Kingfisher Bundle

How Does Kingfisher Navigate the Ever-Changing DIY Market?

The home improvement sector in Europe is undergoing a significant transformation, fueled by consumer demand for sustainable and digitally-integrated solutions. Kingfisher plc, a leading international player, is at the heart of this dynamic shift. From its origins in the UK, the company has expanded to operate over 1,300 stores across eight European countries, constantly adapting to the evolving market.

To truly understand Kingfisher's position, a thorough Kingfisher SWOT Analysis is crucial, examining its strengths and weaknesses within the competitive environment. This deep dive into the Kingfisher competitive landscape will explore its main rivals, market share analysis, and strategic responses within the DIY market. We'll also analyze Kingfisher's business strategy, including its digital transformation and sustainability initiatives, to assess its competitive edge. Ultimately, this analysis provides actionable insights for investors and business strategists seeking to understand the key competitors of Kingfisher and its overall market position.

Where Does Kingfisher’ Stand in the Current Market?

Kingfisher plc holds a significant market position within the European home improvement industry. It operates as a major player across several countries. The company's extensive network includes over 1,300 stores under banners like B&Q, Castorama, Screwfix, and Brico Dépôt, highlighting its broad reach within the DIY market analysis.

The company's primary product lines cover a wide array of home improvement essentials. These include building materials, garden supplies, kitchen and bathroom fittings, and various tools and accessories. Geographically, Kingfisher has a strong presence across Europe, with key markets in the UK, France, Poland, and Romania. The company serves a diverse customer base, from DIY enthusiasts to trade professionals.

Over time, Kingfisher has shown strategic shifts in its positioning. This includes an increased focus on digital transformation and e-commerce capabilities. The company has also emphasized making sustainable home improvement accessible, aligning with growing environmental awareness among consumers. For more insights into their growth strategies, you can explore the Growth Strategy of Kingfisher.

Kingfisher's market share analysis 2024 indicates a strong presence in the European home improvement sector. With over 1,300 stores, the company's reach is extensive. Key markets include the UK, France, Poland, and Romania, where it competes with various Kingfisher competitors.

Kingfisher offers a wide range of products, from building materials to garden supplies. The company serves a diverse customer base, including DIY enthusiasts and trade professionals. This broad appeal helps maintain its competitive advantage in the home improvement sector.

For the fiscal year ending January 31, 2024, Kingfisher reported total sales of £13.0 billion. The company's adjusted pre-tax profit was £568 million. This financial performance demonstrates resilience despite challenging market conditions, influencing Kingfisher's business strategy.

Kingfisher focuses on digital transformation and e-commerce. The company also emphasizes sustainable home improvement. These initiatives are key to adapting to changing consumer habits and strengthening its market position.

Kingfisher's competitive landscape involves adapting to evolving consumer preferences and economic conditions. Its ability to leverage its extensive store network and online presence is crucial. The company's strategic focus on sustainability also plays a role in its market positioning.

- Focus on digital transformation and e-commerce to meet changing consumer habits.

- Emphasis on sustainable home improvement aligns with growing environmental awareness.

- Strong financial performance, with £13.0 billion in sales and £568 million adjusted pre-tax profit in fiscal year 2024.

- Expansion of Screwfix, with sales increasing by 3.7% in the UK and Ireland in fiscal year 2024.

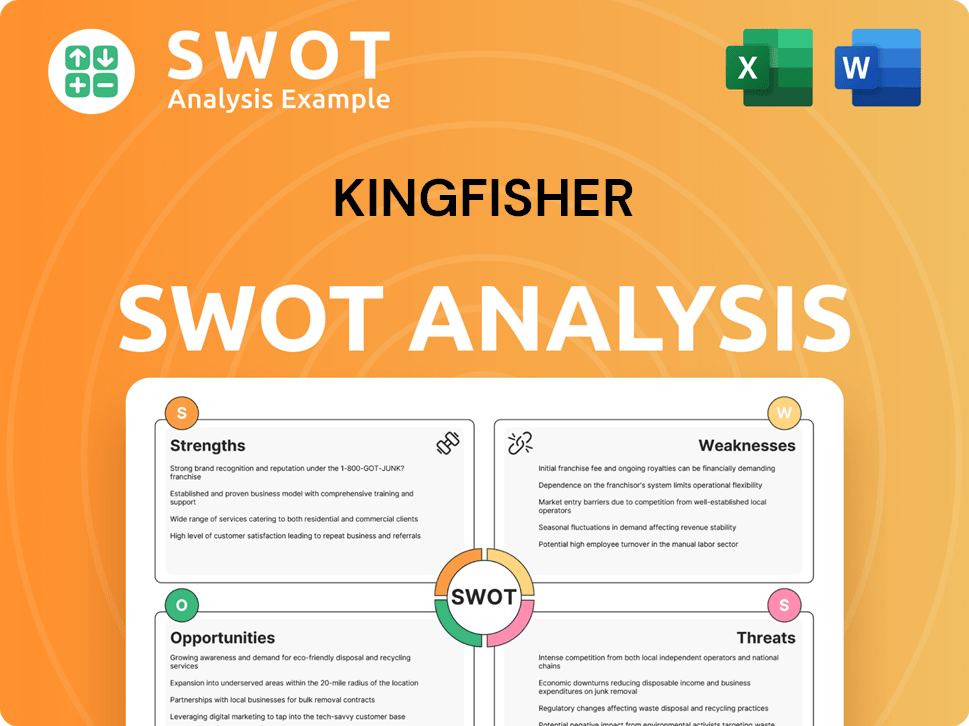

Kingfisher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kingfisher?

The Growth Strategy of Kingfisher involves navigating a complex competitive landscape within the European home improvement sector. This landscape is characterized by a mix of large, established players and emerging online retailers, all vying for market share. Understanding the key competitors and their strategies is crucial for assessing Kingfisher's market position and future growth prospects.

The DIY market is highly fragmented, making it essential to analyze both direct and indirect competitors. The competitive environment is dynamic, with factors such as pricing, product range, digital services, and strategic alliances playing significant roles. Kingfisher's ability to adapt and innovate is critical to maintaining its competitive edge.

Kingfisher's competitive landscape is a key aspect of its business strategy, influencing its market share analysis and overall financial performance. This competitive environment requires constant evaluation and adaptation to maintain a strong market position.

Direct competitors include major European DIY retailers. These companies compete with Kingfisher across various product categories and geographical regions.

ADEO, which operates Leroy Merlin and Bricomarché, is a significant competitor, especially in France and other European countries. They often compete on product range and pricing, directly challenging Kingfisher's Castorama and Brico Dépôt banners.

Travis Perkins primarily focuses on the UK trade market. However, it overlaps with Kingfisher's Screwfix in the professional segment within the UK market.

Hornbach is known for its large-format stores and extensive product selection, providing direct competition in several continental European markets. It is a strong player in the DIY market.

Indirect competition comes from various sources, including supermarkets and online marketplaces. These competitors offer a limited range of home improvement products.

Supermarkets and general merchandise retailers offer a limited range of home improvement products. These retailers compete for a share of the DIY market.

The DIY market is influenced by price wars, especially in building materials and basic supplies. Digital services and e-commerce are also key areas of competition. Strategic alliances and emerging technologies are reshaping the competitive landscape.

- Price Wars: Intense competition often leads to price wars, particularly in essential categories.

- Digital Services: Click-and-collect and online planning tools are becoming increasingly important.

- E-commerce: Online marketplaces, like Amazon, are growing their presence in the DIY sector.

- Strategic Alliances: Mergers and alliances can consolidate market share and create economies of scale.

- Emerging Players: New entrants are leveraging specialized niches and disruptive technologies, such as AI-powered home design tools.

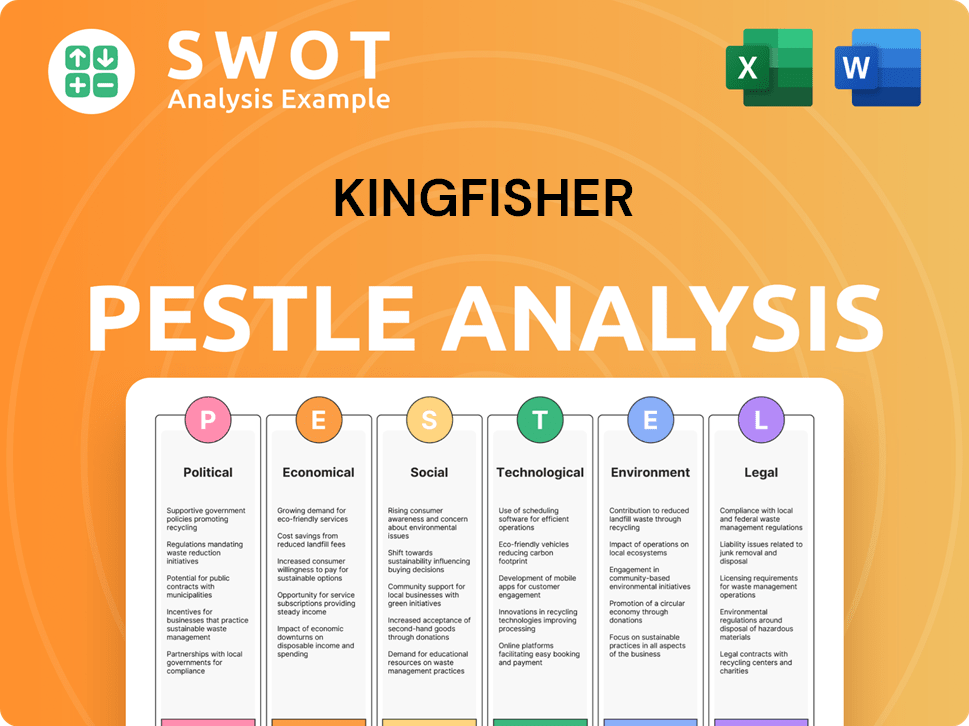

Kingfisher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kingfisher a Competitive Edge Over Its Rivals?

The competitive landscape for Kingfisher is shaped by its strategic moves and key milestones in the home improvement sector. The company has built a strong position through a multi-banner portfolio and a focus on both DIY enthusiasts and trade professionals. Understanding the Target Market of Kingfisher is essential to analyze its competitive advantages.

Kingfisher's competitive edge is derived from its diverse brand portfolio, including B&Q, Castorama, and Screwfix, allowing it to cater to various customer segments and adapt to local market conditions. Economies of scale and efficient supply chain management contribute to competitive pricing and product availability. The company's digital transformation initiatives further enhance its ability to offer a seamless omnichannel experience.

Kingfisher's commitment to sustainability also strengthens its competitive position by appealing to environmentally conscious consumers and aligning with evolving regulatory landscapes. These factors collectively contribute to Kingfisher's ability to maintain its market share and navigate the challenges posed by online competitors and changing consumer preferences.

Kingfisher's diverse portfolio, including B&Q, Castorama, Screwfix, and Brico Dépôt, allows it to target a wide range of customers. This multi-banner strategy enables the company to adapt to different market conditions and customer preferences across Europe. This approach provides a significant advantage in the Kingfisher competitive landscape.

Established brands like B&Q and Screwfix foster customer loyalty and trust, contributing to Kingfisher's overall performance. Screwfix, in particular, is highly regarded for its convenience and product availability, especially among trade customers. Strong brand recognition helps to maintain a competitive edge in the DIY market analysis.

Kingfisher's large purchasing power and extensive store network enable it to negotiate favorable terms with suppliers, leading to competitive pricing. Robust distribution networks and efficient supply chain management further enhance operational efficiencies. These factors are crucial for understanding Kingfisher's business strategy.

Investing in digital capabilities is a key part of Kingfisher's strategy to offer a seamless omnichannel experience. This includes enhanced online platforms, click-and-collect services, and digital tools to assist with home improvement projects. This digital transformation is vital for maintaining a competitive edge.

Kingfisher's commitment to sustainability, by making sustainable home improvement accessible, resonates with environmentally conscious consumers. This focus aligns with evolving regulatory landscapes, potentially offering a long-term competitive edge. The company's sustainability efforts are becoming increasingly important in the Kingfisher industry.

- Kingfisher's sustainability efforts include sourcing sustainable products and reducing its carbon footprint.

- The company aims to offer more sustainable choices to customers, aligning with growing consumer demand.

- These initiatives help strengthen Kingfisher's brand image and attract environmentally conscious consumers.

- Sustainability efforts are also crucial for complying with environmental regulations and reducing operational risks.

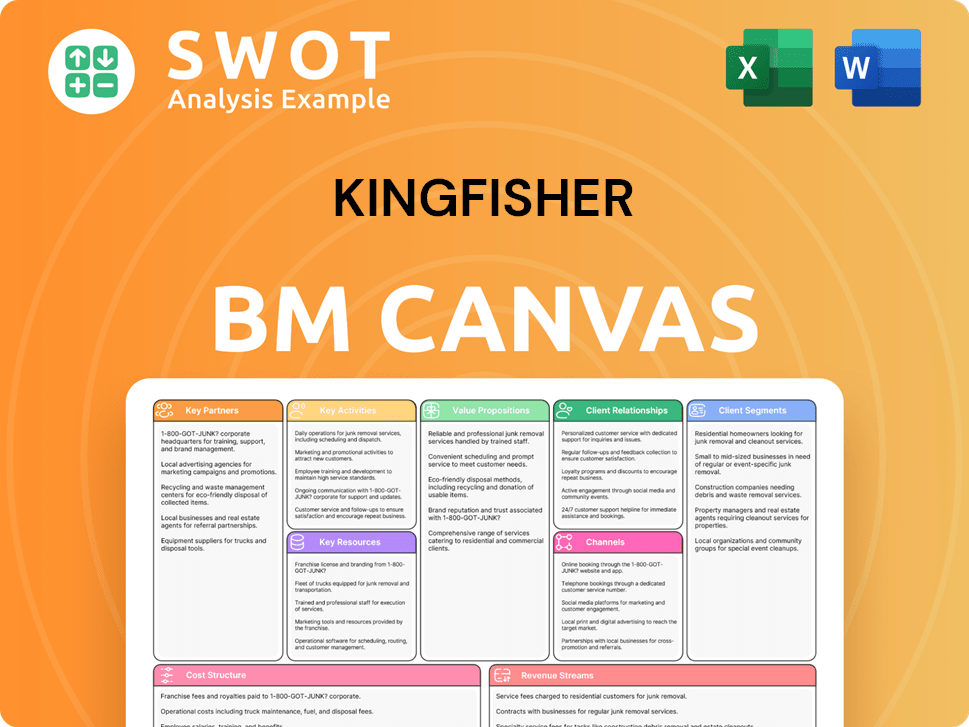

Kingfisher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kingfisher’s Competitive Landscape?

The home improvement industry, where Kingfisher operates, is experiencing significant shifts driven by technological advancements, changing consumer preferences, and regulatory pressures. A thorough Kingfisher market analysis reveals the company is navigating a dynamic environment, requiring strategic adaptation to remain competitive. Understanding the Kingfisher competitive landscape is crucial for assessing its future prospects.

The company faces both challenges and opportunities in this evolving landscape. Economic factors, such as inflation and fluctuating disposable incomes, can impact consumer spending on home improvement projects, affecting sales volumes. However, Kingfisher can leverage its strengths to capitalize on emerging trends and maintain its market position. The company's ability to adapt to these trends, invest in digital transformation, and reinforce its value proposition will be key to its success.

The industry is seeing increased digitalization, with consumers expecting seamless online and in-store experiences. Sustainability is also a major trend, influencing product offerings and supply chains. Furthermore, consumer preferences are shifting towards convenience and value, which impacts the Kingfisher business strategy.

Kingfisher must continually invest in its e-commerce platforms and digital infrastructure to keep pace with competitors. Economic shifts, like inflation, can impact consumer spending. New market entrants and disruptive technologies pose potential threats. The company needs to address these challenges effectively to maintain its market share.

Expansion into emerging markets and the continued growth of successful banners like Screwfix provide growth opportunities. Product innovations, especially in smart home technology and energy efficiency, can generate new revenue streams. Strategic partnerships can also enhance Kingfisher's market reach and offerings.

Kingfisher needs to focus on omnichannel retail, supply chain optimization, and a diversified product portfolio. Investing in digital transformation and reinforcing its value proposition around sustainability and convenience is crucial. These adaptations will help Kingfisher remain resilient in a competitive market.

The Kingfisher competitive landscape is shaped by its ability to adapt to these trends. For instance, the company's focus on sustainability positions it well to capitalize on the growing demand for eco-friendly products. The company's strategies to remain resilient will likely include continued focus on omnichannel retail, supply chain optimization, and a diversified product portfolio. Further insights into the company's structure and financial performance can be found in the article about Owners & Shareholders of Kingfisher.

To thrive, Kingfisher must prioritize digital transformation and enhance its e-commerce capabilities. This includes improving online platforms and integrating digital tools to meet evolving consumer expectations. The company also needs to strengthen its supply chain and product offerings.

- Digitalization: Investing in e-commerce and digital tools.

- Sustainability: Expanding eco-friendly product ranges.

- Market Expansion: Exploring opportunities in emerging markets.

- Supply Chain: Optimizing supply chain operations.

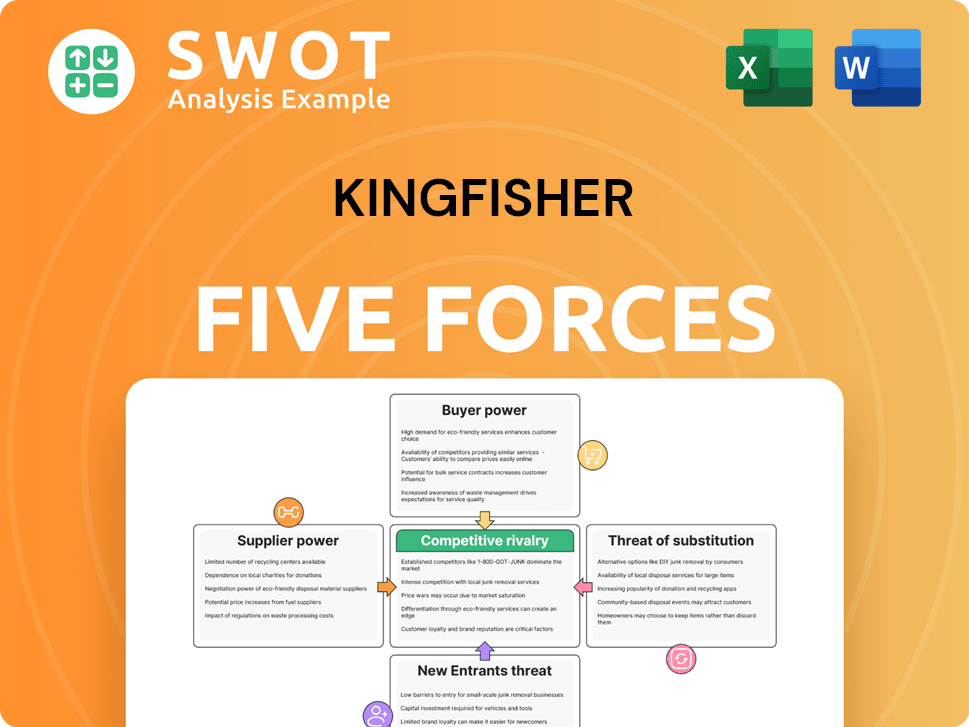

Kingfisher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kingfisher Company?

- What is Growth Strategy and Future Prospects of Kingfisher Company?

- How Does Kingfisher Company Work?

- What is Sales and Marketing Strategy of Kingfisher Company?

- What is Brief History of Kingfisher Company?

- Who Owns Kingfisher Company?

- What is Customer Demographics and Target Market of Kingfisher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.