Grocery Outlet Bundle

Who Really Calls the Shots at Grocery Outlet?

Unraveling the Grocery Outlet SWOT Analysis is just the beginning; understanding the entity's ownership structure is key to grasping its trajectory. Founded in 1946, Grocery Outlet's journey from surplus food sales to a major player in the 'extreme-value' grocery market is a testament to its adaptability. But who has truly steered this ship through decades of change and growth? This exploration unveils the Grocery Outlet owner and Grocery Outlet ownership story.

From its humble beginnings, understanding the Grocery Outlet Inc.'s Grocery Outlet history and its current Grocery Outlet management is crucial. This investigation will examine the evolution of Who owns Grocery Outlet, from its founder's initial vision to its current status as a publicly traded company. This provides valuable insights for anyone tracking Grocery Outlet stock price and Grocery Outlet financial information.

Who Founded Grocery Outlet?

The story of Grocery Outlet's ownership begins with its founder, James Read, who launched the company in San Francisco, California, on June 11, 1946. Initially named Cannery Sales, the venture focused on selling surplus food items. This marked the start of what would become a significant player in the discount grocery sector.

Over time, the company evolved. In 1970, Cannery Sales acquired Globe of California and was renamed Canned Foods Warehouse, which then shifted its focus to closeout and discounted products. The independent operator model, a key aspect of the company's identity, began in 1973 with the first store under the Canned Foods Warehouse name opening in Redmond, Oregon.

Following James Read's passing in 1982, his sons, Steven and Peter Read, took over the leadership. In 1987, the company officially adopted the name 'Grocery Outlet.' The Read family maintained a substantial ownership stake, reflecting their pivotal role in the company's early development and ongoing management.

James Read established the company in 1946, setting the stage for its future in the grocery industry.

Steven and Peter Read assumed leadership in 1982 following their father's death, continuing the family's involvement.

The company officially became 'Grocery Outlet' in 1987, solidifying its brand identity.

The independent operator model, initiated in 1973, empowered store owners, aligning their interests with the company's success.

MacGregor Read and Eric Lindberg, representing the next generation, became co-CEOs in 2006, ensuring continued family involvement.

Agreements with suppliers, such as the 1971 deal with Del Monte Foods, were crucial in establishing the company's supply chain.

The ownership structure of Grocery Outlet Inc. has evolved from its founding by James Read to include family leadership and, eventually, public ownership. Understanding the Grocery Outlet ownership structure helps in grasping the company's strategic decisions and market position. The Read family's influence has been significant throughout the company's history.

- Founding and Early Years: James Read's initial venture set the foundation.

- Family Succession: Steven and Peter Read continued the business after their father.

- Independent Operator Model: This model, starting in 1973, has been a key part of the company's success.

- Public Offering: Grocery Outlet went public in 2019.

- Current Ownership: The company is publicly traded, with institutional investors holding a significant portion of the shares.

Grocery Outlet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Grocery Outlet’s Ownership Changed Over Time?

The ownership of Grocery Outlet has evolved significantly since its inception. Initially a family-owned business, the company saw a major shift in 2009 when Berkshire Partners, a private equity firm, acquired a majority stake in Grocery Outlet Inc. This move injected capital for expansion. Later, in 2014, Hellman & Friedman LLC took over the ownership interest from Berkshire Partners, continuing to support the company's growth trajectory. These changes highlight the dynamic nature of Grocery Outlet's ownership structure, reflecting its journey from a private, family-run enterprise to one with significant institutional backing.

A pivotal moment in Grocery Outlet's history was its Initial Public Offering (IPO) in 2019. The company began trading on the NASDAQ under the ticker symbol 'GO.' This IPO provided additional capital and increased market visibility. As of June 6, 2025, Grocery Outlet Holding Corp. (NASDAQ: GO) has 511 institutional owners and shareholders, holding a total of 141,760,039 shares. Key institutional investors include BlackRock, Inc., Vanguard Group Inc, and IJR - iShares Core S&P Small-Cap ETF. Despite being a public company, the Read family maintains a substantial ownership stake through Read Enterprises, Inc., holding 55% of the shares. This hybrid structure allows for public investment while preserving the founding family's influence.

| Year | Event | Impact on Ownership |

|---|---|---|

| 2009 | Berkshire Partners acquires majority interest | Transition from family-owned to institutional backing |

| 2014 | Hellman & Friedman LLC acquires ownership | Continued support for growth and expansion |

| 2019 | Initial Public Offering (IPO) | Diversification of ownership to include public investors |

The current ownership structure of Grocery Outlet reflects a blend of public and private interests. While the company is publicly traded, the Read family's significant stake ensures a continued connection to the company's roots. This balance allows Grocery Outlet to leverage the benefits of public markets while maintaining a strong sense of its founding vision. For more information on how Grocery Outlet operates, you can read about the Revenue Streams & Business Model of Grocery Outlet.

Grocery Outlet's ownership has evolved from a family-owned business to a publicly traded company with significant institutional and family ownership.

- The IPO in 2019 marked a major shift, bringing in public investors.

- The Read family retains a controlling interest, ensuring continuity with the company's founding.

- Institutional investors like BlackRock and Vanguard hold significant shares.

- This hybrid structure allows for growth while maintaining core values.

Grocery Outlet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Grocery Outlet’s Board?

The current board of directors of Grocery Outlet Holding Corp. significantly influences the company's direction, balancing the interests of various stakeholders. As of recent disclosures, the board includes a mix of members representing major shareholders, the founding family, and independent directors. Eric J. Lindberg, formerly interim President and CEO until February 3, 2025, continues to serve as the Chairman of the Board. Jason Potter, who became President and CEO on February 3, 2025, also joined the Board of Directors.

Grocery Outlet's commitment to corporate governance is evident through its independent board structure, with a majority of directors being independent. The separation of the CEO and Chairman roles, with an independent, non-executive Chairman, further reinforces this commitment. All Board committees are composed entirely of independent directors. The company's governance practices are continuously evolving, as indicated by the roadmap outlined in the 2022 proxy statement, addressing supermajority voting rights, classified Board structure, director resignation policy, and majority voting standards.

| Board Member | Title | Affiliation |

|---|---|---|

| Eric J. Lindberg | Chairman of the Board | (Information typically found in proxy statements) |

| Jason Potter | President and CEO | (Information typically found in proxy statements) |

| Other Board Members | Directors | (Information typically found in proxy statements) |

In terms of voting power, Grocery Outlet operates with a single voting class, ensuring all common stock holders have equal voting rights (one vote per share). The company does not employ dual-class shares or a 'poison pill' defense. The company's structure aims for transparency and fairness in its governance practices, as detailed in the latest proxy statements.

Understanding the Grocery Outlet owner and Grocery Outlet ownership structure is key to grasping its operational dynamics. The board of directors, comprising a mix of independent directors and representatives from major shareholders, guides the company. The governance structure emphasizes independence and equal voting rights for all shareholders, ensuring a balanced approach to decision-making.

- The board includes the Chairman, Eric J. Lindberg, and the President and CEO, Jason Potter.

- Grocery Outlet has a single class of voting shares.

- The company's governance practices are continuously evolving.

- All board committees are composed entirely of independent directors.

Grocery Outlet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Grocery Outlet’s Ownership Landscape?

Recent changes in the Grocery Outlet ownership profile reflect strategic shifts and leadership transitions. Jason Potter assumed the roles of President and CEO on February 3, 2025, succeeding Eric Lindberg Jr., who continues as Chairman of the Board. This leadership change was accompanied by the appointments of Christopher Miller as CFO on January 6, 2025, and Kumar Mishra as CIO.

Institutional ownership remains a significant factor, with over 90% of the stock held by institutions. Data indicates a strong buying trend among institutional investors in Q1 2025, following a period of selling in Q3 2024. Insider activity also saw a shift, with buying outpacing selling in Q4 2024 and Q1 2025, including purchases by the CFO and two directors, totaling $2.2 million in shares. These trends provide insights into the Grocery Outlet ownership structure and investor sentiment.

| Metric | Q3 2024 | Q4 2024 | Q1 2025 |

|---|---|---|---|

| Institutional Ownership Trend | Selling | Buying | Multi-year High Buying |

| Insider Activity | Selling | Buying | Buying |

| Share Buybacks (2024) | Reduced Share Count by 1.2% | Continued | Expected to Continue |

The company’s strategic initiatives include a restructuring plan initiated in Q4 2024 and continuing into 2025, aimed at enhancing profitability and optimizing new store growth. This plan involves consolidating distribution centers and implementing a new real-time order guide. Furthermore, the acquisition of United Grocery Outlet in February 2024 expanded its footprint into the Southeast U.S., adding 40 stores. The company ended 2024 with 533 stores across 16 states. For 2025, Grocery Outlet Inc. plans to open 33-35 net new locations, concentrating on existing and adjacent markets. To understand more about their target market, you can read this article: Target Market of Grocery Outlet.

Jason Potter became CEO on February 3, 2025, succeeding Eric Lindberg Jr. Christopher Miller joined as CFO in January 2025. Kumar Mishra was appointed as CIO.

Institutions hold over 90% of the stock. Buying activity increased in Q1 2025, after some selling in Q3 2024. This indicates a strong market tailwind.

Insiders shifted from selling to buying in Q4 2024 and Q1 2025. The CFO and two directors bought shares, totaling $2.2 million.

A restructuring plan started in Q4 2024, continuing into 2025. The company plans to open 33-35 new stores in 2025.

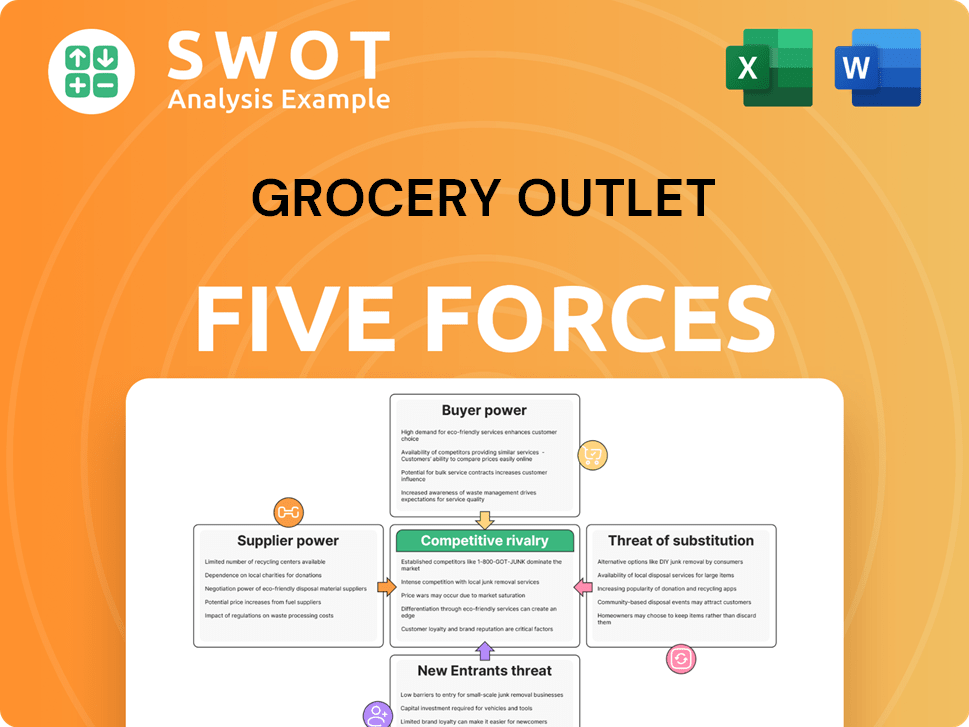

Grocery Outlet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grocery Outlet Company?

- What is Competitive Landscape of Grocery Outlet Company?

- What is Growth Strategy and Future Prospects of Grocery Outlet Company?

- How Does Grocery Outlet Company Work?

- What is Sales and Marketing Strategy of Grocery Outlet Company?

- What is Brief History of Grocery Outlet Company?

- What is Customer Demographics and Target Market of Grocery Outlet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.