Invitation Homes Bundle

Decoding Invitation Homes: How Does This REIT Thrive?

Invitation Homes, a leading Real Estate Investment Trust (REIT), has revolutionized the single-family rental market. With a massive portfolio of Invitation Homes SWOT Analysis and a market capitalization nearing $20.2 billion as of June 2025, it's a force to be reckoned with. But how does this powerhouse of single-family rentals actually work, and what makes it tick?

Invitation Homes' impressive financial performance, with strong core FFO and AFFO growth, highlights its operational efficiency. Understanding the Invitation Homes business model, from its acquisition of properties to its management of rental properties, is key to grasping its success. This deep dive into Invitation Homes will explore its investment strategy, revenue streams, and how it navigates the dynamic rental market.

What Are the Key Operations Driving Invitation Homes’s Success?

Invitation Homes operates by offering professionally managed single-family homes for lease across the United States. The company caters to individuals and families seeking the flexibility of renting, often in desirable neighborhoods. Its core offerings include updated homes, frequently equipped with Smart Home technology, supported by professional property management services.

The company's value proposition revolves around providing high-quality, worry-free living experiences. This includes well-maintained homes and flexible leasing options, distinguishing it within the competitive rental market. The Brief History of Invitation Homes reveals how the company has evolved to meet the demands of the single-family rental market.

Invitation Homes' business model is built on acquiring, renovating, and managing single-family homes. This includes acquiring properties, renovating them, and providing ongoing property management services. The company's strategic approach to real estate investment has enabled it to become a leading player in the single-family rentals sector.

Invitation Homes strategically acquires properties, including distressed assets, and invests in their renovation. This includes a 'build-to-rent' (BTR) operation, which added over 1,300 new homes in 2024. They use data analytics to identify investment opportunities and optimize property management.

The company utilizes a 'pod-based' operations model, with local teams overseeing homes. Technology plays a key role, with a dedicated app for maintenance requests. Customer service is a focus, with an average rating of 4.71 stars on post-maintenance surveys as of September 2024.

Invitation Homes has strategic alliances with homebuilders to streamline asset acquisition. In the second quarter of 2025, they partnered with homebuilders to acquire over 300 newly constructed homes, investing over $100 million. They also launched a developer lending program.

With a resident retention rate of nearly 80%, Invitation Homes focuses on providing a positive customer experience. The company's approach to property management ensures a consistent and high-quality rental experience. This drives customer satisfaction and loyalty.

Invitation Homes' operational model is characterized by scale and efficiency, leading to economies of scale. Their comprehensive approach ensures a consistent rental experience, which translates into customer benefits.

- Build-to-Rent (BTR) Expansion: Added over 1,300 new homes in 2024 through BTR operations.

- Strategic Partnerships: Collaborations with homebuilders to secure a steady pipeline of high-quality assets.

- Technology Integration: Utilizes a dedicated app for digitizing maintenance processes and streamlining the leasing experience.

- Customer Satisfaction: Achieved an average rating of 4.71 stars on post-maintenance surveys as of September 2024.

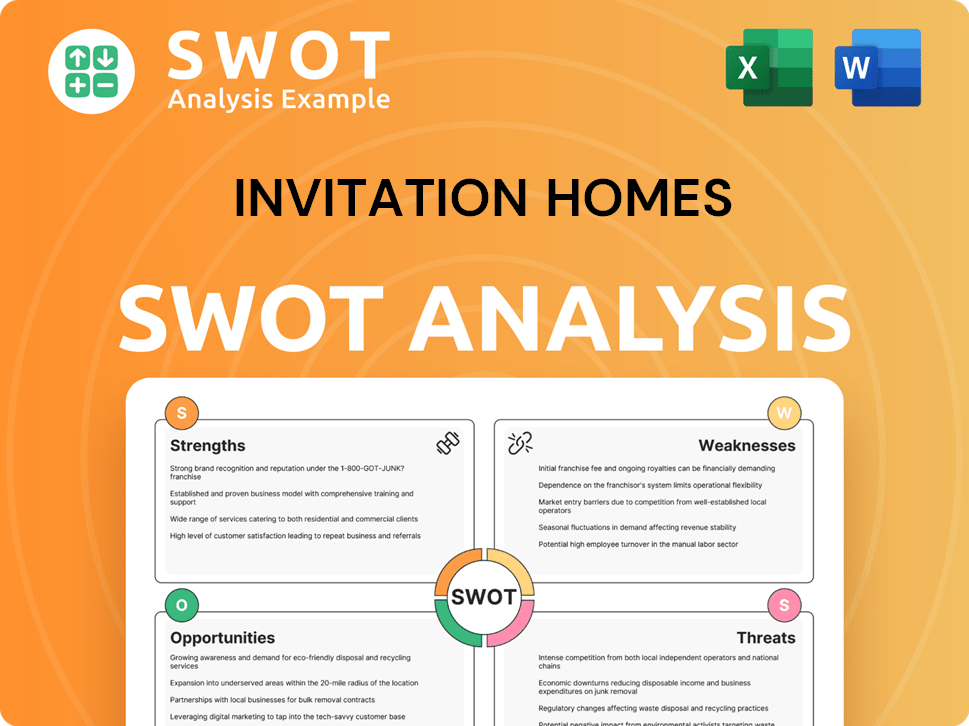

Invitation Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Invitation Homes Make Money?

The primary revenue stream for Invitation Homes, a leading player in the single-family rentals market, is rental income derived from its extensive portfolio of properties. The company's business model is centered on acquiring, renovating, leasing, and managing single-family homes, generating consistent revenue from tenants. Owners & Shareholders of Invitation Homes benefit from this model.

Invitation Homes' financial performance demonstrates the effectiveness of its revenue strategies. For the trailing twelve months ending March 31, 2025, the company reported a total revenue of $2.65 billion. This strong revenue base supports its ongoing operations and strategic initiatives.

In the first quarter of 2025, total revenues increased by 4.4% year-over-year to $674 million, demonstrating continued growth. This growth is driven by a combination of factors, including increased rental rates and the expansion of its property portfolio.

Invitation Homes' core revenue is primarily from rental income. The company has several strategies to boost its revenue, including increasing rental rates and expanding its property portfolio. The company's financial performance reflects these strategies.

- Same-store core revenues grew by 2.5% in Q1 2025.

- Renewal rent growth was solid at 5.2% during Q1 2025.

- New lease rent growth improved to 2.7% in April 2025.

- Blended same-store rent growth was 3.6%.

Beyond direct rental income, Invitation Homes has diversified revenue streams. These include value-add services and third-party property management, which enhance overall revenue performance.

- Other property income includes value-add services like smart home features.

- The third-party property management program significantly expanded in 2024.

- Managed home count grew by more than six and a half times to over 25,000 homes.

- Third-party managed business contributed $0.09 per share to core FFO and AFFO in 2024.

- Anticipated incremental $0.02 per share for 2025.

Invitation Homes employs strategic capital allocation and asset recycling to optimize its financial performance. This approach involves acquiring new properties and selling older ones, ensuring that the company remains competitive and profitable.

- Plans to execute $600 million in wholly-owned acquisitions in 2025.

- Offset by $500 million in dispositions.

- Focus on capital recycling from older assets into new investments.

- Average selling price of older homes was $423,000 as of May 2025.

Invitation Homes maintains a strong financial position, which supports its growth strategies and attracts investors. A consistent dividend policy is a key part of its investor appeal.

- Substantial liquidity of approximately $1.36 billion as of March 31, 2025.

- Q1 2025 dividend of $0.29 per share.

- A 3.57% increase from the previous quarter.

- Annualized dividend of $1.14.

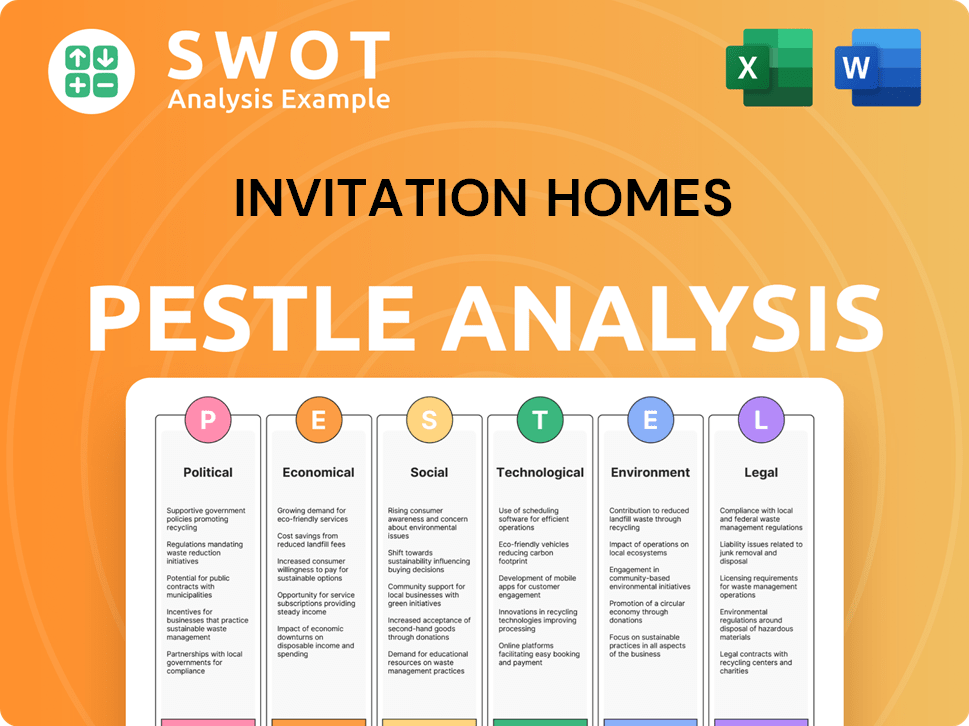

Invitation Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Invitation Homes’s Business Model?

Understanding the operational dynamics of Invitation Homes involves examining its key milestones, strategic initiatives, and competitive advantages within the single-family rentals sector. Emerging from the 2008 financial crisis, the company pioneered the institutional single-family rental market, swiftly establishing itself as a major player. This article delves into the strategies that have propelled Invitation Homes, highlighting its evolution and its approach to navigating the complexities of the rental market.

Invitation Homes has strategically positioned itself to capitalize on the growing demand for single-family rentals. This involves a deep dive into its operational efficiencies, technological integrations, and innovative approaches to property management. By examining its financial performance and market adaptations, we can understand how Invitation Homes maintains its leadership and continues to evolve within the real estate investment trust (REIT) landscape. The company's ability to adapt to market changes and leverage technology provides valuable insights.

The company's success is underscored by its ability to maintain high occupancy rates and generate consistent rental growth. The following sections provide a detailed analysis of the company's strategic moves, competitive strengths, and future outlook, offering a comprehensive view of its operations and market position. The information provided is designed to offer a clear understanding of how Invitation Homes operates and its impact on the rental market.

Invitation Homes emerged from the 2008 housing crisis, becoming the largest corporate owner of single-family homes in the U.S. A significant operational milestone was the complete integration of all assets onto a single operating and technology platform in March 2019. In 2024, the company expanded its joint venture and third-party managed home count by over six and a half times, to more than 25,000 homes.

The company has refined its build-to-rent model and partnered with homebuilders to focus on density and scale in core markets. In 2025, Invitation Homes launched a developer lending program with an initial $32.7 million loan, supporting housing development and securing future acquisition opportunities. The company is also adapting to new trends and technology shifts, utilizing an in-house Transformation and Innovation Office (TIO).

Invitation Homes' scale, with over 85,000 homes, allows for significant economies of scale and operational efficiencies. Its in-house marketing, leasing, and maintenance teams contribute to higher NOI margins. The company's rehabilitation expertise and partnerships with homebuilders provide a steady pipeline of assets. Technology leadership, including Smart Home tech and AI, also contributes to its competitive advantage.

Despite market challenges, including supply pressures and rising interest rates, Invitation Homes has maintained high occupancy rates, averaging 97.2% in Q1 2025. The company consistently achieves positive rental and NOI growth. A high resident retention rate of nearly 80% reflects its commitment to providing a consistent leasing experience.

The Invitation Homes business model focuses on acquiring, renovating, leasing, and managing single-family rental properties. This model allows the company to generate income through rental payments and property management fees. The company's approach involves strategic acquisitions, efficient property management, and leveraging technology to enhance the tenant experience. For a deeper dive, explore the Marketing Strategy of Invitation Homes.

- Acquisition and Renovation: Acquiring properties and renovating them to attract tenants.

- Leasing and Management: Offering a consistent, worry-free leasing experience.

- Technology Integration: Utilizing Smart Home technology and AI for operational efficiency.

- Strategic Partnerships: Collaborating with homebuilders for a steady supply of properties.

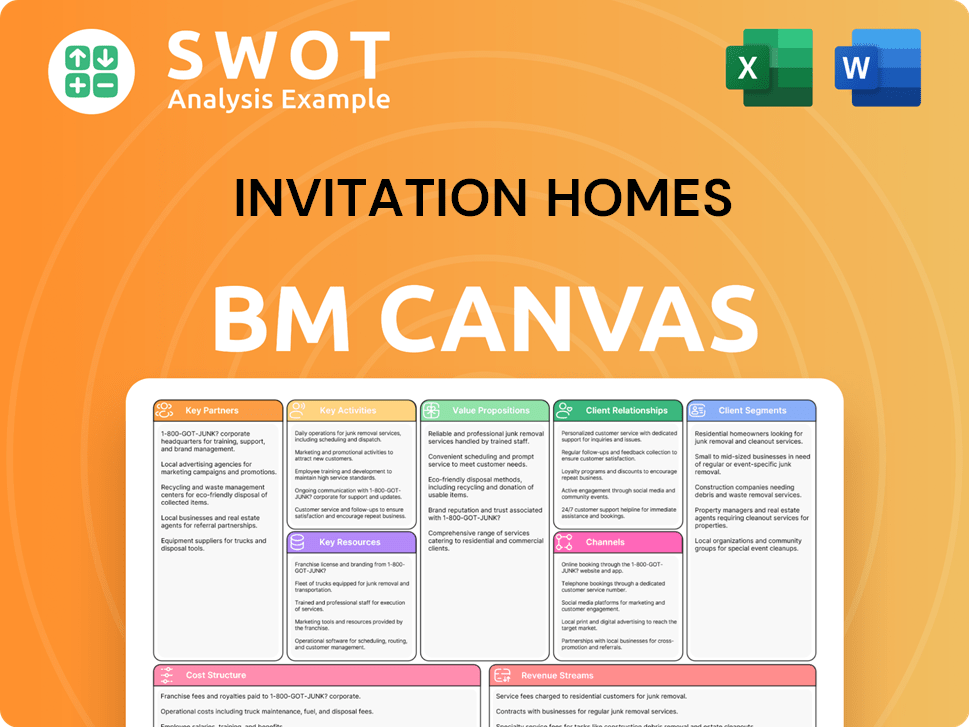

Invitation Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Invitation Homes Positioning Itself for Continued Success?

Invitation Homes holds a leading market position as the premier single-family home leasing and management company in the U.S. Its vast portfolio, exceeding 85,000 homes across 16 markets, provides a significant competitive advantage in the fragmented single-family rental (SFR) sector. The company's ability to maintain high occupancy rates, averaging 97.2% in Q1 2025, highlights robust demand and customer loyalty within the Invitation Homes rental properties.

Despite its strengths, Invitation Homes faces several key risks. Economic uncertainties, regulatory shifts, and market volatility driven by rising interest rates and inflation could impact the rental market. Rising property taxes, projected to increase by 5-6% in 2025, pose a challenge to operational costs. Competition from other REITs, private equity firms, and individual investors, along with new home deliveries, also presents ongoing competitive pressures. The company's high debt levels and dependence on the overall housing market are also factors to consider.

Invitation Homes is a leader in the single-family rentals market, owning a large portfolio of homes. Its scale and operational expertise give it a strong competitive edge. The company consistently achieves high occupancy rates, demonstrating strong demand for its Invitation Homes business model.

Key risks include economic downturns, changes in regulations, and market fluctuations. Rising property taxes and competition from other investors pose challenges. High debt levels and dependence on the housing market are also significant factors to consider.

The company is cautiously optimistic for 2025, projecting core FFO per share between $1.88 and $1.94. Strategic initiatives include expanding third-party property management and developing new homes. The company is focused on capital recycling and leveraging technology to improve operations.

For fiscal year 2025, the company anticipates core FFO per share to range between $1.88 and $1.94, and AFFO per share between $1.58 and $1.64. It projects same-store NOI growth in the range of 1% to 3%. The company plans to maintain an occupancy rate of around 96.5% by year-end 2025.

Invitation Homes is actively expanding its third-party property management program and developing new homes in key U.S. markets. The company plans to execute $600 million in acquisitions, offset by $500 million in dispositions. The company's strong liquidity, totaling $1.36 billion as of March 31, 2025, supports its growth strategy.

- Focus on capital recycling from older assets into new investments.

- Leveraging technology, including AI, to streamline operations.

- Disciplined financial management and strategic partnerships.

- Maintains a positive long-term outlook, emphasizing affordable housing value.

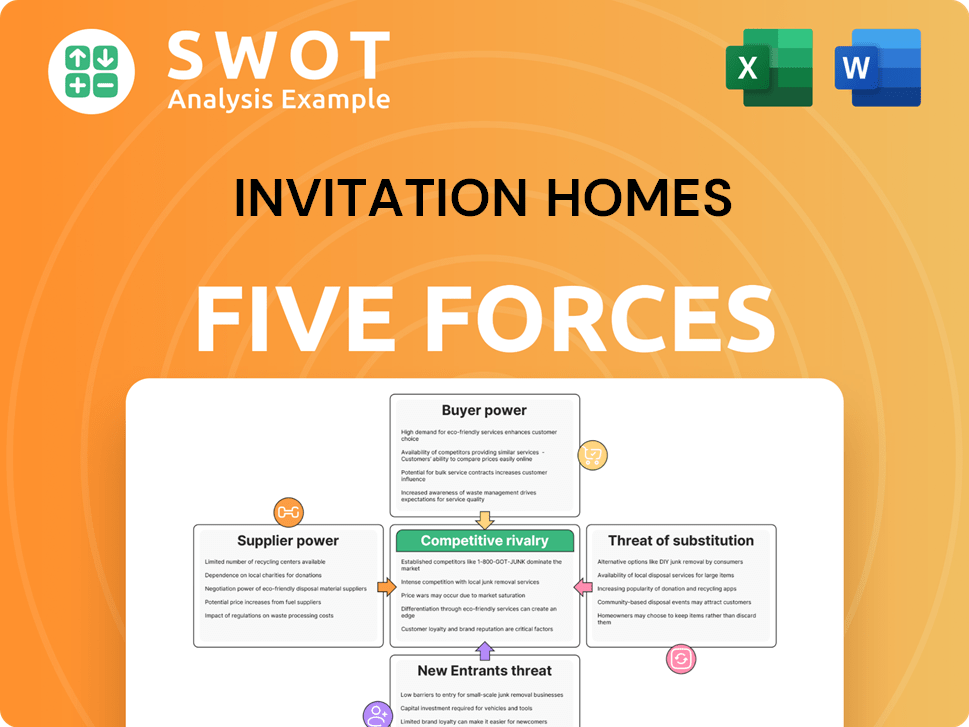

Invitation Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Invitation Homes Company?

- What is Competitive Landscape of Invitation Homes Company?

- What is Growth Strategy and Future Prospects of Invitation Homes Company?

- What is Sales and Marketing Strategy of Invitation Homes Company?

- What is Brief History of Invitation Homes Company?

- Who Owns Invitation Homes Company?

- What is Customer Demographics and Target Market of Invitation Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.