Lamprell Bundle

What's the Story Behind Lamprell's Success?

From its roots in the UAE, Lamprell Company has carved a significant niche in the global energy landscape. Its evolution, spanning nearly five decades, showcases a remarkable journey of adaptation and growth. This exploration uncovers the key milestones that have shaped Lamprell's trajectory, from its early focus on offshore oil and gas to its current involvement in renewable energy projects.

Lamprell's Lamprell SWOT Analysis provides a detailed look at its strategic position. The company's commitment to innovation and its ability to navigate the complexities of the marine engineering sector have been crucial. Understanding the brief history of Lamprell, its projects, and its financial performance offers valuable insights for anyone interested in the energy industry's evolution.

What is the Lamprell Founding Story?

The story of the Lamprell Company began in 1976. Founded by Steven Lamprell in Dubai, United Arab Emirates, the company quickly established itself in the burgeoning offshore oil and gas sector.

Steven Lamprell, born in Great Britain in 1950, moved to the UAE and laid the groundwork for what would become a significant player in marine engineering. The company's initial focus was on servicing and maintaining offshore oil rigs.

This early focus positioned Lamprell to capitalize on the growing demand in the Persian Gulf region. The company's strategic location and service offerings were key to its initial success.

Lamprell's early business model centered on providing essential oilfield services and fabrication within the Middle East, starting with accommodation jackup rig conversions in 1989.

- Refurbishment of jackup drilling rigs began in 1992, solidifying its position in the market.

- The company continued these core activities until the late 1990s.

- Lamprell then diversified into new construction for the offshore oil and gas sector.

- Steven Lamprell sold a majority stake in the company for £265 million in 2006, reflecting substantial growth.

The cultural and economic landscape of the UAE in the 1970s, fueled by the oil and gas industry, provided a conducive environment for Lamprell's establishment and expansion. The company's ability to adapt and expand its services, from rig maintenance to new construction, showcases its strategic foresight.

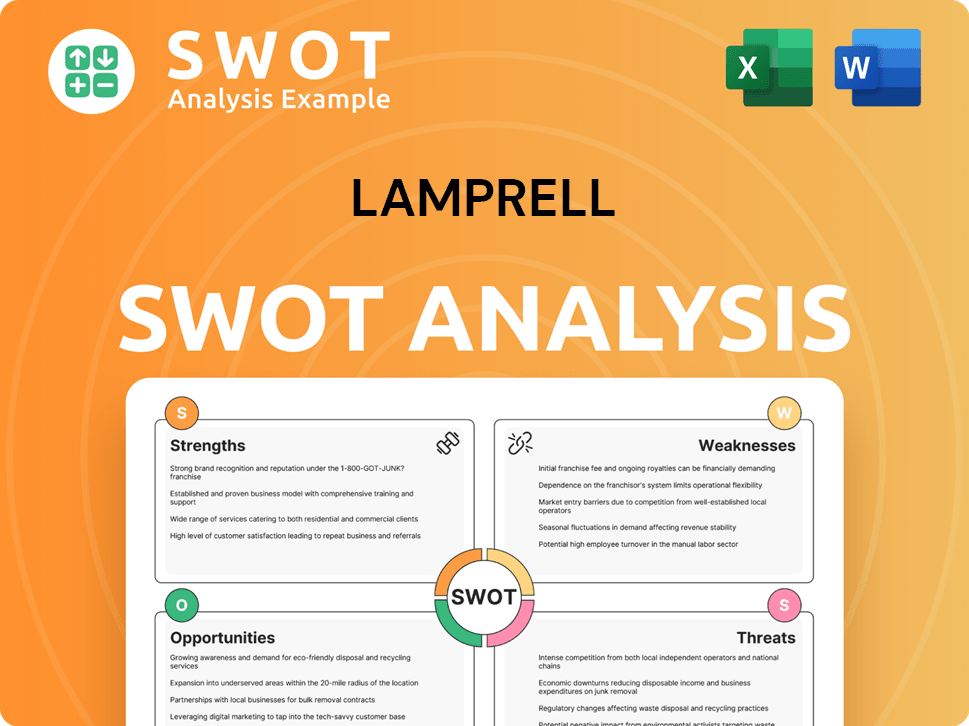

Lamprell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Lamprell?

The early growth of the company saw it establish three sites in the United Arab Emirates and one in Thailand. This expansion set the stage for its later ventures. The company's strategic moves in the late 1980s into jackup rig conversions marked an important step in its development.

In the late 1990s, the company diversified into oil rig construction, broadening its capabilities. This period also included taking on complex fabrication projects, such as building FPSO (Floating Production, Storage, and Offloading) process modules, which enhanced its expertise in marine engineering. These projects helped to solidify its position in the Offshore oil and gas sector.

A key milestone was the initial public offering on the Alternative Investment Market in 2006, followed by a full listing on the London Stock Exchange in 2008. This provided significant capital for further growth. As of May 2025, the company has raised a total of $45 million in funding, with the last round occurring on December 20, 2021.

In the early 2000s, the company further diversified by entering the renewables sector. This involved delivering self-propelled jackup vessels for offshore oil & gas and offshore wind turbine installation. In 2011, the company acquired Maritime Industrial Services (MIS) for an equity consideration of $336 million, effectively doubling its business.

The company's main operational centers and yards are located in the UAE, with a primary facility in Hamriyah, and additional facilities in Jebel Ali and Dubai Investments Park. The current CEO, Ian Prescott, took the helm in 2023. Furthermore, the company has a joint partnership with Saudi Aramco, Bahri, and HHI in the Industrial Maritime Yard in Saudi Arabia. As of September 2024, a new office opened in Chennai, India.

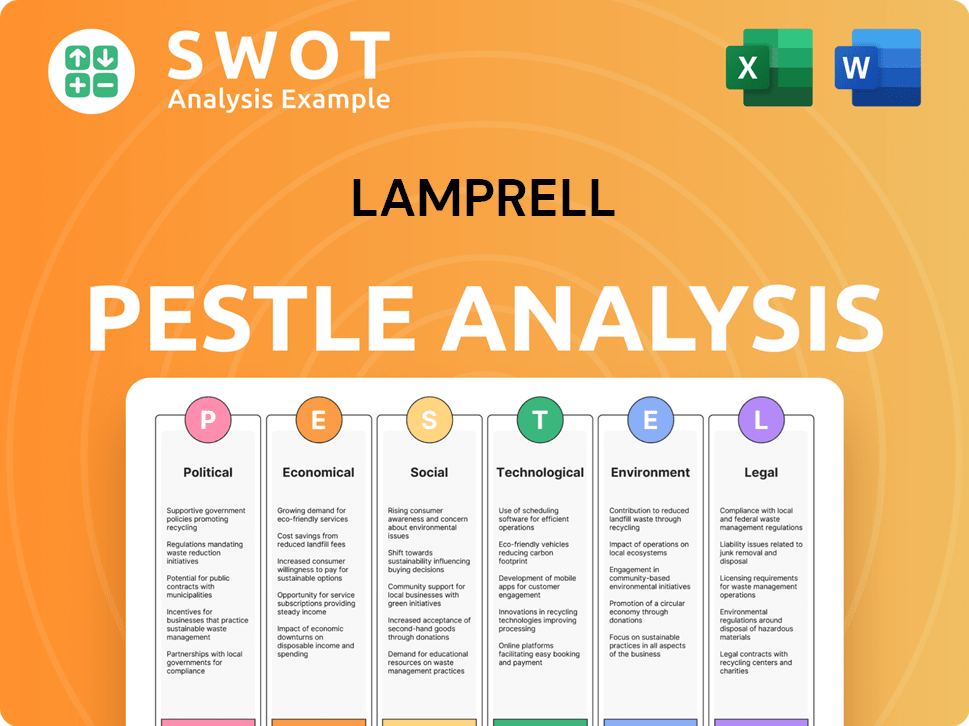

Lamprell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Lamprell history?

The Lamprell Company has marked significant achievements throughout its history, demonstrating its capabilities in marine engineering and its ability to adapt to market changes. From setting world records to diversifying into renewable energy, the company has shown resilience and innovation in the offshore oil and gas sector and beyond. This brief history of Lamprell showcases its journey through various milestones, innovations, and the challenges it has overcome.

| Year | Milestone |

|---|---|

| 2014 | Entered the Guinness World Records for the 'heaviest load moved by self-propelled modular trailers,' transporting a 13,191.98 metric tonne Production, Utilities and Quarters (PUQ) deck. |

| Early 2000s | Diversified into the renewable energy sector, marking a strategic shift for the company. |

| 2016 | Secured a significant contract to construct 60 wind turbine foundation structures for ScottishPower Renewables' East Anglia One project. |

| 2021 | Reorganized its business into three distinct units: Renewables, Oil & Gas, and Digital. |

| 2022 | Acquired by Thunderball Investments, a consortium owned by Blofeld Investment Management and AlGihaz, for approximately £38.8 million ($46.5 million). |

| 2023-2024 | Completed the Moray East wind farm project in Scotland, delivering 60 wind turbine generator transition pieces and two offshore substation transition pieces, on time and within budget. |

Lamprell has consistently sought innovative solutions to meet the evolving demands of the energy sector. A key innovation was the strategic pivot into renewable energy, which led to significant projects in the wind energy sector. The company also established a digital joint venture to create and market innovative digital solutions for the energy industry.

Lamprell's move into renewable energy marked a significant innovation, expanding its service offerings beyond traditional offshore oil and gas projects. This strategic shift allowed the company to tap into the growing demand for sustainable energy solutions and diversify its revenue streams.

The establishment of a digital joint venture with Injazat, with an initial funding of $7 million, demonstrates Lamprell's commitment to technological advancement. This initiative aimed to create and market innovative digital solutions for the energy industry, enhancing operational efficiency and competitiveness.

The record-breaking achievement in transporting heavy loads showcases Lamprell's engineering capabilities and expertise in marine engineering. This innovation highlights the company's ability to handle large-scale projects and complex logistics in the offshore sector.

Reorganizing the business into three distinct units – Renewables, Oil & Gas, and Digital – reflects Lamprell's adaptability to the changing energy landscape. This restructuring allowed for better focus and resource allocation, enhancing operational efficiency and strategic alignment.

The successful completion of projects like the Moray East wind farm, on time and within budget, demonstrates Lamprell's commitment to project delivery excellence. This highlights the company's ability to manage complex projects effectively, ensuring high-quality outcomes and customer satisfaction.

The acquisition by Thunderball Investments and subsequent restructuring provided Lamprell with financial stability and a renewed focus. This strategic move helped address financial challenges and set the stage for future growth and development within the offshore oil and gas sector.

Despite its successes, Lamprell has faced challenges, particularly in its foray into the renewable energy market. The company experienced operational difficulties and pricing missteps on the East Anglia One project, leading to financial losses. However, Lamprell learned from these experiences, investing in improved bidding processes and project management.

Lamprell incurred substantial losses, totaling $80 million in 2017 and an additional $9.4 million in 2018, due to operational challenges and pricing issues on the East Anglia One project. These losses highlighted the risks associated with entering a new market and the need for improved project management.

Operational challenges, including inefficiencies and delays, contributed to the financial setbacks on the East Anglia One project. Addressing these issues required a reassessment of project management practices and resource allocation to improve overall performance.

Inaccurate bidding and pricing strategies on the East Anglia One project resulted in reduced profit margins and financial losses. This underscored the importance of rigorous bidding processes and accurate cost estimation in securing profitable contracts.

Entering the renewable energy market presented challenges, including unfamiliarity with specific project requirements and increased competition. Overcoming these hurdles required strategic adjustments and a focus on developing expertise in the renewable energy sector.

Lamprell's response to these challenges included investing in additional resources, improving bidding processes, and implementing lessons learned from previous projects. These strategic adjustments were crucial for improving project outcomes and ensuring future success.

The competitive landscape in the offshore oil and gas and renewable energy sectors, along with fluctuating market dynamics, posed ongoing challenges for Lamprell. Adapting to these changes required a flexible approach, strategic partnerships, and a focus on innovation.

For more insights into the company's strategic direction, you can explore the Growth Strategy of Lamprell.

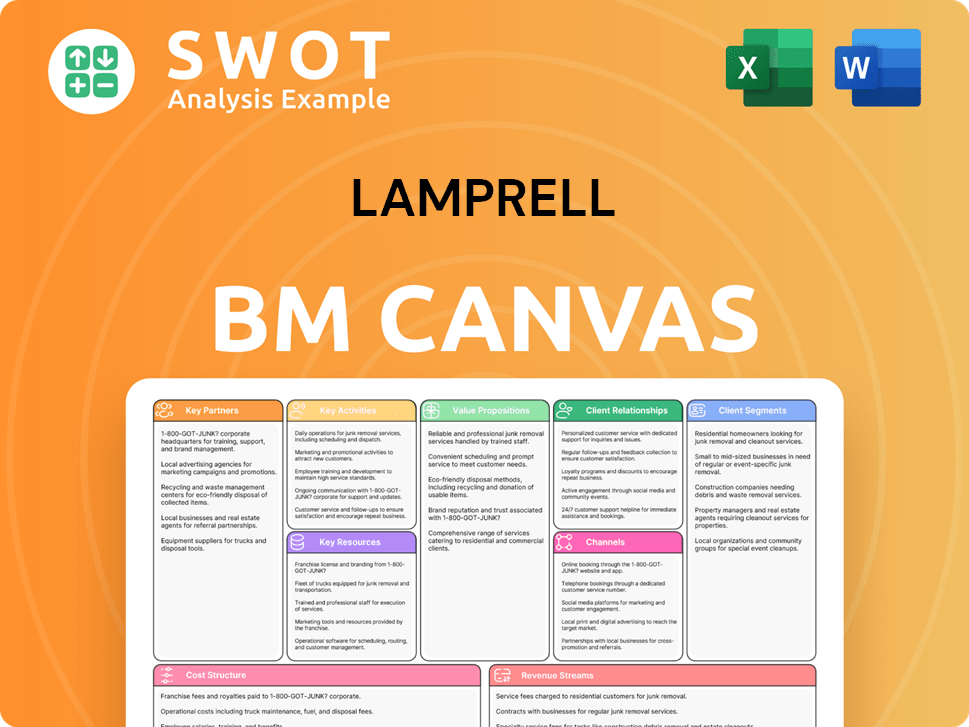

Lamprell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Lamprell?

The brief history of Lamprell Company is marked by significant milestones in the marine engineering and offshore oil and gas sectors. Established in 1976 by Steven Lamprell in Dubai, UAE, the company expanded from jackup rig conversions to rig construction and, eventually, the renewables sector. Publicly listed on the London Stock Exchange in 2008, it diversified its operations through acquisitions and strategic projects, including ventures in offshore wind and collaborations with major industry players like Aramco. The company has navigated market fluctuations, including financial impacts from projects like East Anglia One, while adapting its business units to focus on Renewables, Oil & Gas, and Digital initiatives.

| Year | Key Event |

|---|---|

| 1976 | Established in Dubai, UAE, by Steven Lamprell. |

| Late 1980s | Began jackup rig conversions. |

| Late 1990s | Diversified into oil rig construction. |

| Early 2000s | Entered the renewables sector. |

| 2006 | Launched Initial Public Offering on the Alternative Investment Market. |

| 2008 | Secured a full listing on the London Stock Exchange. |

| 2011 | Acquired Maritime Industrial Services (MIS). |

| 2014 | Entered Guinness World Records for heaviest load moved by self-propelled modular trailers. |

| 2016 | Awarded contract for East Anglia One offshore wind project. |

| 2017-2018 | Incurred significant losses on the East Anglia One project. |

| 2018 | Extended its Offshore Long-Term Agreement (LTA) with Aramco. |

| 2019 | Began fabrication of jacket foundations for the Moray East wind project. |

| 2021 | Reorganized into three business units: Renewables, Oil & Gas, and Digital. |

| 2022 | Acquired by Thunderball Investments and delisted from the London Stock Exchange. |

| 2023-Early 2024 | Delivered the Moray West project on time and on budget. |

| September 2024 | Awarded two contracts by RWE for the supply of 184 transition pieces for the Norfolk Vanguard West and East wind farms. |

| August 2024 | First steel cut for a new oil and gas project involving two production decks and one jacket, with mechanical completion targeted for early 2026. |

| September 2024 | Lamprell India Private Limited was incorporated in Chennai, India. |

| April 2025 | Successfully extended its longstanding Offshore Long-Term Agreement with Aramco. |

| May 2025 | Signed a Memorandum of Understanding (MoU) with Dong Fang Offshore (DFO) for a newbuild NG-9000X wind turbine installation and maintenance vessel to support offshore wind activities in the Asia Pacific region. |

Lamprell is focusing on the renewables sector, especially offshore wind projects. The company is investing in a serial production line to increase efficiency. With a bid pipeline of over $40 billion, the company is well-positioned to capitalize on the growing demand for renewable energy solutions. The company aims to take a broader role in renewables projects.

In the oil and gas sector, Lamprell is maintaining its partnerships with major clients. The company recently extended its long-term agreement with Aramco, a key strategic move. Lamprell is also exploring opportunities in Qatar and receiving inquiries from the US for module work, including downstream LNG projects.

The digital business unit is focused on leveraging technology to enhance Lamprell's traditional businesses. This includes monetizing the company's expertise and improving operations through emerging digital technologies. The company aims for mechanical completion of a current oil and gas project in early 2026.

Lamprell's future is geared towards the energy transition, with a strong emphasis on renewables while maintaining a presence in the oil and gas markets. The company's strategic direction aligns with its founding vision of serving the energy industry. With approximately a 50/50 split between renewables and oil & gas prospects in its current bid pipeline, the company is well-positioned for growth.

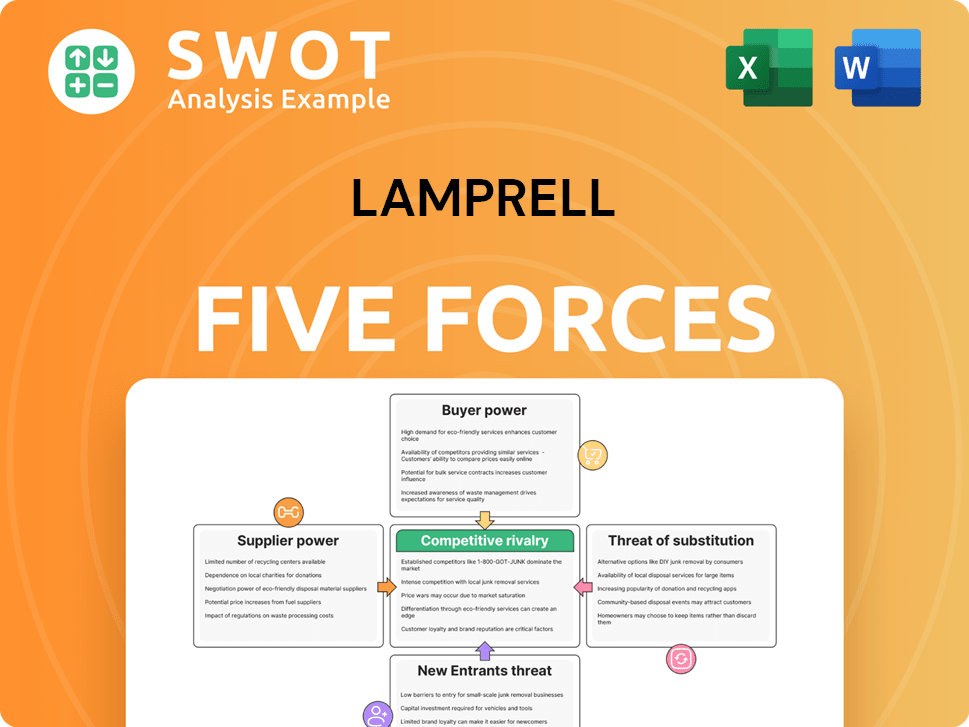

Lamprell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Lamprell Company?

- What is Growth Strategy and Future Prospects of Lamprell Company?

- How Does Lamprell Company Work?

- What is Sales and Marketing Strategy of Lamprell Company?

- What is Brief History of Lamprell Company?

- Who Owns Lamprell Company?

- What is Customer Demographics and Target Market of Lamprell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.