Liberty Bundle

How has Liberty Energy Evolved Since 2011?

From its inception in 2011, Liberty Energy has been a key player in the North American energy services landscape. Initially focused on hydraulic fracturing, the company quickly made its mark. This journey reflects a dynamic adaptation to market shifts and technological advancements.

Liberty Energy's strategic pivot towards a broader energy infrastructure company, including power generation, showcases its foresight in the evolving energy sector. With approximately 40 active hydraulic fracturing fleets as of March 31, 2025, and a significant 18% market share, Liberty Energy continues to innovate, as seen with its digiPrime platform, and remains a top U.S. fracking service provider. For a deeper dive, explore a comprehensive Liberty SWOT Analysis to understand the company's strengths, weaknesses, opportunities, and threats.

What is the Liberty Founding Story?

The Liberty Company history began in 2011, marking its establishment in Denver, Colorado. The company's formation was driven by the vision of providing innovative solutions for well completion in the onshore oil and natural gas sector across North America. This strategic focus positioned the company to capitalize on the evolving dynamics of the energy market.

At the helm of Liberty Energy Inc. is Chris Wright, who serves as the CEO. While specific details about the initial founding team, capital, or funding are not readily available, the company's inception was aimed at delivering advanced and environmentally conscious solutions. The company's mission from the start was to provide abundant, affordable, and reliable energy to improve lives globally.

The company's initial business model centered on providing hydraulic fracturing and related services. Liberty Energy aimed to differentiate itself through a strong focus on next-generation technology. The early 2010s, characterized by the shale revolution in North America, created a fertile ground for companies focused on optimizing extraction processes. This likely influenced Liberty Energy's emphasis on technological advancement and operational excellence from its early days.

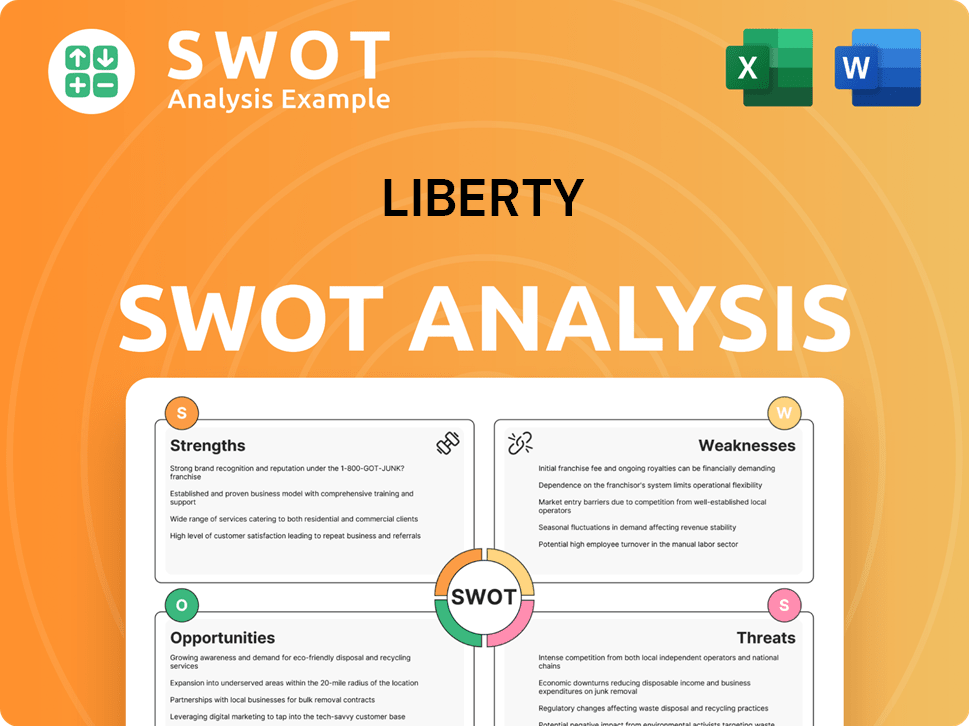

Liberty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Liberty?

The early growth and expansion of Liberty Company, starting in 2011, has been marked by strategic moves and significant advancements. The company's journey from a single hydraulic fracturing fleet to approximately 40 active fleets by March 31, 2025, showcases its rapid development. Key acquisitions and product launches have been instrumental in shaping its trajectory within the energy sector.

In early 2023, Liberty launched Liberty Power Innovations LLC (LPI) to diversify its offerings. This expansion included integrated alternative fuel and power solutions. The focus was on compressed natural gas (CNG) supply, field gas processing, and well site fueling and logistics, enhancing its service portfolio.

A pivotal acquisition was OneStim from Schlumberger in early 2021. This acquisition nearly doubled Liberty's frac spread count and broadened its customer base. Liberty acquired IMG Energy Solutions in Q1 2025, entering high-growth markets like data centers and industrial electrification.

Liberty consistently focused on improving efficiency and operational performance. In 2024, the company fully deployed its Sentinel logistics platform across all U.S. basins. The company's revenue for the full year 2024 was $4.3 billion, although this represented a 9% decrease from 2023.

Despite industry headwinds, Liberty reported solid results for Q1 2025, with revenue of $977 million, a 4% sequential increase from Q4 2024. The company anticipates sequential growth in revenue and profitability for Q2 2025. These efforts have positioned Liberty as a vertically integrated company with a strong competitive advantage. Learn more about the company's history and impact through a detailed exploration of the Brief history.

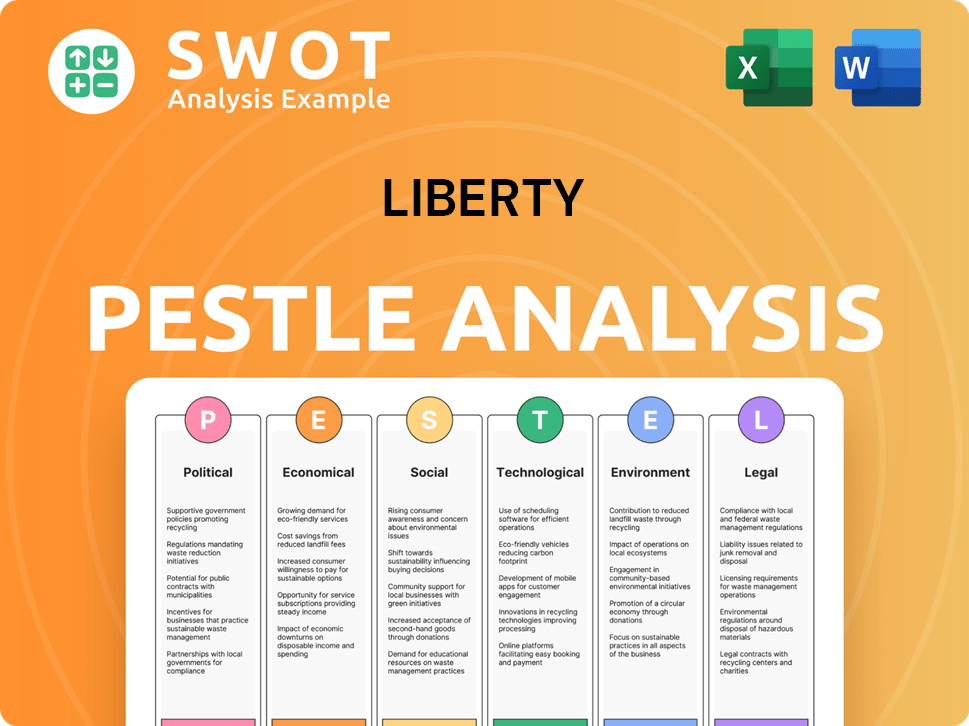

Liberty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Liberty history?

The Liberty Company has seen significant advancements and faced various challenges throughout its history. These developments have shaped its current position in the energy sector, demonstrating its adaptability and commitment to innovation.

| Year | Milestone |

|---|---|

| 2024 | A digiPrime fleet achieved the highest pump efficiency over a one-year period in Liberty's history. |

| Q1 2025 | Liberty, in partnership with Cummins, is deploying the industry's first variable speed, large displacement natural gas engine for its digiPrime hydraulic fracturing platform. |

| Q1 2025 | Acquisition of IMG Energy Solutions, marking an entry into new growth markets beyond the oilfield, such as data centers and industrial electrification. |

One of the key innovations has been the development of its digi platform, which has led to the commercialization of digiFleet technologies. In the first half of 2025, the deployment of a variable speed, large displacement natural gas engine is expected to reduce fuel costs and emissions significantly.

The digiFleet technologies have been a period of significant development over the past five years. This advancement has enabled Liberty to improve operational efficiency and reduce environmental impact.

The digiPrime hydraulic fracturing platform is expected to reduce fuel costs and emissions significantly. It also aims to quadruple the life to overhaul maintenance intervals compared to standard diesel engines.

The expansion of distributed power systems through the acquisition of IMG Energy Solutions in Q1 2025 marks an entry into new growth markets. This diversification includes sectors like data centers and industrial electrification.

The company has faced challenges, including market downturns and competitive pressures, with a roughly 20% decline in active rig and frac spread counts in 2023. In 2024, annual revenue was $4.3 billion, a 9% decrease from 2023.

The industry experienced a roughly 20% decline in active rig and frac spread counts in 2023, with a further 5% reduction in 2024. This impacted Liberty's financial performance.

In 2024, annual revenue was $4.3 billion, a 9% decrease from 2023. In Q1 2025, net income decreased to $20 million from $82 million in Q1 2024.

The company has responded to challenges through strategic pivots, such as its expansion into power generation. Liberty focuses on operational efficiencies and safety to navigate market uncertainties.

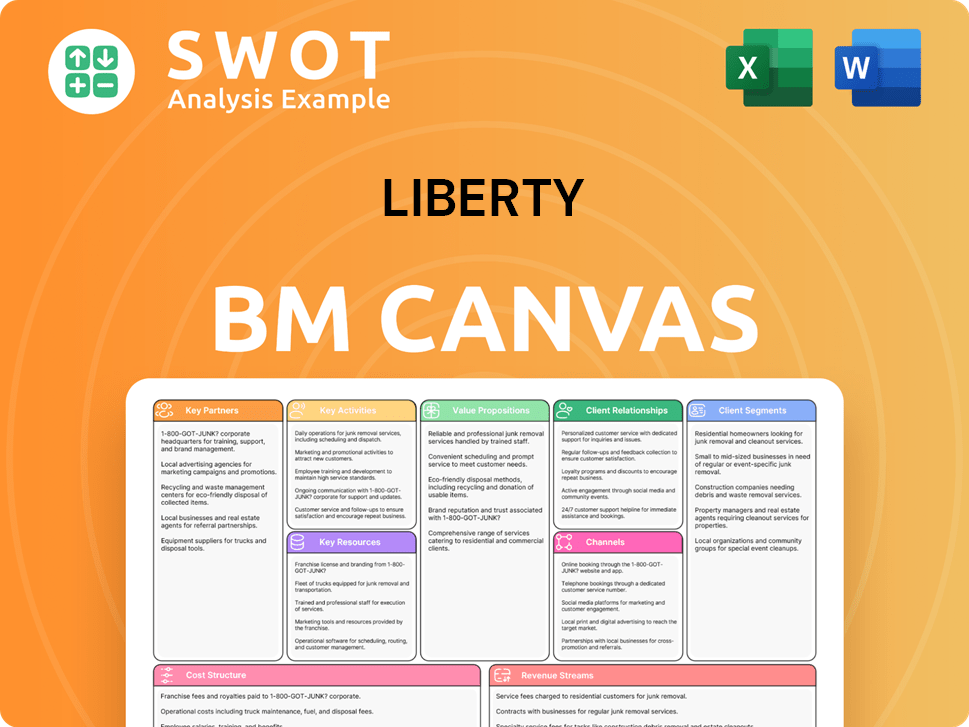

Liberty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Liberty?

The Growth Strategy of Liberty has been marked by significant milestones since its founding. The company's trajectory includes strategic acquisitions, technological advancements, and expansions into new markets and service offerings. The following table outlines key events in the company's history.

| Year | Key Event |

|---|---|

| 2011 | Liberty Energy is founded in Denver, Colorado. |

| 2017 | Liberty Oilfield Services goes public with an Initial Public Offering (IPO) on the NYSE. |

| 2021 | Acquisition of PropX, expanding proppant delivery solutions. |

| Early 2021 | Acquisition of OneStim from Schlumberger, increasing frac spread count and market share. |

| Early 2023 | Launch of Liberty Power Innovations (LPI) for alternative fuel and power solutions. |

| June 2024 | Strategic partnership with Cummins to jointly develop a natural gas engine for hydraulic fracturing. |

| Q3 2024 | Liberty ships a fleet to Australia, commencing international operations. |

| Q4 2024 | Achieved a record 7,143 pumping hours on a single fleet. |

| January 29, 2025 | Announces full year and fourth quarter 2024 financial results, with annual revenue of $4.3 billion. |

| Q1 2025 | Acquires IMG Energy Solutions, expanding distributed power systems offering. |

| April 16, 2025 | Announces Q1 2025 financial results, reporting revenue of $977 million. |

Liberty Energy anticipates sequential growth in revenue and profitability in Q2 2025. The company expects to maintain its full-year consolidated EBITDA guidance of $700-$750 million. The company is focused on expanding its power generation business.

Over the next two years, Liberty aims to deploy an additional 400MW of power generation capacity. The company plans a capital expenditure of $200 million for the first 150MW. By the end of 2025, they plan to deploy 150 MW of power generation capacity.

Liberty expects its entire fleet to consist of low-emissions, natural gas-fueled digiFleets within the next 5-7 years. This move aligns with industry trends. The company is responding to increasing demand for natural gas as a transition fuel.

Liberty reports excess demand for its services. This indicates a 'flight to quality' among customers seeking top-tier providers. The company's leadership emphasizes its strong balance sheet and technological advancements.

Liberty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Liberty Company?

- What is Growth Strategy and Future Prospects of Liberty Company?

- How Does Liberty Company Work?

- What is Sales and Marketing Strategy of Liberty Company?

- What is Brief History of Liberty Company?

- Who Owns Liberty Company?

- What is Customer Demographics and Target Market of Liberty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.