Lamprell Bundle

How Does Lamprell Navigate the Turbulent Offshore Energy Sector?

The offshore energy industry is a high-stakes arena, constantly reshaped by global events and technological advancements. Lamprell, a key player in this dynamic market, has built a legacy on adaptability and expertise. But who are Lamprell's main rivals, and how does it differentiate itself in this competitive landscape? Understanding Lamprell's position is crucial for anyone invested in the future of energy services.

Founded in 1976, Lamprell's journey from a regional startup to a global contender offers valuable insights into the Lamprell SWOT Analysis of the energy services industry. This deep dive into the Lamprell competitive landscape will explore its strengths, weaknesses, and strategic positioning within the offshore oil and gas sector and the burgeoning renewable energy market. We'll analyze Lamprell's market share analysis, its competitors, and the factors influencing its financial performance, providing a comprehensive Lamprell company profile.

Where Does Lamprell’ Stand in the Current Market?

Lamprell's market position is significant within the offshore energy fabrication and services sector, particularly in the Middle East and North Africa (MENA) region. The company specializes in jackup rig fabrication and refurbishment, alongside constructing and servicing offshore rigs, liftboats, and land rigs. It also provides fabrication services for topsides and offers related engineering and project management services. This positions it as a key player in the energy services industry, serving a diverse customer base that includes international and national oil companies and renewable energy developers.

Historically, Lamprell has been strongly associated with the oil and gas sector. However, it has strategically diversified into the renewable energy sector, specifically focusing on offshore wind farm components. This strategic shift aligns with the broader industry trend towards decarbonization, positioning the company to capitalize on the growing demand for renewable energy infrastructure. This diversification is a key aspect of its competitive strategy, allowing it to adapt to changing market dynamics and reduce its reliance on the volatile oil and gas market.

The company's financial performance reflects the cyclical nature of the energy industry. For the fiscal year 2023, Lamprell reported a revenue of $981.4 million, a substantial increase from $298.9 million in 2022. As of December 31, 2023, its order book stood at $1.5 billion, indicating a robust pipeline of future projects. These figures demonstrate a strong recovery and growth trajectory, highlighting its financial health relative to many specialized contractors in the offshore sector. Analyzing the Marketing Strategy of Lamprell can provide further insights into its market approach.

Lamprell's core operations involve the construction and refurbishment of offshore jackup rigs, liftboats, and land rigs. It also fabricates topsides and provides engineering and project management services. These services cater to both the oil and gas and renewable energy sectors, with a growing focus on offshore wind farm components.

The value proposition lies in its specialized services within the offshore energy sector, particularly in the MENA region. Lamprell offers comprehensive solutions, from fabrication to project management, serving a diverse client base. The diversification into renewable energy enhances its value proposition by addressing the growing demand for sustainable energy infrastructure.

Lamprell's primary market focus is the offshore energy sector, with a strong presence in the MENA region. Its services support both the oil and gas and renewable energy industries. The company's strategic shift towards offshore wind farm components indicates a proactive approach to capture opportunities in the expanding renewable energy market.

The customer base includes international and national oil companies, as well as renewable energy developers. Lamprell's ability to serve diverse clients underscores its adaptability and its capacity to meet the evolving demands of the energy market. Its customer relationships are crucial for securing projects and maintaining a strong market position.

Lamprell's strengths include its established infrastructure, long-standing client relationships, and strategic location in the MENA region. Its diversification into renewable energy is a significant advantage. However, weaknesses may include its reliance on the cyclical energy market and the need to adapt to technological advancements.

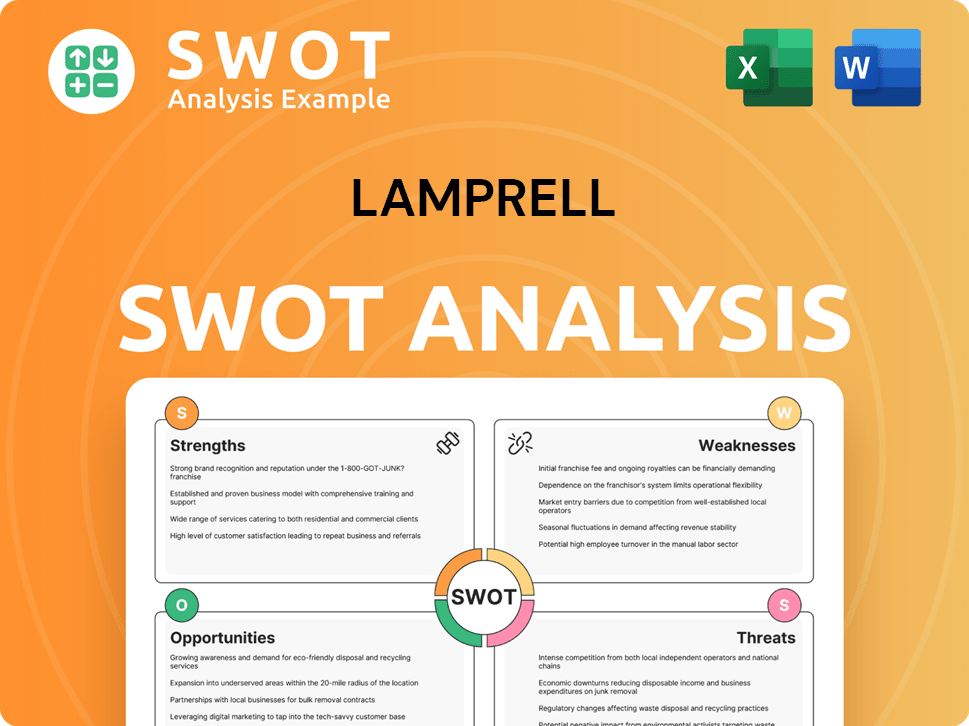

- Strengths: Strong presence in MENA, diversification into renewables, robust order book.

- Weaknesses: Dependence on energy market cycles, need for continuous technological adaptation.

- Opportunities: Growth in renewable energy, expansion in new markets.

- Threats: Oil price fluctuations, increased competition in the offshore sector.

Lamprell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Lamprell?

The Lamprell competitive landscape is shaped by its focus on the offshore oil and gas and renewable energy sectors. The company faces competition from both direct rivals specializing in offshore rig fabrication and refurbishment and indirect competitors offering broader engineering and construction services. Understanding these dynamics is crucial for assessing Lamprell's market position and strategic choices.

The energy services industry is highly competitive, with companies vying for projects in a fluctuating market. Factors such as oil price volatility, technological advancements, and the shift towards renewable energy sources significantly influence the competitive environment. These elements drive the need for continuous adaptation and strategic positioning.

Key competitors for Lamprell include companies with extensive shipbuilding and offshore construction capabilities. These rivals often compete on scale, technological prowess, and global reach. Indirect competition comes from engineering and construction firms that may not specialize in rig building but offer services like topside fabrication or engineering support for offshore energy projects.

Direct competitors include Keppel Offshore & Marine (now part of Seatrium) and DSIC Offshore. These companies have significant shipbuilding and offshore construction capabilities.

Indirect competition comes from firms like McDermott International, Saipem, and TechnipFMC. They offer a wider range of services.

Companies specializing in offshore wind foundation fabrication or turbine installation are becoming indirect competitors. This includes those within the supply chains of Ørsted or Siemens Gamesa.

Emerging players, particularly from Asia, may offer more competitive pricing for fabrication services, increasing the pressure on established companies.

Mergers and alliances, such as the consolidation of Keppel O&M and Sembcorp Marine into Seatrium, significantly alter the competitive landscape. This creates larger, more formidable entities.

These competitive pressures require companies like Lamprell to differentiate and specialize further to maintain their market position. This includes exploring new technologies and project types.

Lamprell's strengths include its experience in offshore fabrication and its strategic location. Challenges involve competition from larger, more diversified companies and the volatility of the oil and gas market.

- Competitive Advantages: Strong project management capabilities, strategic location in the Middle East, and experience in complex offshore projects.

- Challenges: Intense competition from larger players, dependence on oil and gas market fluctuations, and the need to adapt to the growth of renewable energy.

- Market Trends: Increasing demand for offshore wind projects, the need for sustainable solutions, and the impact of mergers and acquisitions on the competitive landscape.

- Strategic Responses: Diversification into renewable energy projects, partnerships to enhance capabilities, and a focus on cost efficiency and technological innovation.

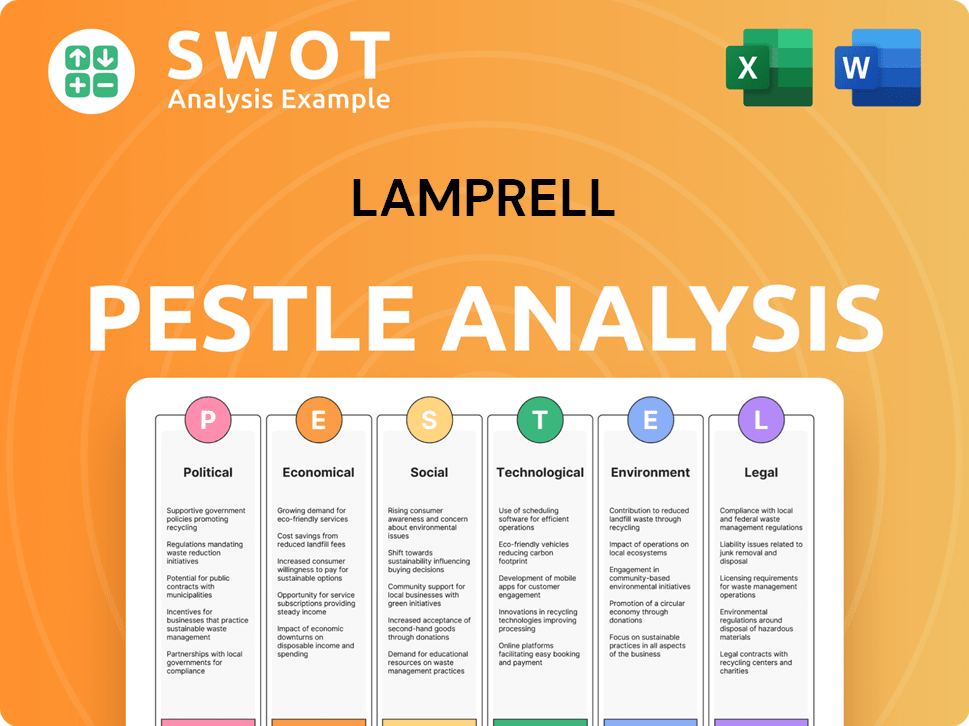

Lamprell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Lamprell a Competitive Edge Over Its Rivals?

The competitive advantages of Lamprell are built upon its specialized expertise, strategic location, and a growing focus on renewable energy. The company has a strong track record in fabricating and refurbishing offshore jackup rigs and liftboats, a skill honed over decades. Lamprell's facilities, especially the Hamriyah Free Zone yard in the UAE, offer significant capacity and deep-water access, which is a logistical advantage for large-scale offshore projects. Understanding the Revenue Streams & Business Model of Lamprell helps to understand the company's position.

Operational efficiencies, proprietary technologies, and project management methodologies are inherent in their sophisticated fabrication processes. Lamprell uses its skilled workforce and established supply chains to deliver projects on time and within budget. This operational excellence fosters strong customer loyalty, particularly with repeat clients in the Middle East. The move into renewable energy, specifically offshore wind foundation fabrication, represents a significant advantage. Leveraging its existing heavy fabrication capabilities, Lamprell is positioning itself in a high-growth market, setting itself apart from competitors focused solely on traditional oil and gas.

This diversification helps mitigate risks associated with the cyclical nature of the oil and gas industry and opens new revenue streams. While the offshore fabrication industry faces threats from imitation and global competition, Lamprell's established reputation, specialized skill sets, and strategic partnerships, such as those in the renewable energy sector, contribute to the sustainability of its advantages. The Lamprell competitive landscape is shaped by these factors, influencing its market share analysis and overall performance within the energy services industry.

Lamprell has a long history in the offshore oil and gas sector. Key milestones include significant project deliveries and expansions of its fabrication facilities. The company's ability to adapt to market changes is crucial for its long-term success. Recent strategic moves include diversification into renewable energy projects.

Lamprell has made strategic moves to enhance its competitive edge. These include investments in advanced fabrication technologies and expanding its presence in key geographic markets. Partnerships and collaborations have been essential for entering new sectors. The company is focused on strengthening its position in the offshore wind market.

Lamprell's competitive edge is based on its specialized expertise and operational efficiency. The company's strategic location in the UAE provides logistical advantages. Its ability to deliver complex projects on time and within budget is a key differentiator. Lamprell's move into renewable energy is a significant advantage.

The offshore oil and gas market is subject to fluctuations in oil prices. The renewable energy sector offers new growth opportunities. Lamprell's market share analysis indicates a strong position in its core markets. The company is adapting to the changing demands of the energy services industry.

Lamprell's strengths include its specialized expertise, strategic location, and operational efficiency. Weaknesses include the cyclical nature of the oil and gas industry and the potential for increased competition. The company's focus on innovation and diversification is key to mitigating these weaknesses. The company's response to industry challenges is crucial for its future outlook and competitive positioning.

- Specialized Expertise: Decades of experience in offshore fabrication.

- Strategic Location: Facilities in the UAE offer logistical advantages.

- Diversification: Expansion into renewable energy mitigates risks.

- Market Volatility: Oil price fluctuations impact the industry.

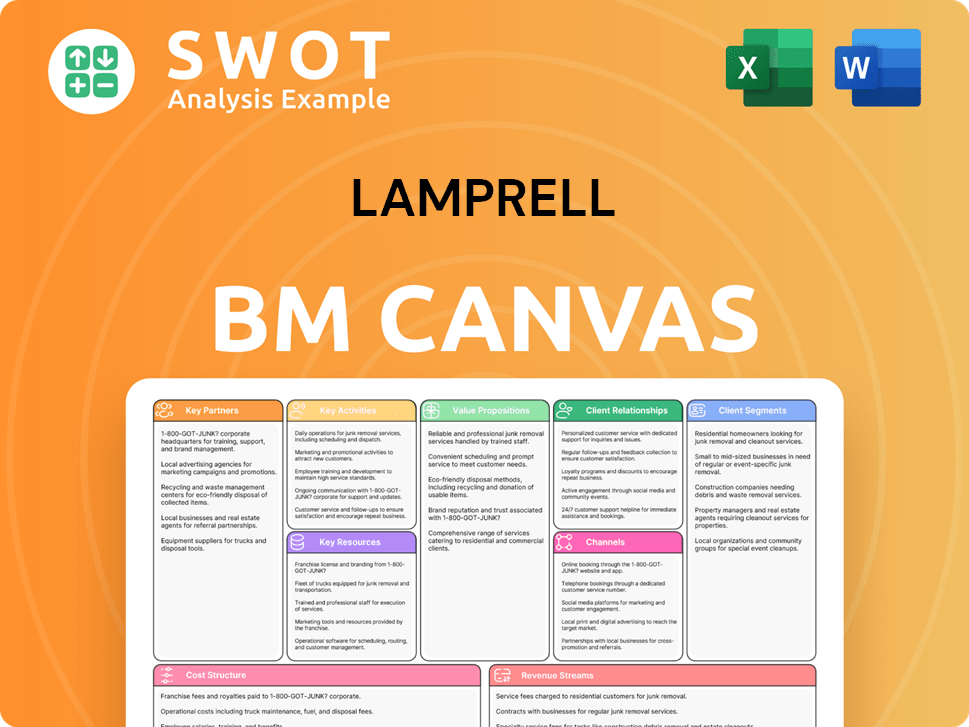

Lamprell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Lamprell’s Competitive Landscape?

The offshore energy industry is currently undergoing significant shifts, creating both challenges and opportunities for companies like Lamprell. The energy transition, with its focus on renewable energy sources, particularly offshore wind, is a major trend. Simultaneously, the demand for energy security continues to support investment in traditional oil and gas, especially in regions like the Middle East. This dual demand allows Lamprell to maintain its established oil and gas business while expanding into renewables, shaping the Growth Strategy of Lamprell.

However, the industry faces cyclicality and sensitivity to commodity price fluctuations, impacting project sanctioning and order books. Regulatory scrutiny on environmental impact and sustainability also adds complexity and cost. Furthermore, intense global competition, particularly from lower-cost Asian yards, and geopolitical instability, including supply chain disruptions, pose significant threats. These factors influence the competitive landscape and require strategic adaptation.

The offshore energy sector is currently influenced by the energy transition, driving investment in offshore wind and the ongoing demand for energy security, which supports traditional oil and gas projects. This dual focus allows companies to diversify their portfolios while maintaining a presence in established markets. The shift towards renewables presents significant opportunities for companies with heavy fabrication expertise, like Lamprell, to secure contracts in the offshore wind sector.

Key challenges include the cyclical nature of the oil and gas sector, sensitivity to commodity price fluctuations, and increased regulatory scrutiny on environmental impact. Intense global competition, particularly from lower-cost Asian yards, and geopolitical instability, along with supply chain disruptions, also pose significant risks. These factors can impact project timelines, profitability, and overall market competitiveness for companies operating in this space.

Opportunities lie in expanding renewable energy portfolios, potentially through strategic partnerships or acquisitions. Technological advancements, like automation in fabrication and digital twin technology, offer avenues for improved efficiency. Focusing on high-value, complex projects where specialized expertise provides a distinct advantage is also crucial. These approaches can enhance a company's competitive position.

Lamprell's strategy involves diversification, operational excellence, and a focus on high-value projects. Adapting to evolving industry dynamics is critical for maintaining a competitive edge. The company's ability to leverage its expertise in both oil and gas and renewables, coupled with strategic investments in technology and partnerships, will be key to its success in the coming years.

The Lamprell competitive landscape requires a strategic approach to navigate industry shifts. Lamprell's market analysis must consider both the growth in renewables and the continued demand for oil and gas. Understanding the strengths and weaknesses of Lamprell competitors is also essential for effective market positioning.

- Diversification into renewable energy projects, such as offshore wind, is crucial.

- Operational efficiency and technological advancements, like automation, can improve competitiveness.

- Strategic partnerships and a focus on high-value projects can provide a distinct advantage.

- Adapting to regulatory changes and geopolitical risks is essential for long-term sustainability.

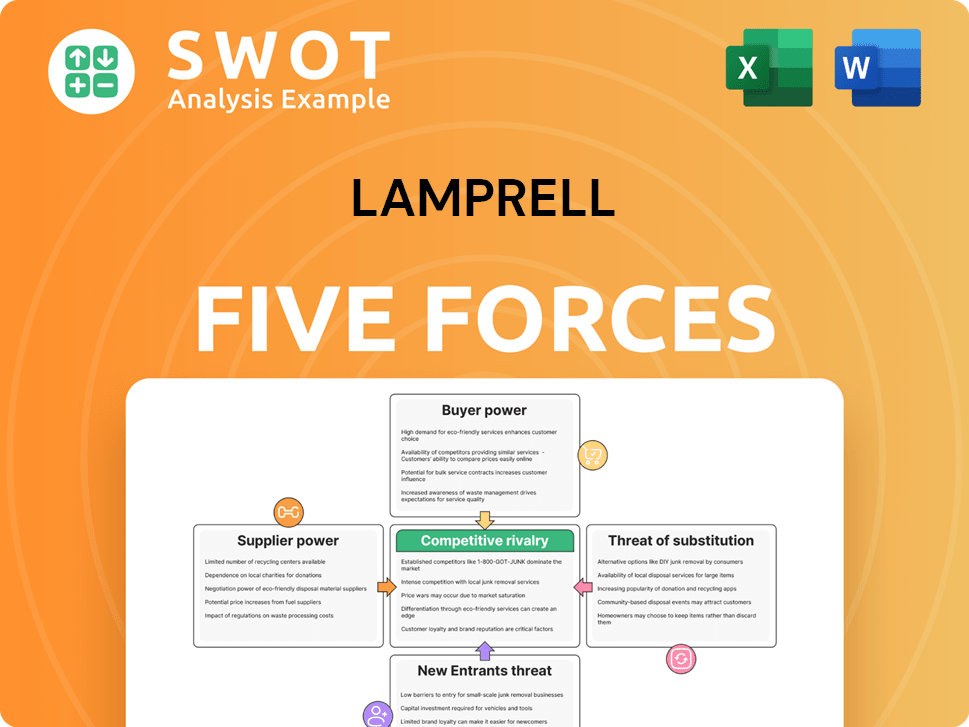

Lamprell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lamprell Company?

- What is Growth Strategy and Future Prospects of Lamprell Company?

- How Does Lamprell Company Work?

- What is Sales and Marketing Strategy of Lamprell Company?

- What is Brief History of Lamprell Company?

- Who Owns Lamprell Company?

- What is Customer Demographics and Target Market of Lamprell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.