Lineage Bundle

How Does Lineage Company Thrive in the Cold Chain?

Lineage Logistics isn't just a warehouse; it's a critical artery in the global food supply, managing over 30% of U.S. temperature-controlled food products. As the world's largest cold storage REIT, Lineage Company's influence is undeniable, highlighted by its impressive $5.3 billion revenue in 2024. But how does this industry giant actually operate, and what makes it tick?

Lineage Logistics offers a comprehensive suite of services, including warehousing, transportation, and supply chain management, making it a vital partner for food and beverage companies. Its strategic network of cold storage facilities and commitment to innovation ensure the safe and efficient movement of perishable goods. To gain a deeper understanding of Lineage operations and its strategic advantages, consider exploring a detailed Lineage SWOT Analysis to uncover its strengths, weaknesses, opportunities, and threats within the competitive landscape of the supply chain.

What Are the Key Operations Driving Lineage’s Success?

Lineage Logistics, a leader in temperature-controlled supply chain solutions, focuses on the storage and distribution of perishable goods. Their core operations revolve around cold storage warehousing, integrated transportation, and comprehensive logistics management. These services are primarily aimed at the food and beverage sector, but also extend to pharmaceuticals and the retail and foodservice industries, ensuring product freshness and quality.

The company's operations are supported by a vast network of over 480 strategically located facilities across North America, Europe, Asia-Pacific, and South America, encompassing over 3 billion cubic feet of space. Lineage leverages cutting-edge technology, including advanced data analytics, automation, and robotics, to optimize its operations. This approach allows them to manage complex supply chains efficiently.

Lineage's value proposition lies in its ability to provide integrated solutions that enhance product shelf life, reduce waste, and optimize supply chains. They achieve this through a combination of strategic partnerships, advanced technology, and a commitment to sustainability, ultimately delivering cost savings and improved efficiency for their clients. For example, the company reported a 25% reduction in carbon emissions in 2024.

Lineage logistics services offered include cold storage warehousing, integrated transportation, and comprehensive logistics management. These services cater to a wide range of industries, ensuring products maintain their quality and freshness. The company's focus is on providing end-to-end solutions for temperature-controlled supply chains.

Lineage Company utilizes advanced technologies such as data analytics, automation, and robotics to optimize its operations. Their warehouses are equipped with advanced monitoring systems and Automated Storage and Retrieval Systems (AS/RS). The Lineage Link application provides real-time visibility into warehouse operations, enhancing efficiency and transparency.

Lineage Company's global presence includes over 480 strategically located facilities. These warehouses are spread across North America, Europe, Asia-Pacific, and South America. The extensive network allows Lineage to provide comprehensive supply chain solutions to its clients worldwide.

Lineage is committed to sustainability, including a 25% reduction in carbon emissions in 2024. This commitment is reflected in their operational practices and strategic initiatives. Their focus on sustainability aligns with the growing demand for environmentally responsible supply chain solutions.

Lineage Company's business model centers on providing integrated, temperature-controlled supply chain solutions. They focus on cold storage, transportation, and logistics management, primarily serving the food and beverage industry. Their model is built on a global network of strategically located warehouses and advanced technology to optimize operations.

- Cold storage warehousing.

- Integrated transportation solutions.

- Comprehensive logistics management.

- Technology-driven solutions.

Lineage's strategic partnerships, such as the agreement with Tyson Foods, enhance its capacity and service integration. Their commitment to innovation, including patented processes and proprietary software, sets them apart in the industry. For more insights into their strategic approach, you can read about the Growth Strategy of Lineage.

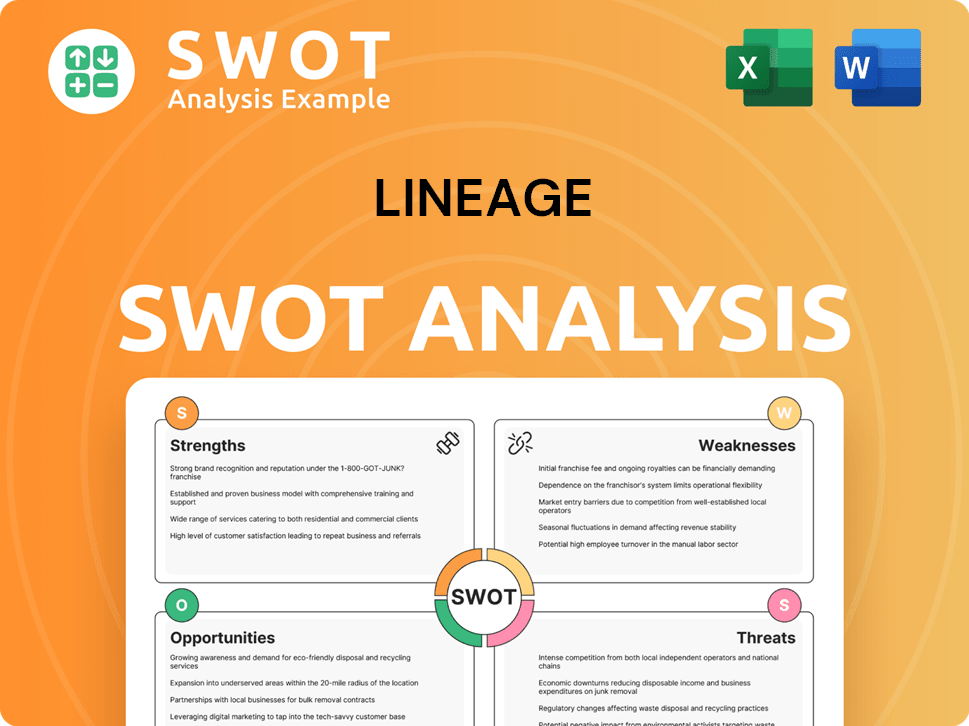

Lineage SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lineage Make Money?

Understanding the revenue streams and monetization strategies of the Lineage Company is crucial for grasping its operational and financial dynamics. The company leverages a comprehensive service-based model to generate income, primarily focusing on warehousing, logistics, and value-added services. This approach allows Lineage to cater to a wide range of customer needs within the temperature-controlled supply chain sector.

In 2024, Lineage reported a total revenue of $5.3 billion. Despite flat revenue compared to the previous year, the company demonstrated strong operational efficiency. This efficiency is reflected in an increase in adjusted EBITDA by 4.0% to $1.3 billion, and an improvement in the adjusted EBITDA margin by 100 basis points to 24.9%. This financial performance illustrates Lineage's ability to maintain profitability and optimize its operations.

Lineage Logistics' financial strategy is centered around providing tailored solutions and establishing long-term partnerships. The company often employs performance-based contracting to align its incentives with client needs, fostering mutual growth and ensuring high-quality service delivery. For more information about the company's structure, you can read about Owners & Shareholders of Lineage.

Lineage Company's business model is built on several key revenue streams and monetization strategies. These elements work together to support the company's growth and market position. Their approach is designed to provide comprehensive solutions for its clients.

- Warehousing Services: This is a primary revenue source, involving the storage and handling of temperature-sensitive goods in Lineage's extensive network of facilities. Fees are determined by storage time, volume, and specific handling requirements.

- Transportation Services: Lineage offers end-to-end transportation services for goods in temperature-controlled environments. This ensures the integrity of products from origin to destination.

- Value-Added Services: Beyond storage and transportation, Lineage provides additional services such as packaging, labeling, quality control, and customs brokerage. These services enhance the overall supply chain solution.

- Technology Solutions: Lineage monetizes its advanced technology, including warehouse management systems and data analytics. This helps optimize supply chain operations for its customers.

- Performance-Based Contracting: The company aligns incentives with client needs through performance-based contracts, fostering mutual growth and ensuring high-quality service delivery.

- Financial Outlook: The company anticipates adjusted EBITDA between $1.35 billion and $1.40 billion for 2025. They also project Adjusted Funds From Operations (AFFO) per share of $3.40 to $3.60, indicating continued profitability growth.

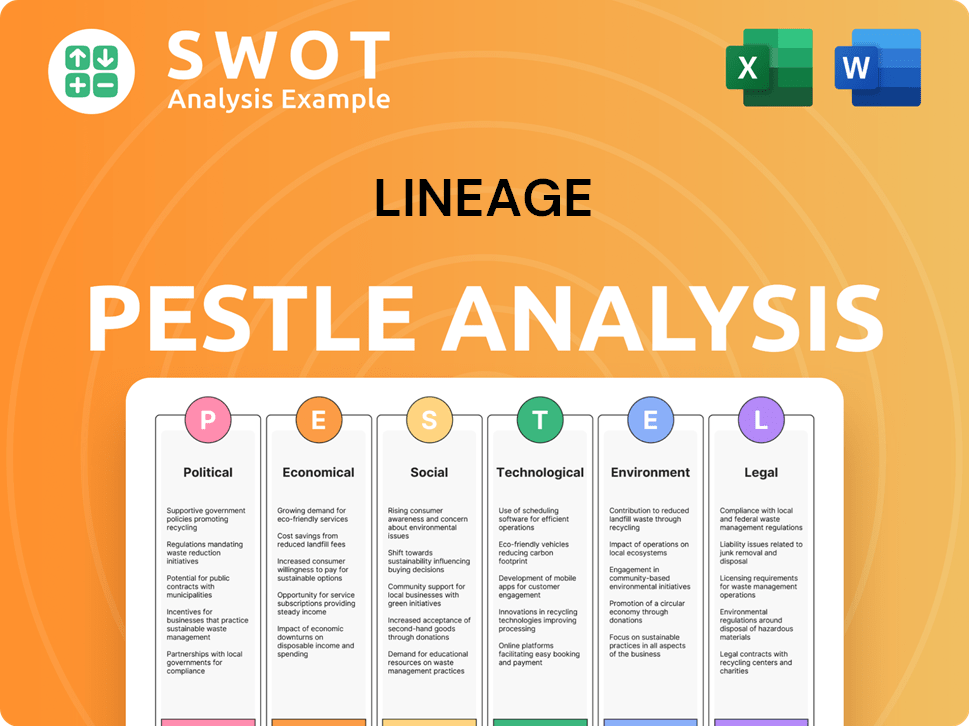

Lineage PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lineage’s Business Model?

The evolution of Lineage Company, a leader in temperature-controlled logistics, is marked by significant milestones and strategic initiatives. Its growth trajectory has been largely shaped by a strategy of rapid expansion, primarily through acquisitions and the construction of new, advanced cold storage facilities. This approach has allowed Lineage to broaden its network and enhance its service offerings to meet the growing demands of the supply chain.

Recent strategic moves demonstrate Lineage's commitment to expanding its operational capacity. A notable agreement in April 2025 involved the acquisition of multiple cold storage warehouses from Tyson Foods for $247 million. This deal added approximately 49 million cubic feet and 160,000 pallet positions to its network. Furthermore, the company plans to invest over $740 million to develop two new fully automated cold storage warehouses by 2028, increasing its capacity by more than 80 million cubic feet.

Despite facing market challenges, such as inventory rebalancing in 2023 and the first half of 2024, Lineage has demonstrated resilience. It has continued to grow, with adjusted EBITDA up 4% and AFFO per share up 6.5% in 2024. The company's ability to navigate these headwinds showcases its adaptability and robust business model. The company’s strategic moves and financial results highlight its strong position in the cold storage and supply chain sectors.

Lineage's competitive edge stems from its extensive global network and technological leadership. Its network of over 480 facilities worldwide provides efficient and reliable logistics solutions. The company's focus on technology, including automation and data analytics, enhances operational efficiency and customer service.

The company's strong financial position, including an investment-grade balance sheet, allows for significant capital deployment, with over $1.5 billion planned for acquisitions and developments in 2025. Lineage also emphasizes sustainability, reporting a 25% reduction in carbon emissions in 2024 and aiming for net-zero carbon emissions by 2040.

Lineage Company's success is built on several key differentiators. The company's extensive network and technological advancements are crucial for its operations. Its specialization in temperature-controlled logistics and commitment to sustainability further enhance its market position. For more insights, explore the Competitors Landscape of Lineage.

- Global Network: Over 480 facilities worldwide.

- Technology: Investments in automation, robotics, and AI-powered computer vision.

- Sustainability: Aims for net-zero carbon emissions by 2040.

- Financial Strength: Over $1.5 billion planned for acquisitions and developments in 2025.

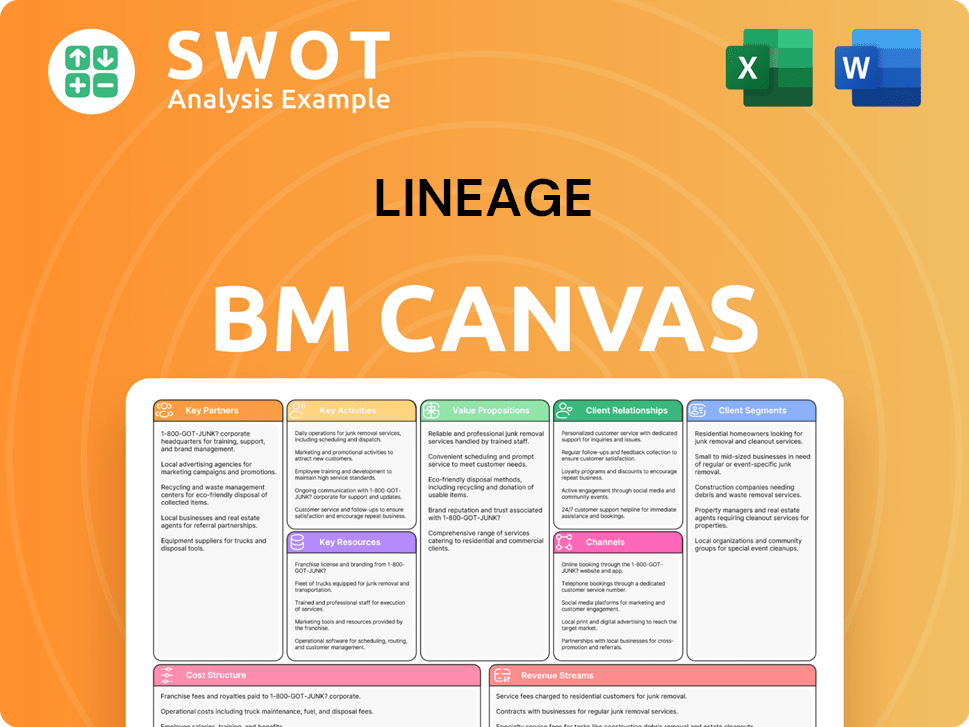

Lineage Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lineage Positioning Itself for Continued Success?

The Lineage Company is positioned as the world's largest global temperature-controlled warehouse REIT. It operates over 480 facilities across 18 countries, serving more than 13,000 customers. In the U.S. alone, Lineage handles over 30% of the temperature-controlled food products, indicating a substantial market share. Their ability to provide tailored solutions and maintain high food safety standards reinforces customer loyalty, which is a critical factor in their success as a leading cold storage provider. Understanding the Lineage operations is key to appreciating its industry dominance.

Despite its robust market position, Lineage faces several risks. Macroeconomic factors, such as rising interest rates, can impact its REIT operations. Changing consumer preferences and technological disruptions from new competitors also present challenges. Reliance on specific sectors, like food and pharmaceuticals (which account for approximately 85% of revenue), creates vulnerability to sector-specific downturns. Additionally, tariffs introduce uncertainty into the global food production chain, affecting financial outcomes. These factors are important to consider when evaluating the Lineage Company's performance.

Lineage Logistics is the world's largest global temperature-controlled warehouse REIT. The company has a significant global reach with over 480 facilities. Lineage Company handles a substantial portion of the temperature-controlled food products in the U.S.

Macroeconomic pressures, such as rising interest rates, can affect Lineage operations. Changing consumer preferences and new competitors pose challenges. Reliance on specific sectors presents a risk if these sectors experience downturns.

Lineage plans to invest over $1.5 billion in 2025 for acquisitions and developments. The company is focused on technological advancements and sustainability. Lineage anticipates full-year 2025 adjusted EBITDA between $1.35 billion and $1.40 billion.

Lineage is expanding its network and enhancing its automated capabilities. The company is committed to leveraging IoT, AI, and automation. Sustainability is a key focus, with a net-zero carbon emissions target by 2040.

Lineage's future outlook is characterized by strategic initiatives aimed at sustained growth and innovation. The company plans to invest significantly in acquisitions and new developments to expand its network and enhance its automated capabilities. This includes a strong emphasis on technological advancements and sustainability.

- Lineage plans to deploy over $1.5 billion in capital in 2025.

- The company is developing two fully automated cold storage warehouses expected to open by 2028.

- Lineage is committed to achieving net-zero carbon emissions by 2040.

- Lineage anticipates full-year 2025 adjusted EBITDA between $1.35 billion and $1.40 billion, and AFFO per share of $3.40 to $3.60.

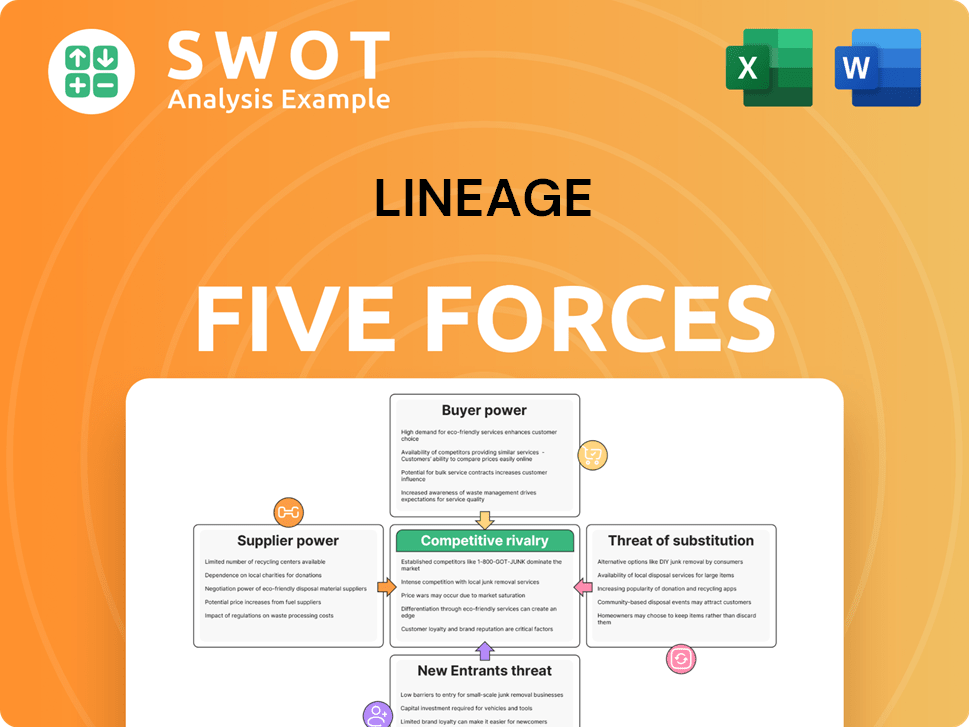

Lineage Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lineage Company?

- What is Competitive Landscape of Lineage Company?

- What is Growth Strategy and Future Prospects of Lineage Company?

- What is Sales and Marketing Strategy of Lineage Company?

- What is Brief History of Lineage Company?

- Who Owns Lineage Company?

- What is Customer Demographics and Target Market of Lineage Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.