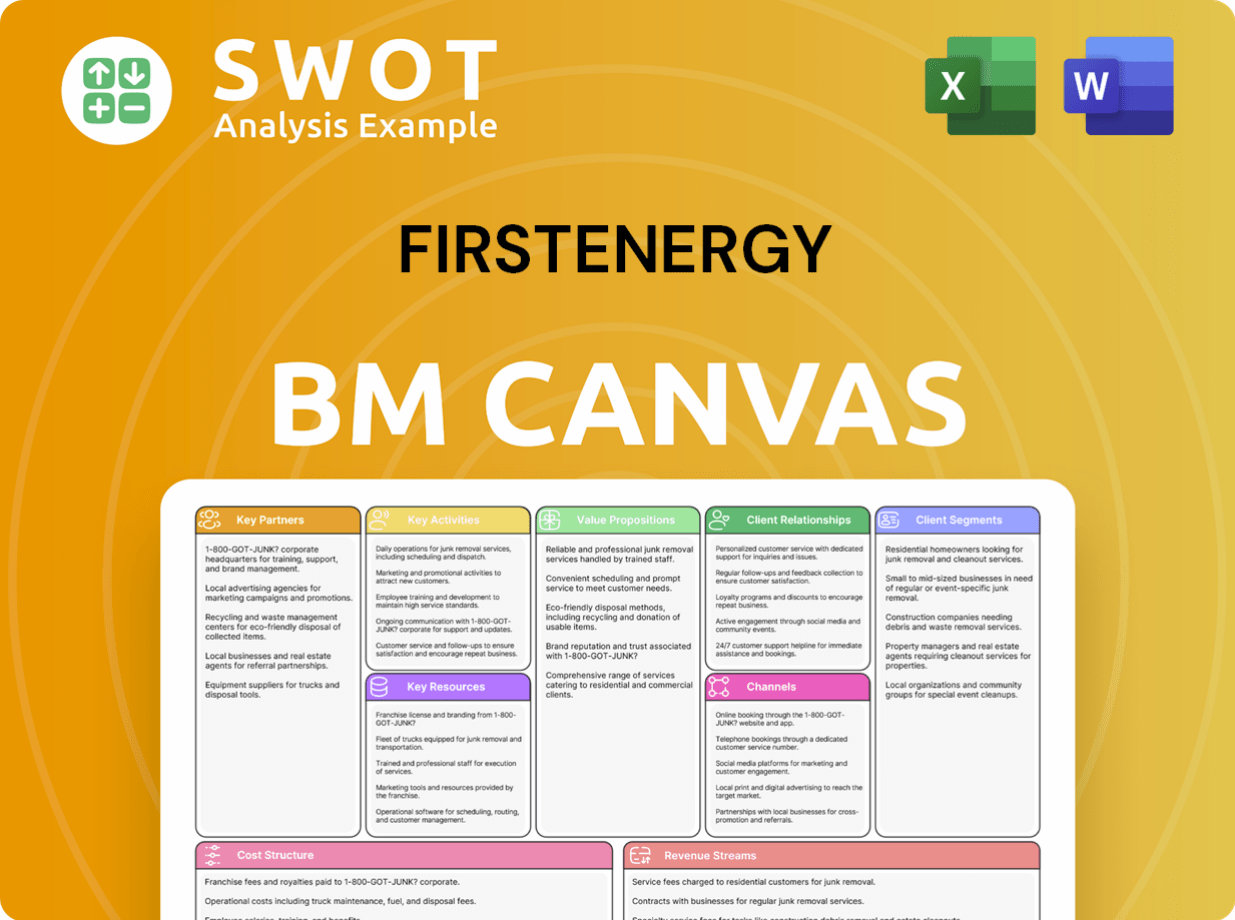

FirstEnergy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is FirstEnergy Positioning Itself for Continued Success?

FirstEnergy Company holds a significant position within the U.S. electric utility industry. As a major energy provider, it serves millions of customers across several states, primarily operating as the main electricity provider in its regulated service territories. Customer loyalty is generally high due to the essential nature of its services.

The company faces various risks, including regulatory changes related to environmental rules and rate-setting. The shift towards cleaner energy sources presents both challenges and opportunities, demanding substantial investments in new technologies and infrastructure. Additionally, severe weather and cybersecurity threats pose ongoing operational risks to FirstEnergy operations.

FirstEnergy is a prominent utility company, with a substantial market share in its service areas. It operates within a regulated framework, providing essential electricity services to a large customer base. Its position is strengthened by the necessity of its services and limited consumer alternatives.

Regulatory changes and environmental rules pose significant risks. Investments in cleaner energy are essential, but require substantial capital. Furthermore, severe weather events and cybersecurity threats present operational risks. The company must navigate these challenges to maintain its financial performance.

FirstEnergy is focused on its 'Energizing the Future' initiative, which involves modernizing its transmission and distribution systems. The company is also advancing grid modernization and smart grid technologies. These efforts aim to enhance reliability and improve customer experience.

The company's strategic initiatives include grid modernization and smart grid technologies to improve operational efficiency and customer experience. These initiatives are critical for adapting to the evolving energy landscape. FirstEnergy aims to sustain its regulated utility model.

FirstEnergy's financial strategy focuses on infrastructure investments and adapting to the changing energy sector. The company is working to sustain its regulated utility model to maintain revenue generation. The company's commitment to grid modernization and smart grid technologies is a key aspect of its strategic vision.

- FirstEnergy plans to invest approximately $5 billion in grid modernization projects between 2021 and 2025.

- The company aims to reduce carbon emissions by 50% by 2030.

- FirstEnergy's regulated utilities serve about 6 million customers.

- The company's focus on operational efficiency and customer service is a priority. For more information on how FirstEnergy approaches its market, see Marketing Strategy of FirstEnergy.

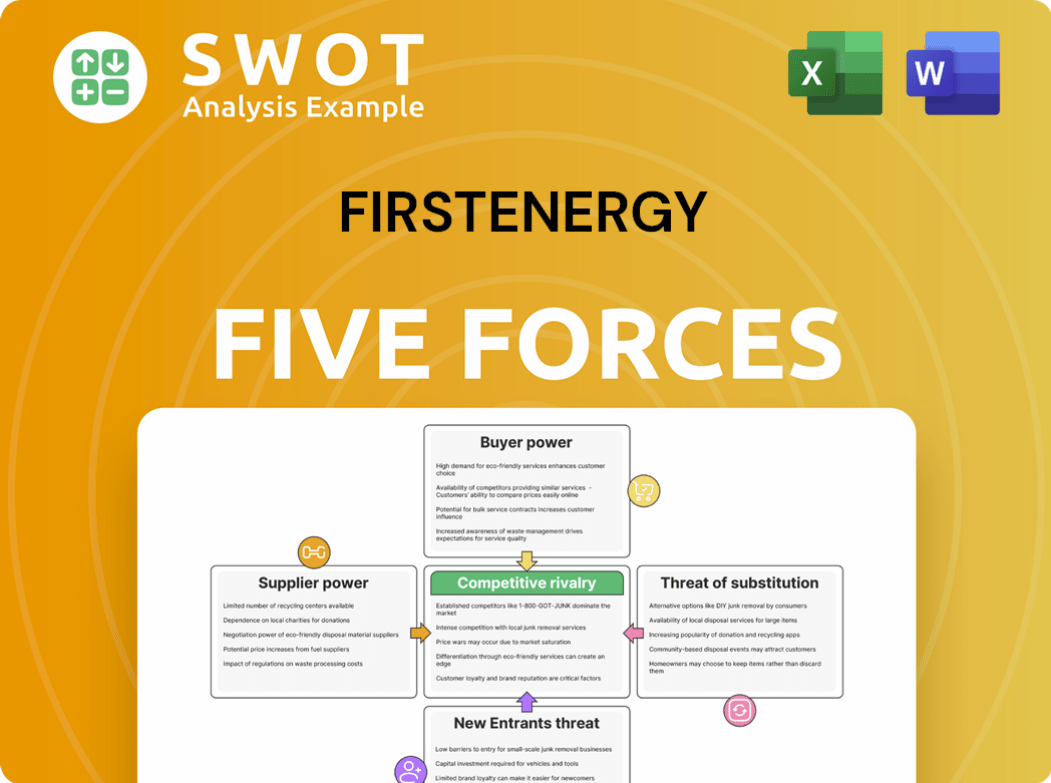

FirstEnergy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FirstEnergy Company?

- What is Competitive Landscape of FirstEnergy Company?

- What is Growth Strategy and Future Prospects of FirstEnergy Company?

- What is Sales and Marketing Strategy of FirstEnergy Company?

- What is Brief History of FirstEnergy Company?

- Who Owns FirstEnergy Company?

- What is Customer Demographics and Target Market of FirstEnergy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.