Lineage Bundle

Who Really Owns Lineage Company?

Uncover the intricate ownership web of Lineage, a titan in the global food supply chain. Following a groundbreaking IPO in July 2024, Lineage Logistics, now Lineage, Inc., has captured the attention of investors worldwide. Understanding the Lineage SWOT Analysis is crucial to understanding its strategic direction. This deep dive explores the evolution of Lineage's ownership, from its origins to its current stakeholders.

From its inception in 2012, Lineage Company has transformed the temperature-controlled warehousing landscape. The company's journey from a private entity to a publicly traded giant raises critical questions about its Lineage Logistics owner and the influence of its Lineage Logistics investors. This analysis will reveal the key players behind Lineage Logistics and the implications of its recent financial maneuvers, providing insights into the future of this industry leader. Explore the Lineage Logistics ownership structure and discover Who owns Lineage.

Who Founded Lineage?

The story of Lineage Logistics begins with former Morgan Stanley investment bankers Kevin Marchetti and Adam Forste. They established Bay Grove Capital, LLC in 2007, setting the stage for what would become a major player in the cold storage industry. Their vision was to create an owner-operator model, building a platform for long-term investment.

Bay Grove Capital's strategy involved acquiring and consolidating fragmented businesses. This 'rollup' approach aimed to build a large-scale food infrastructure. This strategy was pivotal in Lineage's early development, providing both financial support and strategic guidance.

Lineage Logistics was formally established in April 2012 through the consolidation of acquired warehousing and logistics companies. Marchetti and Forste, as co-founders and managing partners of Bay Grove, held significant control from the outset. They currently serve as Co-Executive Chairmen of the board of Lineage Logistics Holdings, LLC.

Bay Grove Capital's initial acquisitions included Seafreeze in December 2008, CityIce in 2009, and Flint River Services in 2010. These acquisitions were key to building the foundation of Lineage Logistics. This strategy of acquiring and consolidating cold storage businesses was central to their growth.

The founders' vision was to create a significant player in the cold storage and logistics sector. Their owner-operator model allowed for long-term investment horizons. This approach set the stage for Lineage's expansion and success in the industry.

The 'rollup' approach of acquiring and consolidating businesses was a core strategy. This allowed Lineage to quickly grow its network and market presence. This strategy was instrumental in building a large-scale food infrastructure.

Kevin Marchetti and Adam Forste, as co-founders, played a crucial role in the company's early development. Their leadership and strategic vision were essential. They continue to influence the company's direction as Co-Executive Chairmen.

While specific initial equity splits aren't public, Marchetti and Forste, through Bay Grove, held significant control. Their early agreements were closely tied to Bay Grove's strategy. This ownership structure was key to implementing their vision.

The acquisition of Henningsen Cold Storage Company in 2012 was a key step in consolidating the industry. This acquisition further strengthened Lineage's market position. This demonstrated the company's commitment to growth through strategic acquisitions.

Understanding the Lineage Company ownership structure is key to grasping its trajectory. Initially, Lineage Logistics owner control was primarily held by Bay Grove Capital and its founders. This model allowed for strategic acquisitions and rapid expansion. For those wondering who owns Lineage, the early structure centered on the founders and their investment firm. The company's growth strategy, as detailed in Growth Strategy of Lineage, has been heavily influenced by its ownership structure and the vision of its founders.

- Bay Grove Capital, founded by Kevin Marchetti and Adam Forste, provided the initial capital and strategic direction.

- The acquisition of Seafreeze, CityIce, and Flint River Services formed the foundation of Lineage Logistics.

- The consolidation of these companies in 2012 marked the official formation of Lineage Logistics.

- The founders, through Bay Grove, maintained significant control, guiding the company's growth through strategic acquisitions.

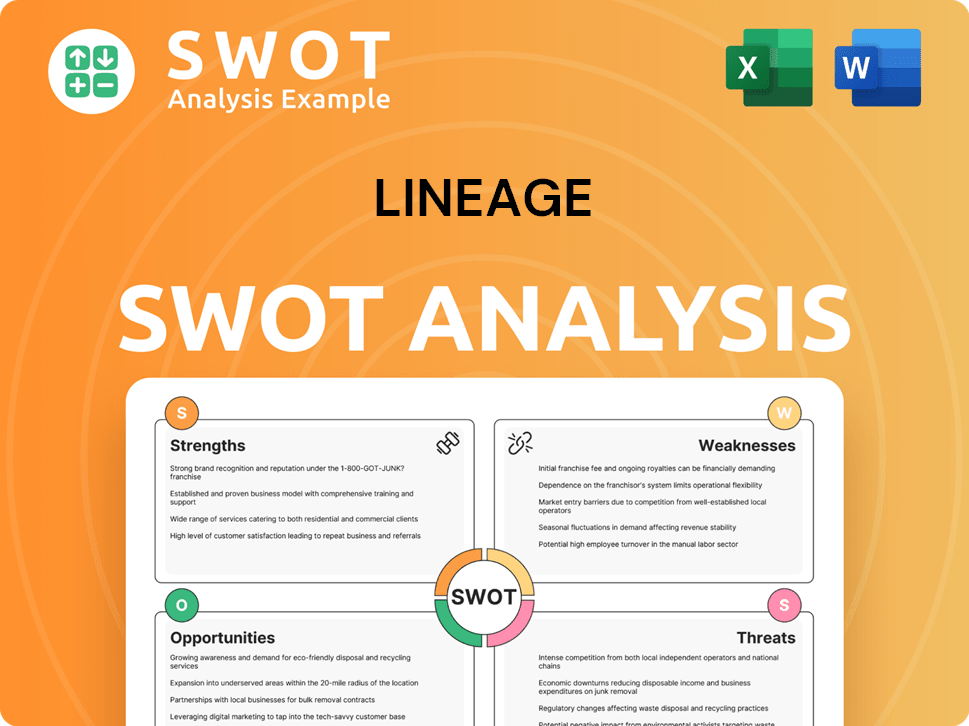

Lineage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Lineage’s Ownership Changed Over Time?

The ownership of Lineage has seen a significant shift, evolving from its beginnings as a privately held entity to a publicly traded company. This transformation has been fueled by an aggressive acquisition strategy, with the company acquiring over 120 companies since 2008. This growth trajectory has reshaped its ownership landscape, bringing in various investors and ultimately leading to its Initial Public Offering (IPO).

Before its IPO, Lineage was primarily backed by private equity firms. Bay Grove Capital, founded by Kevin Marchetti and Adam Forste, held a majority stake. Other key investors included Stonepeak Partners and D1 Capital Partners. For instance, in July 2018, Stonepeak Partners LP, D1 Capital Partners, and existing investors provided a $700 million investment. This investment supported Lineage's operational and expansion activities, with representatives from Stonepeak joining the company's Board of Directors.

| Event | Date | Impact on Ownership |

|---|---|---|

| Investment from Stonepeak Partners, D1 Capital Partners, and existing investors | July 2018 | Strengthened financial backing, supported expansion. |

| Initial Public Offering (IPO) | July 2024 | Lineage became a publicly traded company; Bay Grove Capital retained majority voting stake. |

| Acquisition of over 120 companies | Since 2008 | Expanded the company's footprint and influenced investor base. |

A pivotal moment occurred in July 2024 when Lineage Inc. (formerly Lineage Logistics) launched its IPO on the Nasdaq Global Select Market under the ticker symbol 'LINE'. The IPO was the largest of 2024, raising $4.44 billion by selling nearly 57 million shares at $78 apiece, valuing Lineage at over $18 billion. Despite going public, Bay Grove Capital LLC maintains a majority voting stake, ensuring continuity in its strategic direction. As of March 31, 2024, Lineage reported a total revenue of $5.3 billion for the twelve months ended March 31, 2024, with a net loss of $162.8 million for the same period. For the full year 2024, Lineage reported $5.3 billion in revenue, with a GAAP net loss of $751 million. The company's adjusted EBITDA for the full year 2024 was $1.3 billion. To understand more about the company's strategic direction, consider exploring the Target Market of Lineage.

Lineage's ownership structure has evolved significantly, transitioning from private equity to a publicly traded model.

- Bay Grove Capital remains a majority shareholder.

- The IPO in July 2024 was a major milestone.

- The company's financial performance in 2024 showed substantial revenue.

- Lineage's acquisition strategy has significantly shaped its growth.

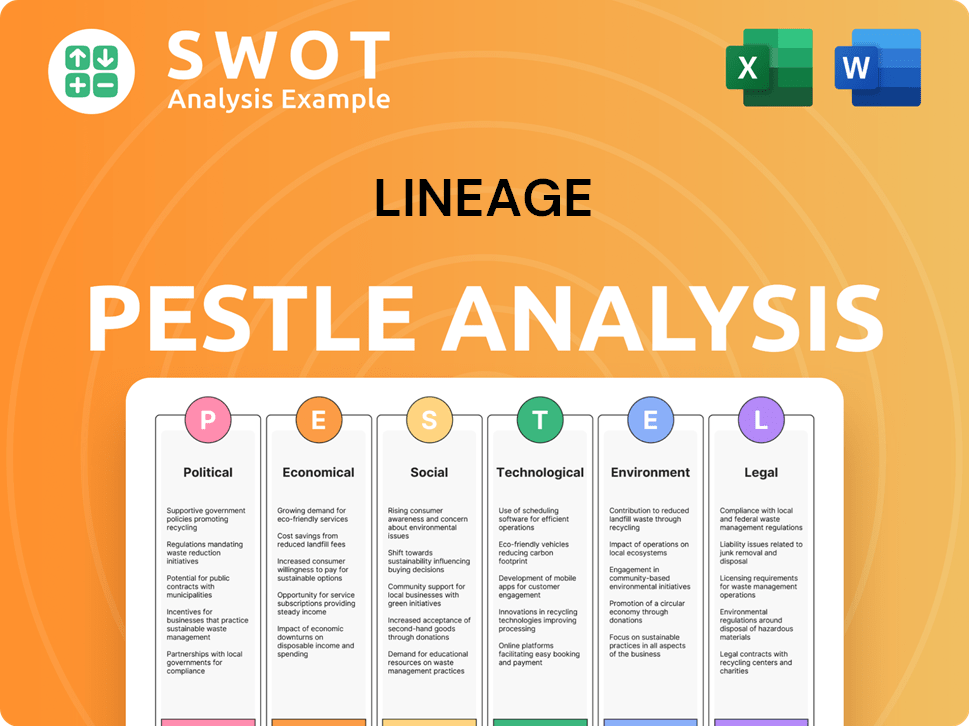

Lineage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Lineage’s Board?

As of April 28, 2025, the Board of Directors for Lineage includes key figures central to its operations and financial backing. Kevin Marchetti and Adam Forste, the co-founders, serve as Co-Executive Chairmen, guiding the company's strategic direction. Greg Lehmkuhl, who has been with the company since June 2015 and currently holds the position of President and Chief Executive Officer, also serves on the board, ensuring alignment between executive decisions and board oversight. The board also benefits from the expertise of representatives from major shareholders.

The board also includes James Wyper, a Senior Managing Director at Stonepeak, who has been a director since May 2018, representing a significant investor. Additional board members include Shellye Archambeau, who joined in April 2024, bringing a fresh perspective, and Michael Turner, who has served since September 2020. John Carrafiell, co-Chief Executive Officer of BentallGreenOak, joined the board in March 2021, adding further financial and real estate expertise. These individuals collectively provide a diverse range of skills and experience to oversee the strategic direction of Lineage.

| Board Member | Title | Affiliation |

|---|---|---|

| Kevin Marchetti | Co-Executive Chairman | Lineage |

| Adam Forste | Co-Executive Chairman | Lineage |

| Greg Lehmkuhl | President and CEO | Lineage |

| James Wyper | Senior Managing Director, Global Head of Transportation and Logistics | Stonepeak |

| Shellye Archambeau | Board Member | N/A |

| Michael Turner | Board Member | N/A |

| John Carrafiell | Co-Chief Executive Officer | BentallGreenOak |

Regarding Lineage Company ownership, the company operates with a straightforward voting structure, where each share of common stock grants one vote. Despite its public listing, Lineage is classified as a 'controlled company' under Nasdaq standards. This is because affiliates of Bay Grove Capital maintain control over more than 50% of the voting power for all classes of stock entitled to vote in director elections. This structure grants Bay Grove Capital substantial influence over Lineage's decision-making processes, which is essential for understanding the Lineage Logistics owner. To learn more about Lineage's business model, check out Revenue Streams & Business Model of Lineage.

Lineage's board includes co-founders and representatives from major shareholders, ensuring strategic oversight.

- Bay Grove Capital's significant voting power makes Lineage a 'controlled company'.

- The company has opted out of certain anti-takeover measures.

- Lineage's ownership structure impacts its strategic direction and decision-making.

- Understanding the Lineage Logistics ownership structure is key to grasping its operational dynamics.

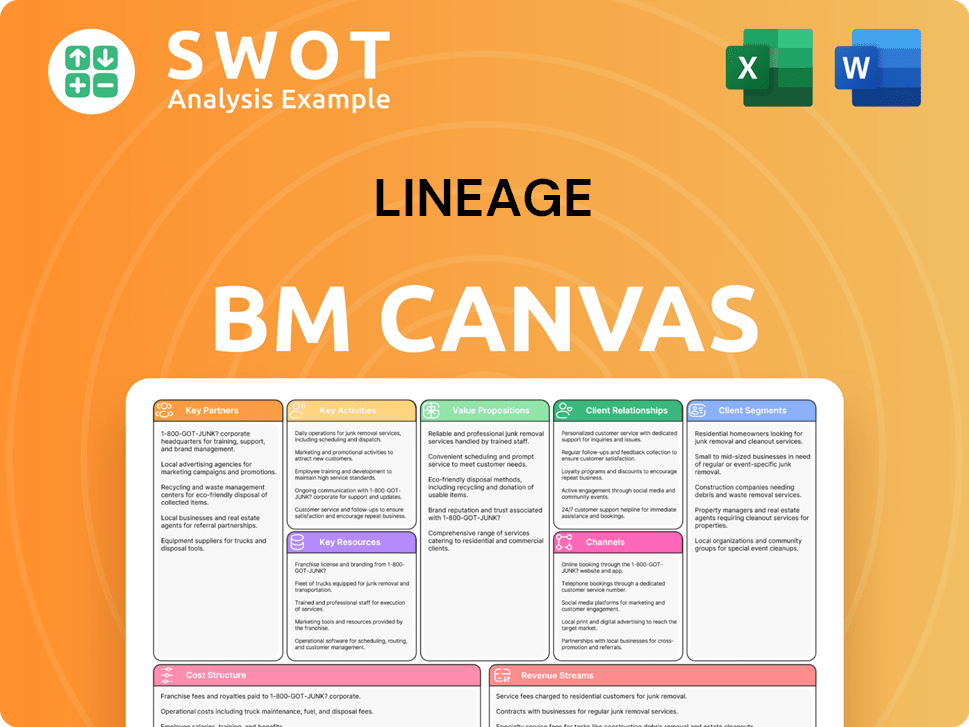

Lineage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Lineage’s Ownership Landscape?

In recent years, the ownership of Lineage has seen significant developments, primarily driven by its aggressive expansion strategy. Over the past three to five years, the company has consistently pursued acquisitions to bolster its market presence. As of April 4, 2025, Lineage completed a total of 5 acquisitions, with 3 in 2024 and 2 in 2025. The average acquisition amount stands at approximately $612 million, reflecting the scale of these strategic moves. Notable acquisitions include Coldpoint in December 2024 for $223 million, Luik Natie in August 2024, Bellingham Cold Storage in April 2025, and Fremantlecoldstores in January 2025.

A pivotal moment in Lineage's ownership structure was its initial public offering (IPO) in July 2024. This IPO, which raised $4.4 billion, was the largest of the year. The IPO allowed the company to raise significant capital, with $4.9 billion of the $5.1 billion in gross proceeds allocated to debt repayment. Despite the IPO, Bay Grove Capital retains a majority voting stake, underscoring its continued influence. As of February 26, 2025, shares of Lineage, Inc. (NASDAQ: LINE) were trading at $56.78, after nearly reaching $90 shortly after the IPO. However, by March 26, 2025, the stock price was approximately 30% below its IPO price, indicating market volatility.

Lineage's financial strategy includes a substantial capital deployment plan for 2025, with over $1.5 billion earmarked for acquisitions and development projects. In April 2025, Lineage announced agreements with Tyson Foods, including the acquisition of four cold storage warehouses for $247 million and plans to develop two new fully automated cold storage warehouses. These initiatives represent a total capital deployment of approximately $1 billion over the coming years. The company anticipates its full-year 2025 adjusted EBITDA to be between $1.35 billion and $1.40 billion, with Adjusted FFO (AFFO) per share projected to range from $3.40 to $3.60. This demonstrates the company's commitment to both expanding its asset base and enhancing its operational efficiency. To learn more about the company's market approach, you can read about the Marketing Strategy of Lineage.

Bay Grove Capital holds a majority voting stake despite the IPO, indicating its continued control over the company.

The company's expansion through acquisitions, with an average acquisition amount of $612 million, is a key trend.

The IPO in July 2024 raised $4.4 billion, with a significant portion used to reduce debt.

Lineage plans to deploy over $1.5 billion in capital in 2025 for its acquisition and development pipeline.

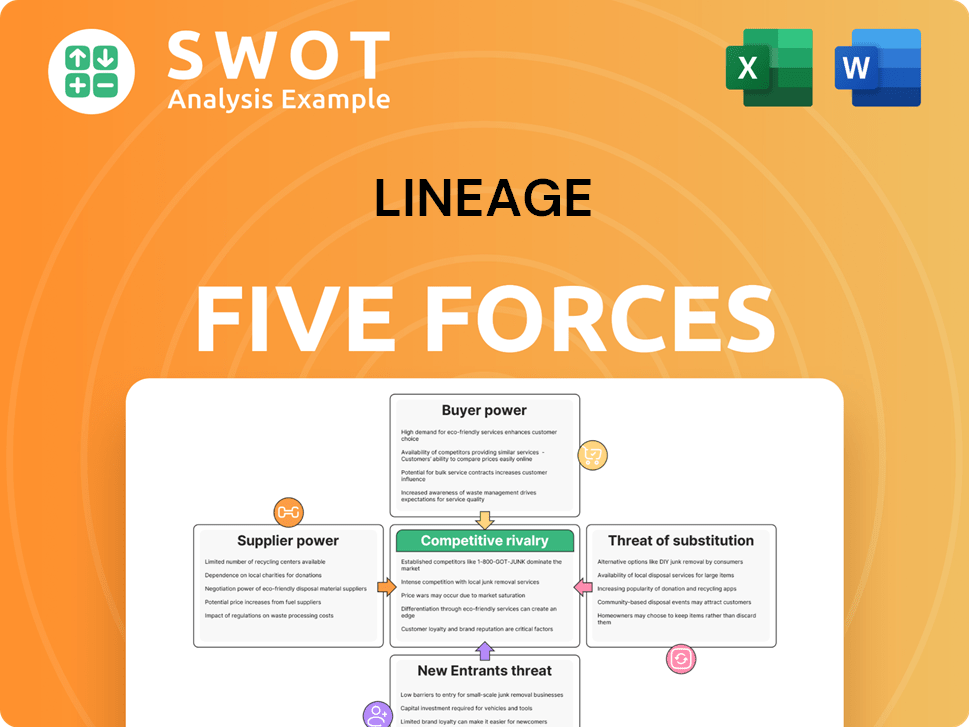

Lineage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lineage Company?

- What is Competitive Landscape of Lineage Company?

- What is Growth Strategy and Future Prospects of Lineage Company?

- How Does Lineage Company Work?

- What is Sales and Marketing Strategy of Lineage Company?

- What is Brief History of Lineage Company?

- What is Customer Demographics and Target Market of Lineage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.