Kingfisher Bundle

How did Kingfisher, a home improvement giant, rise to prominence?

From its humble beginnings to its current status as an international powerhouse, the Kingfisher SWOT Analysis illustrates a compelling journey. Curious about the Kingfisher history? Discover the Kingfisher company's origin story and how it evolved into a leading force in the home improvement sector. Explore the Kingfisher plc journey.

The Kingfisher company has a rich Kingfisher timeline filled with strategic moves and acquisitions. Understanding the Kingfisher brands and Kingfisher stores is key to appreciating its global presence. This brief exploration unveils the Kingfisher company's early years, expansion history, and key milestones, offering valuable insights into its enduring success and the impact on retail.

What is the Kingfisher Founding Story?

The Growth Strategy of Kingfisher began in 1982 with the founding of Kingfisher plc. The company's inception coincided with an increasing demand for home improvement products and services, setting the stage for its future endeavors. Details about the exact founding date, individual founders' names, and their precise backgrounds are not readily available in recent public disclosures.

The initial vision for the Kingfisher company was to offer a wide array of home improvement products and services, catering to both consumers and trade professionals. This strategy likely involved establishing a strong retail presence to tap into the growing market. The company's early business model focused on building a solid foundation for future growth.

Kingfisher's history is marked by strategic acquisitions and brand development, operating under banners like B&Q, Castorama, Screwfix, and Brico Dépôt. This approach enabled the company to serve diverse customer segments and expand geographically. The evolution of the Kingfisher company into an international home improvement entity, with over 1,300 stores across Europe, underscores its commitment to market leadership and expansion.

The company's early strategy focused on meeting the rising demand for home improvement products and services.

- Founded in 1982, Kingfisher plc emerged to capitalize on the growing home improvement market.

- The company's business model aimed to offer a comprehensive range of products and services.

- Kingfisher's growth strategy involved acquiring and developing various retail brands.

- The company's expansion led to a significant international presence with over 1,300 stores across Europe.

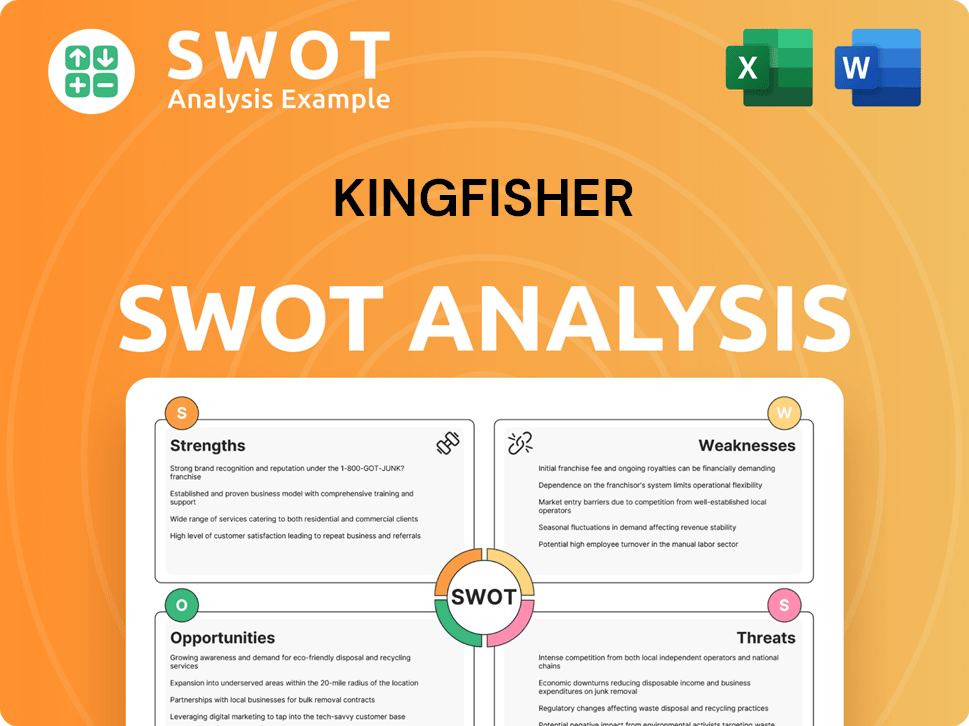

Kingfisher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Kingfisher?

The early growth and expansion of the Kingfisher company involved strategic acquisitions and a focus on building its retail presence across Europe. This expansion included the development of several prominent retail banners. The company's performance has been driven by strong growth in key markets, particularly in the UK and Ireland, and through its international expansion efforts. Digital transformation has also played a crucial role in its growth strategy, with significant investments in e-commerce.

The Kingfisher company operates under several retail banners, including B&Q and Screwfix in the UK and Ireland, and Castorama and Brico Dépôt in France. Screwfix, in the UK and Ireland, has been a strong performer. These brands have been instrumental in establishing the company's presence in the home improvement retail sector across Europe.

In the UK and Ireland, the Kingfisher stores have shown robust performance. Screwfix achieved a 2.4% like-for-like sales increase in Q1 2024/25. The focus on trade customers and e-commerce has been crucial for growth in these markets, contributing to the overall positive results.

International expansion has been a key driver for the Kingfisher plc. Promising trends have been observed in markets such as Poland and Romania. Romania reported a 14.7% like-for-like sales increase in Q1 2024/25, demonstrating the positive contribution of Eastern European operations.

Digital transformation is a central pillar of the Kingfisher history and growth strategy. Total e-commerce sales grew by 12.7% in Q1 2024/25, reaching 18.8% of group sales. The B&Q e-commerce marketplace experienced significant year-over-year growth in gross merchandise value. The company aims for group e-commerce sales to reach 30% of total sales, with one-third from its marketplace.

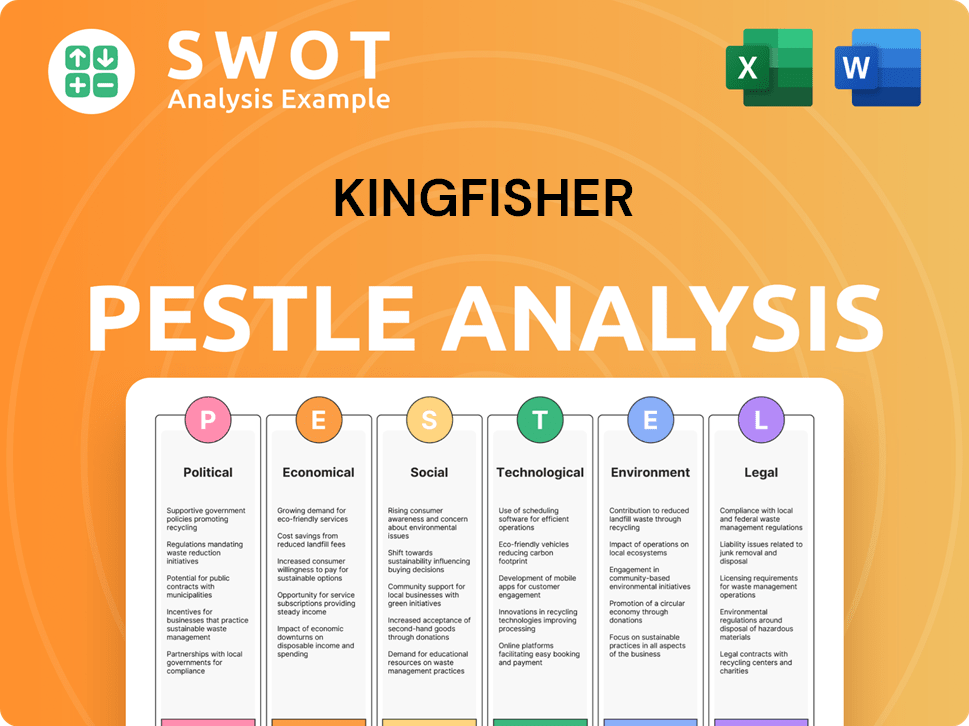

Kingfisher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Kingfisher history?

The Kingfisher company has achieved significant milestones, particularly in its digital transformation and sustainability efforts, while navigating a challenging market. This evolution showcases the company's adaptability and commitment to growth within the retail sector.

| Year | Milestone |

|---|---|

| 2024 | 49.4% of total Group sales came from Sustainable Home Products (SHPs) as of June 2024, demonstrating a strong focus on sustainability. |

| 2025 | The company reported a 1.5% drop in sales to £12.78 billion for the year ended January 2025, reflecting market challenges. |

| 2025 | Reduced Scope 1 and 2 carbon emissions by 62% since the 2016/17 baseline, surpassing its 37.8% goal. |

A key innovation is the launch of an AI-powered digital assistant, 'Hello Casto,' for Castorama France customers, which provides round-the-clock DIY support and product recommendations. This demonstrates the company's commitment to leveraging technology to enhance customer experience and reduce development time for new digital products.

Kingfisher launched 'Hello Casto,' an AI-powered digital assistant for Castorama France customers, enhancing customer support. This innovation, built on the 'Athena' platform, streamlines digital product development.

Kingfisher aims for group e-commerce sales to reach 30% of total sales, with one-third coming from its marketplace. This strategy highlights the company's digital growth ambitions.

The company is scaling up its data and retail media initiatives across all markets. This focus aims to improve customer engagement and drive sales through targeted advertising.

Despite these achievements, Kingfisher has faced challenges, including a 1.5% drop in sales to £12.78 billion for the year ended January 2025. Like-for-like sales in France slumped by 6.2% in the year to January 2025, indicating a tough market environment.

Kingfisher experienced a 1.5% drop in sales to £12.78 billion for the year ended January 2025. Weaker demand for 'big-ticket' items and a 'soft consumer backdrop' contributed to this decline.

Like-for-like sales in France slumped by 6.2% in the year to January 2025. Geopolitical factors also impacted like-for-like sales in France and Poland, which declined by 3.2% in each country in Q1 2025/26.

Kingfisher is accelerating its restructuring plan for Castorama France and focusing on managing gross margin, costs, and cash effectively. The company aims to deliver further market share gains through its strategic objectives.

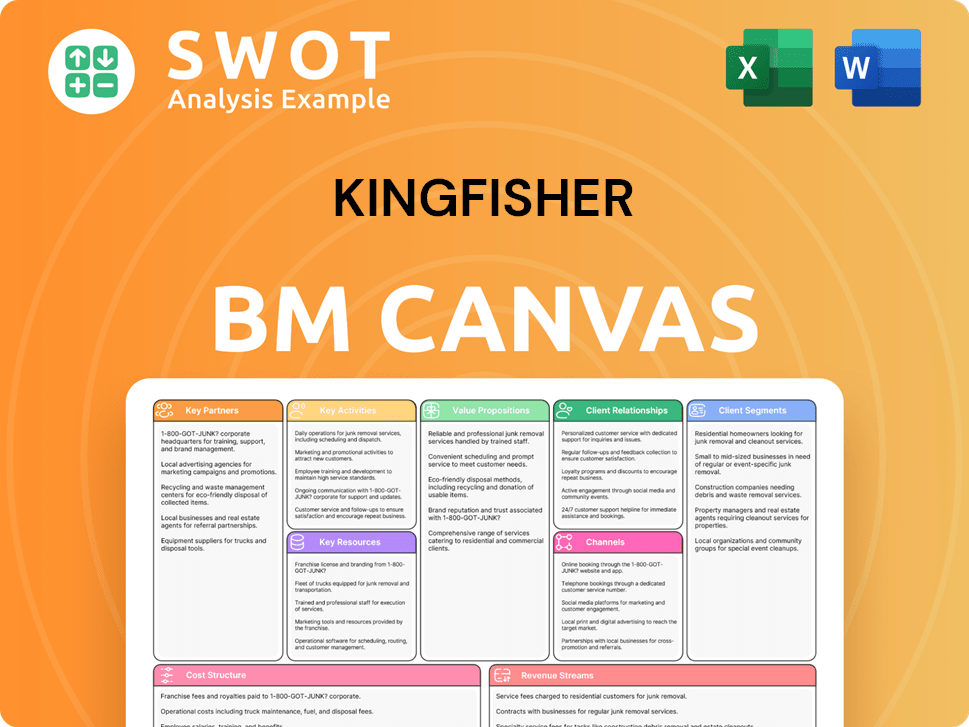

Kingfisher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Kingfisher?

The Kingfisher company has a rich history, marked by strategic growth and adaptation. The company's journey began in 1982, evolving through key milestones such as establishing carbon emission reduction targets in 2016/17 and launching AI-powered tools and marketplaces more recently. With a focus on e-commerce expansion and sustainable practices, Kingfisher continues to adapt to the dynamic retail landscape.

| Year | Key Event |

|---|---|

| 1982 | Kingfisher plc is founded. |

| 2016/17 | Establishes a baseline for carbon emission reduction targets. |

| 2023 | Launches 'Hello Casto,' an AI-powered assistant for Castorama customers, and rolls out marketplaces in all its markets. |

| March 2024 | Successfully launches the B&Q e-commerce marketplace at Castorama France. |

| June 2024 | Reports that 49.4% of total Group sales come from Sustainable Home Products. |

| November 2024 | Morningstar forecasts a 2% decline in revenue for fiscal year 2025 for Kingfisher. |

| December 2024 | Kingfisher Lighting highlights 2025 as an exciting year of growth and development, focusing on continuous improvement of products and services. |

| January 2025 | B&Q's marketplace reaches an e-commerce sales penetration of 43%. Kingfisher drives e-commerce growth with the launch of a new home improvement marketplace at Castorama Poland. |

| March 2025 | Announces final results for the year ended 31 January 2025, reporting a 1.5% drop in sales to £12.78 billion and a 7% fall in adjusted pre-tax profit to £528 million. The company also announces a new £300 million share buyback program. |

| April 2025 | Publishes its 2024/25 Annual Report and Accounts. |

| May 2025 | Completes the divestment of its 100% equity interest in Brico Dépôt Romania. Reports Q1 2025/26 sales of £3.3 billion, a 1.6% increase year-on-year. |

Kingfisher aims for group e-commerce sales to reach 30% of total sales, with one-third coming from its marketplace platforms. The company is investing in its online presence to meet evolving customer expectations and drive sales.

Trade sales penetration, excluding Screwfix, reached 17.9% in January 2025. Kingfisher aims to double trade sales penetration in France and achieve at least 30% in Poland over the medium term, focusing on serving professional customers.

UBS forecasts a profit before tax (PBT) of £532 million for fiscal year 2025. Kingfisher expects adjusted PBT of approximately £480 million to £540 million and free cash flow of around £420 million to £480 million for fiscal year 2025/26.

Kingfisher is committed to sustainability, aiming to become Forest Positive by 2025. The company is focused on making greener and healthier homes more affordable, integrating environmental considerations into its business strategy.

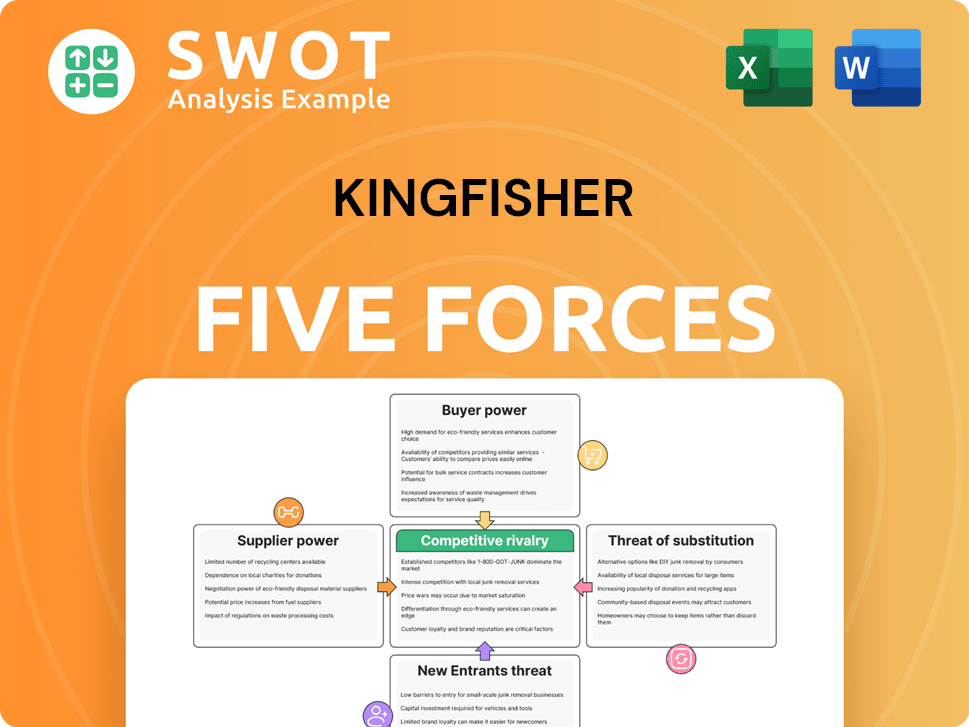

Kingfisher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Kingfisher Company?

- What is Growth Strategy and Future Prospects of Kingfisher Company?

- How Does Kingfisher Company Work?

- What is Sales and Marketing Strategy of Kingfisher Company?

- What is Brief History of Kingfisher Company?

- Who Owns Kingfisher Company?

- What is Customer Demographics and Target Market of Kingfisher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.