Liberty Bundle

Who Really Owns Liberty Energy?

Uncover the intricate web of ownership that shapes Liberty Energy's future. Understanding the Liberty SWOT Analysis is crucial to understanding the company's trajectory. From its founding in 2011 to its current status as a publicly traded entity, the ownership structure of Liberty Company has evolved significantly. This deep dive will reveal the key players and their influence.

The ownership of Liberty Company, a key player in the energy services sector, is a critical factor for investors and stakeholders alike. Knowing who owns Liberty Company offers insights into its strategic direction, financial stability, and long-term prospects. This analysis will explore the company's ownership history, including its founders, major shareholders, and current ownership trends, providing a comprehensive view of this dynamic business.

Who Founded Liberty?

The story of Liberty Energy begins in 2011 with Chris Wright at the helm. He served as the CEO and Chairman of the Board from the very start, shaping the company's direction and vision. His leadership was crucial in establishing the company's initial focus and strategic goals.

While the exact details of the initial ownership structure are not fully available, Chris Wright's role as the founder is well-documented. His previous experience in the energy sector, including founding Pinnacle Technologies, which was later sold to Halliburton in 2008, likely played a significant role in Liberty Energy's early strategic focus on hydraulic fracturing services.

The early days of Liberty Energy were marked by a focus on innovation and technology, setting the stage for its future growth. The company's commitment to value creation through advanced technology reflects the founding team's vision for the future.

Chris Wright founded Liberty Energy and served as its CEO and Chairman of the Board.

The company's early focus was on hydraulic fracturing services.

Wright previously founded Pinnacle Technologies, which was sold to Halliburton in 2008.

The company focused on value creation through innovation and excellence.

The development of next-generation technology was a key part of the early strategy.

The early days of Liberty Energy were marked by a focus on innovation and technology.

Further details on the initial investors and early agreements, such as vesting schedules, are not readily available. However, understanding the Brief History of Liberty provides context on the company's origins and evolution. As of late 2024, the company continues to operate, with its ownership structure evolving over time through various funding rounds and market activities. The company's commitment to innovation and technology has been a constant theme since its founding.

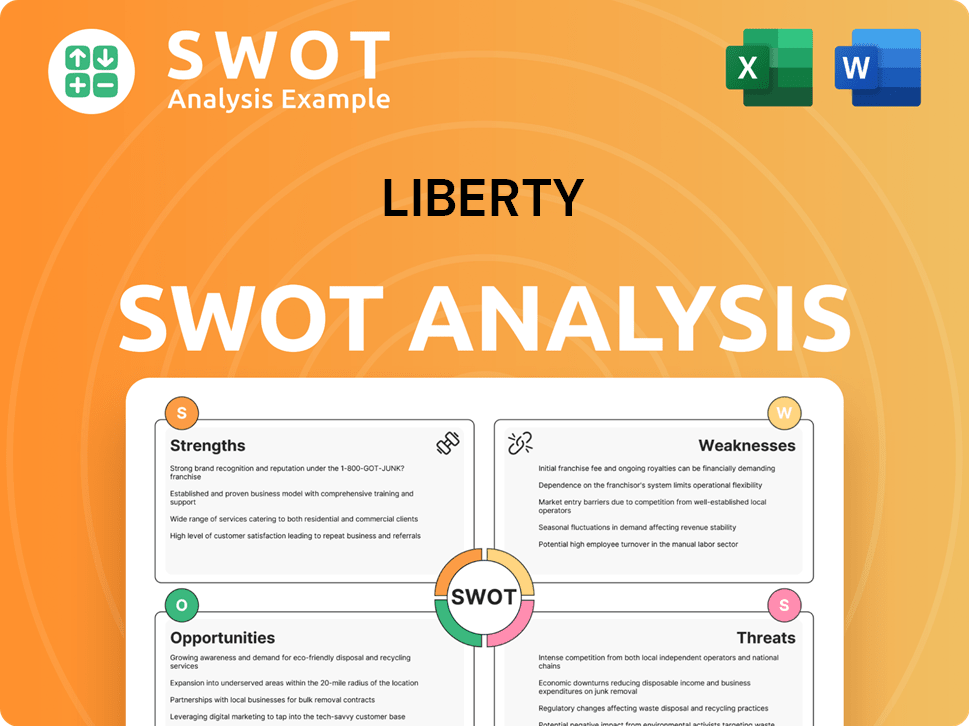

Liberty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Liberty’s Ownership Changed Over Time?

The initial public offering (IPO) of Liberty Energy occurred on January 12, 2018, on the New York Stock Exchange (NYSE) under the ticker LBRT. The IPO involved the sale of 12,731,092 shares of Class A common stock at $17.00 per share, resulting in approximately $220.2 million in net proceeds for Liberty.

As of June 2025, the ownership structure of Liberty Energy includes 726 institutional owners and shareholders, collectively holding 216,384,155 shares. Institutional ownership accounts for 96.20% of the company. Key institutional shareholders include BlackRock, Inc., Vanguard Group Inc, and Fmr Llc.

| Shareholder | Shares Held (as of Dec 31, 2024) | Percentage of Shares |

|---|---|---|

| BlackRock Institutional Trust Company, N.A. | 24,259,433 | 14.32% |

| The Vanguard Group, Inc. | 17,279,360 | 10.20% |

| Fidelity Management & Research Company LLC | 12,828,362 | 7.57% |

Significant events have shaped Liberty Energy's ownership. The acquisition of PropX in 2021 expanded its offerings, and the combination with Nextier in 2023 integrated advanced well completion technology. In March 2025, Liberty Energy acquired IMG Energy Solutions, further broadening its distributed power systems capabilities. These strategic moves have allowed Liberty to diversify its revenue streams and enter new markets. For more insights into the company's growth strategy, you can read this article about Growth Strategy of Liberty.

Understanding the ownership structure is crucial for evaluating Liberty Company. The majority of shares are held by institutional investors, indicating strong market confidence. Key events like acquisitions have diversified the company's business and influenced its ownership.

- Institutional investors hold the majority of shares.

- Founder Chris Wright held approximately 1.8% of shares.

- Strategic acquisitions have shaped the company's growth.

- Schlumberger Limited is a significant shareholder.

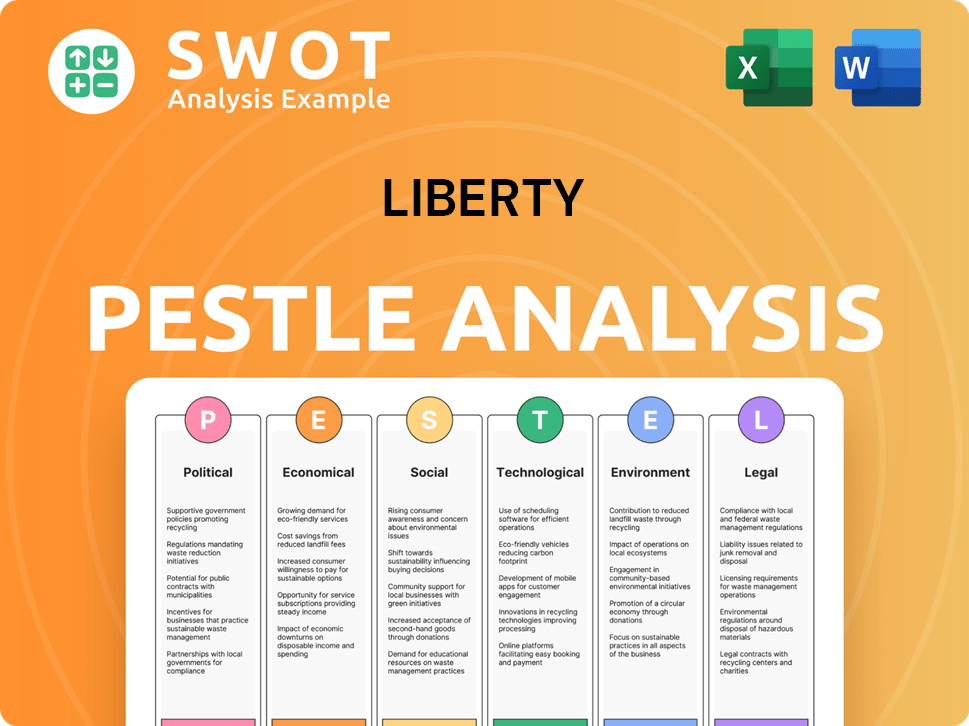

Liberty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Liberty’s Board?

The current board of directors of Liberty Energy Inc. is pivotal in guiding the company's operations. Following Chris Wright's appointment as U.S. Secretary of Energy in February 2025, Ron Gusek assumed the role of Chief Executive Officer and became a board member. William Kimble was elected as the non-executive Chairman of the Board.

These leadership changes reflect the dynamic nature of the Liberty Company and its commitment to strong governance. The board's composition is designed to provide diverse perspectives and expertise, ensuring effective oversight of the company's strategic direction and financial performance. Understanding the board's structure is crucial for anyone seeking to understand the Liberty Company ownership.

| Board Member | Title | Date of Appointment (Approximate) |

|---|---|---|

| Ron Gusek | Chief Executive Officer and Director | February 2025 |

| William Kimble | Non-Executive Chairman | February 2025 |

| (Other Directors) | (Various) | (Various) |

Liberty Energy's voting structure is straightforward, based on one-share-one-vote. Each share of Class A Common Stock grants its holder one vote on matters at the Annual Meeting. Stockholders of record as of February 19, 2025, were eligible to vote at the Annual Meeting held on April 15, 2025. These details are essential for anyone researching the Liberty Company shareholders.

At the April 2025 annual meeting, shareholders approved key charter amendments. These changes included declassifying the board of directors, eliminating supermajority voting requirements, and limiting liability for certain officers. These moves modernize Liberty's corporate governance.

- Declassification of the board of directors

- Elimination of supermajority voting requirements

- Limitation of liability for certain officers

- Election of three Class III directors for a three-year term

- Ratification of Deloitte & Touche LLP as the independent registered public accounting firm for 2025

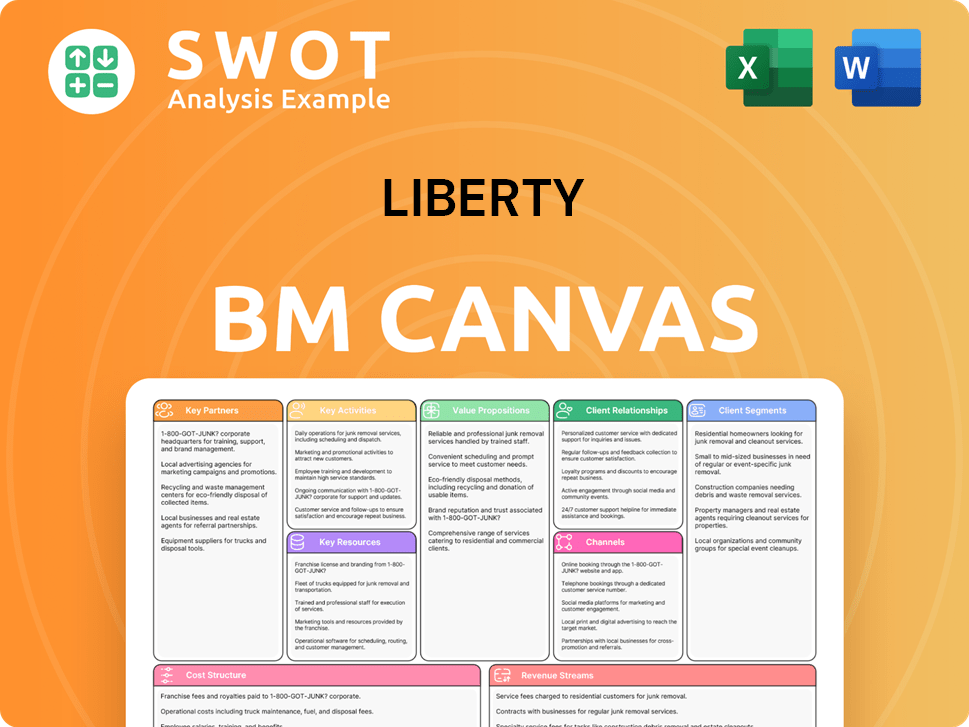

Liberty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Liberty’s Ownership Landscape?

Over the past few years, the focus of the Liberty Company has been on returning capital to shareholders. Since July 2022, the company has repurchased and retired 15.9% of its outstanding shares. As of March 31, 2025, approximately $270 million remained under its share repurchase authorization. In the first quarter of 2025 alone, 1.0% of its shares were repurchased, totaling roughly $24 million. The company also increased its quarterly cash dividend by 14% to $0.08 per share in October 2024, with another dividend of $0.08 per share declared in January 2025 and paid in March 2025.

A significant recent development is the acquisition of IMG Energy Solutions in Q1 2025. This strategic move expands Liberty Company's distributed power systems capabilities. This aligns with broader industry trends towards energy security and decarbonization. The company plans to deploy 400 MW of power generation capacity for commercial applications by 2026.

| Metric | Details | Date |

|---|---|---|

| Share Repurchases | 15.9% of outstanding shares repurchased and retired | Since July 2022 |

| Remaining Share Repurchase Authorization | Approximately $270 million | As of March 31, 2025 |

| Q1 2025 Share Repurchases | 1.0% of shares outstanding | Q1 2025 |

| Q1 2025 Share Repurchase Value | Approximately $24 million | Q1 2025 |

| Quarterly Cash Dividend Increase | 14% to $0.08 per share | October 2024 |

Industry trends indicate increased institutional ownership, with 726 institutional owners holding a substantial portion of Liberty Company's shares. The recent leadership transition, with founder Chris Wright's departure and Ron Gusek's appointment as CEO, marks a pivotal shift. The company is focused on long-term value creation, balancing growth opportunities with capital returns to shareholders. Liberty Company anticipates sequential growth in revenue and profitability in Q2 2025, driven by higher utilization rates and operational efficiencies.

726 institutional owners hold a significant portion of Liberty Company shares, reflecting investor confidence.

The departure of founder Chris Wright and the appointment of Ron Gusek as CEO represents a shift in leadership.

Liberty Company focuses on balancing growth with shareholder returns through share repurchases and dividends.

The company anticipates sequential growth in revenue and profitability in Q2 2025, driven by higher utilization rates.

Liberty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Liberty Company?

- What is Competitive Landscape of Liberty Company?

- What is Growth Strategy and Future Prospects of Liberty Company?

- How Does Liberty Company Work?

- What is Sales and Marketing Strategy of Liberty Company?

- What is Brief History of Liberty Company?

- What is Customer Demographics and Target Market of Liberty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.