Kingfisher Bundle

Can Kingfisher Redefine Home Improvement's Future?

Kingfisher, a titan of the home improvement industry, has a rich history rooted in the democratization of DIY, starting with B&Q in the UK. From its humble beginnings, the company has expanded across Europe, evolving into a multinational force with brands like Castorama and Screwfix. But what does the future hold for this retail giant?

This article dives deep into the Kingfisher SWOT Analysis, examining its current market position and exploring its ambitious Kingfisher growth strategy. We'll dissect Kingfisher's future prospects, including its expansion plans, digital transformation, and sustainability initiatives, to provide a comprehensive Kingfisher company analysis. Understanding its business model and financial performance is crucial to assessing its long-term growth forecast and navigating the competitive landscape.

How Is Kingfisher Expanding Its Reach?

The company is actively pursuing a multi-faceted approach to expansion, focusing on both geographical reach and enhanced service offerings. This Kingfisher growth strategy includes optimizing its existing store footprint and expanding its e-commerce capabilities to meet evolving customer demands. The company's 'Powered by Kingfisher' strategy aims to leverage its scale and capabilities across its different banners, driving efficiency and accelerating growth across its operational footprint.

A key element of the expansion strategy involves rolling out the Screwfix banner in new markets, such as France, to replicate its successful trade-focused model. Beyond new store openings, the company is also focused on improving its existing store formats and enhancing the customer experience. This includes integrating digital tools within physical stores and offering a wider range of services, such as installation and design advice.

Strategic partnerships and potential acquisitions remain a part of Kingfisher's long-term growth playbook, enabling access to new customer segments and diversification of revenue streams. The company is also exploring new product categories and sustainable solutions, aligning with its commitment to sustainable home improvement. These initiatives are crucial for determining the Kingfisher future prospects.

The company is expanding its presence in new geographical markets. The rollout of the Screwfix banner in France is a key example, with Screwfix sales in France increasing by 54.4% in H1 2023/24. This expansion is part of the broader Kingfisher company analysis.

The company is heavily investing in its digital channels. Overall e-commerce sales grew by 5.3% in the first half of FY2023/24, representing 18.2% of total Group sales. This highlights the increasing importance of digital channels in its expansion strategy and Kingfisher's e-commerce strategy.

The company is focused on improving the customer experience in its existing stores. This includes integrating digital tools within physical stores and offering a wider range of services, such as installation and design advice. This is part of the Kingfisher business model.

The company is committed to sustainable home improvement. Kingfisher aims for 60% of its sales to come from sustainable home products by 2025. This aligns with Kingfisher's sustainability initiatives.

The company's expansion strategy involves a combination of geographical expansion, e-commerce growth, and customer experience enhancement. These strategies are designed to drive revenue growth and strengthen the company's market position.

- Rollout of Screwfix in new markets.

- Growth of e-commerce sales.

- Enhancement of customer experience in physical stores.

- Focus on sustainable home products.

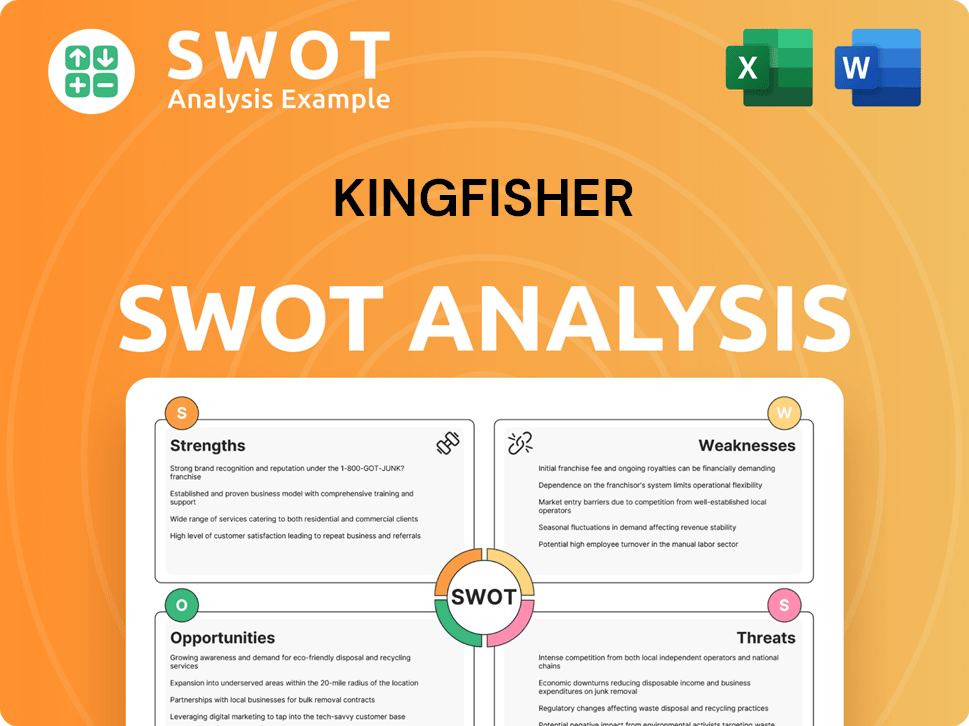

Kingfisher SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kingfisher Invest in Innovation?

The company's innovation and technology strategy is central to its growth, focusing on enhancing the customer experience and operational efficiency. This involves significant investment in digital transformation, including e-commerce platforms, mobile applications, and in-store digital tools. These efforts are designed to create a seamless omnichannel experience, meeting evolving customer needs and preferences.

A key aspect of the strategy is the application of advanced technologies like AI and data analytics. These technologies are used to personalize customer recommendations, optimize supply chains, and improve overall operational efficiency. By leveraging data insights, the company aims to better understand customer preferences and tailor product assortments accordingly.

Sustainability also plays a crucial role in the innovation strategy. The company is committed to developing and offering more energy-efficient and environmentally friendly products. This commitment is reflected in ambitious targets, such as aiming for 60% of sales to come from sustainable home products by 2025.

The company is heavily investing in digital transformation to improve customer experience. This includes e-commerce platforms, mobile apps, and in-store digital tools.

AI and data analytics are used to personalize customer recommendations. They also optimize supply chains and improve operational efficiency.

The company focuses on offering energy-efficient and environmentally friendly products. They have set ambitious targets for sustainable product sales.

Automation in logistics and warehousing operations is a key focus. This helps to improve efficiency and reduce costs.

The 'Powered by' strategy leverages the company's scale to drive innovation. It fosters continuous improvement and technological adoption across its banners.

The aim is to create a seamless omnichannel experience for customers. This involves enhancing online tools and improving inventory management.

The company's innovation strategy is further supported by investments in automation within its logistics and warehousing operations, aiming to enhance efficiency and reduce costs. The 'Powered by' strategy emphasizes leveraging its scale to drive innovation across its banners, fostering a culture of continuous improvement and technological adoption. For more insights into the competitive environment, explore the Competitors Landscape of Kingfisher.

The company's strategy includes several key initiatives to drive growth and improve operational efficiency. These initiatives are central to the company's future prospects.

- E-commerce enhancements: Continuous improvements to online platforms and mobile applications.

- AI and Data Analytics: Implementation of AI and data analytics for personalized recommendations.

- Supply Chain Optimization: Using technology to streamline supply chains and improve efficiency.

- Sustainable Product Development: Focus on creating and offering more environmentally friendly products.

- Logistics Automation: Investing in automation within logistics and warehousing operations.

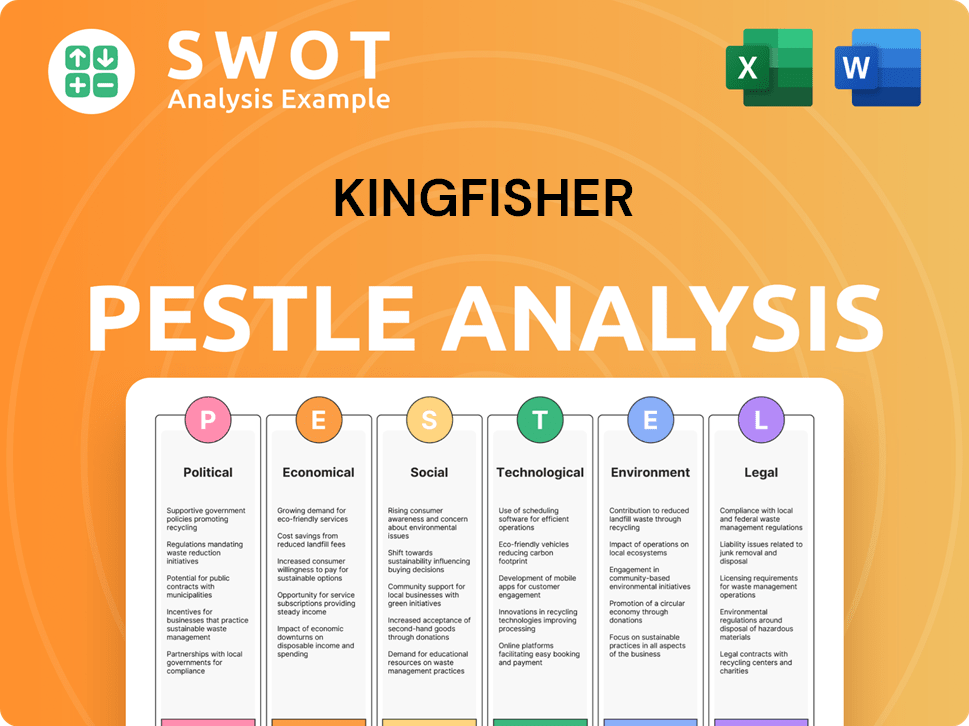

Kingfisher PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kingfisher’s Growth Forecast?

The financial outlook for the company reflects a strategic focus on profitable growth and disciplined capital allocation. The company's financial performance is closely tied to its ability to navigate the home improvement market and execute its strategic initiatives. A comprehensive Marketing Strategy of Kingfisher is essential for driving revenue growth and maintaining a strong market position.

For the full year 2023/24, the company reported total sales of £13.0 billion, demonstrating resilience in a challenging market. The company's financial health is further reflected in its robust balance sheet, with a net cash position of £97 million at the end of FY2023/24. The company's ability to adapt to changing market dynamics and consumer preferences will be critical to its future success.

The company is focused on driving sales growth through strategic initiatives, including the continued expansion of key brands and enhancing its omnichannel capabilities. The company's future prospects are also influenced by external factors such as economic conditions and consumer spending patterns. The company's commitment to shareholder returns, as evidenced by its dividend payout, reflects confidence in its future performance.

Total sales for FY2023/24 were £13.0 billion, a decrease of 1.8% on a like-for-like basis. This reflects the impact of challenging market conditions and strategic decisions. The company's ability to manage costs and optimize operations is crucial for maintaining profitability.

Despite the sales decline, the company demonstrated resilience, with an adjusted pre-tax profit of £568 million. This highlights the company's focus on efficiency and cost management. The company's profit margins are influenced by factors such as sourcing, supply chain optimization, and pricing strategies.

The company maintains a robust financial position, with a net cash position of £97 million at the end of FY2023/24. This strong cash position provides financial flexibility for future investments and strategic initiatives. The company's capital allocation strategy is designed to support sustainable growth and shareholder value.

The company has maintained a strong dividend payout, reflecting its confidence in future performance and commitment to shareholder returns. This demonstrates the company's ability to generate cash and reward its shareholders. The dividend policy is a key component of the company's overall financial strategy.

The company's future growth is expected to be driven by several key factors. These include the expansion of existing brands, particularly Screwfix and Brico Dépôt. The company is also investing in enhancing its omnichannel capabilities to improve customer experience and drive sales. The company's strategic acquisitions and international market entry strategies play a crucial role in its expansion plans.

- Expansion of Screwfix and Brico Dépôt.

- Enhanced omnichannel capabilities.

- Gradual recovery in the home improvement market.

- Focus on cost efficiencies and operational optimization.

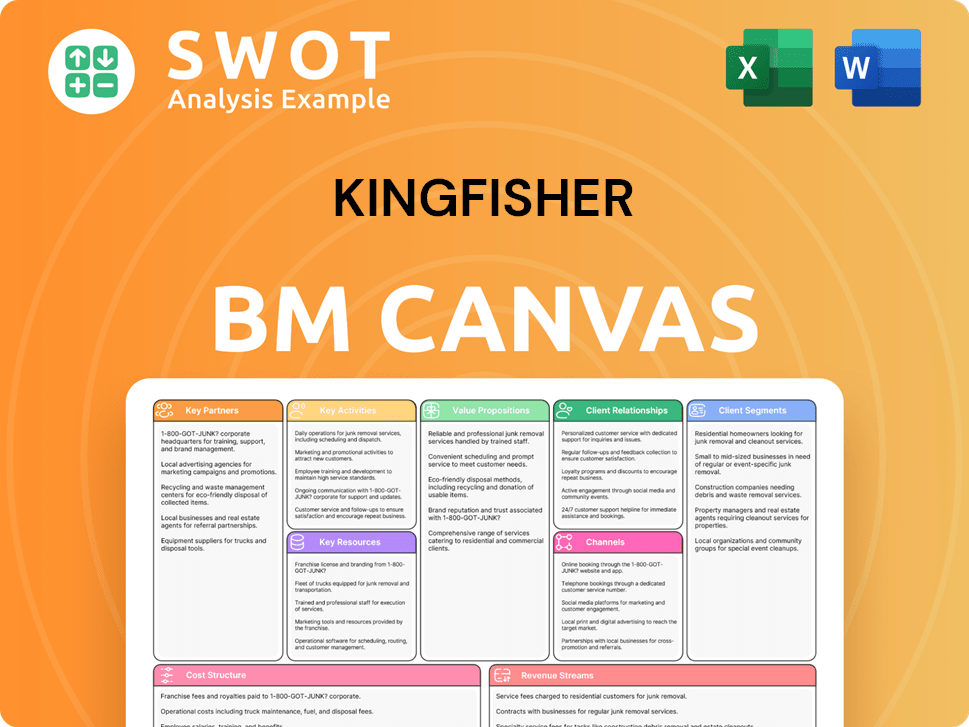

Kingfisher Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kingfisher’s Growth?

The success of the Kingfisher growth strategy is subject to several potential risks and obstacles that could influence its future prospects. The home improvement market is highly competitive, with both large international and smaller local players vying for market share. Economic downturns and shifts in consumer spending habits can also impact the demand for home improvement products, posing challenges to Kingfisher's financial performance.

Supply chain disruptions, due to geopolitical events or logistical issues, present a constant risk to product availability and cost. Regulatory changes, especially those related to environmental standards and product safety, could necessitate significant operational adjustments and investments. Moreover, the rapid advancement of technology and the rise of e-commerce require constant adaptation and investment to maintain a competitive edge, influencing Kingfisher's e-commerce strategy.

Internally, managing a diverse portfolio of brands across multiple countries adds complexities in terms of integration, brand consistency, and operational efficiency. Successfully navigating these challenges is crucial for Kingfisher's long-term growth forecast and maintaining its market position.

The home improvement retail sector is intensely competitive, featuring both large multinational corporations and smaller, more agile local competitors. This competitive landscape can pressure profit margins and necessitate continuous innovation in product offerings and customer service to maintain and enhance Kingfisher's market share analysis. The ability to differentiate from rivals is crucial for sustained success.

Economic downturns and inflationary pressures can significantly affect consumer spending on discretionary items, including home improvement products. During periods of economic uncertainty, consumers may postpone or reduce their spending on non-essential projects, impacting Kingfisher's revenue growth drivers. This necessitates careful management of inventory and operational costs.

Disruptions in the supply chain, whether due to geopolitical events, logistical challenges, or other unforeseen circumstances, can lead to product shortages and increased costs. Such disruptions can affect Kingfisher's supply chain optimization efforts, potentially impacting its ability to meet customer demand efficiently. Diversifying supply sources and improving logistics are crucial for mitigating these risks.

Changes in regulations, particularly those related to environmental standards and product safety, can require significant operational adjustments and investments. Compliance with evolving regulations, such as those concerning sustainable products and packaging, is essential. The company must adapt to meet these standards to avoid penalties and maintain consumer trust, affecting Kingfisher's sustainability initiatives.

The rapid pace of technological change, including the growth of e-commerce and the emergence of new digital tools, demands continuous adaptation and investment to stay competitive. Kingfisher's digital transformation strategy must evolve to meet changing customer expectations and the rise of online retail. This includes enhancements to online platforms and digital marketing strategies.

Managing a diverse portfolio of brands across multiple countries presents complexities in terms of integration, brand consistency, and operational efficiency. Ensuring that all brands align with the overall strategic goals and maintaining consistent standards across different markets is essential for maximizing the company's performance. This can impact Kingfisher's international market entry and expansion plans.

To address these risks, Kingfisher company analysis includes diversification across markets and brands, robust risk management frameworks, and scenario planning to anticipate and respond to potential disruptions. For example, the company has actively managed its inventory levels and optimized its supply chain to mitigate the impact of external shocks. Moreover, a focus on sustainable products and services helps mitigate regulatory risks and aligns with evolving consumer preferences, supporting Kingfisher's innovation in home improvement.

Analyzing Kingfisher's recent financial results reveals the impacts of these risks and the effectiveness of mitigation strategies. The company's ability to maintain profitability and revenue growth in the face of economic challenges and supply chain disruptions is crucial. Detailed examination of financial reports provides insights into the company's resilience and strategic agility. For further insight into the company, you can read about Mission, Vision & Core Values of Kingfisher.

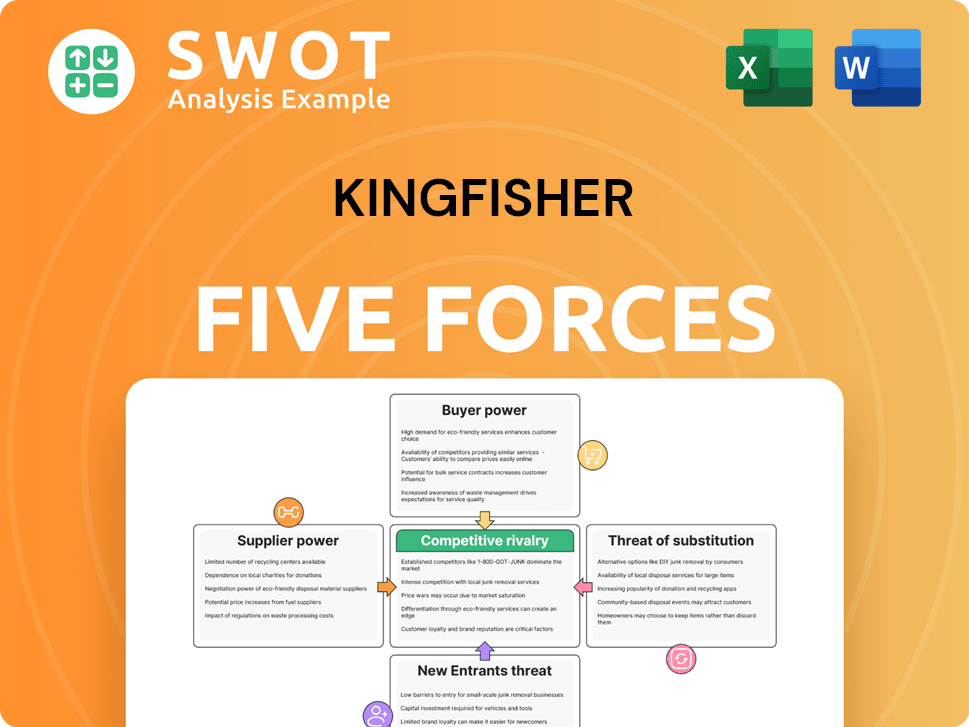

Kingfisher Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kingfisher Company?

- What is Competitive Landscape of Kingfisher Company?

- How Does Kingfisher Company Work?

- What is Sales and Marketing Strategy of Kingfisher Company?

- What is Brief History of Kingfisher Company?

- Who Owns Kingfisher Company?

- What is Customer Demographics and Target Market of Kingfisher Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.