Kier Group Bundle

Decoding Kier Group: How Does This Construction Giant Operate?

Kier Group, a cornerstone of the UK's construction and infrastructure landscape, is currently experiencing significant growth, with a 5% revenue increase to £1.98 billion in the six months leading up to December 31, 2024. Boasting a record £11 billion order book, securing 98% of its expected FY25 revenue, Kier Group demonstrates a strong ability to secure future projects. But how does this industry leader actually function, and what drives its impressive financial results?

This exploration into Kier Group SWOT Analysis will dissect Kier Group's operations, examining its diverse Kier Group projects and Kier Group services, while also analyzing its Kier Group business model and strategic direction. We'll delve into its Kier Group structure, revenue streams, and competitive positioning to provide a comprehensive understanding of this major player in the UK market. Understanding Kier Group's financial performance, including its recent news and government contracts, is crucial for anyone interested in the construction and infrastructure sectors.

What Are the Key Operations Driving Kier Group’s Success?

The core of the business revolves around its key segments: Infrastructure Services, Construction, and Property. These segments enable the company to deliver a wide array of services, from building roads and infrastructure to developing commercial and residential properties. The company's structure allows it to undertake diverse projects across the UK, serving both public and private sectors.

The company's value proposition centers on its ability to provide reliable project delivery, adhere to specifications, and create lasting legacies for communities. This is achieved through a combination of robust project management, design and engineering capabilities, and a focus on sustainable solutions. The company's operational processes, supply chain, and partnerships are all geared towards delivering complex projects efficiently and effectively.

The company's integrated approach, offering specialist design and build capabilities, is a key differentiator. By leveraging the expertise of its people, the company manages and integrates all aspects of a project. This approach ensures that projects are completed to a high standard, meeting the needs of clients and contributing to the company's financial performance. For example, the company secured a five-year renewal of the Anglian Water IOS Alliance, valued at up to £400 million, demonstrating its ability to secure and manage large-scale projects.

The Infrastructure Services segment focuses on designing, building, and maintaining roads, delivering major civil engineering projects, and providing services for the water, energy, and telecom sectors. This segment is crucial for the company's revenue generation, with a strong emphasis on long-term frameworks and alliances. The company's expertise in this area allows it to secure significant government contracts and contribute to essential infrastructure projects across the UK. The company's ability to manage these projects efficiently is a key factor in its financial success.

The Construction segment encompasses regional building, strategic projects, and Kier Places, serving both public and private sectors. This segment is responsible for a wide range of construction projects, from small-scale developments to large-scale infrastructure projects. The company's national coverage and diverse capabilities allow it to meet the varied needs of its clients. This segment plays a vital role in the company's overall growth and profitability.

The Property segment invests in and develops mixed-use commercial and residential schemes across the UK. This segment focuses on identifying and capitalizing on development opportunities, contributing to the company's long-term growth strategy. The company's property projects enhance local communities and generate significant returns. This segment is crucial for diversifying the company's portfolio and creating sustainable value.

The company's value proposition is centered on delivering reliable projects, adhering to specifications, and creating lasting legacies. This is achieved through a combination of robust project management, design and engineering capabilities, and a focus on sustainable solutions. The company's commitment to quality and its integrated approach are key differentiators. The company aims to provide value to its customers and stakeholders through the successful execution of its projects.

The company's operational processes are central to its offerings, including robust project management, design and engineering capabilities, and a focus on sustainable solutions. The company's supply chain, partnerships, and distribution networks are integral to its ability to deliver complex projects. The company emphasizes bidding discipline and risk management to ensure a high-quality and profitable order book. For more insights, you can read about the Brief History of Kier Group.

- Project Management: Ensures projects are completed on time and within budget.

- Design and Engineering: Provides technical expertise for project execution.

- Sustainable Solutions: Focuses on environmentally friendly practices.

- Supply Chain and Partnerships: Manages resources and collaborations effectively.

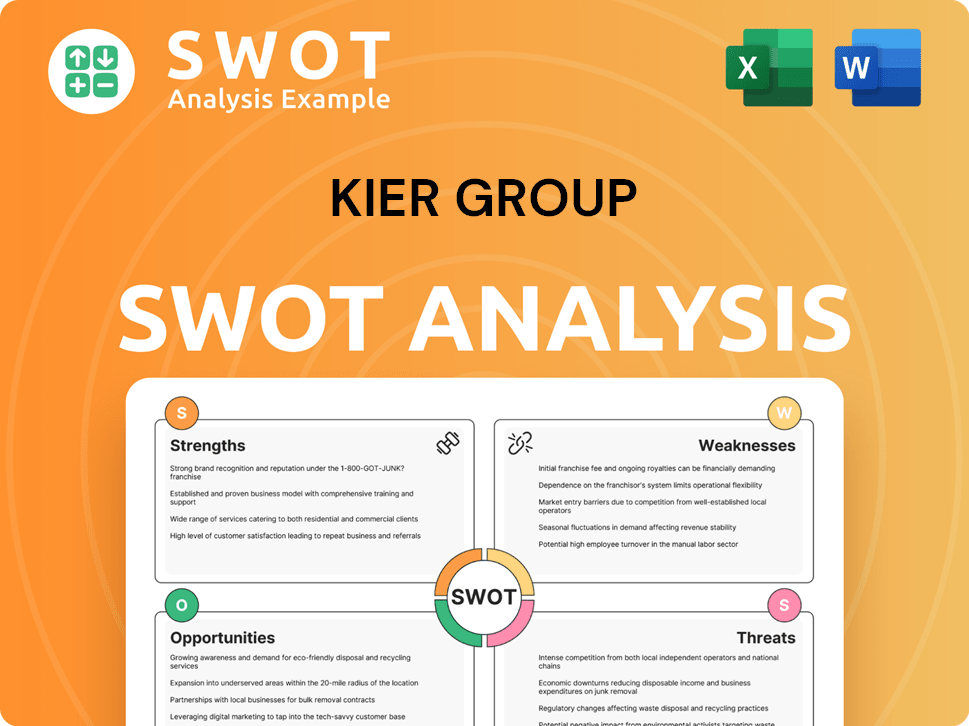

Kier Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kier Group Make Money?

The Kier Group generates revenue through its Infrastructure Services, Construction, and Property segments. The Kier Group business model focuses on securing long-term contracts, particularly within the public sector. This approach provides a stable foundation for the company's financial performance and growth.

For the six months ending December 31, 2024, the Kier Group operations reported a total revenue of £1,978.6 million, reflecting a 5.1% volume increase. For the full year ending June 30, 2024, revenue reached £3,969.4 million, driven by strong operational delivery across its divisions. This growth highlights the effectiveness of the Kier Group's strategies.

The company's revenue streams are diversified across its segments, with Infrastructure Services and Construction playing key roles. Approximately 90% of Kier Group services are derived from public sector and regulated companies, showcasing its strong relationships and UK-based operations. The company's focus on disciplined capital allocation is evident in its share buyback program and investments in the Property segment.

The Infrastructure Services segment saw a 9% increase in revenue for the six months to December 31, 2024, primarily due to the continued ramp-up of capital works on HS2 and volume growth in the water and nuclear sectors. Construction revenue grew by 15.4% in FY24. Kier Group projects benefit from a high degree of revenue visibility due to its substantial order book.

- The order book reached a record £11 billion as of December 31, 2024.

- 98% of expected FY25 revenue is already secured.

- Approximately 60% of the order book is under target cost or cost-reimbursable contracts.

- The company initiated a £20 million share buyback program in January 2025.

- The Property segment targets a Return on Capital Employed (ROCE) of 15%.

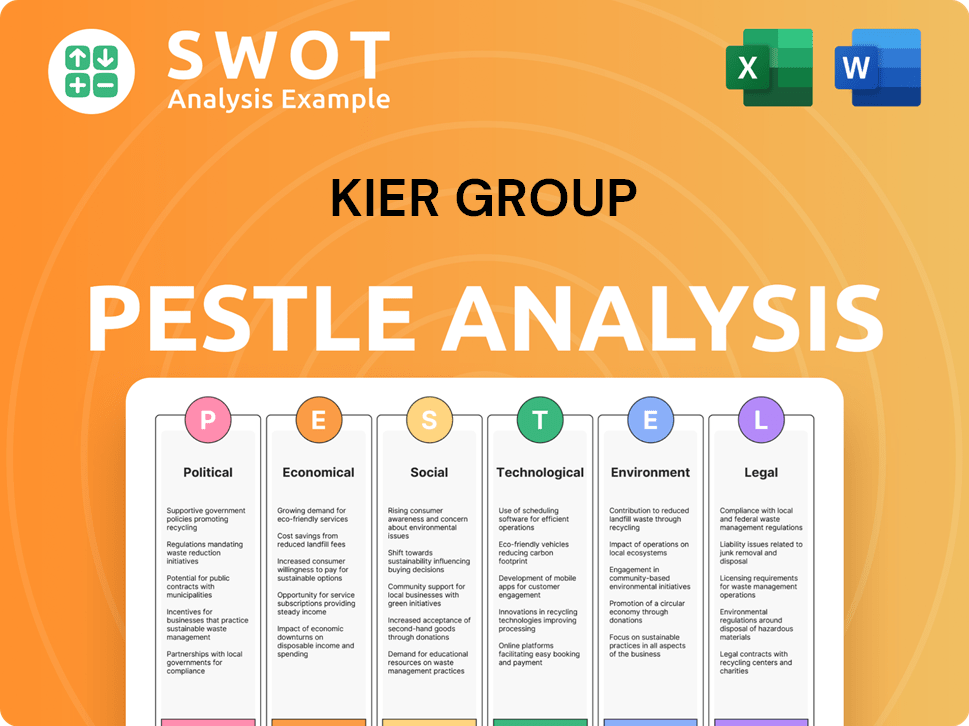

Kier Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kier Group’s Business Model?

The Kier Group has a history marked by significant milestones and strategic shifts that have shaped its Kier Group operations and financial performance. The company's ability to secure substantial contracts and adapt to market dynamics underscores its strategic agility. Recent financial data reflects a company focused on strengthening its balance sheet and ensuring future revenue streams.

A key highlight of Kier Group business is the consistent expansion of its order book. As of December 2024, the order book reached a record £11 billion, providing multi-year revenue visibility. This strong order book, coupled with recent contract wins, positions the company well for future growth. These strategic moves, combined with a focus on operational efficiency, have been critical in navigating a challenging economic environment.

Kier Group has demonstrated resilience and strategic foresight in managing its business. The integration of rail assets from Buckingham Group Contracting Limited into its Infrastructure Services division is a prime example of strategic expansion. The company's focus on bidding discipline and risk management ensures a high-quality and profitable order book, which is further supported by its strong relationships with public sector and regulated clients.

The order book reached a record £11 billion as of December 2024. Secured 98% of its expected FY25 revenue, providing strong revenue visibility. Completed the acquisition of substantially all of Buckingham Group Contracting Limited's rail assets in FY24.

Secured contracts like a place on Yorkshire Water's £850 million AMP8 framework. Won a £240 million contract from the Ministry of Defence. Positioned on the £500 million NHS Shared Business Services decarbonisation framework.

Approximately 90% of revenue generated from public sector and regulated clients. Focus on bidding discipline and risk management. Initiatives include trialing solar and green hydrogen power solutions for sustainability.

Achieved a net cash position of £57.9 million at December 31, 2024. Average month-end net debt materially reduced by £99 million to £(38) million. Focused on strengthening the balance sheet in response to market challenges.

Kier Group benefits from a strong brand and established relationships, particularly within the public sector. The company's ability to secure significant contracts and manage projects effectively is a key differentiator. Adaptability to new technologies and sustainable practices, such as trialing solar and green hydrogen solutions, further strengthens its position. For more details on Kier Group's long-term goals, see Growth Strategy of Kier Group.

- Strong brand and established relationships with public sector clients.

- Focus on bidding discipline and risk management to ensure profitability.

- Adaptation to new technologies, including AI for delay prediction.

- Commitment to sustainability through initiatives like green energy trials.

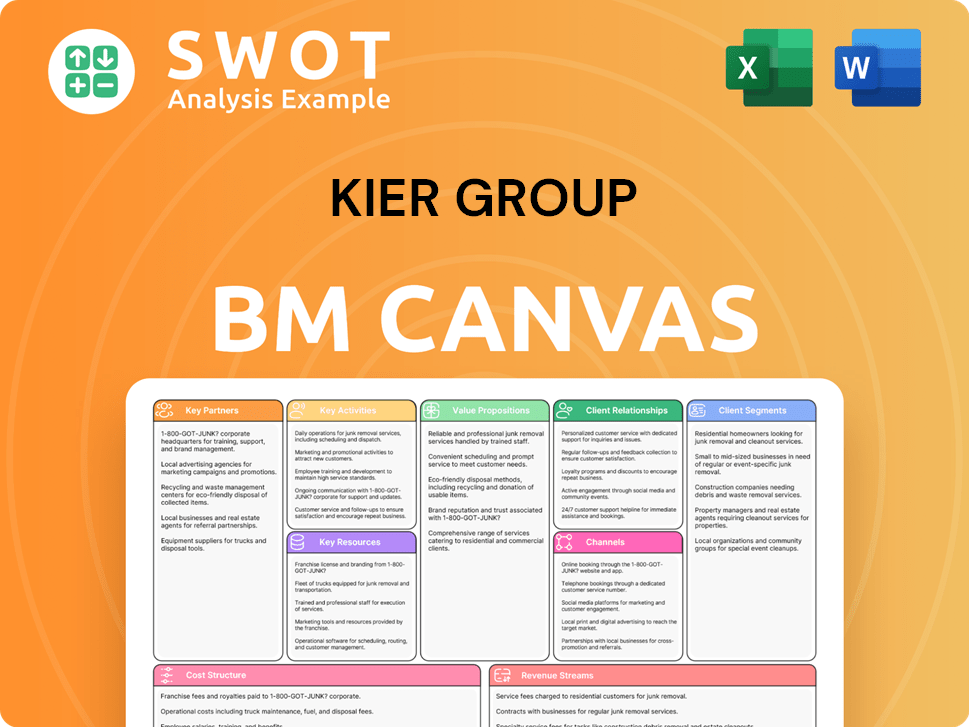

Kier Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kier Group Positioning Itself for Continued Success?

The Growth Strategy of Kier Group positions it strongly within the UK's construction and infrastructure sector. The company's substantial order book and enduring relationships with public sector clients are key strengths. As of December 31, 2024, the order book reached a record £11 billion, ensuring significant revenue visibility for upcoming years. This robust pipeline, with 98% of expected FY25 revenue secured, gives Kier a competitive edge.

Despite its solid industry position, Kier Group operations face inherent risks. These include potential impacts from regulatory changes, intense competition, and broader economic uncertainties, such as geopolitical and trade uncertainties. Labor and skills shortages also pose a significant challenge for the construction industry, affecting project timelines and requiring increased specialist skill sets to meet evolving compliance and safety requirements. Cost overruns and delays in project completion can also impact profitability, as seen in some infrastructure segments in FY24.

Kier Group's strong market position is supported by its large order book, which stood at £11 billion as of December 2024. The company benefits from long-term contracts and frameworks. Securing 98% of FY25 revenue provides significant stability.

The construction industry faces risks from regulatory changes and intense competition. Economic uncertainties, including geopolitical and trade issues, can affect projects. Labor shortages and potential cost overruns also pose challenges for Kier Group projects.

Kier Group is focused on long-term sustainable growth. The company aims to increase its operating profit margin to 4.0%-4.5% within three to five years. Strategic initiatives include investment in the Property segment and exploring innovative solutions.

Kier is focusing on a higher quality order book through tighter risk management. The company is investing in its Property segment, targeting a 15% return on capital employed. They are also exploring innovative solutions like solar and green hydrogen power.

Kier is committed to its long-term sustainable growth plan, aiming to increase its operating profit margin. The company is focused on a higher quality order book. Strategic initiatives include investment in the Property segment and exploring innovative solutions.

- Focus on a higher quality order book through tighter risk management.

- Investment in the Property segment, targeting a 15% return on capital employed.

- Exploring innovative solutions like solar and green hydrogen power.

- Leveraging AI for enhanced risk management.

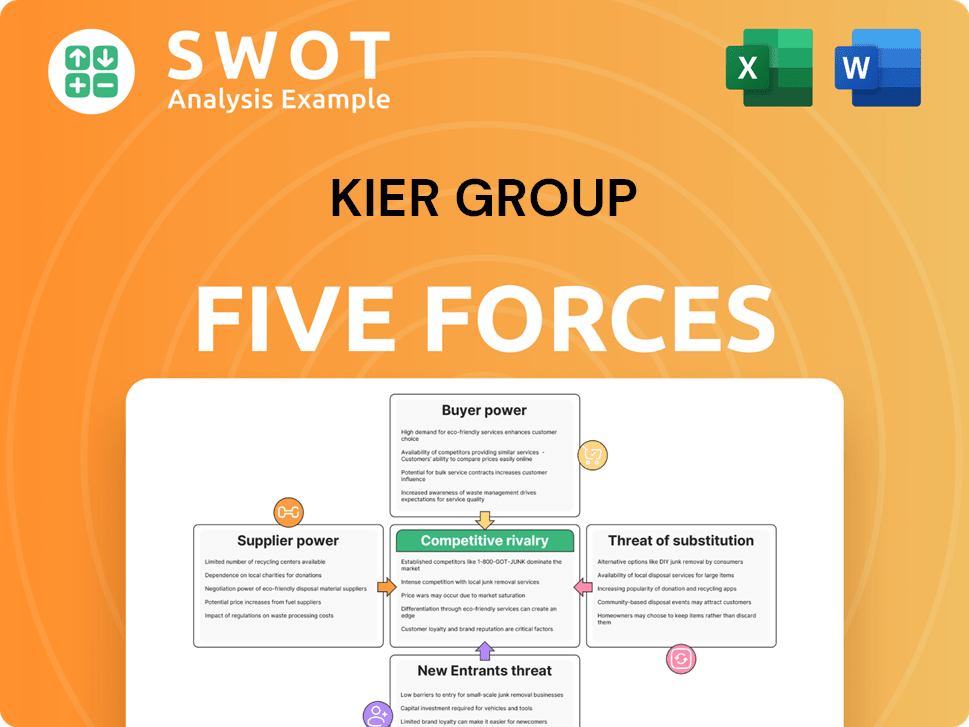

Kier Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kier Group Company?

- What is Competitive Landscape of Kier Group Company?

- What is Growth Strategy and Future Prospects of Kier Group Company?

- What is Sales and Marketing Strategy of Kier Group Company?

- What is Brief History of Kier Group Company?

- Who Owns Kier Group Company?

- What is Customer Demographics and Target Market of Kier Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.