Invitation Homes Bundle

Can Invitation Homes Maintain Its Dominance in the Single-Family Rental Market?

Invitation Homes, a leading Real Estate Investment Trust (REIT), has revolutionized the single-family rental market since its inception in 2012. Born from the ashes of the 2008 housing crisis, the company strategically acquired and renovated properties, offering a new standard in rental living. Today, Invitation Homes stands as the largest owner of single-family rentals in the U.S., a testament to its innovative approach.

Understanding the Invitation Homes SWOT Analysis is crucial for grasping its Growth Strategy and Future Prospects. As the demand for Single-Family Rentals continues to surge, Invitation Homes must navigate a competitive landscape and leverage its market position. This analysis will delve into the company's expansion plans, financial performance, and competitive advantages, offering insights into its long-term investment potential and real estate market outlook.

How Is Invitation Homes Expanding Its Reach?

Invitation Homes' Growth Strategy is centered on expanding its portfolio and solidifying its position in the single-family rental market. The company focuses on strategic acquisitions, build-for-rent initiatives, and portfolio optimization to drive growth. This approach is designed to capitalize on favorable market conditions and meet the increasing demand for rental housing.

The company's expansion efforts are primarily focused on high-growth markets, particularly in the Sunbelt region. These areas offer strong economic fundamentals and demographic trends that support the demand for rental properties. By targeting these markets, Invitation Homes aims to maximize its investment returns and achieve sustainable growth.

A key component of Invitation Homes' strategy involves acquiring single-family homes. The company carefully selects properties based on specific investment criteria. This includes properties in desirable neighborhoods with good schools and amenities. In the first quarter of 2024, Invitation Homes acquired 376 homes for approximately $138 million, showcasing its commitment to portfolio expansion through targeted acquisitions.

Invitation Homes actively acquires single-family homes in high-growth markets. The focus is on properties that meet strict investment criteria. This strategy is a core element of the company's expansion plan.

The company selectively partners with homebuilders for new construction. This allows for the acquisition of modern, energy-efficient homes. This approach helps to diversify the portfolio and cater to different customer segments.

Invitation Homes actively manages its portfolio through strategic dispositions. This involves selling older or underperforming assets. The capital is then reinvested into higher-growth opportunities.

The company focuses on enhancing existing properties through renovations. These upgrades aim to increase rental income and improve resident satisfaction. This strategy supports long-term value creation.

Invitation Homes employs several strategies to drive growth and enhance its market position. These include strategic acquisitions, build-for-rent projects, and portfolio optimization. These initiatives are designed to capitalize on market trends and improve financial performance.

- Targeted Acquisitions: Focus on acquiring properties in high-growth markets.

- Build-for-Rent: Partnering with homebuilders for new construction.

- Portfolio Management: Strategic dispositions and reinvestment of capital.

- Property Enhancements: Renovations and upgrades to increase rental income.

The company's expansion initiatives are supported by a disciplined approach to capital allocation and portfolio management. By focusing on strategic acquisitions, build-for-rent projects, and continuous portfolio optimization, Invitation Homes aims to achieve sustainable growth and deliver value to its shareholders. Further insights into the company's approach can be found in the Marketing Strategy of Invitation Homes.

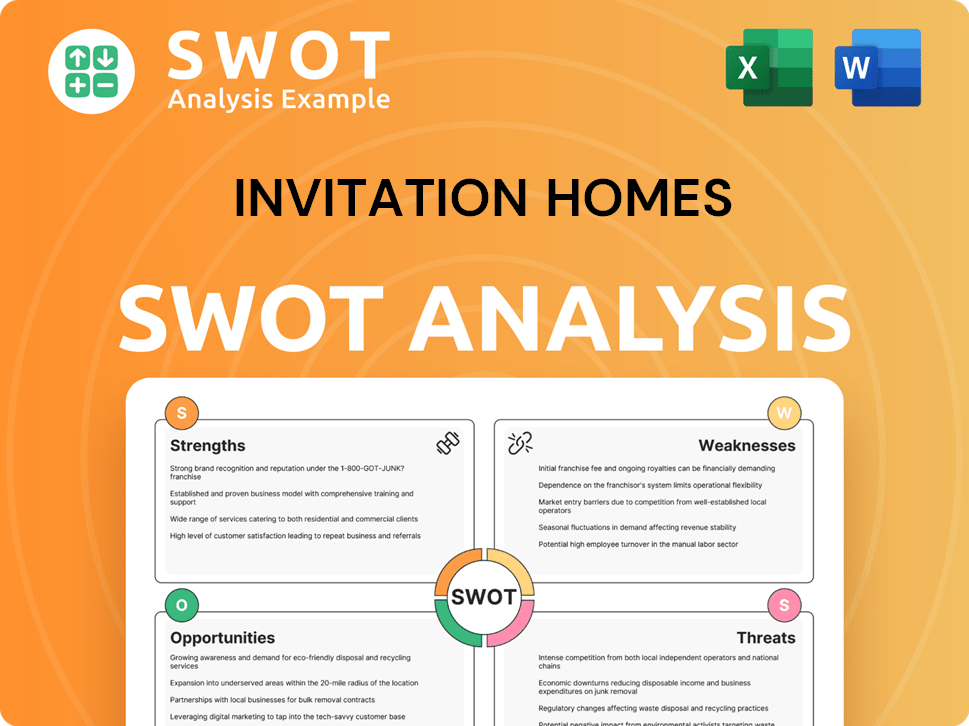

Invitation Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Invitation Homes Invest in Innovation?

Invitation Homes (IH) heavily relies on technology and innovation to fuel its growth strategy and optimize operations in the real estate investment sector. Their approach to digital transformation is evident in their proprietary technology platform. This platform integrates various aspects of the business, supporting data-driven decision-making across acquisitions, pricing, and property management within their single-family rentals portfolio.

The company uses advanced analytics and machine learning to predict market trends and assess property values. This enhances the resident experience. This focus on technological advancement helps IH maintain a competitive edge and supports its future growth potential. For investors looking at long-term investment opportunities, understanding IH's tech strategy is crucial.

A key area of innovation is in property management, where IH employs smart home technology and automation. This streamlines operations and provides enhanced services to residents. This includes smart locks, thermostats, and leak detection systems. These technologies improve energy efficiency, reduce maintenance costs, and offer residents greater control over their living environment. For a deeper dive into the company's foundational principles, explore the Mission, Vision & Core Values of Invitation Homes.

IH's platform enables data-driven decisions. This helps in identifying acquisition opportunities and optimizing rental pricing. The company uses data to manage its vast portfolio of homes efficiently.

IH uses smart home technology to streamline operations and enhance resident services. This includes smart locks, thermostats, and leak detection systems.

IH invests in virtual touring capabilities and online leasing platforms. This makes the rental process more convenient and accessible for prospective residents. This is a key part of their competitive advantages.

IH focuses on sustainability within its properties. They incorporate energy-efficient appliances and water-saving fixtures. This aligns with environmental goals and reduces operational costs.

IH continuously invests in its technological infrastructure and digital tools. This underscores its commitment to maintaining a competitive edge. This supports its growth objectives.

IH uses advanced analytics and machine learning for market analysis. This helps in predicting trends and assessing property values. This is part of their real estate market outlook.

IH's focus on technology and innovation is critical to its growth strategy. This includes data-driven decision-making, smart home technology, and sustainability initiatives. These strategies contribute to the company's financial performance and long-term investment potential.

- Data Analytics: IH uses data analytics to identify acquisition opportunities and optimize rental pricing. This is a key part of their market share analysis.

- Smart Home Integration: Smart home technologies enhance resident experience and improve operational efficiency.

- Online Leasing: Virtual tours and online platforms streamline the rental process.

- Sustainability: Energy-efficient appliances and water-saving fixtures reduce costs and align with environmental goals.

- Continuous Improvement: Ongoing investment in technology ensures a competitive edge and supports expansion plans.

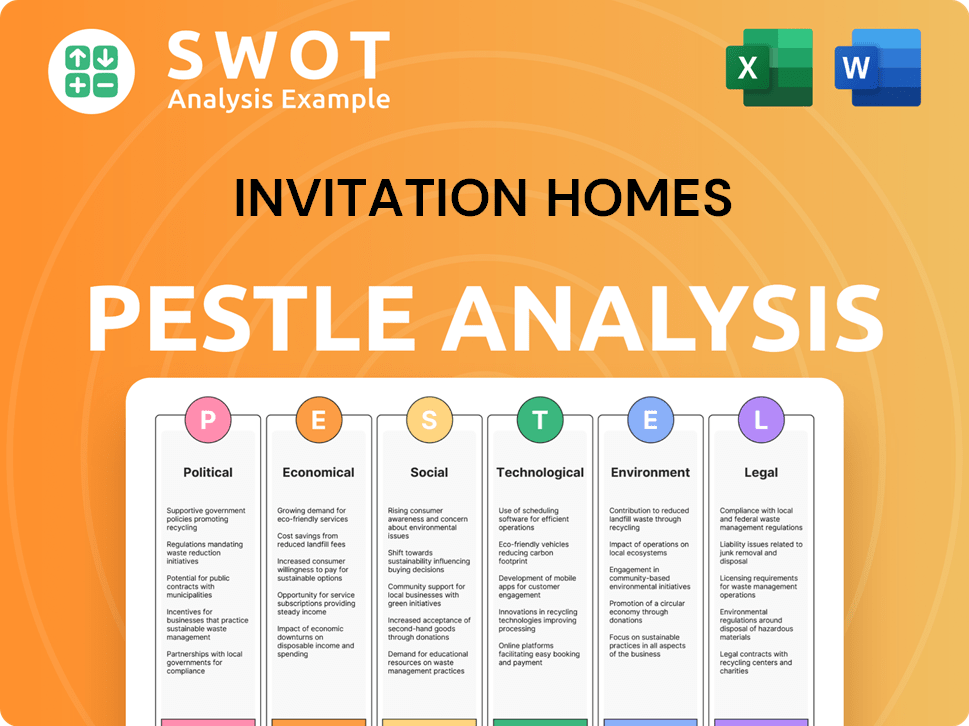

Invitation Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Invitation Homes’s Growth Forecast?

The financial outlook for Invitation Homes is stable, supported by the consistent demand for single-family rentals. The company's disciplined operational strategy further strengthens this outlook. For the full year 2024, the company anticipates core revenue growth of between 4.5% and 6.0%.

Invitation Homes projects adjusted funds from operations (AFFO) per share in the range of $1.81 to $1.87. This anticipated growth is driven by strong occupancy rates and continued rent growth. The company's financial strategy emphasizes maintaining a strong balance sheet and prudent capital allocation.

The company’s ability to generate stable cash flows from its large portfolio of rental homes and its access to capital markets for funding future acquisitions and development projects supports its financial ambitions. Analyst forecasts generally align with the company's positive outlook, anticipating continued growth in rental income and AFFO per share in the coming years.

For the first quarter of 2024, Invitation Homes reported total revenues of $600.9 million, increasing from $564.2 million in the same period last year. This demonstrates solid financial performance and growth. Net income attributable to common shareholders was $80.2 million for the first quarter of 2024.

New lease rent growth for the first quarter of 2024 was 4.4%, while renewal lease rent growth was 5.7%. These figures reflect the company's ability to increase rental income. As of March 31, 2024, occupancy rates were at 97.2%, indicating strong demand for their properties.

Invitation Homes maintains a healthy dividend payout, reflecting its status as a REIT and its commitment to returning value to shareholders. This is an important factor for investors seeking income from their Real Estate Investment.

The company is well-positioned to capitalize on the ongoing demand for single-family rentals. This demand is supported by broader real estate market outlook trends. This is a key element of their growth strategy.

Analysts anticipate continued growth in rental income and AFFO per share. This positive outlook suggests promising future prospects for the company. The Invitation Homes stock price forecast is generally positive.

Their investment strategy focuses on maintaining a strong financial position and allocating capital effectively. This approach helps them navigate the real estate market outlook. Understanding how does Invitation Homes make money is crucial for investors.

The company's financial performance is driven by strong occupancy rates and rent growth. This is a key factor in their Invitation Homes financial performance. Examining Invitation Homes quarterly earnings provides further insights.

With a focus on single-family rentals, the company presents opportunities for Invitation Homes long-term investment. Investors should consider the Invitation Homes dividend history. For more details, check out this article about Invitation Homes.

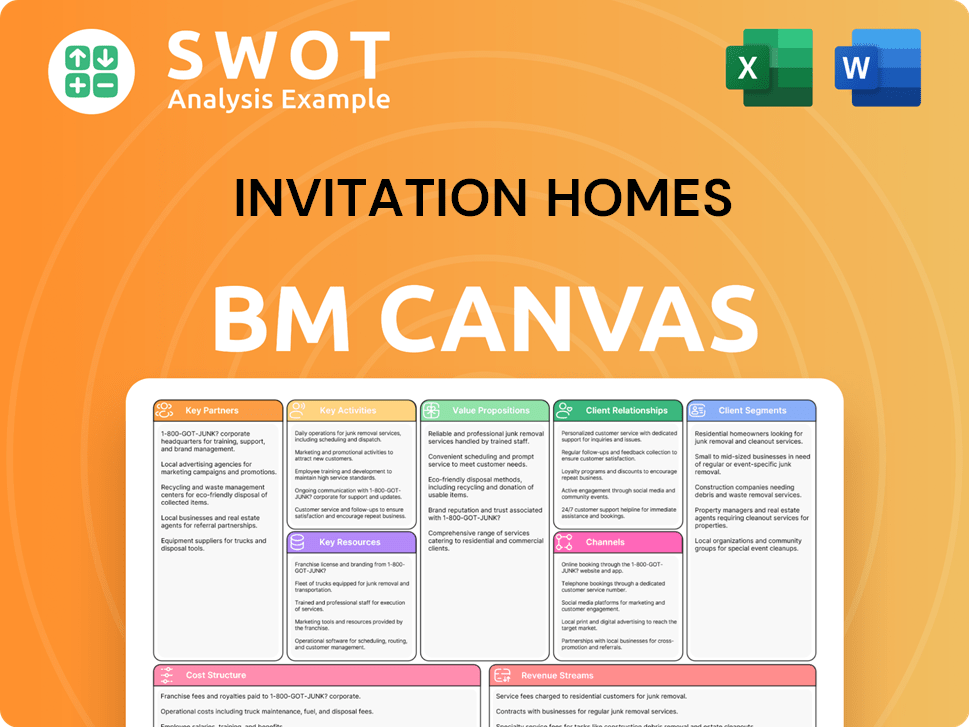

Invitation Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Invitation Homes’s Growth?

The future of Invitation Homes, a key player in the single-family rentals market, faces several potential risks and obstacles. These challenges range from increased competition and regulatory changes to supply chain issues and technological disruptions. Understanding these risks is crucial for assessing the company's long-term growth potential and its ability to navigate the dynamic real estate investment landscape.

Competition from other institutional investors and smaller operators in the single-family rental space can drive up property acquisition costs and potentially limit rent growth. Regulatory changes, such as rent control measures and evolving landlord-tenant laws, could restrict operational flexibility and profitability. These factors, alongside internal resource constraints, could affect the company's service quality and operational scalability.

Furthermore, supply chain vulnerabilities and technological disruptions pose additional challenges. The availability and cost of materials and labor for renovations and maintenance can impact operational expenses. The development of superior platforms or services by competitors may also influence the resident experience and operational efficiency. For more insights, you can read a Brief History of Invitation Homes.

The single-family rental market is becoming increasingly crowded. This includes competition from institutional investors and smaller, local operators. Increased competition can lead to higher acquisition costs for properties, potentially impacting profit margins.

Regulatory changes at local and state levels pose a significant risk. Rent control initiatives, stricter eviction moratoriums, and evolving landlord-tenant laws could limit operational flexibility and profitability for Invitation Homes. These changes can vary significantly by jurisdiction.

Supply chain issues continue to affect the real estate sector. Fluctuations in the cost and availability of materials and labor for renovations and maintenance can lead to higher operational expenses. This impacts the company's financial performance.

Technological advancements could disrupt the market. If competitors develop superior platforms or services that enhance the resident experience or operational efficiency, it could affect Invitation Homes' market position. This demands constant innovation.

Attracting and retaining skilled property management personnel is a challenge. This could affect service quality and operational scalability. A tight labor market can exacerbate these challenges, impacting the ability to manage a large portfolio.

Rising interest rates and broader affordability issues could influence the rental market. Higher interest rates increase borrowing costs for acquisitions, while affordability issues could affect rental demand. These factors require strategic adjustments.

Invitation Homes mitigates these risks through a diversified portfolio across multiple markets. This diversification reduces reliance on any single region. The company also uses robust risk management frameworks, including scenario planning, to address potential economic downturns or significant regulatory shifts.

The real estate market outlook includes factors such as rising interest rates and the broader affordability crisis. These elements influence future rental demand and policy decisions. The company's ability to adapt to these changes will be crucial for its future growth potential.

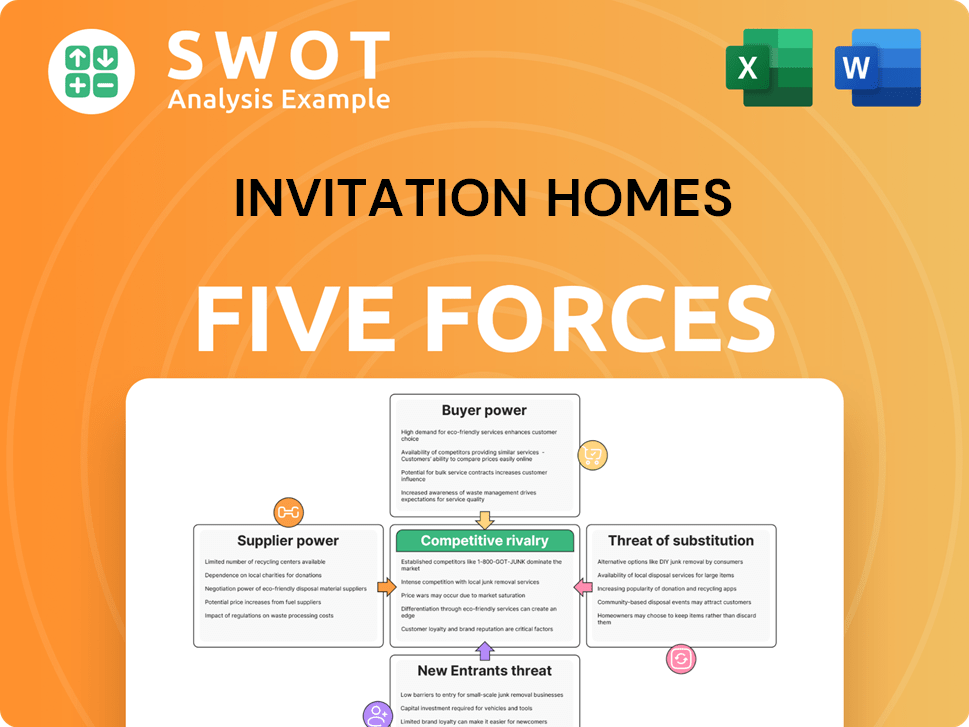

Invitation Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Invitation Homes Company?

- What is Competitive Landscape of Invitation Homes Company?

- How Does Invitation Homes Company Work?

- What is Sales and Marketing Strategy of Invitation Homes Company?

- What is Brief History of Invitation Homes Company?

- Who Owns Invitation Homes Company?

- What is Customer Demographics and Target Market of Invitation Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.