Kier Group Bundle

Can Kier Group Maintain Its Momentum?

Kier Group, a UK construction and infrastructure giant, is riding high with a record £11 billion order book as of late 2024. From its humble beginnings in concrete engineering, Kier Group has evolved into a major player, delivering vital projects across the UK. This evolution begs the question: how will Kier Group leverage its current success for future growth?

This analysis dives deep into the Kier Group SWOT Analysis, exploring its strategic roadmap for the future. We'll examine Kier Group's market share and position, scrutinizing its expansion plans and strategies to understand its long-term growth potential. Furthermore, we'll assess Kier Group's financial performance, including profitability and margin trends, to provide a comprehensive view of this prominent company's journey, considering its sustainable growth initiatives and the impact of economic factors.

How Is Kier Group Expanding Its Reach?

The expansion initiatives of Kier Group are strategically designed to capitalize on its strong presence within the UK's public sector and regulated industries. These sectors are essential to the UK's economy, and Kier Group aims to leverage its position within them. The company focuses on securing work through frameworks, which provide a steady pipeline of projects and reduce competition compared to open market tenders. This approach supports a stable revenue stream and enhances the company's ability to plan for future growth.

As of December 2024, the company's order book reached £11 billion, marking a 2% increase from June 2024. This growth is a testament to Kier Group's strategic focus and operational effectiveness. Approximately 98% of the expected revenue for FY25 is already secured, providing significant financial visibility. This strong position allows for better resource allocation and strategic planning, contributing to sustainable growth. The company's expansion plans and strategies are focused on these key areas.

Kier Group's expansion strategy is also supported by its ability to secure significant contracts across various sectors. These wins not only boost revenue but also reinforce Kier's role as a strategic supplier to key government priorities. This includes sectors such as transport, education, healthcare, justice, defense, and nuclear. The company's focus on these areas reflects its commitment to supporting critical infrastructure and services in the UK. For more information on the Target Market of Kier Group, consider this article.

Kier Group was appointed by Yorkshire Water to its £850 million AMP8 (2025-2030) Complex Non-Infrastructure Works Framework. This framework provides a substantial pipeline of work over the next five years. This significant contract win highlights Kier's expertise in the water sector and its ability to secure long-term projects.

The company secured a place on the £500 million NHS Shared Business Services Decarbonisation of Estates framework. This framework aligns with the growing emphasis on sustainability and decarbonization within the healthcare sector. It allows Kier Group to contribute to the reduction of carbon emissions in NHS estates.

Kier Group was awarded a £240 million contract by the Ministry of Defence for new accommodation at Keogh Barracks. This contract demonstrates Kier's ability to secure and execute large-scale projects for the defense sector. It also reflects the company's strategic focus on building strong relationships with government clients.

Kier Group secured a place on Pagabo's £814 million Facilities Management framework. This framework provides access to a wide range of facilities management projects. This win enhances Kier's ability to diversify its revenue streams and expand its service offerings.

Kier Group plans to increase investment in its Property segment, targeting a Return on Capital Employed (ROCE) of 15%. This investment is expected to be a material contributor to future profits. This strategic move demonstrates the company's commitment to enhancing its financial performance and driving long-term growth potential.

- Kier Group has successfully integrated the rail assets of Buckingham Group, which it acquired earlier. The integration has performed ahead of initial expectations. This integration has improved operational efficiency and expanded Kier's capabilities in the rail sector.

- The company's focus on securing work through frameworks, such as the Yorkshire Water and NHS frameworks, provides a stable pipeline of projects. This approach reduces competition and ensures a steady revenue stream.

- Kier Group's strategic goals and objectives include diversifying revenue streams and reinforcing its role as a strategic supplier to key government priorities. This diversification helps to mitigate risks and supports sustainable growth.

- The company's recent contract wins and framework placements demonstrate its ability to secure significant projects and expand its market share and position. This success is a key driver of Kier Group's financial performance.

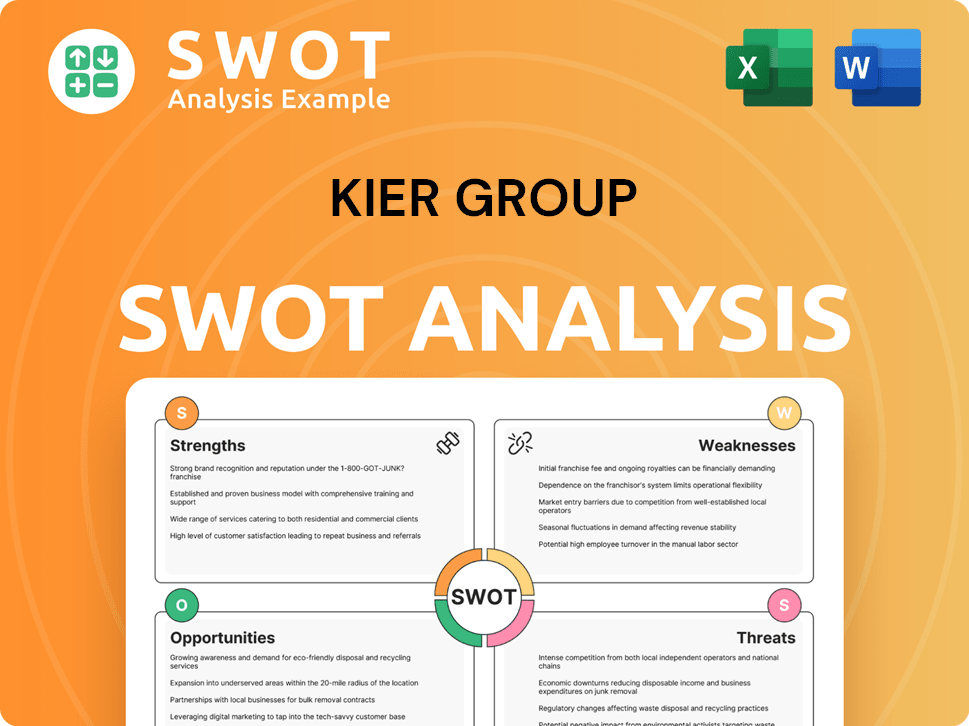

Kier Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kier Group Invest in Innovation?

The Brief History of Kier Group reveals a company deeply committed to integrating innovation and technology into its operations to drive sustainable growth. This strategy is crucial for enhancing operational efficiency and navigating the evolving demands of the construction and infrastructure sectors. The 'Performance Excellence' culture, introduced in 2020, underscores a commitment to digital transformation and robust risk management.

In FY24, the focus was on standardizing site set-up and improving site connectivity, demonstrating a proactive approach to leveraging technology. This strategic focus aligns with the company's broader objectives of enhancing project delivery and reducing operational costs. This approach also supports the company's environmental goals, as seen in its sustainability initiatives.

Kier Group's commitment to innovation extends to smart energy controls. The pilot project at Woodburn Primary School in Scotland showcased the potential of AI-powered sockets, achieving a 47% energy saving and a 34% reduction in CO2 emissions. The payback period for these controls was approximately four months, highlighting the financial and environmental benefits. This success has led to a broader implementation mandate.

Kier Group is actively pursuing digital transformation to streamline operations and enhance project delivery. This includes initiatives like site set-up standardization and improved connectivity. These efforts aim to improve efficiency and reduce costs.

The company is implementing smart energy controls, such as AI-powered sockets, to reduce energy consumption and carbon emissions. The success at Woodburn Primary School demonstrates the effectiveness of these technologies. This initiative supports Kier Group's sustainability goals.

Kier Group is committed to sustainability, with over 50% of its operations powered by renewable energy in 2023. The company aims for net-zero emissions by 2045, reporting a 25% reduction in carbon emissions in 2023 compared to 2020 levels. This commitment is integral to its growth strategy.

Kier Group focuses on enhancing operational efficiency through digital transformation and risk management. The 'Performance Excellence' culture supports these efforts. This focus is crucial for maintaining a competitive edge.

The company has a strong operational and financial risk management framework. This framework is embedded across the Group. This is crucial for long-term success.

Kier Group is expanding the use of measurable.energy sockets across Scotland and the North of England. The company plans nationwide expansion. This expansion supports its sustainability goals.

Kier Group's strategic goals and objectives are closely tied to its technological advancements and sustainability efforts. These initiatives are designed to drive revenue growth and improve market share. The company's focus on digital transformation is also a key element.

- Smart Energy Implementation: Rollout of AI-powered sockets across sites to reduce energy consumption and carbon emissions.

- Renewable Energy Usage: Over 50% of operations powered by renewable energy in 2023.

- Carbon Emission Reduction: A 25% reduction in carbon emissions in 2023 compared to 2020 levels.

- Digital Transformation: Focus on site set-up standardization and enhanced site connectivity.

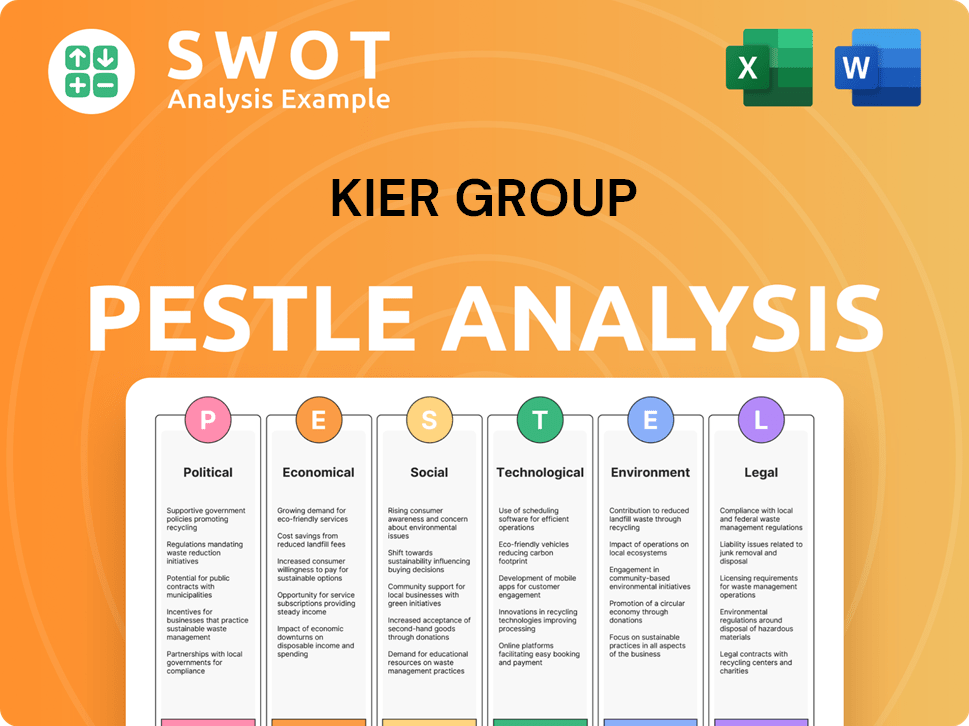

Kier Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kier Group’s Growth Forecast?

The Competitors Landscape of Kier Group reveals a company focused on robust financial health and strategic expansion. The company's financial performance indicates a positive trajectory, supported by a strong order book and strategic financial management. This positions the company favorably for sustained growth within its core markets.

Kier Group's financial outlook is bright, with key metrics demonstrating improvement. The company has shown revenue growth, increased profitability, and a strengthened financial position. These positive trends are supported by strategic initiatives and a focus on operational efficiency.

For the six months ending December 31, 2024, Kier Group reported a 5% revenue increase. Adjusted operating profit grew by 3% to £66.6 million, with an adjusted operating profit margin remaining steady at 3.4%. The reported operating profit rose by 3.6% to £45.7 million. The net cash position significantly improved to £57.9 million, compared to £17.0 million in the prior period.

Kier Group's financial performance for the first half of fiscal year 2025 shows positive trends. Revenue growth and increased profitability are key indicators of the company's strong performance. These figures reflect the company's effective business strategy.

The company's order book reached a record £11 billion by the end of December 2024. This substantial order book provides significant visibility for future revenue. Approximately 98% of the expected FY25 revenue is already secured.

For the fiscal year ending June 30, 2024, Kier's revenue was £3.97 billion, a 17% increase. The adjusted operating profit was £150.2 million, with an adjusted operating margin of 3.8%. These figures highlight the company's strong performance.

Kier Group has a long-term sustainable growth plan. The company aims for GDP+ growth through the cycle for revenue. It targets an adjusted operating profit margin of 3.5%+, and a cash conversion of operating profit around 90%. The company also targets an average month-end net cash position.

The company has recommenced dividend payments, with an interim dividend of 2.00p declared for HY25, representing a 20% increase on the prior interim dividend. An initial £20 million share buyback program was announced in January 2025. Analysts project the Price/Earnings (P/E) ratio to fall from 13.9 times in 2024 to 8.5 times in 2025, reflecting strong earnings growth. S&P Global Ratings anticipates Kier will sustain improved profitability in 2024-2025, with adjusted EBITDA improving to £180 million-£190 million in fiscal 2025. They project the group's sales to increase to about £3.9 billion by fiscal 2025.

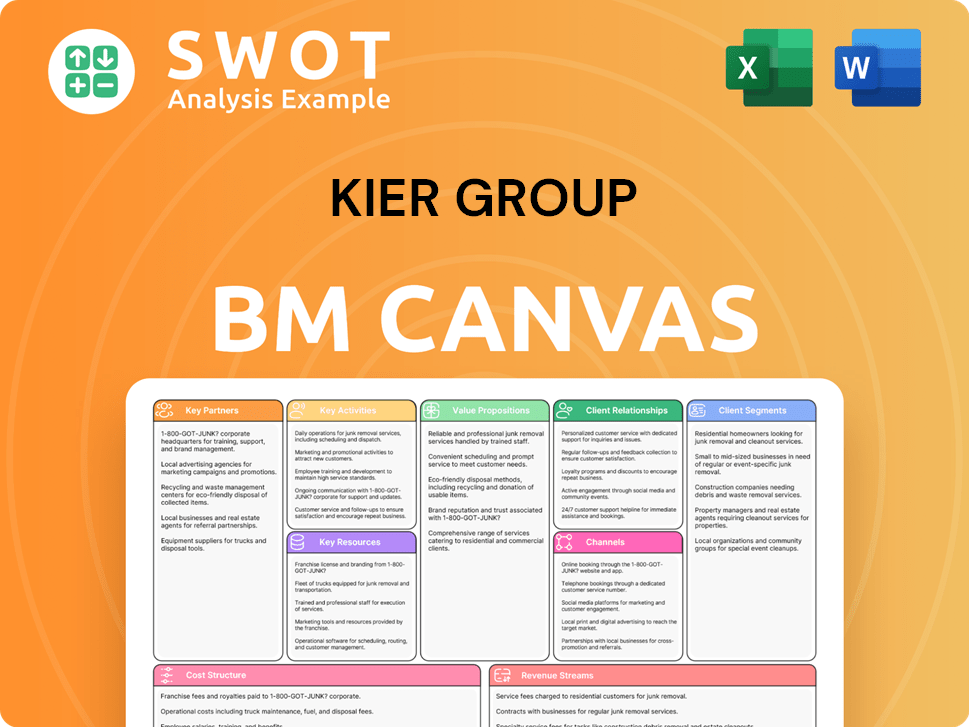

Kier Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kier Group’s Growth?

The Kier Group Company faces several potential risks and obstacles that could influence its growth trajectory. A significant challenge stems from its reliance on public-sector contracts, which exposes the company to fluctuations in government spending and shifts in political priorities. Macroeconomic factors, such as inflation or a potential global recession, could also negatively impact the UK's economic recovery, subsequently affecting Kier Group's performance.

Another constraint is the company's limited geographic diversification, with operations primarily concentrated in the competitive UK market. Budgetary pressures could lead to project delays or postponements, potentially affecting earnings predictability. Supply chain vulnerabilities and the impact of technological disruption also represent ongoing concerns within the construction industry, requiring careful management and strategic planning.

To mitigate these risks, Kier Group employs a robust operational and financial risk management framework, integrated into its contract selection and delivery processes. The company focuses on disciplined bidding and risk management to maintain a high-quality and profitable order book. Working under frameworks, where projects are competitively tendered among a pre-selected group of suppliers, helps to reduce competition and provides revenue visibility. The average order size in its Construction business, at approximately £21 million, also helps limit risk exposure if a project faces challenges. Management continuously assesses and prepares for these risks, including macroeconomic and political risks affecting the UK economy, through robust forecasting and a focus on strong cash generation.

The Kier Group's heavy dependence on public-sector contracts makes it vulnerable to changes in government spending and political priorities. Delays in government infrastructure projects can directly impact the company's revenue and profitability. This dependency necessitates careful monitoring of government policies and proactive engagement to mitigate potential disruptions. Understanding the Kier Group Market Analysis is crucial to addressing this risk.

Economic downturns, inflation, and other macroeconomic shocks could negatively impact the UK's construction market, affecting Kier Group's Financial Performance. These factors can lead to increased costs, reduced project demand, and delays. The company must implement strategies to navigate economic uncertainties, such as cost management and diversification of projects. A detailed Kier Group Business Strategy is essential for navigating these challenges.

The Kier Group's operations are primarily concentrated in the UK, limiting its geographic diversification and exposing it to risks specific to the UK market. Economic downturns or political instability within the UK could significantly impact the company's performance. Expansion into new markets could help mitigate this risk and enhance long-term growth. A detailed look at Kier Group Future Prospects will provide more insights.

Disruptions in the supply chain and the rapid pace of technological advancements pose significant risks to Kier Group. Delays in the delivery of materials, increased costs, and the need to adapt to new technologies can impact project timelines and profitability. Proactive management of supply chains and strategic investments in technology are crucial. Read more about the Kier Group Growth Strategy in our article.

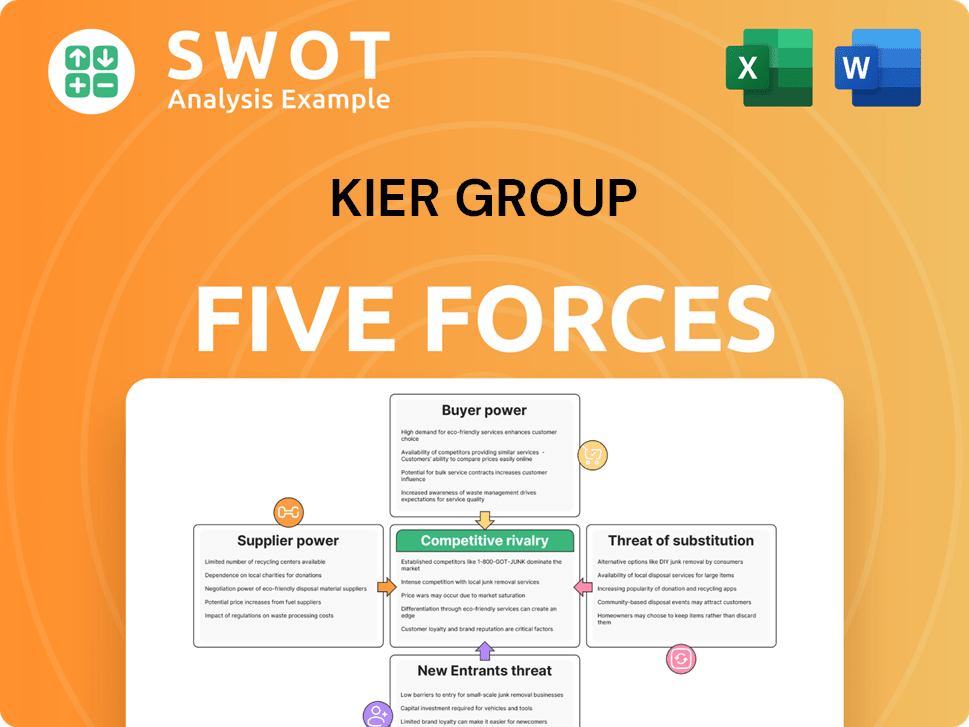

Kier Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kier Group Company?

- What is Competitive Landscape of Kier Group Company?

- How Does Kier Group Company Work?

- What is Sales and Marketing Strategy of Kier Group Company?

- What is Brief History of Kier Group Company?

- Who Owns Kier Group Company?

- What is Customer Demographics and Target Market of Kier Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.