Grocery Outlet Bundle

How Did Grocery Outlet Become a Discount Grocery Giant?

Discover the fascinating journey of Grocery Outlet, a discount grocery store that has redefined value shopping. From its modest beginnings selling government surplus, the company has grown into a major retail force. This brief history of Grocery Outlet explores the key milestones and strategic decisions that shaped its remarkable success.

Grocery Outlet's story is one of resilience and smart adaptation. Understanding the Grocery Outlet SWOT Analysis reveals how this company has navigated challenges and capitalized on opportunities. Explore the early years, significant expansion, and the innovative business model that sets Grocery Outlet apart from other discount grocery stores. Learn about Grocery Outlet's financial performance and its impact on the community.

What is the Grocery Outlet Founding Story?

The story of Grocery Outlet begins in San Francisco, California. It was founded on June 11, 1946, by James Read. This marked the start of what would become a significant player in the discount grocery store market.

Originally called 'Cannery Sales,' the company's early days were marked by Read's resourceful approach. He invested his life savings, about $800, to kickstart the business. This initial investment set the stage for a unique business model focused on affordability.

The Grocery Outlet company quickly found its niche. It focused on buying surplus and closeout merchandise. This allowed them to offer goods at lower prices. The company's mission from the start was to provide affordable necessities. This approach was particularly relevant in the post-war economic climate.

James Read founded the company in 1946 in San Francisco.

- The initial investment was around $800, Read's life savings.

- The business started as 'Cannery Sales,' selling government surplus food.

- The core business model focused on buying discounted goods.

- The post-war era created a demand for affordable products.

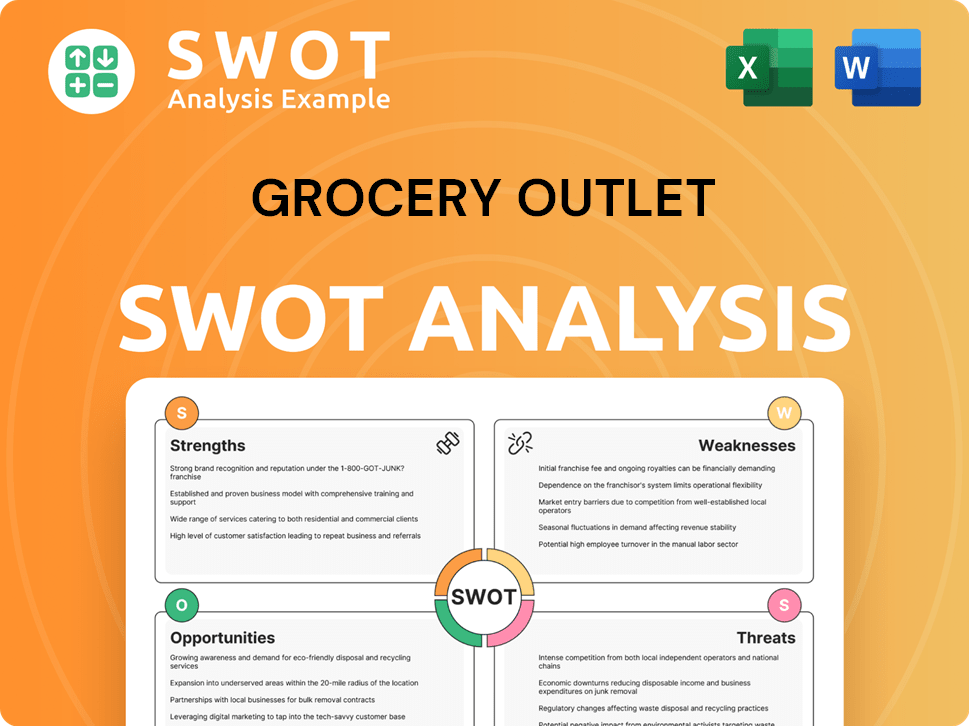

Grocery Outlet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Grocery Outlet?

The early growth of the company, now known as Grocery Outlet, marked a significant transition from its origins. This period was characterized by strategic acquisitions and expansions, solidifying its position in the discount grocery market. The company's evolution showcases its ability to adapt and capitalize on market opportunities, laying the groundwork for its future success.

In 1970, Cannery Sales acquired Globe of California and was renamed Canned Foods Warehouse. This shift signaled a move towards selling closeout, factory second, and discounted products beyond just government surplus. This strategic change broadened the scope of products offered, setting the stage for future growth.

A pivotal moment occurred in 1971 when Canned Foods Warehouse signed its first agreement with Del Monte Foods. This was followed by agreements with major companies like ConAgra, Quaker Oats Company, and Revlon. These partnerships expanded sourcing capabilities, increasing product variety.

The company's first independent store opened in Redmond, Oregon, in 1973. This marked the beginning of the independent operator model, a core element of the company's decentralized structure. The independent operator model has been instrumental in the company's expansion.

Following James Read's death in 1982, his sons, Steven and Peter Read, took over management. In 1987, the company was officially renamed Grocery Outlet. This change reflected the company's evolving identity and market focus.

By 1995, Grocery Outlet celebrated the opening of its 100th store, indicating significant expansion across its operating regions. This milestone demonstrated the company's growing presence and market penetration. This expansion was a testament to the company's successful business model.

The early 2000s saw strategic acquisitions, including the liquidated inventories of Webvan and Wine.com in 2001. These acquisitions demonstrated the company's agility in acquiring distressed assets. This strategy allowed Grocery Outlet to expand its product offerings and market reach.

In 2003, Grocery Outlet expanded its reach by purchasing 17 Yes! Less grocery stores in Texas and Louisiana. This expansion broadened its geographic footprint. This move increased the company's presence in the Southern United States.

The company diversified its product offerings by adding fresh produce in 1999 and fresh meat in 2003. In 2006, the third generation of the Read family, MacGregor Read and Eric Lindberg, became co-CEOs. This diversification broadened its appeal to a wider customer base.

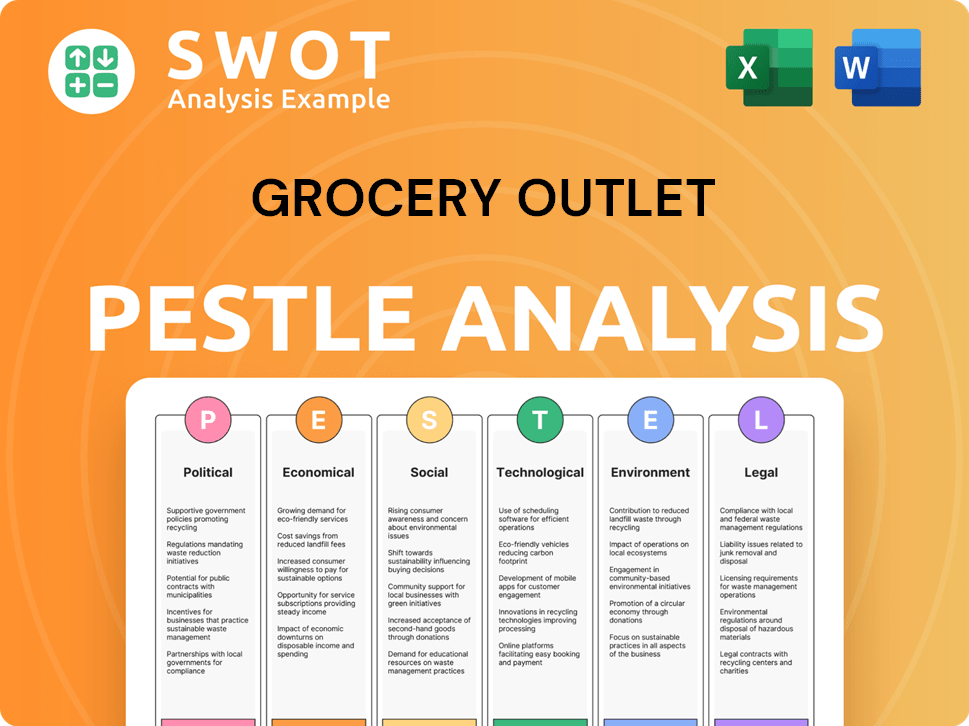

Grocery Outlet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Grocery Outlet history?

The Grocery Outlet company has experienced several pivotal moments and significant growth throughout its history, solidifying its position in the discount grocery store sector. Key milestones have shaped its trajectory, from strategic acquisitions to entering the public market, reflecting its evolving business model and expansion strategies.

| Year | Milestone |

|---|---|

| Early Years | The independent operator model, pioneered by Jim Read, was formalized, allowing local couples to run individual Grocery Outlet stores. |

| 2009 | Berkshire Partners acquired a majority stake in Grocery Outlet, providing capital for further expansion. |

| 2011 | Grocery Outlet expanded its footprint with the acquisition of Amelia's Grocery Outlet, entering the East Coast market. |

| 2014 | Hellman & Friedman LLC acquired Grocery Outlet, supporting continued growth initiatives. |

| June 2019 | Grocery Outlet went public, trading on Nasdaq under the symbol 'GO,' providing additional capital for growth. |

| 2021 | Grocery Outlet celebrated its 75th Anniversary and opened its 400th store, highlighting sustained growth. |

A key innovation is the independent operator model, which empowers local entrepreneurs. This model fosters a neighborhood feel and allows for flexibility in product offerings, catering to local tastes. The company's approach to opportunistic buying, sourcing products at significant discounts, is another core innovation that enables competitive pricing.

This model allows local married couples to run individual stores, fostering a neighborhood feel and catering to local tastes. It empowers entrepreneurial spirit and local decision-making, differentiating Grocery Outlet from other discount grocery stores.

Grocery Outlet sources products at significant discounts, enabling competitive pricing. This strategy allows the company to offer a wide variety of products at reduced prices, attracting budget-conscious consumers.

Grocery Outlet locations often engage with local communities through various initiatives. This includes supporting local food banks and participating in community events, enhancing its brand image and customer loyalty.

The company forms strategic partnerships with suppliers to secure inventory at favorable prices. These partnerships are crucial for maintaining a diverse product selection and competitive pricing within the discount grocery store sector.

Grocery Outlet is continually investing in technology to improve operational efficiency. This includes upgrades to its point-of-sale systems and supply chain management tools to streamline operations.

Grocery Outlet is rolling out a real-time order guide to enhance supply chain efficiencies. This will help improve inventory management and reduce waste, contributing to better financial performance.

Grocery Outlet has faced challenges, particularly with recent technology platform upgrades. In fiscal year 2024, the gross margin declined by 110 basis points to 30.2% year-over-year, mainly due to higher inventory shrinkage related to these system conversion issues. The company initiated a restructuring plan in late fiscal 2024, continuing into 2025, aimed at improving profitability and reducing costs.

The transition to upgraded technology platforms caused disruptions, leading to reduced gross margins. These issues impacted comparable store sales growth, posing a challenge for the company.

Higher inventory shrinkage related to the technology upgrades significantly impacted gross margins. Addressing these issues is crucial for improving profitability and financial performance.

The company initiated a restructuring plan in late fiscal 2024, continuing into 2025, to improve profitability and cash flow. This plan includes terminating leases for underperforming stores and reducing headcount.

Improving the performance of new stores is a key strategic priority for the new CEO, Jason Potter. This includes optimizing store operations and enhancing customer experience to drive sales growth.

Enhancing supply chain efficiencies, such as consolidating distribution centers, is a focus area. These initiatives aim to reduce costs and improve the overall efficiency of the supply chain.

The discount grocery store sector is highly competitive, requiring continuous adaptation. Grocery Outlet must maintain its competitive edge through strategic initiatives and operational improvements.

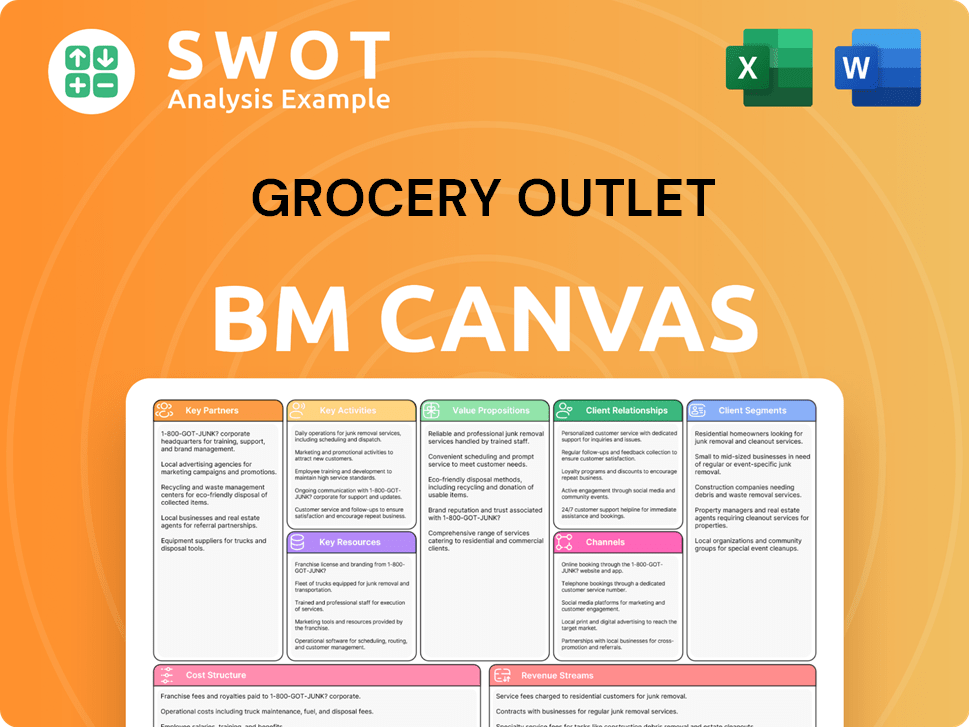

Grocery Outlet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Grocery Outlet?

The Grocery Outlet company has a rich history, starting in 1946 with Jim Read's 'Cannery Sales' in San Francisco. Over the years, it evolved from a canned goods warehouse to a discount grocery store chain, expanding its offerings and store locations. Key milestones include the renaming to Grocery Outlet in 1987, opening its 100th store in 1995, and the 2019 IPO. The company has adapted to market changes, embracing fresh produce and meat, and expanding its reach through acquisitions. Grocery Outlet's growth trajectory reflects its commitment to providing value to customers.

| Year | Key Event |

|---|---|

| 1946 | Jim Read opens 'Cannery Sales' in San Francisco, marking the beginning of the company. |

| 1970 | Cannery Sales acquires Globe of California and is renamed Canned Foods Warehouse. |

| 1971 | Canned Foods Warehouse signs its first supplier agreement with Del Monte Foods. |

| 1973 | The first independent store opens in Redmond, Oregon. |

| 1982 | Jim Read's sons, Steven and Peter Read, assume leadership. |

| 1987 | The company is renamed Grocery Outlet. |

| 1995 | Grocery Outlet opens its 100th store. |

| 1999 | Fresh produce is added to store offerings. |

| 2003 | Fresh meat becomes available in Grocery Outlet stores. |

| 2006 | MacGregor Read and Eric Lindberg become Co-CEOs, representing the third generation of family leadership. |

| 2009 | Berkshire Partners acquires a majority interest in Grocery Outlet. |

| 2011 | Grocery Outlet acquires Amelia's Grocery Outlet, expanding to the East Coast. |

| 2014 | Hellman & Friedman LLC acquires Grocery Outlet. |

| 2019 | Grocery Outlet launches its Initial Public Offering (IPO) on Nasdaq. |

| 2021 | Grocery Outlet celebrates its 75th Anniversary and opens its 400th store. |

| 2024 | Net sales reach $4.37 billion, a 10.1% increase year-over-year, with 533 stores in 16 states. |

| Q1 2025 | Net sales increase by 8.5% to $1.13 billion, reaching 543 locations across 16 states. |

Grocery Outlet is focused on expanding its store count, with a long-term goal of over 4,000 stores nationwide. For fiscal year 2025, the company plans to open 33-35 net new stores, demonstrating its commitment to growth. Grocery Outlet's expansion strategy involves strategic store openings across various locations.

Management anticipates 2025 net sales between $4.7 billion and $4.8 billion, with comparable store sales growth projected at 1-2%. The company is focused on improving gross margins and capital allocation. Grocery Outlet's financial goals reflect its strategic plans for profitability.

Grocery Outlet is investing in technology to enhance the shopping experience, including the rollout of a proprietary real-time order guide, expected to be completed by the end of the second quarter of 2025. The company is exploring online ordering and delivery services. These initiatives aim to improve customer convenience.

Grocery Outlet plans to launch a private label program, starting with the Simply Go brand, to enhance profitability. This initiative aims to offer customers exclusive products and improve the company's bottom line. The private label program is a key part of Grocery Outlet's strategy.

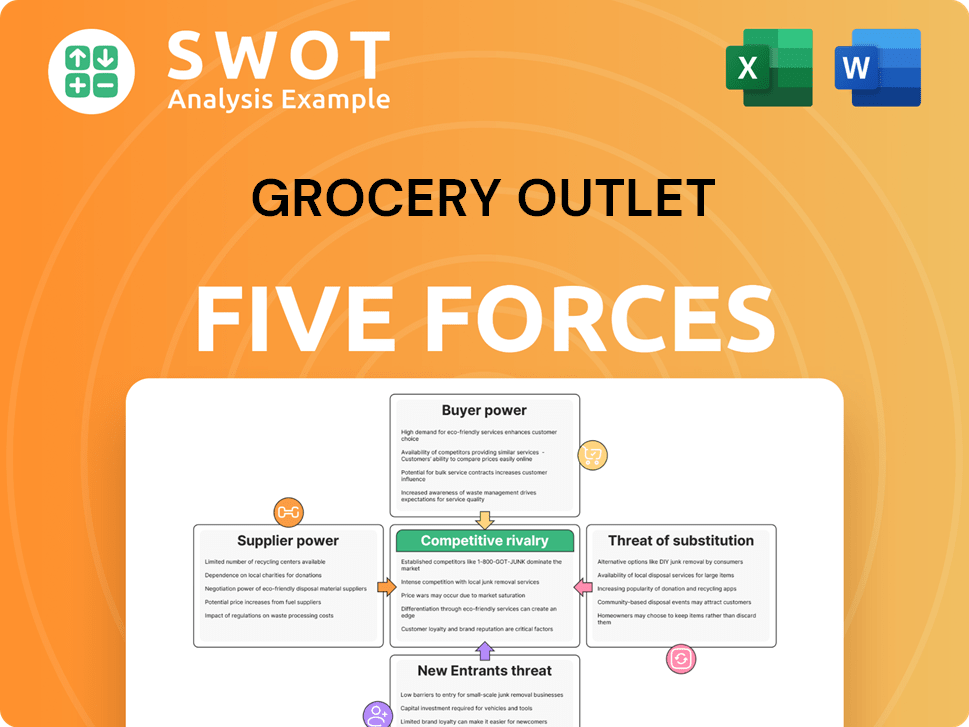

Grocery Outlet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Grocery Outlet Company?

- What is Growth Strategy and Future Prospects of Grocery Outlet Company?

- How Does Grocery Outlet Company Work?

- What is Sales and Marketing Strategy of Grocery Outlet Company?

- What is Brief History of Grocery Outlet Company?

- Who Owns Grocery Outlet Company?

- What is Customer Demographics and Target Market of Grocery Outlet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.