Grocery Outlet Bundle

How Does Grocery Outlet Thrive in the Discount Grocery Market?

Grocery Outlet, a leading extreme-value retailer, offers a compelling value proposition in the competitive grocery landscape. With its focus on name-brand products at significantly reduced prices, Grocery Outlet has captured the attention of budget-conscious consumers. As of late 2024, the company's expansive network of Grocery Outlet stores across multiple states showcases its growing influence and unique Grocery Outlet SWOT Analysis.

This article will explore the inner workings of the Grocery Outlet business model, examining how this discount grocery store sources its products and maintains its competitive Grocery Outlet prices. We'll investigate the company's financial performance, including its revenue generation and strategies for navigating the evolving retail environment. Whether you're an investor, a customer, or simply curious about the success of this extreme value retailer, understanding Grocery Outlet's operations is key.

What Are the Key Operations Driving Grocery Outlet’s Success?

The core operations of Grocery Outlet revolve around its unique opportunistic buying model, enabling the company to offer significant discounts, typically ranging from 40% to 70% compared to traditional retailers. This model involves purchasing overstocked and closeout merchandise directly from name-brand suppliers. This approach allows Grocery Outlet stores to provide budget-conscious consumers with quality products at unbeatable prices, a value proposition that resonates strongly across various economic conditions.

The operational process begins with sourcing products from over 4,000 suppliers, including manufacturers, distributors, and other retailers. This flexible buying model allows Grocery Outlet to acquire surplus inventory, packaging changes, or discontinued items at significantly reduced costs. The products are then distributed to independently operated stores, a key differentiator for the company. These independent operators (IOs) manage the day-to-day operations of their stores, fostering a localized approach and personalized customer service.

What makes Grocery Outlet's operations unique is its 'treasure hunt' shopping experience, driven by an ever-changing assortment of 'WOW!' deals alongside everyday staple products. This dynamic inventory, combined with the extreme-value pricing, encourages frequent customer visits and builds loyalty. The company's supply chain optimization efforts include a new 680,000-square-foot ambient distribution center in Vancouver, Washington, which became fully operational by the end of 2025 to support growing business in the Pacific Northwest. This strategic consolidation aims to improve efficiency, reduce costs, and enhance service levels. To understand more about their customer base, consider reading about the Target Market of Grocery Outlet.

The Grocery Outlet business model is built on opportunistic buying, allowing for deep discounts. They source products from a vast network of suppliers, including manufacturers and distributors.

Grocery Outlet prices are significantly lower than traditional grocery stores. This attracts budget-conscious consumers seeking quality products at affordable prices.

They operate a decentralized model with independent operators (IOs) managing individual stores. The 'treasure hunt' shopping experience with changing inventory keeps customers engaged.

Strategic investments in distribution centers, like the one in Vancouver, Washington, enhance efficiency. This improves service levels and reduces costs.

Grocery Outlet differentiates itself through its unique sourcing and operational strategies. The company's focus on extreme value and a dynamic product selection creates a compelling shopping experience.

- Opportunistic Buying: Sourcing overstocked and closeout merchandise.

- Independent Operators: Localized approach and personalized customer service.

- 'Treasure Hunt' Experience: Ever-changing assortment of deals.

- Supply Chain Efficiency: Strategic investments in distribution.

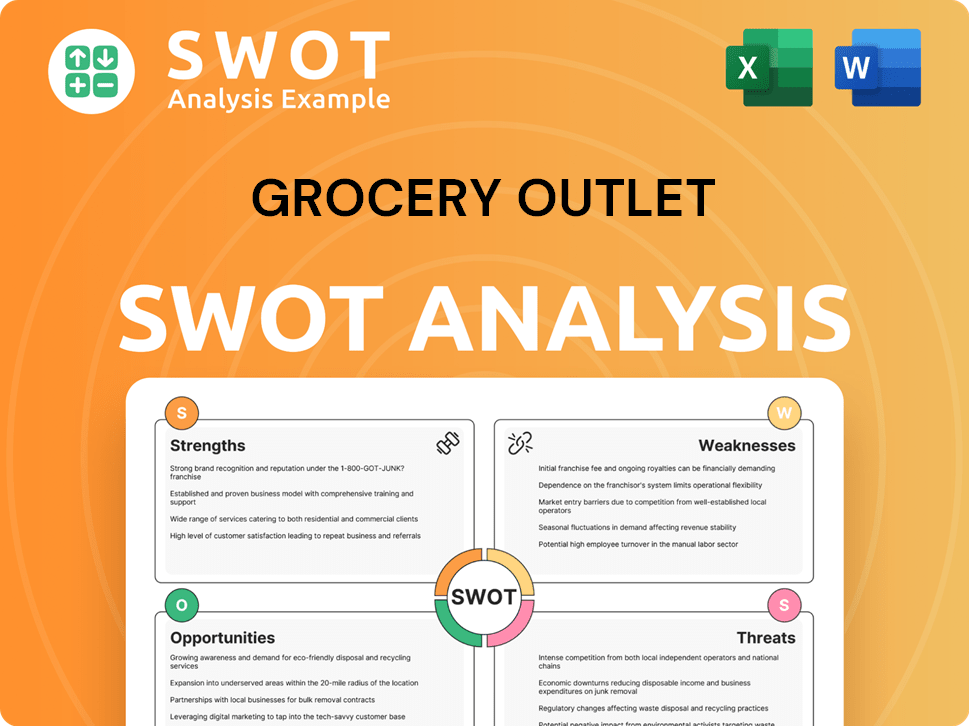

Grocery Outlet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Grocery Outlet Make Money?

The primary revenue stream for Grocery Outlet comes from the sale of groceries and related products. The Grocery Outlet business model focuses on offering significant discounts, attracting value-conscious consumers. This strategy drives sales volume and positions the company as an extreme value retailer.

In fiscal year 2024, Grocery Outlet reported net sales of $4.37 billion, reflecting a 10.1% increase from the previous year. The company's growth continued into the first quarter of fiscal 2025, with net sales reaching $1.13 billion, an 8.5% increase compared to the first quarter of fiscal 2024. This growth was fueled by new store sales, including acquisitions, and a modest increase in comparable store sales.

The company's diverse product assortment includes produce, meat, deli, frozen foods, dairy, beer, wine, health and beauty care, and general merchandise. The opportunistic buying model is central to Grocery Outlet prices, enabling the company to offer products at lower prices than traditional grocery stores. This approach creates a strong value proposition, driving sales volume and customer loyalty.

The company's gross profit for fiscal year 2024 was $1.13 billion, with a gross margin of 30.7%. In Q1 2025, the gross margin was 30.4%, an increase from 29.3% in the prior year, attributed to improvements in inventory management. However, despite revenue growth, profitability has been under pressure. Net income for fiscal year 2024 decreased to $39.5 million from $79.4 million, and in Q1 2025, the company reported a net loss of $23.3 million, a significant increase from a $1.0 million net loss in Q1 2024. These declines are linked to lower gross margins, higher SG&A expenses, and increased net interest expense. For a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of Grocery Outlet.

- The Grocery Outlet's monetization strategy hinges on its ability to source products at favorable prices.

- The company's focus on discount grocery store offerings appeals to a broad customer base.

- The financial results indicate challenges in maintaining profitability despite revenue growth.

- The company's expansion strategy, including new Grocery Outlet stores, is a key driver of revenue.

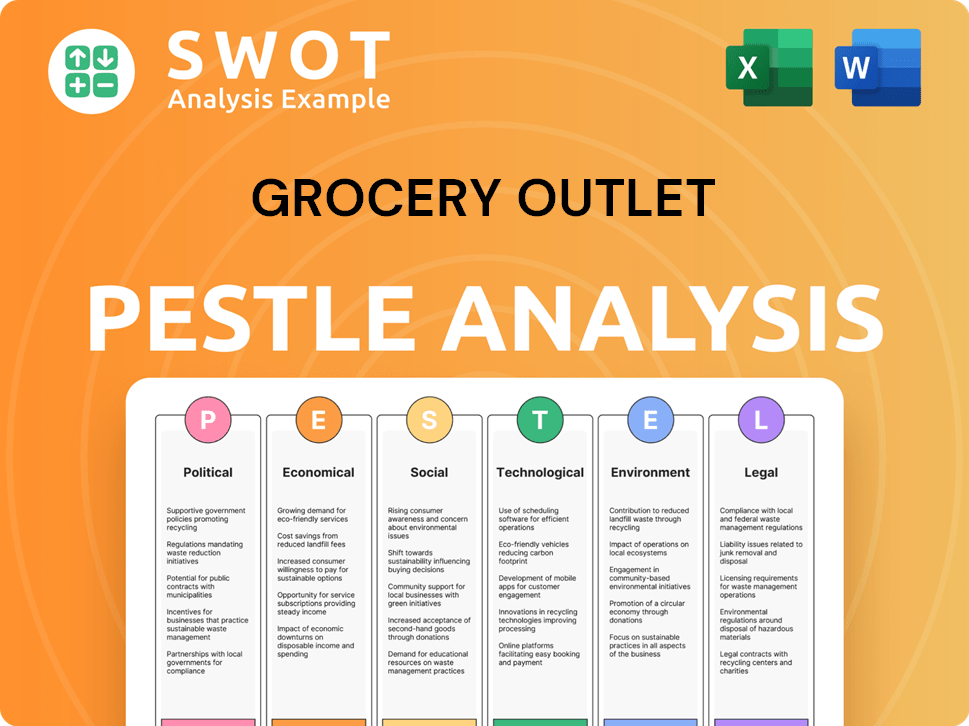

Grocery Outlet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Grocery Outlet’s Business Model?

The journey of Grocery Outlet has been marked by strategic expansions and operational adjustments. The company's approach centers on offering significant savings to consumers through its unique business model. This model focuses on opportunistic buying and a network of independently operated stores.

A crucial aspect of Grocery Outlet's strategy involves adapting to market changes and consumer preferences. This includes expanding its private-label offerings and responding to customer demand. The company's financial performance reflects these strategic moves, with both successes and challenges shaping its trajectory.

As of Q1 2025, Grocery Outlet operated a total of 543 stores across 16 states, demonstrating its continued growth. The company's ability to navigate market dynamics and maintain its competitive edge is critical for its long-term success. For more in-depth information, you can read about Owners & Shareholders of Grocery Outlet.

A major milestone was the acquisition of United Grocery Outlet in April 2024, adding 40 stores and expanding its presence into new states. In fiscal year 2024, the company added a total of 67 new stores. The company opened 11 new stores in Q1 2025.

Grocery Outlet initiated a restructuring plan in Q4 2024, continuing into fiscal 2025, to improve profitability. This plan includes optimizing new store growth and reducing workforce costs. The company reduced its 2025 store opening target to 33-35 net new locations.

Grocery Outlet's competitive advantage lies in its opportunistic buying model, offering products at significantly lower prices. The company benefits from strong supplier relationships and efficient inventory management. The independently operated store model fosters a 'treasure hunt' experience.

The company introduced over 180 new private-label SKUs in fiscal 2024, responding to customer demand for store brands. Grocery Outlet plans to add approximately 150 more private-label SKUs in 2025. This focus on private labels helps to enhance the value proposition for customers.

Grocery Outlet faced systems issues impacting inventory management in Q4 2024 and Q1 2025, leading to lower gross margins and higher inventory shrinkage. The restructuring plan aims to address these issues and improve long-term financial performance. The company is focused on optimizing its operations to enhance profitability.

- Ongoing systems issues impacted inventory management.

- Restructuring plan initiated in Q4 2024, continuing into 2025.

- Focus on optimizing operations for improved profitability.

- Reduced store opening target for 2025.

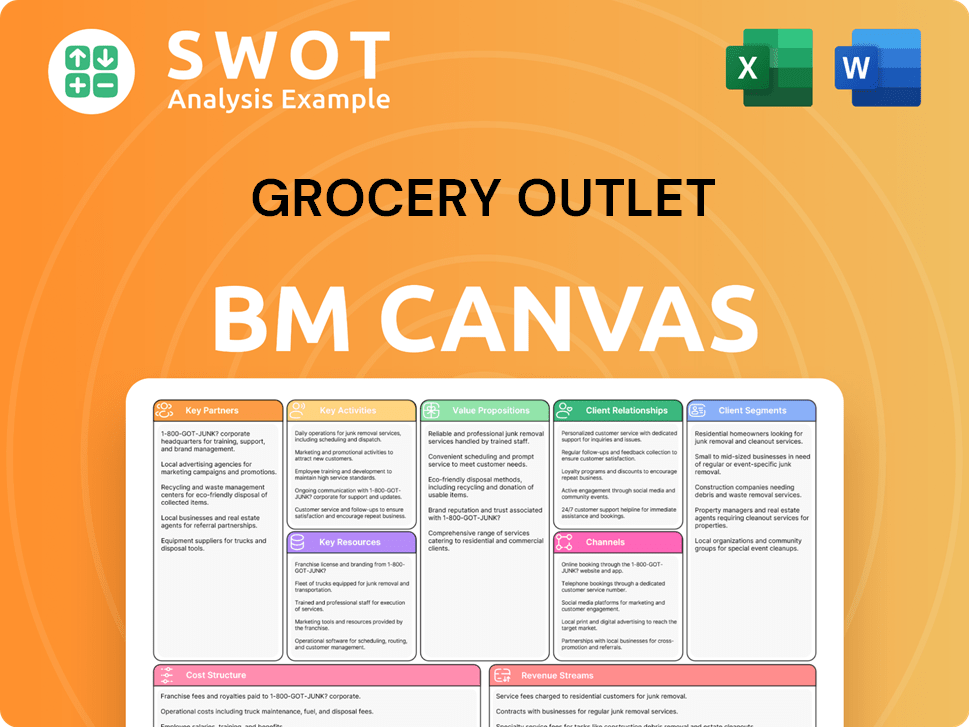

Grocery Outlet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Grocery Outlet Positioning Itself for Continued Success?

The company holds a unique position as the largest 'extreme-value' grocer in the U.S., distinguishing itself within the competitive retail food industry. As of December 28, 2024, the company operated 533 stores across 16 states. By the end of Q1 2025, the store count grew to 543.

However, the company faces several key risks, including reliance on suppliers for opportunistic products and intense competition from various retail formats. Macroeconomic factors and a recent securities class action lawsuit also pose challenges. Despite these hurdles, the company is focused on operational improvements and growth, with plans for new store openings and system upgrades.

The company is the largest 'extreme-value' grocer in the U.S., a segment within the broader discount grocery store market. This niche allows it to target value-conscious consumers. Its business model is built around offering significant discounts on brand-name products.

A primary risk is the reliance on suppliers to provide opportunistic products at attractive prices. Competition from mass and discount retailers, warehouse clubs, and online retailers presents another challenge. Operational risks include potential disruptions to the distribution network and technology system issues.

The company plans to open 33 to 35 net new stores in 2025, focusing on existing and adjacent markets. The company is also continuing system upgrades to enhance merchandising and inventory management. Fiscal 2025 guidance projects total net sales between $4.7 billion and $4.8 billion.

Intense competition comes from mass and discount retailers, warehouse clubs, online retailers, and conventional grocery stores. Increased promotional and pricing activities from competitors are observed. Understanding Grocery Outlet's brief history can provide more context to its competitive landscape.

The company must manage its supply chain effectively to maintain a steady flow of discounted products. Successfully integrating new technology systems is crucial. The ability to adapt to changing consumer behavior and economic conditions will be key to sustained growth.

- Maintaining competitive Grocery Outlet prices while managing costs.

- Enhancing the 'treasure hunt' shopping experience to drive customer loyalty.

- Expanding into new markets and increasing brand awareness.

- Navigating macroeconomic headwinds such as inflation and supply chain issues.

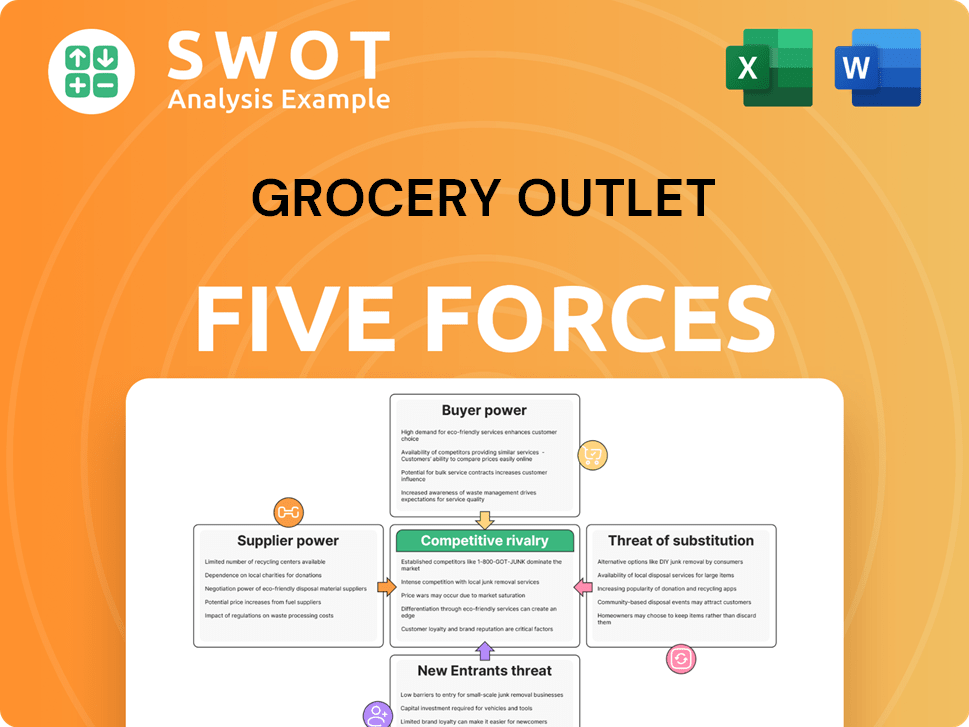

Grocery Outlet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grocery Outlet Company?

- What is Competitive Landscape of Grocery Outlet Company?

- What is Growth Strategy and Future Prospects of Grocery Outlet Company?

- What is Sales and Marketing Strategy of Grocery Outlet Company?

- What is Brief History of Grocery Outlet Company?

- Who Owns Grocery Outlet Company?

- What is Customer Demographics and Target Market of Grocery Outlet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.