Lamprell Bundle

How Does the Lamprell Company Thrive in the Energy Sector?

Lamprell, a key player in the offshore energy sector, offers specialized fabrication, engineering, and contracting services. Its recent financial results, like the $90.9 million in revenue for 2023, demonstrate its continued activity. The company supports both traditional oil and gas and the growing renewable energy markets, making it a crucial entity in global energy infrastructure.

This exploration into Lamprell SWOT Analysis will uncover how the company operates, generates revenue, and maintains its market position. We'll delve into its value creation, competitive advantages, and future prospects in a changing energy landscape. Understanding Lamprell's operations is vital for anyone assessing its resilience and its role in the energy sector, including its involvement in offshore construction and its services for the oil and gas industry.

What Are the Key Operations Driving Lamprell’s Success?

The core of the Lamprell Company lies in its ability to provide essential fabrication, engineering, and contracting services to the offshore energy industry. This includes constructing and refurbishing offshore jackup rigs, liftboats, land rigs, and topsides. The company also offers comprehensive engineering and project management services, serving a diverse clientele within both the oil and gas and renewable energy sectors.

Lamprell operations are highly specialized and integrated, utilizing advanced manufacturing, meticulous material sourcing, and sophisticated engineering design. Their robust project management ensures timely and budget-compliant delivery. The company's supply chain is crucial, involving global procurement networks and strategic partnerships to access key markets.

Lamprell services are unique due to its long-standing expertise in large-scale, complex offshore construction, coupled with its adaptability to serve both traditional and emerging energy sectors. This dual focus helps mitigate risks associated with relying on a single energy source. Its core capabilities translate into enhanced operational efficiency and the provision of high-quality, durable infrastructure.

Lamprell specializes in offshore construction and provides services such as constructing and refurbishing offshore jackup rigs and liftboats. They also offer engineering and project management services. These services are crucial for the oil and gas and renewable energy sectors.

The operational processes include advanced manufacturing and fabrication techniques in state-of-the-art facilities. They focus on meticulous sourcing of high-quality materials and robust project management. This ensures timely and budget-compliant project delivery.

Customers benefit from enhanced operational efficiency, reduced downtime, and high-quality infrastructure. Lamprell's expertise in large-scale construction and adaptability to different energy sectors provide significant value. This dual focus helps in mitigating risks.

Lamprell serves a broad range of customer segments within both the oil and gas and renewable energy sectors. They cater to exploration and production companies, drilling contractors, and renewable energy developers. This diversification helps in market stability.

Lamprell is known for its expertise in offshore construction and its ability to manage complex projects. They focus on providing high-quality services to the energy sector. Their adaptability to both traditional and emerging energy sectors is a key strength.

- Specialized Fabrication: Advanced manufacturing techniques are used.

- Global Supply Chain: They utilize global procurement networks.

- Project Management: Robust project management ensures timely delivery.

- Diverse Customer Base: Serving both oil and gas and renewable energy sectors.

For more insights into Lamprell's strategic direction, consider reading about the Growth Strategy of Lamprell. The company's commitment to quality and its ability to adapt to the changing energy landscape are critical for its continued success. As of early 2024, Lamprell continues to focus on expanding its capabilities in renewable energy projects, aiming to capitalize on the growing demand for sustainable energy solutions. This strategic shift positions them well for future growth, with potential projects in offshore wind and other renewable sectors. Recent financial reports show a steady increase in project backlog, indicating strong demand for their services in both traditional and renewable energy markets.

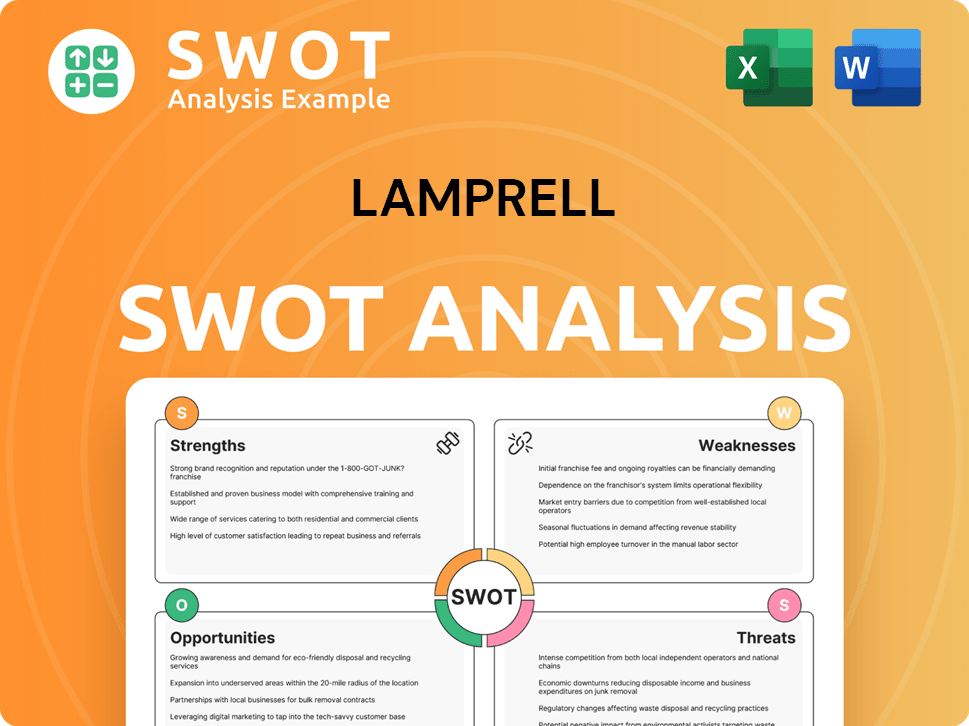

Lamprell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lamprell Make Money?

The core of the Lamprell Company's revenue generation lies in its comprehensive fabrication, engineering, and contracting services. These services are primarily delivered through large-scale project contracts, which are the backbone of its financial model. The company's ability to secure and execute these contracts effectively is crucial for its financial performance.

For the fiscal year ending December 31, 2023, Lamprell reported a revenue of $90.9 million. This revenue is generated through various projects, including the construction of new offshore and land rigs, the refurbishment and upgrade of existing assets, and the provision of specialized engineering services. The company's approach to these projects involves upfront payments, progress payments based on milestones, and final payments upon project completion.

A key aspect of Lamprell operations is its strategic diversification into the renewable energy sector, particularly offshore wind. This move is a significant monetization strategy, allowing the company to tap into new growth areas and reduce its reliance on the cyclical nature of the oil and gas industry. Long-term contracts and repeat business from established clients contribute to revenue stability.

Revenue streams are mainly derived from large-scale project contracts.

These contracts include construction, refurbishment, and engineering services.

Payments are structured with upfront, progress, and final payments.

Diversification into the renewable energy sector, like offshore wind, is a key strategy.

Focus on securing long-term contracts provides revenue stability.

Repeat business from established clients is a significant factor.

Construction of new offshore and land rigs.

Refurbishment and upgrade of existing assets.

Provision of specialized engineering and project management services.

Total revenue reported was $90.9 million.

This reflects the company's performance across its various projects.

The financial data highlights the importance of effective contract management.

Historically, the company has been heavily involved in oil and gas projects.

Currently, there is an active expansion into the renewable energy sector.

This expansion aims to reduce dependency on the oil and gas industry.

Contracts typically involve upfront payments.

Progress payments are based on milestone achievements.

Final payments are made upon project completion and handover.

The primary revenue drivers for Lamprell services are large-scale project contracts, which are essential for its financial health. Effective contract management and project execution are critical for securing these revenues. The company's ability to diversify into the renewable energy sector further supports its revenue streams.

- Large-scale project contracts.

- Diversification into renewable energy.

- Long-term contracts with established clients.

- Repeat business and client relationships.

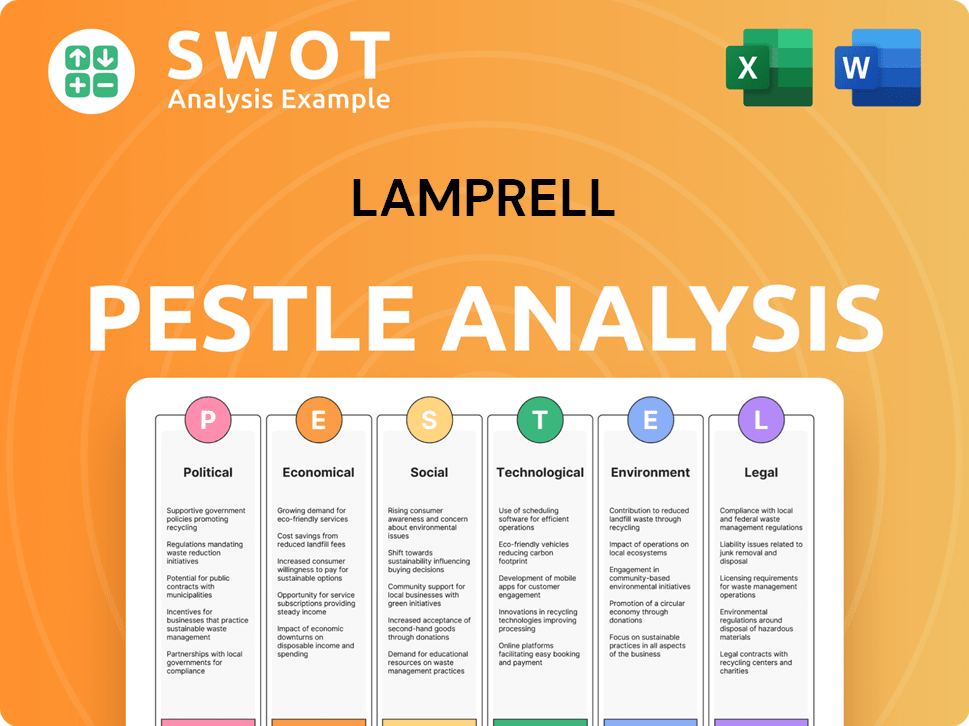

Lamprell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lamprell’s Business Model?

The Lamprell Company has navigated the dynamic energy landscape through several key milestones and strategic moves. These actions have been crucial for maintaining its position in the competitive energy sector. A significant strategic move has been its pivot towards the renewable energy sector, particularly offshore wind, which is vital given the global energy transition.

Operational challenges have included the inherent cyclicality of the oil and gas industry and global economic shifts. In response, Lamprell has focused on operational efficiency, cost control, and leveraging its established reputation for quality and safety. The company's competitive advantages lie in its extensive experience, strong track record in delivering complex projects, state-of-the-art fabrication facilities, and a highly skilled workforce.

Lamprell services continue to evolve to meet new demands. The company continues to adapt to new trends, such as digitalization in project management and advanced manufacturing techniques, to enhance its competitive edge and address evolving client demands in both traditional and renewable energy sectors.

Lamprell's history includes significant project deliveries and strategic expansions. The company has consistently adapted its services to meet market demands. Key milestones include major offshore construction projects and the expansion of its fabrication yards.

A notable strategic move is the diversification into renewable energy, particularly offshore wind. This shift has been crucial for long-term sustainability. Other moves include investments in advanced technologies and strategic partnerships.

Lamprell's competitive edge comes from its expertise in offshore construction and its skilled workforce. The company's strong track record and modern facilities allow it to secure high-value contracts. This advantage is further enhanced by its focus on innovation and sustainability.

In 2023, Lamprell secured a significant contract for the Moray West Offshore Wind Farm project, demonstrating its increasing involvement in renewable energy infrastructure. The company continues to adapt to new trends, such as digitalization in project management and advanced manufacturing techniques, to enhance its competitive edge and address evolving client demands in both traditional and renewable energy sectors.

Lamprell's strengths include its extensive experience and strong project delivery record. The company's focus on safety and quality enhances its reputation. These factors contribute to its ability to secure and execute complex projects in the energy sector.

- Extensive experience in offshore construction.

- Strong track record of delivering complex projects.

- State-of-the-art fabrication facilities.

- Highly skilled workforce.

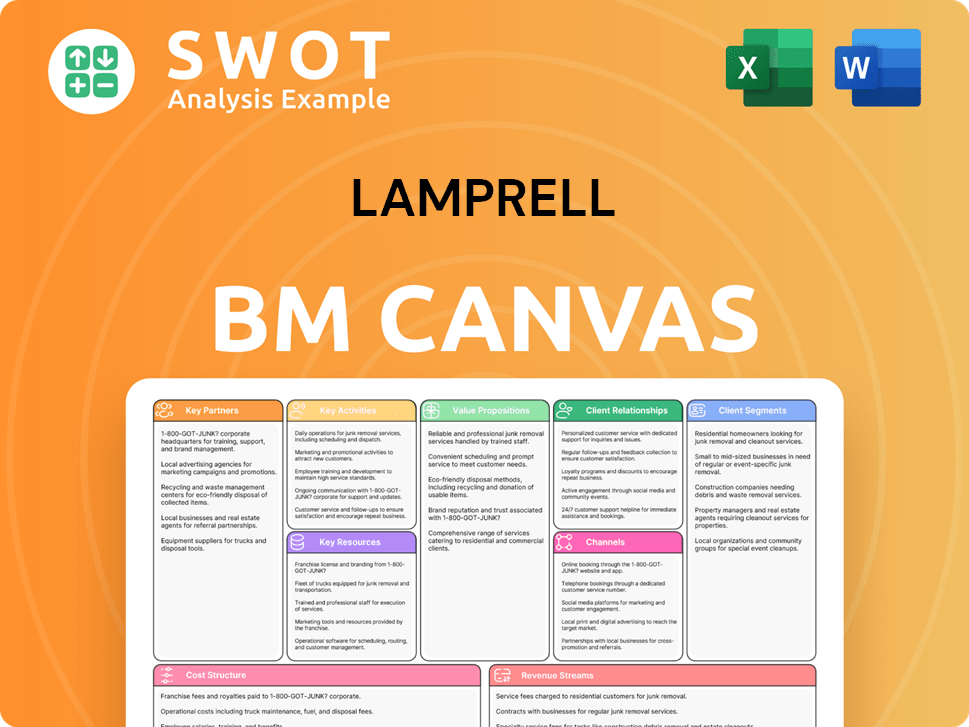

Lamprell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lamprell Positioning Itself for Continued Success?

The Lamprell Company holds a notable position in the offshore energy services industry, demonstrating its capabilities in both oil and gas and renewable energy sectors. With projects spanning various regions, the company caters to a global client base. Its strategic focus includes expanding its footprint in the renewable energy sector and optimizing operational efficiencies.

The company faces risks such as fluctuating oil and gas prices and regulatory changes. However, its shift toward renewables aims to mitigate some of these challenges. Technological advancements in offshore wind turbine technology also require continuous adaptation. For more insights, see Growth Strategy of Lamprell.

Lamprell's industry position is strong, particularly in offshore construction. The company's expertise in fabrication and project management positions it favorably. Lamprell's ability to secure significant contracts, like the Moray West Offshore Wind Farm project, highlights its competitive standing.

Key risks include volatile oil and gas prices, which can impact offshore project investments. Regulatory changes related to environmental policies also pose challenges. Competition from new entrants in the renewable energy space could intensify market competition. Technological advancements require continuous adaptation.

Lamprell plans to expand its renewable energy footprint and optimize operational efficiencies. The company aims to leverage its fabrication expertise for renewable energy projects. It will continue to serve the essential maintenance and upgrade needs of the traditional energy sector.

Strategic initiatives include expanding into the renewable energy sector and optimizing operational efficiencies. Lamprell is exploring new technologies to enhance its service offerings. The company is committed to capitalizing on the growth in offshore wind while maintaining its core capabilities in oil and gas.

Lamprell provides a range of services including offshore construction, fabrication, and project management. The company works on various types of vessels and offers maintenance and upgrade services. Its engineering capabilities and expertise are crucial for its operations.

- Fabrication of offshore platforms

- Project management

- Maintenance and upgrades

- Engineering services

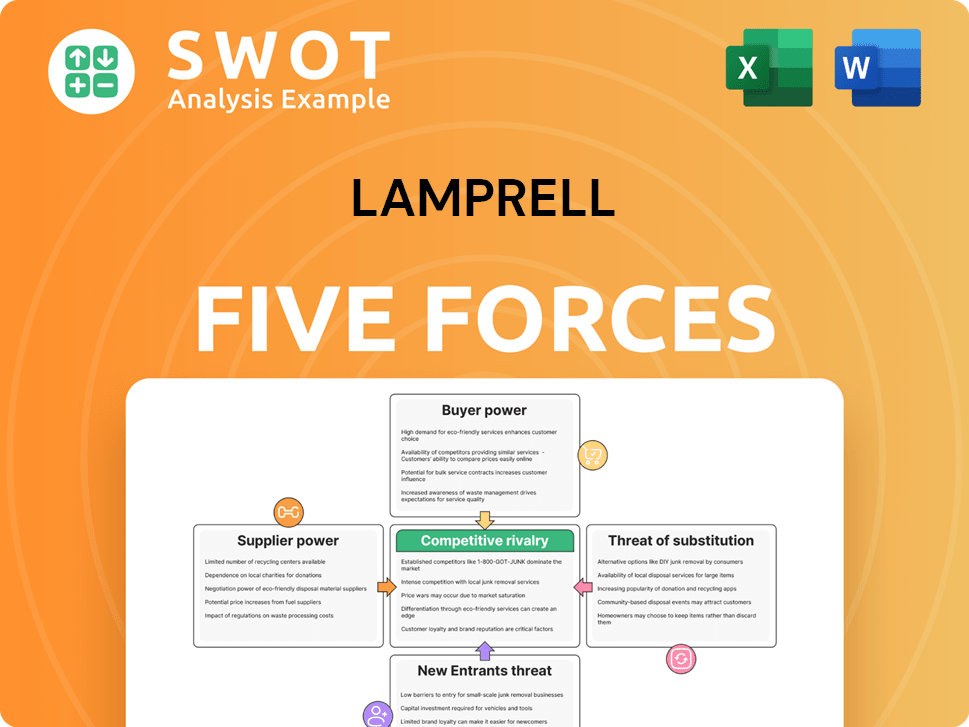

Lamprell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lamprell Company?

- What is Competitive Landscape of Lamprell Company?

- What is Growth Strategy and Future Prospects of Lamprell Company?

- What is Sales and Marketing Strategy of Lamprell Company?

- What is Brief History of Lamprell Company?

- Who Owns Lamprell Company?

- What is Customer Demographics and Target Market of Lamprell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.