Kier Group Bundle

Who Really Controls Kier Group?

Understanding the Kier Group SWOT Analysis is key, but have you ever wondered who truly steers the ship of this major UK construction and infrastructure giant? The company's history, marked by significant restructuring and a century of operations, provides a fascinating backdrop to its current ownership dynamics. Knowing who owns Kier is critical to grasping its strategic direction and future potential.

This exploration into Kier ownership will unravel the intricate web of shareholders, from its founding to its present-day structure. Examining Kier's company structure, we'll uncover the influence of major Kier shareholders and the impact of recent financial performance on its trajectory. We'll also look at the leadership team and the composition of the board, providing insights into the decision-making processes that shape Kier Group's future, including its market capitalization and share price.

Who Founded Kier Group?

The story of Kier Group, and the question of 'Who owns Kier,' begins in 1928. It was founded by two Danish engineers, Jorgen Lotz and Olaf Kier. Initially, the company was named Lotz & Kier and was based in Stoke-on-Trent, focusing on concrete engineering projects.

In the early 1930s, Jorgen Lotz left the company. The business name was then changed to J.L. Kier & Co Ltd, retaining Lotz's initials. Olaf Kier, who was born Olaf Kiaer, was a graduate of the University of Copenhagen. He had a background in the Danish Navy and experience with Christiani & Nielsen before co-founding the company.

The initial ownership structure of Kier Group, specifically the equity split between Lotz and Kier, is not readily available in the provided information. Details regarding early investors and agreements like vesting schedules are also not available. The founders' vision centered on their expertise in concrete engineering, with an ambition to expand into general contracting and house-building, which the company later achieved.

The early days of Kier Group were defined by the expertise of its founders, Jorgen Lotz and Olaf Kier. Their focus on concrete engineering laid the foundation for future growth. Kier Group's evolution and strategic direction are explored in detail in the article Growth Strategy of Kier Group.

- The company's initial focus was on concrete engineering.

- The name changed to J.L. Kier & Co Ltd after Jorgen Lotz's departure.

- Olaf Kier's background in engineering and construction was crucial.

- The founders aimed to expand into general contracting and house-building.

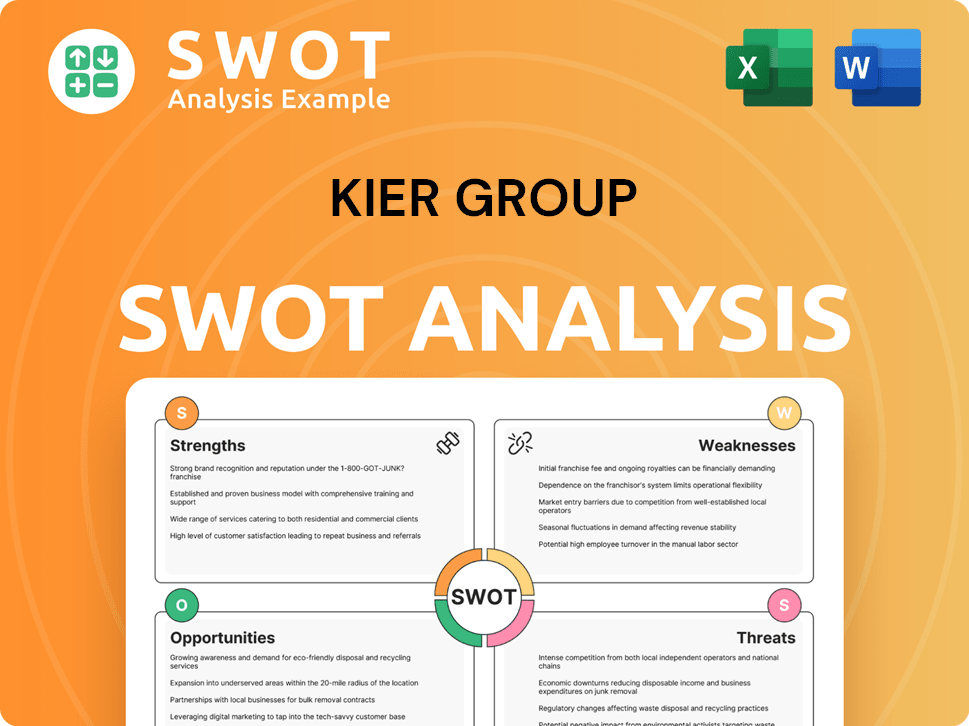

Kier Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kier Group’s Ownership Changed Over Time?

The ownership of Kier Group has seen several shifts since its initial public listing on the London Stock Exchange in 1963. Initially a public company, it was acquired by Beazer in 1986 before passing to Hanson plc. A management buyout in 1992 returned Kier to independent status, followed by a re-listing on the London Stock Exchange in 1996. These changes reflect the company's adaptation to market conditions and strategic decisions.

The early 21st century saw Kier expanding through acquisitions, briefly becoming the second-largest UK construction contractor after the collapse of Carillion in January 2018. However, financial difficulties between 2018 and 2021, including a failed rights issue, led to significant restructuring. This included shedding employees, selling assets like its headquarters and Kier Living (rebranded as Tilia Homes), and a £241 million equity raise in April 2021. These measures aimed to stabilize the company's financial position and ensure its long-term viability. Understanding the Target Market of Kier Group gives further insights into the company's strategic direction.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Listing | 1963 | Became a publicly traded company. |

| Acquisition by Beazer | 1986 | Ownership changed from public to private. |

| Management Buyout | 1992 | Returned to independent control. |

| Re-listing on London Stock Exchange | 1996 | Became a publicly traded company again. |

| Equity Raise | April 2021 | Addressed net debt position, shares offered at 85p. |

As of May 23, 2025, Kier Group plc (GB:KIE) has 46 institutional owners and shareholders. Major institutional shareholders include DISVX - Dfa International Small Cap Value Portfolio - Institutional Class, IEFA - iShares Core MSCI EAFE ETF, Dfa Investment Trust Co - The United Kingdom Small Company Series, and DFIEX - International Core Equity Portfolio - Institutional Class. The company's net cash position at June 30, 2024, was £167.2 million, a significant increase from £64.1 million in FY23. Average month-end net debt for the year ended June 30, 2024, was £(116.1) million, a considerable improvement from £(232.1) million in FY23. These financial improvements reflect the success of the restructuring efforts.

Kier Group's ownership structure has evolved significantly over time, from public to private and back to public, reflecting its strategic and financial challenges.

- Major institutional shareholders include Dfa International Small Cap Value Portfolio and iShares Core MSCI EAFE ETF.

- Restructuring efforts, including asset sales and equity raises, have improved the company's financial health.

- The company's net cash position and debt levels have improved significantly.

- J.O. Hambro Capital Management Ltd. (5.06% as of November 14, 2024), Brewin Dolphin Ltd. (5.02% as of September 10, 2024), Pendal Group Ltd. (Investment Management) (5.01% as of September 10, 2024), and Charles Stanley & Co. Ltd. (Investment Management) (5.01% as of September 10, 2024).

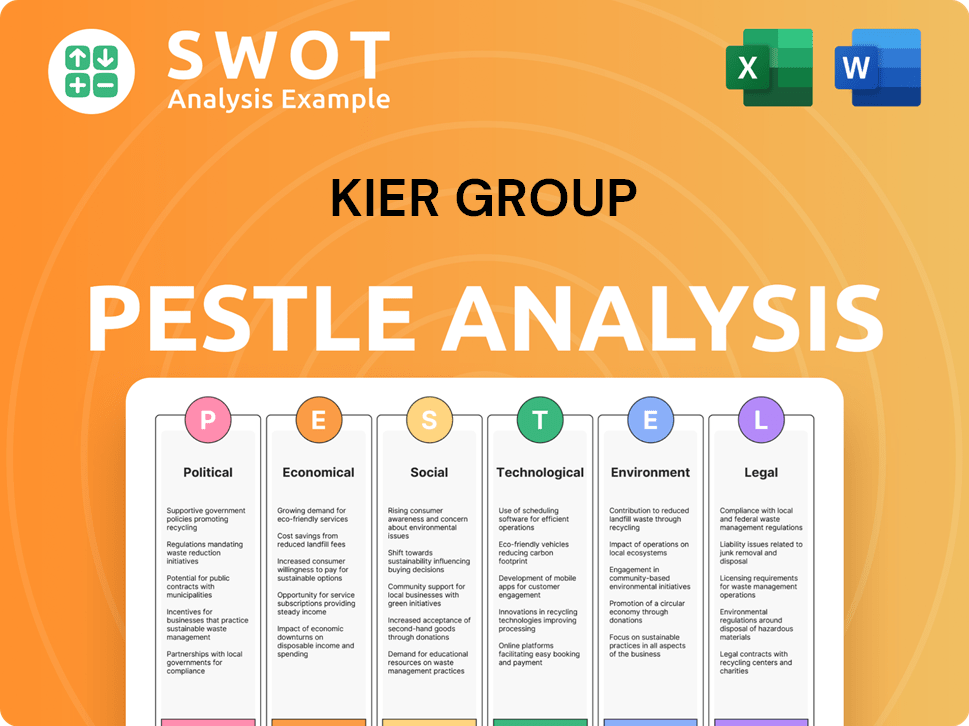

Kier Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kier Group’s Board?

As of June 2025, the leadership of Kier Group includes Andrew Oswell Davies as CEO and Executive Director, and Simon Kesterton as CFO and Executive Director. Stuart Togwell serves as Group Managing Director of Construction and Executive Director, appointed on October 1, 2024. Matthew Lester holds the position of Independent Chairman of the Board. The board also includes Independent Non-Executive Directors such as Chris Browne OBE (Senior Independent Director from October 1, 2024), Margaret Hassall, Clive Watson, Mohammed Saddiq (appointed January 1, 2024), and Alison Atkinson. This structure reflects a blend of executive and non-executive roles designed to oversee the company's strategic direction and operational performance.

The Board of Directors' composition changed with Justin Atkinson's retirement as Senior Independent Director and Non-Executive Director on September 30, 2024, and the appointment of Stuart Togwell. The board currently consists of three executive and six non-executive directors. This structure is aligned with the company's commitment to strong corporate governance, which is guided by its Operating Framework, including a Code of Conduct and regularly reviewed policies and procedures. The Board is responsible for monitoring the implementation of the company's strategy and medium-term value creation plan, focusing on sustainable growth, resource management, risk management, and internal controls.

| Director | Role | Appointment Date |

|---|---|---|

| Andrew Oswell Davies | CEO and Executive Director | N/A |

| Simon Kesterton | CFO and Executive Director | N/A |

| Stuart Togwell | Group Managing Director of Construction and Executive Director | October 1, 2024 |

| Matthew Lester | Independent Chairman | N/A |

| Chris Browne OBE | Senior Independent Director | October 1, 2024 |

| Margaret Hassall | Independent Non-Executive Director | N/A |

| Clive Watson | Independent Non-Executive Director | N/A |

| Mohammed Saddiq | Independent Non-Executive Director | January 1, 2024 |

| Alison Atkinson | Independent Non-Executive Director | N/A |

Shareholder engagement and executive remuneration remain key areas of focus. In November 2022, 44% of Kier shareholders voted against the directors' pay report, highlighting scrutiny over executive compensation. The Annual General Meeting (AGM) on November 14, 2024, included authorization for a share repurchase program, indicating the company's strategies for managing its capital and shareholder value. These factors are crucial when assessing Kier ownership and its financial performance.

The Board of Directors at Kier Group includes a mix of executive and non-executive directors, ensuring diverse expertise and oversight.

- The board structure reflects the company's commitment to good corporate governance.

- Shareholder activism and executive remuneration are closely monitored.

- Kier's financial performance is influenced by strategic decisions made by the board.

- The company's Operating Framework guides its governance practices.

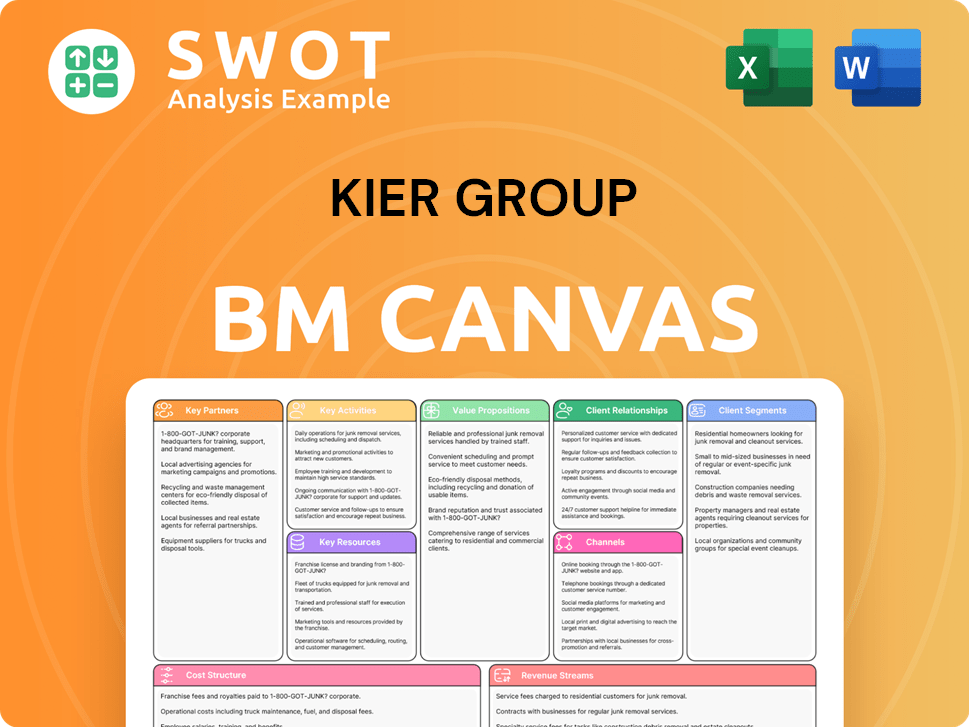

Kier Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kier Group’s Ownership Landscape?

Over the past few years, the ownership profile of Kier Group has seen significant changes, primarily due to its restructuring efforts and focus on financial stability. In January 2025, Kier initiated a £20 million share buyback program, authorized by shareholders on November 14, 2024. This program aims to return capital to shareholders, involving the repurchase of up to 45,270,364 ordinary shares, which represents approximately 10% of its issued share capital. By June 11, 2025, Kier had already purchased a total of 4,194,545 ordinary shares.

The company has also focused on reducing its debt. Average month-end net debt was significantly reduced by £99 million to £(38) million in the six months ending December 31, 2024. Furthermore, its net cash position at December 31, 2024, was £57.9 million, a notable improvement from £17.0 million in the prior period. In March 2024, Kier resumed dividend payments for the first time in five years, with an interim dividend of 2.00p per share announced in March 2025. These actions reflect the company's improved financial health and its commitment to shareholder returns.

Leadership changes have also occurred, with Justin Atkinson retiring from the Board as Senior Independent Director and Non-Executive Director on September 30, 2024, and Stuart Togwell being appointed as an Executive Director from October 1, 2024. Andrew Davies, CEO, is set to retire from the Board of Chemring Group PLC on January 31, 2025, after completing his nine-year term there. Industry trends, such as increased institutional ownership, are evident in Kier's current shareholder base, with a significant portion of shares held by institutional investors. The company's strong order book, which increased by 2% to £11.0 billion as of December 31, 2024, with 98% of expected FY25 revenue secured, positions it well to benefit from UK government infrastructure spending commitments. This strong pipeline supports future growth.

Kier Group has demonstrated improved financial health, as shown by the reduction in net debt and the resumption of dividend payments. The net cash position at the end of December 2024 was £57.9 million, a significant increase. The company's focus on financial stability is evident through these actions.

The share buyback program and the resumption of dividend payments highlight Kier Group's commitment to returning capital to shareholders. The buyback program, authorized in late 2024, involves the repurchase of a substantial portion of the company's shares. The interim dividend of 2.00p per share was announced in March 2025.

Leadership changes and a focus on deleveraging the balance sheet are key developments. Stuart Togwell's appointment as Executive Director and Andrew Davies' upcoming retirement from another board reflect strategic shifts. The company is well-positioned to capitalize on infrastructure spending.

Kier Group's ownership structure reveals a trend towards increased institutional ownership. The company's strong order book, which increased to £11.0 billion as of December 31, 2024, and revenue visibility support future growth. This indicates a stable and promising outlook.

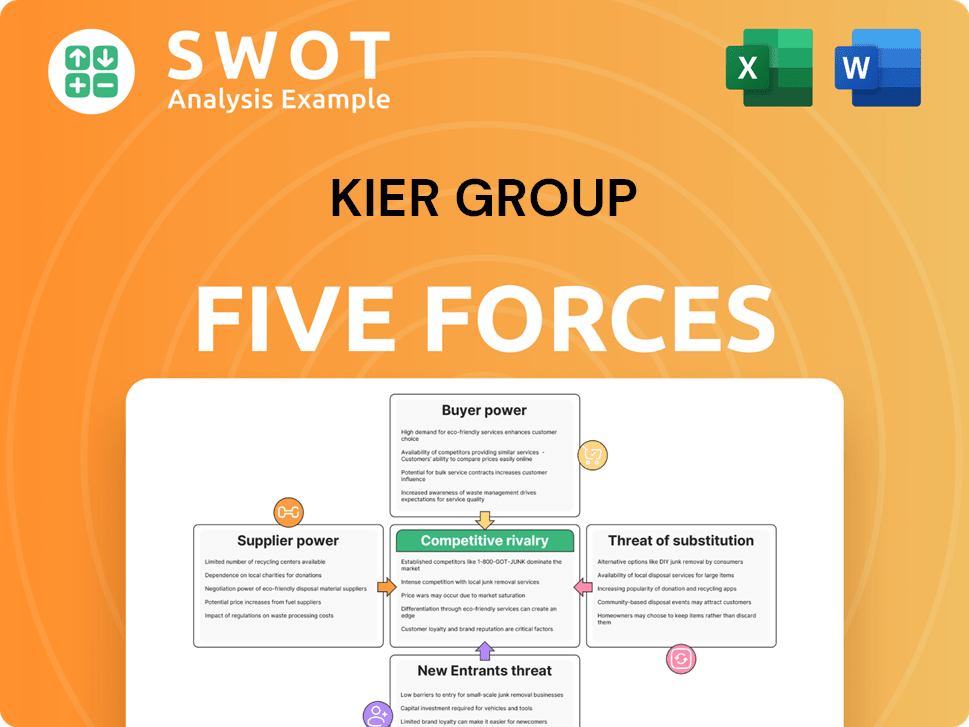

Kier Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kier Group Company?

- What is Competitive Landscape of Kier Group Company?

- What is Growth Strategy and Future Prospects of Kier Group Company?

- How Does Kier Group Company Work?

- What is Sales and Marketing Strategy of Kier Group Company?

- What is Brief History of Kier Group Company?

- What is Customer Demographics and Target Market of Kier Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.