Invitation Homes Bundle

Can Invitation Homes Maintain Its Dominance in the SFR Market?

The single-family rental (SFR) market is booming, reshaping the housing landscape due to changing demographics and affordability issues. Invitation Homes, a key player since 2012, capitalized on the post-2008 financial crisis. They transformed distressed assets into a professionally managed rental portfolio, becoming a leading Invitation Homes SWOT Analysis.

Understanding the Invitation Homes competitive landscape is crucial for investors and strategists alike. This analysis will delve into the company's Invitation Homes competitors, providing a comprehensive Invitation Homes market analysis to assess its position within the dynamic single-family rental market. We'll explore its growth, operational strategies, and financial performance, offering insights into its ability to compete against other real estate investment trusts (REITs) in the rental home industry.

Where Does Invitation Homes’ Stand in the Current Market?

Invitation Homes holds a significant market position within the single-family rental industry. The company is recognized as one of the largest institutional owners and operators of single-family rental homes in the United States. This strong position is built on its extensive portfolio and strategic geographic footprint, primarily concentrated in high-growth areas across 16 states.

The company's focus on acquiring well-located homes that appeal to long-term renters reflects a strategic shift towards a more stable, higher-quality portfolio. Invitation Homes primarily serves a diverse customer segment seeking quality single-family living without the burdens of homeownership, often families or individuals who prefer the space and amenities of a house. The Owners & Shareholders of Invitation Homes benefit from this strategy.

Invitation Homes' financial health is robust, with consistent revenue growth and strong occupancy rates. As reported in its most recent financial disclosures for Q1 2025, the company showed a 5.6% increase in total revenues compared to the prior year period. Its scale provides significant advantages, including economies of scale in property management, maintenance, and marketing, which are often challenging for smaller, individual landlords to achieve.

While precise market share figures for the single-family rental market can vary, Invitation Homes is consistently recognized as one of the largest players. The company's portfolio comprises tens of thousands of homes, demonstrating a substantial presence in the rental home industry. This scale allows for operational efficiencies and a broad geographic reach.

Invitation Homes' geographic footprint is primarily concentrated in sunbelt markets and other high-growth areas. These markets, including Atlanta, Charlotte, Dallas, Phoenix, and Orlando, are characterized by strong job growth and increasing demand for rental housing. This strategic focus supports the company's growth and profitability.

The company primarily serves a diverse customer segment seeking quality single-family living without the burdens of homeownership. This often includes families or individuals who prefer the space and amenities of a house. This targeted approach helps to maintain high occupancy rates and strong customer satisfaction.

Invitation Homes demonstrates robust financial health, with consistent revenue growth and strong occupancy rates. The company's scale provides significant advantages, including economies of scale in property management, maintenance, and marketing. This financial strength supports its market position and long-term growth prospects.

Invitation Homes benefits from several key advantages. The company's scale allows for operational efficiencies and a broad geographic reach. Its focus on high-growth markets and a targeted customer segment contributes to its strong market position.

- Economies of scale in property management and maintenance.

- Strategic focus on high-growth markets.

- Strong financial performance with consistent revenue growth.

- Targeted customer segment seeking single-family living.

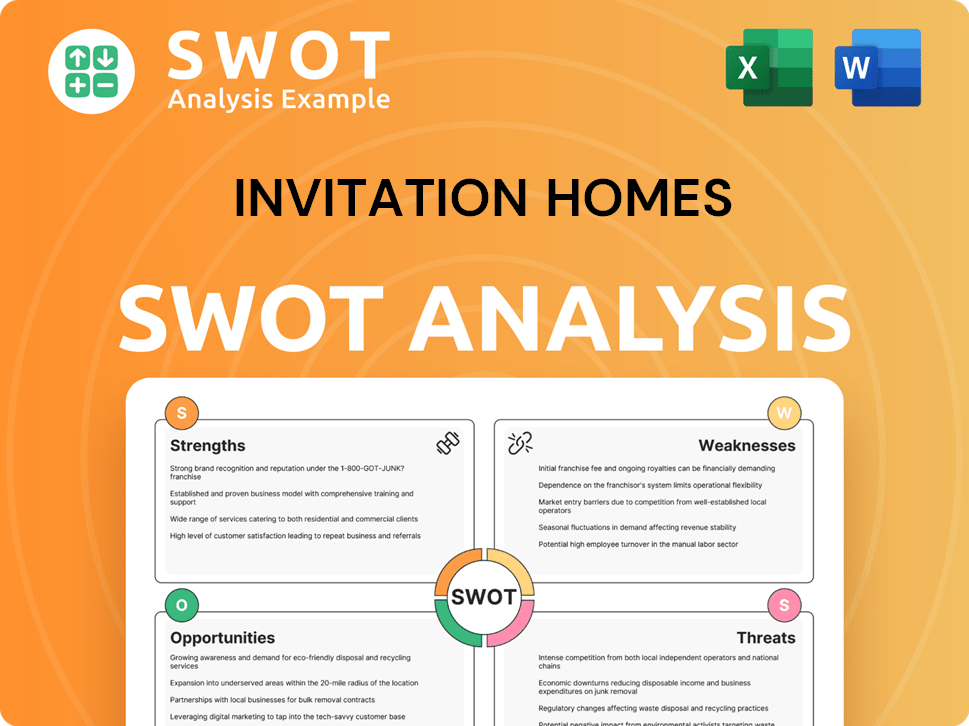

Invitation Homes SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Invitation Homes?

The Growth Strategy of Invitation Homes is significantly shaped by the competitive landscape of the single-family rental market. This market is characterized by both direct and indirect competitors, each vying for market share and tenant acquisition. Understanding these dynamics is crucial for assessing the company's performance and future prospects.

The competitive landscape for Invitation Homes involves a complex interplay of institutional and individual players. The company faces challenges from other large REITs, as well as a vast number of smaller landlords. This competition impacts acquisition strategies, operational efficiencies, and tenant retention efforts.

Direct competitors include publicly traded single-family rental REITs. These companies operate under similar business models. They focus on efficient property management and strategic acquisitions.

A major competitor with a large portfolio of single-family homes across the U.S. They often compete for similar acquisition opportunities and tenant bases. In 2023, AMH reported a total revenue of approximately $1.5 billion.

Tricon Residential has a diversified portfolio including multi-family properties. They have a significant presence in both the U.S. and Canada. In early 2024, Blackstone proposed acquiring Tricon Residential, which indicates consolidation within the industry.

Competition involves acquiring properties at favorable cap rates and optimizing operational efficiencies. Companies invest in smart home technology and streamlined online processes. Resident experiences and high occupancy rates are also key factors.

Indirect competition comes from individual investors and smaller property management companies. These smaller players may offer localized services or niche market expertise. The broader housing market also influences rental demand.

Mergers and acquisitions, like the Blackstone-Tricon deal, indicate consolidation. This trend could intensify competition among the remaining large entities. The single-family rental market is dynamic, with shifts in demand and supply impacting the competitive landscape.

Several factors influence the competitive dynamics within the single-family rental market. These include property acquisition strategies, operational efficiency, and tenant experience.

- Acquisition Strategies: The ability to acquire properties at favorable cap rates is crucial.

- Operational Efficiency: Streamlining property management and reducing costs are key.

- Technology Integration: Utilizing smart home technology and online services enhances tenant experience.

- Tenant Retention: Providing quality services and maintaining high occupancy rates are essential.

- Market Conditions: The broader housing market, including home sales and affordability, influences demand.

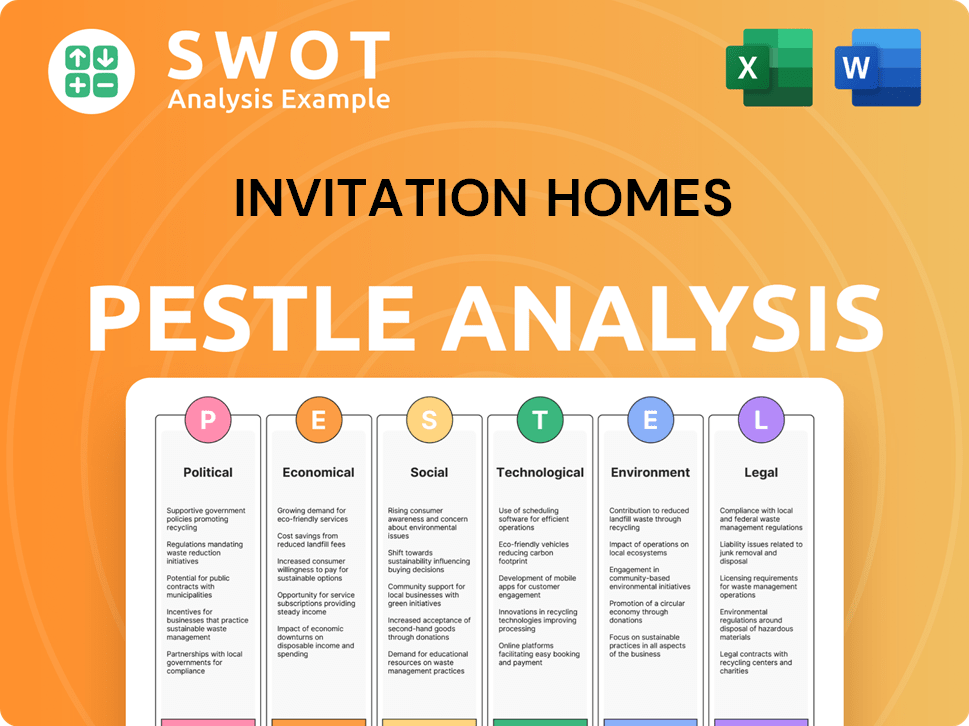

Invitation Homes PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Invitation Homes a Competitive Edge Over Its Rivals?

Understanding the competitive advantages of a company like Invitation Homes is crucial for anyone involved in the single-family rental market or real estate investment trusts (REITs). The company has carved a significant niche in the rental home industry. A deep dive into its strengths reveals how it maintains its position in a competitive landscape.

Invitation Homes' success stems from a combination of strategic moves and operational excellence. These elements contribute to a strong competitive edge. Analyzing these aspects provides valuable insights into the company's ability to sustain and grow its market share. The company's approach offers lessons for investors and competitors alike.

Invitation Homes boasts a substantial portfolio of single-family homes. This portfolio is spread across multiple key U.S. markets. This geographic diversity helps mitigate risks. It also provides opportunities for economies of scale.

The company has invested heavily in technology platforms. These platforms are used for property management and resident services. This investment leads to operational efficiencies and improved resident experiences. The company also uses data analytics to make informed decisions.

Invitation Homes has built a reputation as a reliable landlord. This reputation is a key factor in attracting and retaining residents. The company's focus on quality and consistency further enhances its brand.

As a publicly traded REIT, Invitation Homes has access to capital markets. This access allows for large-scale acquisitions. It also enables strategic investments that many competitors cannot match. This advantage supports the company's growth strategy.

Invitation Homes' competitive advantages are multifaceted. These advantages include significant scale, technological innovation, and a strong brand. These elements create a robust foundation for sustained success in the single-family rental market. For a deeper understanding of the company's target demographic, consider reading about the Target Market of Invitation Homes.

- Scale: Invitation Homes operates with a substantial portfolio of homes across numerous markets. This scale allows for operational efficiencies and cost advantages.

- Technology: The company uses advanced technology for property management and resident services. This technology improves efficiency and resident satisfaction.

- Brand: Invitation Homes has cultivated a strong brand reputation. This reputation is built on reliability and quality.

- Capital Access: As a REIT, the company has access to capital markets. This access supports acquisitions and strategic investments.

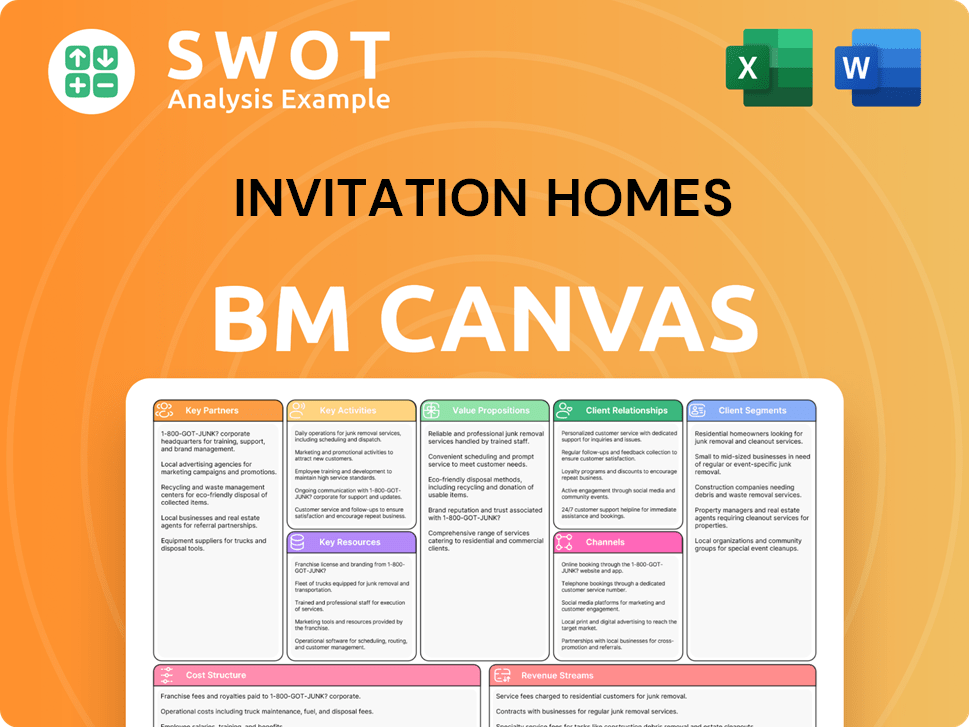

Invitation Homes Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Invitation Homes’s Competitive Landscape?

The single-family rental (SFR) industry is experiencing significant shifts, creating both challenges and opportunities for companies like Invitation Homes. Technological advancements are reshaping property management, with smart home technologies and data analytics playing a crucial role. Regulatory changes, evolving consumer preferences, and economic factors further influence the competitive landscape. Understanding these trends is crucial for strategic planning and maintaining a competitive edge.

Invitation Homes faces a dynamic market. The company must navigate potential impacts from housing affordability, interest rate fluctuations, and shifts in rental demand. Competition from other institutional investors and individual landlords adds further complexity. However, the underlying demand for SFRs, driven by demographic trends and the desire for more space, offers opportunities for growth and expansion. Strategic adaptation and innovation are key to success in this environment.

Technological integration is transforming property management, with smart home features and AI-driven analytics gaining traction. Regulatory changes, including rent control and zoning laws, require constant adaptation. Consumer preferences are evolving, with demand increasing for flexible lease terms and pet-friendly properties. These trends directly impact how Invitation Homes operates and competes within the Invitation Homes’ brief history.

Potential shifts in housing affordability and interest rates could influence the balance between homeownership and renting. An increase in housing supply or a cooling of rental demand in key markets could impact occupancy rates and rental growth. Intense competition from institutional investors and individual landlords will continue to pressure acquisition opportunities and rental pricing. Maintaining consistent property quality and managing maintenance costs across a large portfolio are also ongoing challenges.

The demographic trend of delayed homeownership and the demand for single-family homes continue to fuel the SFR market. Expansion into new, underserved markets with favorable demographics and strong job growth presents a clear opportunity. Innovation in resident services, such as enhanced digital platforms, could further differentiate Invitation Homes. Strategic partnerships, especially with homebuilders for build-to-rent communities, offer a scalable path for portfolio growth. The company can leverage its position to capitalize on the long-term demand for quality rental housing.

Invitation Homes' future depends on operational excellence, technological integration, and strategic portfolio expansion. Adaptability to market fluctuations and capitalizing on the long-term demand for quality rental housing are crucial. The company must focus on innovation in resident services and strategic partnerships to maintain a competitive advantage. Maintaining financial health, such as managing debt and ensuring profitability, is vital for sustained growth.

In 2024, the single-family rental market saw continued growth, with occupancy rates remaining high in many key markets. According to recent reports, the demand for rental homes is expected to remain strong, driven by factors such as affordability and lifestyle preferences. The company's ability to adapt to these trends will be crucial for its future performance. Here are some key factors:

- Market Analysis: Understanding local market dynamics, including rent growth and occupancy rates, is crucial for strategic decision-making.

- Competitive Positioning: Differentiating through service quality, technology, and strategic partnerships can help maintain a competitive edge.

- Financial Performance: Managing costs effectively and optimizing rental pricing are essential for profitability and sustained growth.

- Geographic Footprint: Expanding into new markets with favorable demographics and job growth can boost growth.

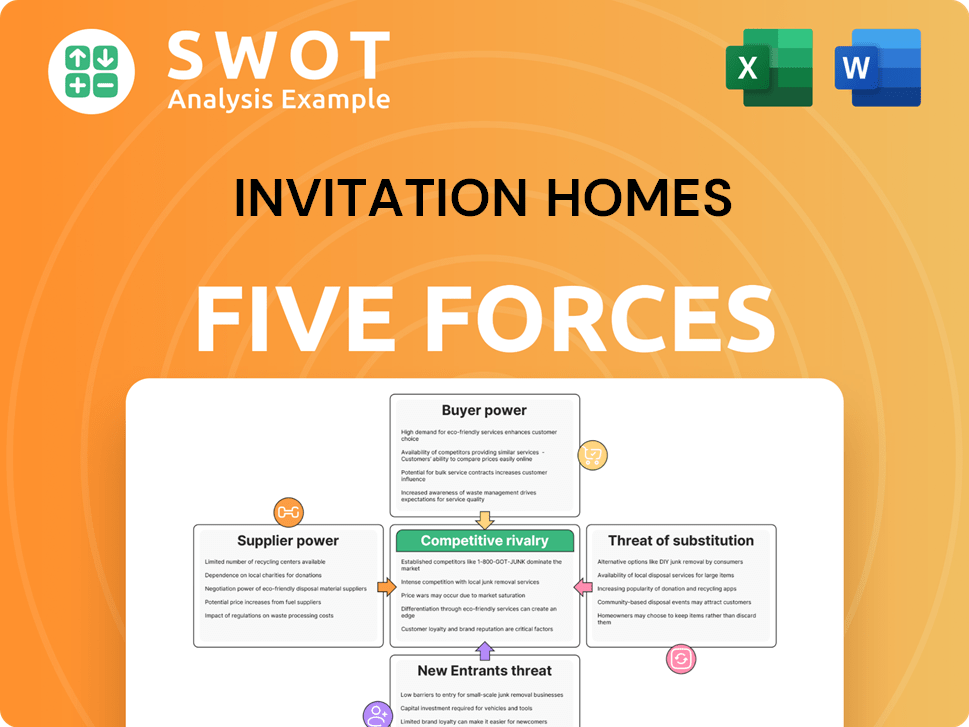

Invitation Homes Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Invitation Homes Company?

- What is Growth Strategy and Future Prospects of Invitation Homes Company?

- How Does Invitation Homes Company Work?

- What is Sales and Marketing Strategy of Invitation Homes Company?

- What is Brief History of Invitation Homes Company?

- Who Owns Invitation Homes Company?

- What is Customer Demographics and Target Market of Invitation Homes Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.