Kier Group Bundle

How Well Do You Know Kier Group's Past?

Journey back in time to uncover the fascinating Kier Group SWOT Analysis and the remarkable story of Kier Group, a British construction giant. From its humble beginnings in 1928 as Lotz & Kier, this infrastructure and construction company has evolved into a major player. Discover the key milestones and strategic shifts that have shaped Kier's enduring presence in the UK market.

This exploration of Kier Group's history will illuminate its expansion from specialized concrete engineering to its current status as a leading construction and infrastructure services provider. We'll examine the pivotal moments, strategic decisions, and significant projects that have defined Kier's journey, including its financial performance and its role in British construction and infrastructure projects. Understand how Kier Group has navigated challenges and capitalized on opportunities to build a lasting legacy.

What is the Kier Group Founding Story?

The Kier Group, a prominent player in the construction and infrastructure sectors, traces its roots back to 1928. The company's founding marks the beginning of a long and complex Kier history, evolving from a small firm to a significant British construction entity.

The Kier company was established by two Danish engineers, Jorgen Lotz and Olaf Kier. Initially named Lotz & Kier, the company's early focus was on concrete engineering, setting the stage for its future endeavors in infrastructure projects.

The company's initial base of operations was in Stoke-on-Trent, UK. Olaf Kier, with his engineering background from the University of Copenhagen and experience in concrete projects, partnered with Lotz to launch the construction business. Shortly after its inception, Jorgen Lotz left the company, and the name was changed to J.L. Kier & Co Ltd, maintaining Lotz's initials.

The initial business model centered around concrete engineering, focusing on innovative techniques such as contiguous cylindrical reinforced concrete grain and cement silos using continuously sliding formwork.

- Early projects included grain silos at Barking in 1929.

- Followed by projects in Northampton, Peterborough, Melksham, Gloucester, and Witham.

- Cement silos were constructed in Norwich, Cambridge, Trinidad, and India.

- This specialization met a need in the growing construction industry, particularly for large-scale concrete structures.

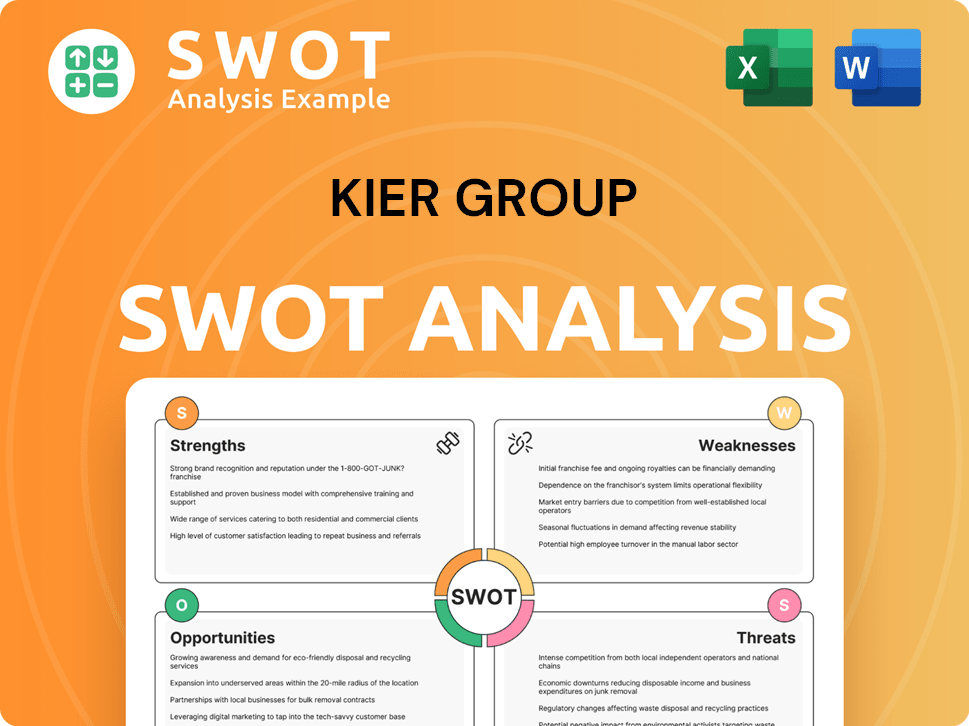

Kier Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Kier Group?

The early years of the Kier Group, a prominent British construction company, were marked by significant growth and strategic shifts. Initially a private entity, J.L. Kier & Co Ltd transitioned to a public listing in 1963, although the Kier family retained a substantial ownership stake. This period set the stage for the company's expansion and its evolution within the British construction landscape.

In 1963, J.L. Kier & Co Ltd became a publicly listed company on the London Stock Exchange. In 1973, Kier merged with W. & C. French to form French Kier. This merger, however, led to financial difficulties due to losses from fixed-price motorway contracts. John Mott, a long-serving Kier engineer, was appointed as chief executive to address these challenges.

The company underwent significant changes in the late 20th century. In 1986, Beazer acquired Kier, and subsequently, Hanson plc bought Beazer in 1991. This led to a management buyout in July 1992, resulting in the formation of Kier Group. Following the buyout, Kier re-entered the housing market in 1993 with the acquisition of Twigden Homes for £30 million.

Kier expanded its operations through strategic acquisitions. In 1996, Kier acquired the southern division of Miller Homes. Bellwinch was acquired in 1998, and Allison Homes in 2001. By 2004, Kier's housing sales exceeded 1,000 units annually, reflecting its growing presence in the housing market. The company was relisted on the London Stock Exchange in 1996, becoming a FTSE 250 constituent.

The early 21st century saw Kier diversify and strengthen its services division. In 2013, Kier acquired May Gurney for £221 million, establishing itself as the fourth-largest contracting firm in the UK at the time. The acquisition of Mouchel in 2015 for £265 million further solidified its position in the UK highways maintenance and management market. In 2017, the company continued its expansion in infrastructure services with the acquisition of McNicholas Construction.

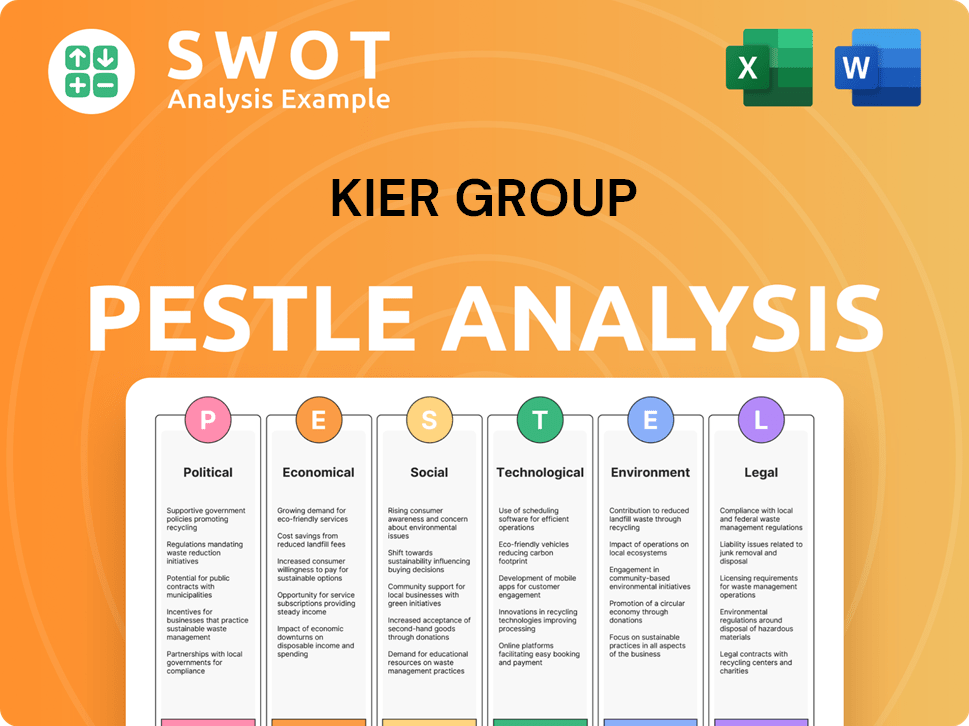

Kier Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Kier Group history?

The Kier Group, a prominent player in the British construction industry, has a rich history marked by significant projects and strategic shifts. The company's journey showcases its evolution, from early civil engineering feats to its current focus on infrastructure and sustainable practices.

| Year | Milestone |

|---|---|

| Early Decades | Kier became known for innovative civil engineering, particularly in reinforced concrete systems for structures like grain and cement silos. |

| Around 2000 | Kier was involved in major UK projects, including the Channel Tunnel Rail Link (CTRL). |

| Early 2000s | Kier completed the construction of Hairmyres Hospital in East Kilbride, the UK's first hospital funded via Private Finance Initiative (PFI). |

| May 2025 | Kier secured a £20.9 million contract for major upgrades at Worcester Sewage Treatment Works. |

| Ongoing | Kier is actively involved in large-scale infrastructure projects, including HS2 lots C2 and C3, and the construction of a new prison in Glasgow, expected to be completed by 2028. |

Throughout its history, Kier has demonstrated a commitment to innovation, particularly in construction techniques. This includes early adoption of advanced methods in reinforced concrete and a focus on sustainable solutions in recent years.

Kier pioneered the use of reinforced concrete systems, which were crucial for constructing tall buildings and specialized structures like silos. This early innovation set the stage for the company's future involvement in complex projects.

Kier was an early adopter of the Private Finance Initiative (PFI) model, as seen in the construction of Hairmyres Hospital. This approach allowed the company to participate in significant public infrastructure projects.

Kier has increased its focus on sustainability, with over 50% of its operations powered by renewable energy in 2023. This commitment is demonstrated through a 92% recycling rate across construction sites.

Despite its successes, Kier has faced significant challenges, including financial difficulties and the need for strategic restructuring. These experiences have led to a more disciplined approach to bidding and risk management.

Between 2018 and 2021, Kier faced significant financial challenges, including a failed rights issue in late 2018 and substantial losses. The company reported a pre-tax loss of £35.5 million in the second half of 2018.

The financial struggles necessitated an extensive restructuring program, including shedding 1,700 employees and selling assets. This involved selling its Bedfordshire headquarters and divesting Kier Living.

Problematic contracts, such as the Broadmoor hospital scheme and a hotel project in the Caribbean, contributed to losses. These issues highlighted the need for improved risk management.

Kier implemented significant strategic pivots, focusing on debt reduction, cost-cutting, and disposals, which allowed the company to return to profitability in 2021. This included a focus on a higher quality order book.

In March 2024, Kier received multiple accreditations, including the London Stock Exchange Green Economy Mark. This validates the company's commitment to sustainability.

By March 2025, Kier reported a net cash position of £57.9 million, a significant improvement from £17 million the previous year. The order book hit £11 billion.

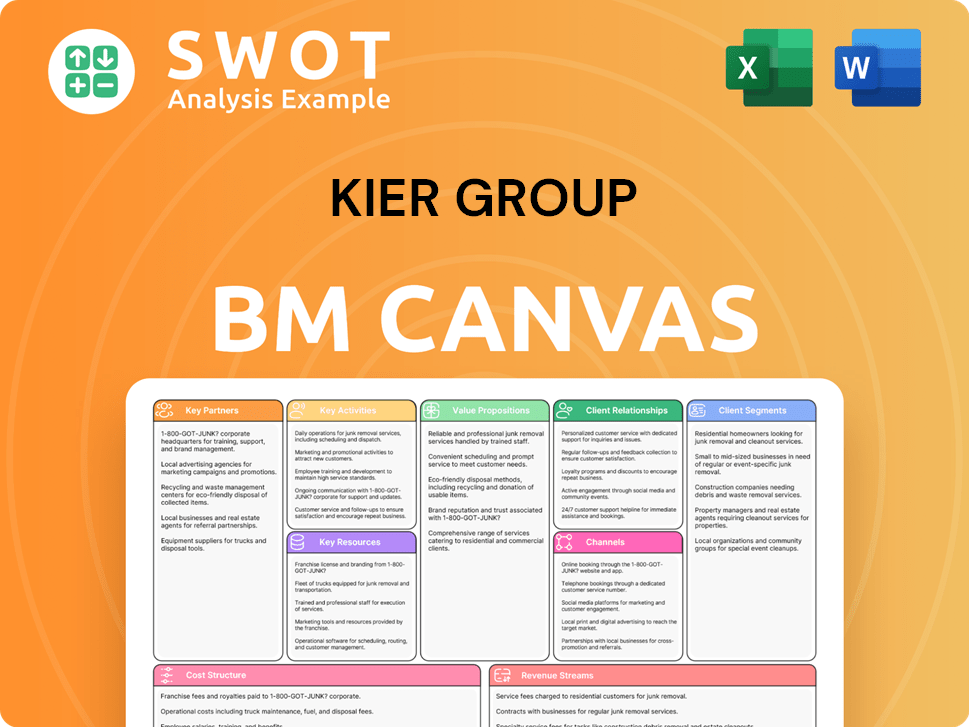

Kier Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Kier Group?

The Kier Group's journey as a British construction and infrastructure company is marked by significant milestones, strategic shifts, and a commitment to growth. From its early beginnings in concrete engineering to its current status as a key player in the UK infrastructure sector, the company has navigated various challenges and opportunities. The following table outlines key events in the

| Year | Key Event |

|---|---|

| 1928 | Founded as Lotz & Kier in Stoke-on-Trent, specializing in concrete engineering. |

| Early 1930s | Renamed J.L. Kier & Co Ltd after Jorgen Lotz's withdrawal. |

| 1963 | J.L. Kier & Co Ltd obtains a listing on the London Stock Exchange. |

| 1973 | Merges with W. & C. French to form French Kier. |

| 1986 | Acquired by Beazer. |

| 1991 | Hanson plc acquires Beazer and decides to dispose of the contracting arm. |

| 1992 | Management buyout of the UK construction businesses from Hanson, forming Kier Group. |

| 1993 | Re-enters the housing market with the acquisition of Twigden Homes. |

| 1996 | Relisted on the London Stock Exchange, becoming a FTSE 250 company. |

| c. 2000 | Involved in major infrastructure projects like the Channel Tunnel Rail Link. |

| 2013 | Acquires May Gurney for £221 million, strengthening its services division. |

| 2015 | Acquires Mouchel for £265 million, becoming a leader in UK highways maintenance. |

| 2017 | Acquires McNicholas Construction, further bolstering infrastructure services. |

| 2018-2021 | Experiences financial difficulties, leading to a major restructuring program. |

| 2021 | Sells its housing business, Kier Living, for £110 million and returns to profitability. |

| September 2023 | Acquires the rail division of Buckingham Group for £9.6 million, including its HS2 contract. |

| March 2025 | Reports a net cash position of £57.9 million and an £11 billion order book. |

| April 2025 | Order book stands at approximately £11 billion, a 2% increase from June 2024. |

| May 2025 | Secures a £20.9 million contract for upgrades at Worcester Sewage Treatment Works. |

The

The company is targeting an adjusted operating profit margin of 4.0%-4.5% in the next three to five years. Approximately 80% of its revenue for FY2026 has already been secured, providing strong visibility. The recent contract wins, such as the £20.9 million project in May 2025, contribute to this financial outlook.

Kier is committed to achieving net-zero emissions for scope 1, 2, and 3 by 2045. This long-term commitment is a key part of their sustainability strategy. This commitment is integrated into their overall approach to infrastructure projects.

The company's future outlook is closely tied to continued government spending on infrastructure. This spending is driven by structural demand related to population growth, transportation pressures, and the need to upgrade aged infrastructure. The

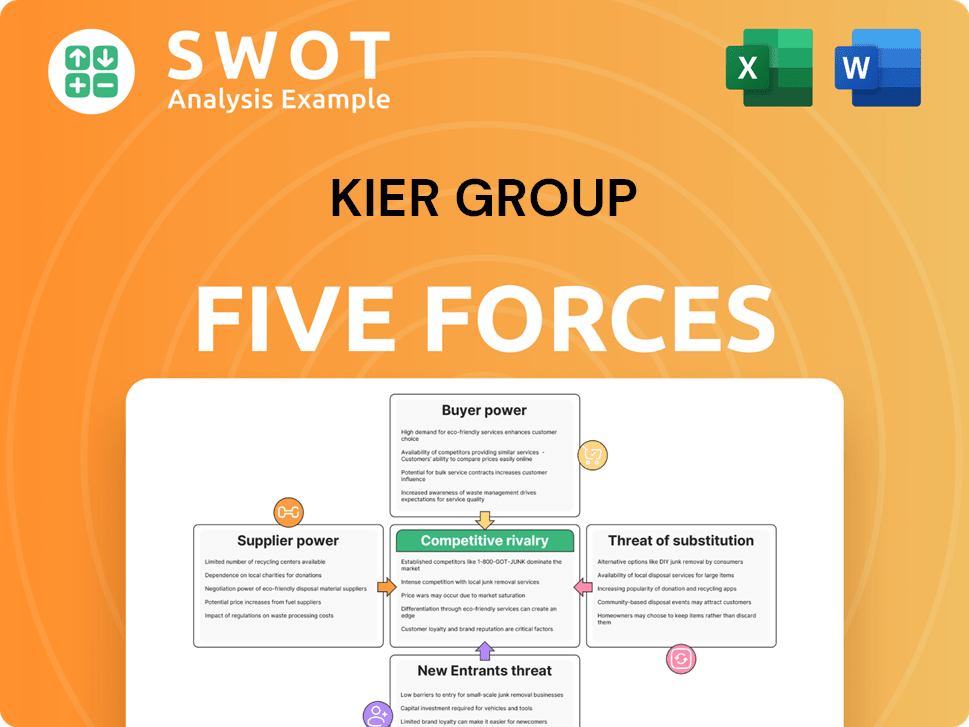

Kier Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Kier Group Company?

- What is Growth Strategy and Future Prospects of Kier Group Company?

- How Does Kier Group Company Work?

- What is Sales and Marketing Strategy of Kier Group Company?

- What is Brief History of Kier Group Company?

- Who Owns Kier Group Company?

- What is Customer Demographics and Target Market of Kier Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.