Flywire Payments Bundle

Who are Flywire's Customers?

In the fast-evolving world of financial technology, understanding customer demographics is key to success. Flywire, a leader in payment solutions, has built its business on a deep understanding of its target market. This exploration dives into Flywire's customer profile, market analysis, and the diverse needs it addresses across various sectors.

Flywire's strategic expansion from education to healthcare, travel, and B2B demonstrates its adaptability and commitment to meeting complex payment needs. Analyzing the Flywire Payments SWOT Analysis reveals how understanding its customer demographics and Flywire target market drives its competitive advantage. This analysis helps to understand who uses Flywire for payments and how Flywire payment solutions market is evolving.

Who Are Flywire Payments’s Main Customers?

Understanding the customer demographics and target market is crucial for a company like Flywire, which operates primarily in the B2B sector, yet ultimately serves a diverse range of end-users. Flywire's payment solutions cater to institutions and businesses across several key verticals. This approach allows Flywire to provide specialized services tailored to the unique needs of each sector, driving efficiency and growth.

Flywire's primary customer segments include educational institutions, healthcare providers, travel companies, and B2B enterprises. Each segment has distinct needs and preferences regarding payment processing. Flywire's ability to adapt its platform to these varied requirements is a key factor in its market success. A detailed look at each segment reveals the specific demographics and payment behaviors that Flywire targets.

The company’s focus on these segments has allowed it to leverage its core technology for broader application. This strategic shift has been driven by market research and the identification of unmet payment needs in these new verticals.

Flywire serves over 3,700 education clients globally as of late 2023. These institutions include universities, colleges, and K-12 schools. The primary customer demographics include international students and their families. These users often require transparent, efficient, and cost-effective cross-border payment solutions.

Flywire assists hospitals, health systems, and other medical providers in managing patient payments, including international patients. This segment often involves older demographics or individuals managing payments on behalf of family members. They prioritize ease of use, clear billing, and diverse payment options. This focus helps Flywire target its customers effectively.

Flywire supports businesses like tour operators and hospitality providers. This segment caters to a broad demographic of travelers who require seamless payment processing for bookings and services. The goal is to provide a smooth and reliable payment experience for their customers.

Flywire’s B2B segment addresses complex invoicing and payment collection for businesses. This often involves corporate treasurers and finance departments focused on reconciliation, security, and global reach. The company's growth in the B2B sector has been driven by the need for streamlined, digital payment solutions.

Flywire’s customer base is diverse, with each segment having unique characteristics. The company's ability to understand and cater to these specific needs is a key factor in its success. This focus allows Flywire to offer tailored payment solutions.

- Education: International students and their families seeking efficient cross-border payments.

- Healthcare: Patients and their families who value ease of use and clear billing.

- Travel: Travelers requiring seamless payment processing for bookings.

- B2B: Corporate treasurers and finance departments focused on secure and global payment solutions.

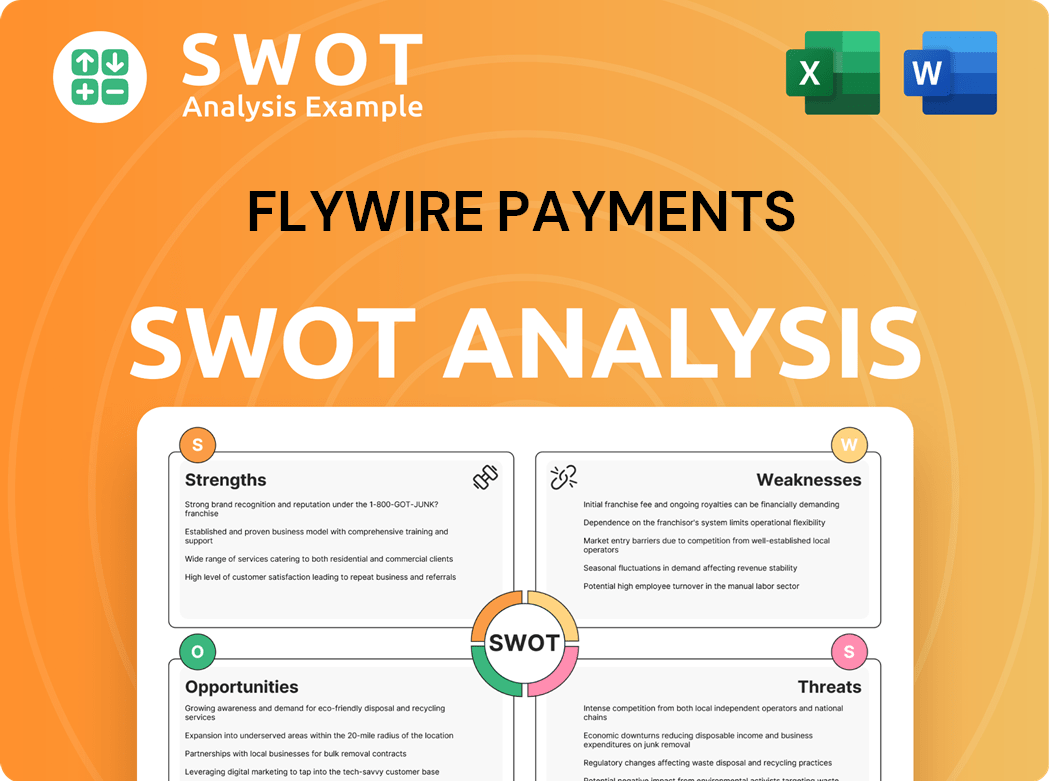

Flywire Payments SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Flywire Payments’s Customers Want?

Understanding the needs and preferences of customers is crucial for any financial technology company. For Owners & Shareholders of Flywire Payments, this means focusing on simplicity, transparency, security, and efficiency across various sectors. This customer-centric approach allows the company to tailor its payment solutions to meet the specific demands of each segment, ensuring satisfaction and driving growth.

The customer demographics of Flywire payments are diverse, spanning education, healthcare, travel, and business-to-business (B2B) sectors. Each sector has unique needs, from international students seeking local currency payment options to healthcare providers needing simplified billing. Flywire's ability to cater to these varied requirements is a key factor in its market success.

Flywire's target market is defined by its ability to offer payment solutions that address common pain points. These include hidden fees, delayed transfers, and a lack of payment options. By providing real-time tracking, transparent fees, and a wide array of local payment methods, Flywire ensures a seamless payment experience for its users.

Flywire's success hinges on understanding and meeting the diverse needs of its customers. The company's payment solutions are designed to address specific challenges faced by each customer segment, ensuring satisfaction and driving adoption. This customer-centric approach differentiates Flywire in the financial technology market.

- Education: International students and educational institutions prioritize local currency payments, competitive exchange rates, and clear payment tracking. The goal is to simplify the payment process and reduce stress.

- Healthcare: Healthcare providers and patients seek simplified billing, flexible payment plans, and a variety of payment methods. This reduces administrative burdens and financial anxiety.

- Travel: Customers in the travel industry require convenient and secure payment processing for bookings, often needing multi-currency support and real-time confirmation. This enhances the booking experience.

- B2B: B2B clients need automated reconciliation, reduced errors, enhanced payment flow visibility, and compliance with international regulations. This streamlines financial operations.

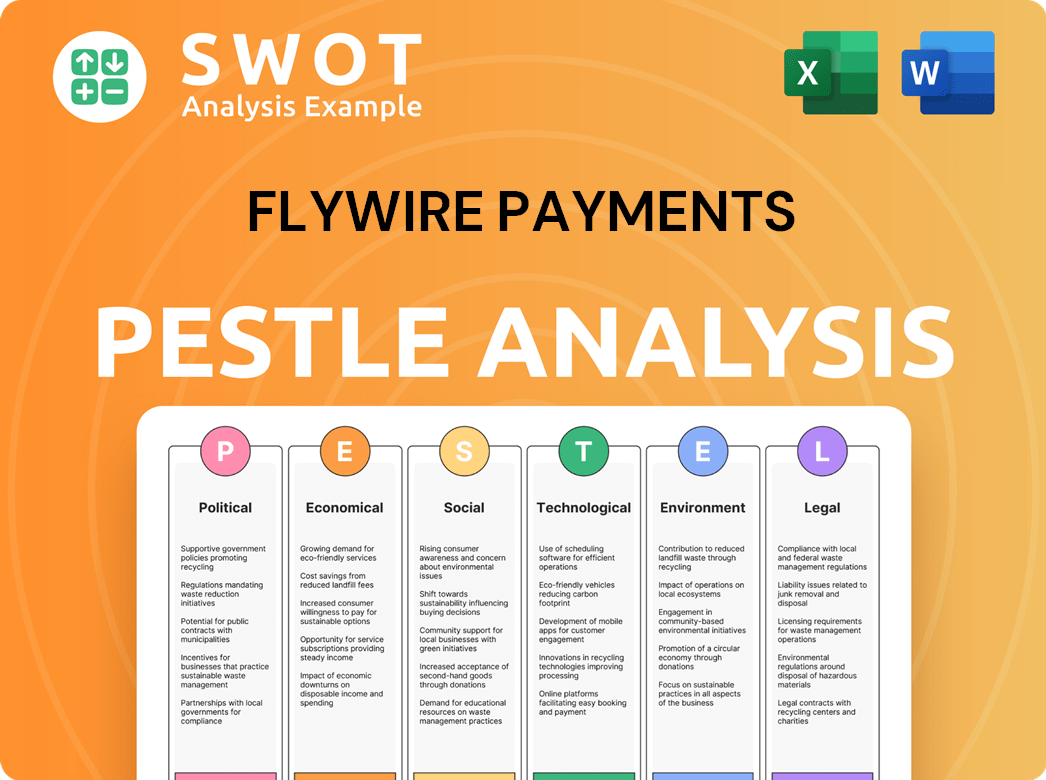

Flywire Payments PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Flywire Payments operate?

The geographical market presence of Flywire is extensive, focusing on regions where complex cross-border payments are common. Initially rooted in North America, particularly the U.S., where it has a strong foothold in education payments, Flywire has broadened its reach significantly. It now operates across Europe, Asia-Pacific, and other key international markets.

Major markets include the United Kingdom, Canada, Australia, and various countries within the EU and Asia. This expansion reflects the global nature of its core sectors: international education, healthcare, and B2B transactions. The company's strategic approach involves establishing offices in multiple locations worldwide, such as London, Valencia, Shanghai, Tokyo, and Singapore.

This global footprint enables Flywire to provide localized support and penetrate markets effectively. The company's Brief History of Flywire Payments shows how it has adapted to different customer demographics and preferences, tailoring its payment solutions to meet regional needs.

Flywire's market presence spans across North America, Europe, Asia-Pacific, and other international regions. This demonstrates a commitment to serving global payment needs.

Key markets include the United Kingdom, Canada, Australia, and several countries in the EU and Asia. These regions are crucial for international education, healthcare, and B2B transactions.

Flywire offers localized payment solutions, supporting a wide array of local payment methods and currencies. This ensures that users can transact in their preferred ways.

Multilingual customer support teams are available globally. This helps Flywire to serve its diverse customer base effectively.

Flywire's approach to its target market involves adapting to regional differences. For instance, in some Asian markets, mobile payment methods are popular, while traditional bank transfers are preferred elsewhere. Flywire supports a wide range of local payment methods and currencies, ensuring that payers can transact in their preferred way. This localized approach extends to customer support, with multilingual teams available globally. Recent expansions focus on strengthening its B2B sector presence and investing in emerging markets, capitalizing on increasing cross-border trade and services. This strategy helps Flywire to effectively target its customers and maintain its market share analysis.

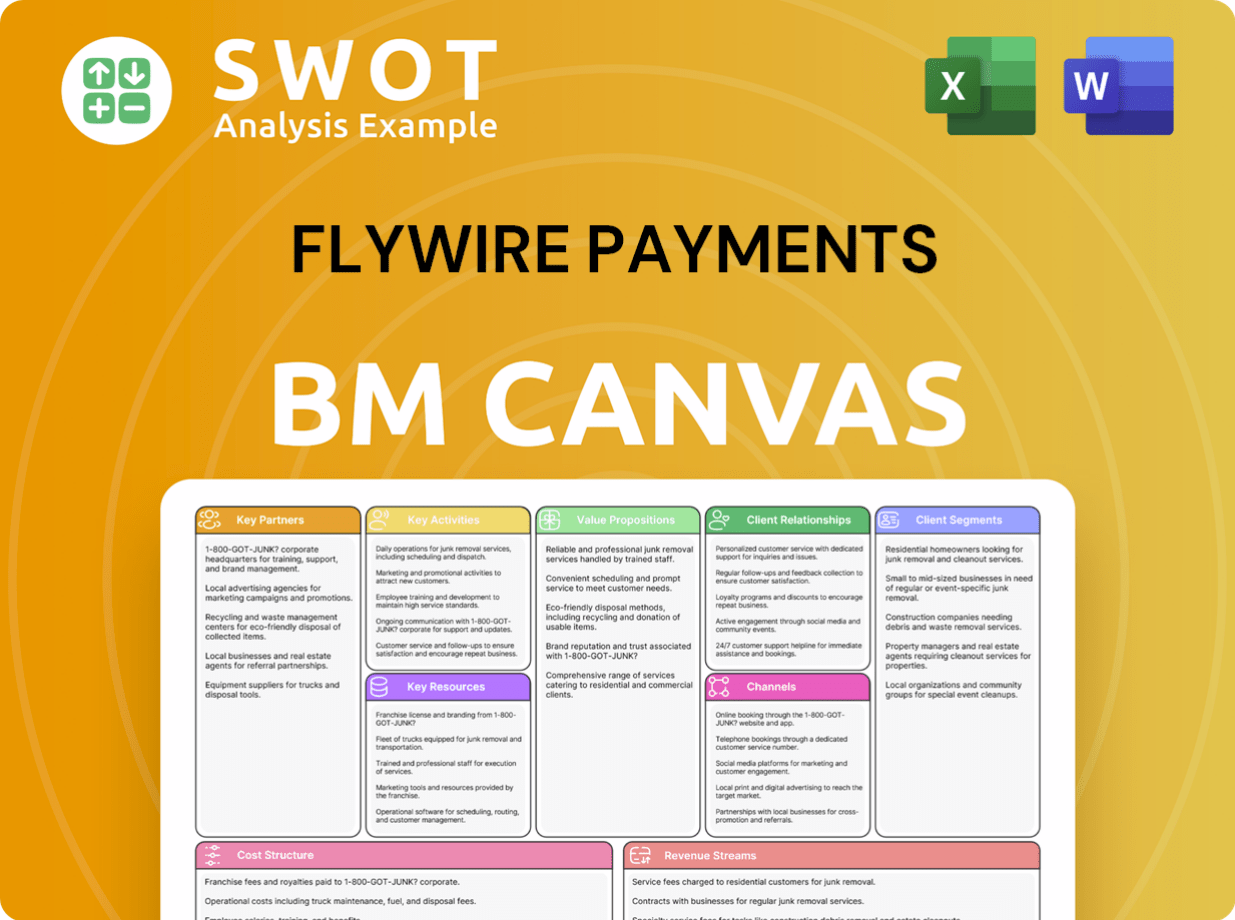

Flywire Payments Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Flywire Payments Win & Keep Customers?

The company employs a comprehensive strategy for acquiring and retaining customers, focusing on both direct sales and strategic partnerships. Their customer acquisition strategies are multi-faceted, utilizing digital marketing, content creation, and targeted outreach to key institutions within their core verticals. They often attend industry conferences and events to directly engage with potential clients, demonstrating how their platform simplifies complex payment processes. Sales tactics emphasize the tangible benefits of their platform, such as reduced administrative burdens, enhanced reconciliation, and improved payment transparency for both institutions and payers.

Customer retention is a core focus, built on providing exceptional customer service, continuous platform innovation, and fostering long-term partnerships. They emphasize dedicated client success teams that work closely with institutions to optimize payment processes and address any challenges. Loyalty is cultivated through the reliability and efficiency of their platform, which aims to reduce payment friction and improve the overall payment experience. The company also concentrates on expanding its offerings to existing clients, encouraging deeper integration of its solutions across different departments or payment types.

The role of customer data and CRM systems is crucial in targeting campaigns and personalizing experiences, allowing the company to identify opportunities for upselling and cross-selling. Changes in strategy over time have included a greater emphasis on integrated software solutions and value-added services beyond just payment processing, which has positively impacted customer lifetime value by making them an indispensable part of their clients' financial operations. A deep understanding of customer demographics is essential for tailoring these strategies effectively.

Utilizing SEO, paid advertising, and content marketing to attract potential clients. This includes targeted campaigns on platforms like LinkedIn and industry-specific websites. They focus on creating educational content and webinars to showcase their payment solutions.

Building relationships with key decision-makers within educational institutions, healthcare providers, and research organizations. Strategic partnerships with software providers and industry associations are also crucial for expanding their reach. This approach helps define the Flywire target market.

Providing dedicated client success teams to assist with onboarding, implementation, and ongoing support. Proactive communication and regular check-ins to ensure customer satisfaction and address any issues promptly are essential. This approach is key for Flywire payments.

Continuously updating and improving the platform to meet evolving customer needs and industry standards. Introducing new features and functionalities based on customer feedback and market trends is crucial. This includes improving Flywire payment methods.

In 2023, the company reported a total payment volume of $29.1 billion, demonstrating the effectiveness of their acquisition strategies. To further understand the company's approach, you can explore the Marketing Strategy of Flywire Payments. This growth reflects successful efforts in acquiring and retaining customers within their target markets. The company's focus on integrated software solutions and value-added services has also positively impacted customer lifetime value.

Focusing on specific verticals like education, healthcare, and research. Tailoring marketing messages and sales efforts to address the unique payment challenges of each sector. This helps identify Flywire's ideal customer.

Utilizing data analytics to understand customer behavior and preferences. This involves analyzing user data to identify trends, personalize experiences, and optimize marketing campaigns. This data helps define Flywire user demographics.

Identifying opportunities to offer additional services and features to existing clients. This includes expanding the use of their platform across different departments or payment types within an institution. This approach helps define Flywire's customer base in research.

Collaborating with software providers to integrate their payment solutions into existing systems. Forming alliances with industry associations to reach a wider audience and gain credibility. This helps define Flywire's target market in education.

Actively seeking and incorporating customer feedback to improve the platform and services. Conducting surveys, interviews, and focus groups to understand customer needs and pain points. This helps define Flywire customer profile.

Implementing loyalty programs to reward long-term clients and encourage repeat business. Offering discounts, exclusive features, and priority support to valued customers. This approach helps understand who uses Flywire for payments.

Flywire Payments Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Flywire Payments Company?

- What is Competitive Landscape of Flywire Payments Company?

- What is Growth Strategy and Future Prospects of Flywire Payments Company?

- How Does Flywire Payments Company Work?

- What is Sales and Marketing Strategy of Flywire Payments Company?

- What is Brief History of Flywire Payments Company?

- Who Owns Flywire Payments Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.