Liberty Bundle

How Does Liberty Energy Stack Up in the Fracking Fray?

Liberty Energy has rapidly become a key player in North America's energy sector, but who are its main rivals? Understanding the Liberty SWOT Analysis is crucial to grasp its position. This analysis dives deep into the competitive landscape, assessing Liberty's strengths, weaknesses, opportunities, and threats within the industry.

To truly understand Liberty Company's business strategy, you must examine its market share and how it navigates the competitive landscape. This involves a detailed Liberty Company market analysis and key competitors analysis. Examining Liberty Company's financial performance compared to competitors reveals its resilience and strategic advantages in a dynamic market. Furthermore, exploring Liberty Company's competitive advantages and disadvantages provides a comprehensive view of its market position and future outlook.

Where Does Liberty’ Stand in the Current Market?

Liberty Energy holds a significant market position within the North American hydraulic fracturing industry. Following the acquisition of OneStim, the company became one of the four largest pressure pumpers in North America, collectively controlling over two-thirds of the market. This strong foothold allows it to serve a wide range of clients in key basins.

The company focuses on providing services to onshore oil and natural gas exploration and production companies. Its primary operational areas include the Permian, Eagle Ford, and Marcellus Shales in the USA and Canada. Liberty Energy's diverse service offerings, including hydraulic fracturing and wireline services, position it as a key player in the energy sector.

Liberty Energy's strategic shift toward a broader energy infrastructure company, including the development of a modular power business, aims to reduce its dependence on traditional oilfield services. This diversification is designed to create more stable revenue streams and enhance its market position. For more details on its target market, see the Target Market of Liberty.

In 2024, Liberty Energy reported a revenue of $4.3 billion and a net income of $316 million. The company's Adjusted EBITDA for 2024 was $922 million. Despite a slight decrease in revenue compared to $4.7 billion in 2023, the company maintains strong profitability metrics.

As of June 5, 2025, Liberty Energy's market capitalization was $1.93 billion. In Q1 2025, the company reported revenue of $977 million, a 4% sequential increase from Q4 2024, although it was lower than the $1.1 billion reported in Q1 2024. These figures highlight the company's current financial standing and market presence.

Liberty Energy's gross profit margin for the last twelve months was 24.65%. The company's return on equity was 13%. With a strong return on assets (ROA) of 1.58%, exceeding industry averages, and a below-average debt-to-equity ratio of 0.27, the company demonstrates a prudent financial strategy.

Liberty Energy offers a comprehensive suite of services, including hydraulic fracturing, wireline services, proppant delivery solutions, and field gas processing. Other services include compressed natural gas (CNG) delivery, data analytics, and technologies that facilitate lower-emission completions. This diverse offering supports its market position.

The competitive landscape for Liberty Energy includes other major pressure pumpers in North America. The company's market share and financial performance are key indicators of its competitive position within the industry. Analyzing its business strategy and market share is crucial for understanding its strengths.

- The company's diversification into modular power is a key strategy to reduce reliance on traditional oilfield services.

- Liberty Energy's financial health, as indicated by its ROA and debt-to-equity ratio, reflects its prudent financial management.

- The company's focus on key basins like the Permian, Eagle Ford, and Marcellus Shales highlights its strategic operational areas.

- Liberty Energy's recent financial results, including revenue and net income, demonstrate its current market position.

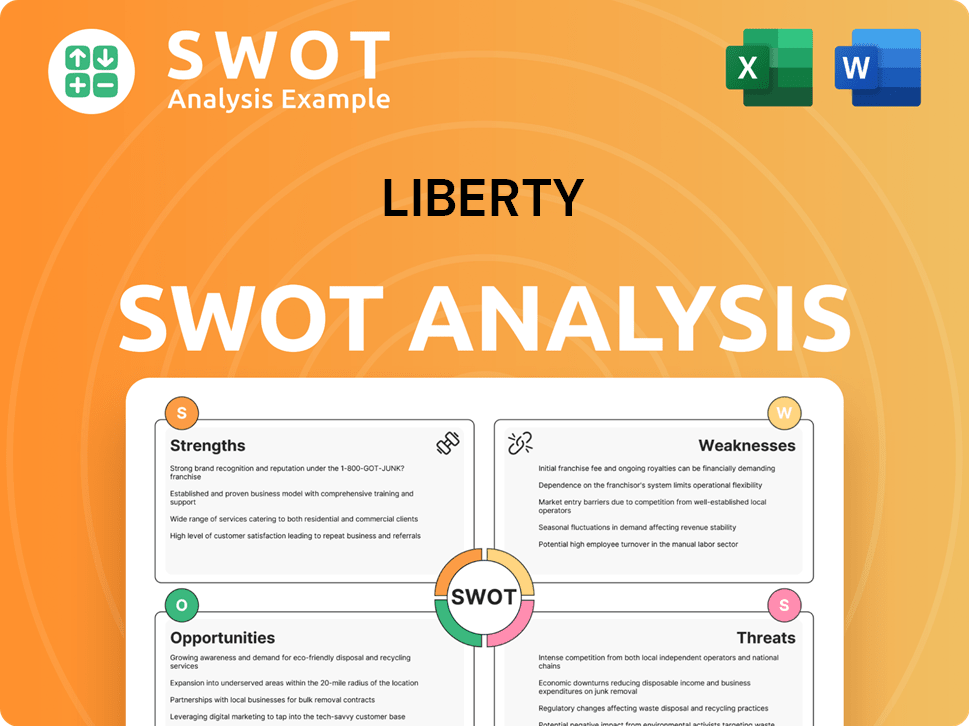

Liberty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Liberty?

The competitive landscape for Liberty Energy within the North American hydraulic fracturing and oilfield services industry is shaped by a mix of global giants and specialized firms. This environment demands a deep understanding of market dynamics and the strategies of key players to maintain a strong market position. A thorough Liberty Company competitive landscape analysis is crucial for strategic decision-making.

Direct competitors to Liberty Energy include major global oilfield service companies and other specialized fracturing firms. These competitors challenge Liberty through various means, including technological innovation, pricing strategies, and expansion of service offerings. Understanding the Liberty Company market analysis and the strengths and weaknesses of its rivals is essential for long-term success.

The main direct competitors for Liberty Energy in the shale gas hydraulic fracturing market include Halliburton, Schlumberger Limited, Baker Hughes, Patterson-UTI Energy, Inc., Calfrac Well Services Ltd., and ProPetro Holding Corp. These companies compete on multiple fronts, including technology, pricing, and service capabilities. A detailed Liberty Company competitors analysis is vital.

Halliburton is a major player in the hydraulic fracturing industry. As of 2025, it holds a significant market share globally. Halliburton is known for its advanced fleets, AI-driven drilling technology, and extensive operations in North America and the Middle East.

Schlumberger Limited is a leading global technology company in the energy sector. It offers a wide range of services and technologies, including well completion and hydraulic fracturing. They are a significant competitor due to their broad portfolio and global reach.

Baker Hughes Company is another major global oilfield services company. It has even partnered with Liberty Energy to improve shale production in key formations. This indicates a complex competitive dynamic where collaboration can also occur.

Patterson-UTI Energy, Inc. became a leading provider of drilling and completion services in the United States. This was after its acquisition of NexTier Oilfield Solutions in September 2023. This acquisition significantly boosted its market presence.

ProPetro Holding Corp., Ranger Energy Services, Nine Energy Service, Select Water Solutions, and Key Energy Services are also direct competitors. These companies focus on various aspects of oilfield services and hydraulic fracturing. They contribute to the competitive pressure.

These competitors challenge Liberty Energy through technology, pricing, branding, and distribution networks. The industry is seeing a shift towards more fuel-efficient fleets. This prompts companies to invest in advanced technologies like electric frac spreads.

The competitive environment is influenced by industry consolidation and technological advancements. The retirement of older fleets could lead to tighter supply and potential pricing power for companies with next-generation fleets.

- Technological Innovation: Competitors are investing in advanced technologies, such as electric frac spreads and dual-fuel systems, to improve efficiency and reduce emissions.

- Industry Consolidation: Mergers and acquisitions reshape the competitive landscape. This requires companies to adapt and innovate to maintain their market position.

- Pricing Strategies: Competitive pricing is a key factor. Companies must balance profitability with the need to win contracts.

- Market Share: The Liberty Company market share is affected by the strategies of its competitors. They compete for contracts and market presence.

- Future Outlook: New players and changing market conditions present ongoing challenges. The Liberty Company business strategy must adapt to these changes.

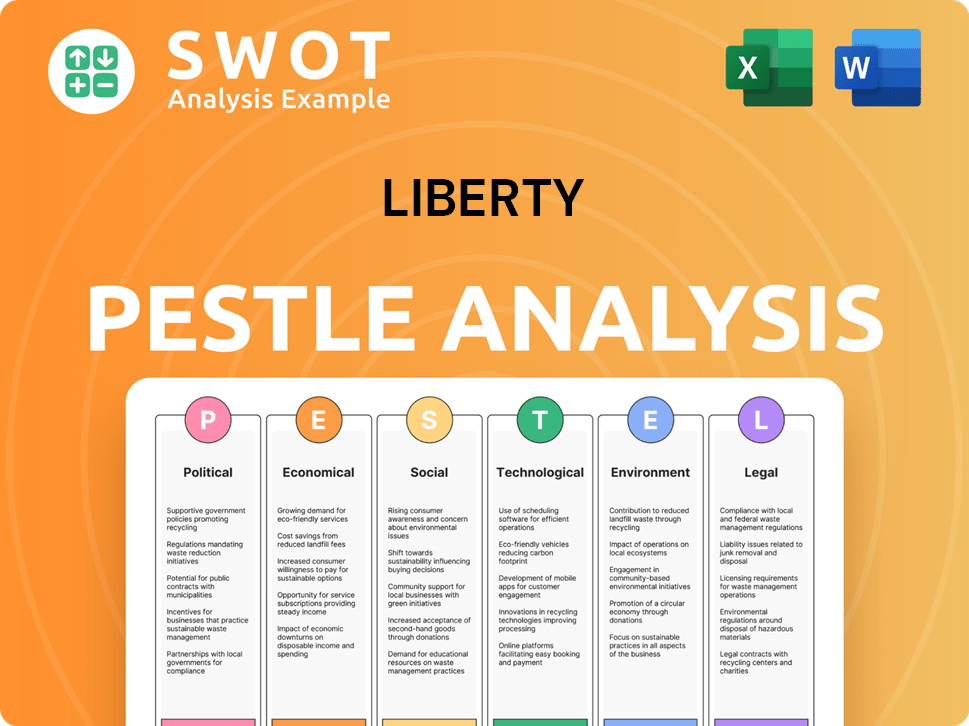

Liberty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Liberty a Competitive Edge Over Its Rivals?

Analyzing the competitive landscape of the Liberty Company reveals a strategic focus on technological innovation and integrated service offerings. This approach has allowed the company to carve out a significant market position, particularly in areas like hydraulic fracturing. The company's ability to adapt and integrate advanced technologies is a key factor in its ongoing success. For a deeper dive into the company's strategic direction, consider reading about Owners & Shareholders of Liberty.

Liberty Company's strategic moves include the development and deployment of proprietary technologies, such as the 'digi' platform, which enhances operational efficiency and reduces emissions. The company has also focused on expanding its service offerings to provide a more integrated solution for its customers. These initiatives are designed to improve operational performance and customer satisfaction. As of 2024, the company's commitment to shareholder returns through share repurchases and consistent dividend increases is evident.

The competitive edge of Liberty Company is reinforced by its commitment to sustainability and financial performance. The company's focus on natural gas-fueled operations and low-emission technologies positions it well in a market increasingly focused on environmental responsibility. Despite market softening, Liberty delivered solid financial results in 2024, with strong returns on capital employed and invested.

Liberty's competitive advantage stems from its advanced technological solutions. The 'digi' platform, including digiFleets and digiPrime, reduces emissions and fuel costs. DigiPrime, the industry's first natural gas variable speed pump, achieved a record of 7,143 pumping hours on a single fleet in 2024. The company holds approximately 500 patents and patent licenses.

Liberty leverages AI-powered logistics platforms like Sentinel to optimize deliveries. This platform reduces costs, congestion, and wait times. Data analytics, including proprietary databases of U.S. unconventional wells, improves fracture design optimization. These capabilities enhance operational efficiency.

Liberty provides a vertically integrated approach through its comprehensive suite of services. This includes wireline services, proppant delivery, and well site fueling. PropX, a Liberty subsidiary, offers patented containerized solutions for last-mile proppant storage and delivery. This integration reduces costs and improves efficiency.

Liberty's focus on natural gas-fueled digiFleets and low-emission technologies provides a significant advantage. This aligns with evolving market demands and regulatory pressures. The company's efforts to reduce emissions and fuel costs are central to its competitive strategy.

Liberty Company's competitive advantages are multifaceted, encompassing technological innovation, integrated services, and a commitment to sustainability. These elements work together to create a robust market position. The company's financial performance in 2024, including strong returns on capital employed, highlights the effectiveness of its strategies.

- Proprietary technologies and innovation, including the 'digi' platform.

- AI-powered logistics and data analytics for optimized operations.

- Integrated services and supply chain solutions.

- Commitment to sustainability and lower emissions.

- Strong financial performance and shareholder returns.

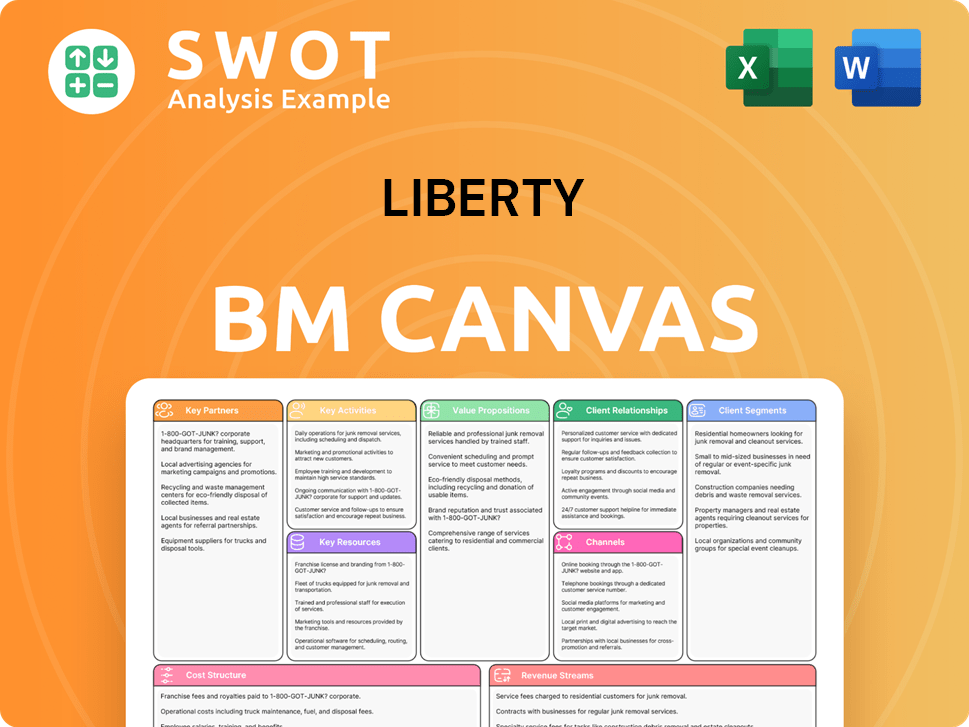

Liberty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Liberty’s Competitive Landscape?

The competitive landscape for Liberty Energy is evolving, shaped by industry trends and strategic shifts. The company is navigating a dynamic market, focusing on technology, sustainability, and diversification. Understanding the Liberty Company competitive landscape is crucial for investors and stakeholders.

The company's position involves both opportunities and challenges. While facing market pressures in the oil and gas sector, Liberty is expanding into new markets like power generation. This strategic pivot aims to ensure resilience and capitalize on growth avenues. A detailed Liberty Company market analysis is essential to understand its trajectory.

Technological advancements are transforming oilfield services, with a focus on automation, AI, and electrification. The push for lower emissions and environmental sustainability is driving demand for eco-friendly solutions. Regulatory changes also influence operational practices and technology adoption.

Softening business conditions in the oil and gas sector can lead to price pressure. Revenue growth has faced challenges compared to industry peers. The industry faces significant backlash from environmental groups and regulatory bodies.

Growing demand for power infrastructure solutions, particularly from data centers and industrial electrification, presents a new market. The ongoing consolidation in the frac services industry could lead to tighter supply. The Permian Basin offers steady demand for advanced oilfield services.

Liberty is strategically expanding its power generation services. The company plans to deploy 130 MW in 2025 and expand to 400 MW by 2026 in its modular power business. This strategic pivot is designed to ensure resilience.

Liberty's future involves a strategic shift from a frac services provider to a broader energy infrastructure company. The company is focused on technology innovation, expansion in power generation, and operational efficiencies. Understanding the Liberty Company key competitors analysis is essential for assessing its future prospects.

- The company is leveraging digiFleets for electric-powered operations and AI tools for logistics management.

- The Permian Basin remains a central focus, offering steady demand for advanced oilfield services year-round.

- The company's expansion into power generation is a key strategy for growth.

- The company's financial health is strong, but revenue growth and net profit margin face challenges compared to industry peers.

To further understand the company's operations, consider reading about Revenue Streams & Business Model of Liberty. The Liberty Company business strategy involves continuous innovation in completions services and expansion into new markets.

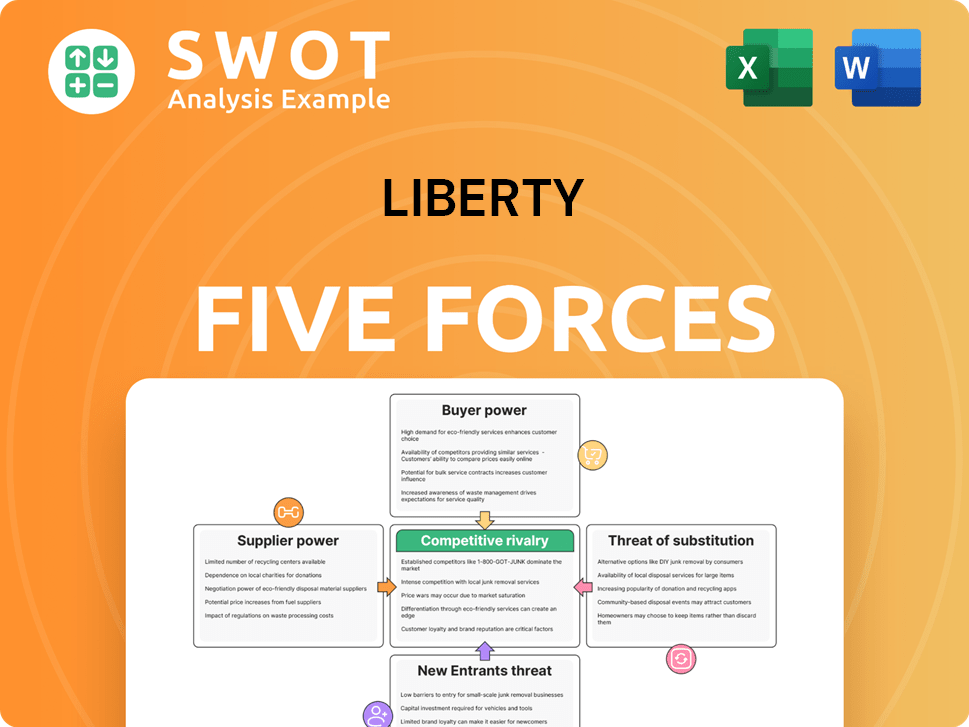

Liberty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Liberty Company?

- What is Growth Strategy and Future Prospects of Liberty Company?

- How Does Liberty Company Work?

- What is Sales and Marketing Strategy of Liberty Company?

- What is Brief History of Liberty Company?

- Who Owns Liberty Company?

- What is Customer Demographics and Target Market of Liberty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.