Lineage Bundle

Can Lineage Logistics Maintain Its Ascent in the Cold Storage Realm?

Lineage Logistics' strategic acquisition spree in early 2024, significantly broadening its global footprint, signals a pivotal moment for the temperature-controlled logistics giant. This expansion is more than just a growth spurt; it's a calculated move within the complex global food supply chain, demanding a robust and forward-thinking Lineage SWOT Analysis. Founded in 2008, Lineage has rapidly transformed, now commanding the largest network of temperature-controlled warehouses worldwide.

This exploration of Lineage's Lineage growth strategy will dissect its ambitious Lineage company future, examining how it plans to navigate evolving Lineage industry trends and the dynamic Lineage competitive landscape. We'll uncover the key drivers behind its impressive expansion and assess its potential for long-term success, considering factors like Lineage business prospects and the company's ability to adapt to market changes.

How Is Lineage Expanding Its Reach?

The Lineage growth strategy centers on aggressive expansion, primarily through strategic mergers and acquisitions. This approach, combined with organic growth, has allowed the company to significantly broaden its market presence, particularly in key regions like Europe and North America. This strategy is driven by the increasing global need for temperature-controlled logistics and the desire to diversify revenue streams.

In 2024, Lineage Logistics continued to expand its footprint by acquiring numerous cold storage facilities. These acquisitions have been instrumental in solidifying its leadership position in the market. The company's focus extends to entering new product categories, such as specialized storage for pharmaceuticals, to broaden its service offerings and customer base.

Lineage's expansion initiatives also include the development of automated facilities. Several new automated warehouses became operational in 2024, with plans for more in 2025. This focus on automation aims to increase efficiency and capacity, supporting the company's long-term growth potential. Strategic partnerships with technology providers also play a crucial role in enhancing end-to-end supply chain visibility and efficiency.

Lineage Logistics has consistently used mergers and acquisitions as a primary growth strategy. This approach has allowed them to quickly expand their capacity and geographic reach. Recent acquisitions have focused on expanding their presence in Europe and North America, enhancing their market share.

Investing in automated warehouses is a key part of Lineage's strategy to increase efficiency. These facilities use advanced technology to streamline operations and reduce costs. The company has been actively expanding its automated facilities, with several new warehouses becoming operational in 2024 and more planned for 2025.

Lineage is expanding its service offerings to include new product categories, such as specialized storage for pharmaceuticals. This diversification helps the company reach new customers and increase revenue streams. This strategic move allows Lineage to adapt to changing market demands.

Collaborations with technology providers are crucial for enhancing supply chain efficiency. These partnerships improve end-to-end visibility and streamline operations. These collaborations are essential for staying competitive and meeting the evolving needs of customers.

Lineage's expansion strategy includes strategic acquisitions, automation, and diversification into new product categories. The company's focus on automated facilities and strategic partnerships enhances its operational efficiency and market position. These initiatives support Lineage's long-term growth potential and market share.

- Acquisition of multiple cold storage facilities in Europe and North America in 2024.

- Operationalization of new automated warehouses in 2024, with more planned for 2025.

- Expansion into specialized storage for pharmaceuticals to broaden service offerings.

- Strategic partnerships with technology providers for enhanced supply chain visibility.

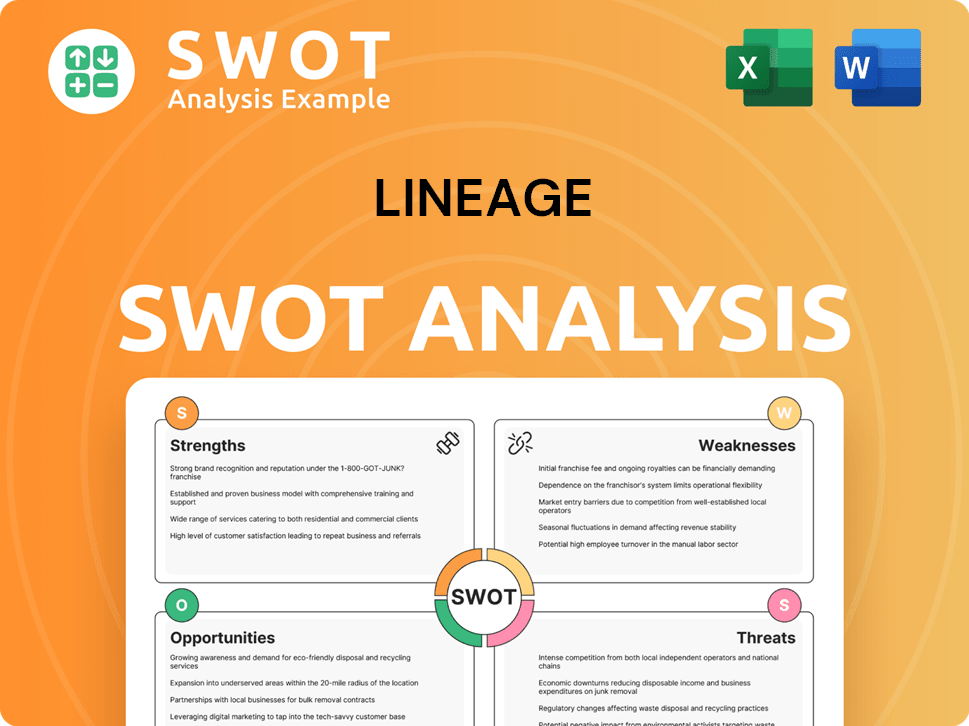

Lineage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lineage Invest in Innovation?

The company focuses heavily on innovation and technology to maintain its competitive edge and drive sustainable growth. This approach is crucial for understanding the Lineage growth strategy and its future prospects. Their commitment to technological advancements is a key factor in their market position.

Significant investments in research and development are a cornerstone of their strategy. They concentrate on areas like automation, data analytics, and artificial intelligence to optimize cold chain operations. This focus helps them stay ahead in the Lineage market analysis and adapt to changing Lineage industry trends.

The deployment of advanced automation technologies within warehouses is a key part of their innovation strategy. This includes automated storage and retrieval systems (ASRS) and robotic material handling. These technologies improve efficiency, reduce labor costs, and enhance inventory accuracy, which are crucial for understanding the Lineage business prospects.

Automated storage and retrieval systems (ASRS) and robotic material handling are used to improve efficiency. These systems reduce labor costs and enhance inventory accuracy, which is vital for Lineage's success. This is a core component of their Lineage company growth strategy 2024.

They are at the forefront of digital transformation within the logistics sector. They use IoT sensors for real-time temperature monitoring and predictive analytics. This minimizes spoilage and optimizes energy consumption, which is important for Lineage's future revenue projections.

Their proprietary software platforms give customers unparalleled visibility into their inventory and supply chain. This enhances transparency and control, which is a key element of their business model and profitability. This is a crucial aspect of their Lineage's competitive advantages in the market.

Lineage is committed to sustainability, implementing energy-efficient technologies. They explore and use solar power and advanced refrigeration systems across their global network. This reduces their environmental footprint and aligns with industry trends.

Technological innovation has led to increased operational efficiency and improved service quality. This has allowed them to offer highly specialized solutions to their diverse client base. These advancements are critical for Lineage's long-term growth potential.

Their focus on technology has led to increased operational efficiency and improved service quality. They offer specialized solutions to a diverse client base. This strategic focus is crucial for understanding Lineage's financial performance and outlook.

Lineage's investment in technology is significant, with a focus on automation, data analytics, and AI. These technologies are key to their operational efficiency and market leadership. The company's commitment to innovation is evident in its strategic partnerships and alliances.

- Automation: Implementation of ASRS and robotic systems to improve warehouse efficiency.

- Data Analytics: Using IoT sensors for real-time monitoring and predictive analytics to reduce spoilage.

- Sustainability: Adoption of energy-efficient technologies like solar power and advanced refrigeration.

- Software: Proprietary platforms offering customers supply chain visibility.

- Investment: Continuous investment in R&D to stay ahead of market changes.

For more details on the company's structure and ownership, you can refer to Owners & Shareholders of Lineage.

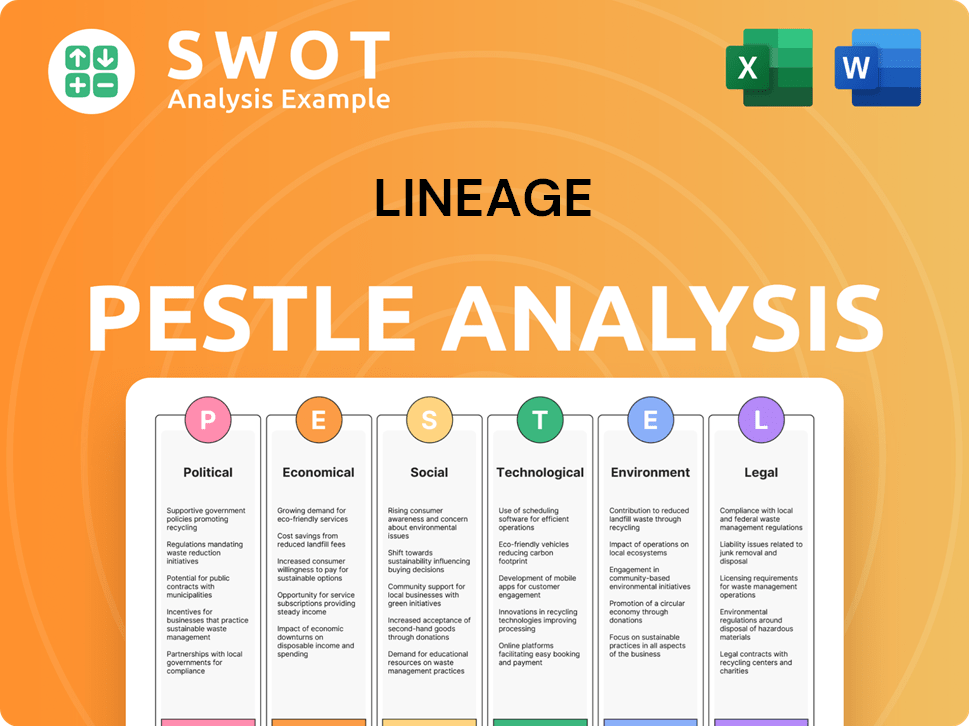

Lineage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lineage’s Growth Forecast?

While specific financial details for Lineage Logistics aren't publicly available, the company's financial health is strongly tied to its growth strategy and market position. The cold chain logistics industry is experiencing significant expansion, creating favorable conditions for companies like Lineage. This growth is driven by increasing demand for temperature-controlled storage and transportation, especially in the food and pharmaceutical sectors. The company's financial outlook is also influenced by its ability to secure funding for acquisitions and technology investments.

Lineage has consistently pursued capital raises and debt financing to fund its expansion. In early 2024, Lineage secured substantial funding rounds, indicating strong investor confidence. This funding supports its global expansion and automation initiatives, which are crucial for maintaining its competitive edge. The company's focus on operational efficiency through automation and digital transformation is expected to contribute to healthy profit margins, a key factor in its long-term financial goals.

Analysts project continued revenue growth for Lineage, fueled by the increasing demand for temperature-controlled logistics services. The company's strategic focus on emerging markets and specialized segments, such as pharmaceuticals, is expected to drive further revenue expansion. The company's financial performance is also influenced by its ability to integrate acquired companies efficiently and leverage economies of scale. For a deeper understanding of the company's business model, consider reading Revenue Streams & Business Model of Lineage.

The cold chain logistics market is experiencing robust growth, with projections indicating continued expansion. This growth is driven by the increasing need for temperature-controlled storage and transportation, particularly in the food and pharmaceutical sectors. Lineage's strategic focus on these sectors positions it well for future growth.

Key industry trends include the adoption of automation, digital transformation, and expansion into emerging markets. Lineage is actively investing in these areas to enhance operational efficiency and expand its global footprint. The company's focus on sustainability and reducing its environmental impact is also becoming increasingly important.

The competitive landscape includes both large, global players and smaller, regional operators. Lineage's scale, strategic acquisitions, and technological investments give it a significant competitive advantage. The company's ability to offer integrated solutions and its focus on customer service are key differentiators.

While specific numbers are not public, analysts project continued revenue growth for Lineage, driven by market expansion and strategic initiatives. The company's focus on emerging markets and specialized segments, such as pharmaceuticals, is expected to drive further revenue expansion. Investments in automation and technology will also contribute to revenue growth.

Lineage's expansion strategy involves both organic growth and strategic acquisitions. The company is actively seeking opportunities to expand its global footprint, particularly in high-growth markets. Investments in new facilities and technologies are also key components of its expansion plans.

Investment opportunities in Lineage are primarily available through private equity markets. The company's consistent capital raises and strong investor interest reflect its potential for long-term growth. The focus on automation and technological advancements makes it an attractive investment.

Lineage's business model focuses on providing temperature-controlled storage and transportation services. Profitability is driven by operational efficiency, strategic acquisitions, and high customer retention rates. The company's ability to offer integrated solutions also contributes to its profitability.

Lineage's core competencies include its extensive network of facilities, its technological capabilities, and its expertise in cold chain logistics. The company's ability to manage complex supply chains and provide tailored solutions to its customers is also a key strength. Its market leadership position is also a core competency.

Lineage's competitive advantages include its scale, its technological investments, and its strategic acquisitions. The company's ability to offer integrated solutions and its focus on customer service are key differentiators. Its global presence and strong relationships with key customers also provide a competitive edge.

Lineage forms strategic partnerships and alliances to enhance its service offerings and expand its market reach. These partnerships often involve collaborations with technology providers, logistics companies, and industry-specific specialists. These alliances help Lineage stay competitive.

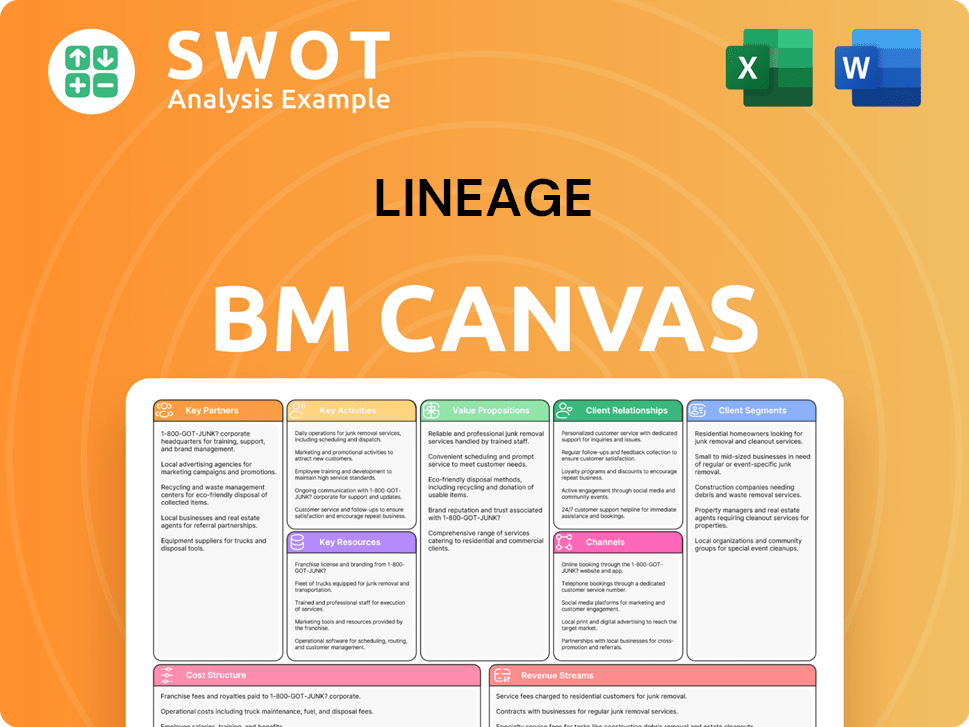

Lineage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lineage’s Growth?

The path of Lineage Logistics, like any major player in the cold storage and temperature-controlled logistics sector, isn't without its challenges. Several potential risks and obstacles could impact its ambitious Lineage growth strategy. These include intense competition, regulatory hurdles, and the ever-present threat of supply chain disruptions.

Understanding these potential pitfalls is crucial for evaluating Lineage's future business prospects. The company must navigate a complex landscape to maintain its competitive edge and achieve its growth targets. This chapter explores the key risks and obstacles Lineage faces, providing a comprehensive view of the challenges ahead.

The competitive landscape in the temperature-controlled logistics market is fierce. Lineage faces competition from established players and new entrants, all vying for market share. These competitors may have different strengths, such as regional expertise or specialized services, requiring Lineage to continuously innovate and improve its offerings to stay ahead. Furthermore, regulatory changes, especially those concerning food safety and environmental standards, can increase operational costs and compliance burdens.

The cold storage market is highly competitive, with numerous players vying for market share. The competitive landscape includes both large, established companies and smaller, regional specialists. This competition can put pressure on pricing and margins.

Changes in food safety regulations, environmental standards, and international trade policies can increase operational costs. Compliance with these regulations requires ongoing investment and adaptation. These changes can impact Lineage's operational costs and require constant adaptation.

Disruptions from geopolitical events, natural disasters, or pandemics can significantly impact global operations. The interconnected nature of supply chains makes them vulnerable to external shocks. These disruptions can lead to delays, increased costs, and potential damage to goods.

The cold storage industry is subject to technological advancements. Lineage must invest in advanced refrigeration and automation systems to remain competitive. Failure to adopt new technologies can lead to inefficiencies and reduced competitiveness.

Managing a rapidly expanding global network and integrating acquisitions presents significant challenges. This includes ensuring operational consistency, effectively managing human capital, and maintaining a unified corporate culture. These challenges can impact efficiency and overall performance.

Economic slowdowns or recessions can affect demand for cold storage services. Reduced consumer spending and decreased production in the food and pharmaceutical industries can lead to lower occupancy rates and reduced revenue. Economic downturns can lead to lower occupancy rates and reduced revenue.

To mitigate these risks, Lineage employs a comprehensive risk management framework. This includes diversifying its client base and geographical footprint. The company also invests in scenario planning and has demonstrated its ability to adapt to unforeseen challenges. For example, during the global pandemic, Lineage leveraged its resilient network and technological capabilities to manage increased demand and operational complexities. For a deeper dive into how Lineage approaches its market, consider reading about the Marketing Strategy of Lineage.

Lineage focuses on diversifying its client base across various sectors. This strategy helps reduce reliance on any single industry or customer. Geographical diversification is another key strategy, reducing exposure to regional economic downturns or disruptions.

The company invests heavily in advanced refrigeration, automation, and data analytics. These technologies improve efficiency, reduce operational costs, and enhance service quality. Investments in technology are crucial for staying competitive.

Lineage forms strategic alliances with key players in the supply chain. These partnerships can provide access to new markets, technologies, and expertise. Strategic partnerships can enhance Lineage's capabilities and market reach.

The company engages in extensive scenario planning to prepare for potential disruptions. This proactive approach enables Lineage to adapt quickly to unforeseen challenges. The ability to adapt is critical for long-term success.

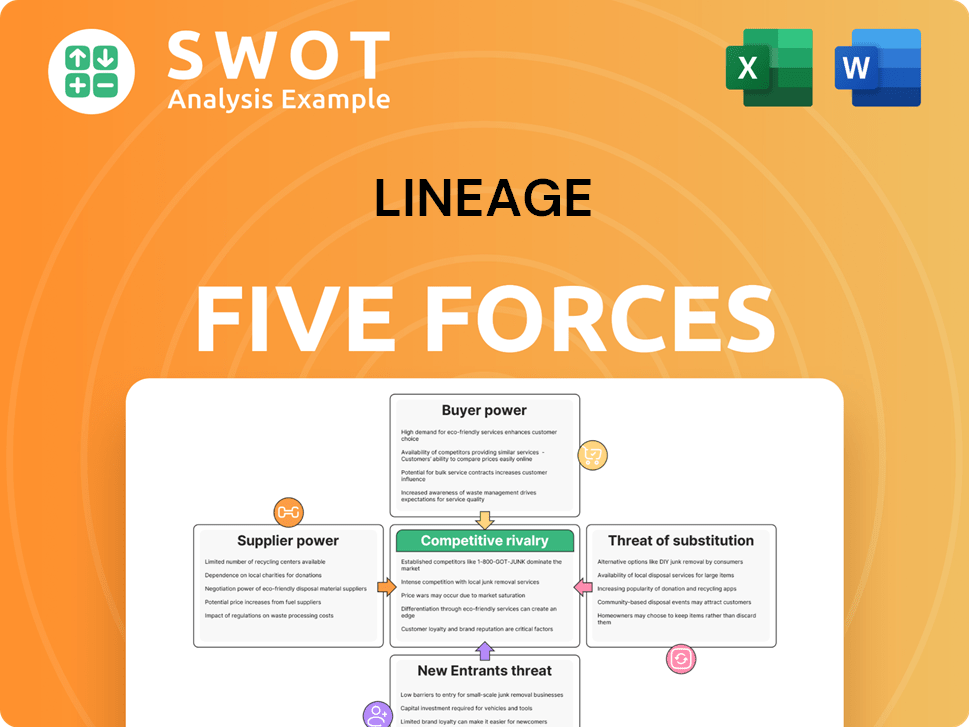

Lineage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lineage Company?

- What is Competitive Landscape of Lineage Company?

- How Does Lineage Company Work?

- What is Sales and Marketing Strategy of Lineage Company?

- What is Brief History of Lineage Company?

- Who Owns Lineage Company?

- What is Customer Demographics and Target Market of Lineage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.