Lineage Bundle

How Did Lineage Company Conquer the Cold Chain?

Lineage, Inc., formerly known as Lineage Logistics, stands as a titan in the temperature-controlled warehousing sector. From its inception in 2008, Lineage has redefined cold storage, evolving into the world's largest global temperature-controlled warehouse REIT. This transformation is a testament to its strategic vision and relentless pursuit of innovation within the food supply chain.

Delving into the Lineage SWOT Analysis, we uncover the strategic moves that propelled Lineage Company from its early days to its current market leadership. Understanding the Lineage history, including the Lineage founders' initial vision and the significant events that shaped its journey, is key to appreciating its impact. The company's achievements, from its innovative business model to its ambitious future plans, highlight its commitment to leading the global cold chain logistics market.

What is the Lineage Founding Story?

The brief history of Lineage Company began in 2008. Founded by Adam Forste and Kevin Marchetti, the company quickly established itself as a key player in the temperature-controlled logistics sector. Their vision was to transform the industry through strategic acquisitions and technological advancements.

The founders, formerly investment bankers at Morgan Stanley, formed Bay Grove Capital, LLC in 2007. This firm served as the foundation for Lineage's 'buy-and-build' strategy. This approach involved acquiring and integrating regional cold storage businesses to create a comprehensive network.

The company's early days were marked by strategic acquisitions. The first major acquisition was Seafreeze in Seattle in December 2008. This was followed by CityIce in 2009, Flint River Services in 2010, and Terminal Freezers of Santa Maria, California, and Richmond Cold Storage in 2011. Lineage rebranded in April 2012, solidifying its position as a major force in the industry.

Lineage's founders identified a significant opportunity in the cold storage industry, which was fragmented and often lacked access to capital. By consolidating these regional and family-owned companies, Lineage aimed to create an integrated network.

- The company's business model focused on providing end-to-end cold chain solutions.

- These solutions included warehousing, transportation, and supply chain management services.

- Lineage's commitment to technology and data analytics was a key differentiator.

- Initial funding came from Bay Grove Capital, which focused on building long-term investment platforms.

Lineage's rapid growth was fueled by its strategic acquisitions and technological focus. The company's name, 'Lineage,' reflects its roots in the cold storage industry, tracing back to businesses like New Orleans Cold Storage, founded in 1885. Understanding the Owners & Shareholders of Lineage provides further insight into the company's structure and growth.

By 2012, Lineage had already become the fifth-largest network of temperature-controlled warehouses in North America. This early success set the stage for continued expansion and innovation in the years to come. The company's focus on end-to-end solutions and technological advancements has allowed it to maintain a strong market position.

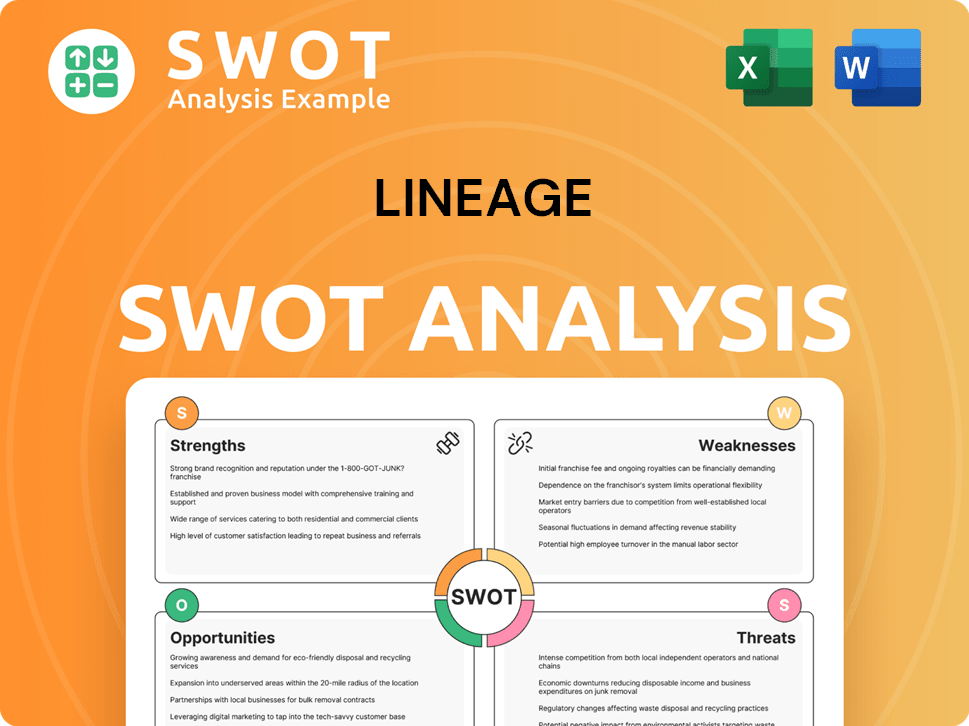

Lineage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Lineage?

The early growth of the Lineage Company was characterized by an aggressive 'buy and build' strategy, quickly acquiring and integrating numerous regional cold storage businesses. This approach allowed Lineage to rapidly expand its footprint across North America. This strategic consolidation continued with further acquisitions, strengthening its operations and market position.

From its establishment in April 2012, the Lineage rapidly expanded. Key early acquisitions included Castle & Cooke Cold Storage in 2012, which significantly expanded its West Coast presence, and Millard Refrigerated Services in 2014 for approximately $1 billion, effectively doubling the company's size. Columbia Colstor was acquired in 2015, strengthening its Pacific Northwest operations. These acquisitions were crucial in shaping the Lineage history and its early days.

In 2015, Greg Lehmkuhl became CEO, marking a significant leadership transition that would further drive the company's expansion. Lineage made its first international expansion in 2017 with the acquisition of Partner Logistics, a European automated cold storage provider, signaling the beginning of its global growth strategy. This was followed by the acquisition of Yearsley Group in 2018, making Lineage the largest cold storage provider in the UK.

The company's growth was underpinned by continuous investment in its technology infrastructure. In 2016, the company launched the Lineage Innovation Center to develop proprietary technology solutions aimed at optimizing cold chain operations. The market reception to Lineage's integrated approach was positive, as it addressed the fragmented and often inefficient nature of the traditional cold storage industry.

The competitive landscape, while present with other key players, saw Lineage differentiate itself through its aggressive acquisition strategy, technological integration, and focus on end-to-end supply chain solutions. Lineage's strategic shifts during this period consistently focused on expanding its network, leveraging technology, and diversifying services to meet the increasing demand for temperature-controlled storage. By 2020, Lineage had completed its largest acquisition to date, purchasing Preferred Freezer Services and adding 39 facilities to its network. By the end of 2023, Lineage had acquired more than 100 companies, showcasing its rapid expansion. If you're interested in learning more about the company's journey, you can read a brief history of Lineage Company.

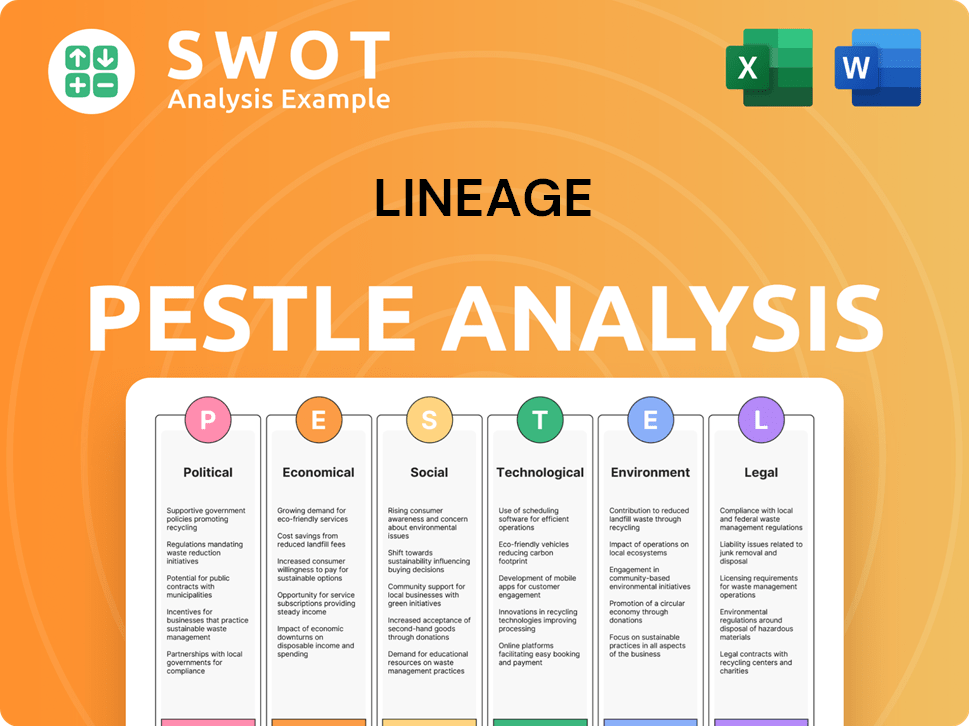

Lineage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Lineage history?

The Lineage Company has a rich Lineage history, marked by significant Lineage achievements and strategic moves that have shaped its position in the cold storage and logistics sector. From its Lineage Company origins to its current status, the company has consistently demonstrated growth and innovation.

| Year | Milestone |

|---|---|

| 2016 | Launched the Lineage Innovation Center to develop proprietary technology solutions for cold chain optimization. |

| 2020 | Acquired Preferred Freezer Services, significantly expanding its global presence. |

| 2021 | Partnered with 8VC to further invest in logistics technology. |

| 2023 | Completed over 100 acquisitions, expanding its global capacity. |

| 2024 | Acquired ColdPoint Logistics for $223 million, expanding its Kansas City presence. |

| April 2025 | Announced the acquisition of four cold storage warehouses from Tyson Foods for $247 million and plans to build two new fully automated cold storage warehouses, representing an investment of approximately $1 billion. |

Lineage Company has consistently invested in technological advancements. The company's proprietary Lineage Link technology platform provides real-time visibility and supply chain optimization, and its LinOS warehouse execution technology is utilized in its automated facilities.

This platform offers real-time visibility and inventory management.

Utilized in automated facilities for efficient warehouse operations.

Dedicated to developing proprietary technology solutions.

As of March 2024, over 75 patents have been granted across multiple jurisdictions.

Despite its growth, Lineage Company faces industry challenges such as competition and the need for continuous investment. The company has also navigated periods of oversupply in the cold storage sector, which is projected to grow at an annual rate of 18% through 2030.

The logistics industry is highly competitive, requiring strategic responses.

Continuous investment is required to meet increasing demand and technological advancements.

The cold storage sector experiences periods of oversupply, necessitating strategic pivots.

The company's commitment to sustainability, including signing The Climate Pledge, reflects its adaptability.

For a deeper dive into the competitive landscape, consider reading about the Competitors Landscape of Lineage.

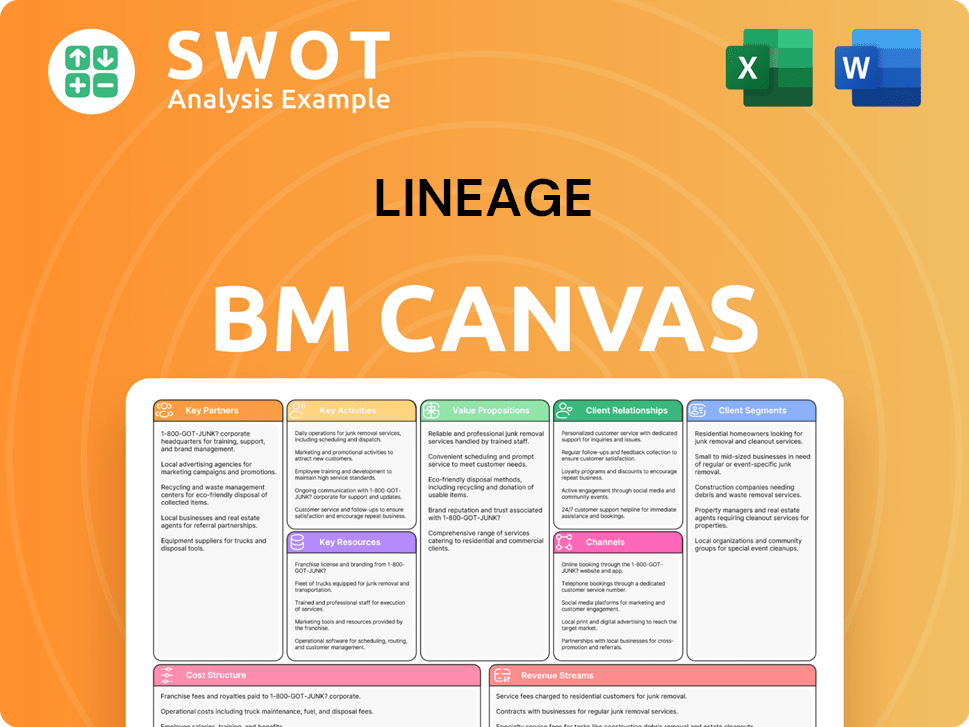

Lineage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Lineage?

The Lineage Company has a rich

| Year | Key Event |

|---|---|

| 2008 | Bay Grove Capital establishes Lineage Logistics through the acquisition of Seafreeze. |

| 2012 | The company rebrands as Lineage, becoming the fifth-largest network of temperature-controlled warehouses in North America. |

| 2014 | Acquires Millard Refrigerated Services for approximately $1 billion, significantly increasing its capacity. |

| 2015 | Greg Lehmkuhl becomes CEO of Lineage Logistics. |

| 2016 | Launches the Lineage Innovation Center to develop proprietary technology solutions. |

| 2017 | Makes its first international expansion with the acquisition of Partner Logistics in Europe. |

| 2018 | Acquires Yearsley Group, becoming the largest cold storage provider in the UK. |

| 2020 | Completes its largest acquisition to date, purchasing Preferred Freezer Services. |

| 2023 | Expands its European network by acquiring Grupo Fuentes and strengthens its presence in northern Vietnam through a joint venture with SK Logistics. Acquires the warehousing and e-commerce assets of Burris Logistics. |

| July 2024 | Lineage completes its Initial Public Offering (IPO) on the Nasdaq, raising $5.1 billion in gross proceeds, the largest real estate IPO of all time. |

| November 2024 | Opens a new, fully automated cold storage warehouse in Hazle Township, Pennsylvania. |

| December 2024 | Acquires ColdPoint Logistics for $223 million, expanding its presence in the Kansas City market. |

| February 2025 | Reports full-year 2024 revenue of $5.3 billion and Adjusted EBITDA of $1.3 billion, and initiates 2025 guidance projecting adjusted EBITDA between $1.35 billion and $1.40 billion. |

| April 2025 | Acquires Bellingham Cold Storage and enters a definitive agreement to acquire four cold storage warehouses from Tyson Foods for $247 million and plans to build two new automated facilities, deploying approximately $1 billion in capital. |

Lineage plans to invest over $1.5 billion in 2025 for acquisitions and development, focusing on expanding its global footprint. This includes strengthening its presence in new and emerging markets, particularly in Asia, Latin America, and Africa. The company aims to capitalize on the rising demand for temperature-controlled logistics in these regions.

Lineage is committed to investing in innovative technologies to enhance operational efficiency. This includes automation, robotics, and data analytics to optimize its warehousing and logistics operations. These technologies are designed to reduce waste and improve overall performance.

Sustainability is a key focus for Lineage, with investments in energy-efficient warehouses and efforts to reduce its carbon footprint. This aligns with growing industry trends and consumer expectations for environmentally friendly solutions. The company is committed to minimizing waste and contributing to a more sustainable food supply chain.

Lineage anticipates continued financial growth, with projections for adjusted EBITDA between $1.35 billion and $1.40 billion in 2025. The company's strong financial position and clear growth strategy position it for sustained success in the global food supply chain. Lineage aims to deliver compounding growth for its shareholders.

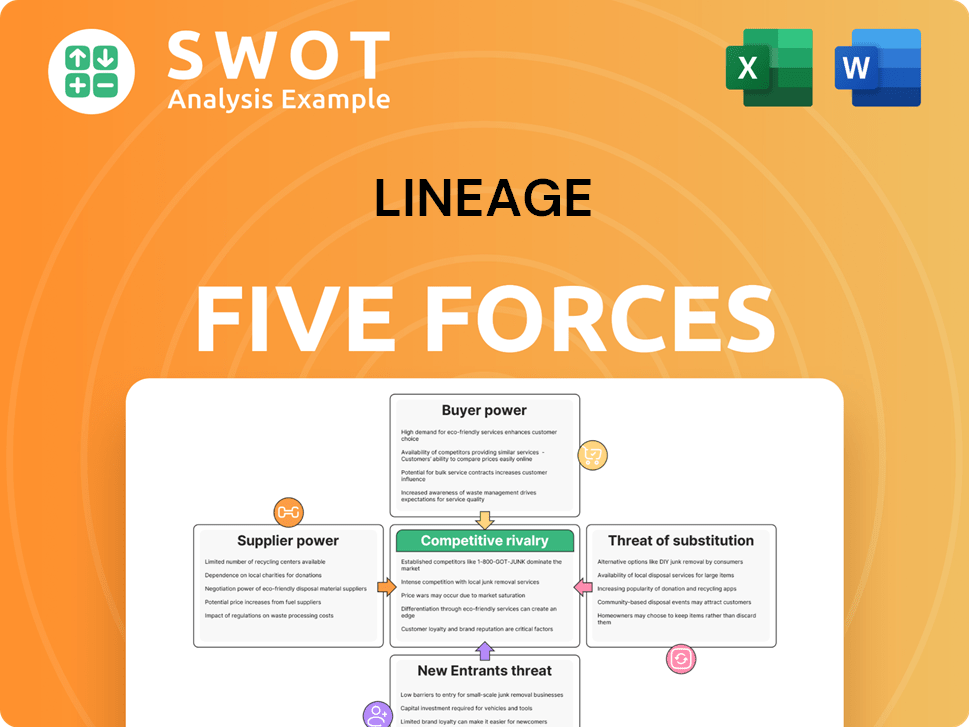

Lineage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Lineage Company?

- What is Growth Strategy and Future Prospects of Lineage Company?

- How Does Lineage Company Work?

- What is Sales and Marketing Strategy of Lineage Company?

- What is Brief History of Lineage Company?

- Who Owns Lineage Company?

- What is Customer Demographics and Target Market of Lineage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.