Flywire Payments Bundle

Can Flywire Conquer the Cross-Border Payments World?

In the dynamic world of fintech, Flywire has carved a niche in cross-border payments. But how does it stack up against the competition? This analysis explores the Flywire Payments SWOT Analysis, delving into its market position, competitive advantages, and the challenges it faces. We'll dissect the Flywire competitive landscape to understand its strategies and assess its future potential.

Flywire's success in the payment processing industry is evident in its Q1 2025 financial results. The company's growth, driven by its innovative Flywire payment solutions, highlights its ability to compete effectively. This report will examine Flywire competitors, its revenue model, and its global presence to provide a comprehensive understanding of its position within the fintech companies sector and its impact on areas like higher education payments.

Where Does Flywire Payments’ Stand in the Current Market?

Flywire has carved a strong niche in the payment processing industry, specializing in complex payments for sectors like education, healthcare, travel, and B2B. Their core operations revolve around a proprietary global payments network and a next-gen payments platform. This platform is combined with vertical-specific software, streamlining intricate financial transactions for clients worldwide.

The company's value proposition lies in simplifying these complex payments, offering solutions that cater to the unique needs of each sector. This approach allows them to handle diverse payment methods in over 140 currencies across more than 240 countries and territories. This global reach and specialized focus have positioned Flywire as a key player in the Flywire competitive landscape.

In Q1 2025, Flywire reported revenue of $133.5 million, marking a 17.0% increase year-over-year. Total payment volume reached $8.4 billion, up 20.4% from Q1 2024. For the full year 2024, revenue hit $492 million, a 22% increase, with total payment volumes rising by 24% to $29.7 billion. This growth underscores Flywire's strong market position and ability to attract and retain clients.

Flywire's market share is significant, particularly in its core sectors. The company's consistent revenue growth, as seen in the 17.0% increase in Q1 2025, highlights its ability to capture and retain market share. The expansion of its client base to over 4,500 by Q4 2024, with over 200 new clients added in Q1 2025 alone, further demonstrates its market penetration.

Flywire's global presence spans over 240 countries and territories, making it a truly international player. The company supports payments in more than 140 currencies, showcasing its broad reach. The EMEA region saw a significant revenue increase in 2024, rising 56% to $189 million, accounting for 39% of total revenue, indicating successful geographic expansion.

Flywire's financial health is robust, with a current ratio of 2.63 in Q1 2025, indicating strong liquidity. The Adjusted EBITDA of $21.6 million in Q1 2025, a 56% year-over-year increase, demonstrates its profitability. The company's strong balance sheet and consistent free cash flow conversion further support its financial stability and position in the Fintech companies landscape.

The acquisition of Sertifi in Q4 2024 for $330 million is a strategic move to expand its travel vertical. Sertifi contributed $4.7 million in revenue in Q1 2025 and is expected to contribute $35-40 million for the full year 2025. These strategic moves enhance Flywire's service offerings and market position.

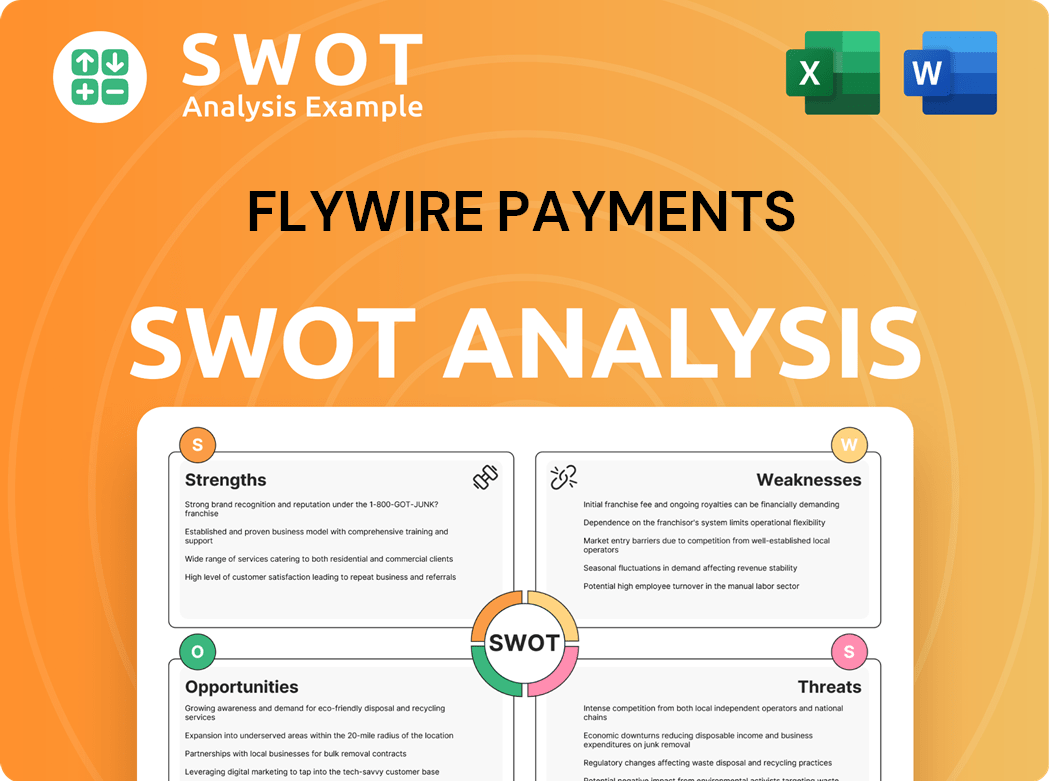

Flywire's strengths lie in its specialized payment solutions, global reach, and robust financial performance. Its weaknesses include reliance on specific sectors and potential impacts from regulatory changes. The company's ability to adapt to market dynamics and expand its service offerings will be crucial for sustained growth.

- Strengths: Strong revenue growth, global presence, and specialized payment solutions.

- Weaknesses: Reliance on specific sectors, such as education, and potential impacts from regulatory changes.

- Opportunities: Expanding into new verticals, strategic acquisitions, and partnerships.

- Threats: Competition from other Flywire competitors and changes in the Higher education payments landscape.

To understand the Flywire's revenue model and how it generates income, further insights can be found in this article: Revenue Streams & Business Model of Flywire Payments. This analysis provides a deeper understanding of Flywire's operations and financial strategy within the Flywire payment solutions industry.

Flywire Payments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Flywire Payments?

The Flywire competitive landscape is dynamic, shaped by both established players and emerging fintech startups. The payment processing industry is intensely competitive, with companies constantly innovating to capture market share. Understanding Flywire's competitors is crucial for assessing its position and future prospects.

Flywire payment solutions face competition from various fronts. These competitors range from large, diversified payment platforms to specialized providers focusing on particular niches. This competitive environment influences Flywire's strategies, including pricing, partnerships, and technological developments.

The competitive landscape includes a mix of direct and indirect competitors. Direct competitors offer similar services, while indirect competitors might address different aspects of the payment process or target different customer segments. Flywire's market share analysis depends on its ability to differentiate itself and provide unique value to its customers.

PayPal is a major competitor with a vast user base and extensive global reach. It provides a wide array of payment solutions, including online and mobile payments. PayPal's brand recognition and established infrastructure give it a significant advantage in the Flywire competitive landscape.

Stripe is a significant player in the payment processing industry, known for its developer-friendly platform. It enables businesses to accept online payments and has gained considerable adoption across various sectors. Stripe's focus on technology and ease of integration makes it a strong competitor.

Adyen offers a comprehensive payment platform, often targeting larger enterprise clients. It provides a full-stack solution for businesses, including payment processing, risk management, and acquiring services. Adyen's focus on enterprise solutions positions it as a direct competitor to Flywire payment solutions.

Wise is a key competitor in cross-border payment solutions, offering transparent fees and efficient international transfers. It has expanded its global presence and provides competitive alternatives to Flywire's payment solutions. Wise's focus on international payments makes it a direct competitor in this area.

Payoneer specializes in digital commerce and payment platforms, particularly for businesses and freelancers. It provides payment solutions tailored to the needs of these customer segments. Payoneer's focus on specific market segments positions it as a competitor in the fintech companies landscape.

Western Union is a global provider of money movement and payment services, leveraging a vast physical network. It serves both consumers and businesses, offering a wide range of payment options. Western Union's established presence and brand recognition make it a significant competitor.

The Flywire competitive landscape is also shaped by emerging players and strategic initiatives. Flywire's recent acquisitions and partnerships are crucial for its growth and market positioning. Understanding these dynamics is essential for evaluating Flywire's future outlook.

- Mergers and Acquisitions: Flywire's recent acquisitions, such as Sertifi, expand its service offerings and market reach. These moves impact competitive dynamics by broadening the scope of services provided.

- Strategic Partnerships: Collaborations with financial institutions like Bank of America and payment providers like China UnionPay enhance Flywire's indirect sales strategy. These partnerships help expand its ecosystem and reach.

- Niche Market Focus: New entrants often target niche markets or specific payment needs, disrupting the traditional competitive landscape. This includes specialized solutions for higher education payments and healthcare.

- Global Presence: Companies like Wise and Western Union have a strong Flywire's global presence, which influences the competitive dynamics in international payments.

- Technology and Innovation: The continuous development of Flywire's technology platform is crucial for staying competitive. Innovations in payment processing, security, and user experience are key differentiators.

- Market Share and Growth: The competition for Flywire market share analysis is intense, with each company striving to increase its customer base and transaction volume.

- Customer Reviews and Pricing: Flywire's customer reviews and Flywire pricing comparison are important factors.

- Funding and Investment: The level of Flywire funding and investors is a critical factor in the competitive landscape.

For more information on the company's financial performance and ownership structure, you can read this article about Owners & Shareholders of Flywire Payments.

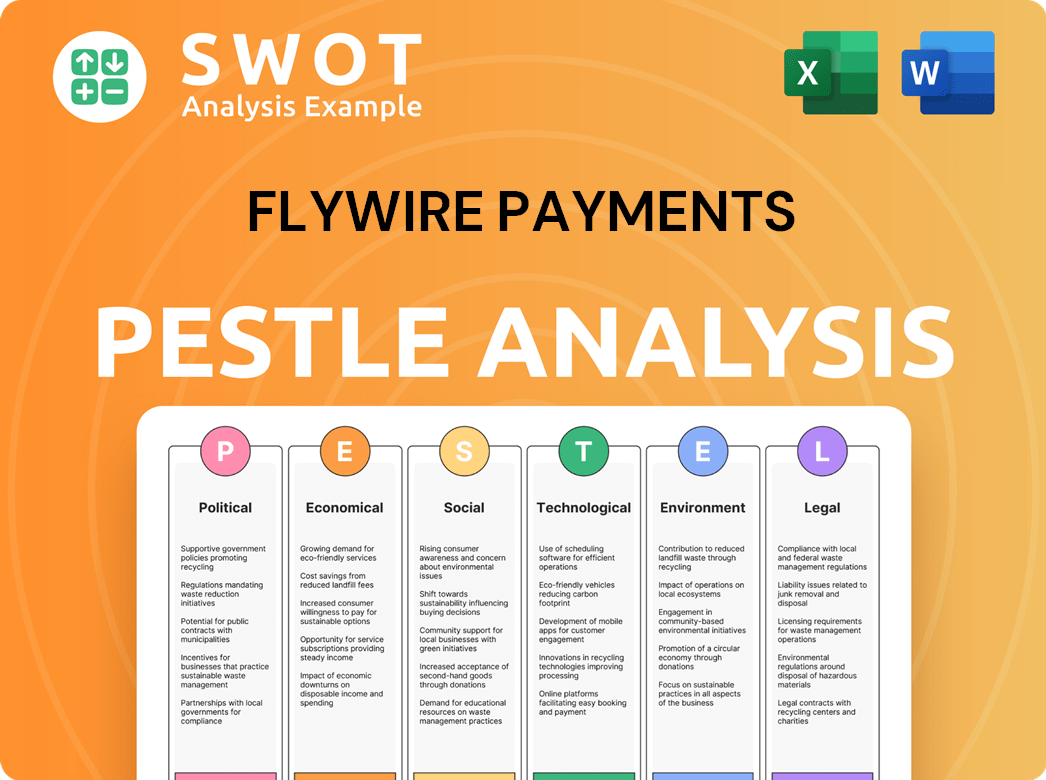

Flywire Payments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Flywire Payments a Competitive Edge Over Its Rivals?

The competitive landscape for companies like Flywire is shaped by their specialized approach and technological prowess within the payment processing industry. Key milestones include significant investments in technology and strategic partnerships that have expanded its global reach and enhanced its service offerings. This has allowed it to carve out a niche by focusing on specific verticals, providing tailored solutions that meet the unique needs of its clients.

Strategic moves have focused on deepening its integrations within client workflows and expanding its global payment network. This includes integrating with leading ERP systems, which streamlines operations and eliminates challenges for organizations. These moves have helped Flywire to differentiate itself from general payment processors and create a competitive edge in the fintech sector.

The competitive edge of Flywire stems from its deep industry expertise and its proprietary global payments network. Operating in over 240 countries and territories, supporting payments in more than 140 currencies, the company offers a seamless payment experience. This extensive reach, combined with its focus on transaction security and regulatory compliance, positions it as a trusted partner for businesses managing international payments.

Flywire's global presence, operating in over 240 countries and territories, allows businesses to make payments in their local currency. This reduces geo-complexity and enhances conversion rates. The ability to support payments in more than 140 currencies is a significant advantage, offering flexibility and convenience for international transactions.

Flywire's focus on specific verticals, such as education, healthcare, and travel, allows it to develop tailored payment solutions. This approach enables the company to deeply embed its software within existing accounts receivable workflows. This specialization provides customized solutions that meet the specific needs of its clients.

Continuous investment in technology, including data architecture for AI-driven analytics and automation, is a key differentiator. The integration with leading ERP systems like NetSuite optimizes the payment experience and eliminates operational challenges. This commitment to innovation helps Flywire stay ahead in the competitive landscape.

Prioritizing transaction security and ensuring compliance with global regulations provides clients with peace of mind. This focus on security is crucial in the payment processing industry, building trust and reliability. Flywire's commitment to these standards helps it maintain a strong competitive position.

Flywire's competitive advantages are rooted in its specialized, vertical-focused approach and its extensive global payment network. The company's ability to streamline payment processes and reduce manual intervention helps businesses save time and money. Understanding the Marketing Strategy of Flywire Payments provides further insight into how it leverages these strengths.

- Vertical Specialization: Flywire deeply embeds its payment solutions within existing accounts receivable workflows for clients in education, healthcare, travel, and B2B industries.

- Global Reach: Operating in over 240 countries and territories, supporting payments in more than 140 currencies, reduces geo-complexity and enhances conversion rates.

- Technology and Innovation: Continuous investment in technology, including data architecture for AI-driven analytics and automation, optimizes the payment experience.

- Security and Compliance: Prioritizing transaction security and ensuring compliance with global regulations provides clients with peace of mind.

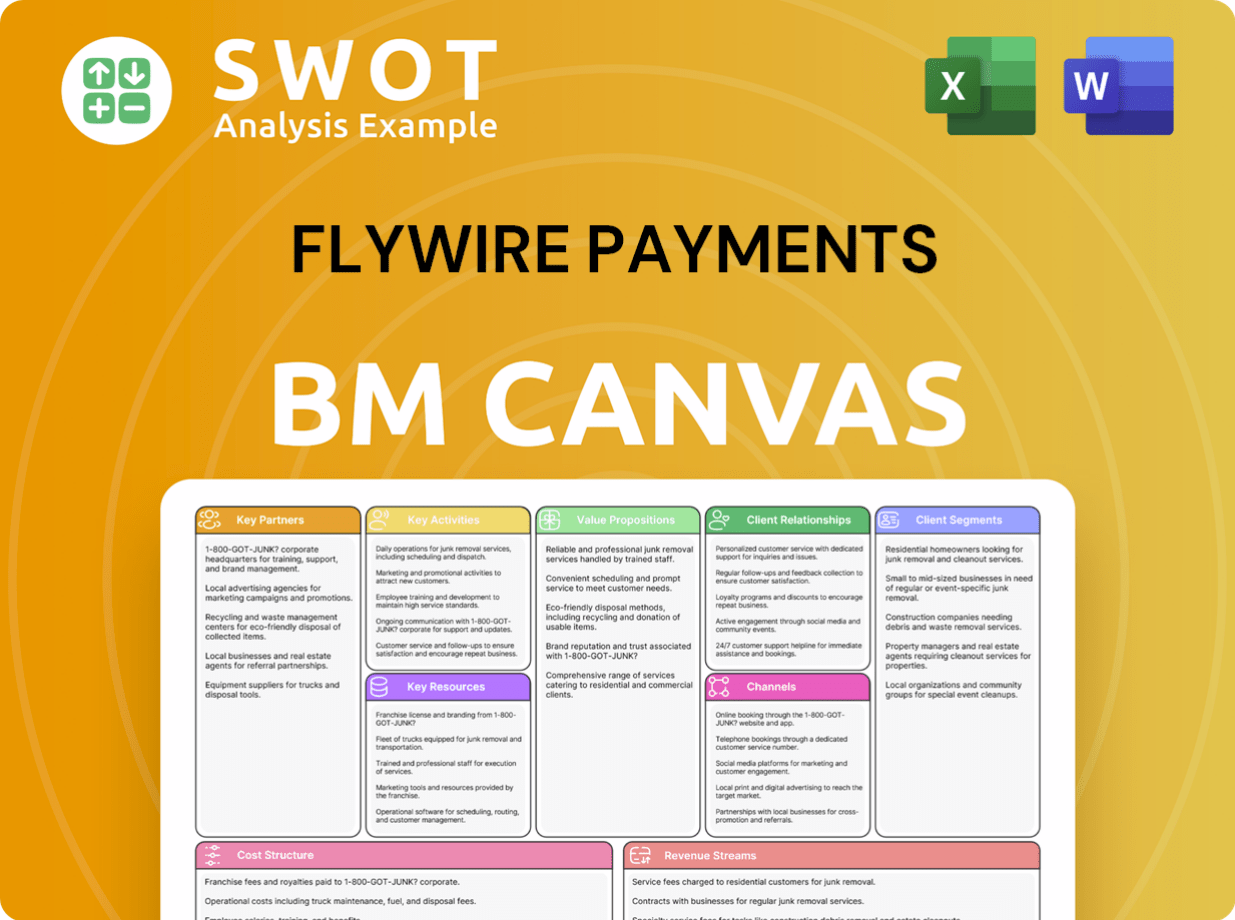

Flywire Payments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Flywire Payments’s Competitive Landscape?

The Flywire competitive landscape is significantly shaped by industry trends, including the rapid shift towards digital payments and increasing globalization. This environment presents both opportunities and challenges for companies like Flywire, which offers specialized Flywire payment solutions. The fintech sector is dynamic, with constant innovation and new entrants influencing market dynamics.

Flywire's position is also influenced by evolving regulatory landscapes and technological advancements, particularly in AI and automation. These factors require strategic adaptation to maintain a competitive edge. Flywire's ability to navigate these trends will determine its future success in the payment processing industry.

The rise of digital payments and globalization are key drivers for Flywire. Technological advancements, especially in AI and automation, are reshaping the sector. Evolving regulatory landscapes and the emergence of new fintech companies are also significant.

Increased competition and changing business models pose ongoing challenges. Potential threats include declining demand in specific segments due to policy changes. Increased regulation and aggressive new competitors are also a concern for Flywire.

Expansion into new markets, such as India, through partnerships with major financial institutions. Product innovations, like enhanced recurring payment solutions, are key. Strategic partnerships and acquisitions are crucial for expanding reach and offerings.

Flywire is investing in digital transformation, optimizing costs, and leveraging automation and AI. The company anticipates strong revenue growth of 17-23% (including Sertifi) in 2025. Continued Adjusted EBITDA margin expansion of 100-300 basis points is expected.

Flywire is expanding into new markets like India through partnerships with Avanse and the State Bank of India. Product innovations, such as improved recurring payment solutions and further development of SFS software, are critical growth drivers. Strategic acquisitions, like Sertifi, are part of the strategy.

- Flywire aims to capture a substantial share of education loan payment volumes in India.

- Enhancements to recurring payment solutions are planned for the U.S. market.

- The acquisition of Sertifi expands Flywire's reach in the travel and education sectors.

- Flywire is focusing on digital transformation to enhance operational efficiency.

Flywire Payments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flywire Payments Company?

- What is Growth Strategy and Future Prospects of Flywire Payments Company?

- How Does Flywire Payments Company Work?

- What is Sales and Marketing Strategy of Flywire Payments Company?

- What is Brief History of Flywire Payments Company?

- Who Owns Flywire Payments Company?

- What is Customer Demographics and Target Market of Flywire Payments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.