Flywire Payments Bundle

How Did Flywire Revolutionize Global Payments?

Born from a need to simplify international transactions, Flywire Payments has become a powerhouse in the FinTech industry. This Flywire Payments SWOT Analysis reveals how a simple solution for international education payments evolved into a global payment platform. Discover the remarkable journey of a company that transformed the way businesses and individuals handle complex financial transactions worldwide.

Flywire's brief history showcases its innovative approach to payment solutions and its ability to adapt to evolving market demands. From its founding, Flywire focused on streamlining online payments, particularly in education and healthcare. This strategic focus, combined with its commitment to security and efficiency, has propelled Flywire's growth and solidified its position as a key player in the global payments landscape, impacting how cross-border payments are managed.

What is the Flywire Payments Founding Story?

The brief history of Flywire begins with its inception in 2009. The company, originally named peerTransfer, was founded by Iñaki Berenguer. His personal experience with the complexities of international tuition payments fueled the creation of a solution.

Berenguer's frustration with the existing system highlighted the need for a more efficient and transparent method for cross-border transactions. This led to the development of Flywire, a fintech company focused on simplifying international payments, particularly for educational institutions and students.

The core problem Flywire aimed to solve was the inefficiency and high cost of traditional banking methods for international payments. These methods often involved unfavorable exchange rates and a lack of clear tracking. Flywire's initial focus was on providing a more streamlined payment process for educational institutions, offering better exchange rates, lower fees, and increased transparency.

Flywire, initially known as peerTransfer, was founded in 2009 by Iñaki Berenguer. The company's primary focus was to simplify international tuition payments.

- Berenguer's personal experience with international tuition payments led to the company's creation.

- The original business model centered on providing a better payment platform for students and educational institutions.

- Early funding likely involved bootstrapping and seed rounds from investors.

The transition from peerTransfer to Flywire signaled a strategic shift towards broader market appeal. This reflected the company's expanding services and global reach. Berenguer's background, likely in technology or finance, provided the necessary expertise to address the complex financial and logistical challenges. The increasing globalization and the rising number of international students created a favorable environment for Flywire's growth.

The initial product was a secure online payment portal tailored for the education sector. While specific details about the early funding rounds are not widely publicized, the company likely secured seed funding to support its growth. The cultural context of increasing globalization and the rising number of international students created a fertile ground for a solution like Flywire to thrive.

Flywire's payment solutions have expanded beyond education to include healthcare and other industries. The company's growth reflects its ability to adapt and meet the evolving needs of the global payment market. As of 2024, Flywire continues to be a significant player in the fintech industry, processing billions of dollars in transactions annually. In 2024, Flywire's revenue reached approximately $380 million, demonstrating its strong market position and continued growth. The company's success is a testament to its innovative approach to international payments and its ability to address the needs of a global customer base.

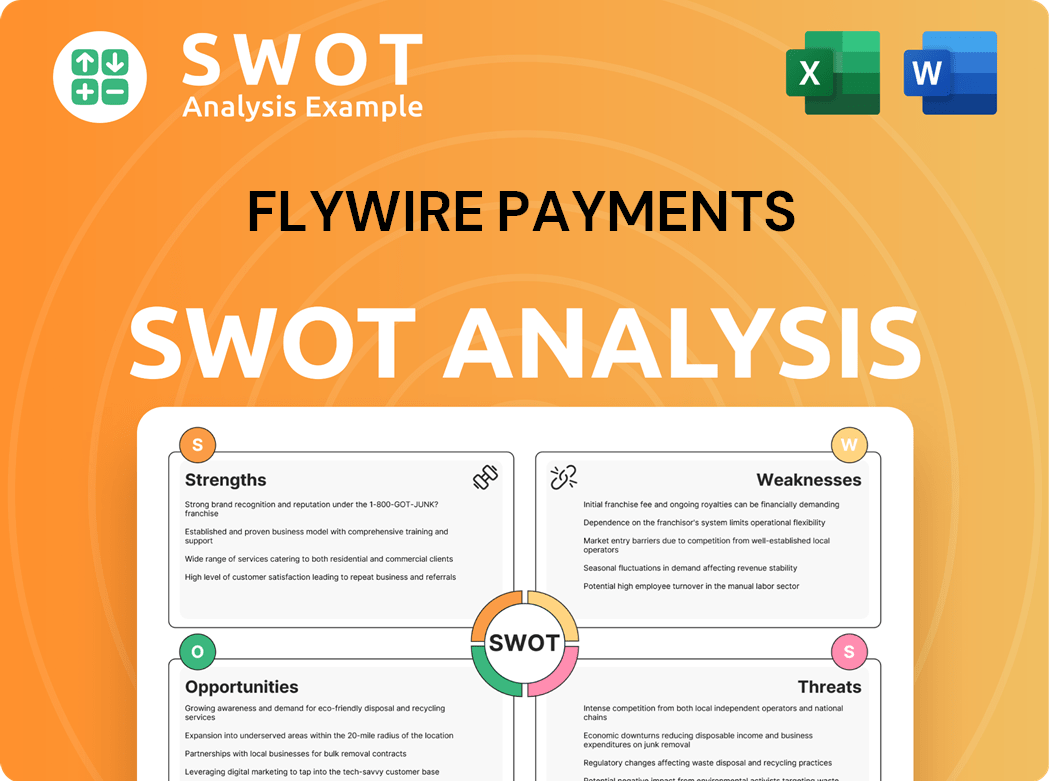

Flywire Payments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Flywire Payments?

The early growth of Flywire was largely fueled by its success in the education sector. Initially known as peerTransfer, the company focused on simplifying international student payments. This focus allowed Flywire to establish a strong foundation before expanding into other areas.

Flywire, formerly peerTransfer, gained traction by addressing the inefficiencies of international student payments. The company secured partnerships with numerous universities and colleges, which became its primary clients. This strategic focus on education provided a solid base for future expansion.

The shift from peerTransfer to Flywire around 2013 signaled a strategic move beyond education. The company began exploring new markets, both geographically and in terms of industry verticals. This expansion was crucial for its long-term growth and diversification.

The company expanded its team significantly, moving beyond its core founders to build out sales, customer support, and technology departments. The initial office in Boston, Massachusetts, was strategically located near many academic institutions. This expansion supported the company's growing operations.

Flywire offered a clear value proposition, providing cost savings, transparency, and efficiency in international payments. The market reception was largely positive, as it addressed a need for better payment solutions. The company's focus on innovation helped it stand out in the Marketing Strategy of Flywire Payments.

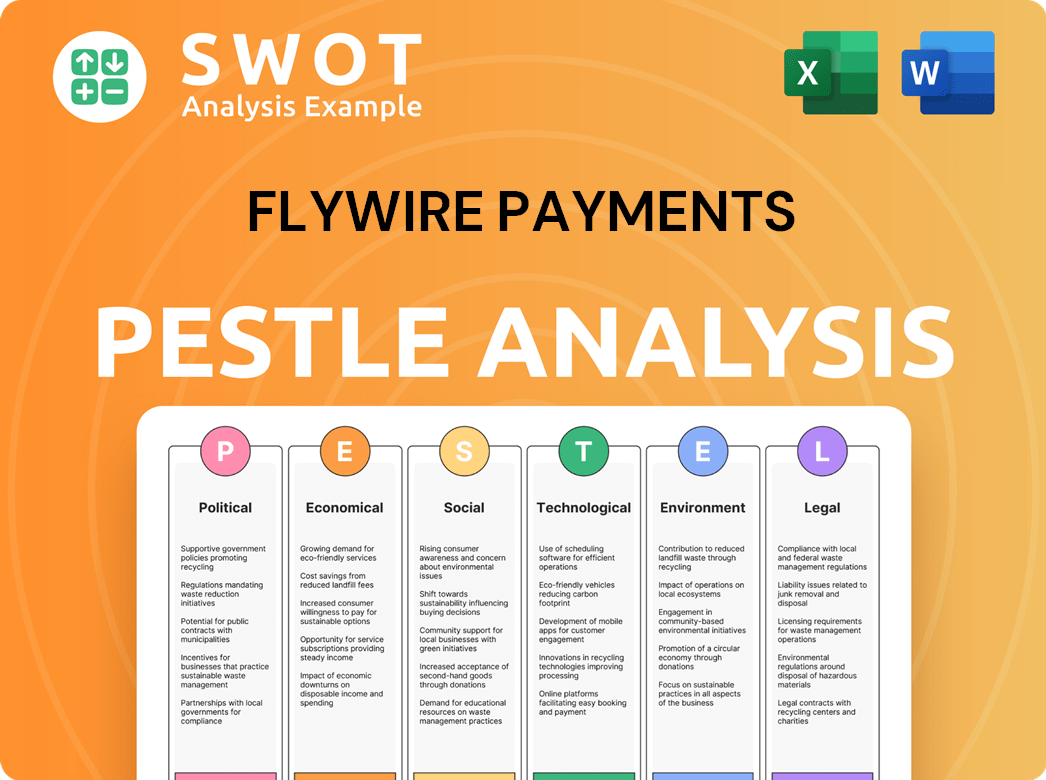

Flywire Payments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Flywire Payments history?

The brief history of Flywire payments is marked by significant growth and strategic pivots, establishing its position as a key player in the fintech industry. From its inception, Flywire has focused on providing tailored payment solutions for various sectors, including education and healthcare. Its journey reflects a commitment to innovation and adapting to the evolving demands of the global payments landscape.

| Year | Milestone |

|---|---|

| 2009 | Founded as peerTransfer, initially focused on simplifying international tuition payments for students. |

| 2014 | Rebranded as Flywire, expanding its payment solutions to healthcare and other sectors. |

| 2015 | Acquired peerTransfer, consolidating its position in the education sector. |

| 2020 | Flywire went public, marking a significant step in its growth and expansion. |

| 2023 | Flywire processed over $8.3 billion in payments in Q3 2023. |

Flywire's innovations have been central to its success as a fintech company. The company developed a proprietary global payments network that streamlined cross-border transactions, offering greater transparency and cost-effectiveness. This network, combined with its software platform, enabled Flywire to provide industry-first solutions for reconciling complex payments across various currencies and payment methods.

Flywire's proprietary network facilitates efficient and transparent cross-border transactions, reducing costs and complexities.

The platform offers comprehensive payment solutions, including reconciliation and currency conversion, tailored to specific industries.

Flywire provides customized payment processing for education, healthcare, and other sectors, addressing their unique needs.

Collaborations with educational institutions and healthcare providers have expanded Flywire's reach and market presence.

This acquisition strengthened Flywire's position in the education sector, broadening its customer base and service offerings.

Flywire has expanded its services to include healthcare, travel, and B2B payments, diversifying its revenue streams and customer base.

Despite its successes, Flywire has faced challenges common to the fintech industry. Navigating complex international regulations and compliance requirements has been an ongoing operational hurdle. The competitive landscape, with established players and emerging fintech companies, demands continuous innovation and adaptation to maintain a competitive edge. For more insights into the company's financial model, you can explore the Revenue Streams & Business Model of Flywire Payments.

Adhering to varying international regulations and compliance standards presents a continuous challenge for Flywire.

The fintech sector is highly competitive, requiring Flywire to constantly innovate and differentiate its services.

Keeping up with technological advancements and integrating new payment methods requires ongoing investment and adaptation.

Economic downturns and shifts in market dynamics can impact transaction volumes and revenue.

Ensuring the security of payment data and protecting against fraud are critical and ongoing concerns.

Managing complex payment flows, currency conversions, and international transactions adds to operational challenges.

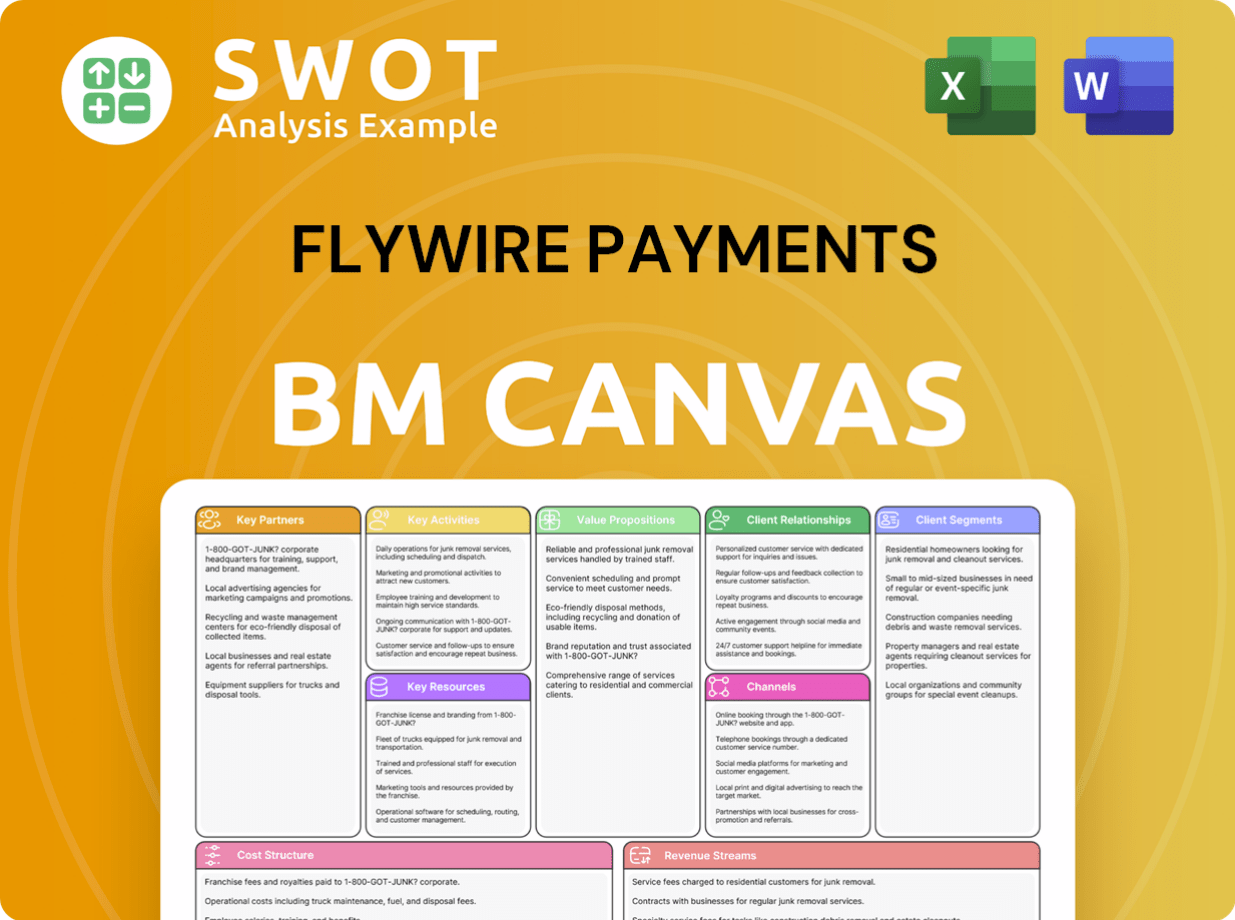

Flywire Payments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Flywire Payments?

The story of Flywire, a prominent player in the Flywire payments landscape, is marked by strategic pivots and significant growth. Founded in 2009 as peerTransfer by Iñaki Berenguer, the company initially focused on international education payments. A pivotal rebranding to Flywire in 2013 signaled broader ambitions, leading to expansion into healthcare, travel, and B2B payments. The company's journey includes securing substantial funding rounds, going public on the Nasdaq in 2021, and strategic acquisitions like WPM Education in 2022. Throughout 2023 and into 2024, Flywire continues to enhance its platform and expand its global reach, focusing on digital payment experiences and compliance. For more insights into the company's core values, you can read this article: Mission, Vision & Core Values of Flywire Payments.

| Year | Key Event |

|---|---|

| 2009 | Founded as peerTransfer, specializing in international education payments. |

| 2013 | Rebranded to Flywire, expanding market focus beyond education. |

| 2015-2019 | Expanded into healthcare, travel, and B2B payments, securing significant funding. |

| 2021 | Went public on the Nasdaq under the ticker FLYW. |

| 2022 | Acquired WPM Education to enhance payment solutions. |

| 2023 | Reported strong financial results, demonstrating revenue growth and client base expansion. |

| 2024 | Continues to expand its global payment network, focusing on enhanced digital payment experiences. |

| 2025 | Expected to leverage AI and machine learning for optimized payment processes. |

Flywire is focused on expanding its global payment network, enhancing its platform with advanced features, and deepening its penetration within education, healthcare, travel, and B2B sectors. The company aims to drive long-term growth by improving customer experiences and expanding its solution set. This includes continuous innovation and providing a seamless, transparent, and secure payment experience for its clients.

The increasing demand for digital payment solutions and the rise of cross-border commerce are key factors impacting Flywire's future. Analysts predict continued growth in the global digital payments market, which supports Flywire's specialized offerings. Regulatory environments are also becoming more complex, influencing Flywire's strategies in compliance and security.

Flywire is expected to leverage AI and machine learning to optimize payment routing, fraud detection, and reconciliation processes. This will strengthen its position as a leader in complex global payments. The company's commitment to innovation is central to its strategy, focusing on providing a seamless, secure payment experience.

Flywire has demonstrated strong financial results, with continued revenue growth and expansion across its target industries. While specific financial projections for 2025 are not available, the company's strategic initiatives and market position suggest continued positive performance. The focus remains on enhancing customer experiences and expanding its solution set.

Flywire Payments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Flywire Payments Company?

- What is Growth Strategy and Future Prospects of Flywire Payments Company?

- How Does Flywire Payments Company Work?

- What is Sales and Marketing Strategy of Flywire Payments Company?

- What is Brief History of Flywire Payments Company?

- Who Owns Flywire Payments Company?

- What is Customer Demographics and Target Market of Flywire Payments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.