Lamprell Bundle

Can Lamprell Navigate the Shifting Sands of the Energy Sector?

In a world hungry for energy, how does a company like Lamprell chart its course? Lamprell, a veteran in the offshore energy industry, has a rich history and a pivotal role in shaping the sector's landscape. From its roots in Dubai to its current global footprint, the company's journey offers a compelling case study in strategic adaptation.

This article delves deep into the Lamprell SWOT Analysis, exploring its Lamprell growth strategy and Lamprell future prospects. We'll dissect the Lamprell company analysis, examining its market position, financial performance, and business overview to understand its potential in the evolving energy market. The analysis will also cover Lamprell company growth strategy 2024, its future prospects in offshore wind, and the impact of the oil and gas market to provide a comprehensive Lamprell company long-term outlook.

How Is Lamprell Expanding Its Reach?

The Lamprell growth strategy is centered on diversifying its revenue streams and expanding into high-growth markets, especially within the renewable energy sector. This strategic shift involves leveraging its established fabrication and engineering expertise for offshore wind projects. The company's strategic initiatives are designed to capitalize on the increasing demand for sustainable energy solutions.

A key aspect of the

Furthermore,

In February 2024, Lamprell secured an EPCI contract for foundations for an offshore wind farm in the North Sea, valued at approximately $200 million. This project is expected to be completed by Q3 2026. This contract highlights Lamprell's growing presence in the offshore wind market and its ability to secure significant projects.

The company is targeting expansion in Europe and North America, where offshore wind development is accelerating. These markets offer significant opportunities for growth and diversification. This strategic move is part of Lamprell's broader plan to reduce its reliance on the oil and gas sector.

Lamprell is exploring new product categories within its core oil and gas offerings, such as specialized modules for LNG facilities and CCUS projects. These initiatives are designed to meet evolving energy demands and provide additional revenue streams. This diversification strategy aims to capture opportunities in emerging markets.

Partnerships with renewable energy developers and technology providers are crucial for enhancing market penetration. These collaborations will improve project delivery capabilities and allow Lamprell to leverage external expertise. This collaborative approach is vital for navigating the complexities of the renewable energy sector.

Lamprell anticipates that its renewable energy backlog will constitute over 40% of its total backlog by the end of 2025, up from approximately 25% in early 2024. This significant increase demonstrates the company's commitment to the renewable energy sector and its success in securing new projects.

- EPCI contract secured in February 2024 for an offshore wind farm in the North Sea, valued at approximately $200 million.

- Focus on expanding in Europe and North America, where offshore wind development is accelerating.

- Exploring new product categories within oil and gas, such as LNG modules and CCUS projects.

- Partnerships with renewable energy developers to enhance market penetration.

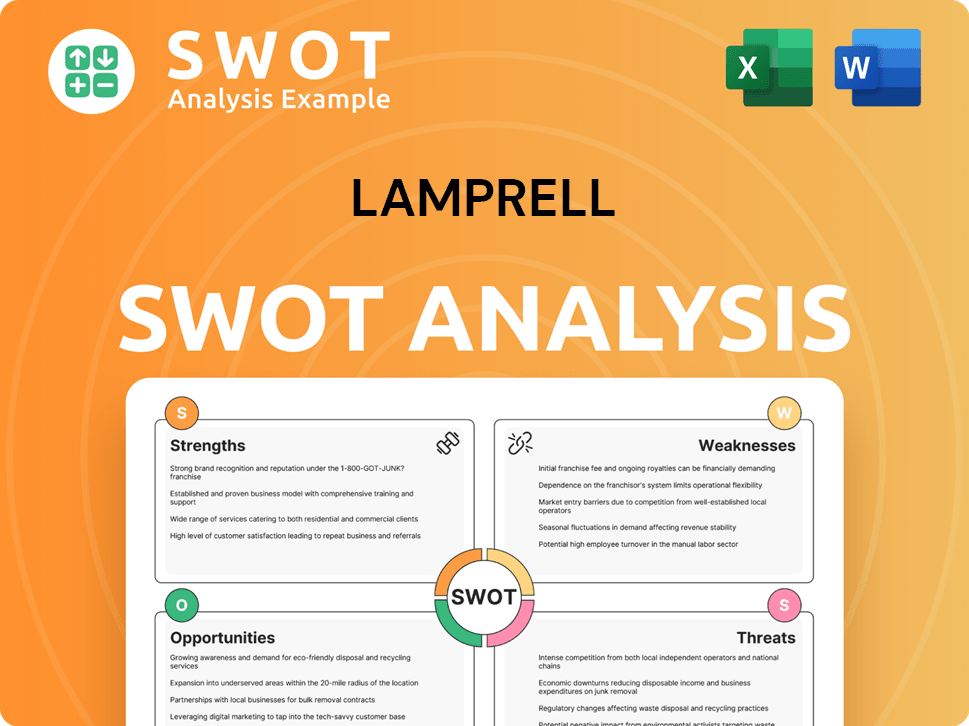

Lamprell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lamprell Invest in Innovation?

The innovation and technology strategy of the company is a critical component of its overall Lamprell growth strategy. This strategy is designed to improve operational efficiency, enhance safety protocols, and develop new solutions to meet the changing demands of the energy sector. The company's approach to technology and innovation is integral to its Lamprell future prospects, especially in the evolving landscape of renewable energy.

The company's commitment to innovation is evident in its substantial investment in research and development (R&D). This investment is a key aspect of the Lamprell company analysis, demonstrating its dedication to staying ahead of industry trends. The focus areas for R&D include automation in fabrication processes and advanced welding techniques, aimed at reducing project timelines and costs.

The company is also undergoing a digital transformation, implementing advanced project management software and data analytics platforms. This is aimed at optimizing project execution and resource allocation. The exploration of AI for predictive maintenance and IoT sensors for real-time monitoring further underscores its commitment to technological advancement. The company's strategic initiatives in technology are vital for its Lamprell business overview.

The company allocates approximately 3-4% of its annual revenue to R&D. This significant investment underscores the company's commitment to innovation and technological advancement. This investment is a key factor in its Lamprell financial performance.

The company is implementing advanced project management software and data analytics platforms. This initiative aims to optimize project execution and resource allocation, improving overall efficiency. The use of AI and IoT further enhances these efforts.

The company is developing capabilities for constructing specialized foundations for offshore wind turbines. It is also exploring green steel technologies for its fabrication processes. These initiatives are crucial for its Lamprell sustainability initiatives.

The company received an industry award in late 2023 for its innovative approach to modular construction in offshore wind projects. This recognition highlights its leadership and innovative capabilities in the renewable energy sector. This is a key indicator of its Lamprell market position.

These advancements allow the company to undertake more complex projects and improve its competitiveness. They also help the company meet the stringent requirements of the renewable energy sector. This is a key factor in its Lamprell company strategic initiatives.

The primary focus areas for R&D include automation in fabrication processes and advanced welding techniques. These innovations are designed to reduce project timelines and costs, improving overall efficiency. These efforts are vital for its Lamprell business model and strategy.

These technological advancements play a crucial role in the company's growth objectives. They enable the company to undertake more complex projects, improve competitiveness, and meet the stringent requirements of the renewable energy sector. The company's commitment to innovation is also reflected in its sustainability initiatives. For further insights into the company's core values, consider reading about the Mission, Vision & Core Values of Lamprell.

The company's technological initiatives are focused on several key areas to drive growth and efficiency.

- Automation in fabrication processes to reduce project timelines and costs.

- Implementation of advanced project management software and data analytics platforms.

- Exploration of AI for predictive maintenance and IoT sensors for real-time monitoring.

- Development of capabilities for constructing specialized foundations for offshore wind turbines.

- Exploration of green steel technologies for fabrication processes.

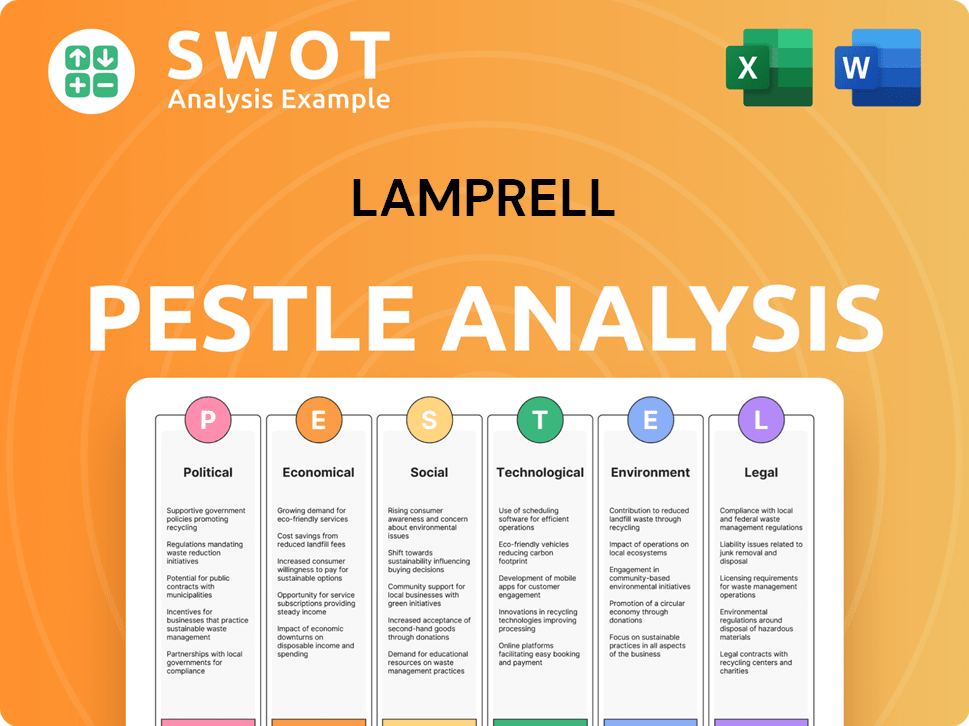

Lamprell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lamprell’s Growth Forecast?

The financial outlook for the company reflects a strategic shift towards higher-growth sectors while maintaining a solid base in its traditional business. The company's Lamprell growth strategy focuses on diversification and expansion in the renewable energy sector, which is expected to drive significant revenue growth in the coming years. This strategic pivot is designed to capitalize on the increasing demand for sustainable energy solutions, thereby enhancing the company's long-term value.

For the fiscal year 2024, the company projects revenue targets between $850 million and $900 million. This increase is primarily driven by a robust project pipeline in both the oil and gas and renewable energy sectors. This represents a notable increase compared to the approximately $720 million in revenue achieved in 2023. The company aims to improve profit margins, targeting an EBITDA margin of 8-10% by the end of 2025, up from 6.5% in 2023.

The company's investment levels are expected to remain substantial. Capital expenditure is projected at $40-50 million annually for 2024-2025. These investments are primarily directed toward facility upgrades, new equipment for renewable energy projects, and research and development. The company's Lamprell future prospects include achieving a revenue mix of 50% from renewable energy projects and 50% from oil and gas by 2027, diversifying its portfolio and reducing reliance on a single sector.

The company anticipates revenues between $850 million and $900 million for 2024. This projection demonstrates a significant increase from the $720 million reported in 2023. The growth is fueled by strong project pipelines in both the oil and gas and renewable energy sectors.

The company is targeting an EBITDA margin of 8-10% by the end of 2025. This represents an improvement from the 6.5% margin achieved in 2023. The increase is expected to come from operational efficiencies and higher-value contracts, especially in the renewables sector.

Capital expenditure is projected to be $40-50 million annually for 2024 and 2025. These investments are primarily allocated to facility upgrades, new equipment for renewable energy projects, and research and development. These investments support the company’s long-term growth strategy.

The company aims to achieve a revenue mix of 50% from renewable energy projects and 50% from oil and gas by 2027. This diversification strategy will reduce its reliance on a single sector and strengthen its market position. This is a key element of the Lamprell company analysis.

The company's financial strategy includes several key initiatives aimed at driving growth and improving profitability. These initiatives are supported by a strong balance sheet and a clear focus on operational excellence. The successful capital raise of $120 million in early 2024 underscores investor confidence in the company's strategic direction and its ability to execute its plans.

- Revenue growth driven by both oil and gas and renewable energy projects.

- Improved EBITDA margins through operational efficiencies and higher-value contracts.

- Strategic investments in facilities, equipment, and R&D to support growth.

- Diversification of revenue streams to reduce sector-specific risks.

- Successful capital raise to support expansion and working capital needs.

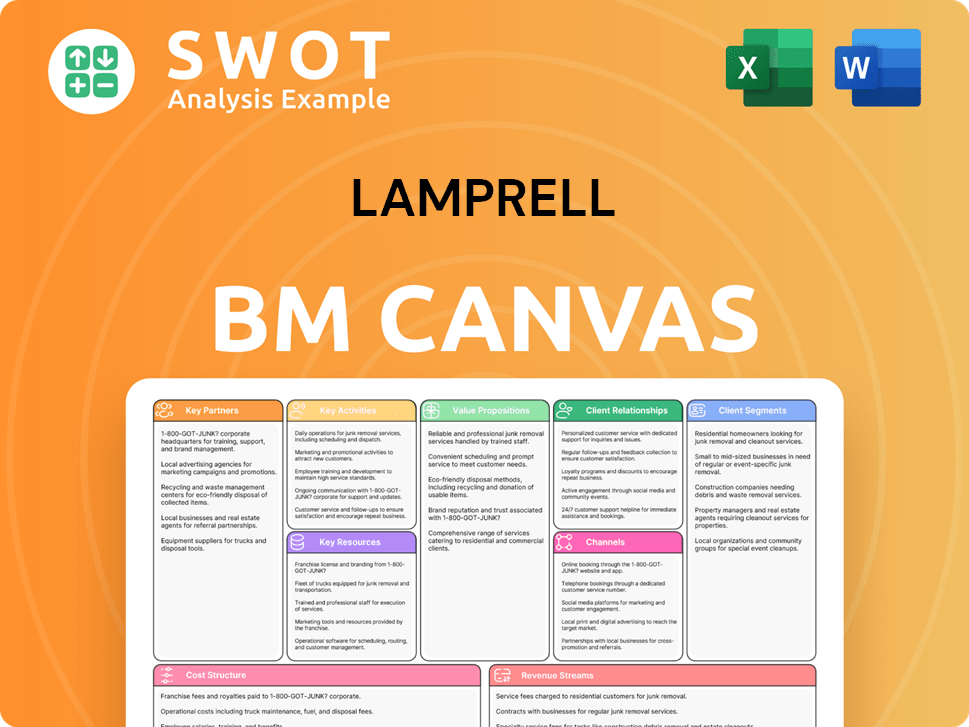

Lamprell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lamprell’s Growth?

The path of the company's growth strategy is not without its hurdles. Several strategic and operational risks could potentially impact the company's trajectory. Understanding these potential roadblocks is crucial for a comprehensive Lamprell company analysis.

Market competition, regulatory changes, and supply chain vulnerabilities present ongoing challenges. Furthermore, technological advancements and internal resource constraints add to the complexity. A deep dive into these areas offers a clearer view of the Lamprell future prospects.

The company's ability to execute its expansion plans is tied to how well it navigates these risks. The company's strategic initiatives include diversification and proactive management to mitigate these challenges. For a broader perspective, consider exploring Target Market of Lamprell.

Competition is fierce in both oil and gas and renewable energy sectors. Established players and new entrants constantly vie for projects, impacting the company's market position. This competition can affect project profitability and the ability to secure new contracts.

Changes in environmental policies and offshore safety standards can significantly affect project costs and timelines. Stricter regulations may require the company to adapt its operational practices, potentially increasing expenses. These factors should be part of the Lamprell financial results analysis.

Global events can disrupt supply chains, affecting material availability and timely project delivery. Delays in receiving essential components or materials can lead to project cost overruns and schedule slippage. This is a key consideration for the Lamprell business model and strategy.

Competitors introducing more advanced or cost-effective solutions pose a risk. The company must continuously invest in technology to remain competitive. Failure to adapt can impact the company's long-term outlook.

A shortage of skilled labor or project management capacity can hinder project execution. Efficient project management is essential for success. This impacts the company's ability to execute its expanding project portfolio.

Increasing volatility in commodity prices and the potential for project delays due to extreme weather events pose emerging risks. These factors can affect project profitability and operational efficiency. This influences the Lamprell investment potential.

The company employs a comprehensive risk management framework to address these challenges. This includes diversifying its project portfolio across sectors and geographies. Robust contract negotiations and scenario planning are also utilized to prepare for various market conditions.

The company actively invests in training programs to mitigate skilled labor shortages. This proactive approach helps ensure it has the workforce needed to meet project demands. This is crucial for the Lamprell company growth strategy 2024.

In late 2023, the company successfully managed supply chain disruptions for a major offshore wind project. This was achieved by leveraging its global procurement network and pre-ordering critical components. This showcases effective supply chain management.

The company's proactive measures include diversifying its project portfolio and investing in training programs. These actions underscore its commitment to managing risks and achieving its strategic goals. This impacts the Lamprell stock performance forecast.

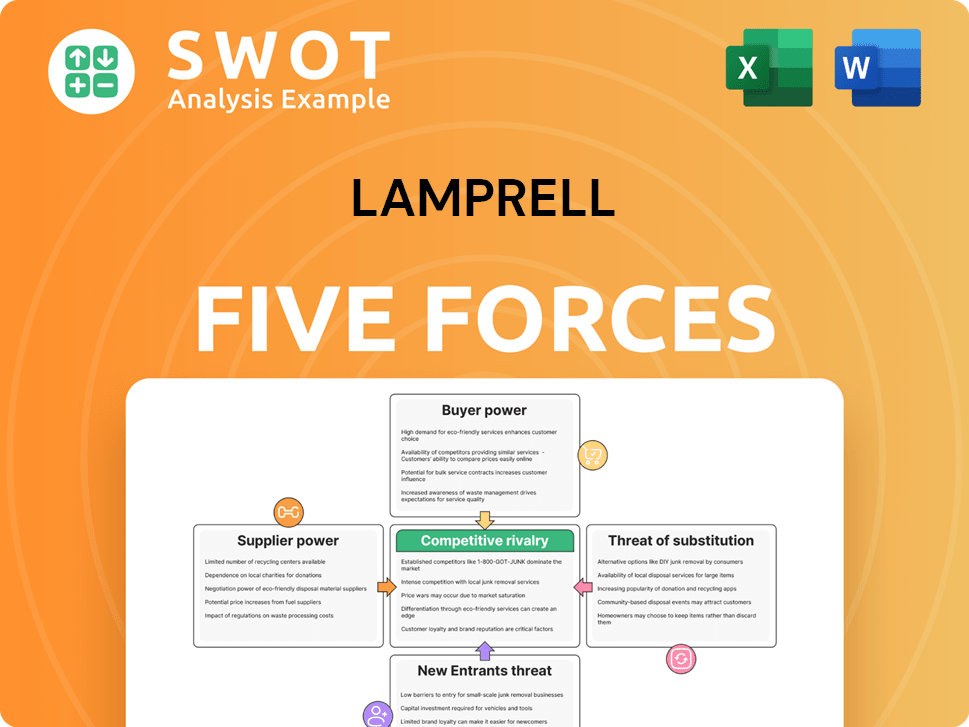

Lamprell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lamprell Company?

- What is Competitive Landscape of Lamprell Company?

- How Does Lamprell Company Work?

- What is Sales and Marketing Strategy of Lamprell Company?

- What is Brief History of Lamprell Company?

- Who Owns Lamprell Company?

- What is Customer Demographics and Target Market of Lamprell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.