Invitation Homes Bundle

How Did Invitation Homes Revolutionize the Rental Market?

The single-family rental landscape saw a dramatic shift with the rise of institutional players, and at the forefront of this change was Invitation Homes. Founded in 2012 in Dallas, Texas, the company emerged with a bold vision: to professionalize the rental experience for single-family homes. This marked a significant departure from the fragmented market dominated by individual landlords.

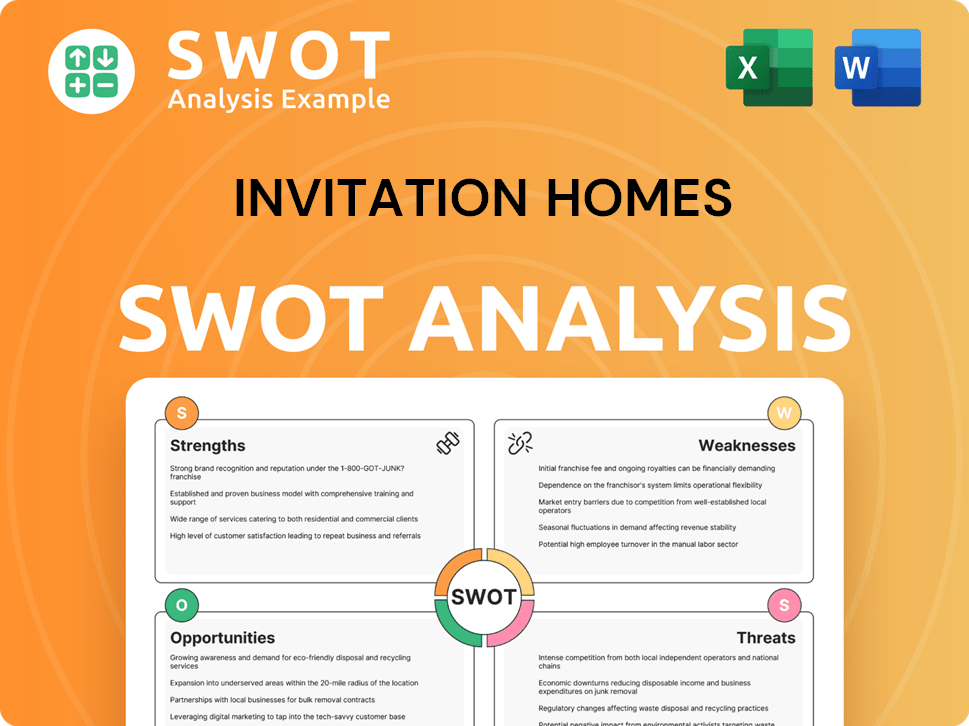

Invitation Homes' Invitation Homes SWOT Analysis reveals a company shaped by the 2008 housing crisis, capitalizing on distressed properties to create quality rental homes. Its journey from a startup to a leading Real Estate Investment Trust (REIT) is a testament to strategic foresight and market adaptation. This article will delve into the brief history of Invitation Homes, exploring its founding, growth strategy, and impact on the single-family rentals and real estate investment landscape.

What is the Invitation Homes Founding Story?

The founding story of Invitation Homes is rooted in the aftermath of the 2008 financial crisis. The company emerged in 2012, spearheaded by Colony Capital, a real estate investment firm under the leadership of Thomas J. Barrack Jr. This venture was a strategic response to the surge of foreclosed single-family homes that flooded the market, presenting a unique investment opportunity.

Colony Capital recognized the potential to acquire these properties at reduced prices, renovate them, and then offer them as rental homes. This approach aimed to fulfill the housing needs of individuals and families who either couldn't or preferred not to own homes, while also generating returns from a novel asset class. This marked the beginning of a significant player in the single-family rentals market.

Invitation Homes' inception was a direct reaction to the economic conditions following the 2008 financial crisis, focusing on acquiring and renovating foreclosed single-family homes.

- The company's initial business model involved bulk acquisitions of foreclosed homes, primarily from banks and government-sponsored enterprises.

- These properties underwent significant renovations before being leased to residents, allowing for rapid portfolio expansion.

- The venture was initially funded through substantial capital injections from Colony Capital and other institutional investors.

- The expertise in real estate investment and asset management was key in navigating the complexities of managing thousands of properties.

The initial business model of Invitation Homes was centered on acquiring foreclosed homes in bulk, mainly from banks and government-sponsored enterprises. These properties, often in disrepair, underwent extensive renovations to meet quality standards before being leased. This strategy enabled Invitation Homes to rapidly build a substantial portfolio. The company secured its initial funding through significant capital injections from Colony Capital and other institutional investors. The availability of properties and the low-interest-rate environment at the time were key factors. The expertise of the founding team in real estate investment and asset management was crucial in managing thousands of properties across various markets, establishing a new segment in the real estate industry. For more insights into the company's core values, you can read the article on Mission, Vision & Core Values of Invitation Homes.

As of Q1 2024, the company's portfolio included approximately 80,000 homes across 16 markets. Invitation Homes has demonstrated consistent growth, with a focus on operational efficiency and resident satisfaction. The company's strategic acquisitions and property management practices have been key to its success in the single-family rental market.

Invitation Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Invitation Homes?

The early years of Invitation Homes were marked by rapid expansion and strategic acquisitions, quickly establishing it as a major player in the single-family rental market. Founded in 2012, the company aggressively acquired properties, leveraging significant capital to build its portfolio. This rapid growth was a key factor in shaping the company's early success and market position.

Following its 2012 founding, Invitation Homes implemented an aggressive acquisition strategy. By 2013, the company had already acquired approximately 40,000 homes. This rapid accumulation was primarily focused on Sun Belt markets, which were impacted by foreclosures and had strong rental demand.

The company developed a robust property management infrastructure to handle its geographically dispersed portfolio. This included establishing local teams for property maintenance, leasing, and resident services. This infrastructure was crucial for managing its growing portfolio of single-family rentals.

In 2017, Invitation Homes completed its initial public offering (IPO) on the New York Stock Exchange under the ticker symbol 'INVH.' The IPO allowed the company to raise substantial capital, further solidifying its financial position. This capital was used to support continued strategic growth and acquisitions.

Also in 2017, Invitation Homes merged with Starwood Waypoint Homes in an all-stock transaction valued at approximately $5.5 billion. This merger expanded Invitation Homes' portfolio by around 30,000 homes. The combined entity had over 80,000 homes, solidifying its leadership in the single-family rental market.

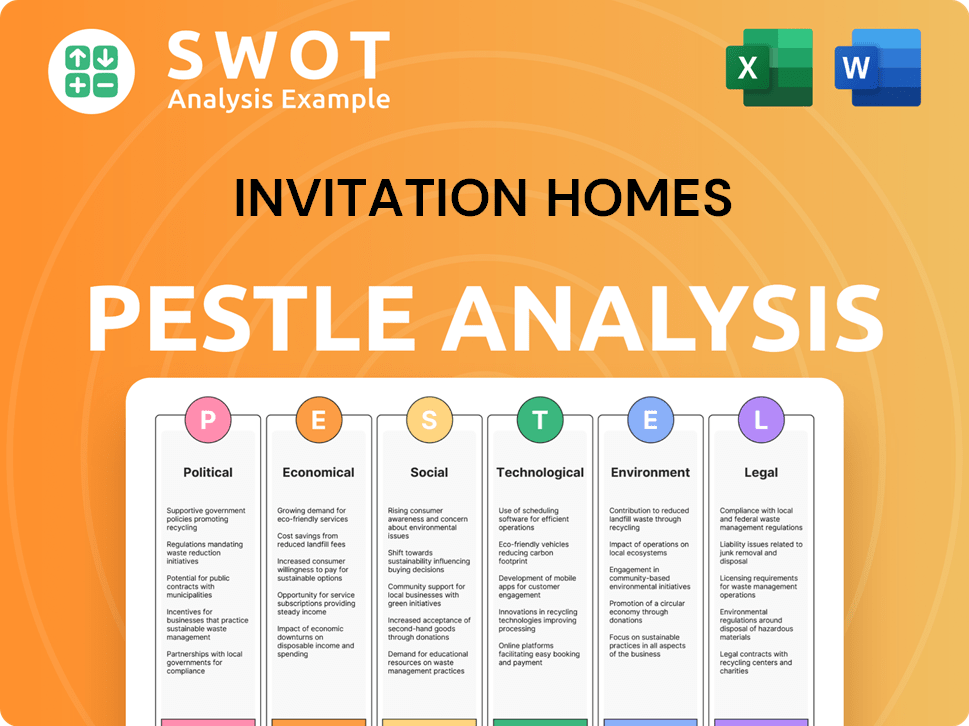

Invitation Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Invitation Homes history?

The Invitation Homes company has achieved significant milestones, transforming the single-family rental market. These accomplishments include pioneering the institutionalization of single-family rentals and becoming a major player in real estate investment.

| Year | Milestone |

|---|---|

| 2012 | Founded as a real estate investment trust (REIT) focused on acquiring and managing single-family rental homes. |

| 2017 | Completed an initial public offering (IPO), marking a significant step in its growth and providing a new avenue for public investment. |

| 2017 | Merged with Starwood Waypoint Homes, significantly expanding its portfolio and operational capabilities. |

| 2023 | Reported a revenue of approximately $3.6 billion, demonstrating its financial performance and market position. |

Invitation Homes has been at the forefront of innovation in the single-family rental sector. The company developed advanced technological platforms for property management, streamlining processes for residents and enhancing operational efficiency.

Invitation Homes transformed a fragmented sector into a professionally managed asset class, attracting institutional investment. This shift brought standardization and improved management practices to the single-family rental market.

The company implemented sophisticated systems for resident screening, rent collection, and maintenance requests. These technological advancements improved the efficiency and consistency of the rental experience.

Invitation Homes utilizes data analytics to optimize property selection, pricing strategies, and operational efficiencies. This data-driven approach helps to maximize returns and improve decision-making.

Despite its successes, Invitation Homes has faced several challenges throughout its history. These challenges include logistical hurdles in property management and economic fluctuations impacting the real estate market.

The sheer scale of operations presented logistical challenges in acquiring, renovating, and maintaining properties across diverse geographical regions. Managing a vast portfolio requires significant operational expertise and resources.

Economic downturns and fluctuations in housing markets have posed risks, impacting property values and rental demand. The company must adapt to changing economic conditions to maintain profitability.

Rising interest rates and inflation impact acquisition strategies and operational costs. The company must find ways to mitigate these financial pressures.

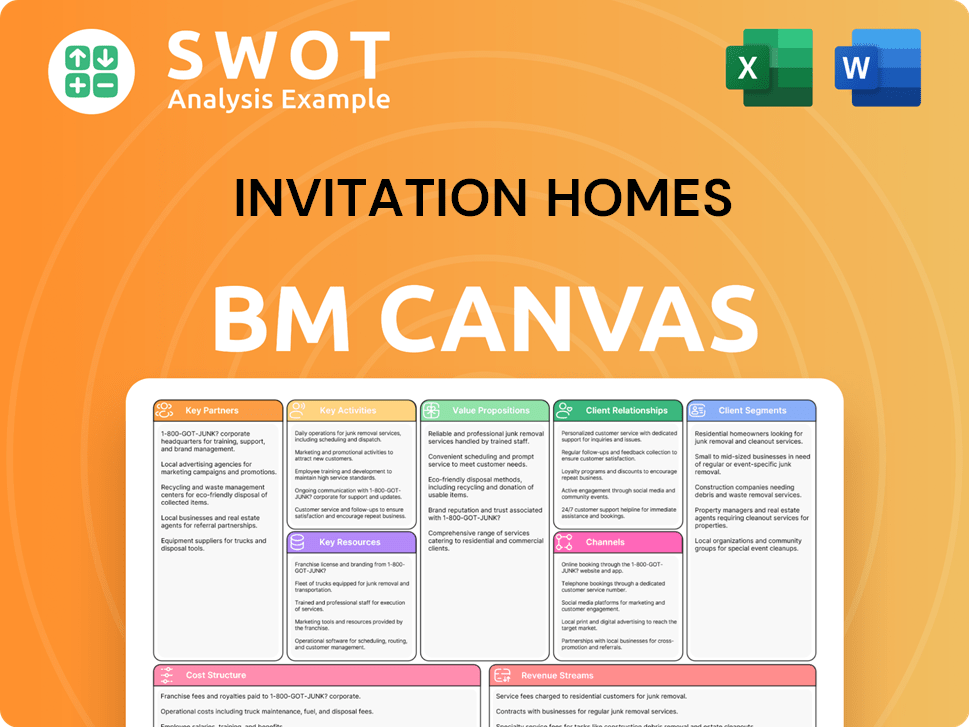

Invitation Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Invitation Homes?

Here's a look at the key milestones in the history of Invitation Homes, a significant player in the single-family rental market.

| Year | Key Event |

|---|---|

| 2012 | Invitation Homes was founded by Colony Capital. |

| 2013 | The company rapidly acquired approximately 40,000 homes. |

| 2017 | Invitation Homes completed its Initial Public Offering (IPO) on the New York Stock Exchange (NYSE: INVH). |

| 2017 | Invitation Homes merged with Starwood Waypoint Homes, significantly expanding its portfolio to over 80,000 homes. |

| 2019 | The company announced initiatives to enhance resident experience and invested in smart home technology. |

| 2020-2021 | Invitation Homes experienced strong demand for single-family rentals amidst the COVID-19 pandemic, leading to increased occupancy and rental growth. |

| 2023 | Invitation Homes continued strategic acquisitions in high-growth markets, focusing on optimizing its portfolio. |

| 2024 | The company navigated a dynamic interest rate environment, emphasizing operational efficiency and resident retention. |

Invitation Homes is positioned to continue its growth, driven by ongoing demand for single-family rentals. The company is focusing on expanding its portfolio in markets with strong demographic trends and job growth. This strategic approach is expected to support long-term value creation.

The single-family rental market is expected to remain strong, supported by demographic shifts favoring renting, affordability challenges in homeownership, and a preference for spacious living. These factors are expected to drive continued demand for Invitation Homes' properties. For a deeper dive, consider reading this article on Invitation Homes company.

Invitation Homes plans to leverage technology to enhance property management efficiency, optimize resident services, and potentially explore new revenue streams. This focus on innovation aims to improve operational performance and resident satisfaction. The company is committed to providing quality housing and professional management.

Invitation Homes will continue to adapt to evolving market conditions, focusing on sustainable growth and maximizing shareholder value within the dynamic real estate sector. The company's ability to respond to changes in the market will be crucial for its long-term success. The company's strategic approach is designed to create value.

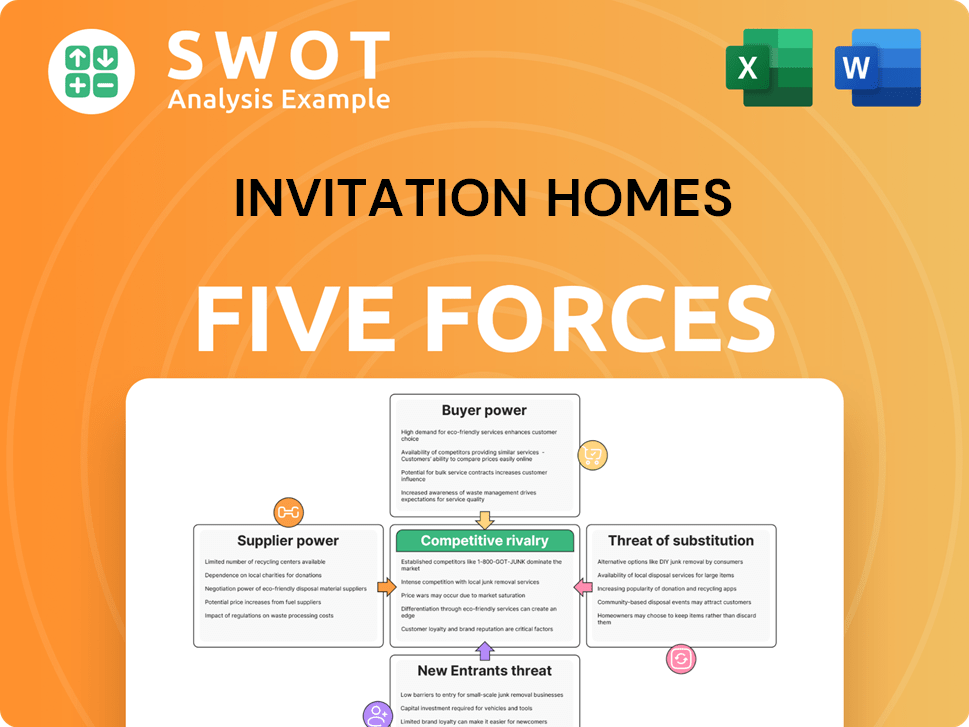

Invitation Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Invitation Homes Company?

- What is Growth Strategy and Future Prospects of Invitation Homes Company?

- How Does Invitation Homes Company Work?

- What is Sales and Marketing Strategy of Invitation Homes Company?

- What is Brief History of Invitation Homes Company?

- Who Owns Invitation Homes Company?

- What is Customer Demographics and Target Market of Invitation Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.